Goodwill Itemized Donation List Printable

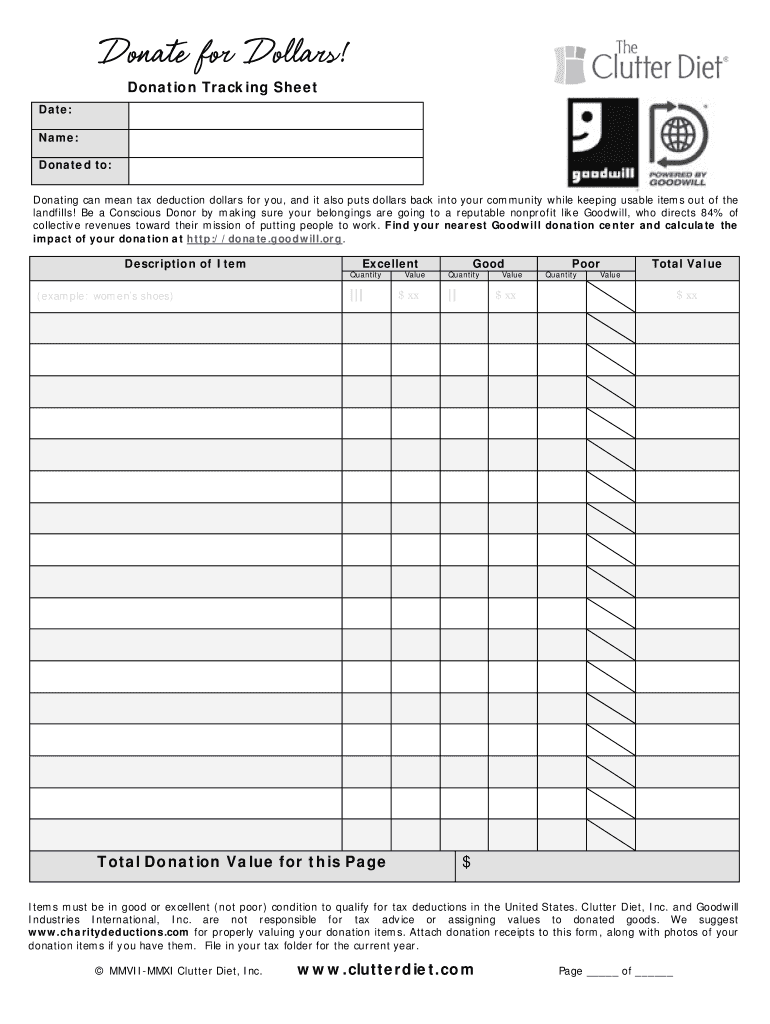

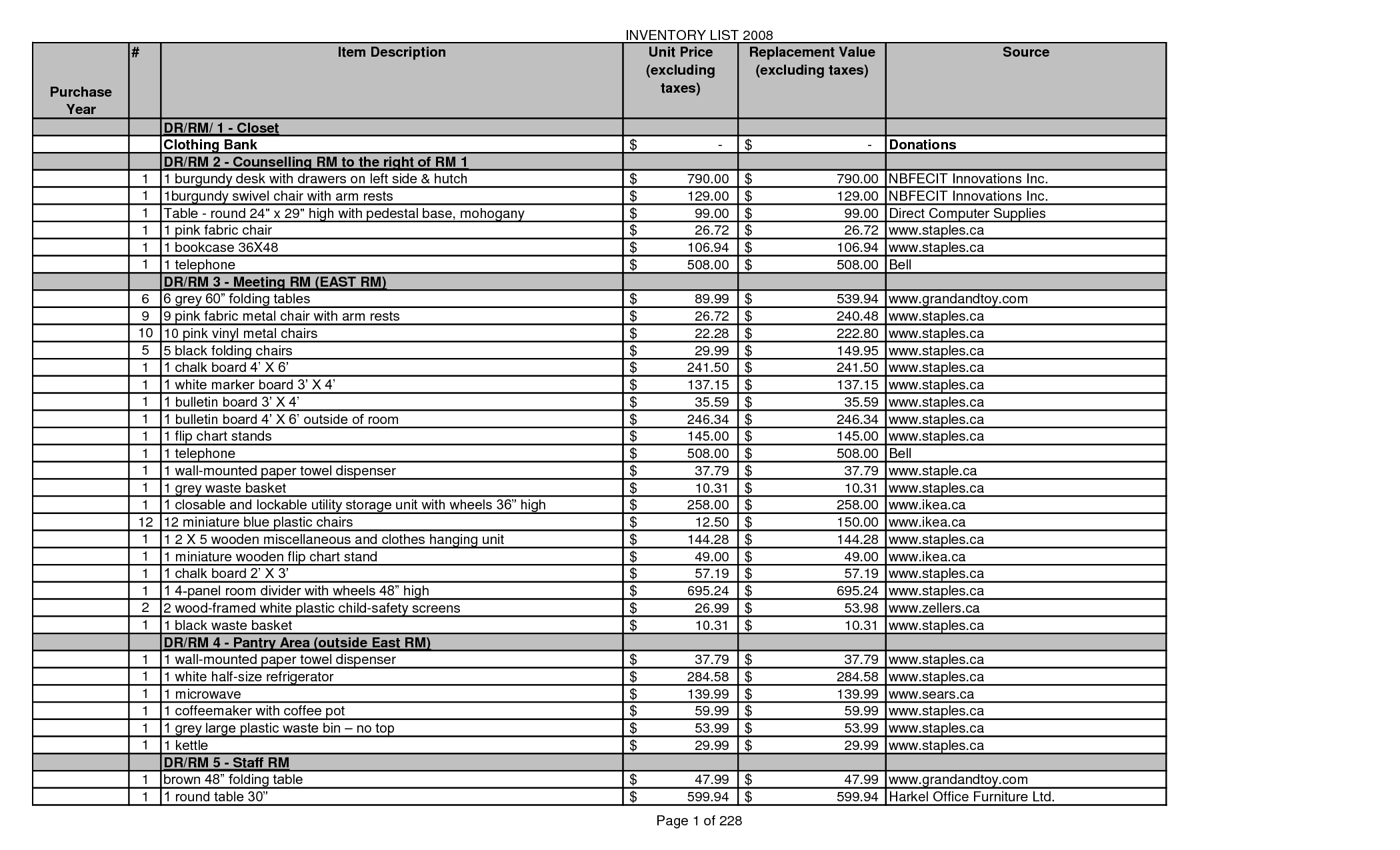

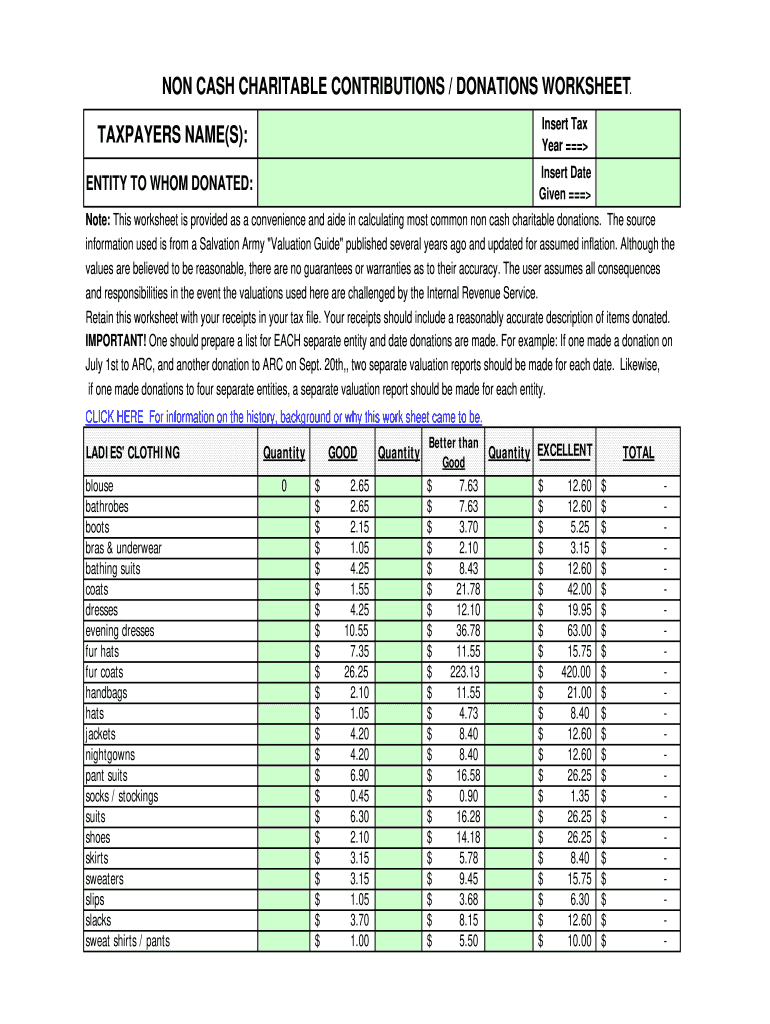

Goodwill Itemized Donation List Printable - This form is available at the time of donation from our stores and donation centers in maine, new hampshire and vermont. Here's a guide to check the values. Web goodwill industries international supports a network of more than 150 local goodwill organizations. Web to get started, download the goodwill donation valuation guide, which features estimates for the most commonly donated items. Goodwill® won’t put a dollar value on Goodwill cannot assign a tax value for you. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books, and so forth. Internal revenue service (irs) requires donors to value their items. Web if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Download your updated document, export it to the cloud, print it. Web follow the goodwill donation guidelines to know what goodwill does and does not accept for donations at their stores. Web you must take into consideration the quality and condition of your items when determining a value. Internal revenue service (irs) requires donors to value their items. Web goodwill industries international supports a network of more than 150 local goodwill organizations. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. Download your updated document, export it to the cloud, print it. The items donated must be in good used condition or better, and remember, the price ranges are only estimated values. Web what is my donation worth? Web if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. The donation impact calculator is a great way to see how your donations support your goodwill’s programs and services. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. This form is available at the time of donation from our stores and donation centers in maine, new hampshire and vermont. Web calculate the impact your donation will make on the community by using goodwill's used goods donation impact calculator. Web what is my donation worth? Web you must take into consideration the quality and condition of your items when determining a value. Web after you make a donation to goodwill, ask for a donation receipt. Fill out the donation receipt form and specify each item you donated. Fair market value is the price a willing. Goodwill® won’t put a dollar value on Fair market value is the price a willing. Fill out the donation receipt form and specify each item you donated. Simply enter the number of donated items into the form below to calculate the total value of your donation. We can only verify your gift. This form is available at the time of donation from our stores and donation centers in maine, new hampshire and vermont. Web estimate. The list should include the name of the organization, the date of the donation, the amount of the donation, the payment method, and any other relevant information. Use this receipt when filing your taxes. Web to get started, download the goodwill donation valuation guide, which features estimates for the most commonly donated items. You, the donor, must determine the fair. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. Internal revenue service (irs) requires donors to value their items. A donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and basic personal information (name, city, address, state, zip). Download your updated document, export. You, the donor, must determine the fair market value of those donations. Web estimate the value of your donations automatically with this handy donation calculator and receipt form. Web estimate donation calculator if you itemize deductions on your federal tax return (using the long form), you are entitled to claim a charitable deduction for your donation to goodwill. A donation. You, the donor, must determine the fair market value of those donations. It’s a good idea to check with your accountant or. Download your updated document, export it to the cloud, print it. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books, and so forth. Need. We can only verify your gift. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Use the price ranges as a general guide to assess the value to claim on your tax return. Be sure to get a receipt when you donate your goods. Fair market value is the. Be sure to get a receipt when you donate your goods. We can only verify your gift. When you’re done, print the form and take it, along with your donations, to your nearest goodwill donation center for a goodwill. Refer to irs.gov for more information. Use the list below as a general guide to assess the “fair market value” you. Download your updated document, export it to the cloud, print it. Internal revenue service (irs) requires donors to value their items to obtain a charitable donations itemized tax deduction. Web follow the goodwill donation guidelines to know what goodwill does and does not accept for donations at their stores. Web if you itemize deductions on your federal tax return, you. Web what is my donation worth? Web estimate donation calculator if you itemize deductions on your federal tax return (using the long form), you are entitled to claim a charitable deduction for your donation to goodwill. Web you must take into consideration the quality and condition of your items when determining a value. We can only verify your gift. Here's. Here's a guide to check the values. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. Internal revenue service (irs) requires donors to value their items. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes,. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books, and so forth. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. Web calculate the impact your donation will make on the community by using goodwill's used goods donation impact calculator. Web follow the goodwill donation guidelines to know what goodwill does and does not accept for donations at their stores. Web if you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Fair market value is the price a willing. A donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and basic personal information (name, city, address, state, zip). Web what is my donation worth? To help guide you, we have complied a list providing price ranges for items commonly sold in goodwill ncw stores and training centers. Goodwill cannot assign a tax value for you. Web you must take into consideration the quality and condition of your items when determining a value. To find the goodwill headquarters responsible for your area, visit our locator. Be sure to get a receipt when you donate your goods. Fill out the donation receipt form and specify each item you donated. Refer to irs.gov for more information. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.Itemized Donation List Printable

Goodwill Itemized Donation List Printable

Goodwill Itemized Donation List Printable

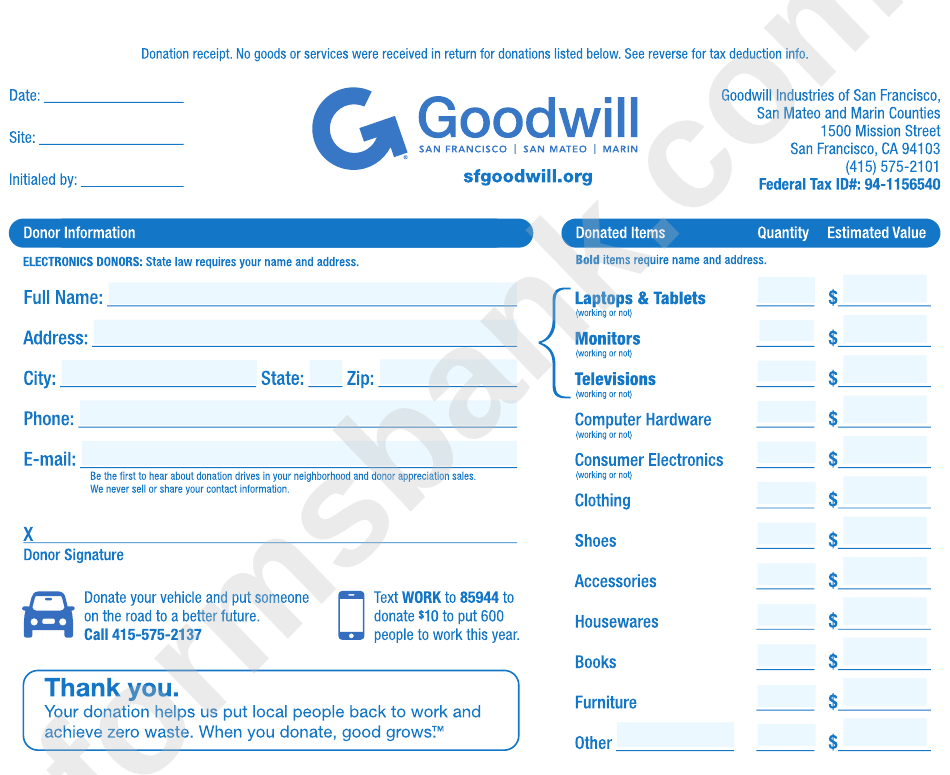

Free Goodwill Donation Receipt Template PDF eForms

Goodwill Valuation Guide 20072024 Form Fill Out and Sign Printable

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Itemized Donation List Printable Goodwill Master of

Goodwill Itemized Donation List Printable

Printable Goodwill Donation Form

Goodwill Itemized Donation List Printable

A Donation Receipt Is Used To Claim A Tax Deduction For Clothing And Household Property Itemized On An Individual’s Taxes.

It’s A Good Idea To Check With Your Accountant Or.

You, The Donor, Must Determine The Fair Market Value Of Those Donations.

Web Estimate Donation Calculator If You Itemize Deductions On Your Federal Tax Return (Using The Long Form), You Are Entitled To Claim A Charitable Deduction For Your Donation To Goodwill.

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-24.jpg)