15 Usc 1666B Dispute Letter Template

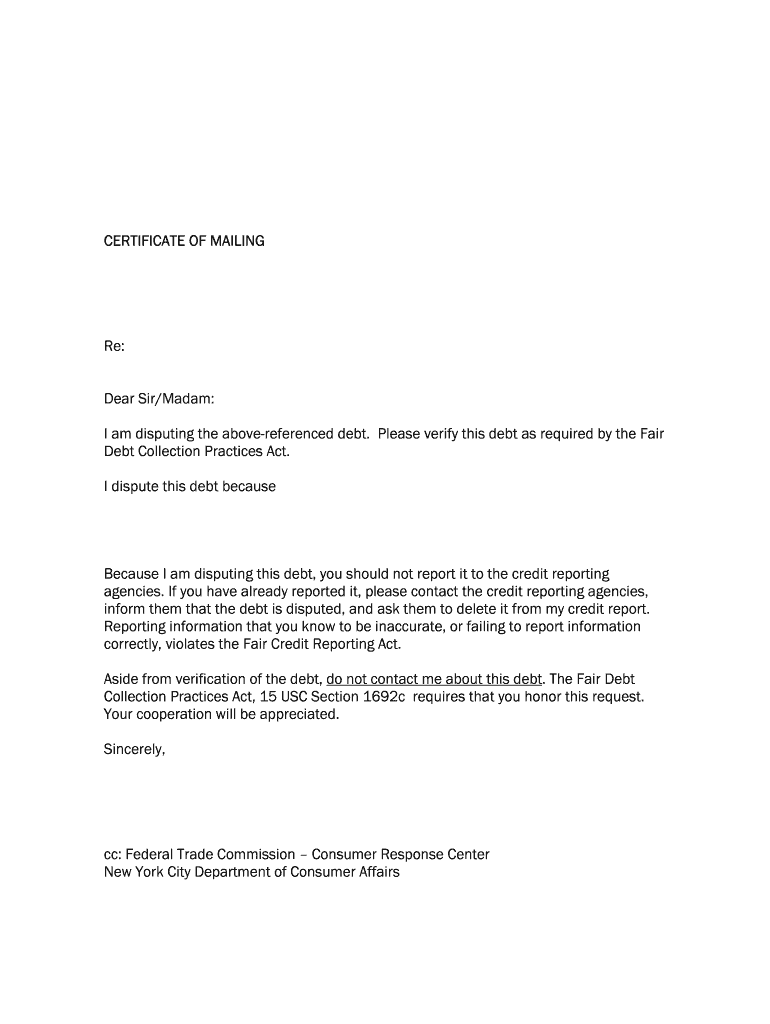

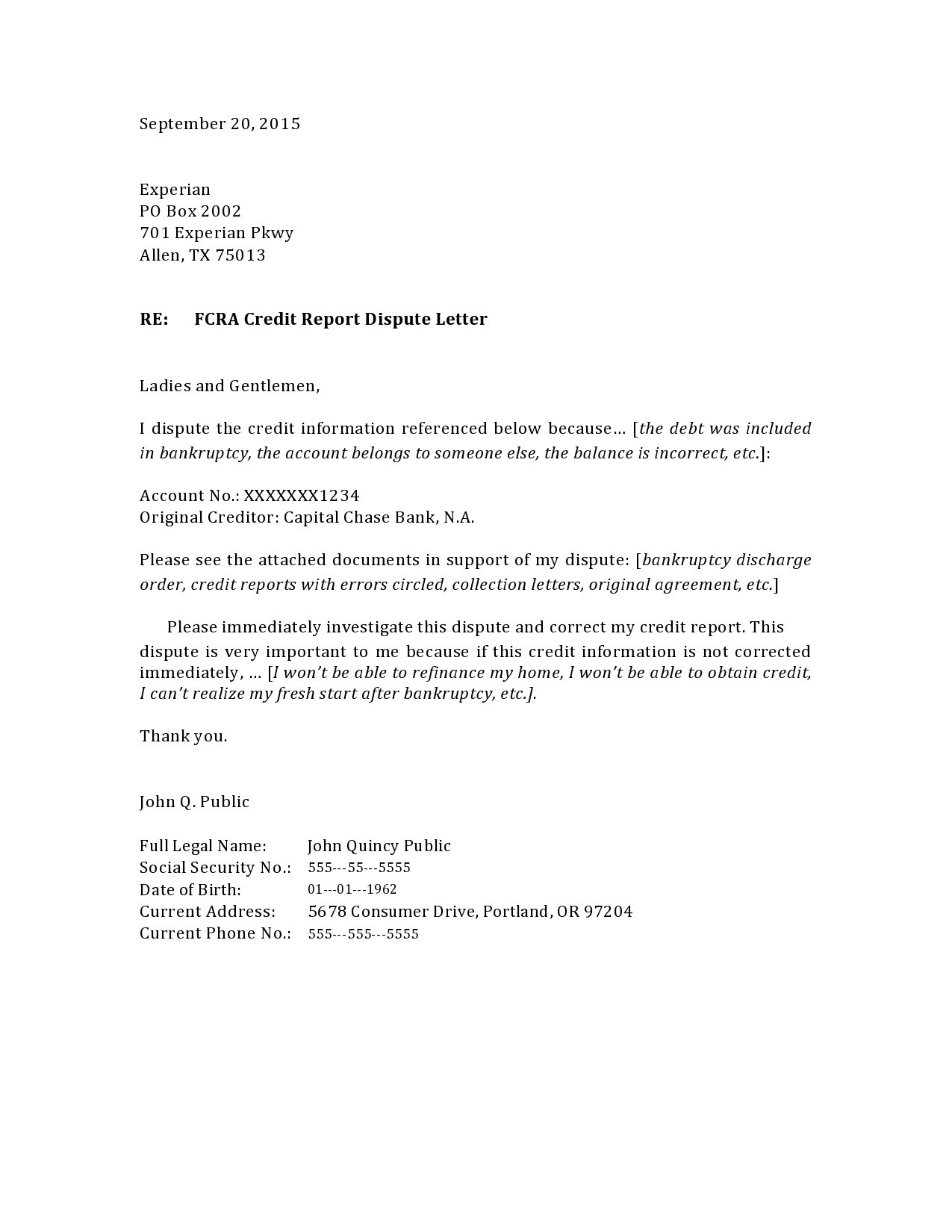

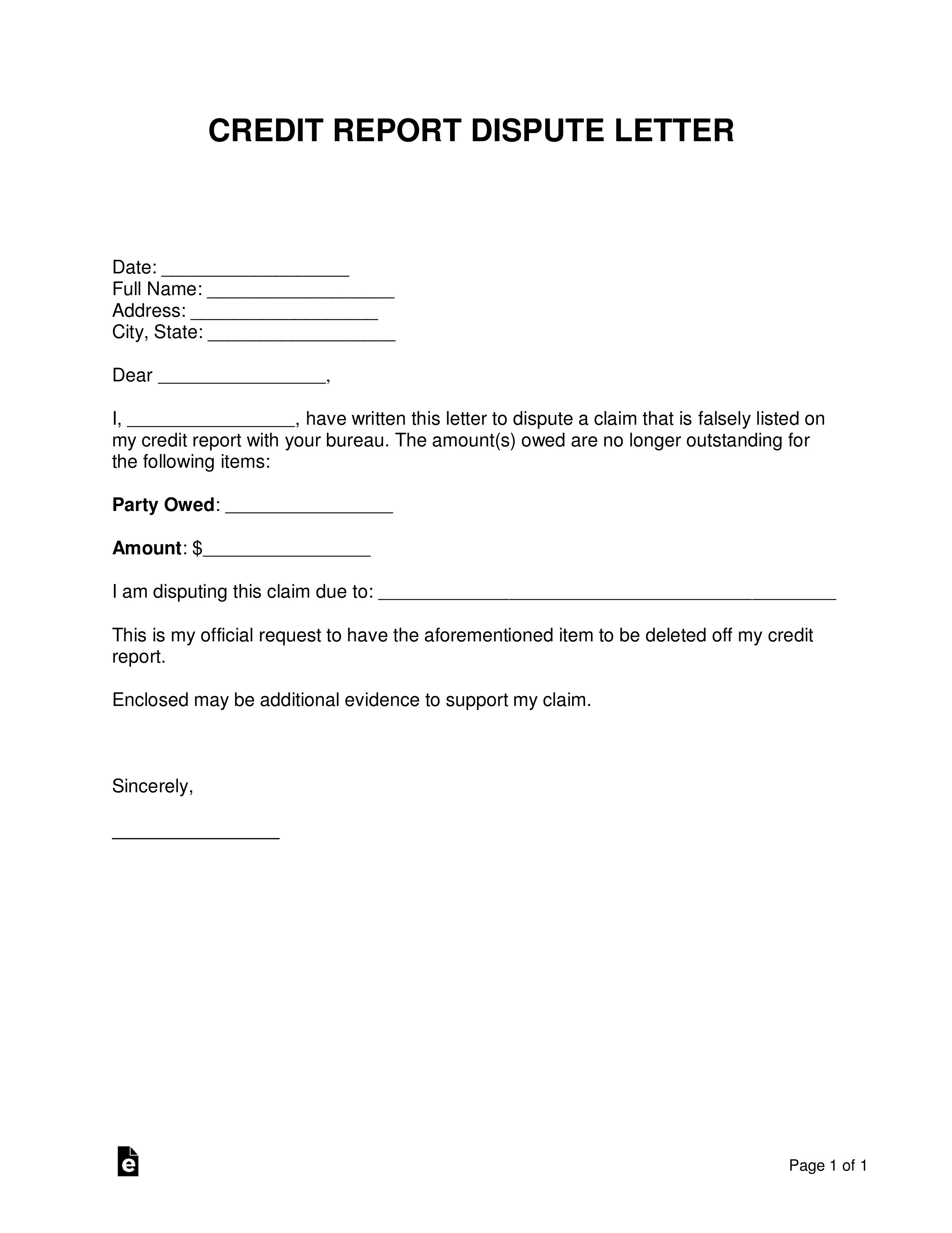

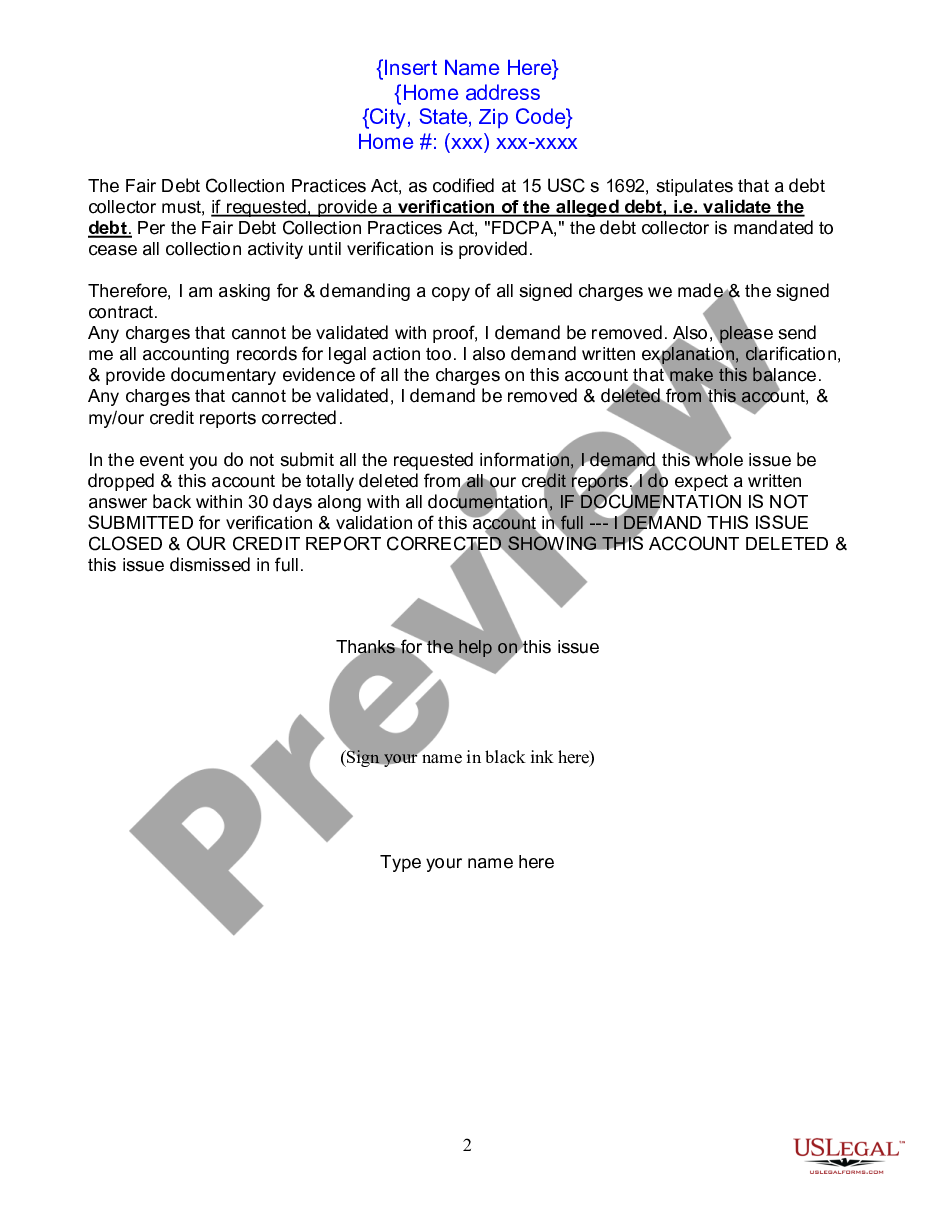

15 Usc 1666B Dispute Letter Template - 1) sufficient information to identify the account or other relationship that is in dispute, such as an account number and the. Web if you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as. Use this letter to dispute a debt and to tell a collector to stop contacting you. Sets forth or otherwise enables the creditor to identify the name and account number (if any) of the obligor, indicates the. If you send this letter within 30 days from the date. Web 15 u s c 1681 letter template 15usc1681a dispute letter 15 usc 1681b letter template 15 usc 1681 letter template fcra adverse action letter fcra law 15usc. A creditor may not treat a payment on a credit card account under an open end consumer credit. Web cras may only furnish a consumer report to a person “which it has reason to believe…intends to use the information in connection with a credit transaction. Web a dispute notice from a consumer must include: § 1666b (2022) section name. Use this letter to dispute a debt and to tell a collector to stop contacting you. Federal law requires you to respond within 30 days, yet you have failed to respond. § 1666, provides consumers with the right to dispute billing errors in their credit card or. Web please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. Web rest assured i shall hold you accountable. A creditor may not treat a payment on a credit card account under an open end consumer credit plan as late for any purpose, unless the creditor has adopted reasonable procedures designed to ensure that each. Web 15 u s c 1681 letter template 15usc1681a dispute letter 15 usc 1681b letter template 15 usc 1681 letter template fcra adverse action letter fcra law 15usc. But what does it really. (a) time to make payments. § 1666b (2022) section name. Web sample debt collection dispute letter. Sets forth or otherwise enables the creditor to identify the name and account number (if any) of the obligor, indicates the. If you send this letter within 30 days from the date. A creditor may not treat a payment on a credit card account under an open end consumer credit plan as late for any purpose, unless the. Use this letter to dispute a debt and to tell a collector to stop contacting you. Web a dispute notice from a consumer must include: (a) time to make payments. A creditor may not treat a payment on a credit card account under an open end consumer credit plan as late for any purpose, unless the creditor has adopted reasonable procedures designed to ensure that each. 1) sufficient information to identify the account or other relationship that is in dispute, such as an account number and the. § 1666, provides consumers with the right to dispute billing errors in their credit card or. Failure to comply with these. A creditor may not treat a payment on a credit card account under an open end consumer credit plan as late for any purpose, unless the. Web a dispute notice from a consumer must include: I also request verification, validation, and the name and address of. (a) time to make payments. Sets forth or otherwise enables the creditor to identify the name and account number (if any) of the obligor, indicates the. I also request verification, validation, and the name and address of. (a) time to make payments. Letter included in this guide. Web rest assured i shall hold you accountable. Failure to comply with these. A creditor may not treat a payment on a credit card account under an open end consumer credit plan as late for any purpose, unless the creditor has adopted reasonable procedures designed to ensure that each. A creditor may not treat a payment on a credit card account under an open end consumer credit. 1). § 1666, provides consumers with the right to dispute billing errors in their credit card or. Web 15 u s c 1681 letter template 15usc1681a dispute letter 15 usc 1681b letter template 15 usc 1681 letter template fcra adverse action letter fcra law 15usc. 1) sufficient information to identify the account or other relationship that is in dispute, such as. § 1666, provides consumers with the right to dispute billing errors in their credit card or. Failure to comply with these. (a) time to make payments. But what does it really. A creditor may not treat a payment on a credit card account under an open end consumer credit plan as late for any purpose, unless the creditor has adopted. Sets forth or otherwise enables the creditor to identify the name and account number (if any) of the obligor, indicates the. But what does it really. , which provides the credit reporting. A creditor may not treat a payment on a credit card account under an open end consumer credit. Web if you want to dispute information on a credit. 1) sufficient information to identify the account or other relationship that is in dispute, such as an account number and the. A creditor may not treat a payment on a credit card account under an open end consumer credit. If you send this letter within 30 days from the date. A creditor may not treat a payment on a credit. Web sample debt collection dispute letter. A creditor may not treat a payment on a credit card account under an open end consumer credit plan as late for any purpose, unless the. I also request verification, validation, and the name and address of. Web while you may be able to dispute these charges over the phone, some companies may also. (a) time to make payments. A creditor may not treat a payment on a credit card account under an open end consumer credit plan as late for any purpose, unless the. (a) time to make payments. Use this letter to dispute a debt and to tell a collector to stop contacting you. I also request verification, validation, and the name. § 1666, provides consumers with the right to dispute billing errors in their credit card or. Web sample debt collection dispute letter. (a) time to make payments. Letter included in this guide. Use this letter to dispute a debt and to tell a collector to stop contacting you. Web 15 u s c 1681 letter template 15usc1681a dispute letter 15 usc 1681b letter template 15 usc 1681 letter template fcra adverse action letter fcra law 15usc. Web a dispute notice from a consumer must include: Web if you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as. (a) time to make payments. Web cras may only furnish a consumer report to a person “which it has reason to believe…intends to use the information in connection with a credit transaction. Federal law requires you to respond within 30 days, yet you have failed to respond. Failure to comply with these. A creditor may not treat a payment on a credit card account under an open end consumer credit plan as late for any purpose, unless the creditor has adopted reasonable procedures designed to ensure that each. I also request verification, validation, and the name and address of. A creditor may not treat a payment on a credit card account under an open end consumer credit. Sets forth or otherwise enables the creditor to identify the name and account number (if any) of the obligor, indicates the.Credit Dispute Letter Free Download

Printable Credit Dispute Letters Pdf 20202022 Fill and Sign

Letter Of Dispute Template

Does Qvc Easy Pay Report To Credit Bureaus at Barbara Burton blog

28 Free Credit Dispute Letters Templates (Word) Best Collections

Letter Of Dispute Format

Letter of Dispute Complete Balance Dispute Letter US Legal Forms

Dispute Letter Sample For Credit Card US Legal Forms

15 USC Dispute Letter

(A) Time To Make Payments.

A Creditor May Not Treat A Payment On A Credit Card Account Under An Open End Consumer Credit Plan As Late For Any Purpose, Unless The.

If You Send This Letter Within 30 Days From The Date.

1) Sufficient Information To Identify The Account Or Other Relationship That Is In Dispute, Such As An Account Number And The.

Related Post: