503020 Budget Template

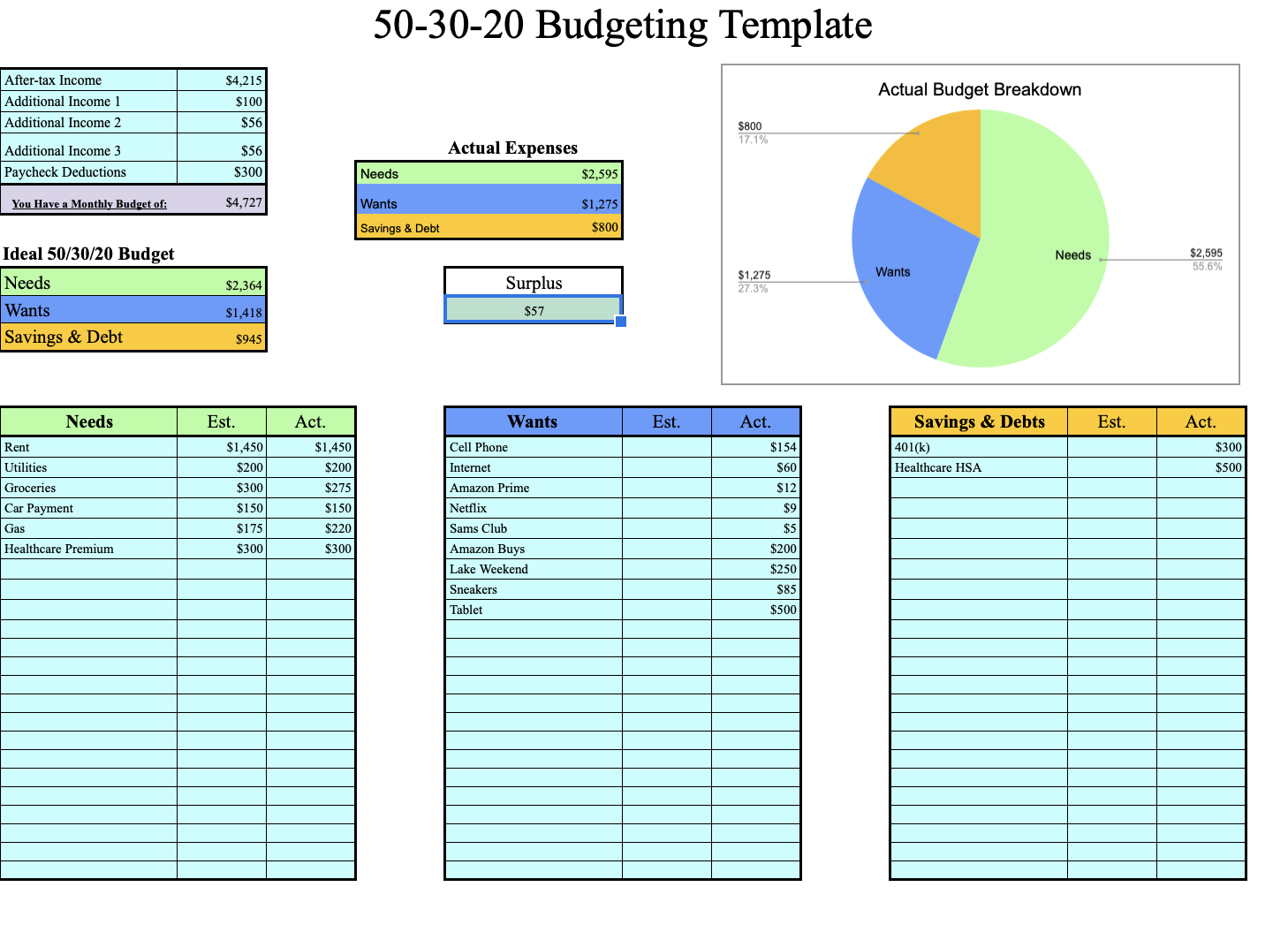

503020 Budget Template - Web interested in building your best budget yet? Web ready to make a financial plan and start budgeting while making sure you're contributing to your savings and investments? The 50% needs category is for all your monthly essentials. Limit you wants to 30% of your income. Essentials include things you simply. Allocate 50% of your income to essentials, 30% to wants, and 20% to savings and debt repayment. All 15 are 100% free! Web how much of your income should go to bills? Web if the thought of having a budget tracker with a predetermined formula excites you, then take a look at our review of some of our best 50/30/20 google sheets budget templates for you to get started in no time. The 50 30 20 budget rule is one of the most popular budgeting guides available. Figure out your total monthly income. All 15 are 100% free! Allocate 50% of your income to essentials, 30% to wants, and 20% to savings and debt repayment. You can change and edit it according to your needs. Get your free 50/30/20 budget spreadsheet here, along with a detailed overview and instructions. Embrace the renowned 50/30/20 rule effortlessly with our monthly budget template. The 50% needs category is for all your monthly essentials. Dein nettoeinkommen wird dabei in drei verschiedene hauptkategorien geteilt. Web the rule is a template that's intended to help individuals manage their money. Web grab your free 50 30 20 budget spreadsheet and learn how to use the flexible 50 30 20 budget rule to manage your budget monthly. Here are some tips to help you categorize your expenses. Figure out your total monthly income. Spend 20% of your income on savings and debt payments. How long it would take to save the recommended three months salary in an emergency fund. Web ready to make a financial plan and start budgeting while making sure you're contributing to your savings and investments? 50% for needs, 30% for wants, and also 20% for savings. Web the rule is a template that's intended to help individuals manage their money. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Ziel dabei ist, dass du auf dauer weniger geld ausgibst, ohne auf die wichtigen dinge im leben verzichten zu müssen. And remember, you can always use a 50 30 20 calculator or even a 50 30 20 budget template to create yours. 50% for needs, 30% for wants, and also 20% for savings. Includes real examples,a spreadsheet & free budget printables! It helps you allocate your money into three. Brittney gets paid $2,000 every 2 weeks. Web learn about the 50 30 20 rule for budgeting your money. Web ready to make a financial plan and start budgeting while making sure you're contributing to your savings and investments? You can change and edit it according to your needs. Web 50/30/20 budget calculator to plan your income and expenses. It balances paying for necessities with saving for emergencies and retirement. Web if the thought of having a budget tracker. With the free templates below, you can quickly see: Figure out your total monthly income. Web 50/30/20 budget calculator to plan your income and expenses. Ziel dabei ist, dass du auf dauer weniger geld ausgibst, ohne auf die wichtigen dinge im leben verzichten zu müssen. Here are some tips to help you categorize your expenses. Limit your needs to 50% of your income. Here are some tips to help you categorize your expenses. The 50 30 20 budget rule is one of the most popular budgeting guides available. Web the 50/30/20 budget rule provides simple monthly spending guidelines that can help you make steady progress toward your financial goals. In this post, you'll find five. Her total monthly income that she will budget based on is $4,000. Figure out your total monthly income. How long it would take to save the recommended three months salary in an emergency fund. Web learn about the 50 30 20 rule for budgeting your money. Allocate 50% of your income to essentials, 30% to wants, and 20% to savings. It balances paying for necessities with saving for emergencies and retirement. Web ready to make a financial plan and start budgeting while making sure you're contributing to your savings and investments? Read why its a great starter budget. With the free templates below, you can quickly see: Web master your monthly budget using the 50/30/20 budgeting method with these free. Make adjustment and stick to it! With the free templates below, you can quickly see: Web ready to make a financial plan and start budgeting while making sure you're contributing to your savings and investments? It balances paying for necessities with saving for emergencies and retirement. We’ll also show you how to create a 50/30/20 budget from scratch if you. Brittney gets paid $2,000 every 2 weeks. Web 50/30/20 budget calculator to plan your income and expenses. Make adjustment and stick to it! Here are some tips to help you categorize your expenses. You can change and edit it according to your needs. Essentials include things you simply. Limit you wants to 30% of your income. How long it would take to save the recommended three months salary in an emergency fund. The 50 30 20 budget rule is one of the most popular budgeting guides available. Read why its a great starter budget. Limit your needs to 50% of your income. Web ready to make a financial plan and start budgeting while making sure you're contributing to your savings and investments? Web interested in building your best budget yet? Web the 50/30/20 budget rule provides simple monthly spending guidelines that can help you make steady progress toward your financial goals. It balances paying. Her total monthly income that she will budget based on is $4,000. Limit you wants to 30% of your income. Get your free 50/30/20 budget spreadsheet here, along with a detailed overview and instructions. The 50% needs category is for all your monthly essentials. Web learn how to make a 50/30/20 budget template to separate your earnings into needs, wants, and savings. Here are some tips to help you categorize your expenses. Web if the thought of having a budget tracker with a predetermined formula excites you, then take a look at our review of some of our best 50/30/20 google sheets budget templates for you to get started in no time. Spend 20% of your income on savings and debt payments. The 50 30 20 budget rule is one of the most popular budgeting guides available. Web interested in building your best budget yet? Web the rule is a template that's intended to help individuals manage their money. Web ready to make a financial plan and start budgeting while making sure you're contributing to your savings and investments? 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Allocate 50% of your income to essentials, 30% to wants, and 20% to savings and debt repayment. Web the 50/30/20 budget rule provides simple monthly spending guidelines that can help you make steady progress toward your financial goals. All 15 are 100% free!Printable 503020 Budget Planner Template Monthly Budget Etsy

The 503020 Budget Method Defined Financial Best Life

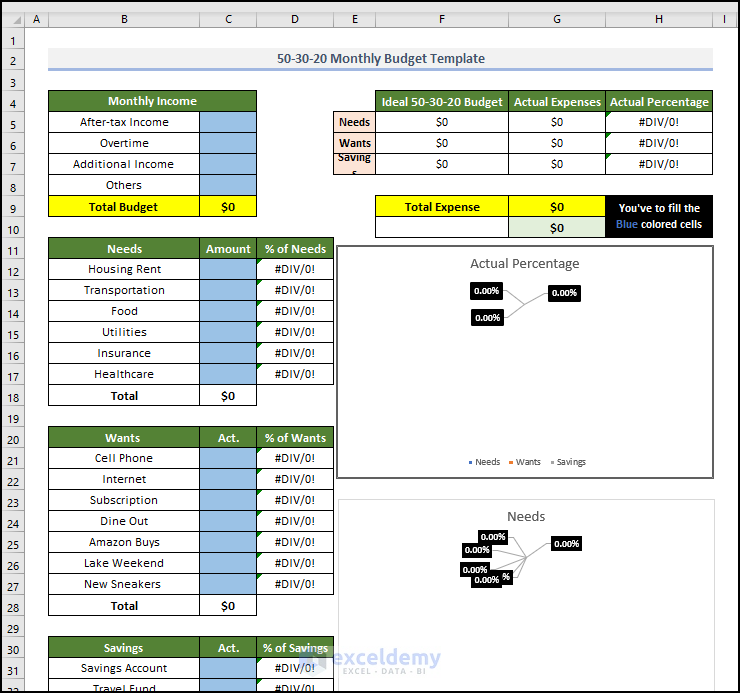

50 30 20 Template

50/30/20 Budget Template Google Sheets 503020 Monthly Budget

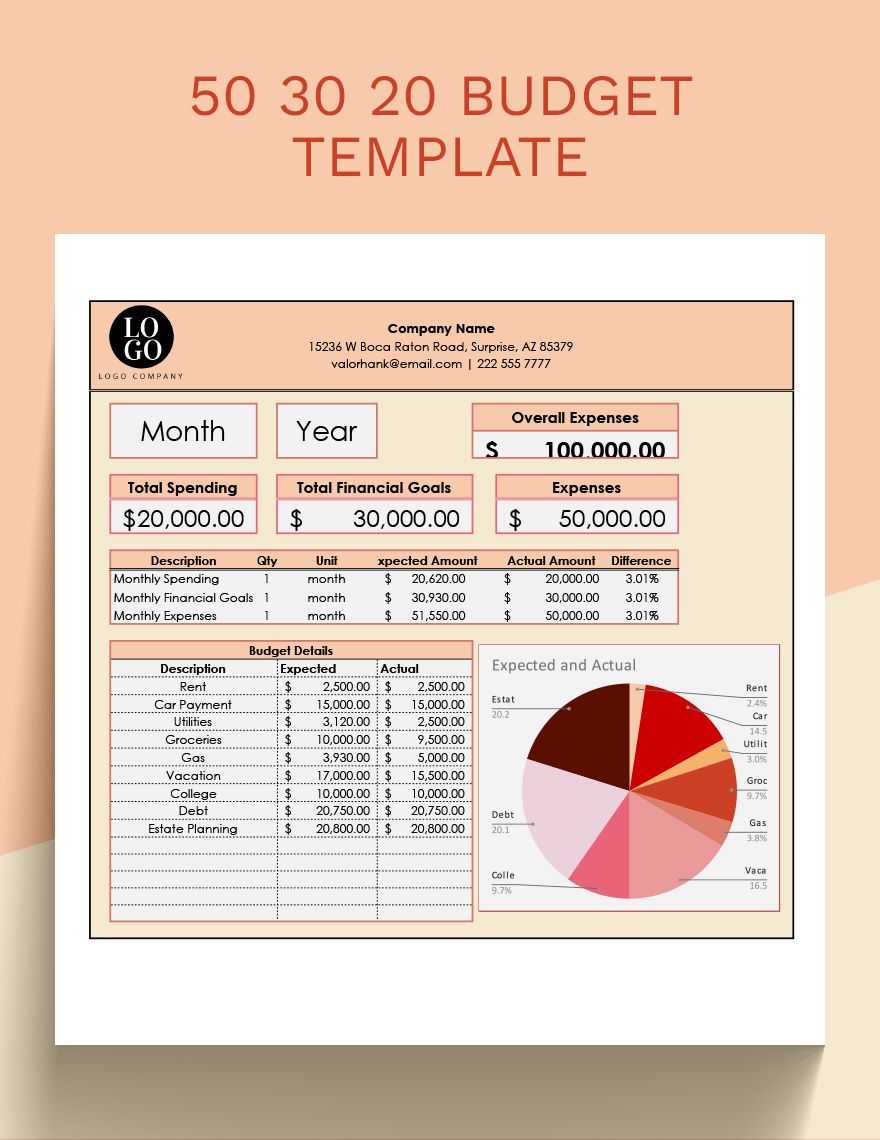

Printable 503020 Budget Template vrogue.co

50/30/20 Budget Template Printable, Monthly Budget Planner 50/30/20

503020 Budget Template Google Sheets vrogue.co

50/30/20 Budget Template Instant Download Printable

503020 Monthly Budget Spreadsheet Excel Budget Planner Google Sheets

503020 Budget Template Google Sheets vrogue.co

50% For Your Needs, 30% For Your Wants And 20% For Your Savings.

Brittney Gets Paid $2,000 Every 2 Weeks.

Figure Out Your Total Monthly Income.

50% For Needs, 30% For Wants, And Also 20% For Savings.

Related Post: