Accountable Plan Template

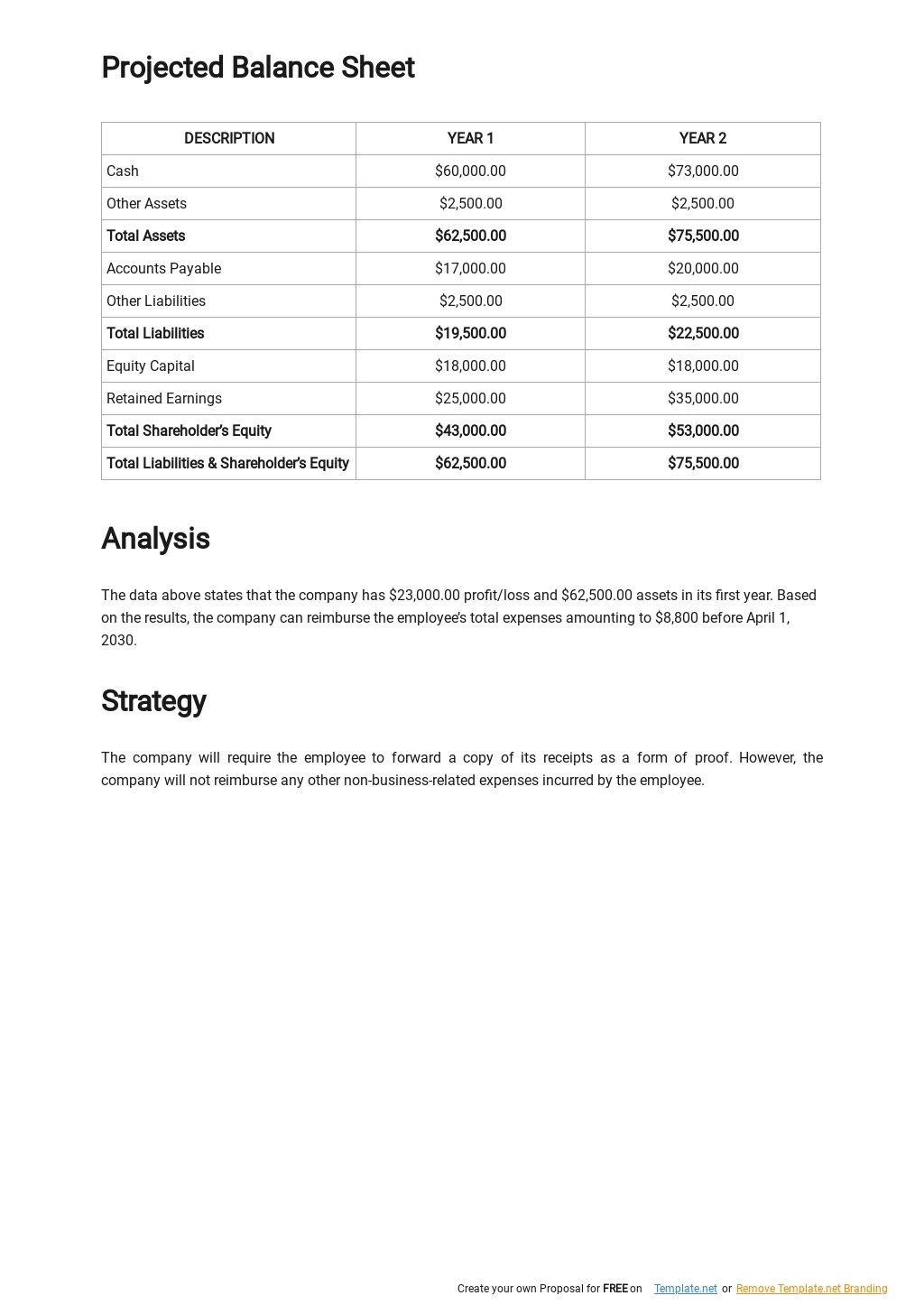

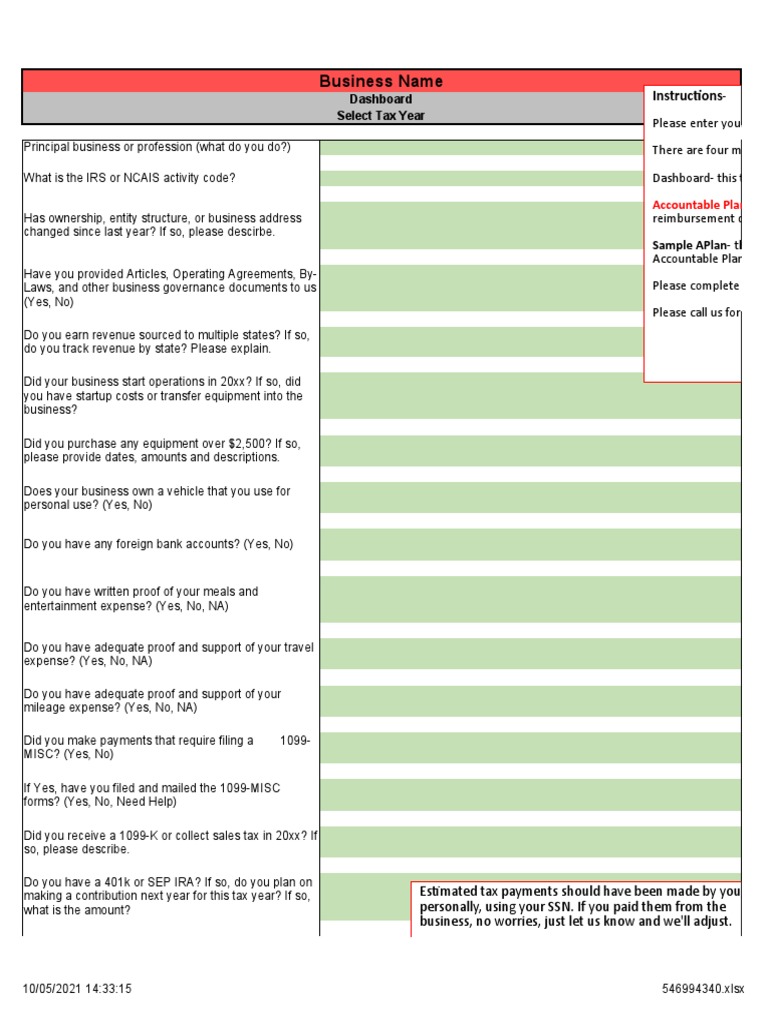

Accountable Plan Template - Web if this sounds like you, an irs accountable plan might be your solution. (1) a clear statement of the plan’s purpose, (2) a description of the eligible expenses and the business connection, (3) the documentation and substantiation requirements for employees to prove their expenses, (4) the deadlines for submitting. Web agreement to adopt an accountable plan part i: Did you know that the tax cuts and jobs act (tcja) eliminated itemized deductions for employees who incur unreimbursed expenses for company business for 2018 through 2025? Web an accountable plan is a reimbursement policy and expense reporting system that allows owners and their employees to turn in expense reports to the business for reimbursement in a way that keeps those amounts from being counted as taxable income. Web an accountable plan template should include the following critical elements to meet irs standards: Web an accountable plan is a document created by a business that outlines company policies on reimbursable business expenses for the employees. Web the accountable plan is usually drafted as a business policy and later adopted through corporate minutes, if your underlying entity is a corporation, and the plan satisfies three basic irs requirements: Accountable plans are not subject to taxation, as they are not considered a form of workers'. Except as otherwise noted in part ii below, any person now or hereafter employed by _____ We call this our simplified biz ops worksheet or sbo for short. Accountable plan desires to establish an expense reimbursement policy pursuant to reg. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to expense reimbursements. Web sample accountable plan for business expense reimbursement. Web sample accountable plan for business expense reimbursement. Web an accountable plan is an arrangement between employers and employees where the company reimburses employees for specified business expenses. This document can be used as a guide to draft an accountable plan for expense reimbursements however, it is merely an example, and it is not meant to be adopted or adapted without consulting appropriate legal counsel. Did you know that the tax cuts and jobs act (tcja) eliminated itemized deductions for employees who incur unreimbursed expenses for company business for 2018 through 2025? This document can be used as a guide to draft an accountable plan for expense reimbursements however, it is merely an example, and it is not meant to be adopted or adapted without consulting appropriate legal counsel. Web agreement to adopt an accountable plan part i: Use the template to create your own policy for the benefits you want to implement so you can roll them out to employees successfully. Web an accountable plan is an arrangement between employers and employees where the company reimburses employees for specified business expenses. Web the accountable plan is usually drafted as a business policy and later adopted through corporate minutes, if your underlying entity is a corporation, and the plan satisfies three basic irs requirements: Web sample accountable plan for business expense reimbursement. Accountable plans are simple to qualify for and benefit employers and employees. Web an accountable plan is a reimbursement policy and expense reporting system that allows owners and their employees to turn in expense reports to the business for reimbursement in a way that keeps those amounts from being counted as taxable income. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to expense reimbursements. Agreement to adopt an accountable plan. Except as otherwise noted in part ii below, any person now or hereafter employed by _____ Accountable plans are not subject to taxation, as they are not considered a form of workers'. Web if this sounds like you, an irs accountable plan might be your solution. Web an accountable plan is a reimbursement policy and expense reporting system that allows owners and their employees to turn in expense reports to the business for reimbursement in a way that keeps those amounts from being counted as taxable income. Agreement to adopt an accountable. We call this our simplified biz ops worksheet or sbo for short. Web sample accountable plan for business expense reimbursement. Web the accountable plan is usually drafted as a business policy and later adopted through corporate minutes, if your underlying entity is a corporation, and the plan satisfies three basic irs requirements: Use the template to create your own policy. An accountable plan allows businesses to reimburse employees, owners, and shareholders for business expenses, including any home office expenses they incur. We call this our simplified biz ops worksheet or sbo for short. This article covers what an accountable plan is, the benefits of having one, and tips for setting yours up. Web an accountable plan is an arrangement between. Web sample accountable plan for business expense reimbursement. This document can be used as a guide to draft an accountable plan for expense reimbursements however, it is merely an example, and it is not meant to be adopted or adapted without consulting appropriate legal counsel. An accountable plan allows businesses to reimburse employees, owners, and shareholders for business expenses, including. This article covers what an accountable plan is, the benefits of having one, and tips for setting yours up. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to expense reimbursements. This document can be used as a guide to draft. Web an accountable plan is a reimbursement policy and expense reporting system that allows owners and their employees to turn in expense reports to the business for reimbursement in a way that keeps those amounts from being counted as taxable income. Here’s how the accountable plan. Accountable plan desires to establish an expense reimbursement policy pursuant to reg. Accountable plans. The business is then able to deduct those reimbursed amounts as if the business had incurred the initial expense, itself. An accountable plan allows businesses to reimburse employees, owners, and shareholders for business expenses, including any home office expenses they incur. This document can be used as a guide to draft an accountable plan for expense reimbursements however, it is. Web an accountable plan is an arrangement between employers and employees where the company reimburses employees for specified business expenses. Fill out this worksheet regularly, like every quarter, to help with accurate tax planning and keeping good records. Use the template to create your own policy for the benefits you want to implement so you can roll them out to. Web an accountable plan template should include the following critical elements to meet irs standards: Web if this sounds like you, an irs accountable plan might be your solution. The business is then able to deduct those reimbursed amounts as if the business had incurred the initial expense, itself. (1) a clear statement of the plan’s purpose, (2) a description. Web agreement to adopt an accountable plan part i: Desires to establish an expense reimbursement policy pursuant to reg. Web sample accountable plan for business expense reimbursement. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to expense reimbursements. Web an. We call this our simplified biz ops worksheet or sbo for short. Fill out this worksheet regularly, like every quarter, to help with accurate tax planning and keeping good records. Accountable plans are not subject to taxation, as they are not considered a form of workers'. This document can be used as a guide to draft an accountable plan for expense reimbursements however, it is merely an example, and it is not meant to be adopted or adapted without consulting appropriate legal counsel. Accountable plans are simple to qualify for and benefit employers and employees. Except as otherwise noted in part ii below, any person now or hereafter employed by _____ Web an accountable plan is a reimbursement policy and expense reporting system that allows owners and their employees to turn in expense reports to the business for reimbursement in a way that keeps those amounts from being counted as taxable income. Agreement to adopt an accountable plan. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to expense reimbursements. Web an accountable plan is a plan that follows the internal revenue service (irs) regulations for reimbursing workers for business expenses in which reimbursement is not counted as income. Did you know that the tax cuts and jobs act (tcja) eliminated itemized deductions for employees who incur unreimbursed expenses for company business for 2018 through 2025? Web agreement to adopt an accountable plan part i: This article covers what an accountable plan is, the benefits of having one, and tips for setting yours up. Web the accountable plan is usually drafted as a business policy and later adopted through corporate minutes, if your underlying entity is a corporation, and the plan satisfies three basic irs requirements: Web by crafting a reimbursement policy that adheres to irs accountable plan rules, you’re building a systematized process through which employee reimbursements can be excluded from the employee’s taxable income and, by extension, from the employer’s wage base for. This means that reimbursements are not subject to.Accountable Plan Excel Template PDF Expense Payments

Accountable Plan Template

Accountable Plan Template

Accountable Plan Templates in Word FREE Download

Fillable Online Accountable Plan Expense Reimbursement Form WCG CPAs

Accountable Plan Template [Free PDF]

Accountable Plan Template

Accountable Plan In Word Free Template Download Templ vrogue.co

Accountability Plan Template

Accountable Plan Template

(1) A Clear Statement Of The Plan’s Purpose, (2) A Description Of The Eligible Expenses And The Business Connection, (3) The Documentation And Substantiation Requirements For Employees To Prove Their Expenses, (4) The Deadlines For Submitting.

Here’s How The Accountable Plan.

Web If This Sounds Like You, An Irs Accountable Plan Might Be Your Solution.

Web An Accountable Plan Template Should Include The Following Critical Elements To Meet Irs Standards:

Related Post:

![Accountable Plan Template [Free PDF]](https://images.template.net/62889/Accountable-Plan-Template-1.jpeg)