Credit Repair Letter Template

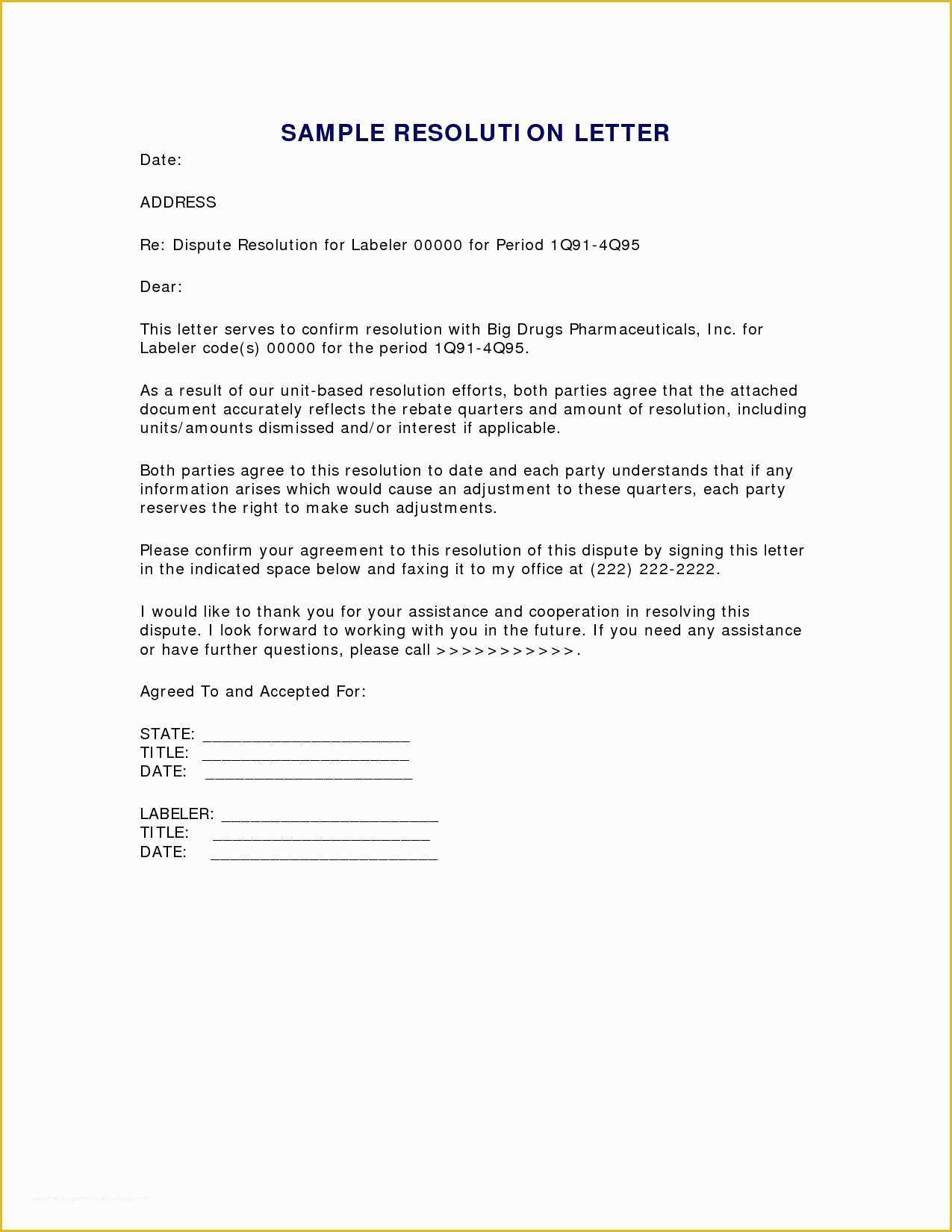

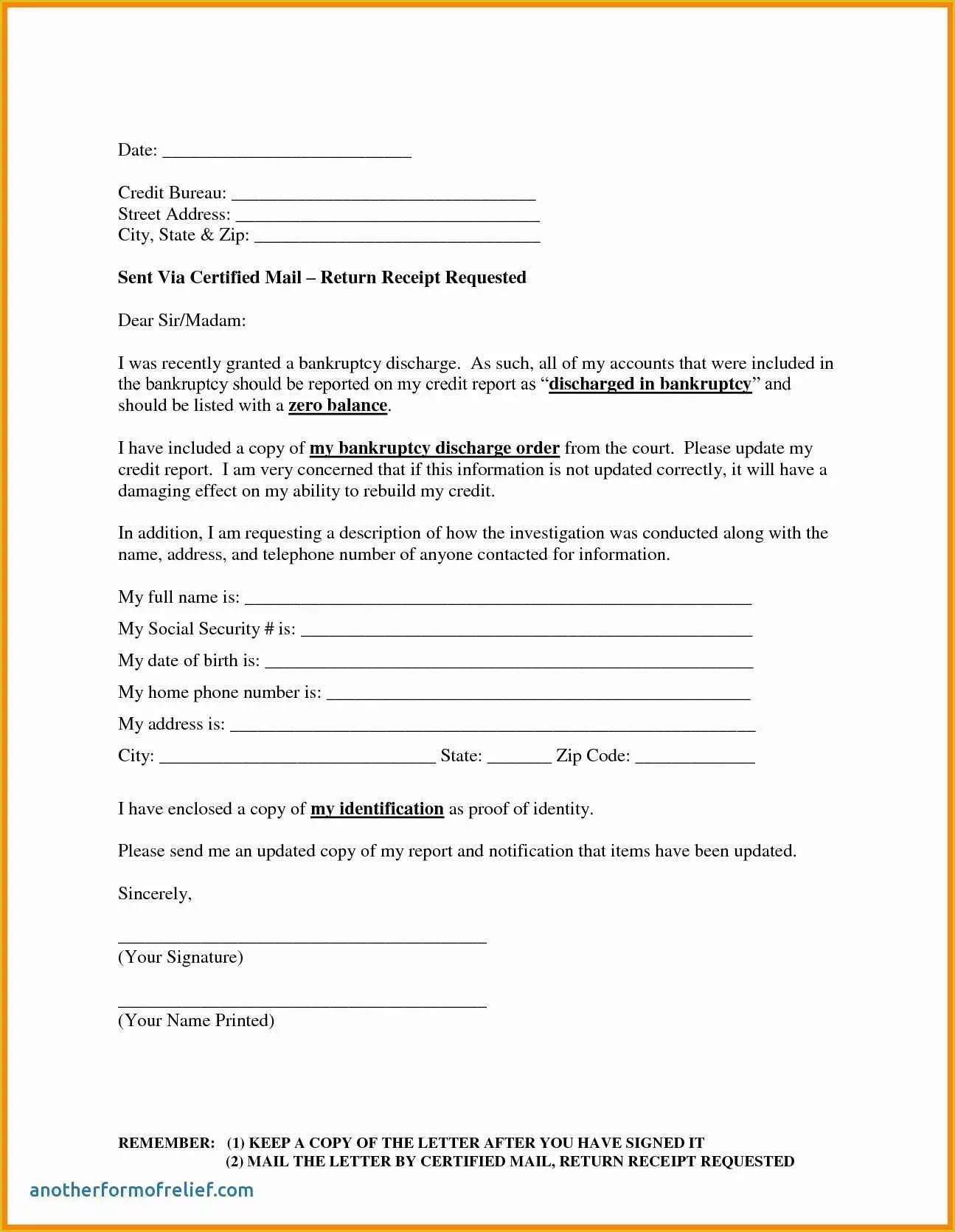

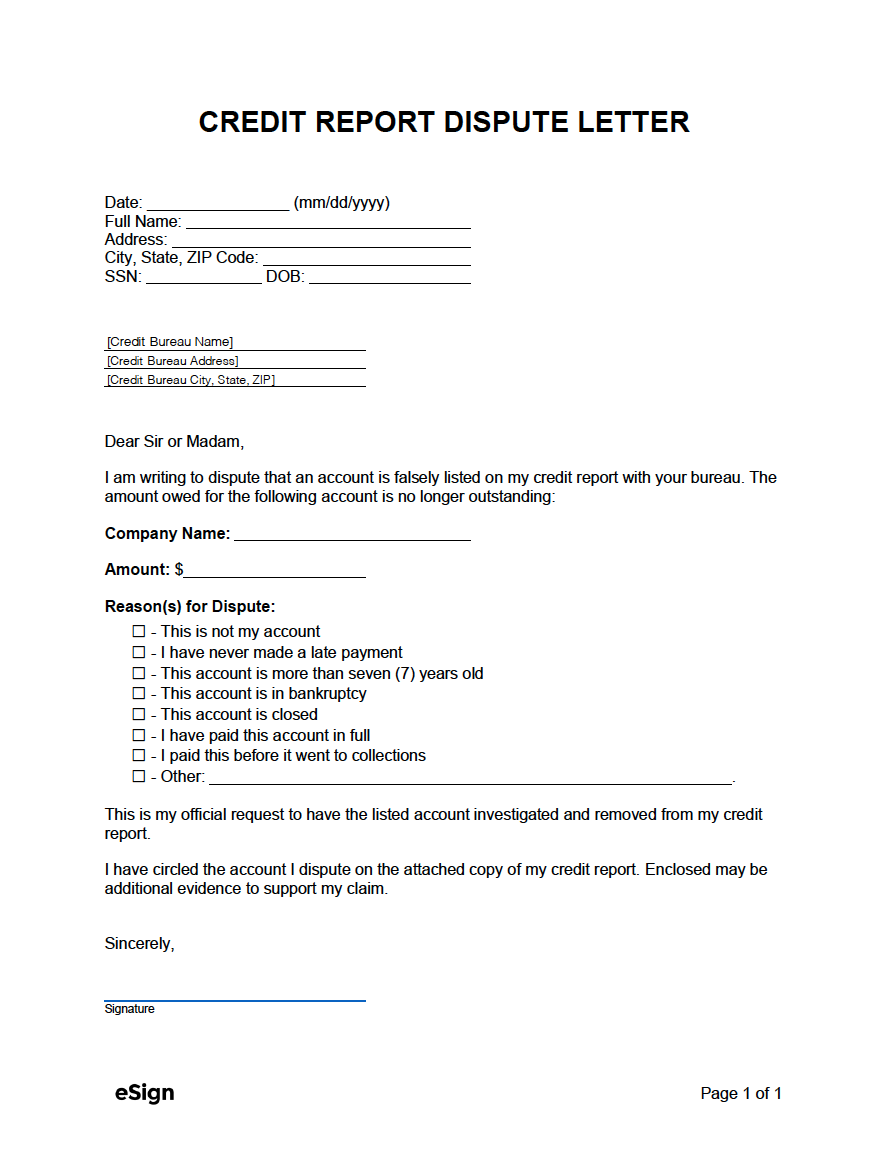

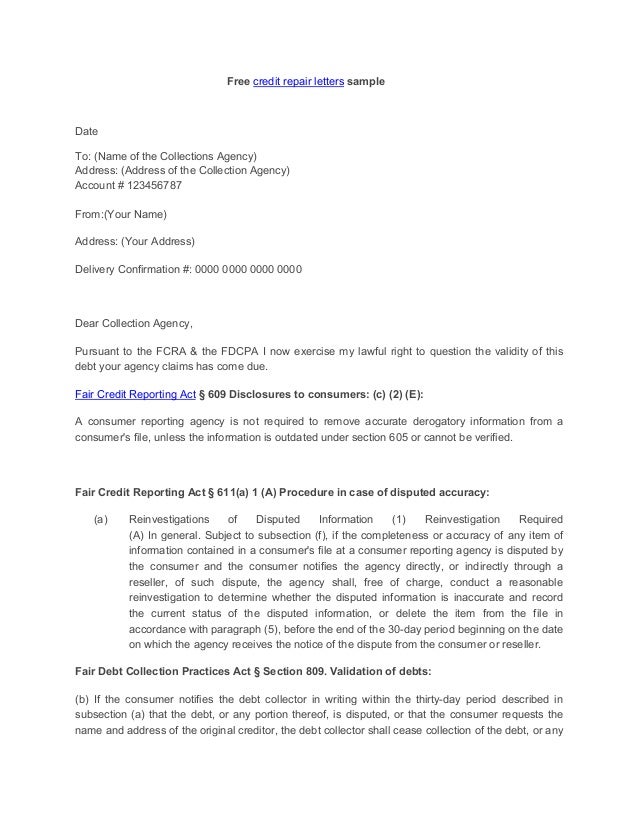

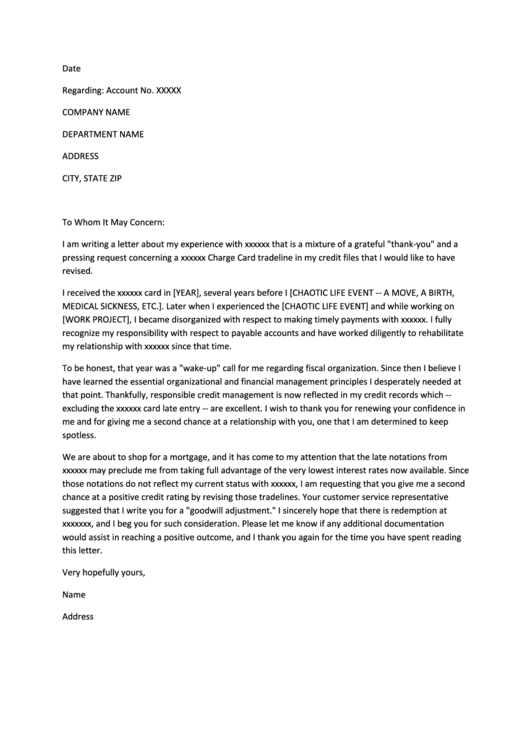

Credit Repair Letter Template - You can download, print and use these credit dispute letters to remove negative information. Don’t get hung up on crafting the perfect letter — just know what you are saying and make sure they understand what you are presenting to them. Compare the pros and cons of each choice below to make a decision that’s right for you. Web unlock the diy guide to credit repair with letter templates and expert insights on transunion, equifax, and experian. Web if you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. That your credit report contains. Web a credit report dispute letter allows consumers to challenge inaccurate, incomplete, or outdated information on their credit reports. Web in most cases, you have two options for sending your dispute. We’ve gathered all of our sample letter templates, as well as writing tips to help you personalize your letter and get the best outcome for your dispute or negotiation. Web a 609 letter, also known as a 609 dispute letter, can help you remove “unverifiable” bad marks, boost your credit score, and help you qualify for loans that you otherwise wouldn’t meet the requirements for. Web a credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed, or if the debt is more than seven years old. Web our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. Web our diy credit repair kit includes everything you need to repair your credit. We’ve gathered all of our sample letter templates, as well as writing tips to help you personalize your letter and get the best outcome for your dispute or negotiation. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. This document can allow you to correct any mistakes in your credit history, which can help you take charge of your credit rating and financial future. That your credit report contains. Web a 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. These include debt validation letters, ‘pay for delete’ letters, goodwill letters, and more. Web a credit report dispute letter allows consumers to challenge inaccurate, incomplete, or outdated information on their credit reports. Web if you're disputing information on your experian credit report by mail, start the process of writing a credit dispute letter by filling out a dispute form—or follow the simple guidelines below for writing your own letter. And tools you can use if you believe. Web our diy credit repair kit includes everything you need to repair your credit. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. Web a credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed, or if the debt is more than seven years old. Web unlock the diy guide to credit repair with letter templates and expert insights on transunion, equifax, and experian. Web one way to fix an error on your credit report is to write a credit dispute letter and mail it to one or more credit bureaus. Web a 609 letter, also known as a 609 dispute letter, can help you remove “unverifiable” bad marks, boost your credit score, and help you qualify for loans that you otherwise wouldn’t meet the requirements for. Don’t get hung up on crafting the perfect letter — just know what you are saying and make sure they understand what you are presenting to them. Compare the pros and cons of each choice below to make a decision that’s right for you. Web use this sample letter to dispute mistakes on your credit report. Web fixing errors and inaccuracies in your credit line is possible. You can download, print and use these credit dispute letters to remove negative information. Web remove the mystery of the section 609 letter as we explain how to submit a credit dispute letter and debunk credit repair. However, there are several other letters that can be used to repair your credit. Learn how to fix credit disputes, handle verifications, and improve credit scores effectively. Web a 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. Web in most cases, you have two options for sending your. And tools you can use if you believe. Compare the pros and cons of each choice below to make a decision that’s right for you. If written correctly, a credit dispute letter can be highly effective in removing negative items from your credit reports and fixing bad credit. A sample letter outlines what to include. Learn how to fix credit. Web they are often used to dispute inaccurate or incomplete information, or to challenge a negative item on a credit report. Web writing a letter to the credit bureaus or a debt collection agency can be daunting. Web fixing errors and inaccuracies in your credit line is possible. We’ve gathered all of our sample letter templates, as well as writing. Web our free credit repair letters are meant to give you direction on what to state in your letter. Web if you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. Web our free. Web if you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. Web a credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid,. Web our diy credit repair kit includes everything you need to repair your credit. It is important to dispute inaccurate information Web writing a letter to the credit bureaus or a debt collection agency can be daunting. Web fixing errors and inaccuracies in your credit line is possible. Learn how to fix credit disputes, handle verifications, and improve credit scores. Web our free credit repair letters are meant to give you direction on what to state in your letter. Web writing a letter to the credit bureaus or a debt collection agency can be daunting. Web in most cases, you have two options for sending your dispute. You can download, print and use these credit dispute letters to remove negative. A sample letter outlines what to include. Web a 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. Web fixing errors and inaccuracies in your credit line is possible. These include debt validation letters, ‘pay for delete’ letters, goodwill letters, and more. Web unlock the diy guide to credit. That your credit report contains. It’s named after section 609 of the fair credit reporting act (fcra), a federal law that protects consumers from unfair credit and collection practices. A sample letter outlines what to include. Web our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit. Compare the pros and cons of each choice below to make a decision that’s right for you. Web remove the mystery of the section 609 letter as we explain how to submit a credit dispute letter and debunk credit repair hogwash. These include debt validation letters, ‘pay for delete’ letters, goodwill letters, and more. Web if you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. Web one way to fix an error on your credit report is to write a credit dispute letter and mail it to one or more credit bureaus. Web our free credit repair letters are meant to give you direction on what to state in your letter. Web our diy credit repair kit includes everything you need to repair your credit. Information that is inaccurate or incomplete, and you would like to submit a dispute of that information to the credit reporting company. A sample letter outlines what to include. This document can allow you to correct any mistakes in your credit history, which can help you take charge of your credit rating and financial future. Don’t get hung up on crafting the perfect letter — just know what you are saying and make sure they understand what you are presenting to them. Learn how to fix credit disputes, handle verifications, and improve credit scores effectively. It is important to dispute inaccurate information All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. You can download, print and use these credit dispute letters to remove negative information. That your credit report contains.150 DIY Credit Repair Letter Templates Etsy

Free Sample Credit Repair Letters And Templates Printable Templates

Free Sample Credit Repair Letters And Templates Printable Templates

Letter Of Credit Template

14 Sample Letter of Credit Templates Samples, Examples & Format

Credit Repair Letter! PDF Credit History Credit Bureau

Credit repair letter

Credit Repair Letter Templates at

Credit Repair Letter Template printable pdf download

609 Credit Repair Letter Template Pdf Fill and Sign Printable

Web If You're Disputing Information On Your Experian Credit Report By Mail, Start The Process Of Writing A Credit Dispute Letter By Filling Out A Dispute Form—Or Follow The Simple Guidelines Below For Writing Your Own Letter.

It’s Named After Section 609 Of The Fair Credit Reporting Act (Fcra), A Federal Law That Protects Consumers From Unfair Credit And Collection Practices.

Web A 609 Letter, Also Known As A 609 Dispute Letter, Can Help You Remove “Unverifiable” Bad Marks, Boost Your Credit Score, And Help You Qualify For Loans That You Otherwise Wouldn’t Meet The Requirements For.

Web A Credit Report Dispute Letter Allows Consumers To Challenge Inaccurate, Incomplete, Or Outdated Information On Their Credit Reports.

Related Post: