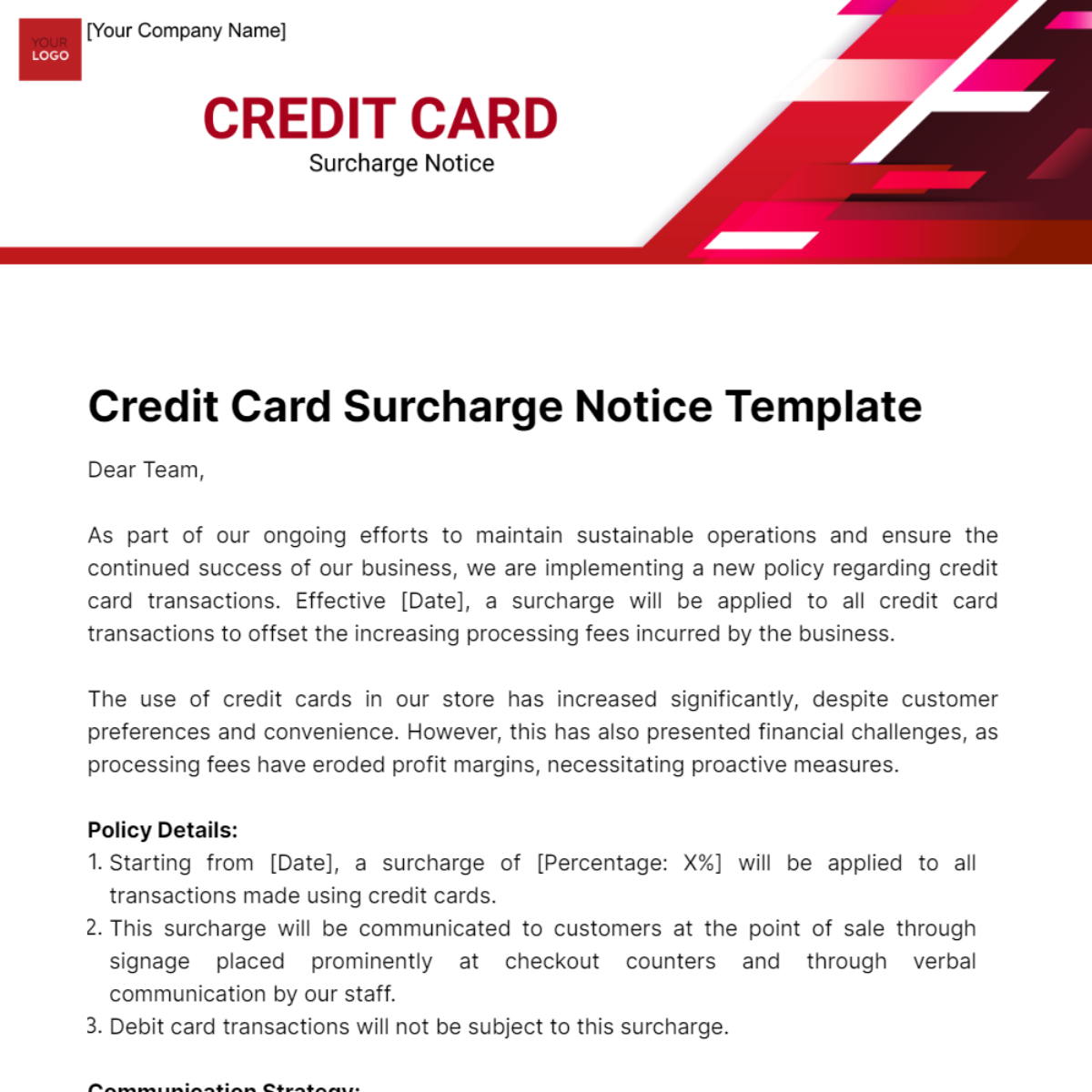

Credit Card Surcharge Notice Template

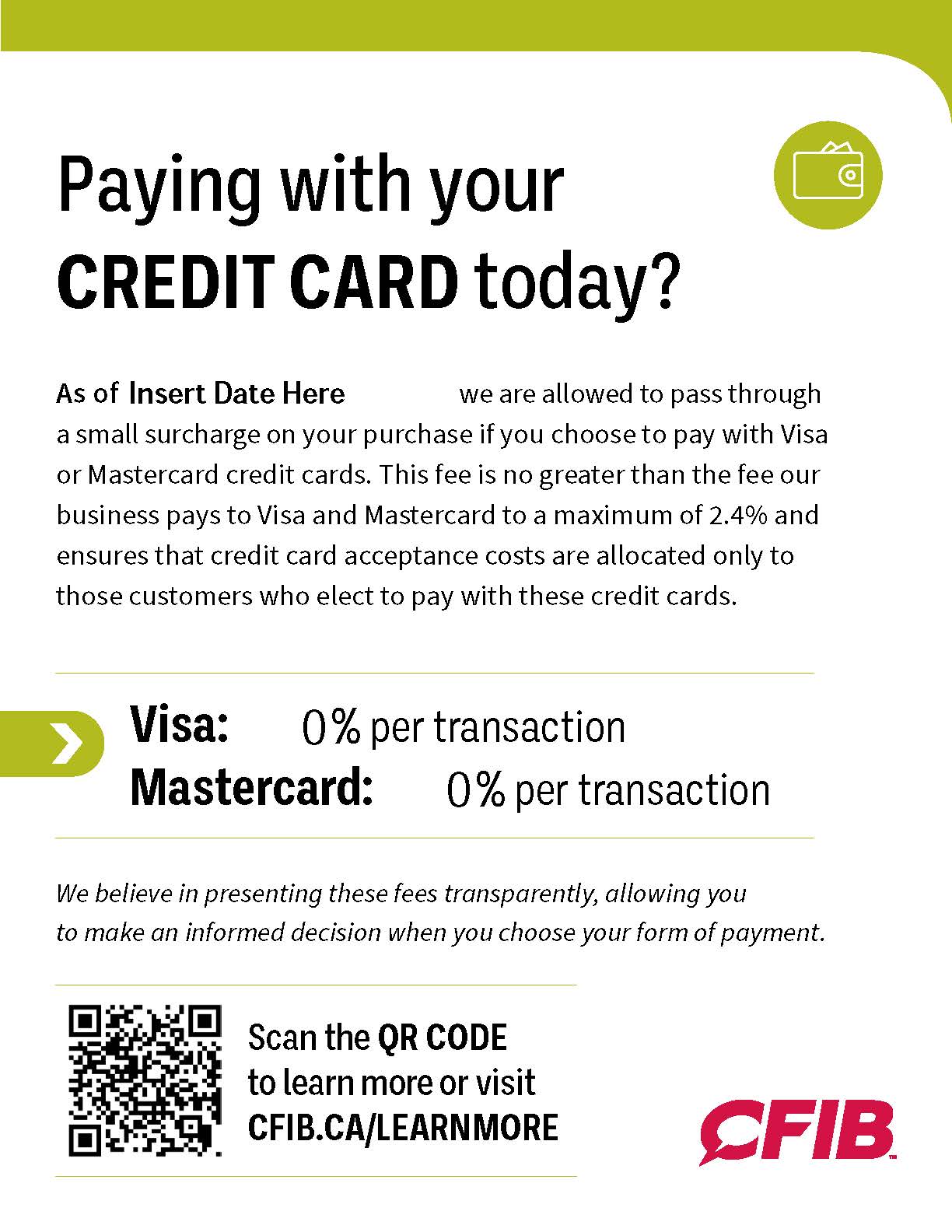

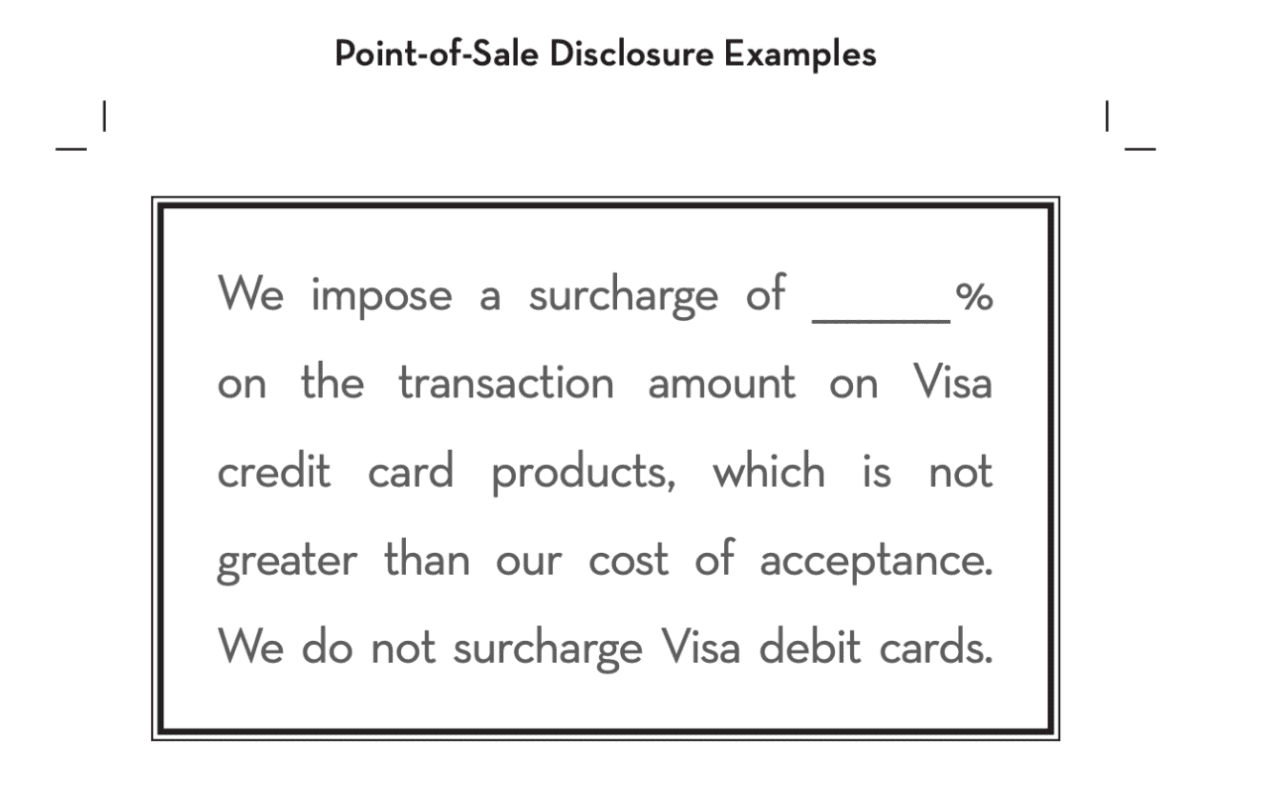

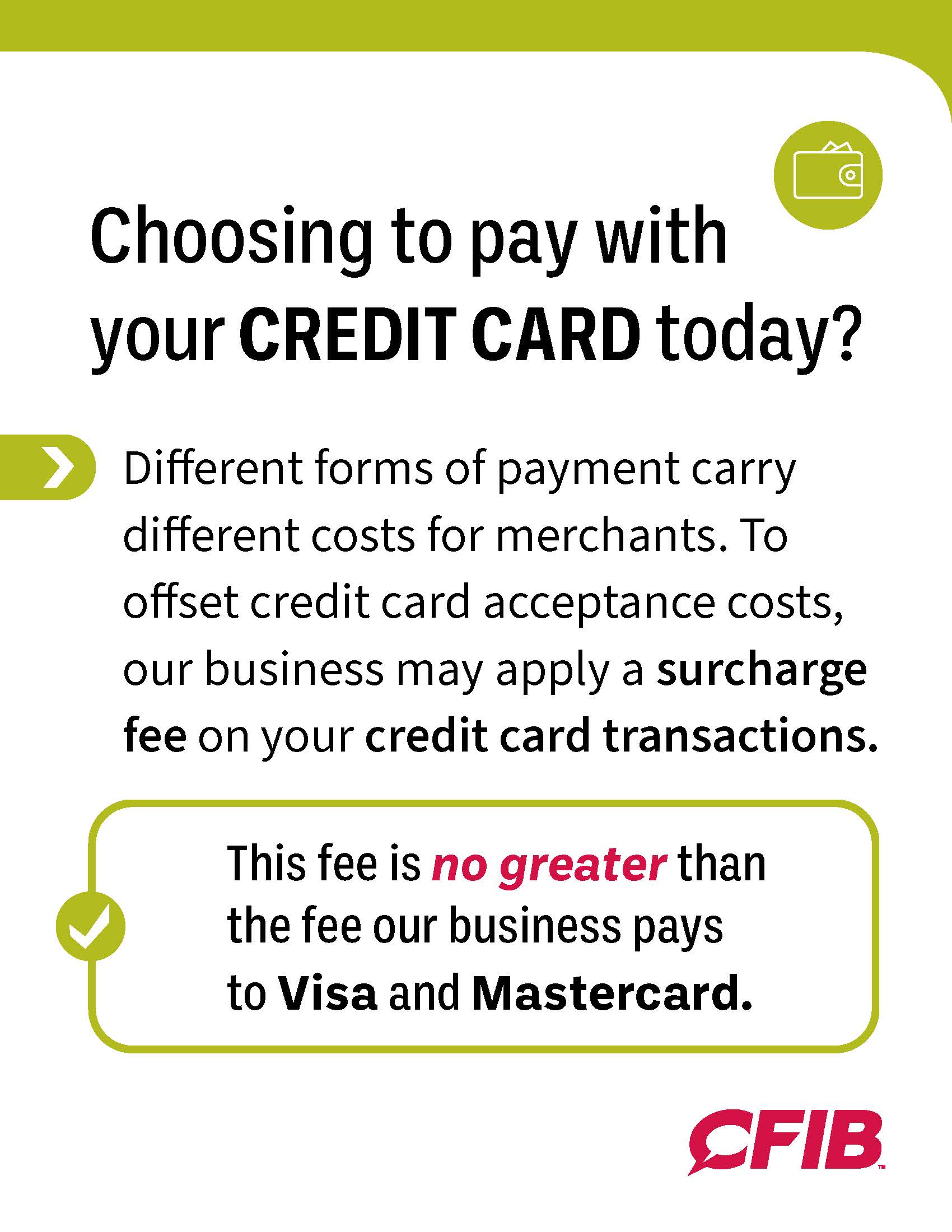

Credit Card Surcharge Notice Template - Web this includes debit card transactions that are “run on credit” and routed through the same network as your credit card transactions. Need some signage for your surcharges? Web learn what credit card surcharges are, how they can offset the cost of payment processing fees, and what legal requirements and limitations apply to them. You can still dodge these fees by paying through apple pay, google pay and paypal, but that loophole will eventually be closed. Web learn how to effectively communicate credit card surcharges to your customers and maintain their trust and satisfaction. Web starting from [date], a surcharge of [percentage: Just follow our easy steps below to create your own signage in minutes. It’s super important to make sure your pos system is set up to remove any surcharge fees when customers pay with a debit card. Find examples of surcharge sign templates and wording, and the difference between surcharge and convenience fee. Web use your card payment machine's surcharging feature to control the surcharge amount and when it is applied. Web learn how to create and display credit card surcharge signs that comply with federal and state laws and card network guidelines. Adjust the rates for different types of credit cards to account for varying acceptance costs. These signs inform customers about the additional charges associated with using credit cards for payments. Web learn how to create effective notice for your surcharging program and comply with legal requirements. Take advantage of the instruments we provide to submit your document. Web learn what credit card surcharges are, how they can offset the cost of payment processing fees, and what legal requirements and limitations apply to them. Explore the pros and cons of surcharging, the customer perception and checkout experience, and the industries that may benefit from it. Web learn how to use credit card authorisation forms to prevent chargebacks and protect your business. Just follow our easy steps below to create your own signage in minutes. Web having a credit card surcharge notice template is essential for any business that charges customers an additional fee for using a credit card as a form of payment. Web learn what credit card surcharging is, how it works, and why some businesses choose to pass on credit card fees to customers. Web this includes debit card transactions that are “run on credit” and routed through the same network as your credit card transactions. Web the enclosed signage is provided as an example of compliant surcharge disclosure. Web having a credit card surcharge notice template is essential for any business that charges customers an additional fee for using a credit card as a form of payment. Set minimum and maximum transaction amounts that trigger the surcharge, as well as minimum and maximum surcharge. Find out how to calculate your cost of acceptance, display surcharge amounts to customers and avoid excessive surcharging penalties. Find examples of surcharge sign templates and wording, and the difference between surcharge and convenience fee. The surcharges come into play when merchants try to recoup the cost of the interchange fees, also known as swipe fees. Territories, and what rules and requirements you need to follow. Need some signage for your surcharges? And the conditions, caps and disclosure requirements for doing so. Web learn about the ban on excessive payment surcharges for certain card types in australia, and how to calculate and report them. Web having a credit card surcharge notice template is essential for any business that charges customers an additional fee for using a credit card as a form of. Find examples of surcharge sign templates and wording, and the difference between surcharge and convenience fee. Web learn how to create and display credit card surcharge signs that comply with federal and state laws and card network guidelines. Find out the legal and regulatory rules for surcharges in different states and countries, and the benefits and drawbacks of using them.. In this article, we will delve into the. Find out what costs businesses can include in their surcharges, and what fees they can't charge. Web learn how to use credit card authorisation forms to prevent chargebacks and protect your business. Find examples of surcharge sign templates and wording, and the difference between surcharge and convenience fee. Need some signage for. You can still dodge these fees by paying through apple pay, google pay and paypal, but that loophole will eventually be closed. Find out what costs businesses can include in their surcharges, and what fees they can't charge. Web learn how to add a surcharge to credit card transactions in the u.s. Scoot has reintroduced payment processing fees for debit. Adjust the rates for different types of credit cards to account for varying acceptance costs. These signs inform customers about the additional charges associated with using credit cards for payments. Web this includes debit card transactions that are “run on credit” and routed through the same network as your credit card transactions. Web learn how to use credit card authorisation. Web learn what credit card surcharges are, how they work, and why businesses apply them. • surcharging applies only to credit transactions in the u.s. Merchants are free to develop their own signage that meets surcharging requirements and are permited to combine brand messages if more than one credit card brand is surcharged (e.g., visa and mastercard). This surcharge will. Web learn how to create effective notice for your surcharging program and comply with legal requirements. Take advantage of the instruments we provide to submit your document. Web learn how to use credit card authorisation forms to prevent chargebacks and protect your business. Just follow our easy steps below to create your own signage in minutes. Find out the limits,. Web learn how to create effective notice for your surcharging program and comply with legal requirements. Web 30 days’ notice required. Find out how to calculate your cost of acceptance, display surcharge amounts to customers and avoid excessive surcharging penalties. Web learn what credit card surcharges are, how they work, and why businesses apply them. X%] will be applied to. Web learn what credit card surcharges are, how they can offset the cost of payment processing fees, and what legal requirements and limitations apply to them. Adjust the rates for different types of credit cards to account for varying acceptance costs. Locate credit card surcharge notice to customers template and click get form to get started. Web displaying credit card. Web learn how to effectively communicate credit card surcharges to your customers and maintain their trust and satisfaction. Web create your own surcharge signage. Find out how to calculate your cost of acceptance, display surcharge amounts to customers and avoid excessive surcharging penalties. Debit and prepaid cannot be. Set minimum and maximum transaction amounts that trigger the surcharge, as well. It’s super important to make sure your pos system is set up to remove any surcharge fees when customers pay with a debit card. In this article, we will delve into the. Web learn how to apply a surcharge to mastercard credit cards in the u.s. Web learn how to surcharge fairly and legally on eftpos, debit and credit card transactions, according to the reserve bank of australia (rba) guidelines. Find out the maximum surcharge cap and the specific rule change for each product type and merchant category. Web learn the legal rules and requirements for surcharge signs in australia, and download a free printable template for your business. Web displaying credit card surcharge signs is a legal requirement for merchants who add an extra fee to transactions made with a credit card. Web the enclosed signage is provided as an example of compliant surcharge disclosure. Merchants are free to develop their own signage that meets surcharging requirements and are permited to combine brand messages if more than one credit card brand is surcharged (e.g., visa and mastercard). • surcharging applies only to credit transactions in the u.s. Web use your card payment machine's surcharging feature to control the surcharge amount and when it is applied. This surcharge will be communicated to customers at the point of sale through signage placed prominently at checkout counters and through verbal communication by our staff. Find out how to calculate your cost of acceptance, display surcharge amounts to customers and avoid excessive surcharging penalties. Web learn how to use credit card authorisation forms to prevent chargebacks and protect your business. Find examples of surcharge sign templates and wording, and the difference between surcharge and convenience fee. Find out the factors to consider when selecting a credit card processing provider and the top providers for small businesses.Credit Card Surcharge Notice Template

FREE Notice Templates & Examples Edit Online & Download

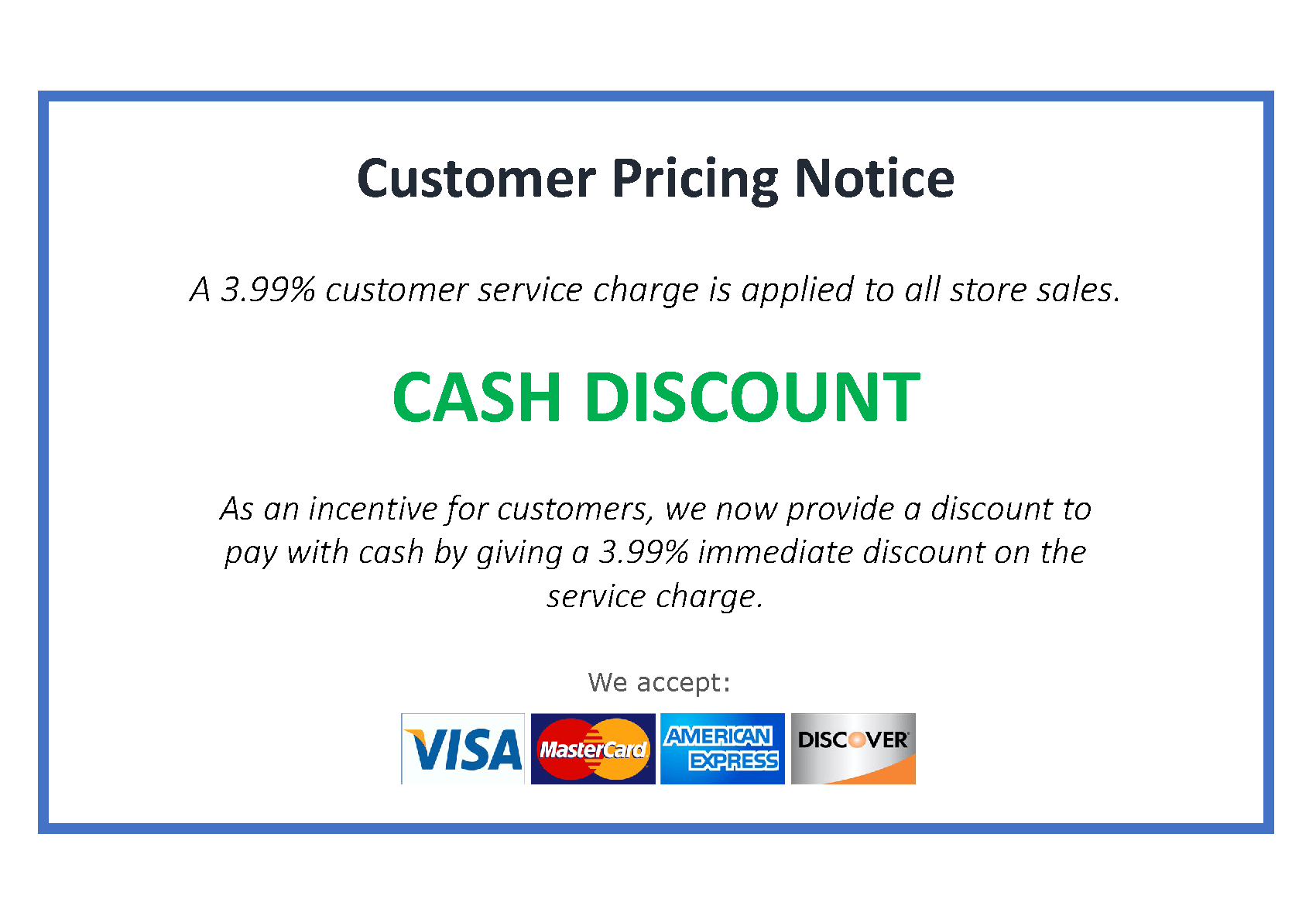

Cash Discount Program Signage

Surcharging and What It Means For Your Business

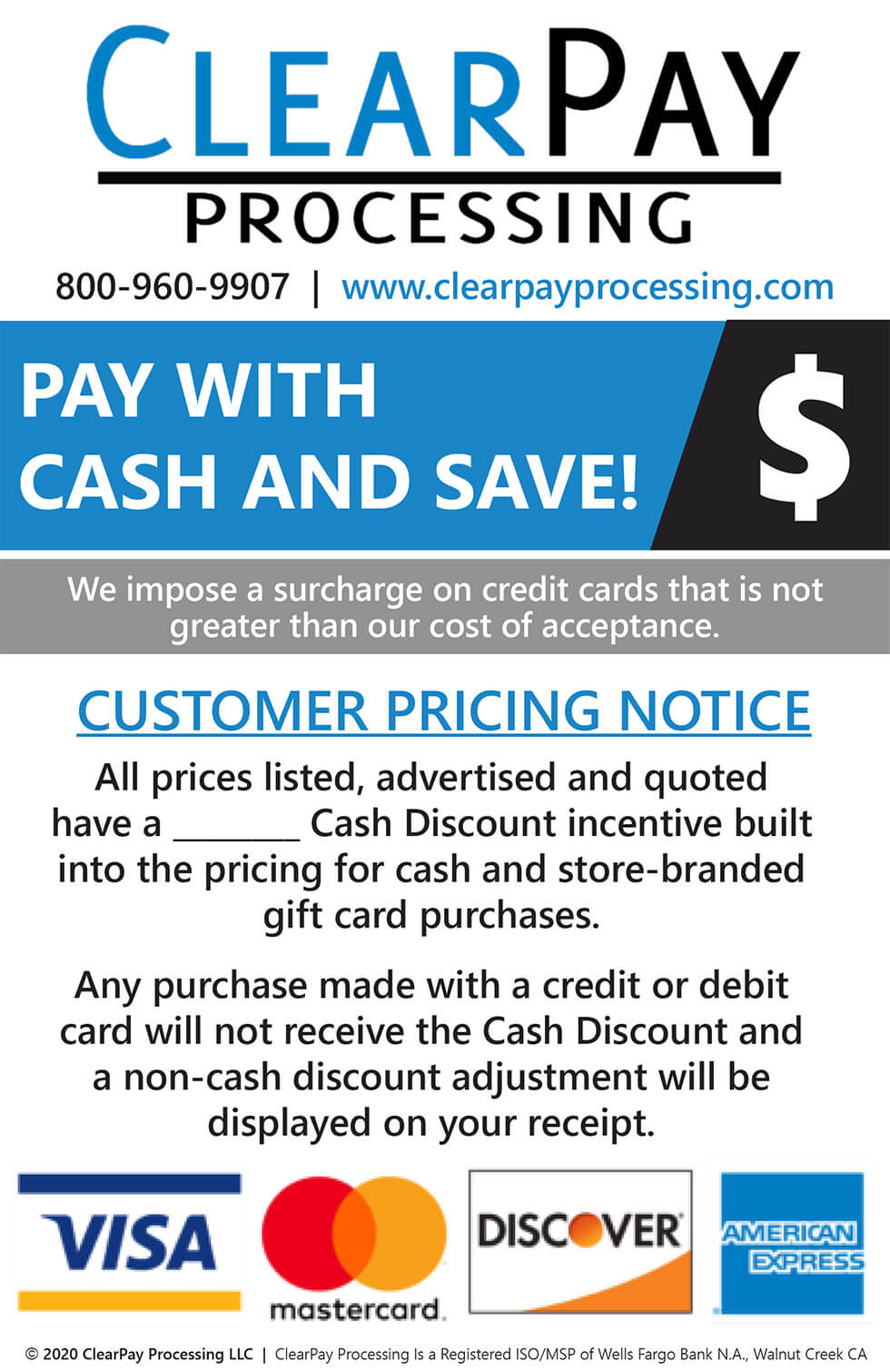

Dual Pricing ClearPay Processing

Beginner’s Guide to Credit Card Surcharging Merchant Cost Consulting

Credit Card Surcharge Notice Template

Surcharge Letter Template prntbl.concejomunicipaldechinu.gov.co

Credit Card Surcharge Notice Template

Free Sign For Credit Card Fee 3.00

Scoot Has Reintroduced Payment Processing Fees For Debit And Credit Cards On Flights Departing From Australia, Japan, Taiwan And Thailand, Ranging From 1.05% To 2.48%.

Web Learn How To Effectively Communicate Credit Card Surcharges To Your Customers And Maintain Their Trust And Satisfaction.

Find Out The Rules, Tips, And Scripts For Implementing Convenience Fees And Compare Them With Surcharges.

And The Conditions, Caps And Disclosure Requirements For Doing So.

Related Post: