Business To Business Credit Application Template

Business To Business Credit Application Template - Do you wish there were a better way? Web 48 free templates for business credit application. Web these free business credit application forms will help you collect and organize the appropriate information so both the lender and borrower can stay on the same page and make informed decisions. Web contents [hide] 1 credit application templates. Do you email them a pdf of your credit application with instructions to fill it out, sign it, scan it, and send it back? This written report helps the business secure funds from lenders, suppliers, or leasing companies to meet the price of the required products or services, or even machinery and equipment that is needed for. It's one tool that lenders use to evaluate a company's fitness for financing. Business credit application template 01. Web a business credit application is a formal document that a company submits to a creditor when applying for a line of credit. Web a business credit application form is used by businesses to request funding or lines of credit with a bank through the business’s website. What’s the process for when a new customer applies for business credit at your company? Web completing a business credit application form would be important for businesses that seek to build or expand their credit lines. Here are some business credit application templates you can use in your operations or as inspiration for creating your own: Web business credit application templates provide a structured and standardized approach to applying for credit. A business credit application template is a standardized form companies use to collect essential information from businesses wishing to apply for credit terms. Web a business credit application can be tailored to the specifics of any industry. Web automation in banking doesn’t have to be complicated, and it can come in many forms: Web a credit application for a business account is a form used to initiate a request for financing from a financial institution. If you own or manage a business, streamline your borrowing process with a free commercial credit application form. Here are the business credit applications that you can use. Simplify the credit or loan application process for customers using an online form. It collects identifiable information about the business to determine its creditworthiness. Web download your fillable business credit application template in pdf. Web these free business credit application forms will help you collect and organize the appropriate information so both the lender and borrower can stay on the same page and make informed decisions. 4 information to include in your credit application. A business credit application template is a standardized form companies use to collect essential information from businesses wishing to apply for credit terms. By using these templates, businesses can ensure that the necessary information is collected accurately and consistently,. Here are some business credit application templates you can use in your operations or as inspiration for creating your own: Web download your business credit application template in ms word (.docx). How to make business credit applications for new customers. Everything you need to plan, manage, finance, and grow your business. Web completing a business credit application form would be important for businesses that seek to build or expand their credit lines. Web you should use the business account credit application form template when you want to establish credit accounts between your business and its suppliers or vendors. Web a. Web download your business credit application template in ms word (.docx). Web contents [hide] 1 credit application templates. This written report helps the business secure funds from lenders, suppliers, or leasing companies to meet the price of the required products or services, or even machinery and equipment that is needed for. Web you should use the business account credit application. Web business credit application templates provide a structured and standardized approach to applying for credit. Everything you need to plan, manage, finance, and grow your business. Web business credit applications are critical to help businesses assess and manage credit risk because they will, if you use them correctly, help you identify companies who you may want to be careful with. Web completing a business credit application form would be important for businesses that seek to build or expand their credit lines. Web business credit application templates provide a structured and standardized approach to applying for credit. Web automation in banking doesn’t have to be complicated, and it can come in many forms: Web a credit application for a business account. Web 40 free credit application form templates & samples. What’s the process for when a new customer applies for business credit at your company? 7 what to consider when making a credit application template? Do you email them a pdf of your credit application with instructions to fill it out, sign it, scan it, and send it back? It provides. Everything you need to plan, manage, finance, and grow your business. Completing a credit application form for business financing tells the bank you need money to support your company's operations. 5 important terms for your credit application. Business credit application template 01. It collects identifiable information about the business to determine its creditworthiness. What’s the process for when a new customer applies for business credit at your company? Web you can apply for a loan or credit from lending institutions to start a business. Web you should use the business account credit application form template when you want to establish credit accounts between your business and its suppliers or vendors. Web automation in. Do you email them a pdf of your credit application with instructions to fill it out, sign it, scan it, and send it back? Web contents [hide] 1 credit application templates. It's one tool that lenders use to evaluate a company's fitness for financing. Web completing a business credit application form would be important for businesses that seek to build. A business credit application template is a standardized form companies use to collect essential information from businesses wishing to apply for credit terms. This form template is designed to collect information from businesses applying for credit. 2 what is a credit application? 5 important terms for your credit application. Web 48 free templates for business credit application. Web a business credit application can be tailored to the specifics of any industry. This written report helps the business secure funds from lenders, suppliers, or leasing companies to meet the price of the required products or services, or even machinery and equipment that is needed for. It collects identifiable information about the business to determine its creditworthiness. Web a. Web how to make business credit applications for new customers. A business credit application template is a standardized form companies use to collect essential information from businesses wishing to apply for credit terms. Web these free business credit application forms will help you collect and organize the appropriate information so both the lender and borrower can stay on the same page and make informed decisions. It provides a structured format to gather essential details required for assessing creditworthiness and making informed decisions. Web business credit applications are critical to help businesses assess and manage credit risk because they will, if you use them correctly, help you identify companies who you may want to be careful with when extending credit. Web download your business credit application template in ms word (.docx). Web business credit application form. Web completing a business credit application form would be important for businesses that seek to build or expand their credit lines. This form template is designed to collect information from businesses applying for credit. Here are some business credit application templates you can use in your operations or as inspiration for creating your own: Do you email them a pdf of your credit application with instructions to fill it out, sign it, scan it, and send it back? Web contents [hide] 1 credit application templates. Explore our comprehensive collection of business credit application templates, designed to simplify the credit evaluation process for businesses seeking to extend credit to reliable customers efficiently. This form helps streamline the credit application process and allows you to make informed decisions about creditworthiness. If you own or manage a business, streamline your borrowing process with a free commercial credit application form. It's one tool that lenders use to evaluate a company's fitness for financing.Free Printable Business Credit Application Templates [Word, PDF, Excel]

Free Printable Business Credit Application Templates [Word, PDF, Excel]

Free Printable Business Credit Application Templates [Word, PDF, Excel]

Business Credit Application Samples Excel Word Template

48 Blank Business Credit Application Templates (100 FREE)

40 Free Credit Application Form Templates & Samples

40 Free Credit Application Form Templates & Samples

business credit application pdf Doc Template pdfFiller

Free Printable Business Credit Application Templates [Word, PDF, Excel]

Free Printable Business Credit Application Templates [Word, PDF, Excel]

Web Business Credit Application Templates Provide A Structured And Standardized Approach To Applying For Credit.

Collect The Data You Need From Customers And Automate Backend Workflows To Ensure Customers Get Onboarded Fast.

Do You Wish There Were A Better Way?

Here Are The Business Credit Applications That You Can Use.

Related Post:

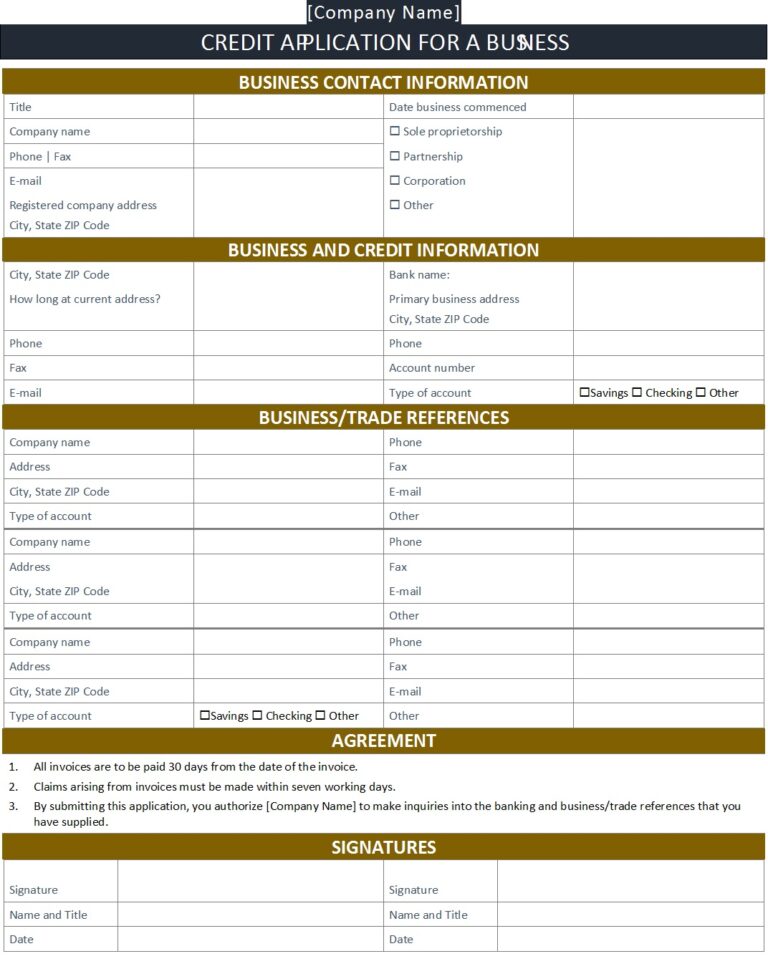

![Free Printable Business Credit Application Templates [Word, PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/05/business-line-of-credit-application-form.jpg?gid=433)

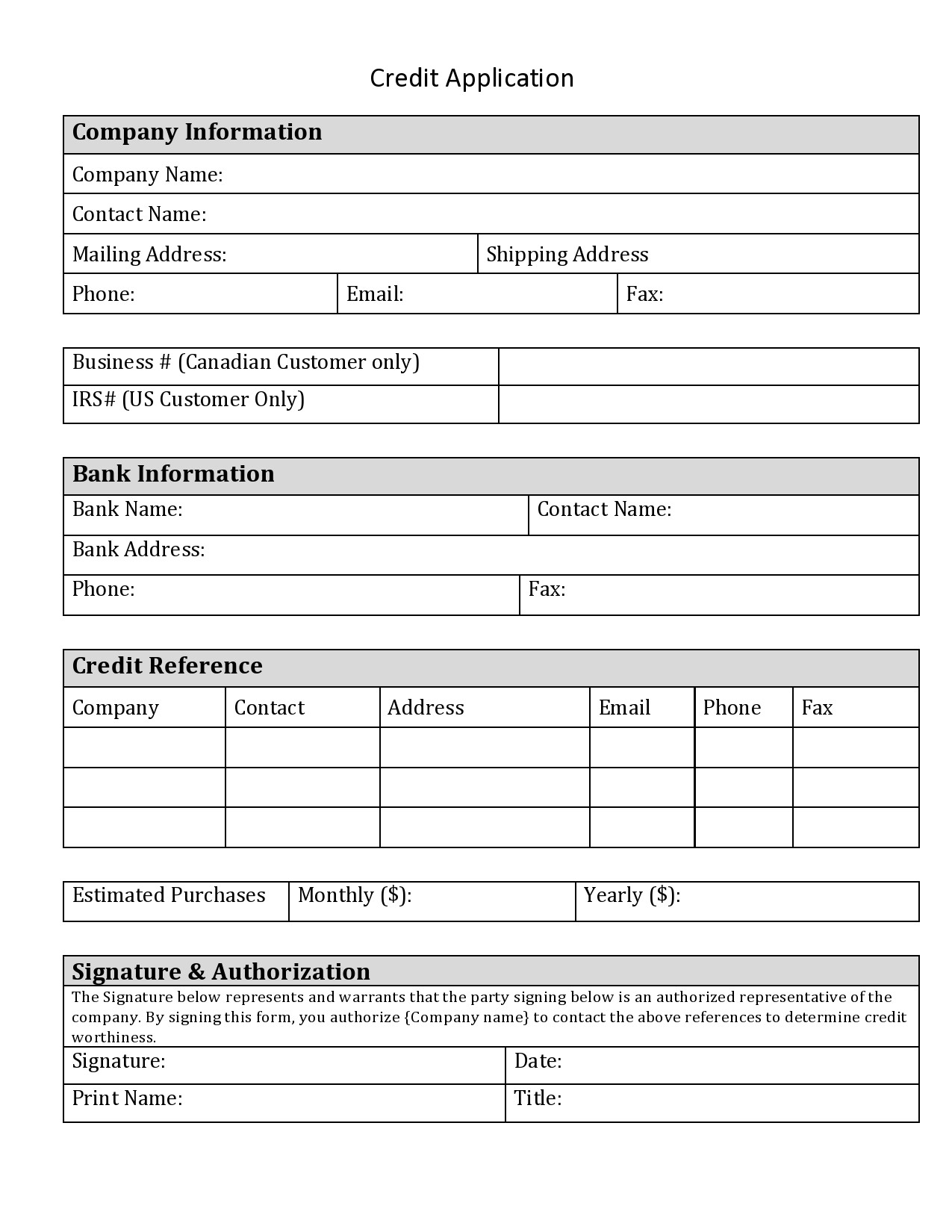

![Free Printable Business Credit Application Templates [Word, PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/05/business-to-business-credit-application-template.jpg?gid=433)

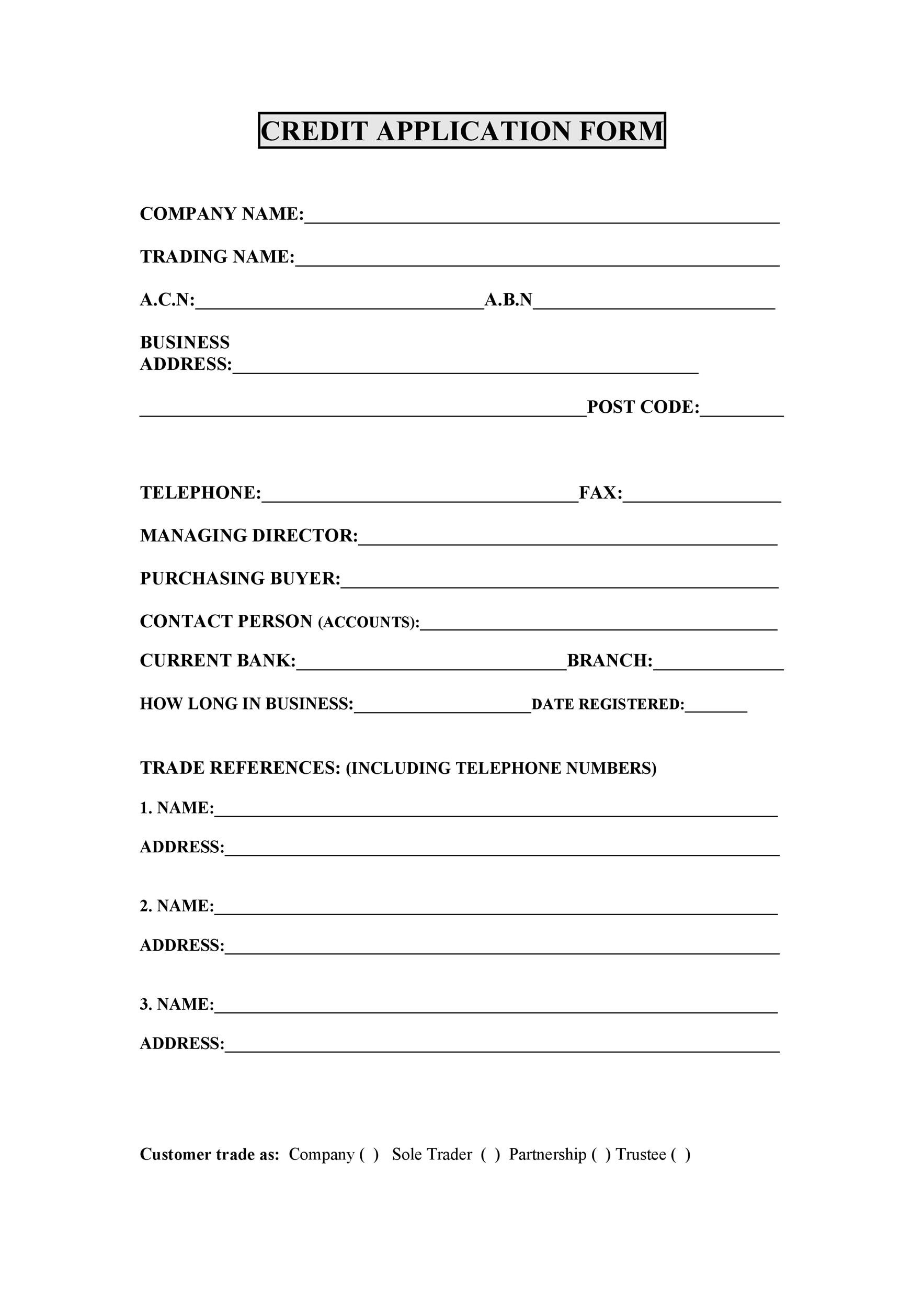

![Free Printable Business Credit Application Templates [Word, PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/05/printable-free-business-credit-application-template-word.jpg?gid=433)

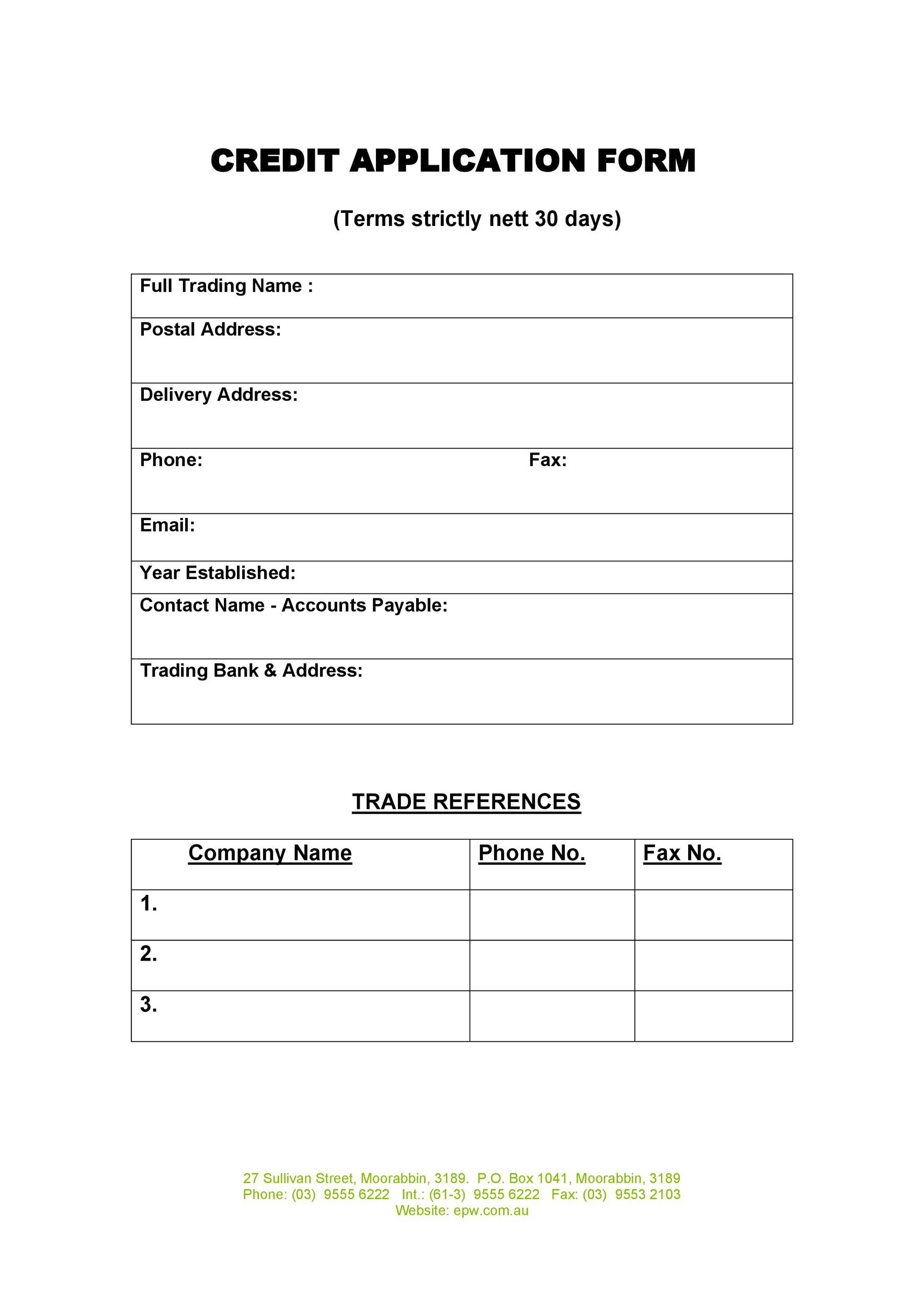

![Free Printable Business Credit Application Templates [Word, PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/05/business-new-customer-credit-application-form.jpg)

![Free Printable Business Credit Application Templates [Word, PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/05/business-credit-application-template-excel.jpg?gid=433)