Bank Reconciliation Template

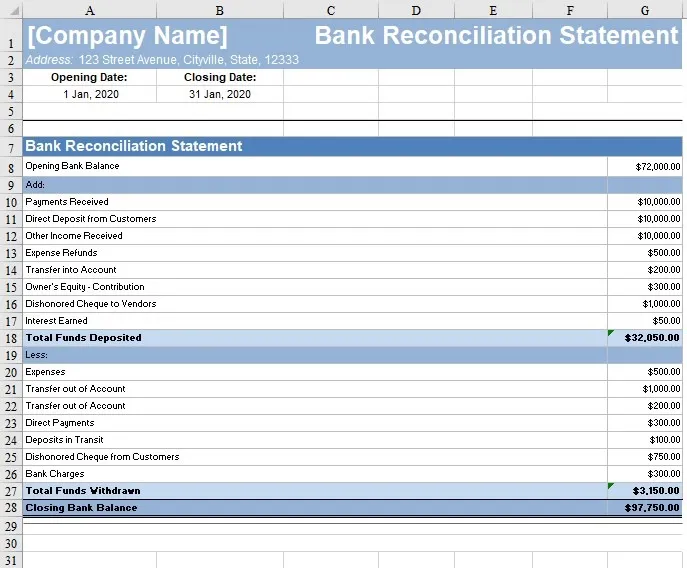

Bank Reconciliation Template - Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Utilizing a robust set of functions, our template empowers you to organize, reconcile, and understand your financial status with incredible ease and accuracy. Learn how to create your own reconciliation template and streamline your financial processes. And the template will automatically display the difference. This can cut hours or even days off the monthly close, depending on how many accounts you have to reconcile and how active they are. Web the purpose of a bank reconciliation template is to help individuals or businesses reconcile their bank statements with their internal financial records. The statement outlines the deposits, withdrawals, and other activities affecting a bank account for a specific period. For more financial management tools, download cash flow and other accounting templates. How you choose to perform a bank reconciliation depends on how you track your. Reconciling the two accounts helps identify whether accounting changes are needed. Web this template streamlines the process of reconciling your bank statements and accounts in microsoft excel. A bank reconciliation statement is a document that compares or reconciles the company’s bank account with its financial records and provides a summary of all banking information and business activities. Web this bank reconciliation statement template shows you how to calculate the adjusted cash balance using the bank statement and a company's accounting record. Learn how to create your own reconciliation template and streamline your financial processes. Web we offer a selection of four distinct bank reconciliation sheet templates, each designed to meet specific needs. Web 14 free bank reconciliation templates in excel. This can cut hours or even days off the monthly close, depending on how many accounts you have to reconcile and how active they are. For more financial management tools, download cash flow and other accounting templates. It lists all bank account transactions for a given time frame, including deposits, withdrawals, bank. You’ll need a few items to perform a bank reconciliation, including your bank statement, internal accounting records, and a record of any pending cash transactions (either inflows or outflows). It shows what transactions have cleared on your statement with the corresponding transaction listed in your journal. Web efficiently manage your finances with our collection of 13 free bank reconciliation templates for excel and google sheets. This can cut hours or even days off the monthly close, depending on how many accounts you have to reconcile and how active they are. A bank reconciliation statement is a document that compares or reconciles the company’s bank account with its financial records and provides a summary of all banking information and business activities. Web this template streamlines the process of reconciling your bank statements and accounts in microsoft excel. Learn how to create your own reconciliation template and streamline your financial processes. Web this bank reconciliation statement template shows you how to calculate the adjusted cash balance using the bank statement and a company's accounting record. You can also download the bank reconciliation template. Web 14 free bank reconciliation templates in excel. Web this article will help you learn all about bank reconciliation, bank reconciliation forms and even how to prepare a good bank reconciliation example. Web how to do a bank reconciliation. Web efficiently manage your finances with our collection of 13 free bank reconciliation templates for excel and google sheets. Choose your method for reconciliation. Web this article demonstrates how to do bank reconciliation in excel with easy steps. Web this bank reconciliation template enables finance and accounting teams at tech companies to: Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Web this template streamlines the process of reconciling your bank statements and accounts in microsoft excel. It lists all bank account transactions for a given time frame, including deposits, withdrawals, bank. You can also download the bank reconciliation template. You’ll need a few items to perform. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Learn how to create your own reconciliation template and streamline your financial processes. Includes a free excel bank reconciliation statement template. Utilizing a robust set of functions, our template empowers you to organize, reconcile, and understand your financial status with incredible ease and accuracy. This can. Utilizing a robust set of functions, our template empowers you to organize, reconcile, and understand your financial status with incredible ease and accuracy. You’ll need a few items to perform a bank reconciliation, including your bank statement, internal accounting records, and a record of any pending cash transactions (either inflows or outflows). Web find out how to complete a bank. Web this bank reconciliation statement template shows you how to calculate the adjusted cash balance using the bank statement and a company's accounting record. Web get freshbooks free bank reconciliation template and create detailed records of transactions to and from your business account with ease. Web the purpose of a bank reconciliation template is to help individuals or businesses reconcile. Web the purpose of a bank reconciliation template is to help individuals or businesses reconcile their bank statements with their internal financial records. Utilizing a robust set of functions, our template empowers you to organize, reconcile, and understand your financial status with incredible ease and accuracy. You can customize all of the templates offered below for business use or for. A bank reconciliation statement is a document that compares or reconciles the company’s bank account with its financial records and provides a summary of all banking information and business activities. Update the bank book and enter the outstanding cheques, outstanding deposits, bank charges, etc. And the template will automatically display the difference. Learn how to create your own reconciliation template. Learn how to create your own reconciliation template and streamline your financial processes. Choose your method for reconciliation. Web efficiently manage your finances with our collection of 13 free bank reconciliation templates for excel and google sheets. You’ll need a few items to perform a bank reconciliation, including your bank statement, internal accounting records, and a record of any pending. For more financial management tools, download cash flow and other accounting templates. You can also download the bank reconciliation template. Web this template streamlines the process of reconciling your bank statements and accounts in microsoft excel. Web this bank reconciliation template enables finance and accounting teams at tech companies to: Web free excel bank reconciliation statement that will help you. The statement outlines the deposits, withdrawals, and other activities affecting a bank account for a specific period. Web our bank reconciliation template in excel provides a comprehensive and automated way to streamline your bank reconciliation process. Web a bank reconciliation statement is a document that is created by the bank and must be used to record all changes between your. Web we offer a selection of four distinct bank reconciliation sheet templates, each designed to meet specific needs. And the template will automatically display the difference. Web our bank reconciliation template in excel provides a comprehensive and automated way to streamline your bank reconciliation process. Web this template streamlines the process of reconciling your bank statements and accounts in microsoft excel. This can cut hours or even days off the monthly close, depending on how many accounts you have to reconcile and how active they are. Web 14 free bank reconciliation templates in excel. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Web how to do a bank reconciliation. This will make the reconciliation process much easier. But why is reconciliation so important in the first place? Web this bank reconciliation statement template shows you how to calculate the adjusted cash balance using the bank statement and a company's accounting record. Update the bank book and enter the outstanding cheques, outstanding deposits, bank charges, etc. A bank reconciliation statement is a document that compares or reconciles the company’s bank account with its financial records and provides a summary of all banking information and business activities. For more financial management tools, download cash flow and other accounting templates. Web this bank reconciliation template enables finance and accounting teams at tech companies to: The statement outlines the deposits, withdrawals, and other activities affecting a bank account for a specific period.50+ Bank Reconciliation Examples & Templates [100 Free]

50+ Bank Reconciliation Examples & Templates [100 Free]

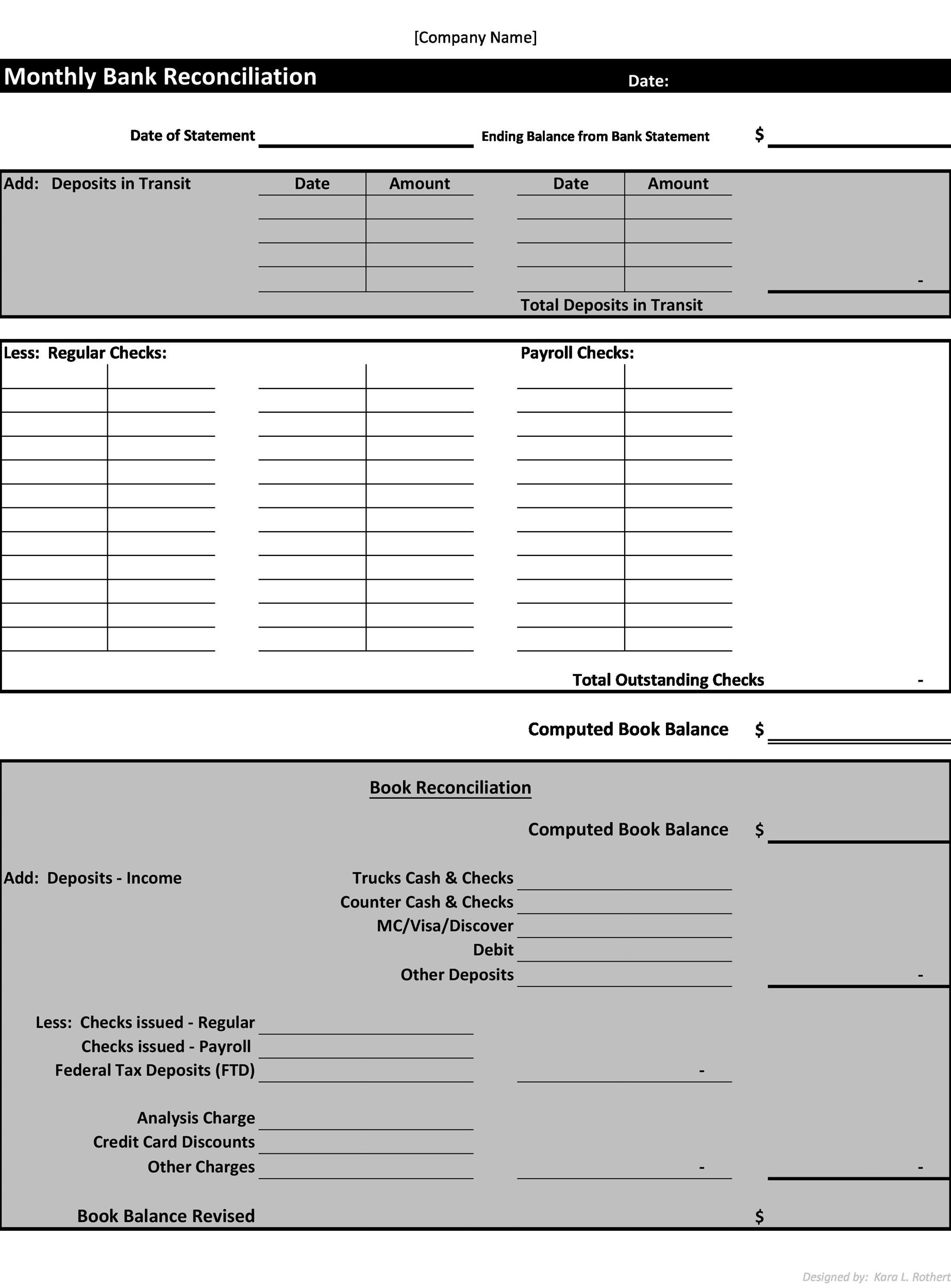

Business Bank Reconciliation Template

50+ Bank Reconciliation Examples & Templates [100 Free]

50+ Bank Reconciliation Examples & Templates [100 Free]

50+ Bank Reconciliation Examples & Templates [100 Free]

50+ Bank Reconciliation Examples & Templates [100 Free]

Bank Reconciliation Template Free Download FreshBooks

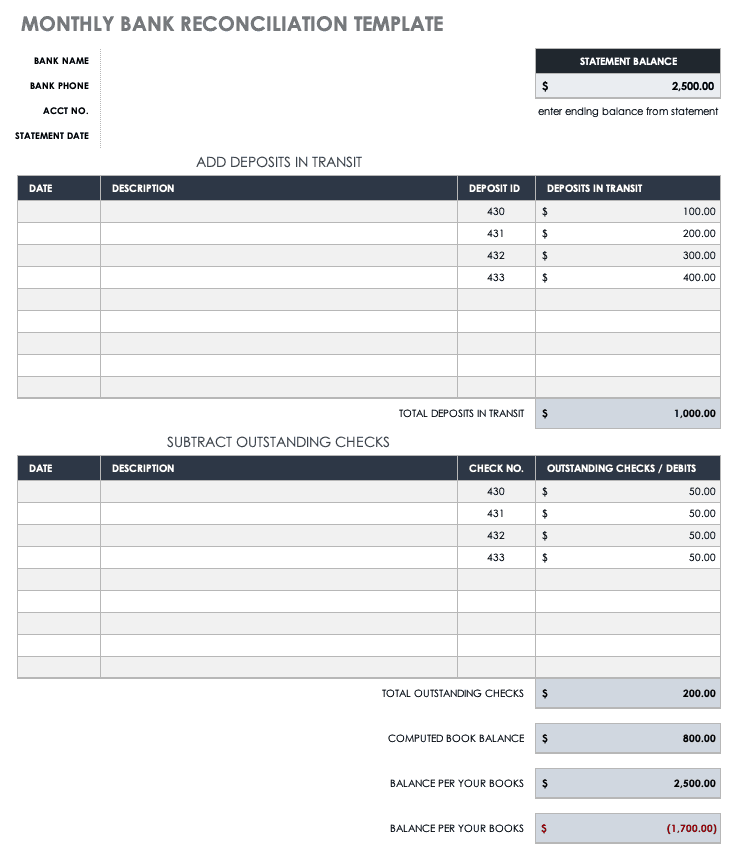

Free Account Reconciliation Templates Smartsheet

50+ Bank Reconciliation Examples & Templates [100 Free]

Web Find Out How To Complete A Bank Reconciliation With Your Cashbook And Why It Is So Important.

Reconciling The Two Accounts Helps Identify Whether Accounting Changes Are Needed.

Includes A Free Excel Bank Reconciliation Statement Template.

Web Get Freshbooks Free Bank Reconciliation Template And Create Detailed Records Of Transactions To And From Your Business Account With Ease.

Related Post:

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-38.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-30.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-05.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-31.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-40.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-39.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-47.jpg?w=320)