Debt Snowball Template

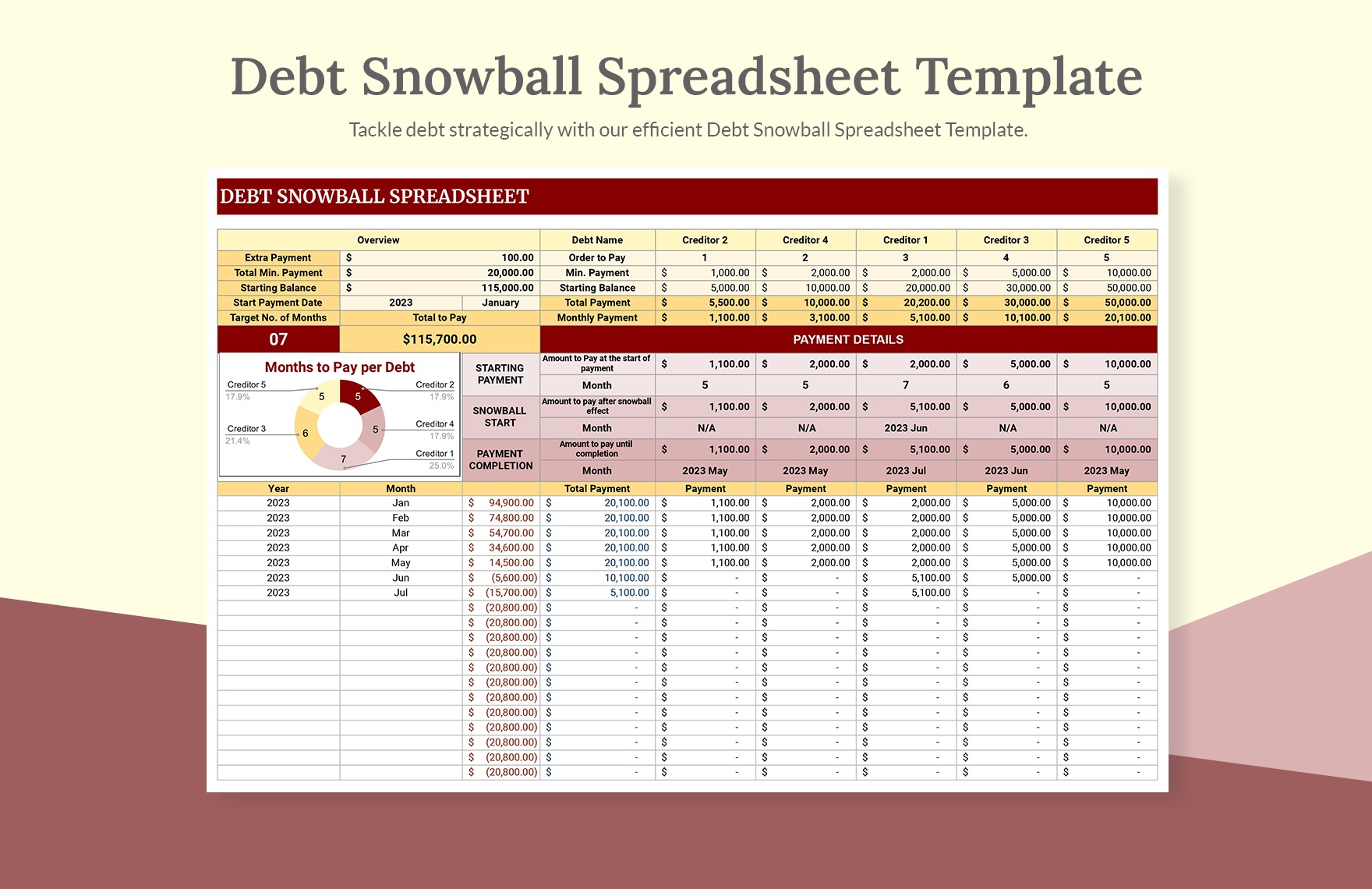

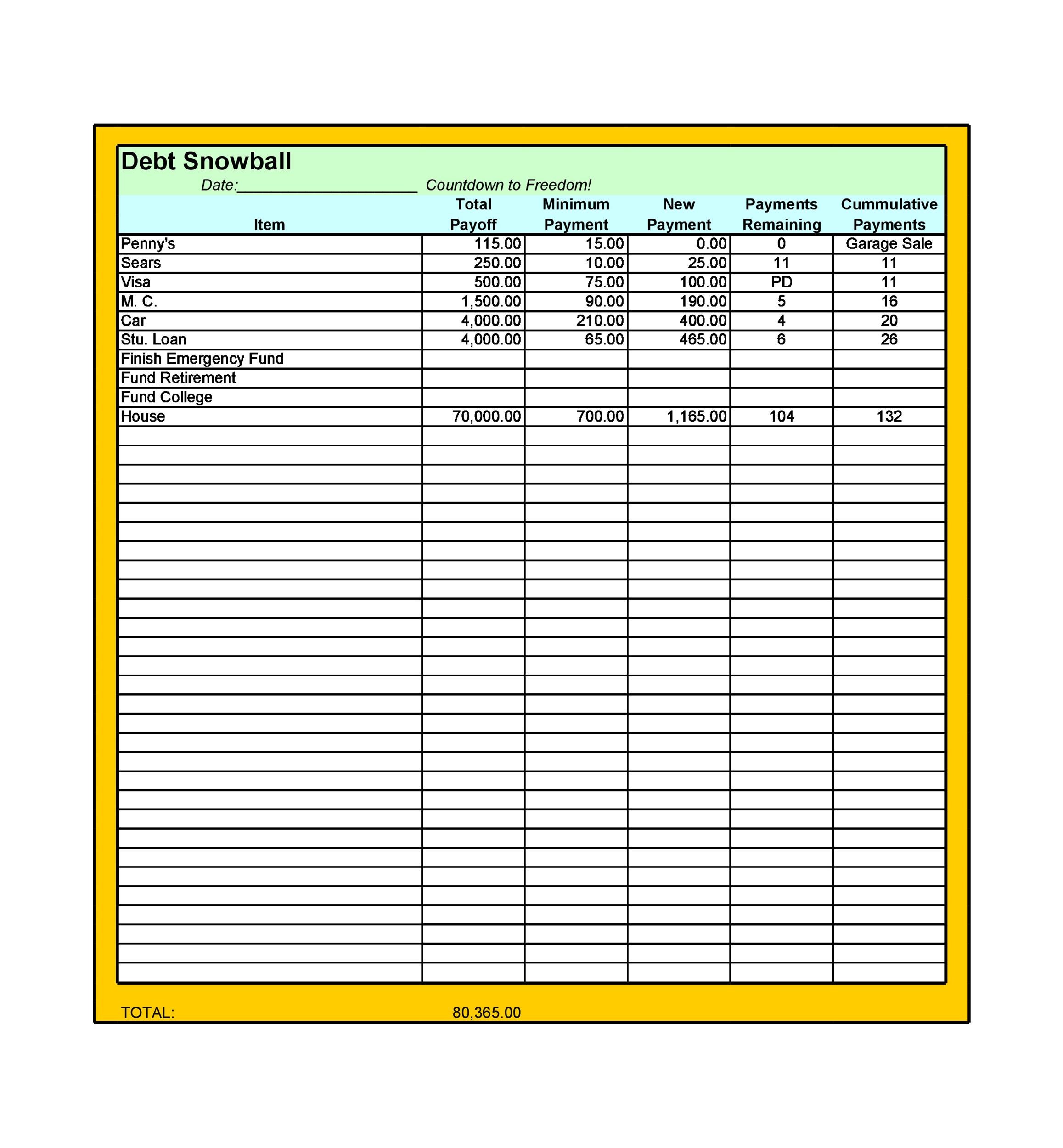

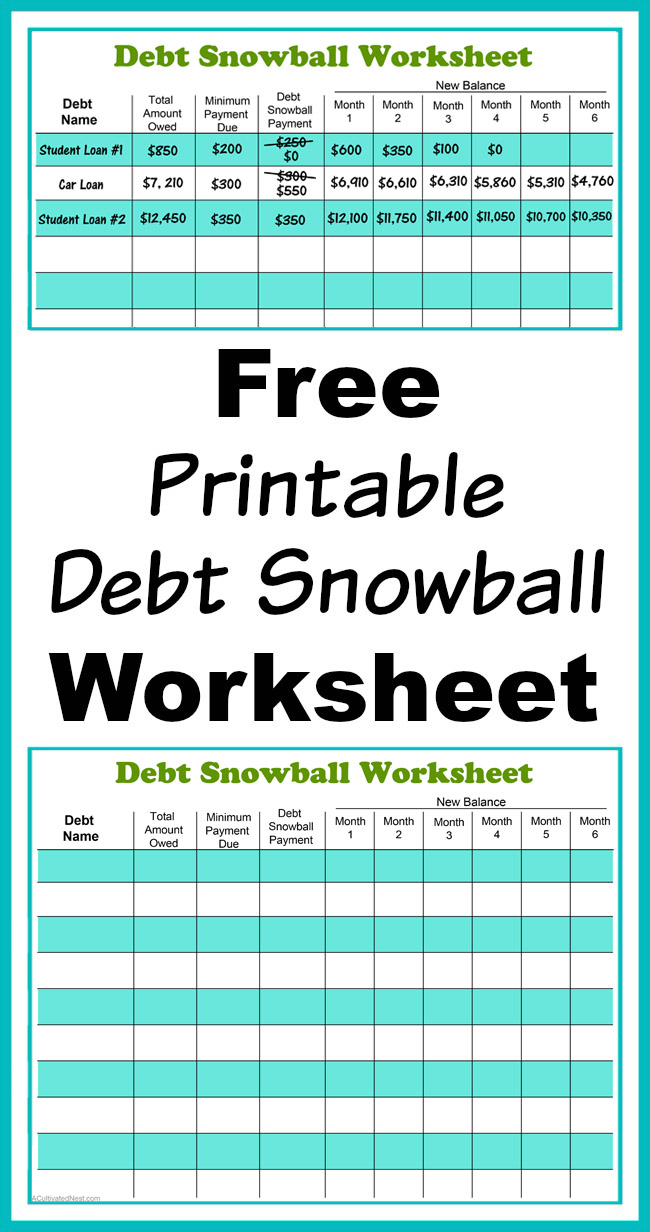

Debt Snowball Template - It’s never easy to tackle debt, but having a clear plan in place can make it a whole lot more manageable. Knock out the smallest debt first. You need to work out how much you can put towards this first debt while covering the minimum payments. Use snowball, avalanche, or whatever payoff strategy works best for you. Then start your debt snowball by repaying your smallest balance aggressively. Web in this article, let us discuss the top 5 free debt snowball spreadsheet google sheets templates. This is the exact amount you have leftover at the end of the month. Web here are 7 free debt snowball spreadsheets to help you save money, reduce stress, and avoid paying higher interest rates in 2023 with a plan to pay debt off. Web see the updated debt snowball tracker template below: About the debt payoff template for google sheets. Web simply fill out the form with all your debts, enter a monthly dollar amount you can add to your payoff plan, and click the “calculate debt snowball” button. This motivates you to keep going. Below is more information about the debt snowball plan to help you break free of the debt monster. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. As you roll the payments on your cleared debts into larger debts, your debt reduction will gain momentum—like a snowball rolling down a hill. Like travel or retire early. Just like an actual snowball rolling down a hill, the idea is the amount you pay towards each debt accumulates over time, and your debt is paid off faster. Web next to each one write down the total balance owed. Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt. If you haven’t already, download a copy of my budget template, fill out all your budget details, and then see what is left. It helps a person who owes multiple accounts pay off the smallest balances first while paying the minimum payment on larger debts. .paying off debt doesn't have to be so hard. List down all your debts and arrange them from the biggest to the smallest. Web simply fill out the form with all your debts, enter a monthly dollar amount you can add to your payoff plan, and click the “calculate debt snowball” button. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. Web a debt snowball worksheet is a fillable form that users can complete to create a snowball plan to repay their debts. There’s a basic spreadsheet that lets you list up to ten debts you can get for free. As you can see, by paying an extra $500 a month, we’ll be able to snowball them and escape the grips of debt in just 1.6 years (instead of over four years). It’s never easy to tackle debt, but having a clear plan in place can make it a whole lot more manageable. Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt. Web next to each one write down the total balance owed. Then, take what you were paying on that debt and add it to the payment of your next smallest debt. Web below are 10 debt snowball worksheets that you can download for free to use to track your debt payoff process. Web the vertex42 debt snowball spreadsheet includes a. Web use this debt snowball worksheet to stay organized and track the progress of your own debt payment. Web in this article, let us discuss the top 5 free debt snowball spreadsheet google sheets templates. This is the exact amount you have leftover at the end of the month. .paying off debt doesn't have to be so hard. It lists. Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. Knock out the smallest debt first. There’s a basic spreadsheet that lets you list up to ten debts you can get for free. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment. Like travel or retire early. You can even create a payment schedule and payoff summary. Web simply fill out the form with all your debts, enter a monthly dollar amount you can add to your payoff plan, and click the “calculate debt snowball” button. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. This comprehensive. It centers on the psychological win of clearing small balances. There’s a basic spreadsheet that lets you list up to ten debts you can get for free. It helps a person who owes multiple accounts pay off the smallest balances first while paying the minimum payment on larger debts. Web a debt snowball spreadsheet is a tool used in this. This is the exact amount you have leftover at the end of the month. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. Knock out the smallest debt first. Web debt repayment template. Then start your debt snowball by repaying your smallest balance aggressively. Available as printable pdf or google docs sheet. Like travel or retire early. About the debt payoff template for google sheets. Web use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Web see the updated debt snowball tracker template below: Web in this article, let us discuss the top 5 free debt snowball spreadsheet google sheets templates. Below is more information about the debt snowball plan to help you break free of the debt monster. If you prefer to use a spreadsheet to track your debt payoff progress, you can grab my debt payoff toolkit here. Knock out the smallest. About the debt payoff template for google sheets. Web the debt snowball method is a debt reduction strategy designed for you to pay off your debts efficiently. Web debt snowball spreadsheet and payoff planner. Web the debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. Below is more information. There’s a basic spreadsheet that lets you list up to ten debts you can get for free. Like travel or retire early. Web here are 7 free debt snowball spreadsheets to help you save money, reduce stress, and avoid paying higher interest rates in 2023 with a plan to pay debt off. It helps a person who owes multiple accounts. Web below are 10 debt snowball worksheets that you can download for free to use to track your debt payoff process. Web see the updated debt snowball tracker template below: This motivates you to keep going. Web a debt snowball spreadsheet is a tool used in this popular method for paying off debt. It lists all debt in ascending order by balance owed and includes the minimum payments due. If you prefer to use a spreadsheet to track your debt payoff progress, you can grab my debt payoff toolkit here. Below is more information about the debt snowball plan to help you break free of the debt monster. Web in this article, let us discuss the top 5 free debt snowball spreadsheet google sheets templates. Just like an actual snowball rolling down a hill, the idea is the amount you pay towards each debt accumulates over time, and your debt is paid off faster. This comprehensive template is designed to help you understand your current debt situation and make a plan to pay it off. Web the debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. Web debt repayment template. The worksheets are designed to simplify the process by guiding users where and what information to input. Web if you have multiple credit card balances, the debt snowball method helps you prioritize paying off your debt by smallest amount. Put every extra dollar you can find towards paying off that smallest debt. If you haven’t already, download a copy of my budget template, fill out all your budget details, and then see what is left.38 Debt Snowball Spreadsheets, Forms & Calculators

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Debt Snowball Tracker Printable

Debt Snowball Tracker Printable Debt Free Chart Debt Payoff Etsy Canada

Debt Snowball Excel Template 38 Debt Snowball Spreadsheets Forms

Free Printable Debt Snowball

Printable Debt Snowball Worksheet Debt Snowball Planner Etsy

38 Debt Snowball Spreadsheets, Forms & Calculators

Free Printable Debt Snowball Worksheet Pay Down Your Debt!

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Available As Printable Pdf Or Google Docs Sheet.

Web Here Are 7 Free Debt Snowball Spreadsheets To Help You Save Money, Reduce Stress, And Avoid Paying Higher Interest Rates In 2023 With A Plan To Pay Debt Off.

Web The Debt Snowball Method Is A Debt Reduction Strategy Designed For You To Pay Off Your Debts Efficiently.

It Helps A Person Who Owes Multiple Accounts Pay Off The Smallest Balances First While Paying The Minimum Payment On Larger Debts.

Related Post:

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball.jpg)

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/05/debt-snowball-excel-template.jpg?gid=443)