Capitalization Table Template

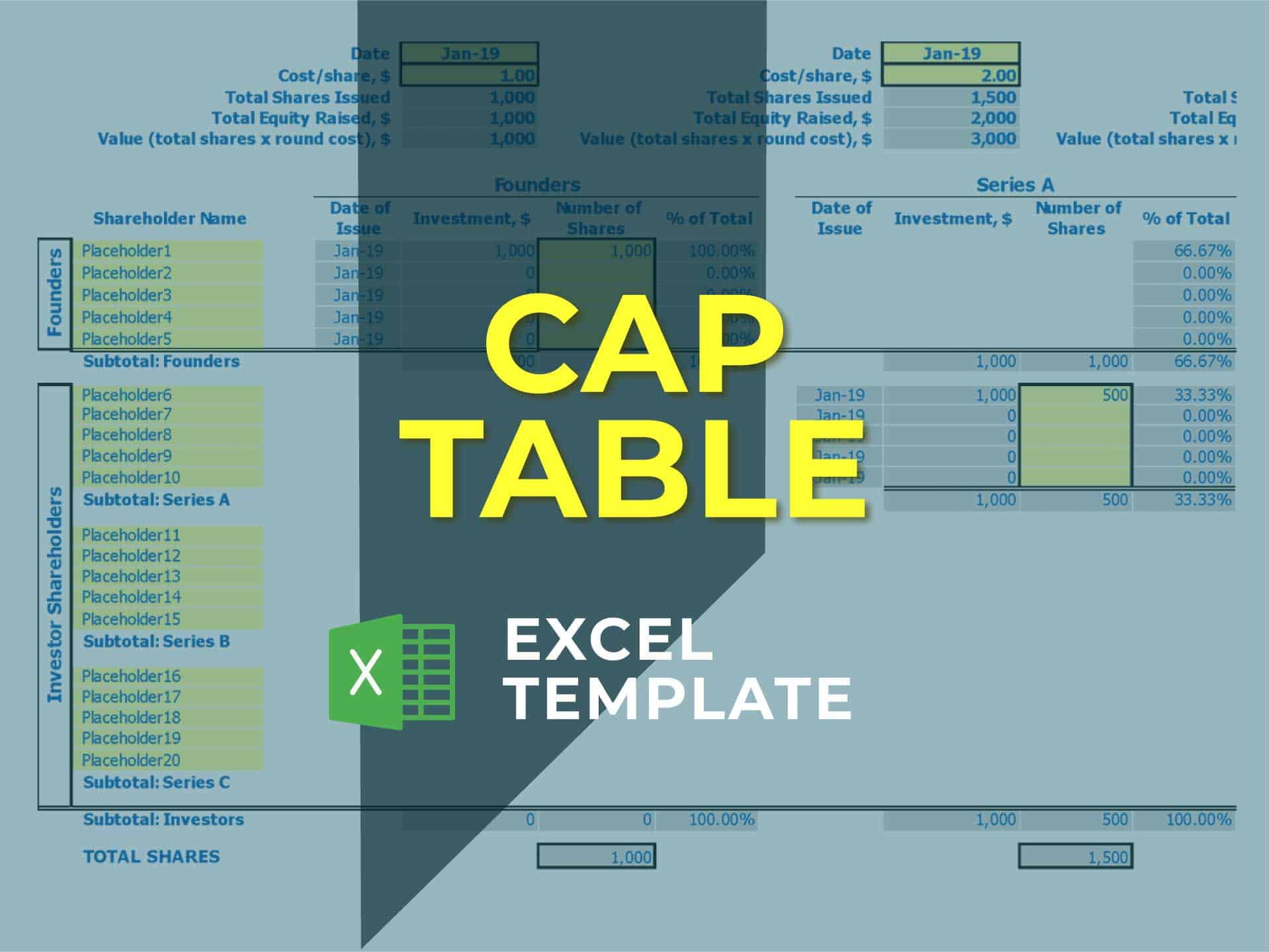

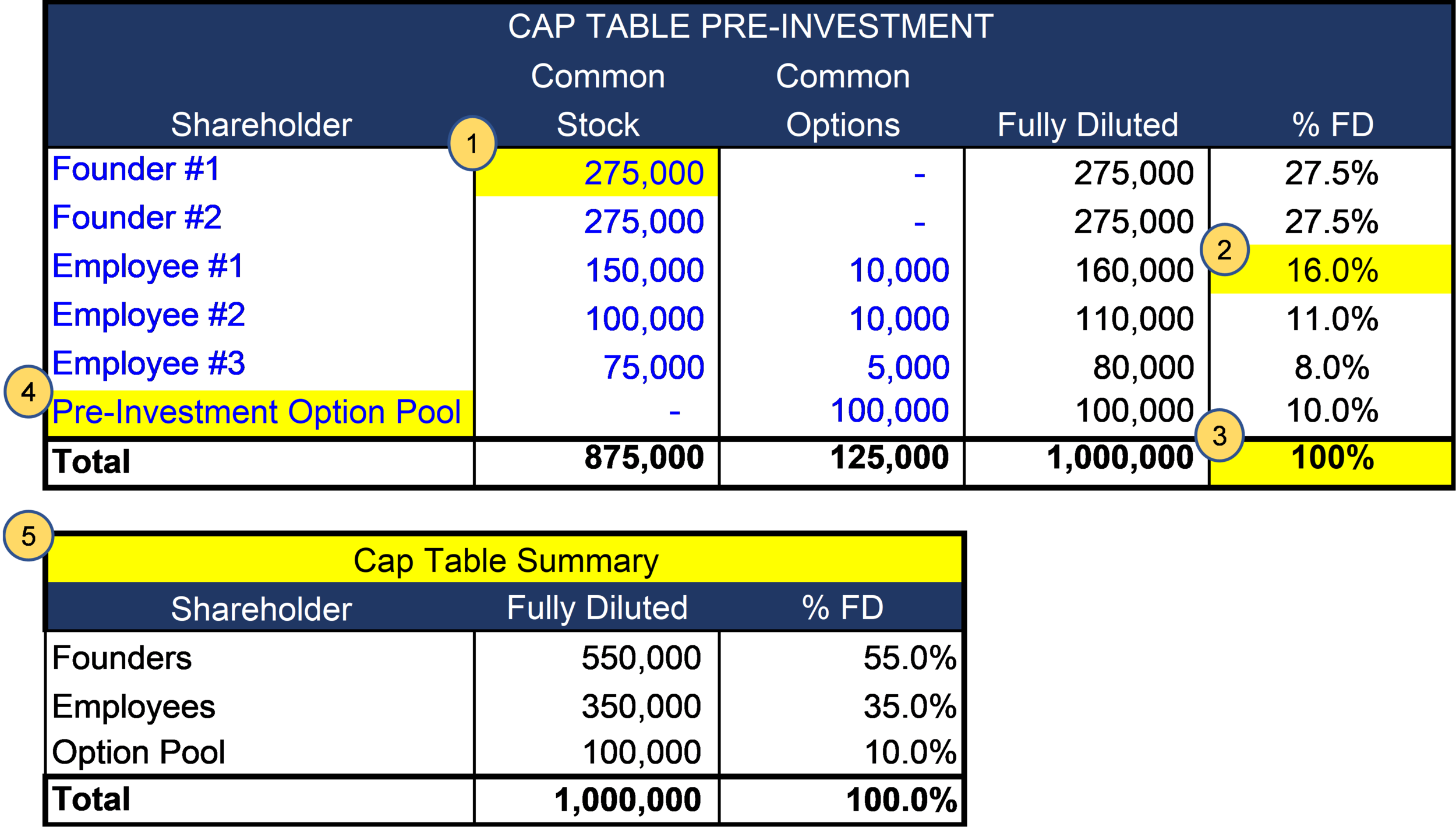

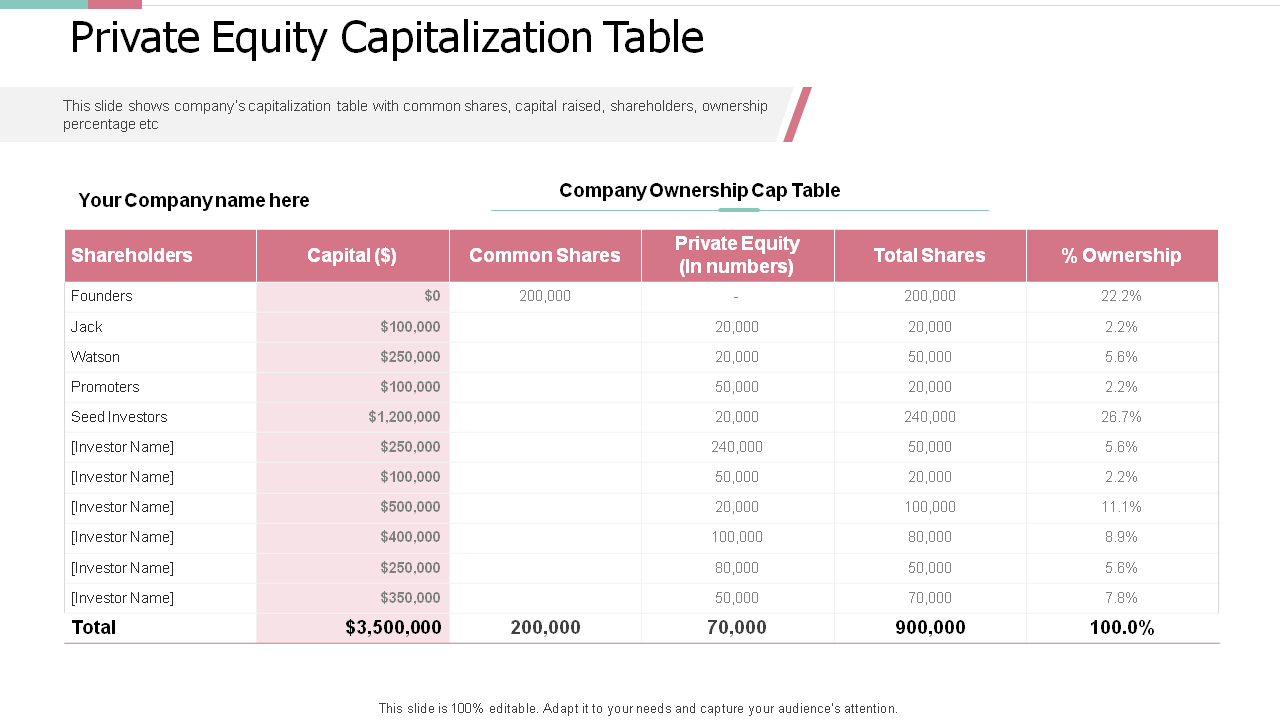

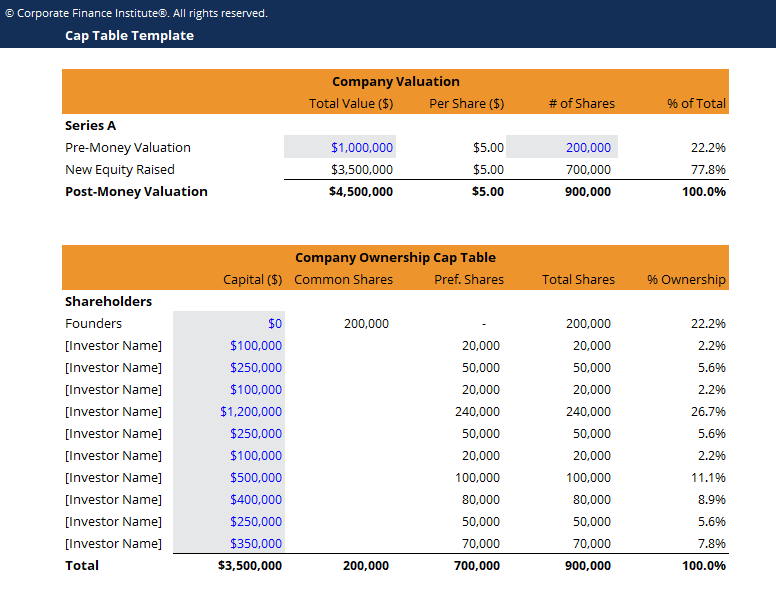

Capitalization Table Template - How to create and manage it? Ideal for early stage companies or startups. Here is a preview of the capitalization table template: Web it refers to a chart, table, or spreadsheet used to show the ownership stakes of anyone who has equity in a startup. Download the free capitalization table template A cap table (or capitalization table) lists all the securities or shares in a company including stock, convertible notes, warrants, and equity grants. Web download a cap table template for microsoft excel & google sheets. Web what is a cap table? It lists your company's securities (i.e., stock, options, warrants, etc.), how much investors paid for them, and each investor's percentage of ownership in the company. Web a capitalization table is a spreadsheet that shows a company's equity capitalization. The template includes the ownership structure and the capital committed. Management employees, board of directors) into single rows on the spreadsheet. This includes stocks, common shares, preferred shares, convertible notes, safes, options, and warranties. Web download a free cap table template to get started. Pulley helps companies navigate early equity decisions and grows with you as you scale. Ideal for early stage companies or startups. Export it in pdf or excel or save it to invite your shareholders. It monitors the equity ownership position of the company's shareholders, including founders, investors, and other owners. It’s used to list a company’s securities. Here is a preview of the capitalization table template: Web you can download a free cap table template for a company below. Here is a preview of the capitalization table template: It monitors the equity ownership position of the company's shareholders, including founders, investors, and other owners. The template includes the ownership structure and the capital committed. Web a cap table (or capitalization table) is a document, commonly a spreadsheet, detailing who has ownership in a company. Use this tool to build a cap table for free. Web a cap table, aka capitalization table, is a spreadsheet or table that shows a company’s stake in the business. It lists all the securities or number of shares of a company including stock, convertible notes, warrants, and equity ownership grants. It lists your company's securities (i.e., stock, options, warrants, etc.), how much investors paid for them, and each investor's percentage of ownership in the company. Export it in pdf or excel or save it to invite your shareholders. It lists all the securities or number of shares of a company including stock, convertible notes, warrants, and equity ownership grants. How to create and manage it? The template includes the ownership structure and the capital committed. Web a cap table, short for capitalization table, is a detailed spreadsheet or document that outlines a company’s ownership structure, including shares owned. Web a cap table template, also known as a table template, is a tool used to track a company’s ownership structure. Web a cap table, aka capitalization table, is a spreadsheet or table that shows a company’s stake in the business. Gain clear insights into your startup's financial trajectory. This includes stocks, common shares, preferred shares, convertible notes, safes, options,. Here is a preview of the capitalization table template: Web for simplicity sake, this cap table combines groups of individuals (e.g. Management employees, board of directors) into single rows on the spreadsheet. In a company, the cap table or capitalization table is a document that details how many shares and of what type each shareholder has. Web capitalization table, or. Web make confident decisions about your startup's future. Web a cap table, short for capitalization table, is a detailed spreadsheet or document that outlines a company’s ownership structure, including shares owned by investors, employee equity awards, and options… it lists out all your company’s securities: You can use this free template to calculate ownership, track you capitalization table, or to. Build your first capitalization table by downloading our free cap table template in google sheets. Web a capitalization table is a spreadsheet that shows a company's equity capitalization. How does it impact your ownership and capital wealth? Web download a free cap table template to get started. It's essential for financial decisions involving market capitalization and value. Why do i need one? Export it in pdf or excel or save it to invite your shareholders. How to use the template: The template includes the ownership structure and the capital committed. The cap table lists the stocks, warrants, options and shows the amount each investor paid for them and the percentage each investor owns in the startup. Web a capitalization table, or a cap table, represents the ownership position and structure via a spreadsheet. How to create and manage it? It's essential for financial decisions involving market capitalization and value. Web it refers to a chart, table, or spreadsheet used to show the ownership stakes of anyone who has equity in a startup. Input your securities into. Pulley helps companies navigate early equity decisions and grows with you as you scale. Web you can download a free cap table template for a company below. Web future flow’s cap table (short for capitalization table) template is built to allow quick and simple inputs by users, yet generates powerful, useful, insightful outputs. For a more complete cap table, you. It's essential for financial decisions involving market capitalization and value. The cap table lists the stocks, warrants, options and shows the amount each investor paid for them and the percentage each investor owns in the startup. Web a capitalization table is a spreadsheet that shows a company's equity capitalization. Explore cap table template to understand its structure and how it. Gain clear insights into your startup's financial trajectory. Web a capitalization table is a spreadsheet that shows a company's equity capitalization. The template includes the ownership structure and the capital committed. Explore cap table template to understand its structure and how it can assist you in managing your equity. Why do i need one? Pulley helps companies navigate early equity decisions and grows with you as you scale. Web a cap table, or capitalization table, is a chart typically used by startups to show ownership stakes in the business. The cap table lists the stocks, warrants, options and shows the amount each investor paid for them and the percentage each investor owns in the startup. It lists all the securities or number of shares of a company including stock, convertible notes, warrants, and equity ownership grants. How to use the template: How to create and manage it? What is a cap table? Use this tool to build a cap table for free. The template includes the ownership structure and the capital committed. Why do i need one? Explore cap table template to understand its structure and how it can assist you in managing your equity. Download free cap table template. A cap table (or capitalization table) lists all the securities or shares in a company including stock, convertible notes, warrants, and equity grants. Web a cap table, aka capitalization table, is a spreadsheet or table that shows a company’s stake in the business. It’s used to list a company’s securities. Web you can download a free cap table template for a company below.Capitalization Table Template Matttroy

What is a cap table for a startup? [+ Free Google Sheets Template]

Capitalization Table Excel Template eFinancialModels

Capitalization Table Template Matttroy

Capitalization Table Template Excel

Capital Table Template

Capitalization Table Template Matttroy

Cap Table Capitalization Table Investors Table Excel Template Etsy

Capitalization Table Template Download Free Excel Template

5+ Printable Capitalization Table Template room

What Is A Cap Table?

Here Is A Preview Of The Capitalization Table Template:

Management Employees, Board Of Directors) Into Single Rows On The Spreadsheet.

Gain Clear Insights Into Your Startup's Financial Trajectory.

Related Post:

![What is a cap table for a startup? [+ Free Google Sheets Template]](https://assets-global.website-files.com/5e9451ac176f31e759c9fd0c/6343d9824d90332c31a4315e_Captable-v2.jpg)