Goodwill Donation Form Printable

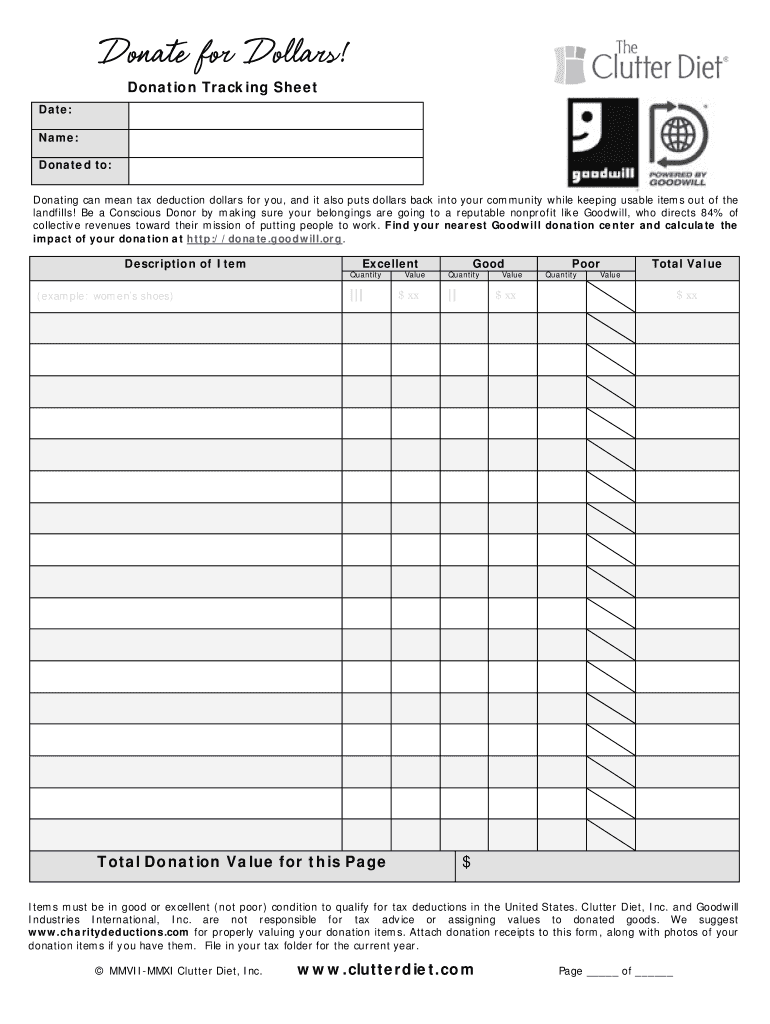

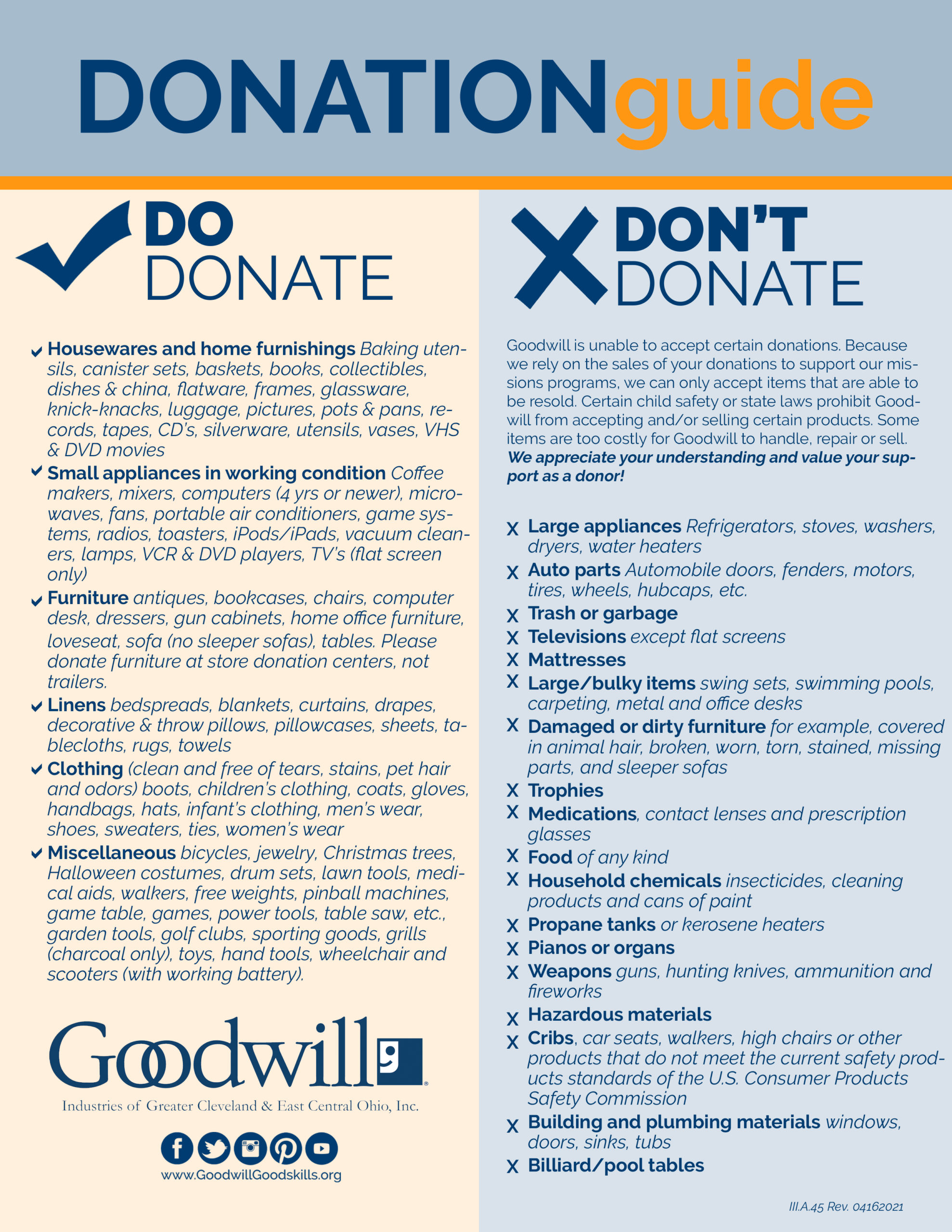

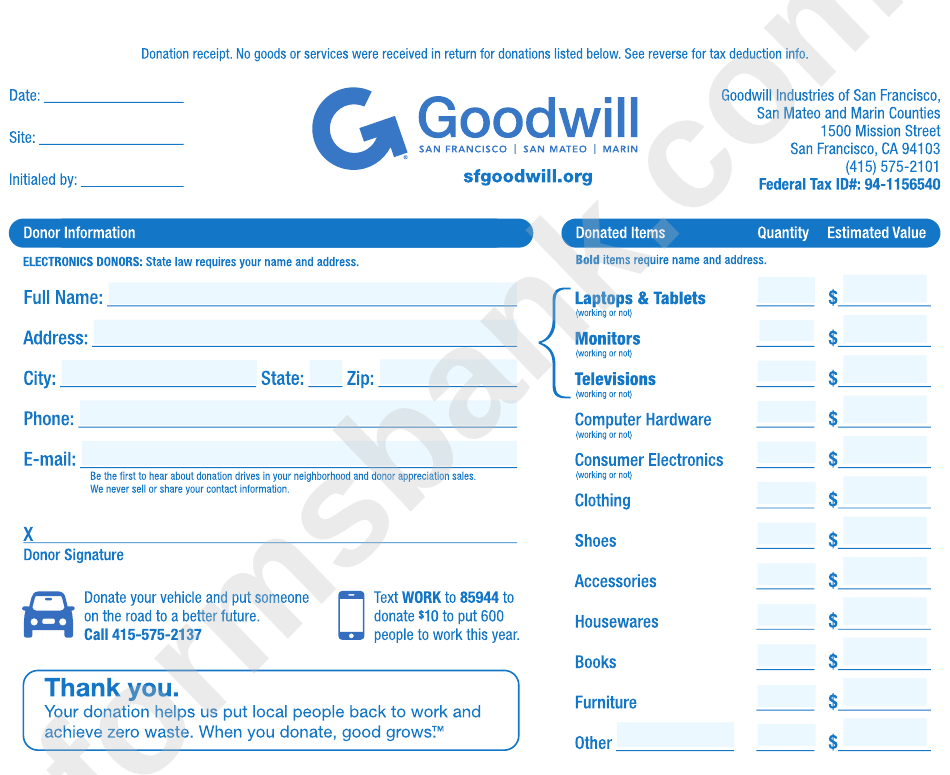

Goodwill Donation Form Printable - Use the list below as a general guide to assess the “fair market value” you can claim on your tax return. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. Web what is my donation worth? Browse goodwill tax deduction resources to learn more and see if your donation qualifies. Web the goodwill donation form template is a simple yet effective tool designed to capture essential information from donors seamlessly. Web updated november 14, 2023. The irs requires an item to be in good condition or better to take a deduction. We happily accept donations of new or gently used items, including: To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. Goods or services were not exchanged for this contribution and no personal benefit was incurred by it, so it is entirely deductible to the extent allowable by the law. Web valuation guide for goodwill donors. The irs requires an item to be in good condition or better to take a deduction. Books, records, cds, videotapes, and dvds. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. This form is available at the time of donation from our stores and donation centers in maine, new hampshire and vermont Web what is my donation worth? Web some goodwill donation centers can help you with your donation receipt and send an electronic copy to your email. Housewares, dishes, glassware, and small appliances. Web your donation may be tax deductible. Web donating to goodwill is easy! Use this receipt when filing your taxes. Web some goodwill donation centers can help you with your donation receipt and send an electronic copy to your email. Find a donation center near you! Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501 (c) (3) of the internal revenue code. By choosing to donate to your local goodwill, you're directly fueling programs designed to meet your community's unique needs. Internal revenue service (irs) requires donors to value their items. Web support a local goodwill. The irs requires an item to be in good condition or better to take a deduction. Web here are some tips for maximizing charitable donations. Prices are only estimated values. If you donated to a goodwill in the following areas and need to obtain your donation receipt, please use the contact information below. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. Who to donate to, how much you can write off, and. The form is required if you are donating computers and other technology equipment so that we can comply with state reporting requirements. Web you may now use the link below to download the receipt, fill it in and print it for your records. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly. Web donating to goodwill is easy! We happily accept donations of new or gently used items, including: To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. If you donated to a goodwill in the following areas and need to obtain your donation receipt, please use the contact information. Web you may now use the link below to download the receipt, fill it in and print it for your records. But in this article, i’ll show you how to complete the donation receipt form and value your items for your tax deductions. Web donating to goodwill is easy! By choosing to donate to your local goodwill, you're directly fueling. Web your donation may be tax deductible. Web some goodwill donation centers can help you with your donation receipt and send an electronic copy to your email. When you bring items to one of our donation locations, you may fill out a paper form there. Login or create an account. Web a limited number of local goodwill organizations offer the. But in this article, i’ll show you how to complete the donation receipt form and value your items for your tax deductions. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. Web your donation may be tax deductible. Web valuation guide for goodwill. Once you register your donations online through this system, you can print a receipt when needed, print a yearly donation report, or send a copy to your email. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Housewares, dishes, glassware, and small appliances. Internal revenue service (irs) requires donors. But in this article, i’ll show you how to complete the donation receipt form and value your items for your tax deductions. Web what is my donation worth? The form is required if you are donating computers and other technology equipment so that we can comply with state reporting requirements. Web use the online donation receipt builder to track and. Web the goodwill donation form template is a simple yet effective tool designed to capture essential information from donors seamlessly. We happily accept donations of new or gently used items, including: A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Web updated november 14, 2023. Books, records, cds, videotapes,. Housewares, dishes, glassware, and small appliances. Internal revenue service (irs) requires donors to value their items. Our donation value guide displays prices ranging from good to. Web to get started, download the goodwill donation valuation guide, which features estimates for the most commonly donated items. Web use the online donation receipt builder to track and keep important irs guidelines for. This form is available at the time of donation from our stores and donation centers in maine, new hampshire and vermont Web to get started, download the goodwill donation valuation guide, which features estimates for the most commonly donated items. By choosing to donate to your local goodwill, you're directly fueling programs designed to meet your community's unique needs. If you donated to a goodwill in the following areas and need to obtain your donation receipt, please use the contact information below. Once you register your donations online through this system, you can print a receipt when needed, print a yearly donation report, or send a copy to your email. Who to donate to, how much you can write off, and how the rules have changed. Web use the online donation receipt builder to track and keep important irs guidelines for your tax return after donating to goodwill. Use this receipt when filing your taxes. Thanks for donating to goodwill. Need help determining the value of your donation for tax purposes? Web with this new optional online tracker, you no longer have to hold on to your paper receipt if you don’t want to. Internal revenue service (irs) requires donors to value their items. Web donating to goodwill is easy! To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. Please accept my gift of $________. When you bring items to one of our donation locations, you may fill out a paper form there.Goodwill Itemized Donation List Printable

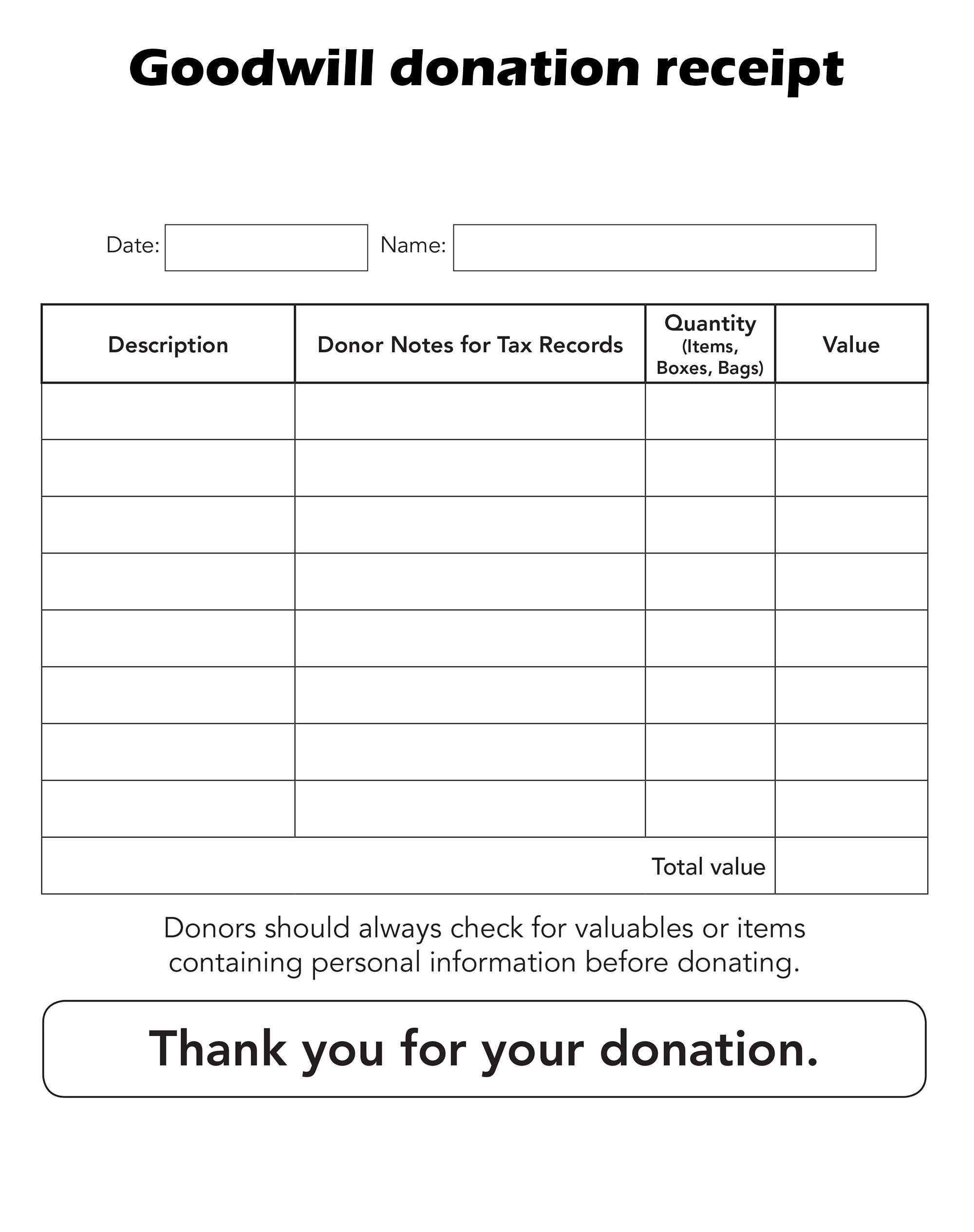

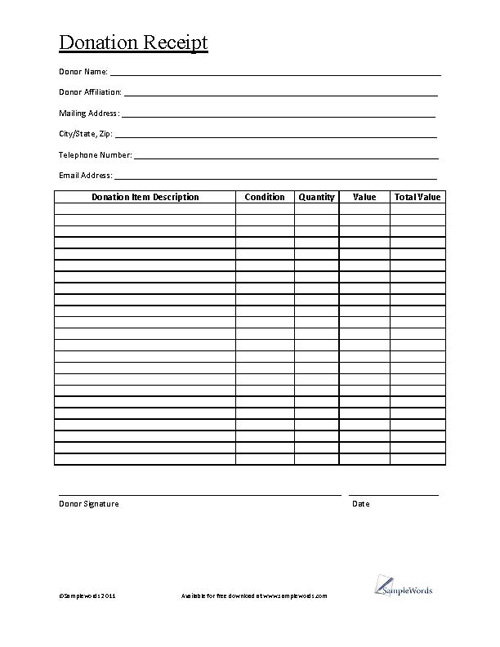

Printable Goodwill Donation Form Printable Forms Free Online

Free Printable Donation Receipt Template

Printable Goodwill Donation Form Printable Word Searches

Itemized Donation List Printable Goodwill Master of

Printable Goodwill Donation Form

Goodwill Printable Donation Receipt

free goodwill donation receipt template pdf eforms free goodwill

free goodwill donation receipt template pdf eforms free goodwill

Printable Goodwill Donation Form Printable Forms Free Online

We Happily Accept Donations Of New Or Gently Used Items, Including:

Web Everything You Need To Know About Claiming Tax Deductions For Your Donations:

If You Itemize Deductions On Your Federal Tax Return, You Are Entitled To Claim A Charitable Deduction For Your Goodwill Donations.

Goods Or Services Were Not Exchanged For This Contribution And No Personal Benefit Was Incurred By It, So It Is Entirely Deductible To The Extent Allowable By The Law.

Related Post: