501 C 3 Forms Template

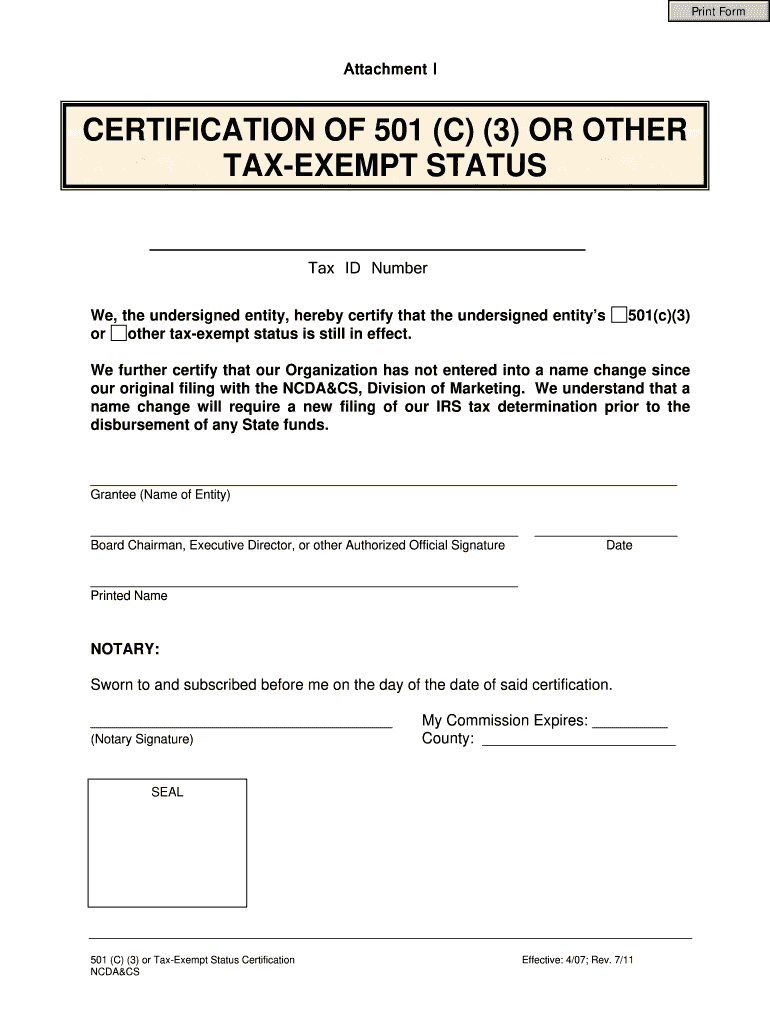

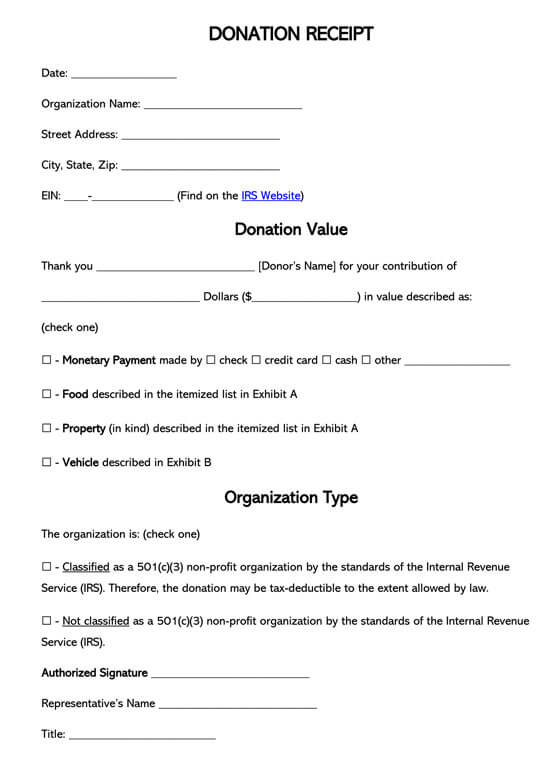

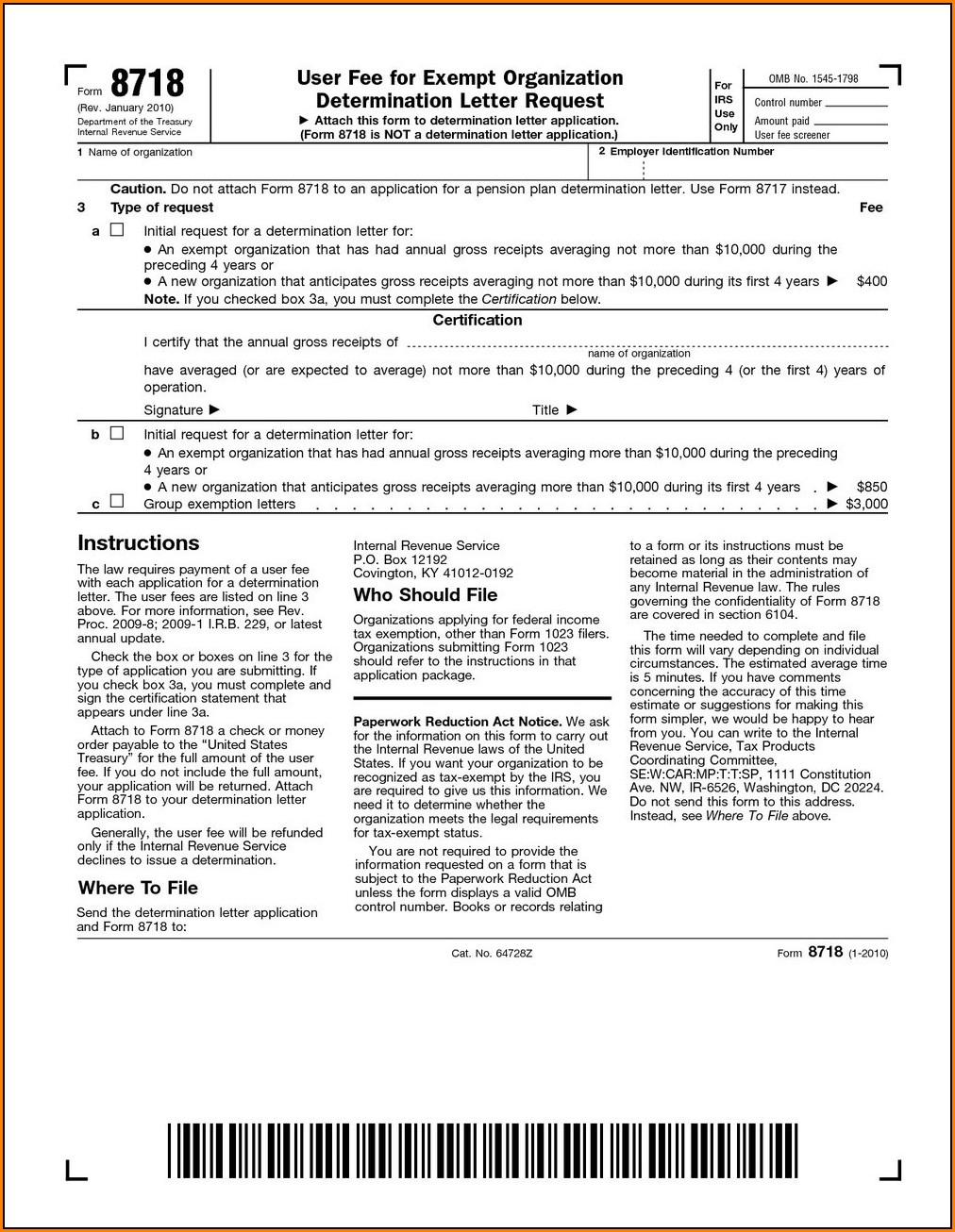

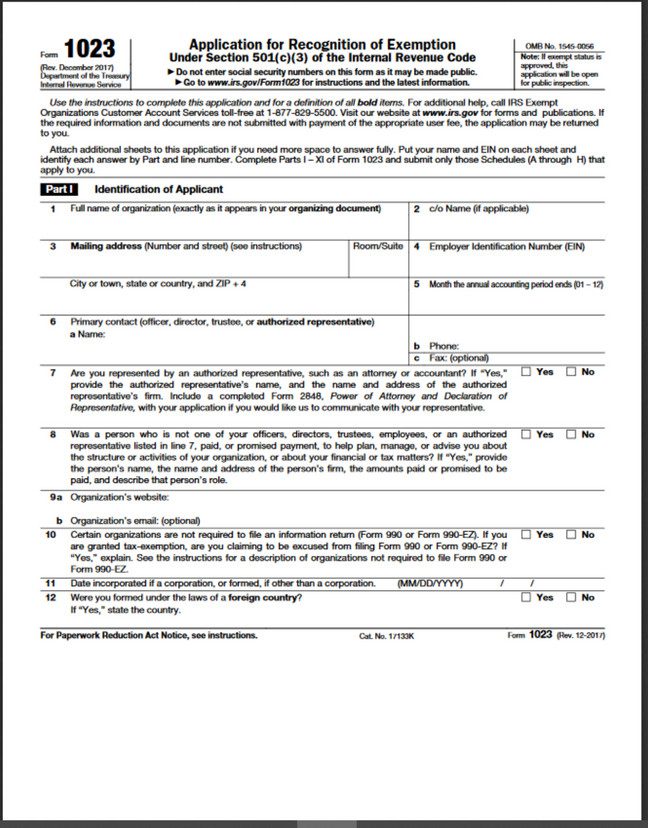

501 C 3 Forms Template - Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. A donation can be in the form of cash or property. Web the following are examples of a charter (draft a) and a declaration of trust (draft b) that contain the required information as to purposes and powers of an organization and disposition of its assets upon dissolution, in. Web section 501(c)(3) requires that upon dissolution of your organization, your remaining assets must be used exclusively for exempt purposes, such as charitable, religious, educational, and/or scientific purposes. Web free nonprofit articles of incorporation template. Form your nonprofit using our adaptable template. It allows you to create and customize the draft of your receipt contents. Web to streamline the process of collecting donations and issuing 501(c)(3) donation receipts, download our free form template below. Thank you for your donation with a value of ___________________________ dollars. All you need to do is fill the relevant fields with the donors information and you are free of all legal liability. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web these 29 types of nonprofit organizations can file for tax exemption under section 501 (c) of the internal revenue code. This comprehensive guide includes tips, best practices, and faqs to ensure you're following irs guidelines and maximizing. We will populate it automatically with all the necessary donation details and organization info. Web the following are examples of a charter (draft a) and a declaration of trust (draft b) that contain the required information as to purposes and powers of an organization and disposition of its assets upon dissolution, in. To maintain 501(c)(3) status, organizations must meet annual filing and compliance requirements , which include submitting a corporate annual report to the state, filing irs form 990, and. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. The most common of these is the 501 (c) (3), which includes all charitable, religious, scientific, and literary organizations. Web organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501 (c) (3). Form your nonprofit using our adaptable template. The most common of these is the 501 (c) (3), which includes all charitable, religious, scientific, and literary organizations. This means, among other things, that the organization’s organizing documents must contain certain provisions. All you need to do is fill the relevant fields with the donors information and you are free of all legal liability. Form your nonprofit using our adaptable template. Web to qualify for exemption under section 501 (c) (3), an organization must be organized exclusively for purposes described in that section. It allows you to create and customize the draft of your receipt contents. Web most organizations seeking recognition of exemption from federal income tax must use specific application forms prescribed by the irs. Web to streamline the process of collecting donations and issuing 501(c)(3) donation receipts, download our free form template below. Thank you for your donation with a value of ___________________________ dollars. Web these 29 types of nonprofit organizations can file for tax exemption under section 501 (c) of the internal revenue code. Web nonprofit bylaws template for 501c3 [sample & example] what are nonprofit bylaws? It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value. The most common of these is the 501 (c) (3), which includes all charitable, religious, scientific, and literary organizations. A donation can be in the form of cash or property. Web section 501(c)(3) requires that upon dissolution of your organization, your remaining assets must be used exclusively for exempt purposes, such as charitable, religious, educational, and/or scientific purposes. We will. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web to streamline the process of collecting donations and issuing 501(c)(3) donation receipts, download our free form template below. Web these 29 types of nonprofit organizations can file for tax exemption under section 501. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. The application must be submitted electronically on pay.gov and must, including the appropriate user fee. The most common of these is the 501 (c) (3), which includes all charitable, religious, scientific, and literary. A donation can be in the form of cash or property. Form your nonprofit using our adaptable template. Web the following are examples of a charter (draft a) and a declaration of trust (draft b) that contain the required information as to purposes and powers of an organization and disposition of its assets upon dissolution, in. It’s utilized by an. All you need to do is fill the relevant fields with the donors information and you are free of all legal liability. Web most organizations seeking recognition of exemption from federal income tax must use specific application forms prescribed by the irs. A donation can be in the form of cash or property. Web these 29 types of nonprofit organizations. The most common of these is the 501 (c) (3), which includes all charitable, religious, scientific, and literary organizations. The application must be submitted electronically on pay.gov and must, including the appropriate user fee. A donation can be in the form of cash or property. This means, among other things, that the organization’s organizing documents must contain certain provisions. 501c3. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Web the application for securing tax exempt status for one’s organization is the form 1023 application for recognition of exemption under section 501(c)(3) of the internal revenue code and must be filed within. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. We will populate it automatically with all the necessary donation details and organization info. Web the following are examples of a charter (draft a) and a declaration of trust (draft b) that contain the required. This comprehensive guide includes tips, best practices, and faqs to ensure you're following irs guidelines and maximizing. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. 501c3 tax exempt language included. Web nonprofit bylaws template for 501c3 [sample & example] what are. This means, among other things, that the organization’s organizing documents must contain certain provisions. Form your nonprofit using our adaptable template. Web the application for securing tax exempt status for one’s organization is the form 1023 application for recognition of exemption under section 501(c)(3) of the internal revenue code and must be filed within 27 months from the end of the month in which it The most common of these is the 501 (c) (3), which includes all charitable, religious, scientific, and literary organizations. 501c3 tax exempt language included. Web to qualify for exemption under section 501 (c) (3), an organization must be organized exclusively for purposes described in that section. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web section 501(c)(3) requires that your organizing document provide that upon dissolution, your remaining assets be used exclusively for section 501(c) (3) exempt purposes, such as charitable, religious, educational, and/or scientific purposes. Web most organizations seeking recognition of exemption from federal income tax must use specific application forms prescribed by the irs. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. To maintain 501(c)(3) status, organizations must meet annual filing and compliance requirements , which include submitting a corporate annual report to the state, filing irs form 990, and. We will populate it automatically with all the necessary donation details and organization info. Web organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501 (c) (3). Web the following are examples of a charter (draft a) and a declaration of trust (draft b) that contain the required information as to purposes and powers of an organization and disposition of its assets upon dissolution, in. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Thank you for your donation with a value of ___________________________ dollars.Free Donation Receipt Template 501(c)(3) PDF Word eForms

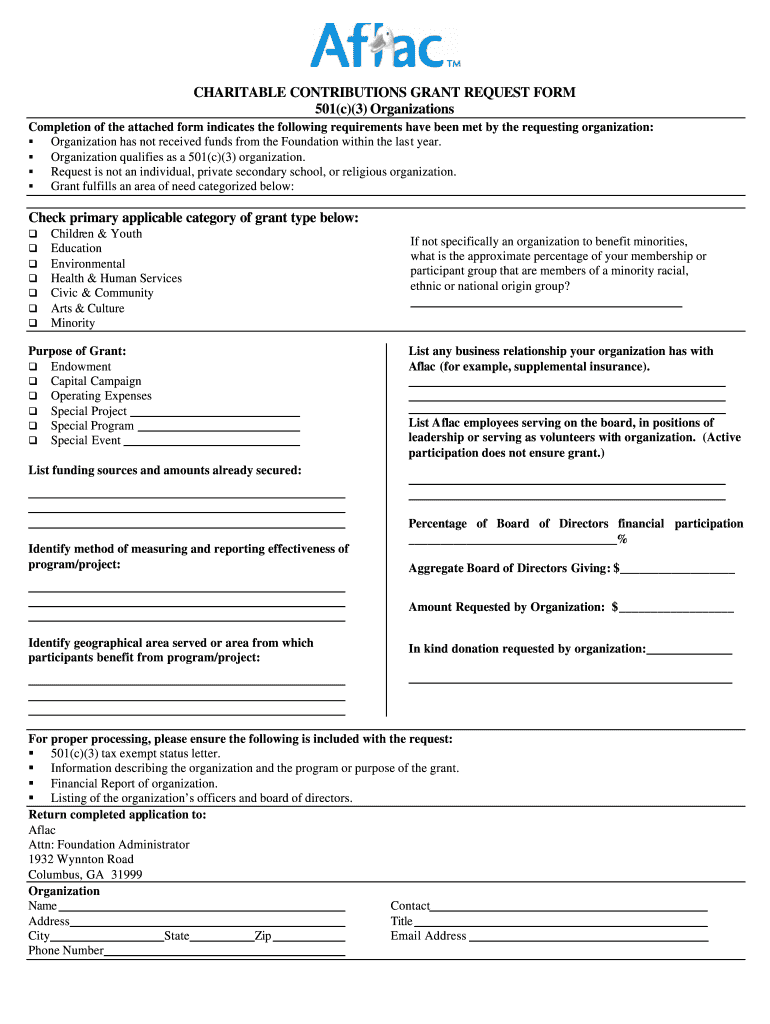

501c3 Form Download Form Resume Examples EZVgQqk9Jk

501 C 3 Document Form

501C3 Bylaws Template

501c3 Application PDF Editable template airSlate SignNow

501c3 Donation Receipt Template Printable [Pdf & Word]

NC Certification of 501(c)(3) or Other TaxExempt Status 2011 Fill

501(c)(3) Letter Bright Horizons Foundation

Free 501(c)(3) Donation Receipt Templates Word PDF

501c3 Donation Receipt ,501c3 Donation Receipt Template , 501c3

Web These 29 Types Of Nonprofit Organizations Can File For Tax Exemption Under Section 501 (C) Of The Internal Revenue Code.

A Donation Can Be In The Form Of Cash Or Property.

This Comprehensive Guide Includes Tips, Best Practices, And Faqs To Ensure You're Following Irs Guidelines And Maximizing.

It Allows You To Create And Customize The Draft Of Your Receipt Contents.

Related Post:

![501c3 Donation Receipt Template Printable [Pdf & Word]](https://templatediy.com/wp-content/uploads/2022/03/501c3-Donation-Receipt-PDF.jpg)