Fake Irs Letter Template

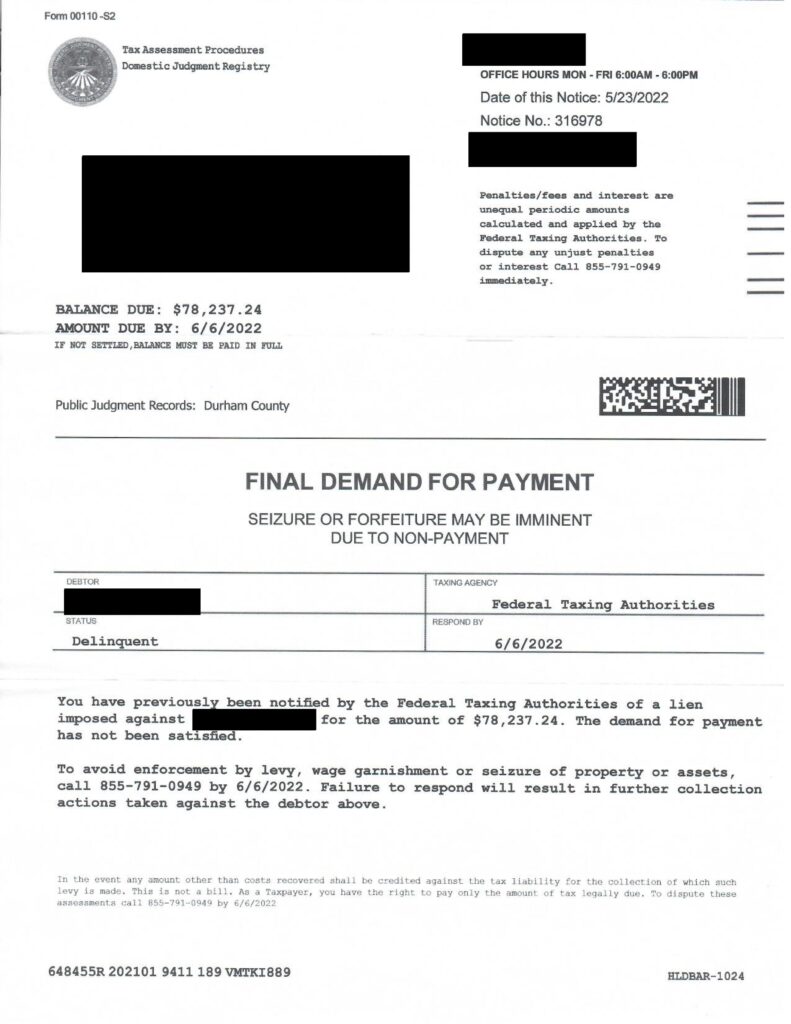

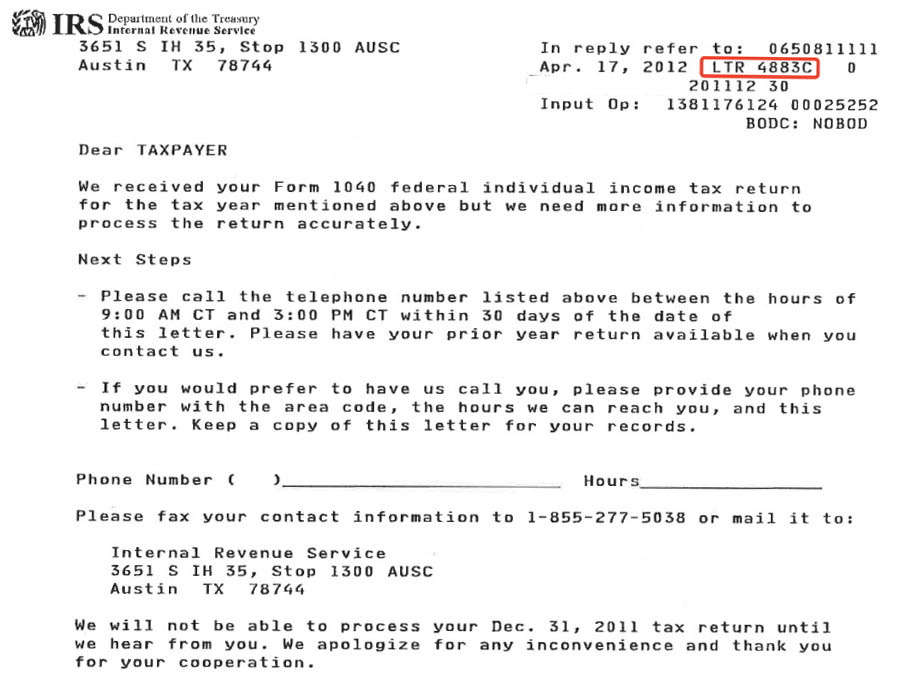

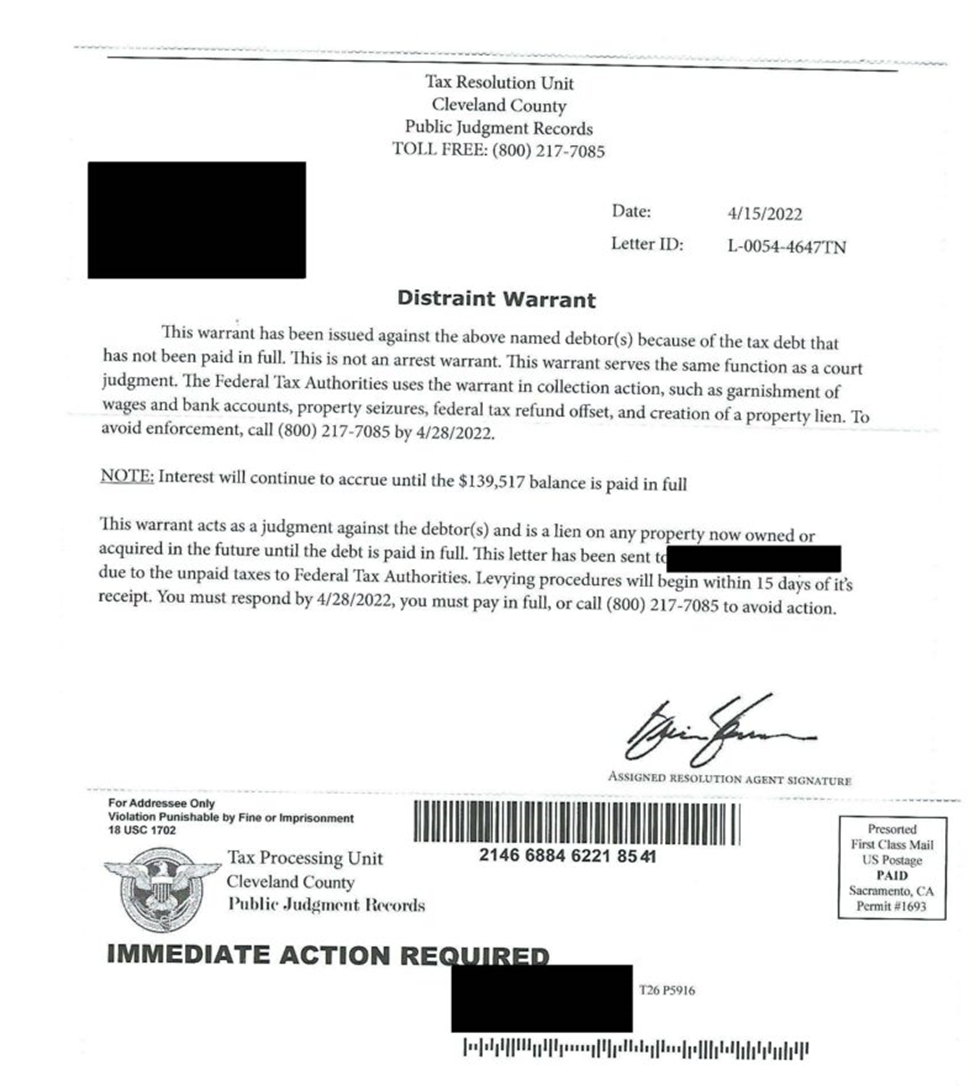

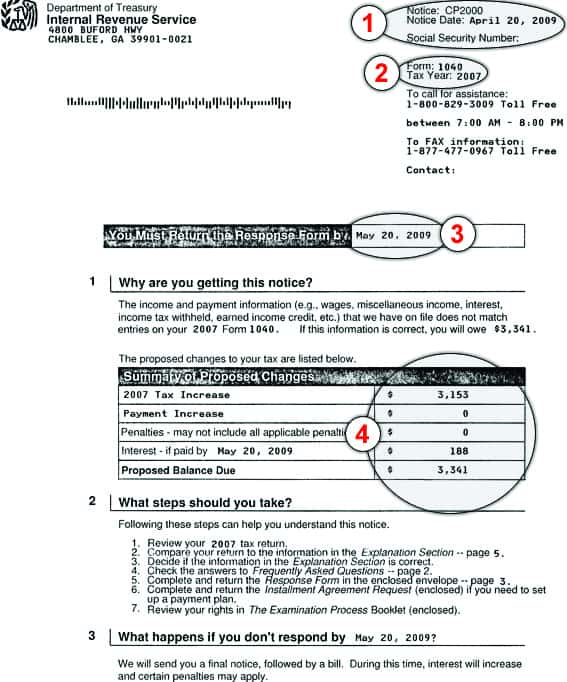

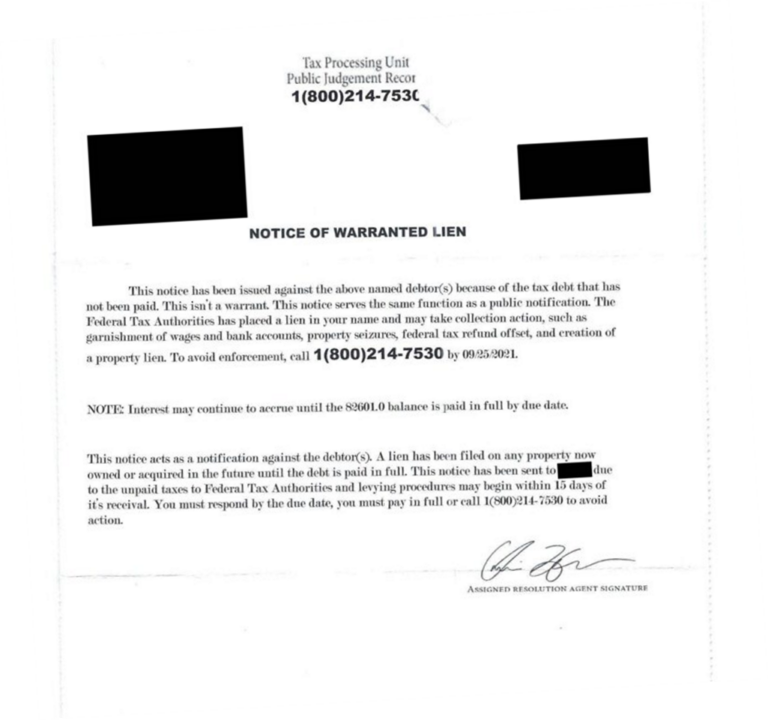

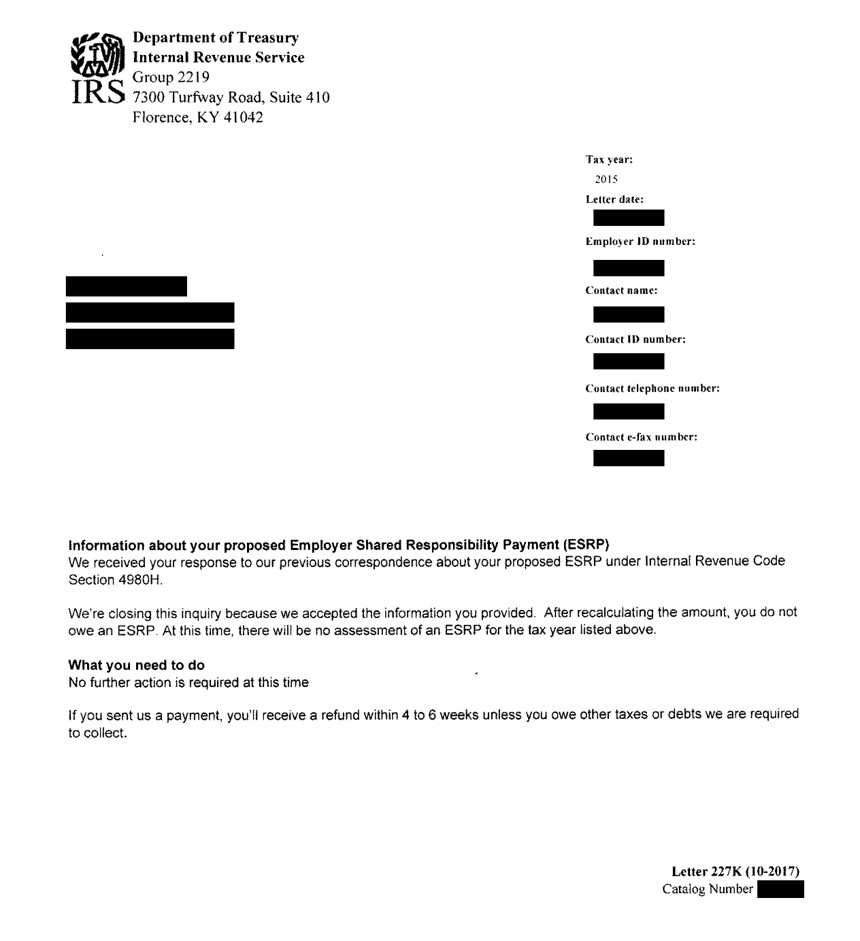

Fake Irs Letter Template - Understanding official communication methods from the irs can help identify fraudulent correspondence. Identifying fake letters can prevent issues such as tax refund schemes. Web taxpayers targeted by postal scams often struggle to determine if a letter from the irs is real. One day, you receive a letter in the mail appearing to be from the irs. You can educate yourself on the latest pervasive tax scams with the annual dirty dozen report from the irs. Web counterfeit or deceptive communication claiming to be from the irs is generally easy to spot. Additionally, the irs has helpful resources that can verify the validity of a letter. Web if you receive mail from the internal revenue service (irs), you should evaluate the letter’s legitimacy. Web irs mail comes in official government envelopes with the irs logo. Web worried that your notice might be a scam? The new scheme involves a mailing coming in a cardboard envelope from a delivery service. Web taxpayers should learn to recognize fake irs letters to avoid becoming victims of scams. Web worried that your notice might be a scam? You can educate yourself on the latest pervasive tax scams with the annual dirty dozen report from the irs. Knowing the common types of irs scams and steps to take upon receiving a suspicious letter are key in protecting oneself. Web our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. Web the irs does send letters to taxpayers. Verify the letterhead and notice number: Web misleading social media advice leads to false claims for fuel tax credit, sick and family leave credit, household employment taxes; Web if you receive mail from the internal revenue service (irs), you should evaluate the letter’s legitimacy. Web irs mail comes in official government envelopes with the irs logo. As you read the letter, you begin to sweat: Web our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. A link or attachment with a slightly misspelled url or an unusual one. Consider filing a report with the treasury inspector general if you're dealing with an impersonation issue or the federal trade. A proper irs letter will usually arrive in a. Understand their traits, verify content, and report suspicious activity promptly. Additionally, the irs has helpful resources that can verify the validity of a letter. The problem with many of these scams is that the irs rarely calls or emails taxpayers unless they are solicited to do so. Many scammers utilize the internet or smartphones to try to trick taxpayers into making false payments or offering up sensitive personal information. These letters say that you owe money to the irs, and they often threaten severe consequences such as asset seizures or jail time. The problem with many of these scams is that the irs rarely calls or emails taxpayers unless they are solicited to do so. The new scheme involves a mailing coming in a cardboard envelope from a delivery. Many scammers utilize the internet or smartphones to try to trick taxpayers into making false payments or offering up sensitive personal information. The new scheme involves a mailing coming in a cardboard envelope from a delivery service. Learn how to protect your valuable data with advice from our tax pros. Unfortunately, scam artists and some marketers use fake letters to. But there are some ways to spot a legit irs letter from a fake one. Many scammers utilize the internet or smartphones to try to trick taxpayers into making false payments or offering up sensitive personal information. Knowing the common types of irs scams and steps to take upon receiving a suspicious letter are key in protecting oneself. One day,. Unfortunately, scam artists and some marketers use fake letters to trick people into sending them money or signing up for their services. Faqs help address common questions, next steps for those receiving irs letters You can educate yourself on the latest pervasive tax scams with the annual dirty dozen report from the irs. Verify the letterhead and notice number: Web. Web there are a few key features on your irs letter that will prove it to be legitimate or fake. Understanding official communication methods from the irs can help identify fraudulent correspondence. As you read the letter, you begin to sweat: You can educate yourself on the latest pervasive tax scams with the annual dirty dozen report from the irs.. The new scheme involves a mailing coming in a cardboard envelope from a delivery service. In the maze of the tax season, distinguishing between a legitimate irs letter and a cleverly disguised scam can be. Web there are a few key features on your irs letter that will prove it to be legitimate or fake. Learn the common signs of. Genuine irs letters always display the irs logo on the top left. If you don’t owe any money to the irs, then the letter is likely a scam. Web the irs does send letters to taxpayers. Web the security summit warns this fake letter arrives in a cardboard envelope, with an irs masthead and wording that the notice is in. Web the irs does send letters to taxpayers. The new scheme involves a mailing coming in a cardboard envelope from a delivery service. As you read the letter, you begin to sweat: Web a fake irs letter is any mailed communication from a party who is wrongfully posing as the irs in order to scam you out of money. Spelling. Unfortunately, scam artists and some marketers use fake letters to trick people into sending them money or signing up for their services. Understanding official communication methods from the irs can help identify fraudulent correspondence. Web irs scam letters from scam artists. The most popular type of irs scam letter is from a scam artist who is trying to steal your. But there are some ways to spot a legit irs letter from a fake one. One day, you receive a letter in the mail appearing to be from the irs. Web the irs does send letters to taxpayers. If you don’t owe any money to the irs, then the letter is likely a scam. Here are a few tips: Web taxpayers should learn to recognize fake irs letters to avoid becoming victims of scams. Real irs letters inform you of the balance owed and provide payment options, without using aggressive collection tactics. Check out our guide to fake irs letters to figure out. Understanding official communication methods from the irs can help identify fraudulent correspondence. Web how to know if you have received a fake irs collection letter. We’ll show you how to identify genuine irs letters. Identifying fake letters can prevent issues such as tax refund schemes. Web the security summit warns this fake letter arrives in a cardboard envelope, with an irs masthead and wording that the notice is in relation to the person’s unclaimed refund. Web washington ― the internal revenue service warned taxpayers today to be on the lookout for a new scam mailing that tries to mislead people into believing they are owed a refund. As you read the letter, you begin to sweat: Web worried that your notice might be a scam? One day, you receive a letter in the mail appearing to be from the irs. A proper irs letter will usually arrive in a. Consider filing a report with the treasury inspector general if you're dealing with an impersonation issue or the federal trade. Additionally, the irs has helpful resources that can verify the validity of a letter. Web taxpayers targeted by postal scams often struggle to determine if a letter from the irs is real.How to know if you have received a fake IRS collection letter IRS Tax

Printable Prank Letters

Fake irs letter envelope tatabag

Fake Irs Letter 2021

Fake Irs Letter Template

How to Spot (And Handle) A Fake IRS Letter

How to know if you have received a fake IRS collection letter IRS Tax

Fake Irs Letter Template

Fake Irs Letter Template

Fake Irs Letter Template prntbl.concejomunicipaldechinu.gov.co

Web The Irs Does Send Letters To Taxpayers.

The Problem With Many Of These Scams Is That The Irs Rarely Calls Or Emails Taxpayers Unless They Are Solicited To Do So.

Many Scammers Utilize The Internet Or Smartphones To Try To Trick Taxpayers Into Making False Payments Or Offering Up Sensitive Personal Information.

It’s Threatening To Seize Your Property, Garnish Your Wages, Levy Your Bank Accounts.

Related Post: