Charge Dispute Letter Template

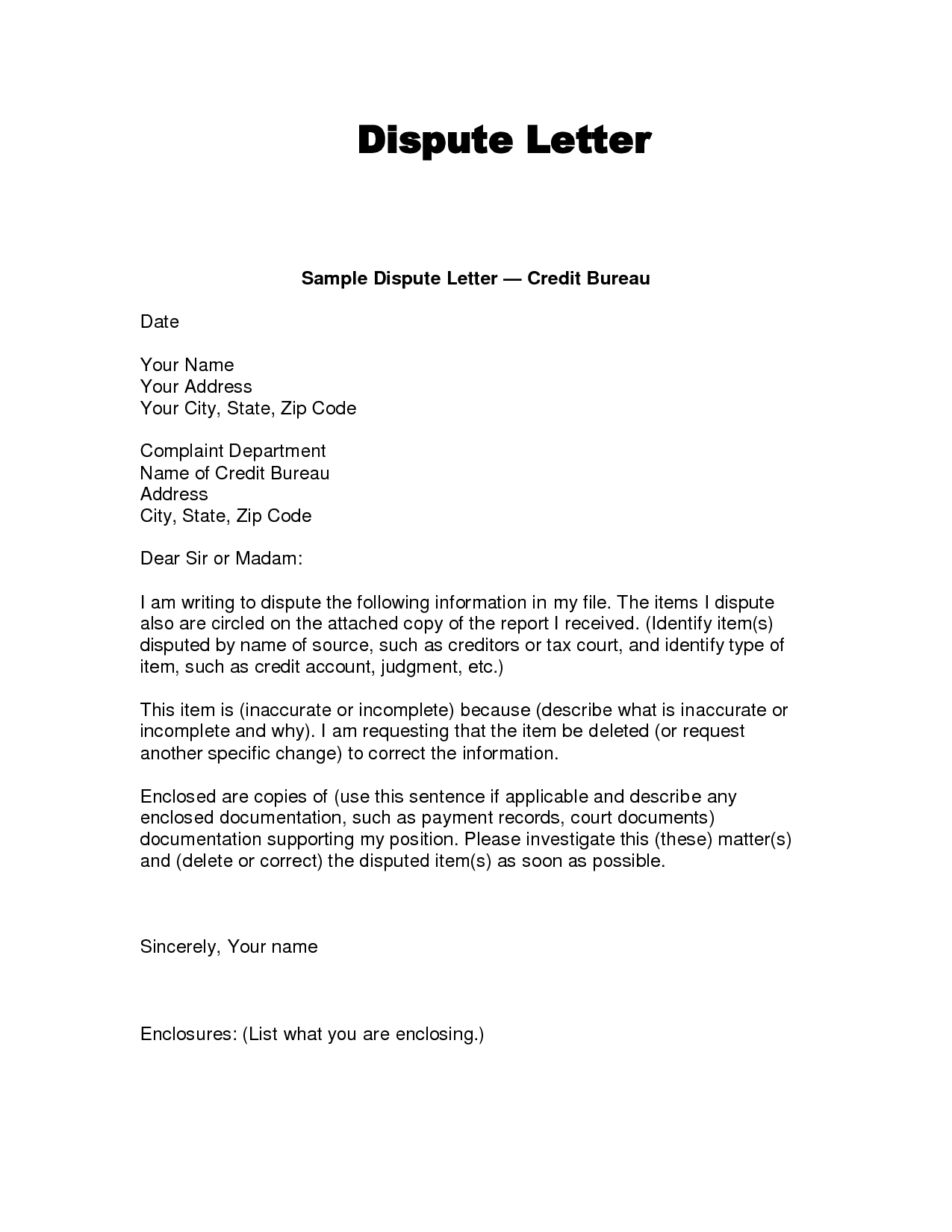

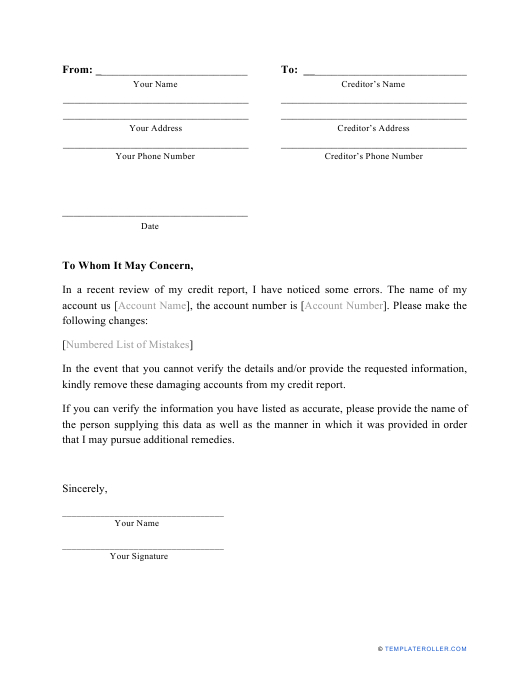

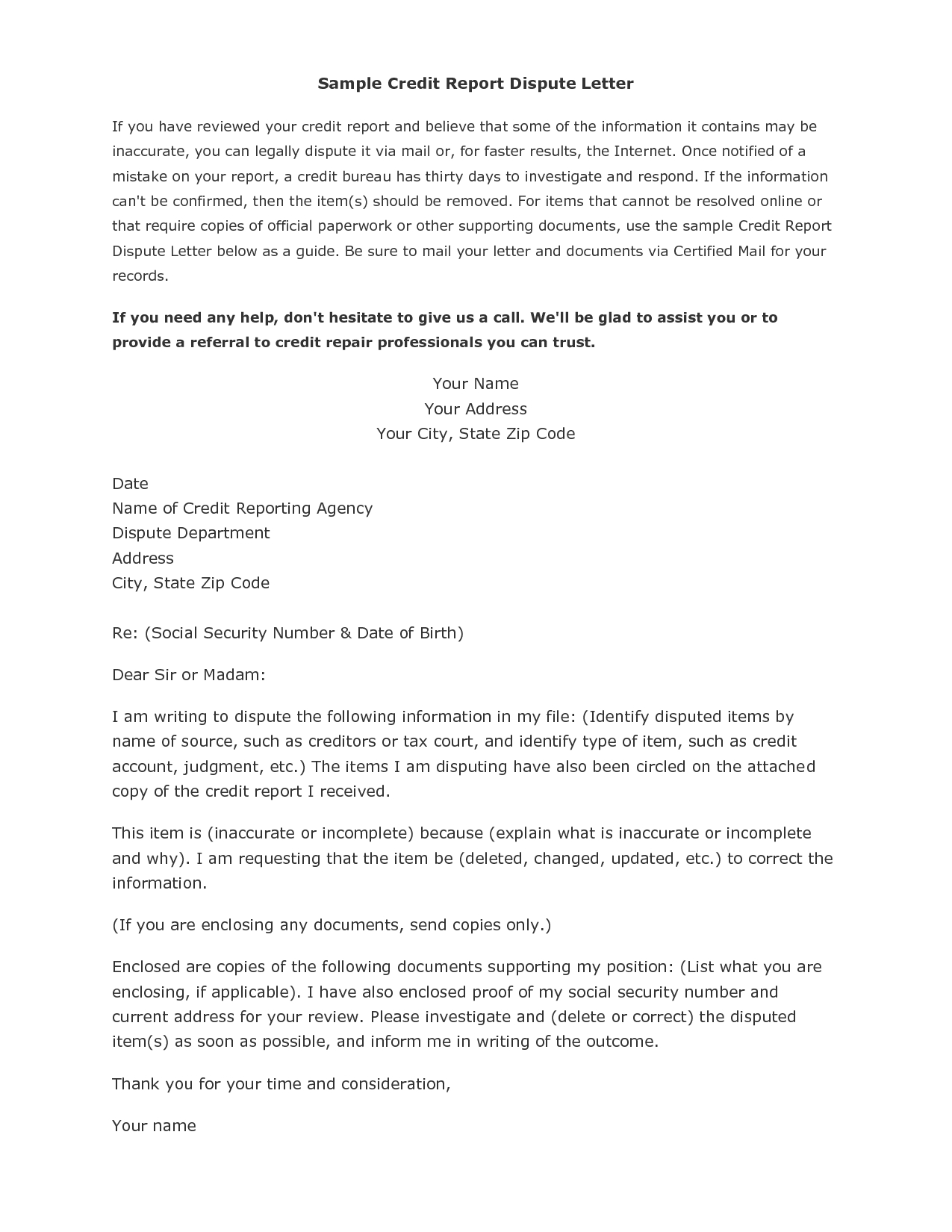

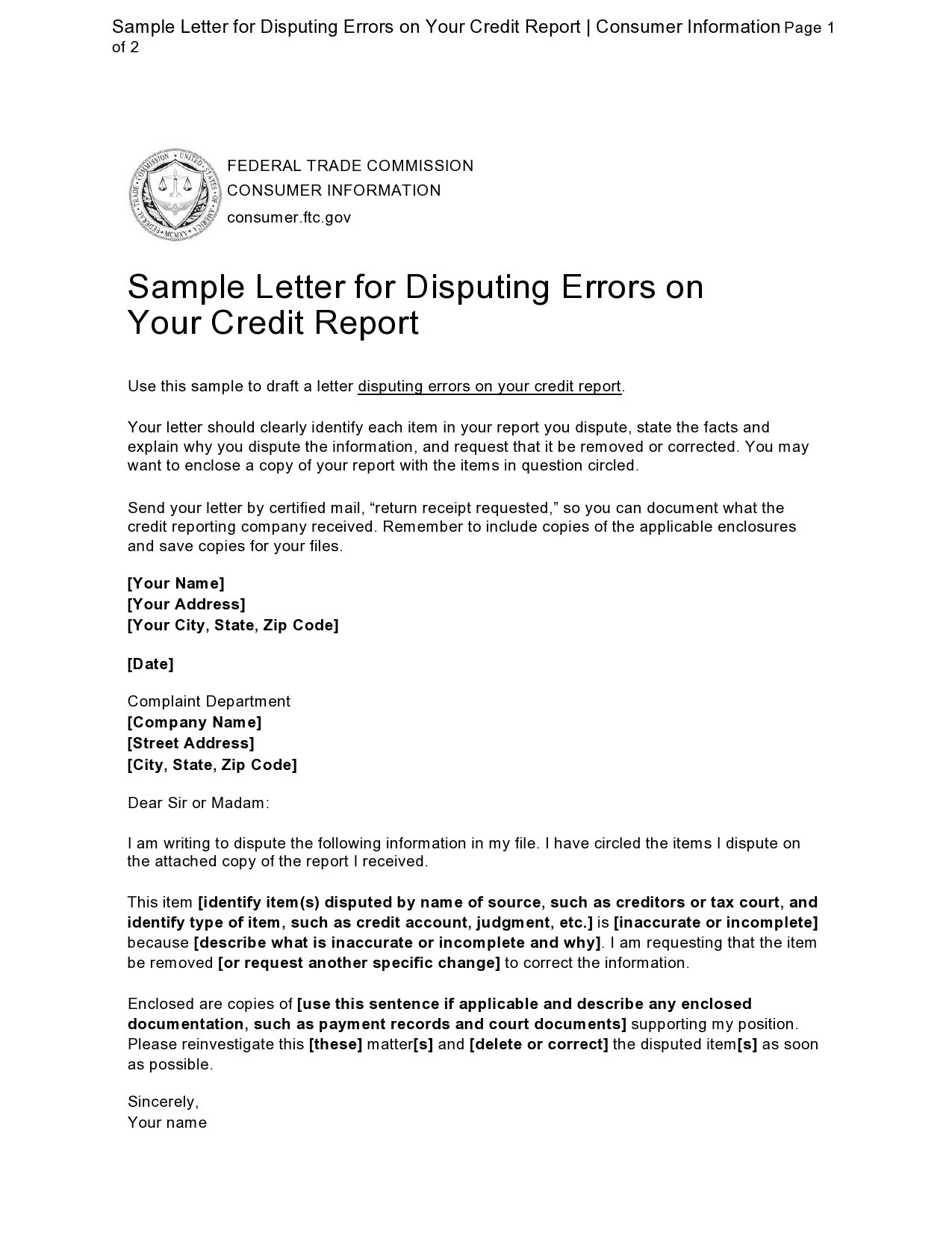

Charge Dispute Letter Template - Ensure the error has been removed by requesting confirmation from the consumer reporting company. Web a credit report dispute letter allows consumers to challenge inaccurate, incomplete, or outdated information on their credit reports. Web writing a clear and concise chargeback rebuttal letter is an important step to winning any dispute. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. Insider tips from personal experience to boost your chances of success. To guide you through writing an effective dispute letter for credit and debit card charges. Whether you take on a diy approach or hire a professional, you can see positive results if you correctly execute the process. There are many reasons why you might need to dispute charges to your credit or debit card. This document can allow you to correct any mistakes in your credit history, which can help you take charge of your credit rating and financial future. Web our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. This document can allow you to correct any mistakes in your credit history, which can help you take charge of your credit rating and financial future. Web one way to fix an error on your credit report is to write a credit dispute letter and mail it to one or more credit bureaus. Web while you may be able to dispute these charges over the phone, some companies may also require you to send a written, more formal letter to explain the issue and why you are not responsible for the credit card debt. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. Download our winning 609 dispute letter, plus free tips to help you boost your credit. Insider tips from personal experience to boost your chances of success. Web writing a clear and concise chargeback rebuttal letter is an important step to winning any dispute. Web our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. Download our sample letter and instructions to submit a dispute. Web findlaw explains your rights when dealing with false charges on your credit card and provides a sample letter to send to your lender in a billing dispute. Insider tips from personal experience to boost your chances of success. Ensure the error has been removed by requesting confirmation from the consumer reporting company. Web your report contains a consumer identification or report number that should be included with your dispute to allow the credit reporting company to identify you. Web get your free 609 dispute letter that works! Web our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. There is no charge for submitting a dispute. For example, the items weren’t delivered, i was overcharged, i returned the items, i. Web while you may be able to dispute these charges over the phone, some companies may also require you to send a written, more formal letter to explain the issue and why you are not responsible for the credit card debt. Download our winning 609 dispute letter, plus free tips to help you boost your credit. For tips and a sample template, read more from kount. Web were you charged without your permission, more than you agreed to pay, or for things you didn’t buy? Download our winning 609 dispute letter, plus free tips to help you boost your credit. Web a credit report dispute letter allows consumers to challenge inaccurate, incomplete, or outdated information on. Web if you're disputing information on your experian credit report by mail, start the process of writing a credit dispute letter by filling out a dispute form—or follow the simple guidelines below for writing your own letter. To guide you through writing an effective dispute letter for credit and debit card charges. Web a credit card dispute letter is a. Download our winning 609 dispute letter, plus free tips to help you boost your credit. Web our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. This document can allow you to correct any mistakes in your credit history, which can help you take charge of. For tips and a sample template, read more from kount. Web if you're disputing information on your experian credit report by mail, start the process of writing a credit dispute letter by filling out a dispute form—or follow the simple guidelines below for writing your own letter. Web a credit report dispute letter is used to remove an invalid collection. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. Web a credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed, or if the debt is more than seven years old. Web sample letters to dispute information on a. Web a credit report dispute letter allows consumers to challenge inaccurate, incomplete, or outdated information on their credit reports. Web sample letters to dispute information on a credit report. Web i am writing to dispute a charge of [$______] to my [credit or debit card] account on. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online,. There are many reasons why you might need to dispute charges to your credit or debit card. Web a credit report dispute letter allows consumers to challenge inaccurate, incomplete, or outdated information on their credit reports. Web a credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed,. Below is a sample letter you can use when you need to dispute credit card charges. We’ve tested over 15 dispute letters. Web get your free 609 dispute letter that works! Ensure the error has been removed by requesting confirmation from the consumer reporting company. For tips and a sample template, read more from kount. Web one way to fix an error on your credit report is to write a credit dispute letter and mail it to one or more credit bureaus. This document can allow you to correct any mistakes in your credit history, which can help you take charge of your credit rating and financial future. For example, the items weren’t delivered, i. This document can allow you to correct any mistakes in your credit history, which can help you take charge of your credit rating and financial future. Web writing a clear and concise chargeback rebuttal letter is an important step to winning any dispute. Web a credit card dispute letter is a written communication from a cardholder to the credit card. For example, the items weren’t delivered, i was overcharged, i returned the items, i. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. Web a credit card dispute letter is a written communication from a cardholder to the credit card issuer, detailing a dispute over a credit card transaction. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. A sample letter outlines what to include. Insider tips from personal experience to boost your chances of success. Web sample letters to dispute information on a credit report. Web our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. For tips and a sample template, read more from kount. Web i am writing to dispute a charge of [$______] to my [credit or debit card] account on. Ensure the error has been removed by requesting confirmation from the consumer reporting company. To guide you through writing an effective dispute letter for credit and debit card charges. The charge is in error because [explain the problem briefly. Web one way to fix an error on your credit report is to write a credit dispute letter and mail it to one or more credit bureaus. This document can allow you to correct any mistakes in your credit history, which can help you take charge of your credit rating and financial future. Web findlaw explains your rights when dealing with false charges on your credit card and provides a sample letter to send to your lender in a billing dispute.Dispute Charge Letter Sample

Best Charge Off Dispute Letter Template Riteforyouwellness

Free Charge Off Dispute Letter Template Riteforyouwellness

Charge Off Dispute Letter Template Collection Letter Template Collection

Get Our Sample of Charge Off Dispute Letter Template for Free in 2020

Charge Off Dispute Letter Template

Charge Off Dispute Letter Sample with Examples [Word]

Charge Off Dispute Letter Template

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

609 Dispute Letter For Charge Off

Web Writing A Clear And Concise Chargeback Rebuttal Letter Is An Important Step To Winning Any Dispute.

There Are Many Reasons Why You Might Need To Dispute Charges To Your Credit Or Debit Card.

We’ve Tested Over 15 Dispute Letters.

If Written Correctly, A Credit Dispute Letter Can Be Highly Effective In Removing Negative Items From Your Credit Reports And Fixing Bad Credit.

Related Post:

![Charge Off Dispute Letter Sample with Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2023/03/Charge-Off-Dispute-Letter-Word.jpg?fit=1414%2C2000&ssl=1)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-06-790x1022.jpg)