70 20 10 Budget Template

70 20 10 Budget Template - Web learn how to use the 70 20 10 budget method to divide your monthly income into three categories: Web the 70/20/10 budget rule is a money management strategy you can use to dictate where you want your income to go. With 70% allocated for daily living costs, 20% for savings and investment, and 10% for debt or giving, this method offers a balanced approach to managing your money. Needs (70%), wants (20%), and savings (10%). Web find the best budget template for your needs and preferences from this guide. Find out the pros and cons of this budgeting system and see examples and templates. Web like other budgeting guidelines, such as the 50/30/20 rule, the 70/20/10 budget offers a framework that tells you how much of your income to. $3,000 x.70 (1 = 100%, so.7 is 70%) = $2,100. 70 percent for living expenses, 20 percent for savings, and 10 percent for debt. Web get ahead in 2024 with our 70/20/10 monthly budget planner a free and editable google sheet and excel template. 20% of your income towards your savings. Web get ahead in 2024 with our 70/20/10 monthly budget planner a free and editable google sheet and excel template. Last, calculate the final 10%: Download now for seamless financial planning! 70% for living expenses, 20% for savings, and 10% for debt repayment or donations. Using the popular 70/20/10 budgeting method, allocate your finances into three main categories: Find out the advantages, disadvantages, and examples of this budgeting framework. Here's how to use the 70 20 10 rule budget to budget the easy way! Web the 40/30/20/10 rule is a budgeting strategy that aims to help you do that. Find out the pros and cons of this budgeting system and see examples and templates. Web learn how to use the 70/20/10 budget to divide your income into three categories: Web the 40/30/20/10 rule is a budgeting strategy that aims to help you do that. Download now for seamless financial planning! Find out the pros and cons of this budgeting system and see examples and templates. Web the 70/20/10 budget rule is a money management strategy you can use to dictate where you want your income to go. Learn the pros and cons of this system and how it can help you reach your financial goals. 20% of your income towards your savings. With 70% allocated for daily living costs, 20% for savings and investment, and 10% for debt or giving, this method offers a balanced approach to managing your money. 70 percent for living expenses, 20 percent for savings, and 10 percent for debt. The 40/30/20/10 rule is a simple budgeting strategy that divides your spending by categories, including an. Using the popular 70/20/10 budgeting method, allocate your finances into three main categories: Web to see how the 70/20/10 budget works, let’s use an example. Find out the advantages, disadvantages, and examples of this budgeting framework. Find out which categories to include, how to save and invest, and how to pay off debt faster. Download now for seamless financial planning! With 70% allocated for daily living costs, 20% for savings and investment, and 10% for debt or giving, this method offers a balanced approach to managing your money. Using the popular 70/20/10 budgeting method, allocate your finances into three main categories: $3,000 x.2 (1 = 100%, so.2 is 20%) = $600. This budgeting system makes it easy to create budget. Web the 40/30/20/10 rule is a budgeting strategy that aims to help you do that. Find out which categories to include, how to save and invest, and how to pay off debt faster. Get a free printable template and tips to follow this simple but effective budgeting method. Learn the pros and cons of this system and how it can. Web learn how to divide your income into three categories: Using the popular 70/20/10 budgeting method, allocate your finances into three main categories: 70 percent for living expenses, 20 percent for savings, and 10 percent for debt. Expenses, savings and debt payoff. Web find the best budget template for your needs and preferences from this guide. Web learn how to use the 70 20 10 budget method to divide your monthly income into three categories: This budgeting system makes it easy to create budget categories that you add money to each month. 70% for living expenses, 20% for savings, and 10% for debts or treats. Download now for seamless financial planning! Using the popular 70/20/10 budgeting. $3,000 x.2 (1 = 100%, so.2 is 20%) = $600. Here's how to use the 70 20 10 rule budget to budget the easy way! Needs (70%), wants (20%), and savings (10%). The 40/30/20/10 rule is a simple budgeting strategy that divides your spending by categories, including an. Using the popular 70/20/10 budgeting method, allocate your finances into three main. Learn the pros and cons of this system and how it can help you reach your financial goals. Web the 70/20/10 budget is a budgeting strategy that’s gained popularity in recent years. Web learn how to budget your income with the 70 20 10 rule, which divides your money into needs, wants, savings, and debt repayment or donations. Download now. In this blog, we'll delve into the budgeting concept, explore how it can benefit your. Web find the best budget template for your needs and preferences from this guide. 70% of your income towards your monthly spending. Web learn how to use the 70/20/10 budgeting method to manage your income, expenses, savings, debt and donations. Spending, saving and debt payoff. Web like other budgeting guidelines, such as the 50/30/20 rule, the 70/20/10 budget offers a framework that tells you how much of your income to. Find out the pros and cons of this budgeting system and see examples and templates. Web to see how the 70/20/10 budget works, let’s use an example. Find out the advantages, disadvantages, and examples of. Web learn how to use the 70/20/10 budgeting method to manage your income, expenses, savings, debt and donations. Learn the pros and cons of this system and how it can help you reach your financial goals. Web learn how to divide your income into three categories: When learning about this rule, you may discover that there are a number of. Needs (70%), wants (20%), and savings (10%). In this blog, we'll delve into the budgeting concept, explore how it can benefit your. Spending, saving and debt repayment/giving. 70 percent for living expenses, 20 percent for savings, and 10 percent for debt. Web learn how to budget your income with the 70 20 10 rule, which divides your money into needs, wants, savings, and debt repayment or donations. $3,000 x.70 (1 = 100%, so.7 is 70%) = $2,100. Web find the best budget template for your needs and preferences from this guide. Allocate 70% for needs, 20% for savings, and 10% for wants to achieve financial stability. Web the 40/30/20/10 rule is a budgeting strategy that aims to help you do that. Web learn how to use the 70/20/10 budget to divide your income into three categories: Web get ahead in 2024 with our 70/20/10 monthly budget planner a free and editable google sheet and excel template. Web to see how the 70/20/10 budget works, let’s use an example. Spending, saving and debt payoff. Web the 70/20/10 budget rule is a money management strategy you can use to dictate where you want your income to go. Find out who can benefit from this rule, how to adjust it, and what other budgeting methods to blend with it. Find out the advantages, disadvantages, and examples of this budgeting framework.Easy Beginner Guide on the 70/20/10 Budget (Free Printable)

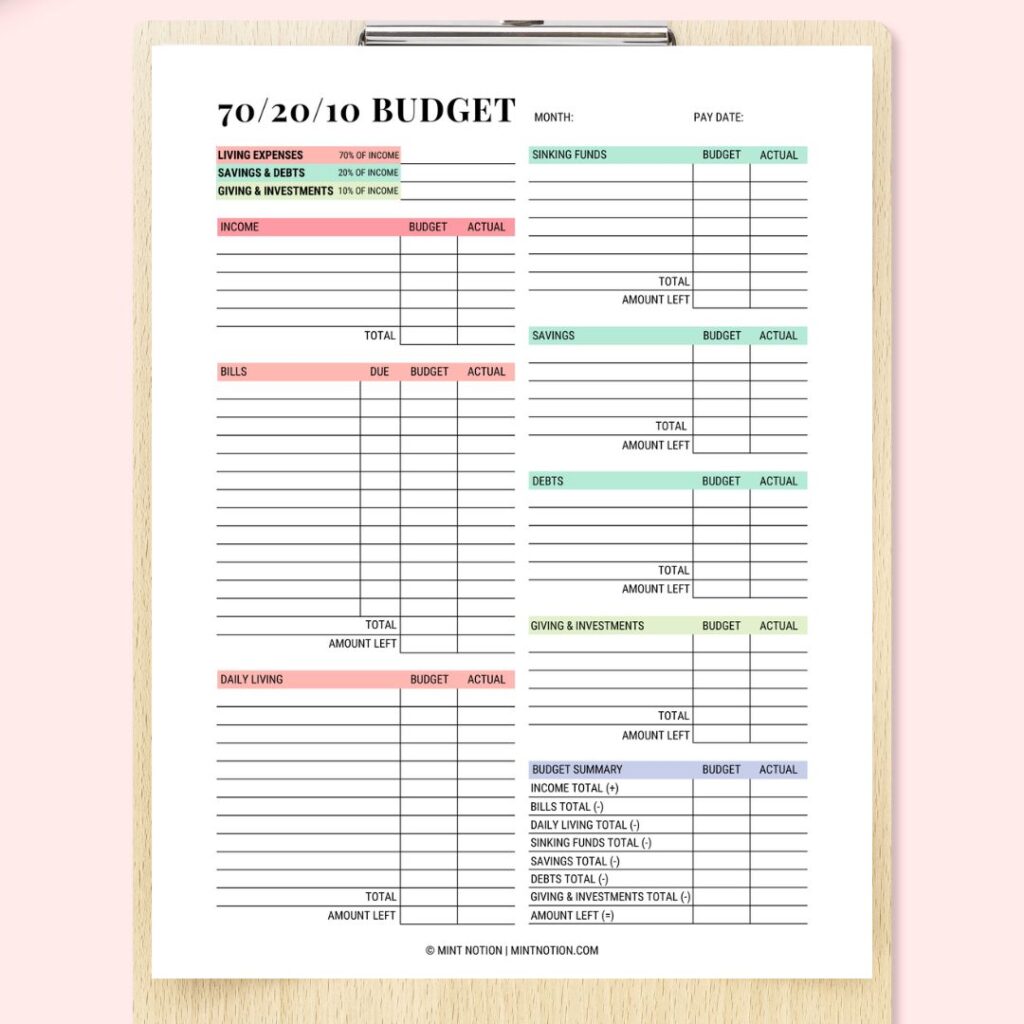

What is the 702010 Budget Rule? Mint Notion

70 20 10 Rule Budget (What is It & How Does it Work?)

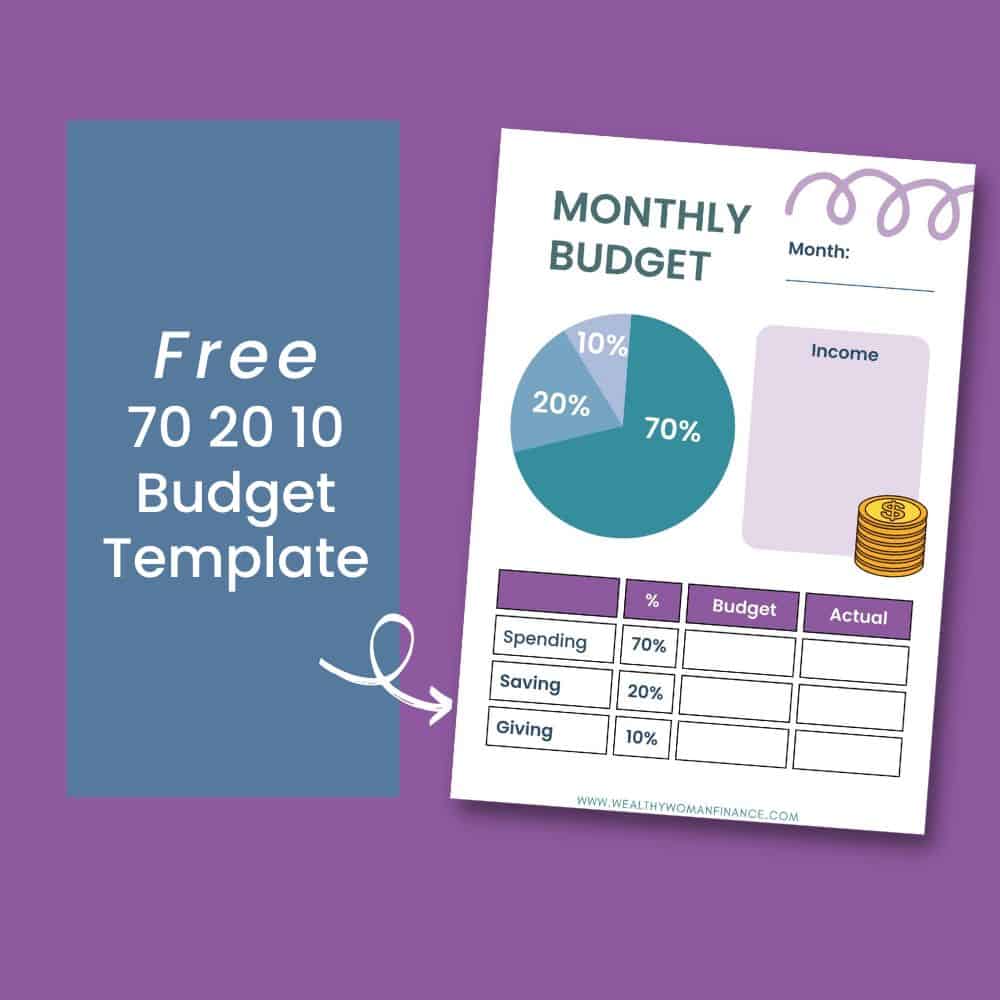

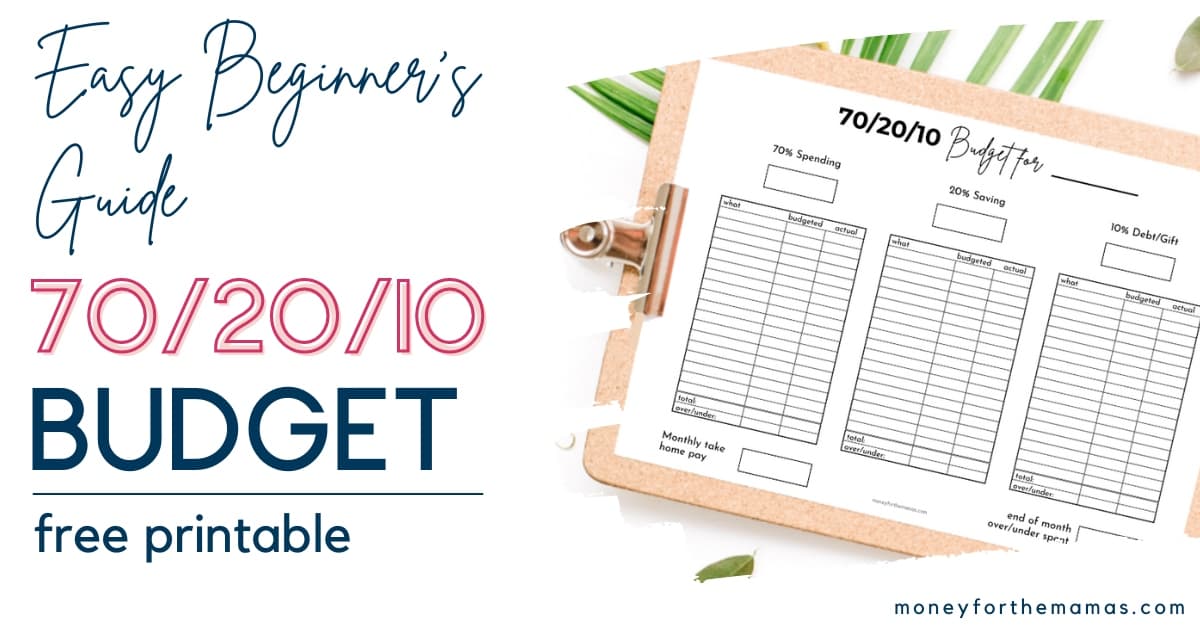

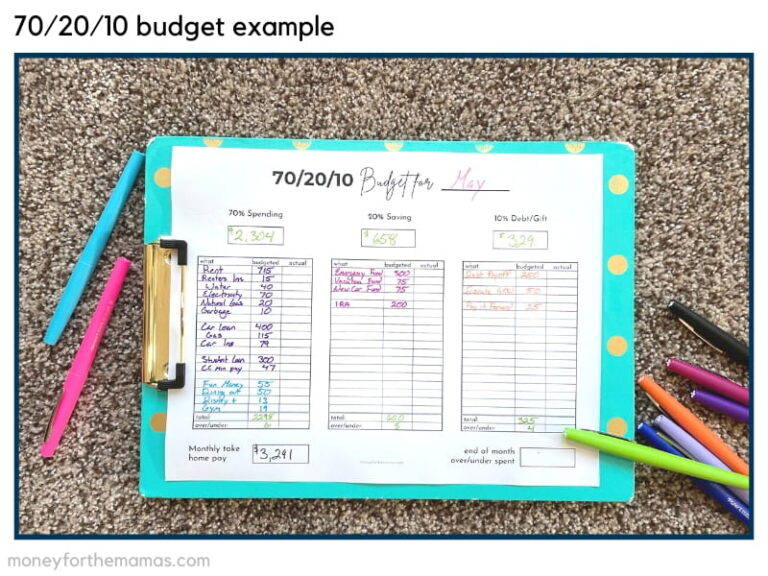

Easy Beginner Guide on the 70/20/10 Budget (Free Printable)

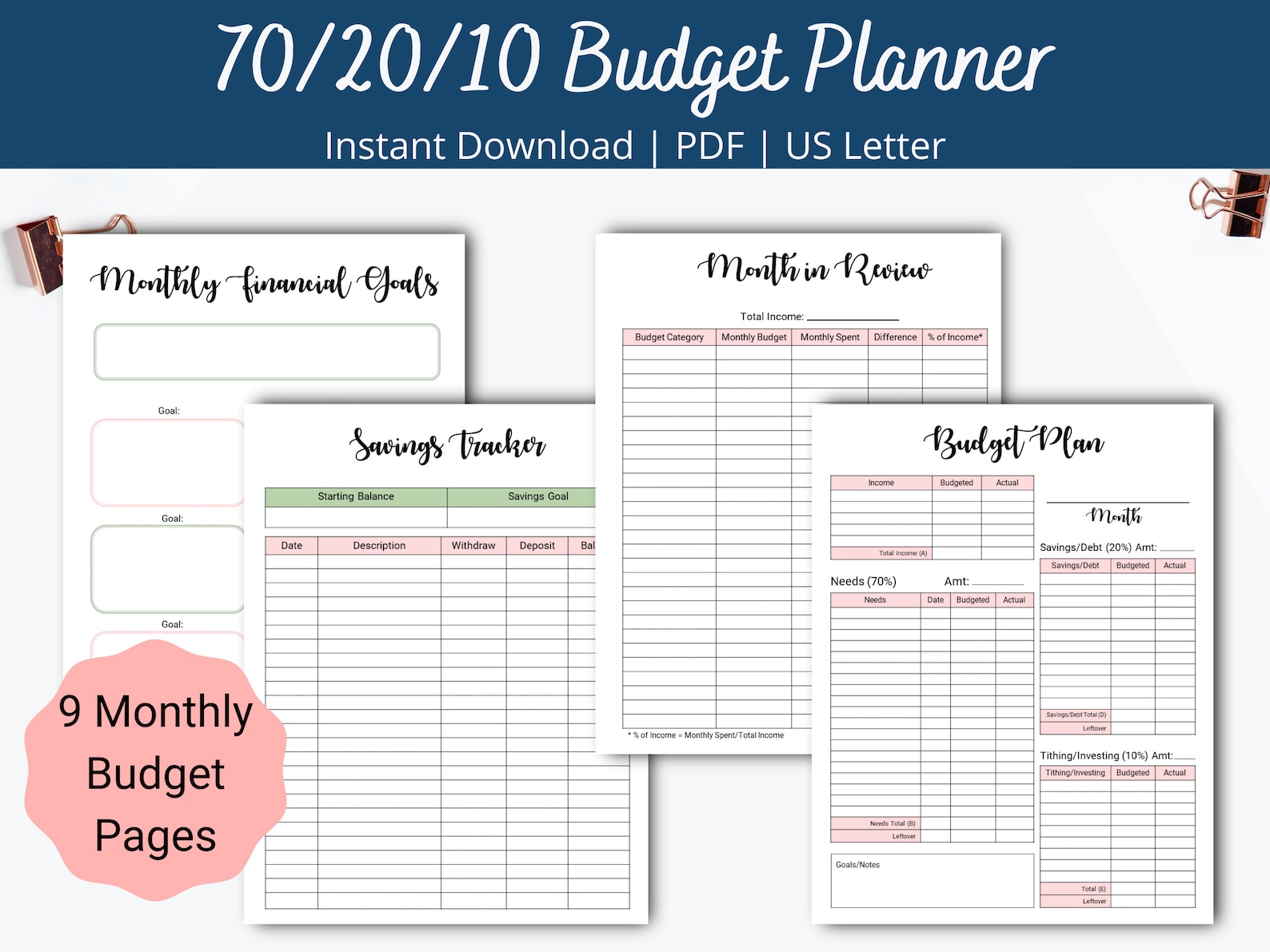

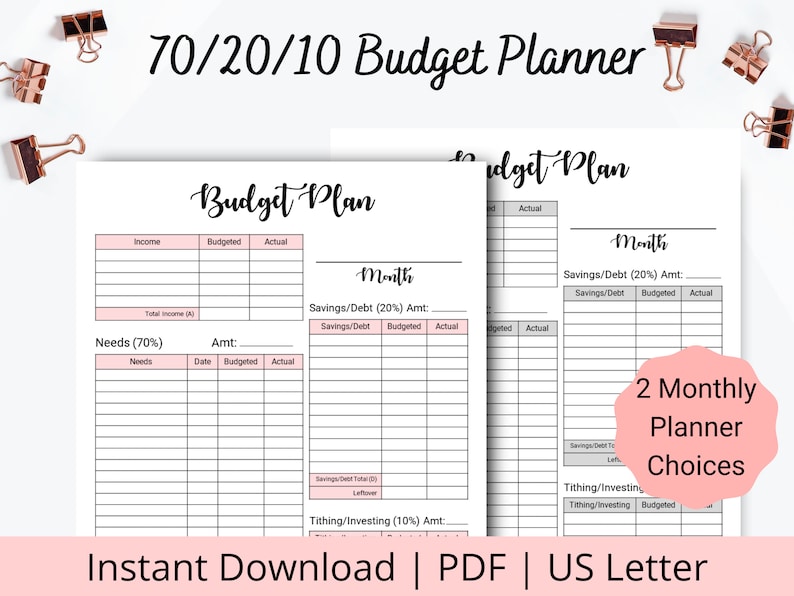

70 20 10 Budget Planner, Budget Printable Template, ,monthly Budget

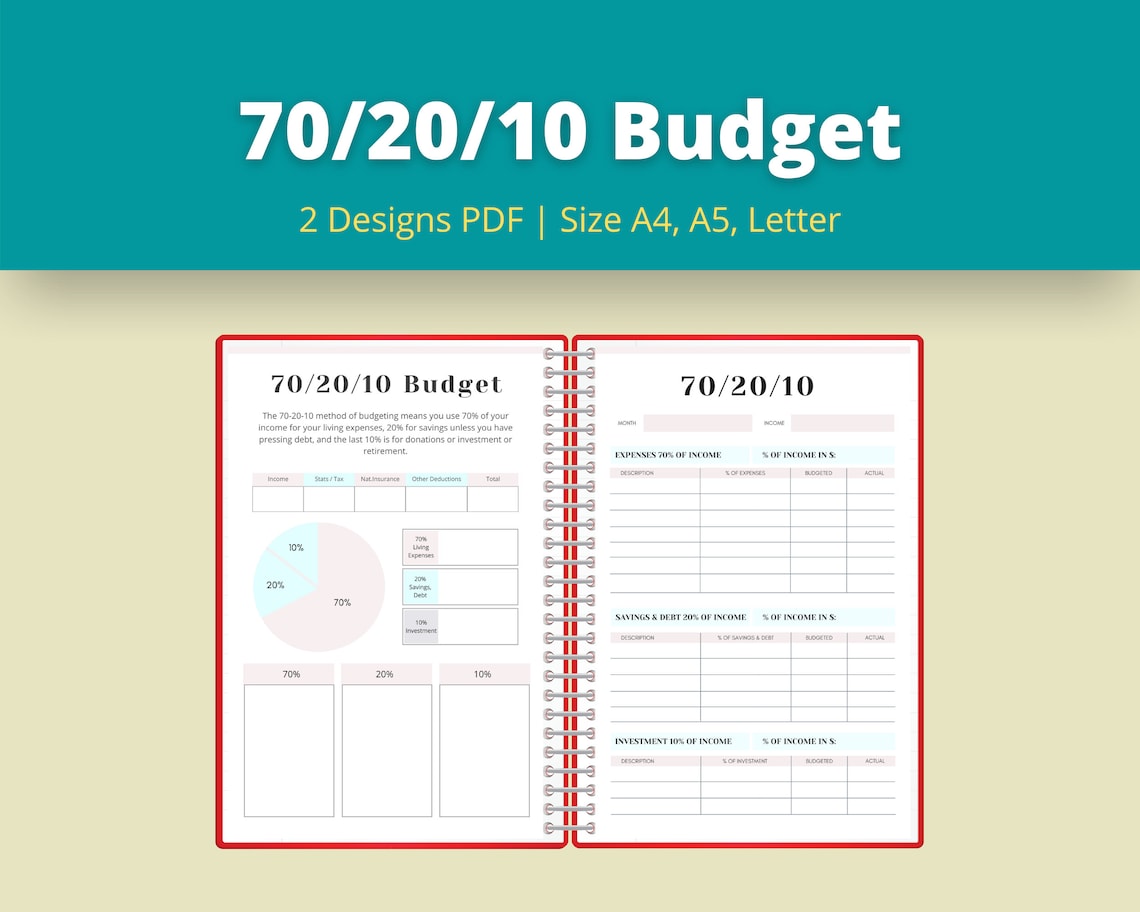

70 20 10 Budget Planner 70 20 10 Budget Printable Monthly Budget

Easy Beginner Guide on the 70/20/10 Budget (Free Printable)

70 20 10 Budget Printable 70 20 10 Budget Planner Monthly Budget

70/20/10 Budget Planner 70 20 10 Template 70 20 10 Method Etsy

Easy Beginner Guide on the 70/20/10 Budget (Free Printable)

It's Similar To The Popular 50/30/20 Rule But Incorporates A Giving Back Component That Can Make It Easier To Budget Funds To Support A Charity Or Nonprofit.

20% Of Your Income Towards Your Savings.

Web Learn How To Use The 70/20/10 Budget Rule To Manage Your Finances Effectively.

Learn The Pros And Cons Of This System And How It Can Help You Reach Your Financial Goals.

Related Post: