Car Allowance Policy Template

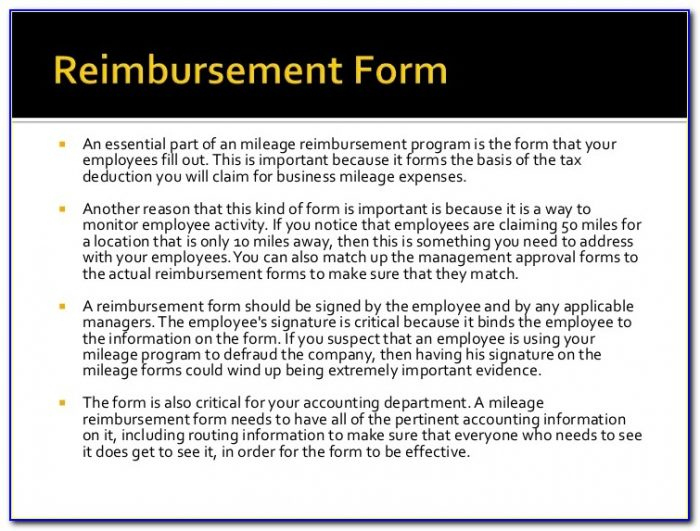

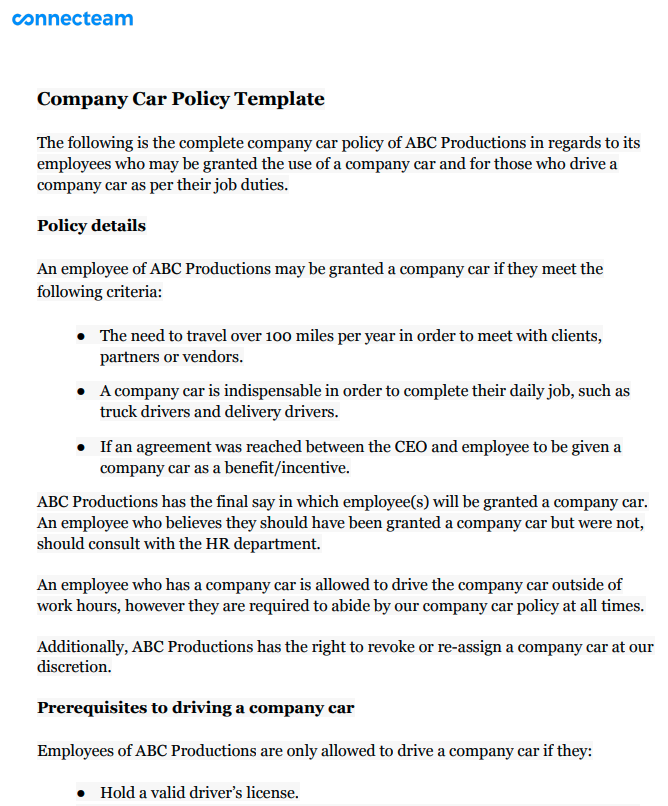

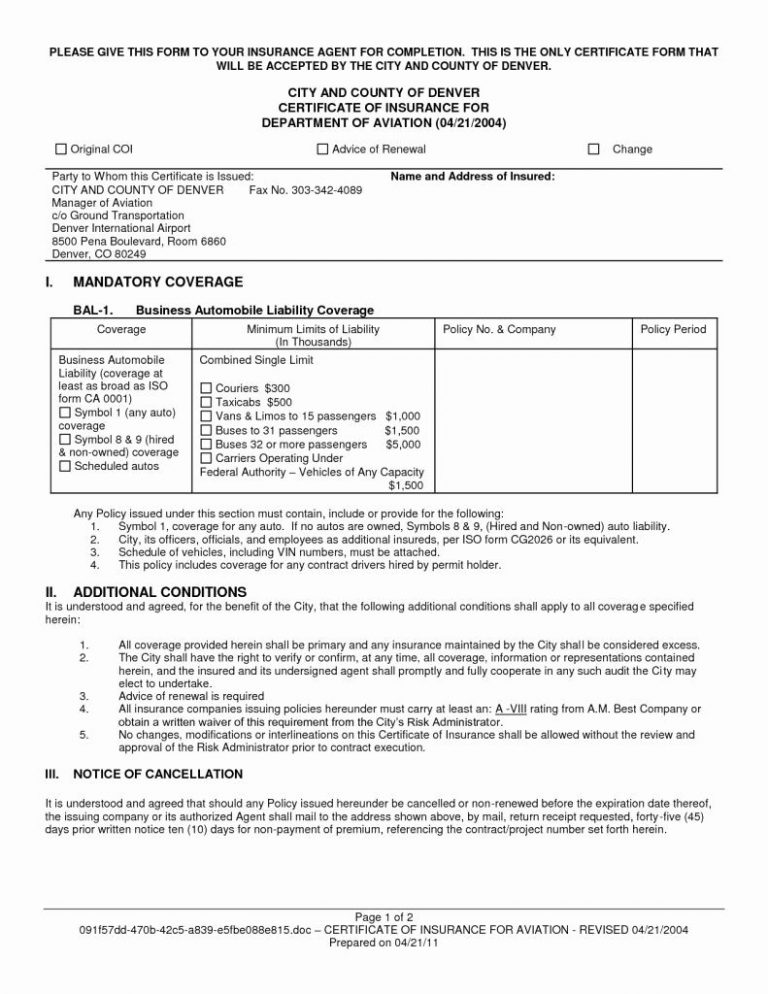

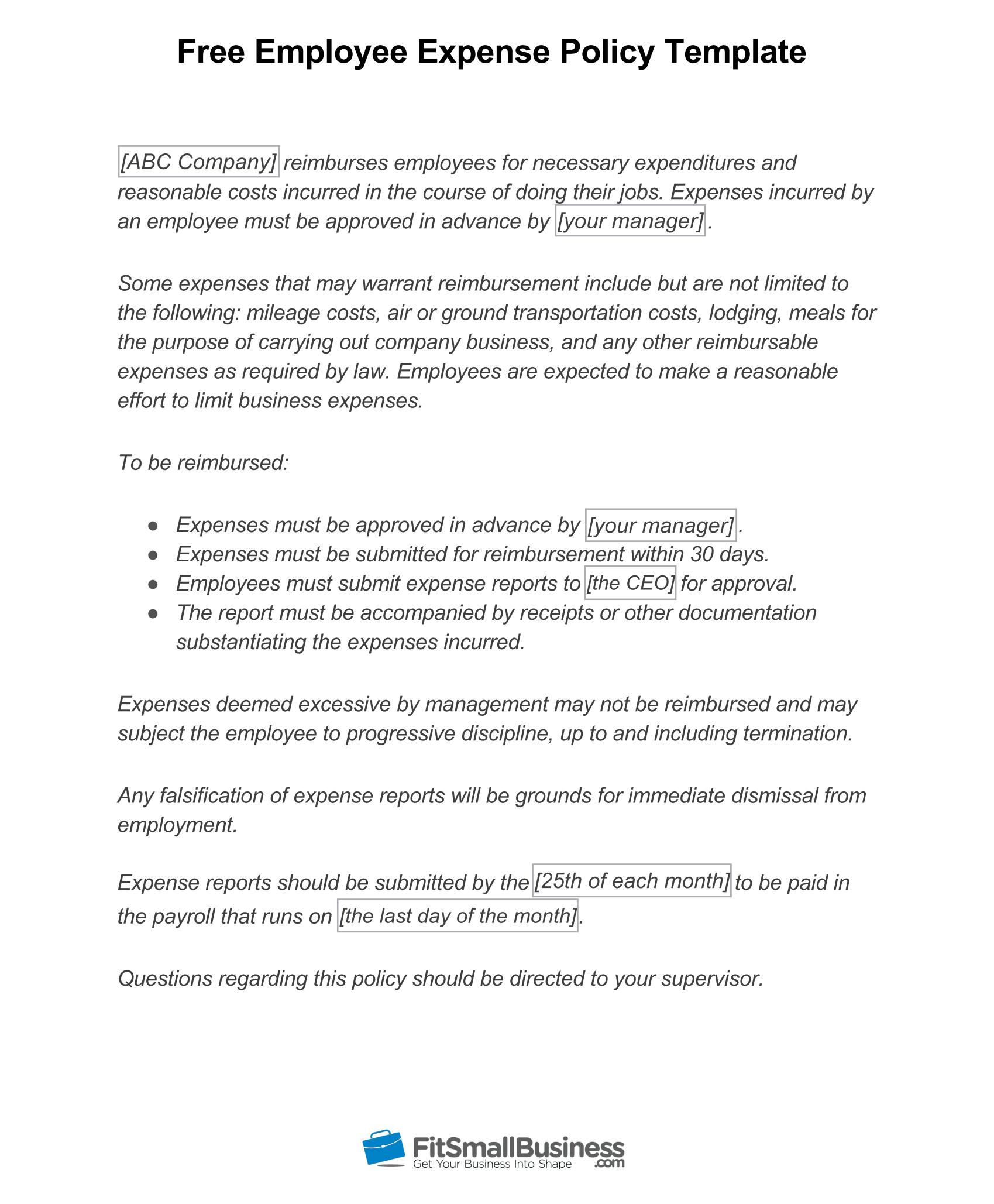

Car Allowance Policy Template - Web in this guide, we’ll give you all the knowledge needed to take advantage of car allowances in relation to company cars for business use. An allowance in the amount of £450per month will be paid pro rata on a monthly basis, in arrears. As long as you follow the sections mentioned above, you should have no issues. The company shall provide the executive an automobile allowance of $750 per month during the term of executive’s employment hereunder. Web to be eligible for a vehicle allowance, idea employees must incur significant business mileage reimbursement expenses during the prior fiscal year. Web many comthe template below helps business and organizations define and create a company car policy template. Car allowances can be great for staff retention and for giving your workforce the cash sum they need to buy a car for work. Web if your business has employees who use personal vehicles for work reasons, you may consider a car allowance policy. In essence, a car allowance becomes taxable when it is paid to employees by the employer at a set monthly rate. Download your mileage and car allowance policy template now. What is a car allowance and how does it work? Web in this guide, we’ll give you all the knowledge needed to take advantage of car allowances in relation to company cars for business use. Web if your business has employees who use personal vehicles for work reasons, you may consider a car allowance policy. Web this private car allowance policy is intended to be the foundation on which you can base your own policy and covers: Understand the rationale behind each car allowance policy as only certain car allowance policies are taxable. Lease or buy vehicles for certain employees. The car allowance will cover any expenses incurred when traveling for business, inclusive of mileage and other operation expenses when utilising your personal automobile. • what type of vehicle is acceptable both in age, style and cost. In essence, a car allowance becomes taxable when it is paid to employees by the employer at a set monthly rate. Let's go over what this means and how you can decide if it's the right move for your organization. The car allowance will cover any expenses incurred when traveling for business, inclusive of mileage and other operation expenses when utilising your personal automobile. We’ve broken down the sections into more detail to. • what type of vehicle is acceptable both in age, style and cost. Download your mileage and car allowance policy template now. A car allowance policy template or a sample car allowance policy can serve as an excellent starting point for organizations looking to. It defines eligibility, prerequisites for driving, driver obligations, and procedures following accidents. An allowance in the amount of £450per month will be paid pro rata on a monthly basis, in arrears. Web a company car allowance policy details the structure of the car allowance that’s offered to the employee by the employer. 1.1 this policy has been written to complement the national joint council for local government. Understand the rationale behind each car allowance policy as only certain car allowance policies are taxable. It defines eligibility, prerequisites for driving, driver obligations, and procedures following accidents. We’ve broken down the sections into more detail to help get your started, along with some brief examples. • the employee’s duties regarding having a suitable licence and. The first thing we need to clarify is that there’s a difference between providing an employee with a car and. This policy should outline eligibility, the amount of the allowance, and any necessary documentation for expenses. As long as you follow the sections mentioned above, then you should have no issues with missing anything out. 1.1 this policy has been written to complement the national joint council for local government. Download your mileage and car allowance policy template now. Web. Web mid sussex district council (new) car allowance scheme april 2023. Web many comthe template below helps business and organizations define and create a company car policy template. Lease or buy vehicles for certain employees. Web this is why understanding how to create and enforce a fair car allowance policy is essential for business owners. Web 7.1 you will be. As long as you follow the sections mentioned above, you should have no issues. Web in this guide, we explain the process and what you need to keep in mind for your company car policy to work effectively. 1.1 this policy has been written to complement the national joint council for local government. Web 1this document outlines the options, allowances. It defines eligibility, prerequisites for driving, driver obligations, and procedures following accidents. As long as you follow the sections mentioned above, then you should have no issues with missing anything out. What is a car allowance and how does it work? In essence, a car allowance becomes taxable when it is paid to employees by the employer at a set. Web this is why understanding how to create and enforce a fair car allowance policy is essential for business owners. We’ve broken down the sections into more detail to help get your started, along with some brief examples. As long as you follow the sections mentioned above, then you should have no issues with missing anything out. • the employee’s. As long as you follow the sections mentioned above, then you should have no issues with missing anything out. Lease or buy vehicles for certain employees. Web download your car allowance policy template and crush your business goals with the business in a box toolkit 1.1 this policy has been written to complement the national joint council for local government.. Let's go over what this means and how you can decide if it's the right move for your organization. The company shall provide the executive an automobile allowance of $750 per month during the term of executive’s employment hereunder. As long as you follow the sections mentioned above, you should have no issues. Web to be eligible for a vehicle. Download your mileage and car allowance policy template now. Web employee will receive a car allowance in the amount of five hundred dollars and 00/100 cents ($500.00) per month. We’ve broken down the sections into more detail to help get your started, along with some brief examples. In essence, a car allowance becomes taxable when it is paid to employees. A car allowance policy template or a sample car allowance policy can serve as an excellent starting point for organizations looking to. Web this private car allowance policy is intended to be the foundation on which you can base your own policy and covers: The first thing we need to clarify is that there’s a difference between providing an employee. Sample 1 sample 2 sample 3 see all (21) car allowance. Web this private car allowance policy is intended to be the foundation on which you can base your own policy and covers: Web a company car allowance policy details the structure of the car allowance that’s offered to the employee by the employer. A car allowance policy template or a sample car allowance policy can serve as an excellent starting point for organizations looking to. Web there are many different templates for car allowance policies online. Web download your car allowance policy template and crush your business goals with the business in a box toolkit Web to be eligible for a vehicle allowance, idea employees must incur significant business mileage reimbursement expenses during the prior fiscal year. Web in this guide, we’ll give you all the knowledge needed to take advantage of car allowances in relation to company cars for business use. Web in this guide, we explain the process and what you need to keep in mind for your company car policy to work effectively. Web there are many different templates for car allowance policies online. The company shall provide the executive an automobile allowance of $750 per month during the term of executive’s employment hereunder. This template provides different sections that the policy should include and also gives sample guideline statements for each section. Web for tax purposes, a new car allowance policy is one of the main things you should think about. The car allowance will cover any expenses incurred when traveling for business, inclusive of mileage and other operation expenses when utilising your personal automobile. Lease or buy vehicles for certain employees. The policy emphasizes safe driving, proper vehicle maintenance, and the importance of adhering to legal and company standards.Awesome Company Car Allowance Policy Template Sparklingstemware

Company Car Policy Template Free PDF Download

Stunning Car Allowance Agreement Template Policy template, Agreement

Free Company Car Allowance Policy Template chasiupaperstimes

Employee Vehicle Use Agreement Template Company Vehicle Policy Template

Stunning Company Car Allowance Policy Template Sparklingstemware

Car allowance letter to employee template Fill out & sign online DocHub

Free Company Car Allowance Policy Template Sparklingstemware

editable company car allowance policy template excel in 2023

Vehicle Allowance Policy Template

It Defines Eligibility, Prerequisites For Driving, Driver Obligations, And Procedures Following Accidents.

Web Many Comthe Template Below Helps Business And Organizations Define And Create A Company Car Policy Template.

As Long As You Follow The Sections Mentioned Above, You Should Have No Issues.

• What Type Of Vehicle Is Acceptable Both In Age, Style And Cost.

Related Post: