Contribution Margin Income Statement Template

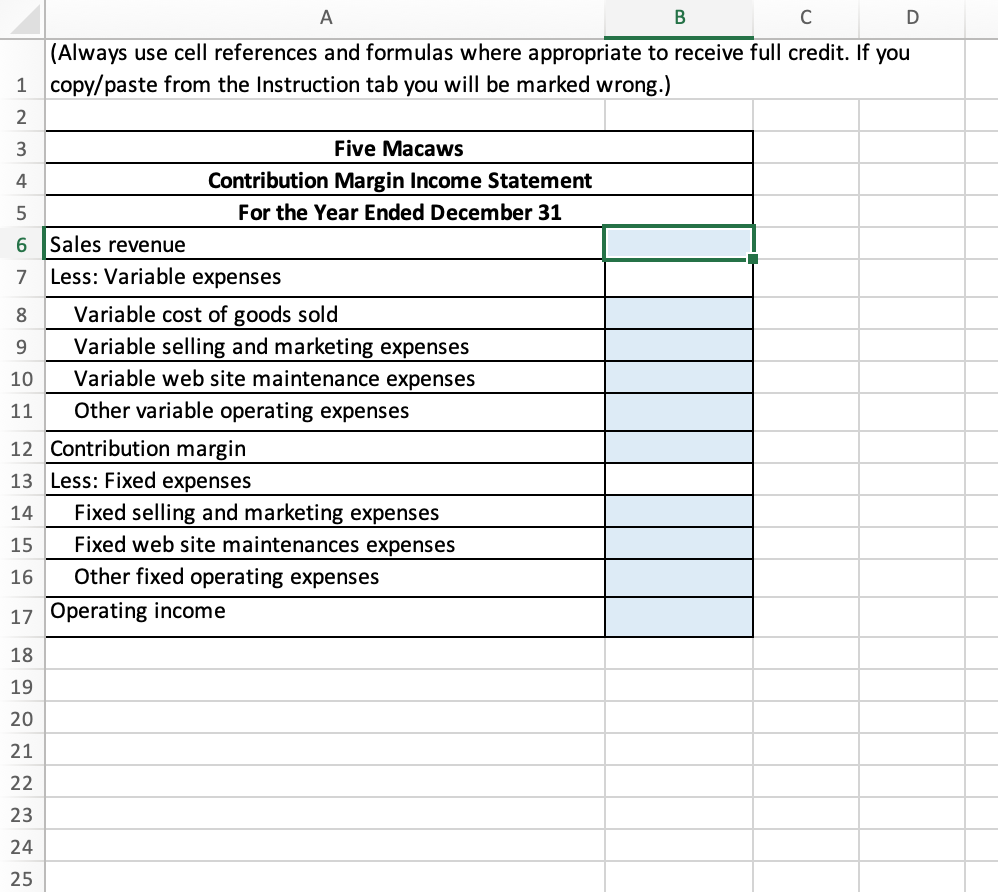

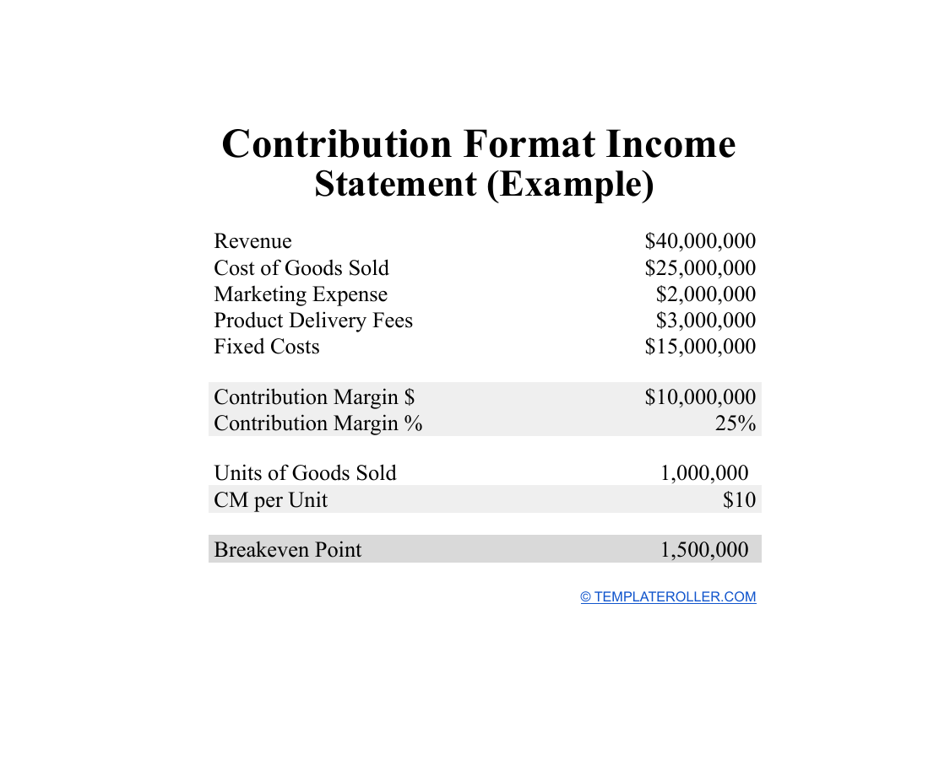

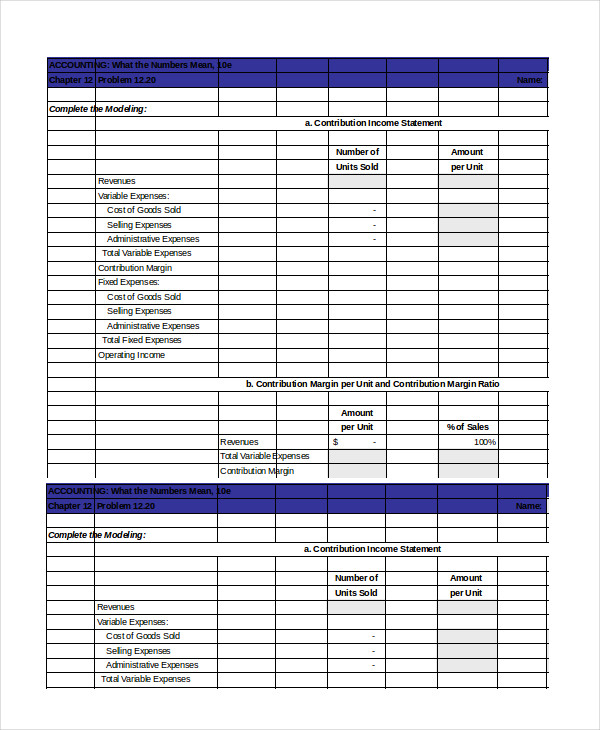

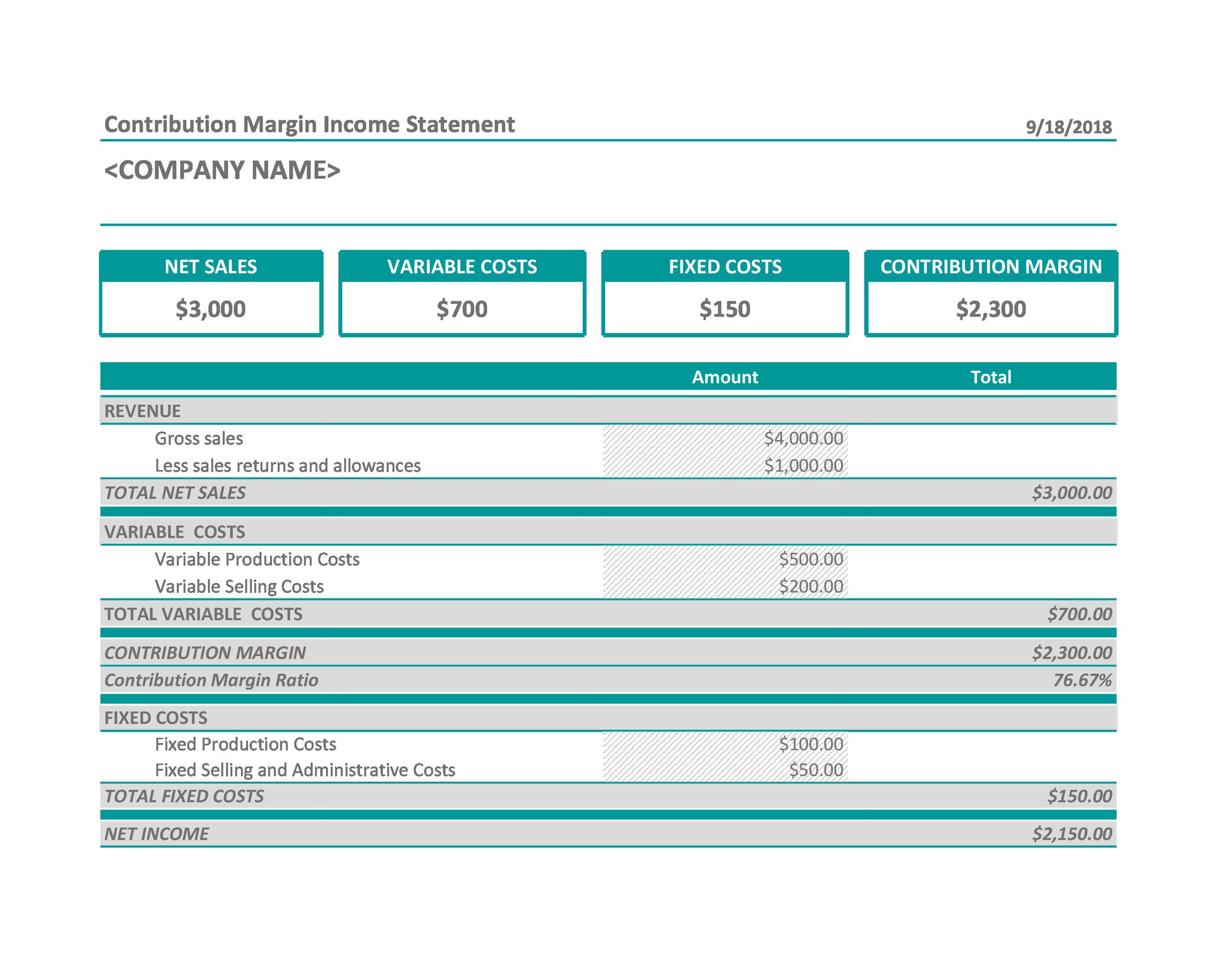

Contribution Margin Income Statement Template - Web to prepare a contribution format income statement, you need to: In other words, this is a special income statement format that lists variable costs and fixed costs in order to calculate the contribution margin of the company. Web a contribution margin income statement deducts variable expenses from sales and arrives at a contribution margin. Web before going further, let’s note several key points about cvp and the contribution margin income statement. 2.7 absorption costing income statement. It helps us understand how much contribution margin any organization has to meet its fixed costs and what is left over as a profit share. 2.4 pro forma income statement. Subtract the fixed costs from the contribution margin to get the net income. The contribution margin represents sales revenue left over after deducting variable costs from sales. The leftover sales revenue of a product once you deduct the variable costs of producing and selling that particular product. Web the contribution margin income statement simplifies the cost structure by dividing it into fixed and variable. In this article, we’ll look at what a contribution margin income statement is, the format, and how it can help your business. The contribution margin represents sales revenue left over after deducting variable costs from sales. Web this income statement is known as the contribution margin income statement or simply the contribution income statement. Web the contribution margin income statement is how you report each product's contribution margin—a key part of smart operating expense planning. It helps us understand how much contribution margin any organization has to meet its fixed costs and what is left over as a profit share. Variable costs are direct and indirect expenses incurred by a business from producing and selling goods or services. In other words, this is a special income statement format that lists variable costs and fixed costs in order to calculate the contribution margin of the company. This highlights the margin and helps illustrate where a company’s expenses. Calculate the total variable costs. Separate variable costs from fixed costs. Fixed expenses are then subtracted to arrive at the net profit or loss for the period. Web the contribution margin income statement separates the fixed and variables costs on the face of the income statement. Web the contribution margin income statement simplifies the cost structure by dividing it into fixed and variable. 1 what is an income statement? These are a few questions this article answers! Calculate the total variable costs. The contribution margin represents sales revenue left over after deducting variable costs from sales. The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability. Web to prepare a contribution format income statement, you need to: 2.6 contribution margin income statement. Web a contribution margin income statement allows a business to understand which profit center its contribution margin comes from. 2.5 common size income statement. Web guide to what is contribution margin income statement. The contribution income statement is a special recipe to see how sweet your lemonade sales are. It separates fixed and variable costs to show which products or services contribute most to generating profit. Separate variable costs from fixed costs. Web what is the contribution margin income statement and what's the formula to calculate it? 2 types of income statements. Subtract the total variable costs from total sales to find the contribution margin. Web the contribution margin income statement is how you report each product's contribution margin—a key part of smart operating expense planning. 2.5 common size income statement. Fixed expenses are then subtracted to arrive at the net profit or loss for the period. Here we explain its format, examples, and their advantages and disadvantages. Web this income statement is known as. 2.5 common size income statement. It separates fixed and variable costs to show which products or services contribute most to generating profit. Fixed expenses are then subtracted to arrive at the net profit or loss for the period. Contribution margin can be presented as the total amount, amount for each product line, amount per unit, or as a percentage of. 2.4 pro forma income statement. Web analyzing the contribution margin helps managers make several types of decisions, from whether to add or subtract a product line to how to price a product or service to how to structure sales. Imagine your business is like a big lemonade stand. Web before going further, let’s note several key points about cvp and. Web guide to what is contribution margin income statement. Web before going further, let’s note several key points about cvp and the contribution margin income statement. The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability. 1 what is an income. First, the contribution margin income statement is used for internal purposes and is not shared with external stakeholders. 2 types of income statements. The contribution margin 12 represents sales revenue left over after deducting variable costs from sales. Web this income statement is known as the contribution margin income statement or simply the contribution income statement. 2.5 common size income. In this article, we’ll look at what a contribution margin income statement is, the format, and how it can help your business. Contribution margin can be presented as the total amount, amount for each product line, amount per unit, or as a percentage of net sales. Variable expenses can be compared year over year to establish a trend and show. Web the contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit. The leftover sales revenue of a product once you deduct the variable costs of producing and selling that particular product. 2 types of income statements. First, you count all the. It helps us understand how much contribution margin any organization has to meet its fixed costs and what is left over as a profit share. Web the contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit. 2 types of income statements.. These are a few questions this article answers! Web this income statement is known as the contribution margin income statement or simply the contribution income statement. 2.5 common size income statement. Then, all fixed expenses are subtracted to arrive at the net profit or net loss for the period. Variable costs are direct and indirect expenses incurred by a business from producing and selling goods or services. In other words, this is a special income statement format that lists variable costs and fixed costs in order to calculate the contribution margin of the company. Web guide to what is contribution margin income statement. The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability. 1 what is an income statement? Subtract the fixed costs from the contribution margin to get the net income. The contribution margin income statement separates variable and fixed costs in an effect to show external users the amount of revenues left over after variable costs are paid. Web a contribution margin income statement allows a business to understand which profit center its contribution margin comes from. Web a contribution margin income statement deducts variable expenses from sales and arrives at a contribution margin. It helps us understand how much contribution margin any organization has to meet its fixed costs and what is left over as a profit share. Here is a screenshot of the contribution margin ratio: 2.7 absorption costing income statement.The Contribution Margin Statement Accounting for Managers

21 Contribution Margin Statement Excel Template Free Popular

FREE 7+ Sample Contribution Statement Templates in PDF MS Word

8 Contribution Statement Templates to Download Sample Templates

Contribution Format Statement Template Download Printable PDF

Contribution Margin Statement Template Excel HQ Template Documents

41 FREE Statement Templates & Examples TemplateLab

Contribution Margin Statement Excel Template Collection

FREE 7+ Sample Contribution Statement Templates in PDF MS Word

41 FREE Statement Templates & Examples TemplateLab

It Separates Fixed And Variable Costs To Show Which Products Or Services Contribute Most To Generating Profit.

Contribution Margin Is A Business’s Sales Revenue Less Its Variable Costs.

The Contribution Margin 12 Represents Sales Revenue Left Over After Deducting Variable Costs From Sales.

Subtract The Total Variable Costs From Total Sales To Find The Contribution Margin.

Related Post: