Corporate Credit Card Policy Template

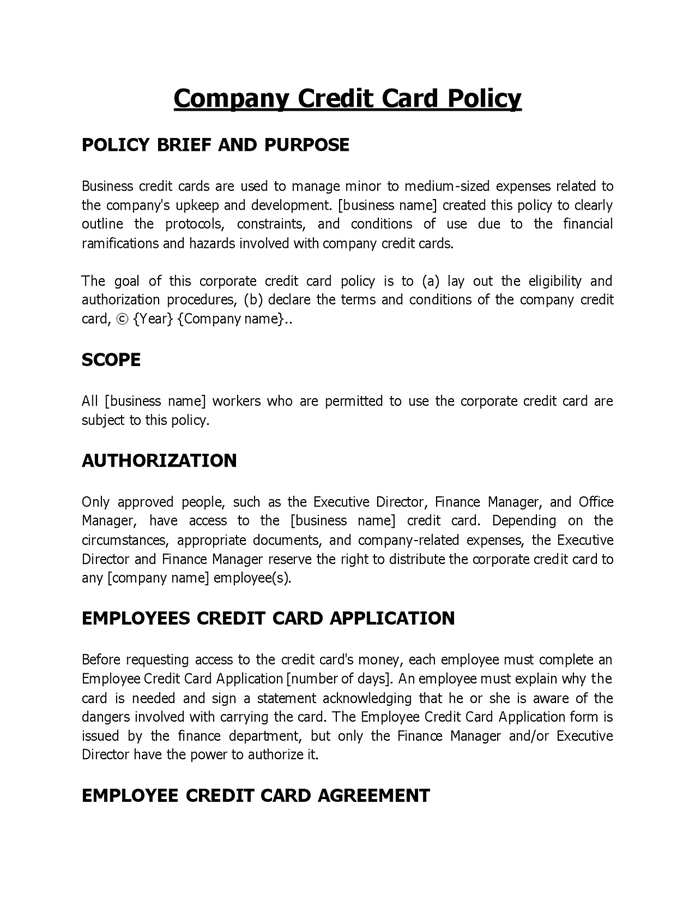

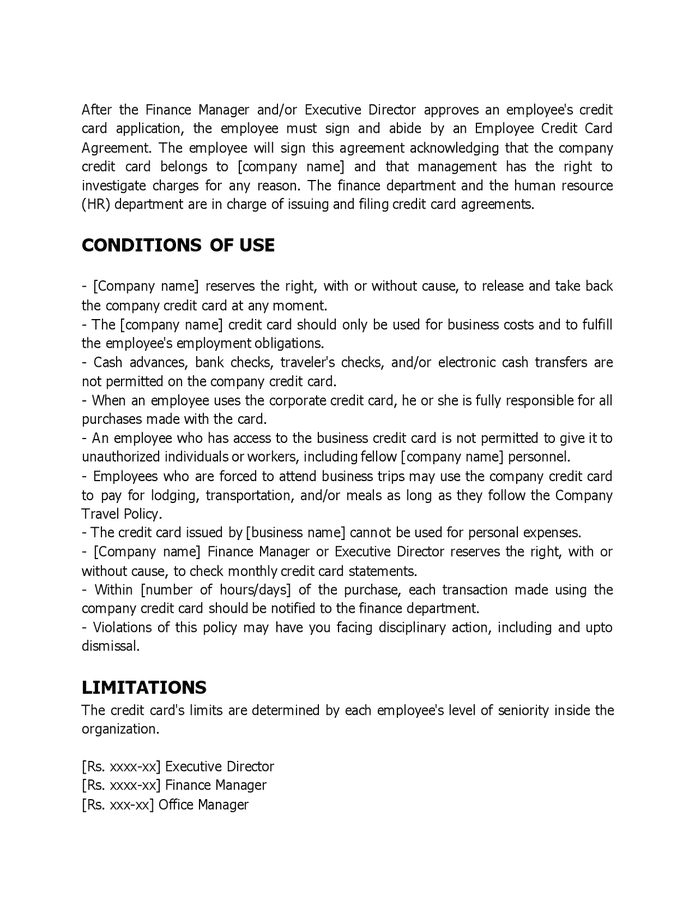

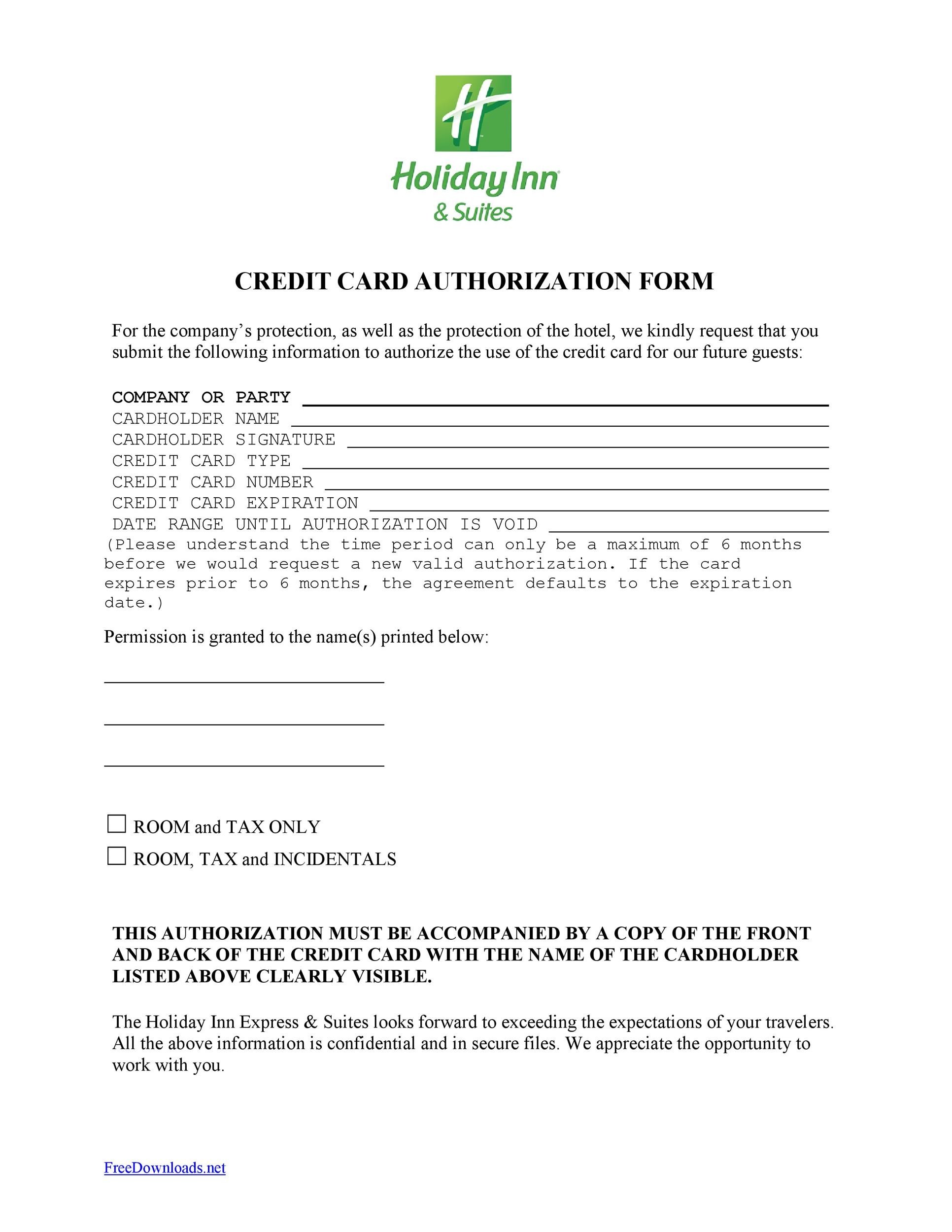

Corporate Credit Card Policy Template - Web to create an effective policy, identify the purpose of corporate cards, define eligible employees, describe acceptable uses and limits, explain reporting requirements, and detail consequences for misuse. It clarifies the terms of use of a company card issued in employees’ names. Ensure compliance and transparency with your organization's financial guidelines. It will open as a pdf document that you can edit. Web a corporate credit card policy template is a document that outlines the rules and regulations for using a company credit card. Who needs a corporate credit card? Web a credit card policy is crucial as it establishes clear guidelines for the responsible use of company funds, ensuring transparency and accountability. The purpose of these cards is to allow the chief executive officer, general managers, managers and authorised staff with delegation to pay for goods and services necessarily incurred in the performance of their duties. [company name] (“company”) will issue company credit cards to certain employees for use in their jobs. Writing using the corporate credit card business case. The purpose of these cards is to allow the chief executive officer, general managers, managers and authorised staff with delegation to pay for goods and services necessarily incurred in the performance of their duties. The agreement is styled to be favorable to the employer and holds the employee personally responsible for charges associated with misuse of the card. Web this sample corporate credit card use agreement template is written for use in a situation in which a company provides a corporate card for employee use. Web the corporate cedit card policy is a document that explains what a corporate credit card can be used for, who is eligible to receive a corporate credit card, and the ongoing requirements that must be upheld when using a corporate credit card. Web a corporate credit card policy is a set of rules, guidelines, and procedures that a company creates to regulate the issuance, usage, and management of an employee credit card. Proposed credit limit (based on anticipated usage of the card and the likely expenditure to be incurred). This policy sets out the acceptable and unacceptable uses of such credit cards. Company credit cards can help eliminate the need for reimbursements and make it easier to track business transactions. This corporate credit card policy sets forth the company guidelines that will be applied to all employees who are issued a corporate credit card. It reduces the risks associated with credit card usage, ensures compliance with company regulations and legal requirements, and helps to detect fraudulent activities. Web create a comprehensive company credit card policy with this template. This policy conveys company expectations and procedures for the issuance, application, use, safeguarding, payment, and termination of the corporate credit card issued to [insert company name]’s. Effective corporate card manuals start with sound preparation. Learn essential elements, best practices, and how to simplify policy adherence from employees. Writing using the corporate credit card business case. This corporate credit card policy sets forth the company guidelines that will be applied to all employees who are issued a corporate credit card. To download the sample credit card usage policy, simply click the image below. Web this sample corporate credit card use agreement template is written for use in a situation in which a company provides a corporate card for employee use. It reduces the risks associated with credit card usage, ensures compliance with company regulations and legal requirements, and helps to detect fraudulent activities. The answer is the first step to building a successful policy. If you need help, review these tips. It helps prevent misuse, fraud, and unauthorized spending by outlining permissible expenses, spending limits, and reporting procedures. Web a credit card policy is part of a company’s accounting policies. Effective corporate card manuals start with sound preparation. Web create a comprehensive company credit card policy with this template. It helps prevent misuse, fraud, and unauthorized spending by outlining permissible expenses, spending limits, and reporting procedures. Web the corporate cedit card policy is a document that explains what a corporate credit card can be used for, who is eligible to receive a corporate credit card, and the ongoing requirements that must be upheld when using a corporate credit card.. Web application for a corporate credit card. The answer is the first step to building a successful policy. Web this corporate credit card policy sets forth the company guidelines that will be applied to all employees who are issued a corporate credit card. Justification for issue (that adequately explains the rationale for the issue of a card); This corporate credit. Web customizable company credit card policy template. This policy will provide understanding and guidance for staff who use a corporate credit card. It helps prevent misuse, fraud, and unauthorized spending by outlining permissible expenses, spending limits, and reporting procedures. The agreement is styled to be favorable to the employer and holds the employee personally responsible for charges associated with misuse. Web customizable company credit card policy template. It will open as a pdf document that you can edit. This policy will provide understanding and guidance for staff who use a corporate credit card. Writing using the corporate credit card business case. The agreement is styled to be favorable to the employer and holds the employee personally responsible for charges associated. Ensure the policy is reviewed and signed by employees before issuing corporate cards. This policy outlines the responsibilities. Writing using the corporate credit card business case. Web company credit card usage policy. Ensure compliance and transparency with your organization's financial guidelines. To download the sample credit card usage policy, simply click the image below. Writing using the corporate credit card business case. This policy outlines the responsibilities. Rarely does every employee need a card, so avoid going down that road. A strong company policy, and the right card to enforce it, can mitigate both of these risks. This policy will provide understanding and guidance for staff who use a corporate credit card. Choosing the ones who receive a corporate credit card should be based on factors like: Web corporate credit card policy. A strong company policy, and the right card to enforce it, can mitigate both of these risks. Web how to write a company credit card. Web customizable company credit card policy template. Effective corporate card manuals start with sound preparation. Company credit cards can help eliminate the need for reimbursements and make it easier to track business transactions. Web a corporate credit card policy is a set of rules, guidelines, and procedures that a company creates to regulate the issuance, usage, and management of an. Company credit cards can help eliminate the need for reimbursements and make it easier to track business transactions. Justification for issue (that adequately explains the rationale for the issue of a card); A strong company policy, and the right card to enforce it, can mitigate both of these risks. Learn essential elements, best practices, and how to simplify policy adherence. Web this credit card policy and procedures template for company credit cards is a set of guidelines and regulations on how the employee should properly utilize the company credit card, as its use is bound by a contract between the company and the employee. The answer is the first step to building a successful policy. But when left unchecked, corporate cards could potentially lead to unauthorized spending and expense fraud. This corporate credit card policy sets forth the company guidelines that will be applied to all employees who are issued a corporate credit card. Web application for a corporate credit card. Effective corporate card manuals start with sound preparation. These policies also aim to protect the company from inappropriate use and to make sure the repercussions are clear. To download the sample credit card usage policy, simply click the image below. Proposed credit limit (based on anticipated usage of the card and the likely expenditure to be incurred). Ensure the policy is reviewed and signed by employees before issuing corporate cards. This policy sets out the acceptable and unacceptable uses of such credit cards. Writing using the corporate credit card business case. Company credit cards can help eliminate the need for reimbursements and make it easier to track business transactions. This policy conveys company expectations and procedures for the issuance, application, use, safeguarding, payment, and termination of the corporate credit card issued to [insert company name]’s. [company name] (“company”) will issue company credit cards to certain employees for use in their jobs. This policy will provide understanding and guidance for staff who use a corporate credit card.Corporate Credit Card Agreement Template Professional Template

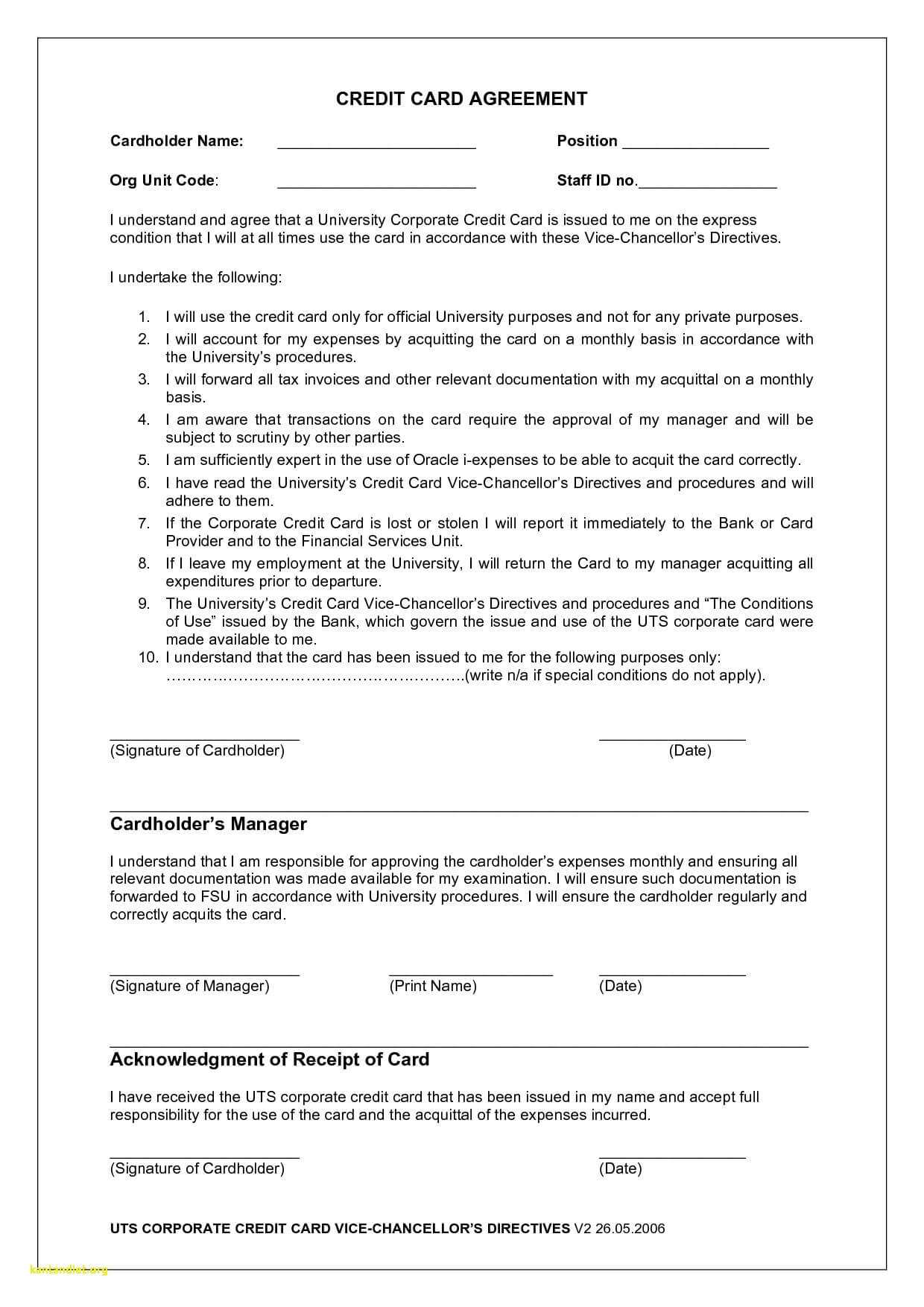

Company credit card policy in Word and Pdf formats

Company credit card policy in Word and Pdf formats page 2 of 3

15+ Corporate Credit Card Policy Template DocTemplates

Company credit card policy in Word and Pdf formats page 3 of 3

Corporate Credit Card Policy And Procedures Pdf Free Download With

Corporate Credit Card Policy Alexander Street, A Proquest For Company

Company Credit Card Policy Template

Free Corporate Credit Card Policy Template Rocket Lawyer

Corporate Credit Card Policy Template Leah Beachum's Template

Choosing The Ones Who Receive A Corporate Credit Card Should Be Based On Factors Like:

Web A Credit Card Policy Is Part Of A Company’s Accounting Policies.

It Clarifies The Terms Of Use Of A Company Card Issued In Employees’ Names.

The Purpose Of These Cards Is To Allow The Chief Executive Officer, General Managers, Managers And Authorised Staff With Delegation To Pay For Goods And Services Necessarily Incurred In The Performance Of Their Duties.

Related Post: