B Notice Template

B Notice Template - Failure to comply and rectify the 1099 filing can result in withholdings, penalties, or audits. Try taxrobot, get an r&d credit of up to $250,000. Web send first b notice template via email, link, or fax. Web first b notice form pdf details. You must have the irs or ssa validate your taxpayer identification number and return it to us before _____. Web customize and download this first b notice. Identify and review the payee’s name and tin listed on the notice. Web however, i wanted to share with you some best practices and tips from the episode: Web a first b notice is defined as a name and tin combination that hasn't been identified in a b notice received within the last three calendar years. Applied significant penalties for noncompliance. An individual’s tin is his or her social security number (ssn). Web also known as an irs b notice, the irs notifies the 1099 filer that a name and taxpayer identification number (tin) don’t match the irs database and need correction. Built a process around identifying mismatches. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. You can also download it, export it or print it out. Compare this information with your records and with irs records. Web templates should be created with approved messaging to send to b notice recipients that will request the proper information. The irs provides a template letter in publication 1281 that can be useful for this purpose. Web this notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Web customize and download this first b notice. Identify and review the payee’s name and tin listed on the notice. Edit your b notice template online. If your business receives a cp2100 or cp2100a notice, you must take the following steps: You should update your account records if the payee sends corrected information. Otherwise, payment hold or withholding will begin. When you receive the first irs notice, you should follow these steps: Try taxrobot, get an r&d credit of up to $250,000. Add “important tax document enclosed” to the envelope, increasing the potential that your vendor will open it. Web find out what to do if you become subject to a backup withholding b program due to a payee failing to furnish their correct taxpayer identification number. Web however, i wanted to share with you some best practices and tips from the episode: Web to resolve this issue, the irs has taken three key steps: Compare this information with your records and with irs records. An individual’s tin is his or her social security number (ssn). What does a b notice look like? Built a process around identifying mismatches. Created procedures for filers to resolve issues. What does a b notice look like? Web this notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Payers that issue 1099s to freelance and gig workers (payees) may receive an irs b notice if the irs finds mismatches for taxpayer. Web this notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. You can also download it, export it or print it out. Applied significant penalties for noncompliance. An individual’s tin is his or her social security number (ssn). Web what is a b notice (i.e., cp2100 or 972cg)? The first b notice is a critical notification that alerts individuals and entities about discrepancies between their account information and the data held by the internal revenue service (irs) or the social security administration (ssa). Otherwise, payment hold or withholding will begin. Web this notice tells you how to help us make your account records accurate and how to avoid. Identify and review the payee’s name and tin listed on the notice. The first b notice is a critical notification that alerts individuals and entities about discrepancies between their account information and the data held by the internal revenue service (irs) or the social security administration (ssa). Web this notice tells you how to help us make your account records. If your business receives a cp2100 or cp2100a notice, you must take the following steps: Web what is a b notice (i.e., cp2100 or 972cg)? Web to resolve this issue, the irs has taken three key steps: This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Draw. Web send first b notice template via email, link, or fax. Web templates should be created with approved messaging to send to b notice recipients that will request the proper information. Web find out what to do if you become subject to a backup withholding b program due to a payee failing to furnish their correct taxpayer identification number. If. When a form 1099 is filed, the irs undergoes a process to match the recipient name and tin information listed on the form 1099 they receive with the irs database. Why your tin may be considered as incorrect? Try taxrobot, get an r&d credit of up to $250,000. Sign it in a few clicks. Web in addition to backup withholding,. When you receive the first irs notice, you should follow these steps: Failure to comply and rectify the 1099 filing can result in withholdings, penalties, or audits. You must have the irs or ssa validate your taxpayer identification number and return it to us before _____. Web to resolve this issue, the irs has taken three key steps: The result. Web this notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. You must have the irs or ssa validate your taxpayer identification number and return it to us before _____. Web irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to. Created procedures for filers to resolve issues. Built a process around identifying mismatches. Web any missing or incorrect information can trigger a “b” notice. The result of this effort is a b notice. The first b notice is a critical notification that alerts individuals and entities about discrepancies between their account information and the data held by the internal revenue service (irs) or the social security administration (ssa). When you receive the first irs notice, you should follow these steps: Web this notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Otherwise, payment hold or withholding will begin. This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Web a backup withholding notice, sometimes called a b notice, states that the nonemployee's taxpayer id number is either missing or incorrect. You must have the irs or ssa validate your taxpayer identification number and return it to us before _____. Web this notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty. Web what is a b notice (i.e., cp2100 or 972cg)? Web the backup withholding rate is 28%. What does a b notice look like? Edit your b notice template online.FREE Notice Templates & Examples Edit Online & Download

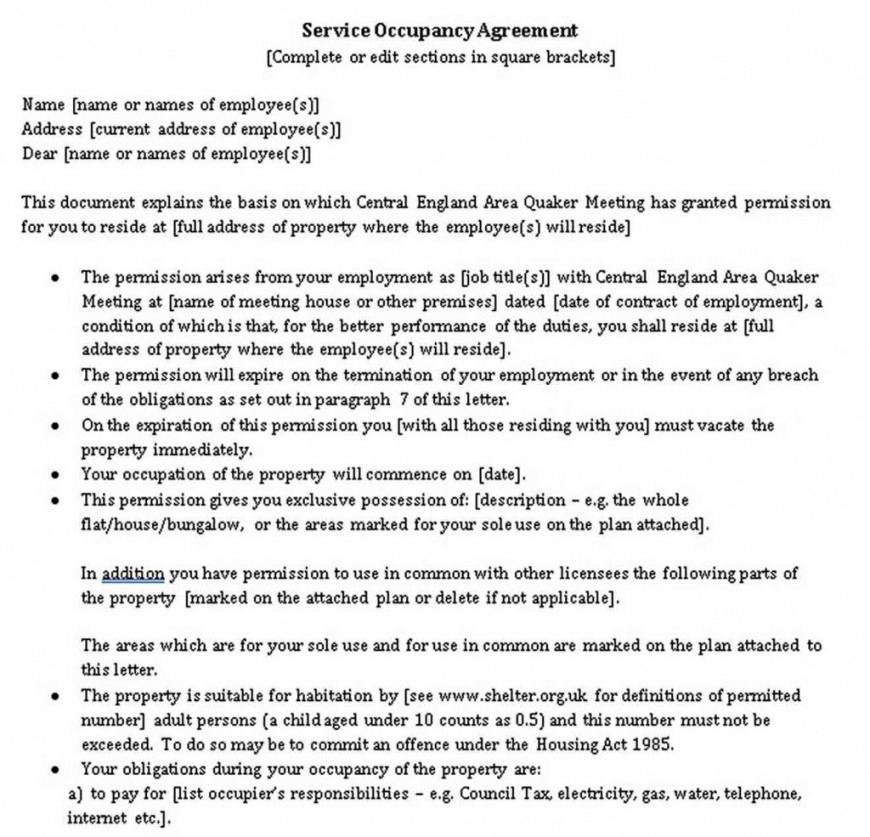

First B Notice Form Template Word

B Notice Form Complete with ease airSlate SignNow

Free Two Weeks Notice Letter Template Printable Templates

B Notice Irs Fill Online, Printable, Fillable, Blank pdfFiller

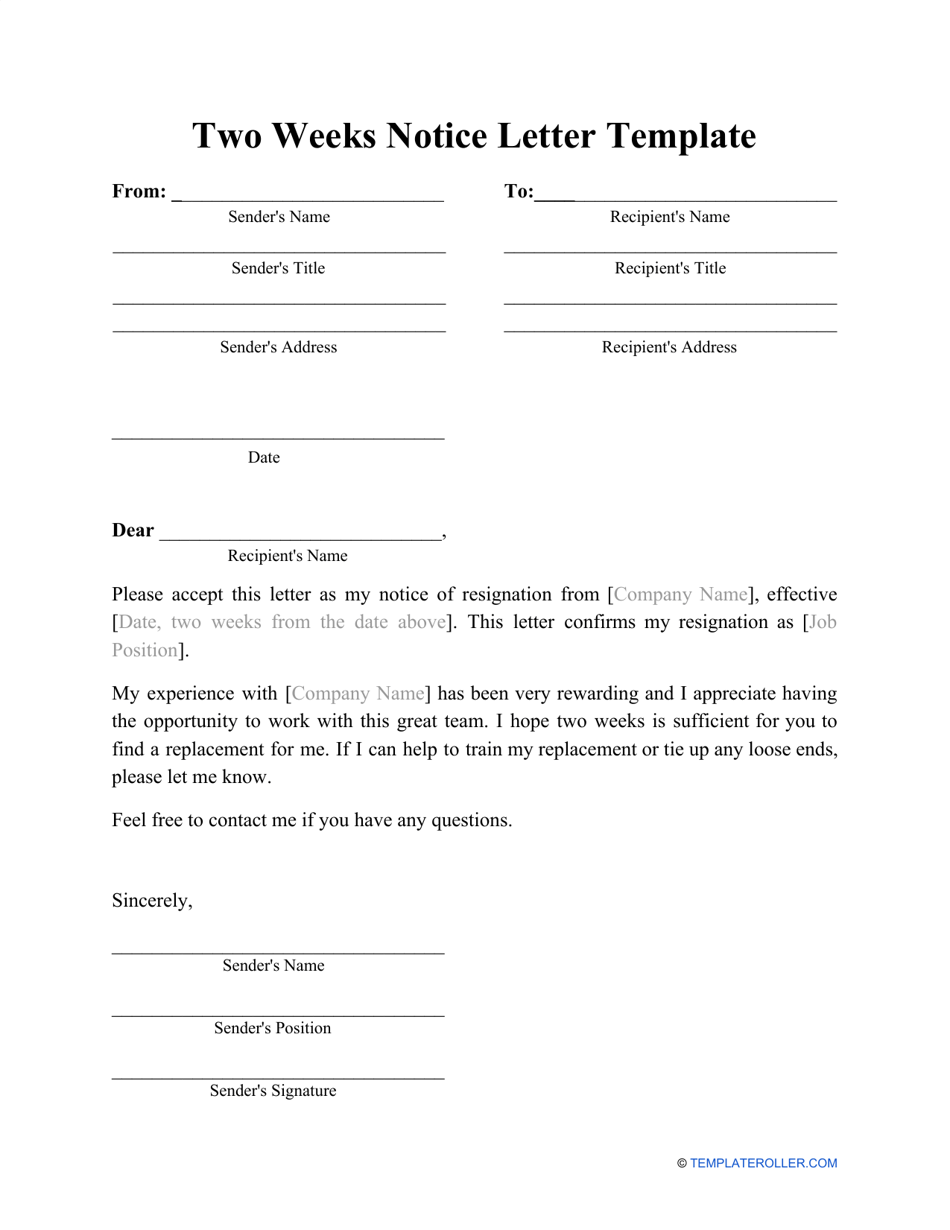

Two Weeks Notice Letter Template Download Printable PDF Templateroller

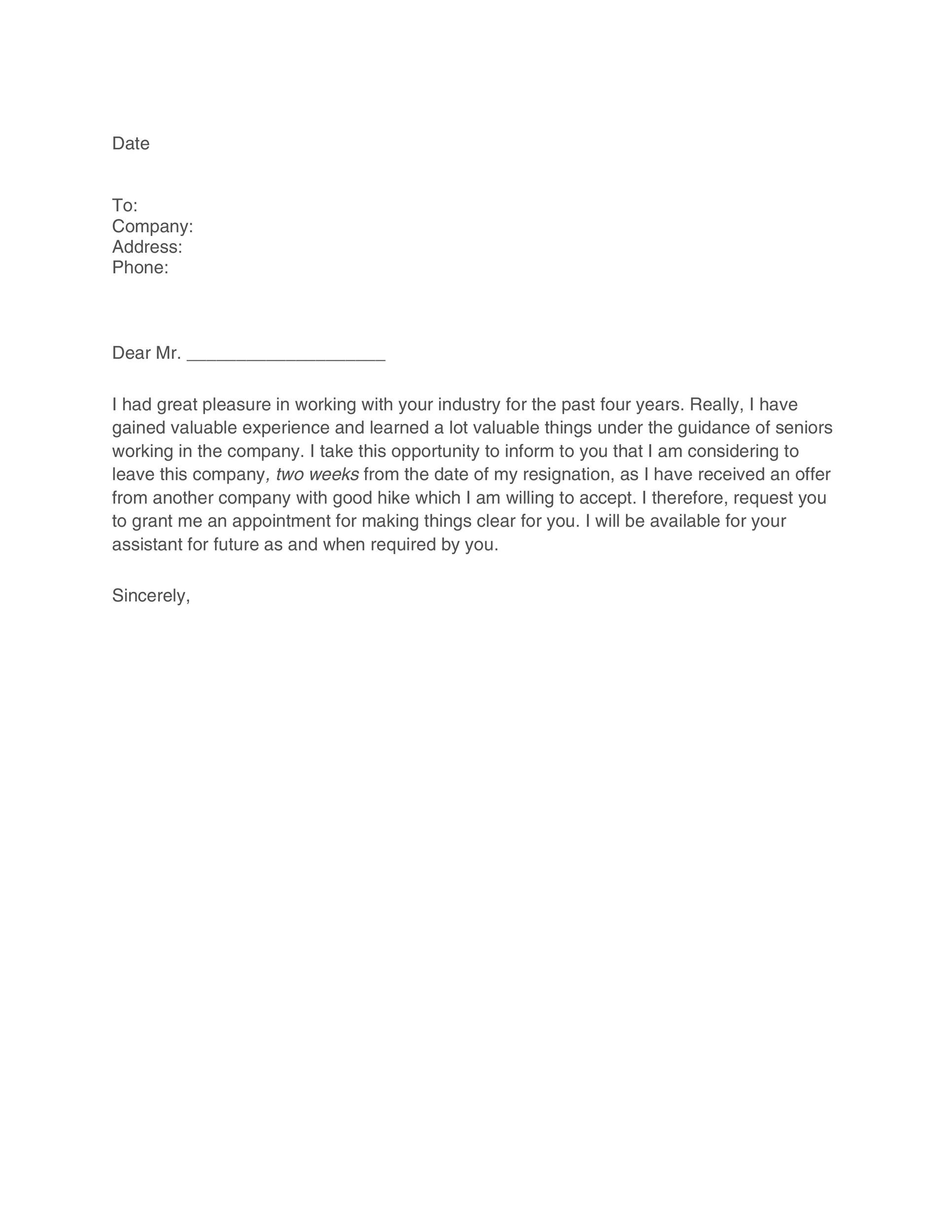

Two Weeks’ Notice Letter Template—Free Download Smallpdf

Two Week Notice Template Word Card Template

First B Notice Form Template Word

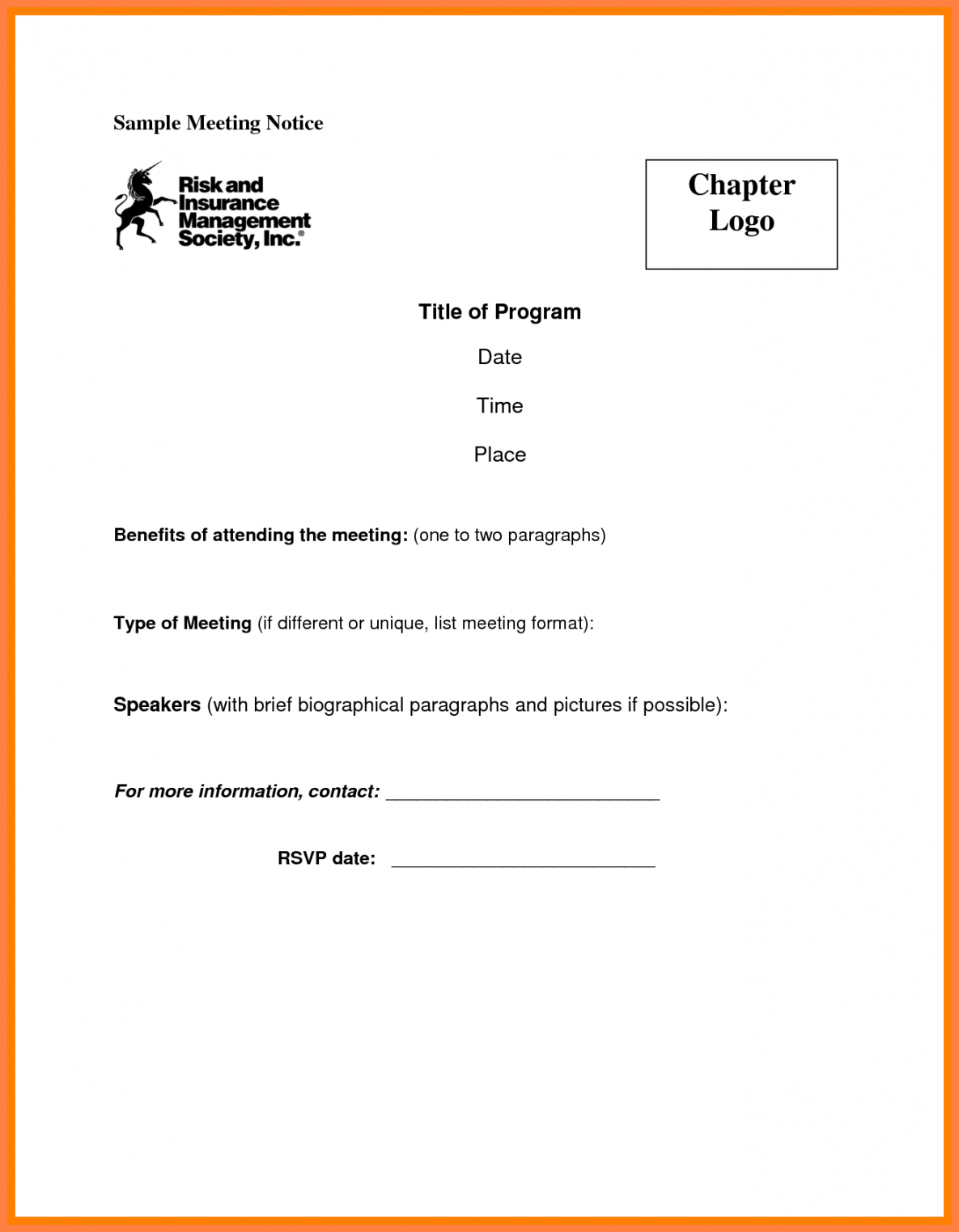

Amazing Meeting Notice Template Launcheffecthouston

Web Find Out What To Do If You Become Subject To A Backup Withholding B Program Due To A Payee Failing To Furnish Their Correct Taxpayer Identification Number.

In Addition To Backup Withholding, You May Be Subject To A $50 Penalty By The Irs For Failing To Give Us Your Correct Name/Tin Combination.

Web What Is An Irs B Notice?

A “B” Notice Is A Backup Withholding Notice And Is Sent To A Filer Of Forms 1099.

Related Post: