Credit Report Dispute Letter Template

Credit Report Dispute Letter Template - A sample letter outlines what to include. Imagine you’ve just received your credit report. Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. This document can allow you to correct any mistakes in your credit history, which can help you take charge of your credit rating and financial future. Where to file a complaint against a credit reporting agency. And tools you can use if you believe. Download our sample letter and instructions to submit a dispute with an information furnisher. Web free section 609 letter template. Web don't worry if you're not quite sure about the best way to phrase a credit report dispute letter. Notify lenders and employers of the updated report; Download our sample letter and instructions to submit a dispute with an information furnisher. Web this guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate, and you would like to submit. If written correctly, a credit dispute letter can be highly effective in removing negative items from your credit reports and fixing bad credit. Create credit dispute letters using pandadoc. Steps to submitting a dispute letter. In your dispute letter to the creditor, you may want to enclose a copy of the relevant portion of your credit report and highlight the items in question. Dispute of that information to the company that provided the information to the credit reporting company (called. Web if you spot an error in your credit report, you need to contact both the credit bureau and your creditor in order to dispute the incorrect information. A sample letter outlines what to include. Use it to request an update to, or removal of, inaccurate information on your credit report. Web use this sample letter to dispute incorrect or inaccurate information that a business supplied to credit bureaus. A credit report dispute letter is a one (1) page document sent to the major credit reporting bureaus to request the removal of incorrect information on a credit report. A credit dispute letter is a powerful tool used by businesses to rectify credit report inaccuracies, safeguarding credibility and financial accuracy. What is really annoying is the fact that these people have faithfully kept their credits clean. If written correctly, a credit dispute letter can be highly effective in removing negative items from your credit reports and fixing bad credit. Web 50 best credit dispute letters templates [free] there are times when people get surprised with letters they receive from credit bureaus informing them about shortcomings. It is important to dispute inaccurate information We've included a sample credit report dispute letter that you can send to credit bureaus. What about ‘pay for delete’ letters? This document can allow you to correct any mistakes in your credit history, which can help you take charge of your credit rating and financial future. Dispute of that information to the company that provided the information to the credit reporting company (called. Use it to request an update to, or removal of, inaccurate information on your credit report. Web a credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed, or if the. Dispute of that information to the company that provided the information to the credit reporting company (called. Eliminate bad debts and reporting errors; Web use this sample letter to dispute incorrect or inaccurate information that a business supplied to credit bureaus. Web our free credit report dispute letter templates help you write effective dispute letters so you can get negative. Web you can use a credit dispute letter template to simplify the drafting process. What happens to your dispute letter. Web this guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate, and you would like to submit. What is really annoying is the fact that these people have faithfully. Remove fraudulent accounts and loans; Notify lenders and employers of the updated report; All three credit reporting bureaus ( equifax , experian , and transunion ) accept dispute requests online, standard mail, and by phone. Imagine you’ve just received your credit report. If written correctly, a credit dispute letter can be highly effective in removing negative items from your credit. What is really annoying is the fact that these people have faithfully kept their credits clean. Web one way to fix an error on your credit report is to write a credit dispute letter and mail it to one or more credit bureaus. Vipul taneja, vp, finance transformation. Web use this sample letter to dispute mistakes on your credit report.. Web you can use a credit dispute letter template to simplify the drafting process. Web if you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. A credit dispute letter is a powerful tool. Web our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. Vipul taneja, vp, finance transformation. Dispute of that information to the company that provided the information to the credit reporting company (called. Web if you want to dispute information on a credit report, you may. All three credit reporting bureaus ( equifax , experian , and transunion ) accept dispute requests online, standard mail, and by phone. Web our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. Web sample credit dispute letter. Web free section 609 letter template. Steps to. Web this guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate, and you would like to submit. Web a credit report dispute letter allows consumers to challenge inaccurate, incomplete, or outdated information on their credit reports. Remove fraudulent accounts and loans; What happens to your dispute letter. Web sample. Where to file a complaint against a credit reporting agency. Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. Web if you spot an error in your credit report, you need to contact both the credit bureau and your creditor. Web use this sample letter to dispute mistakes on your credit report. Steps to submitting a dispute letter. Use it to request an update to, or removal of, inaccurate information on your credit report. What happens to your dispute letter. Web don't worry if you're not quite sure about the best way to phrase a credit report dispute letter. It is important to dispute inaccurate information Web one way to fix an error on your credit report is to write a credit dispute letter and mail it to one or more credit bureaus. Web you can use a credit dispute letter template to simplify the drafting process. Dispute of that information to the company that provided the information to the credit reporting company (called. A credit dispute letter is a powerful tool used by businesses to rectify credit report inaccuracies, safeguarding credibility and financial accuracy. Some businesses associated with the 609 letter strategy. Web our free credit report dispute letter templates help you write effective dispute letters so you can get negative items removed from your credit file. What about ‘pay for delete’ letters? Remove fraudulent accounts and loans; Web this guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate, and you would like to submit. Whether you take on a diy approach or hire a professional, you can see positive results if you correctly execute the process.50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

What Is A 609 Dispute Letter

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Credit Report Dispute Letter Template

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Credit Report Dispute Letter Template

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

How To Write A Letter To The Irs To Dispute

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab Credit

This Document Can Allow You To Correct Any Mistakes In Your Credit History, Which Can Help You Take Charge Of Your Credit Rating And Financial Future.

In Your Dispute Letter To The Creditor, You May Want To Enclose A Copy Of The Relevant Portion Of Your Credit Report And Highlight The Items In Question.

What Is Really Annoying Is The Fact That These People Have Faithfully Kept Their Credits Clean.

Eliminate Bad Debts And Reporting Errors;

Related Post:

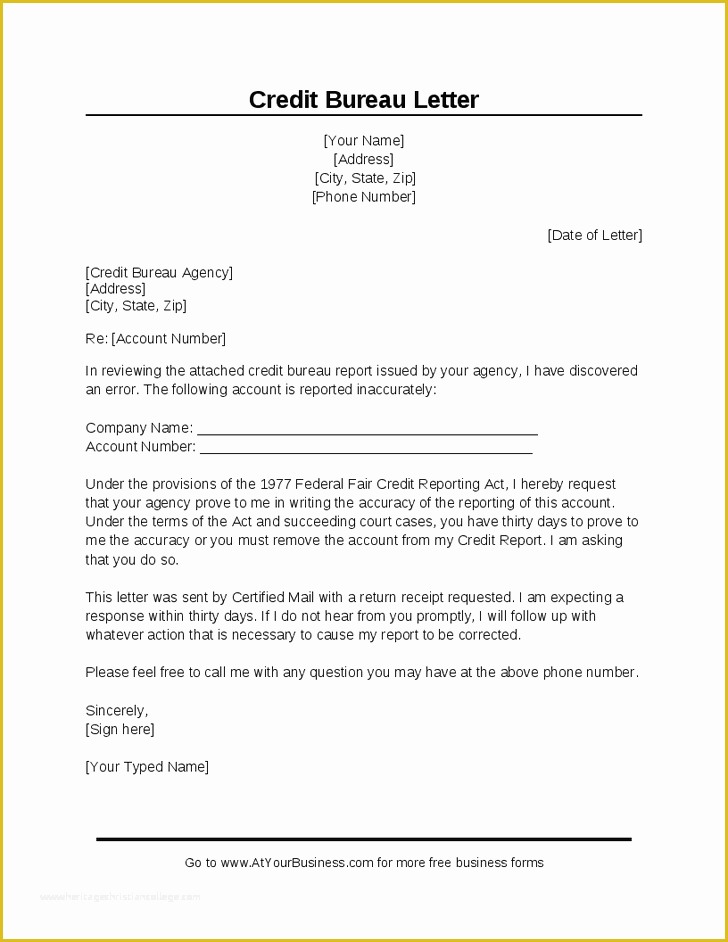

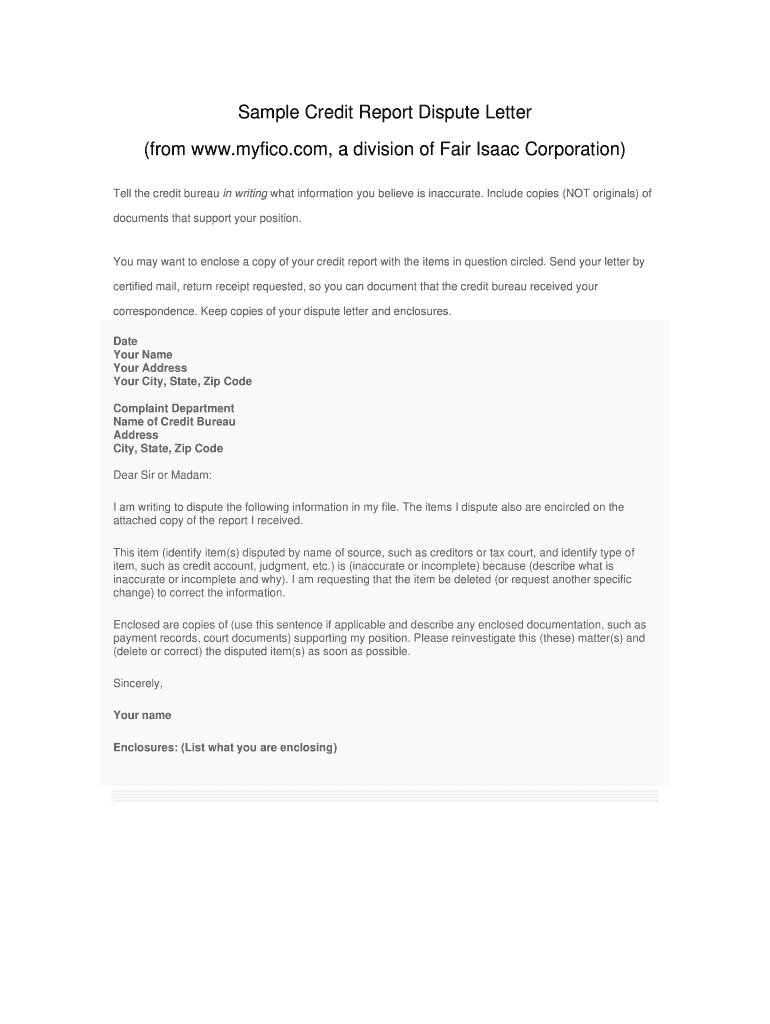

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-28.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-20.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-41.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-03.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-01-790x1022.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab Credit](https://i.pinimg.com/originals/49/9e/e1/499ee112cb1f6759eff37ed4d0d19b63.jpg)