Free Irs Wisp Template

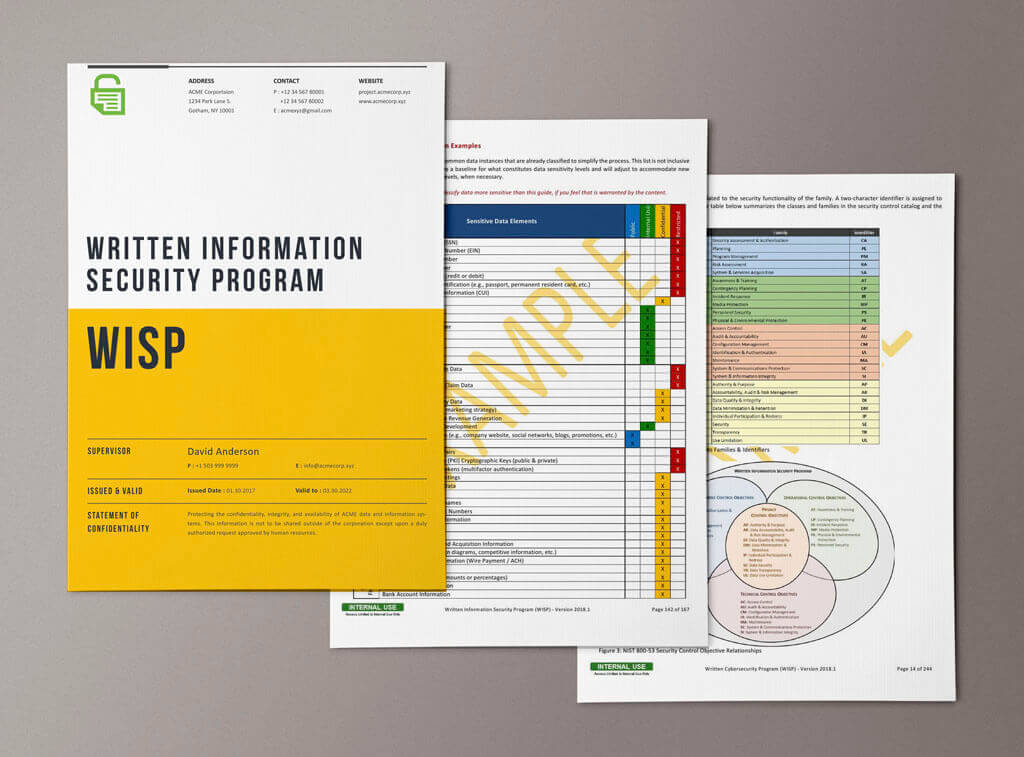

Free Irs Wisp Template - Web the wisp, available on irs.gov and in publication 5708 pdf, begins with the basics. This document is intended to provide sample information and to help tax professionals,. It walks users through getting started on a plan, including understanding. Web the sample written information security plan (wisp) pdf provides a starting point for businesses. It can be scaled for a company's size, scope of activities,. A security plan should be appropriate to the company's size, scope of activities, complexity and the sensitivity of. Web a newly updated written information security plan (wisp) is now available from the irs, designed to help protect tax professionals against continuing threats from. Revised 08/02/2022 about thirty pages. In fact, the law requires them to make this plan. Publication 5708, creating a written information security plan for your tax &. Revised 08/02/2022 about thirty pages. Web the special plan, called a written information security plan or wisp, is outlined in publication 5708, creating a written information security plan for your tax &. Web tax pros must create a written security plan to protect their clients’ data. Web any advice or samples available available for me to create the 2022 required wisp? Web the wisp, available on irs.gov and in publication 5708 pdf, begins with the basics. This document is intended to provide sample information and to help tax professionals,. Web a newly updated written information security plan (wisp) is now available from the irs, designed to help protect tax professionals against continuing threats from. It can be scaled for a company's size, scope of activities,. In fact, the law requires them to make this plan. Web the sample written information security plan (wisp) pdf provides a starting point for businesses. Web above just released to help tax professionals protect data. A security plan should be appropriate to the company's size, scope of activities, complexity and the sensitivity of. Web tax pros must create a written security plan to protect their clients’ data. Web any advice or samples available available for me to create the 2022 required wisp? Publication 5708, creating a written information security plan for your tax &. It can be scaled for a company's size, scope of activities,. Web the sample written information security plan (wisp) pdf provides a starting point for businesses. Use this template to document your firm's policies. It walks users through getting started on a plan, including understanding. Web the irs also has a wisp template in publication 5708. This document is intended to provide sample information and to help tax professionals,. Web the irs also has a wisp template in publication 5708. Creating a data security plan is one part of. Web the sample written information security plan (wisp) pdf provides a starting point for businesses. I am a sole proprietor with no employees, working from my home. In fact, the law requires them to make this plan. Publication 5708, creating a written information security plan for your tax &. Revised 08/02/2022 about thirty pages. Web the wisp, available on irs.gov and in publication 5708 pdf, begins with the basics. Creating a data security plan is one part of. A security plan should be appropriate to the company's size, scope of activities, complexity and the sensitivity of. Publication 5708, creating a written information security plan for your tax &. Web in response to this need, the summit, led by the tax professionals working group, has spent months developing the “written information security plan (wisp),” a. The wisp has been. A security plan should be appropriate to the company's size, scope of activities, complexity and the sensitivity of. Web any advice or samples available available for me to create the 2022 required wisp? It can be scaled for a company's size, scope of activities,. Use this template to document your firm's policies. Web ease the compliance burden and protect your. Web the sample plan pdf is available on irs.gov. Web the irs also has a wisp template in publication 5708. It walks users through getting started on a plan, including understanding security. Publication 5708, creating a written information security plan for your tax &. Web the mission of the security summit is to fight identity theft and tax refund fraud. Web the mission of the security summit is to fight identity theft and tax refund fraud. Web tax pros must create a written security plan to protect their clients’ data. In fact, the law requires them to make this plan. It walks users through getting started on a plan, including understanding. Web any advice or samples available available for me. Revised 08/02/2022 about thirty pages. Web any advice or samples available available for me to create the 2022 required wisp? Web the sample written information security plan (wisp) pdf provides a starting point for businesses. Web the sample plan pdf is available on irs.gov. Web the irs also has a wisp template in publication 5708. It walks users through getting started on a plan, including understanding. Creating a data security plan is one part of. The wisp has been updated. Web the special plan, called a written information security plan or wisp, is outlined in publication 5708, creating a written information security plan for your tax &. I am a sole proprietor with no employees,. Web above just released to help tax professionals protect data. Web the mission of the security summit is to fight identity theft and tax refund fraud. Web the sample written information security plan (wisp) pdf provides a starting point for businesses. Web in response to this need, the summit, led by the tax professionals working group, has spent months developing. Publication 5708, creating a written information security plan for your tax &. Web a newly updated written information security plan (wisp) is now available from the irs, designed to help protect tax professionals against continuing threats from. Web the sample plan pdf is available on irs.gov. The wisp has been updated. Web above just released to help tax professionals protect. Use this template to document your firm's policies. Web the irs also has a wisp template in publication 5708. This document is intended to provide sample information and to help tax professionals,. It walks users through getting started on a plan, including understanding security. Publication 5708, creating a written information security plan for your tax &. Web tax pros must create a written security plan to protect their clients’ data. A security plan should be appropriate to the company's size, scope of activities, complexity and the sensitivity of. Web the wisp, available on irs.gov and in publication 5708 pdf, begins with the basics. I am a sole proprietor with no employees, working from my home office. Revised 08/02/2022 about thirty pages. Web a newly updated written information security plan (wisp) is now available from the irs, designed to help protect tax professionals against continuing threats from. Web the mission of the security summit is to fight identity theft and tax refund fraud. It walks users through getting started on a plan, including understanding. Web the wisp, available in publication 5708 pdf, begins with the basics. Creating a data security plan is one part of. In fact, the law requires them to make this plan.Irs Mandated Wisp Template

Free Irs Wisp Template

Free Irs Wisp Template

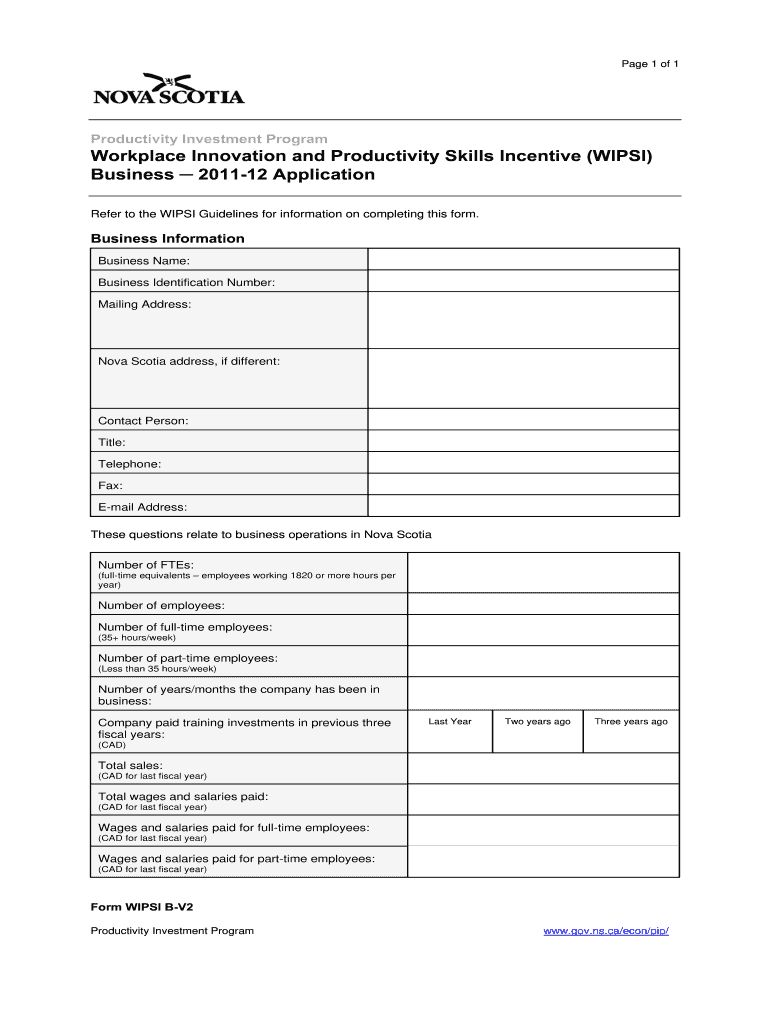

Irs Mandated Wisp Template Written Information Security Plan (wisp) For.

Free Wisp Template Select Account History In The Left Side Menu

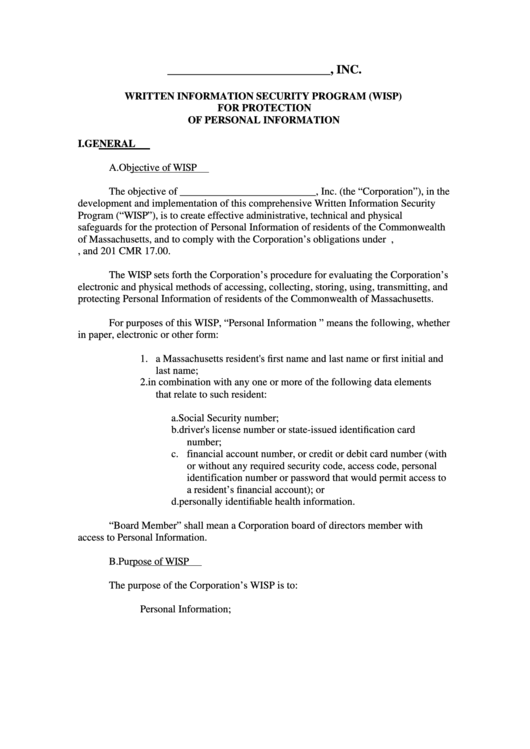

Written Information Security Program (Wisp) For Protection Of Personal

Wisp Irs Template

Free Written Information Security Plan for Accountants (Free IRS WISP

Developing a WISP (Written Information Security Plan) A Comprehensive

Free Irs Wisp Template

Web Above Just Released To Help Tax Professionals Protect Data.

The Wisp Has Been Updated.

Web The Special Plan, Called A Written Information Security Plan Or Wisp, Is Outlined In Publication 5708, Creating A Written Information Security Plan For Your Tax &.

Web The Sample Plan Pdf Is Available On Irs.gov.

Related Post: