Debt Dispute Letter Template

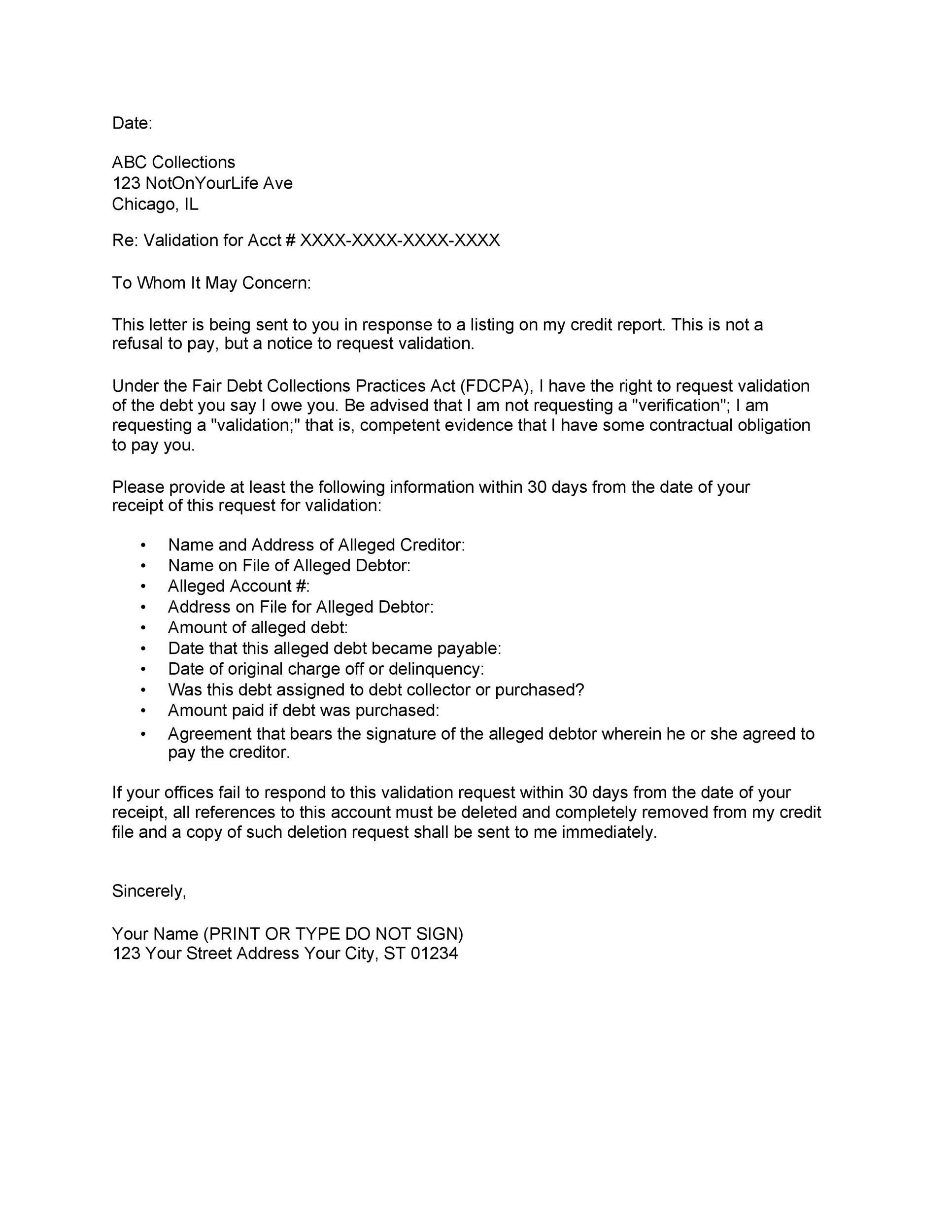

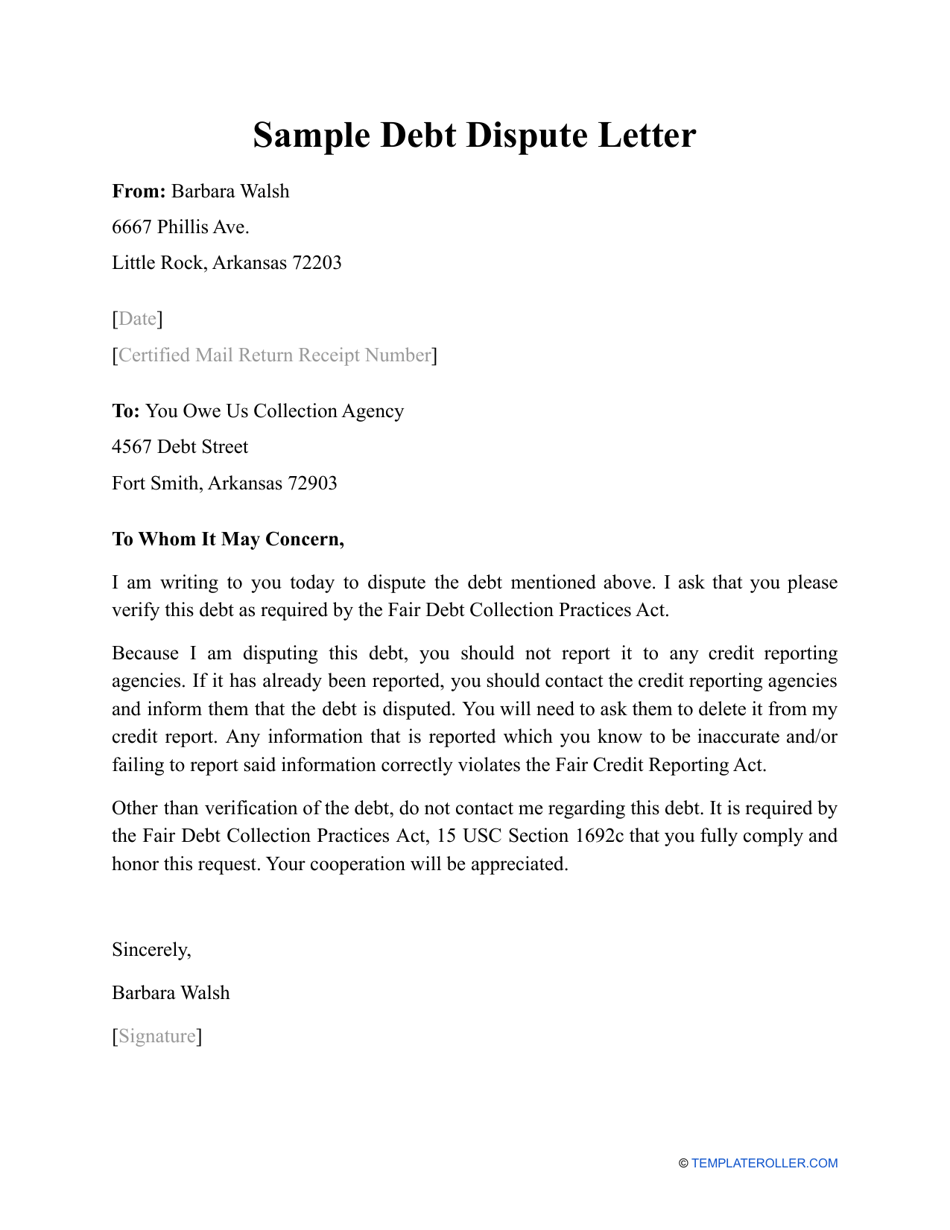

Debt Dispute Letter Template - Web sample letter to collection agency disputing debt. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Web purpose of sending the letter: Web if you've received a notice from a debt collector, but have reason to believe you don't actually owe that debt (or owe a lot less than they say you owe), federal law gives you a brief. Contact us for advice before using this letter. Start customizing without restrictions now! Leverage our comprehensive workflow for generating effective dispute debt collection letters, ensuring compliance with fdcpa laws and thorough documentation. Web compose a letter that clearly outlines your claim regarding the disputed debt. Research the fair debt collection practices act (fdcpa) document all communications regarding the debt. Please provide a complete and itemized breakdown of the debt, including the original creditor's name, the original account number, the date the debt was incurred, and the amount owed. Web use our credit report dispute letter template to challenge any inaccurate or outdated items on your credit report and improve your financial situation. This document is intended to be used by the debtor (the business or individual owing money) who will send the letter to the collection agency that originally contacted them to obtain more information about the debt. Web if you've received a notice from a debt collector, but have reason to believe you don't actually owe that debt (or owe a lot less than they say you owe), federal law gives you a brief. Also request that they provide proof that you owe. Disputing liability for a debt. This blank is 100% printable and editable. Be sure to keep a copy of your letter and always send a letter like this “certified with a return receipt”. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. A debt collections letter is a notice that is sent by a creditor seeking payment for an outstanding amount with instructions to the debtor. Be concise and persuasive, while maintaining a professional tone. Learn how to write an effective collection dispute letter with our guide and templates. Web how to write a dispute letter (+ dispute letter template) if the debt validation letter you receive didn’t include a detachable form, or you need more space to explain your dispute or request additional information, you can write a dispute letter. Web use our credit report dispute letter template to challenge any inaccurate or outdated items on your credit report and improve your financial situation. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Contact us for advice before using this letter. Use this letter to dispute a debt and to tell a collector to stop contacting you. Be concise and persuasive, while maintaining a professional tone. Web purpose of sending the letter: Web a credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed, or if the debt is more than seven years old. This blank is 100% printable and editable. Contact us for advice before using this letter. Web dispute debt collection letter template. Web a debt validation letter is sent by a consumer to verify a debt by requesting evidence of the claim. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must stop all collection activities. This blank is 100% printable and editable. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. Web dear {insert name of collector or company}, i am writing in response to your (letter or phone call) dated {insert date}, (copy enclosed) because i do not believe i owe what you say i. Research the fair debt collection practices act (fdcpa) document all communications regarding the debt. Web dispute debt collection letter template. Web a dispute letter can be very simple to create. You just say you’re responding to a collection contact and you don’t think you owe the debt. This blank is 100% printable and editable. Please provide a complete and itemized breakdown of the debt, including the original creditor's name, the original account number, the date the debt was incurred, and the amount owed. Web compose a letter that clearly outlines your claim regarding the disputed debt. Learn how to write an effective collection dispute letter with our guide and templates. Web a dispute letter. Learn how to write an effective collection dispute letter with our guide and templates. You can choose to send a letter in your own name or in joint names. Identify the owed collection debt. Web a debt dispute letter is a written refusal to accept debt in response to a collector's notice. Web sample debt collection dispute letter. Web a dispute letter can be very simple to create. Disputing liability for a debt. Web use this letter to complain to debt collection agencies who are pursuing you when you do not owe the debt. Research the fair debt collection practices act (fdcpa) document all communications regarding the debt. Be concise and persuasive, while maintaining a professional tone. Web purpose of sending the letter: Identify the owed collection debt. Use this letter where you dispute liability for a debt for which you are being chased. Web sample debt collection dispute letter. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Web use our credit report dispute letter template to challenge any inaccurate or outdated items on your credit report and improve your financial situation. Web a debt dispute letter is a written refusal to accept debt in response to. Easily change the text, images, and more. Web use our credit report dispute letter template to challenge any inaccurate or outdated items on your credit report and improve your financial situation. Leverage our comprehensive workflow for generating effective dispute debt collection letters, ensuring compliance with fdcpa laws and thorough documentation. Web use this letter to complain to debt collection agencies. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. Leverage our comprehensive workflow for generating effective dispute debt collection letters, ensuring compliance with fdcpa laws and thorough documentation. Contact us for advice before using this letter. Web if you've received a notice from a debt collector, but have reason to believe. Web use our credit report dispute letter template to challenge any inaccurate or outdated items on your credit report and improve your financial situation. This document is intended to be used by the debtor (the business or individual owing money) who will send the letter to the collection agency that originally contacted them to obtain more information about the debt. A debt collections letter is a notice that is sent by a creditor seeking payment for an outstanding amount with instructions to the debtor. Web how to write a dispute letter (+ dispute letter template) if the debt validation letter you receive didn’t include a detachable form, or you need more space to explain your dispute or request additional information, you can write a dispute letter. You just say you’re responding to a collection contact and you don’t think you owe the debt. Please provide a complete and itemized breakdown of the debt, including the original creditor's name, the original account number, the date the debt was incurred, and the amount owed. Start customizing without restrictions now! Also request that they provide proof that you owe. Web a debt validation letter is sent by a consumer to verify a debt by requesting evidence of the claim. Contact us for advice before using this letter. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Use this letter to dispute a debt and to tell a collector to stop contacting you. It is a necessary step you will need to make if someone is trying to make you pay back money that you don't actually owe, or perhaps, would owe a much smaller amount. Web a debt dispute letter is a written refusal to accept debt in response to a collector's notice. Web accurately documented dispute letters help rectify debt records while reducing the impact on your credit report.Professional Debt Collection Dispute Letter Template Etsy

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Sample Debt Dispute Letter Fill Out, Sign Online and Download PDF

Dispute Letter To Creditor Template

FREE 43+ Collection Letter Examples in Google Docs MS Word Pages PDF

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Debt Collection Dispute Letter Template. Google Docs/microsoft Etsy

Free Credit Report Dispute Letter Template PDF & Word

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

If You Send This Letter Within 30 Days From The Date You First Receive A Debt Collection Letter, The Debt Collector Must Stop All Collection Activities Until It Verifies The Debt.

Web Our Free Credit Report Dispute Letter Templates Help You Write Effective Dispute Letters So You Can Get Negative Items Removed From Your Credit File.

Web Use This Free Debt Dispute Letter Template To Formally Dispute A Debt And Protect Your Rights In Dealing With Creditors.

Web Compose A Letter That Clearly Outlines Your Claim Regarding The Disputed Debt.

Related Post:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-13.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-04.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-17.jpg)