3210 Letter Template

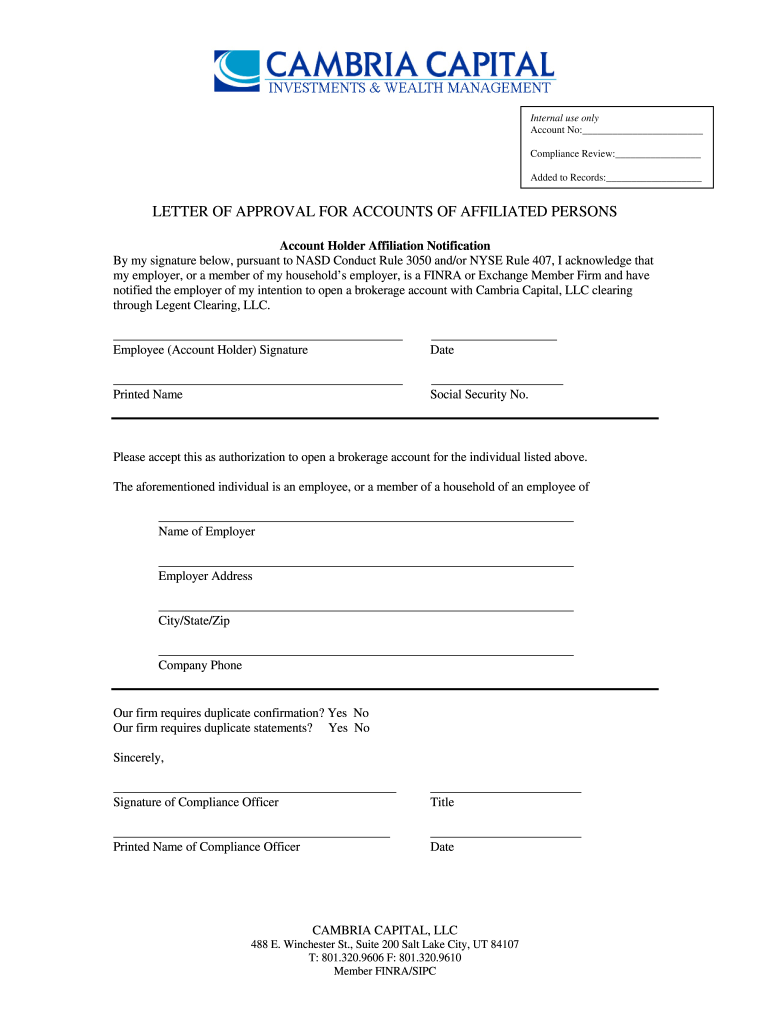

3210 Letter Template - Edit your 3210 letter template online. Web rule 3210 now requires an associated person to notify the company and the executing firm in writing, prior to opening a securities account or placing an initial order for the purchase or sale of securities with another member or other financial institution. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web finra rule 3210 requires prior notification by an associated person to their member firm before they establish an account at another financial institution. (a) no person associated with a member (employer member) shall, without the prior written consent of the member, open or otherwise establish at a member other than the employer member (executing member), or at any other financial institution, any account in which. Web a 3210 letter—formerly known as a 407 letter—refers to the written permission that an employer gives for certain member employees to hold investments. Type text, add images, blackout confidential details, add comments, highlights and more. Web the requirement under finra rule 3210 is relatively straightforward: Web in order for the proposed finra rule 3210 to provide an exemption for such other insurance contracts, the committee proposes that the following clause be added to the list of exempt transactions under sm.03: You can also download it, export it or print it out. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web the new rule 3210 provides a better protection against the conflict of interests than the old rule 407, it also provides a better protection to the investors. All registered investment advisors must declare their outside accounts to their member firm and notify their member firm in writing when they intend to open any new account. You fill out this part. Web finra rule 3210 requires that an associated person 5 must obtain the prior written consent of his or her employer when opening an account, as specified by the rule, at another member or other financial institution. Web finra 3210 letter template. (a) no person associated with a member (employer member) shall, without the prior written consent of the member, open or otherwise establish at a member other than the employer member (executing member), or at any other financial institution, any account in which. Web rule 3210 governs accounts opened by members at firms other than where they work. Web what is finra rule 3210? Get a fillable 3210 letter template online. Web fill 3210 letter template, edit online. You fill out this part. All registered investment advisors must declare their outside accounts to their member firm and notify their member firm in writing when they intend to open any new account. Get a fillable 3210 letter template online. Firms can also request to receive duplicate account statements so that they can see the securities held in a member’s personal investment accounts. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. This is known as finra rule 3210. Web a 3210 letter—formerly known as a 407 letter—refers to the written permission that an employer gives for certain member employees to hold investments. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Web a 3210 letter—formerly known as a 407 letter—refers to the written permission that an employer gives for certain member employees to hold investments. Web finra rule 3210 requires an executing member, upon written request by an employer member, to transmit duplicate copies of confirmations and statements, or the transactional data contained therein, with respect to an account subject to the rule. Web the requirement under finra rule 3210 is relatively straightforward: Web in order for the proposed finra rule 3210 to provide an. Web finra rule 3210 requires that an associated person 5 must obtain the prior written consent of his or her employer when opening an account, as specified by the rule, at another member or other financial institution. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. The purpose of finra rule 3210 (and formerly rule 407). Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Edit your 3210 letter template online. Web finra rule 3210 requires that an associated person 5 must obtain the prior written consent of his or her employer when opening an account, as specified by the rule, at another member or other financial institution.. Type text, add images, blackout confidential details, add comments, highlights and more. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Get a fillable 3210 letter template online. Web what is finra rule 3210? All employees must declare their intent and obtain their employers' consent if they wish to open or maintain an. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Web fill 3210 letter template, edit online. Web finra 3210 letter template. Web finra rule 3210 requires an executing member, upon written request by. You fill out this part. Firms can also request to receive duplicate account statements so that they can see the securities held in a member’s personal investment accounts. Web finra rule 3210 requires prior notification by an associated person to their member firm before they establish an account at another financial institution. The purpose of finra rule 3210 (and formerly. Web finra rule 3210 requires that an associated person 5 must obtain the prior written consent of his or her employer when opening an account, as specified by the rule, at another member or other financial institution. (a) no person associated with a member (employer member) shall, without the prior written consent of the member, open or otherwise establish at. You fill out this part. Web send finra 3210 letter template via email, link, or fax. Rule 3210 requires financial advisors to make a request and obtain consent from the finra member firm they work for to keep their accounts somewhere else. Web the finra 3210 letter. Sign it in a few clicks. This is known as finra rule 3210. Web rule 3210 governs accounts opened by members at firms other than where they work. We’ll also explore how complysci’s undisclosed account alerts can automate your organization’s compliance processes to save time and money. Sign it in a few clicks. Web the new rule 3210 provides a better protection against the conflict of. (a) no person associated with a member (employer member) shall, without the prior written consent of the member, open or otherwise establish at a member other than the employer member (executing member), or at any other financial institution, any account in which. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Web the new. Web the new rule 3210 provides a better protection against the conflict of interests than the old rule 407, it also provides a better protection to the investors. Web finra rule 3210 requires prior notification by an associated person to their member firm before they establish an account at another financial institution. All employees must declare their intent and obtain their employers' consent if they wish to open or maintain an. You can also download it, export it or print it out. The purpose of finra rule 3210 (and formerly rule 407) is to ensure that registered brokerage firms, brokers and financial advisors are able to avoid any conflicts of interests by maintaining high ethical standards. Web the requirement under finra rule 3210 is relatively straightforward: Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. The new rule requires that employee of new brokerages must disclose all the information required under the rule 3210, under just a month. Web a 3210 letter—formerly known as a 407 letter—refers to the written permission that an employer gives for certain member employees to hold investments. Rule 3210 requires financial advisors to make a request and obtain consent from the finra member firm they work for to keep their accounts somewhere else. Web according to the financial industry regulatory authority (finra), all registered representatives of an investment advisory firm must receive written consent before opening or establishing a brokerage account with another finra firm. Web edit your 3210 letter template form form online. Web in order for the proposed finra rule 3210 to provide an exemption for such other insurance contracts, the committee proposes that the following clause be added to the list of exempt transactions under sm.03: We’ll also explore how complysci’s undisclosed account alerts can automate your organization’s compliance processes to save time and money. Edit your 3210 letter template online. Web a 3210 letter—formerly known as a 407 letter—refers to the written permission that an employer gives for certain member employees to hold investments.Freight Broker Email Template

Free Printable Letter Templates

Notarized Letter Templates 27+ Free Sample, Example Format Free

3210 Letter Template

3210 Letter Template 20032024 Form Fill Out and Sign Printable PDF

Pin on templates

EX3200 EXCITER EX3210 Cover Letter Permissive Change Authorization

Letters Letter 3210 Gleaves Family

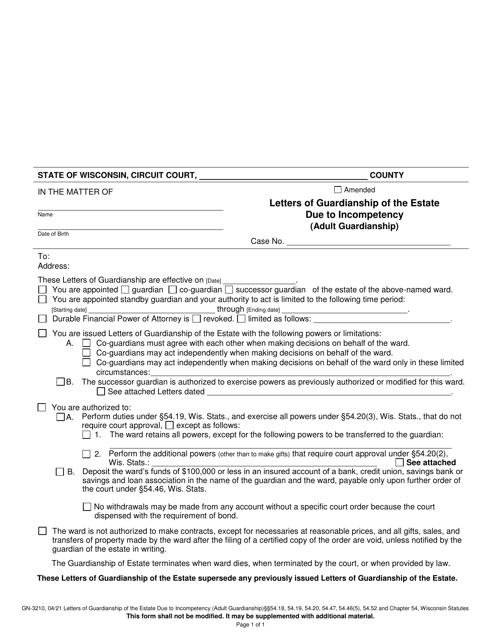

Form GN3210 Fill Out, Sign Online and Download Printable PDF

3210 letter Fill out & sign online DocHub

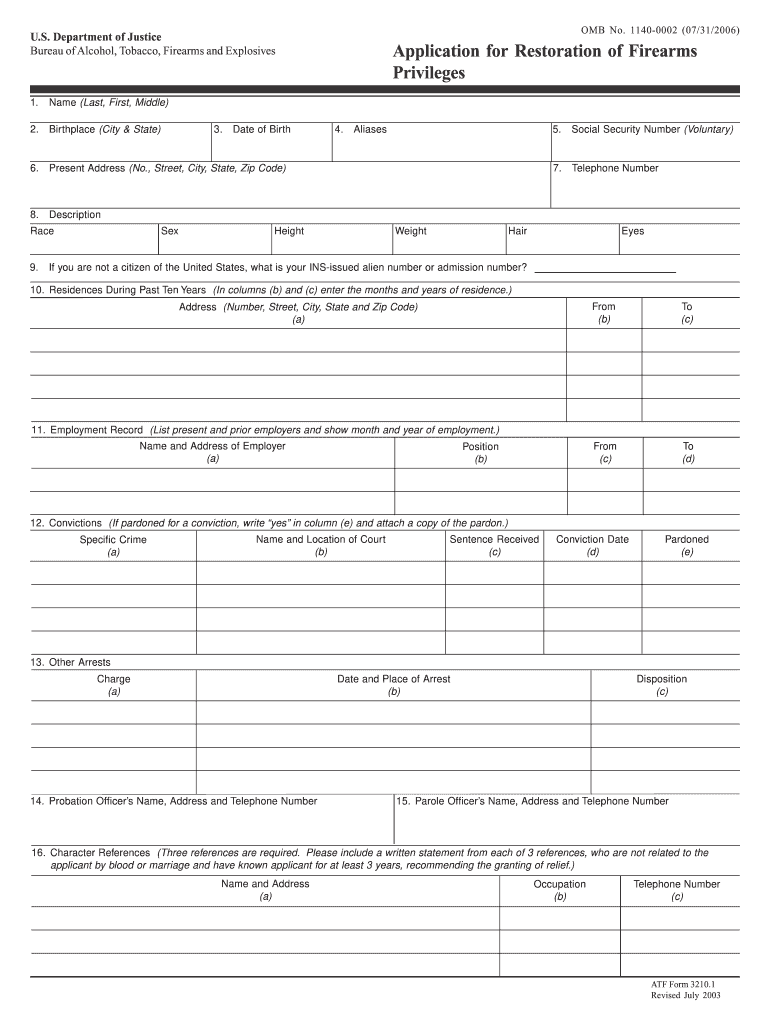

You Fill Out This Part.

Web Finra Rule 3210 Requires That An Associated Person5 Must Obtain The Prior Written Consent Of His Or Her Employer When Opening An Account, As Specified By The Rule, At Another Member Or Other Financial Institution.

Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Associated Person's Request To Open An Outside Brokerage Account.

Related Post: