Debt Payoff Template

Debt Payoff Template - Web about debt pay off tracker free excel template. Web your student loans? Then start your debt snowball by repaying your smallest balance aggressively. Easily visualize your progress as you make payments and unlock new levels of determination. Don't request for permission to edit, simply go to file > make a copy. Check it out here for a free download. Web just use a debt payoff spreadsheet or a debt snowball worksheet. Web eliminate debt fast with a debt snowball spreadsheet. It helps a person who owes multiple accounts pay off the smallest balances first while paying the minimum payment on larger debts. Experiment with variables including monthly payment amounts and time to debt payoff. Web just use a debt payoff spreadsheet or a debt snowball worksheet. Just like an actual snowball rolling down a hill, the idea is the amount you pay towards each debt accumulates over time, and your debt is paid off faster. Edit the labels for each column and then enter the minimum payment (min) and start debt (sd) amounts. Web the debt snowball worksheet from template lab for excel is a simplified template that can be used to work out successive payments due, starting from the smallest amount owed to the largest amount outstanding with the goal of giving you a good idea as to when your debts will be paid off in full. Web download free credit card payoff and debt reduction calculators for excel. The general rule of thumb is to start with your consumer debt (i.e. Check it out here for a free download. Easily visualize your progress as you make payments and unlock new levels of determination. Experiment with variables including monthly payment amounts and time to debt payoff. Then start your debt snowball by repaying your smallest balance aggressively. Don't request for permission to edit, simply go to file > make a copy. Then make a custom debt payoff plan based on. Web see how different payoff amounts and other variables impact your debt freedom date. Web use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to different payoff methods. Web download free credit card payoff and debt reduction calculators for excel. Make a plan to get out of debt and estimate how much you can save. This template is fully customizable! How to make a debt payoff tracker in google sheets. Web if you have multiple credit card balances, the debt snowball method helps you prioritize paying off your debt by smallest amount. Learn how to create one and download our free template to track your payments and save money. Edit the labels for each column and then enter the minimum payment (min) and start debt (sd) amounts. Web download free credit card payoff and debt reduction calculators for excel. Visualize your progress with clear charts and graphs, and. Track your debt payoff goals. Web if you have multiple credit card balances, the debt snowball method helps you prioritize paying. Easily record and monitor your outstanding balances, interest rates, and monthly payments. Web download printable debt payoff charts and trackers for excel and pdf. Which type of debt should you pay off first? Web if you have multiple credit card balances, the debt snowball method helps you prioritize paying off your debt by smallest amount. Below we have outlined the. It helps a person who owes multiple accounts pay off the smallest balances first while paying the minimum payment on larger debts. Then start your debt snowball by repaying your smallest balance aggressively. Experiment with variables including monthly payment amounts and time to debt payoff. Check it out here for a free download. Web enter google sheets debt payoff templates. Track multiple debts with a single worksheet. Easily visualize your progress as you make payments and unlock new levels of determination. Web use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to different payoff methods. You can change everything in it — colors. How to make a debt payoff tracker in google sheets. Web for the debt trackers provided here, all you need to do is scroll through the images below and decide which one you think will be the most helpful and beneficial for your personal finance circumstances, click on the image, download the pdf file to your computer, and print! List. It helps a person who owes multiple accounts pay off the smallest balances first while paying the minimum payment on larger debts. Web for the debt trackers provided here, all you need to do is scroll through the images below and decide which one you think will be the most helpful and beneficial for your personal finance circumstances, click on. Which type of debt should you pay off first? The set includes a debt overview sheet, a debt payoff tracking sheet, and a debt thermometer to give you a visual of your progress as you are working on paying off your debts. Just like an actual snowball rolling down a hill, the idea is the amount you pay towards each. Easily visualize your progress as you make payments and unlock new levels of determination. The cells are automatically updated. Web use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to different payoff methods. Edit the labels for each column and then enter the. These spreadsheets work best with the debt snowball method. The cells are automatically updated. Track multiple debts with a single worksheet. Then make a custom debt payoff plan based on. Web see how different payoff amounts and other variables impact your debt freedom date. Learn how to create one and download our free template to track your payments and save money. The cells are automatically updated. Which type of debt should you pay off first? Web download printable debt payoff charts and trackers for excel and pdf. Web enter google sheets debt payoff templates. Web use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to different payoff methods. Which type of debt should you pay off first? Web download free credit card payoff and debt reduction calculators for excel. Web see how different payoff amounts and other variables impact your debt freedom date. Web your student loans? Visualize your progress with clear charts and graphs, and. Web download printable debt payoff charts and trackers for excel and pdf. Web about debt pay off tracker free excel template. Edit the labels for each column and then enter the minimum payment (min) and start debt (sd) amounts. Just like an actual snowball rolling down a hill, the idea is the amount you pay towards each debt accumulates over time, and your debt is paid off faster. The cells are automatically updated. Web just use a debt payoff spreadsheet or a debt snowball worksheet. Then start your debt snowball by repaying your smallest balance aggressively. Web download the free debt tracker printable from financial best life to strategize and track your debt while paying it off faster. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Web use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to different payoff methods.Paying off Debt Worksheets

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Debt Snowball Tracker Printable Debt Free Chart Debt Payoff Etsy Canada

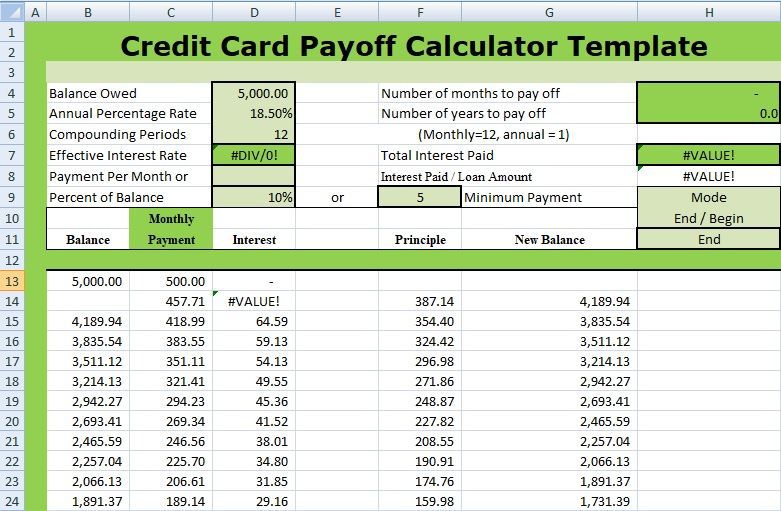

Credit Card Debt Payoff Spreadsheet Excel Templates

Free Debt Payoff Printable Printable Templates

Debt List Template Web Offers You Professionally Written

Debt List Template Web Offers You Professionally Written

Debt Tracker Excel Template, Debt Payoff Planner, Debt Repayment

Credit Card Debt Payoff Tracker Printable Credit Card Payoff Payoff

Paying off Debt Worksheets

Easily Visualize Your Progress As You Make Payments And Unlock New Levels Of Determination.

The General Rule Of Thumb Is To Start With Your Consumer Debt (I.e.

This Includes Payday Loans, Government Debt, Credit Cards, Medical Bills, Car Loan Debt, Student Loans, Etc.

Web Debt Payoff Tracker For Excel And Google Sheets, Debt Snowball, Debt Avalanche, Custom Debt Order.

Related Post:

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball.jpg)