Bi Weekly Paycheck Budget Template

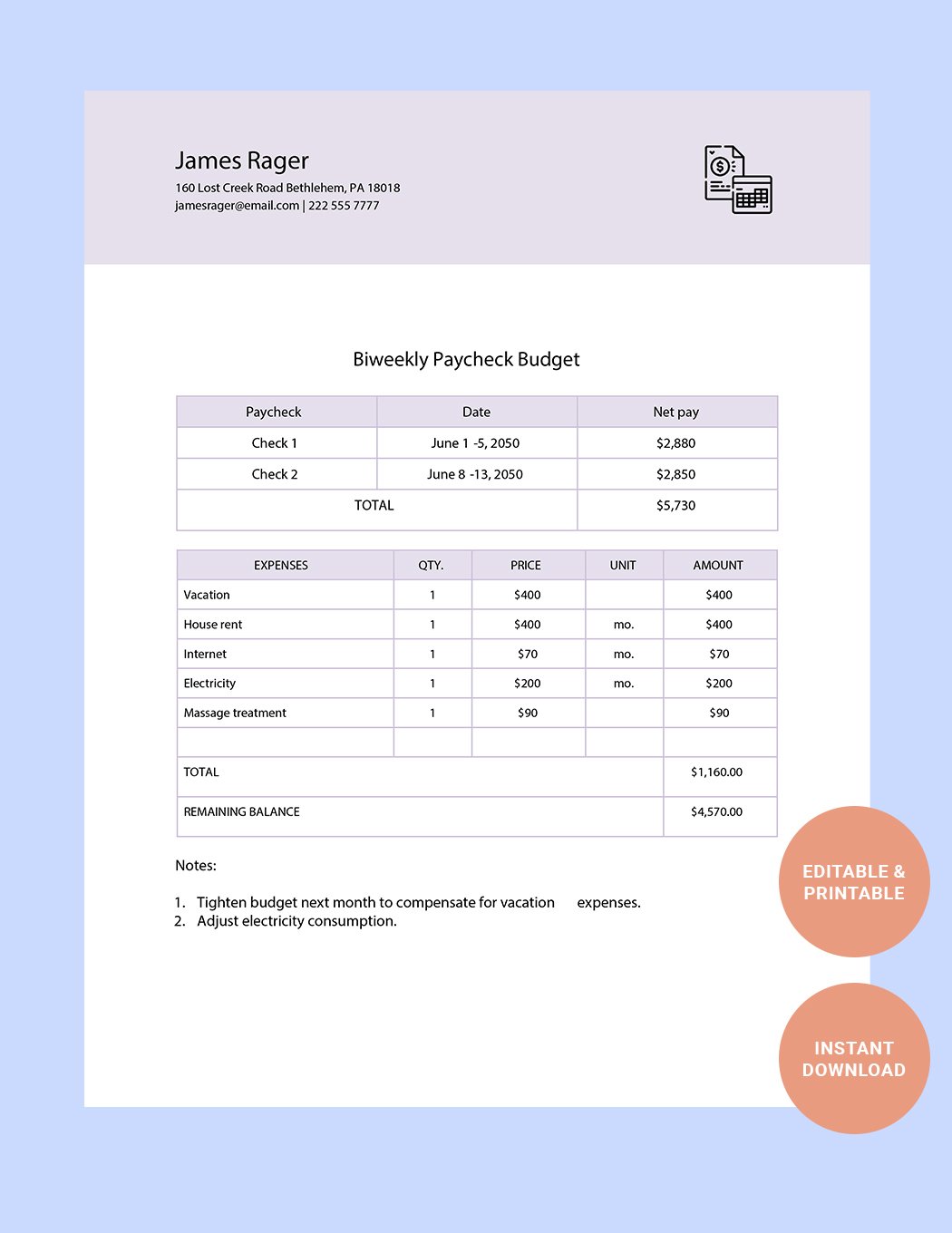

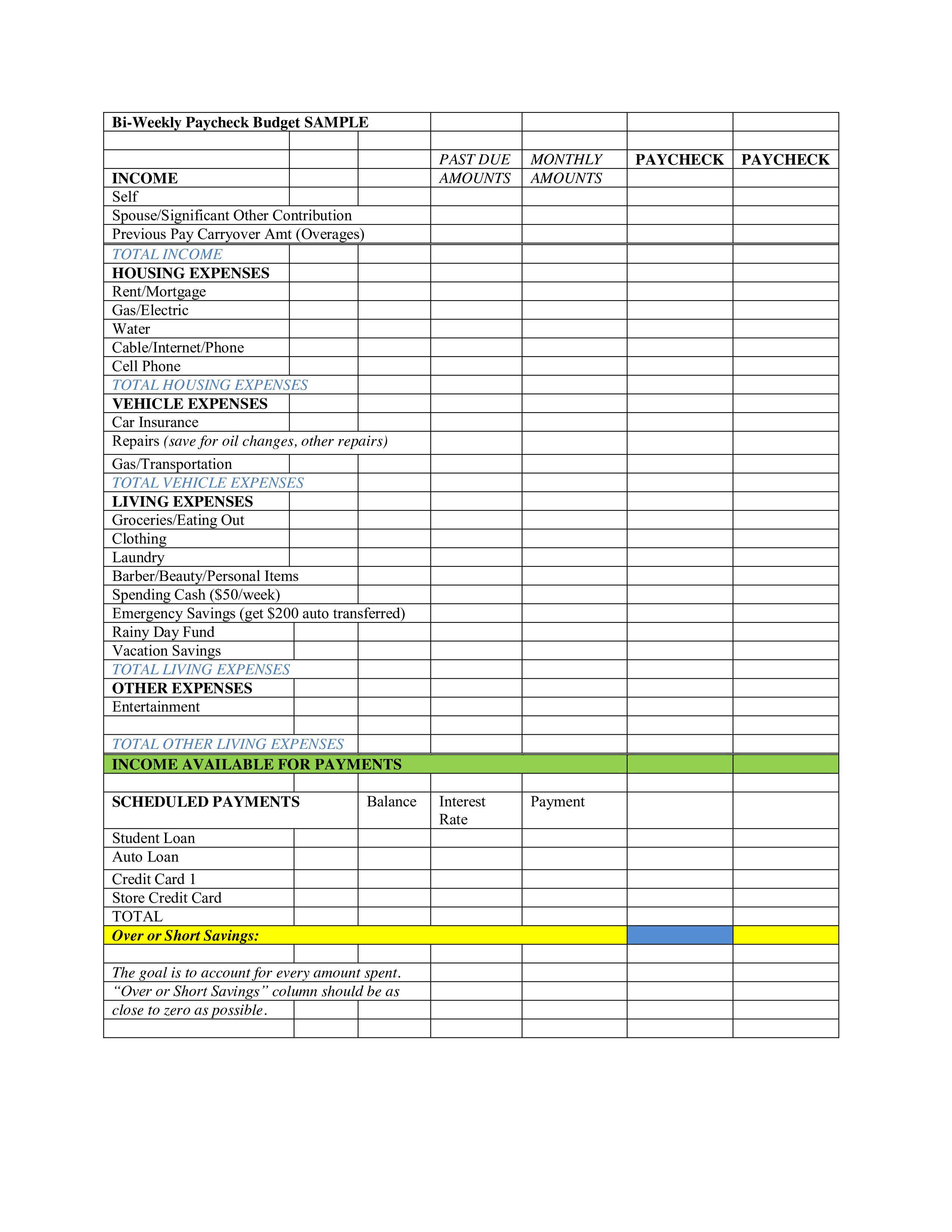

Bi Weekly Paycheck Budget Template - Write your first biweekly budget (paycheck #1) 6. Web biweekly budget template: While you can use a pen and notebook to write down your budget, there’s many paycheck budgeting templates available to help you get started. Web start with a daily budget and then proceed to a weekly and finally to a monthly budget. Fill out a monthly budget calendar 3. 6 easy steps to follow. Decide on your savings, investing, & financial goals. Web a biweekly budget lets you allocate part of your expenses to each of your paychecks more effectively than a monthly budget. You can structure your budget around your paychecks so you don’t miss anything with your money, and you can find out how here! Get your paystubs & income details. It is helpful to people who receive biweekly paychecks or have inconsistent income and is a great option for managing your finances. Set aside money for savings 4. Decide on your savings, investing, & financial goals. Web gain control over your finances with a free excel biweekly budget template. 6 easy steps to follow. Get your paystubs & income details. How do i create a biweekly. This can be helpful for those who want to better track their spending or for those who want to save money. You can structure your budget around your paychecks so you don’t miss anything with your money, and you can find out how here! Gather your bills & determine expenses. It also include a budget calendar in this workbook. A biweekly budget is a spending plan which you are paid your salary every other week instead of at the end of the month. It is helpful to people who receive biweekly paychecks or have inconsistent income and is a great option for managing your finances. Web there’s a simple answer to the “how to budget biweekly paycheck” question: Then add up variable spending and set savings goals. While you can use a pen and notebook to write down your budget, there’s many paycheck budgeting templates available to help you get started. This progression allows you to transition smoothly from one form of period or cycle to another one. Set aside money for savings 4. Decide on your savings, investing, & financial goals. Web why use a monthly budget when you're paid every other week? Web a biweekly budget divides your budget into two parts, one for each paycheck that is received. Web how to budget biweekly paychecks in 7 easy steps: Pros & cons of biweekly budgeting. Web start with a daily budget and then proceed to a weekly and finally to a monthly budget. But watch out for 3 mistakes that will bust. A biweekly budget is perfect for those who get paid every other week. How do i create a biweekly. But watch out for 3 mistakes that will bust it! Web a biweekly budget lets you allocate part of your expenses to each of your paychecks more effectively than a monthly budget. Create your monthly spending categories 5. It also include a budget calendar in this workbook. Create a budget for each pay period of the month, and then track your progress. List all your bills 2. Here are the free weekly budget templates that you download. It is helpful to people who receive biweekly paychecks or have inconsistent income and is a great option for managing your. Bill payments and due dates are easier to track using a budget. Create your monthly spending categories 5. Write your second biweekly budget (paycheck #2) 7. List all your bills 2. Then add up variable spending and set savings goals. Write your first biweekly budget (paycheck #1) 6. Web start with a daily budget and then proceed to a weekly and finally to a monthly budget. Gather your bills & determine expenses. There’s room for 5 paychecks on these sheets, so that you’ll be set in those months that seep into a 5 th pay period. Web why use a. There’s room for 5 paychecks on these sheets, so that you’ll be set in those months that seep into a 5 th pay period. 6 easy steps to follow. Web start with a daily budget and then proceed to a weekly and finally to a monthly budget. Pros & cons of biweekly budgeting. Download the free easy budget biweekly budget. Here are the free weekly budget templates that you download. Web a biweekly budget is an imperative skill to have if your income is inconsistent, or if you are paid biweekly, because it’s the true way to tell your money what to do each pay period and reach your financial goals. Web start with a daily budget and then proceed. Therefore, we will show you an alternative with which you can improve your financial planning. Get your paystubs & income details. Set aside money for savings 4. Pros & cons of biweekly budgeting. Download the free easy budget biweekly budget template here. This can be helpful for those who want to better track their spending or for those who want to save money. This progression allows you to transition smoothly from one form of period or cycle to another one. Simplify paycheck management & personalize your budgeting to achieve financial stability. Web a biweekly budget is an imperative skill to have if. Simplify paycheck management & personalize your budgeting to achieve financial stability. But watch out for 3 mistakes that will bust it! Web how to budget biweekly paychecks in 7 easy steps: For example, i’m writing this in. Here are the free weekly budget templates that you download. Web a biweekly budget lets you allocate part of your expenses to each of your paychecks more effectively than a monthly budget. This can be helpful for those who want to better track their spending or for those who want to save money. Fill out a monthly budget calendar 3. Decide on your savings, investing, & financial goals. Web gain control over your finances with a free excel biweekly budget template. Here are the free weekly budget templates that you download. Write your second biweekly budget (paycheck #2) 7. Then add up variable spending and set savings goals. Web there’s a simple answer to the “how to budget biweekly paycheck” question: List all your bills 2. Create a budget for each pay period of the month, and then track your progress. Create your monthly spending categories 5. You can structure your budget around your paychecks so you don’t miss anything with your money, and you can find out how here! How do i create a biweekly. Web why use a monthly budget when you're paid every other week? A biweekly budget is perfect for those who get paid every other week.Bi Weekly Budget Planner Template Paycheck Budget Printable Etsy

Printable Bi Weekly Budget Template Customize and Print

Weekly Budget and BiWeekly Spreadsheet for Excel

11 Free BiWeekly Budget Templates

Bi Weekly Paycheck Budget Template in Word, Google Docs Download

Bi Weekly Budget Template Template Business

BiWeekly Budget Template 3 Free Templates in PDF, Word, Excel Download

Bi Weekly Paycheck Budget Templates at

Free Printable Bi Weekly Budget Worksheets

BIWEEKLY Budget Overview Template Printable Paycheck Budget Etsy

For Example, I’m Writing This In.

Web When You Are Paid On A Biweekly Basis, It May Make Sense To Create A Biweekly Budget.

Bill Payments And Due Dates Are Easier To Track Using A Budget.

Get Your Paystubs & Income Details.

Related Post: