Irs Abatement Letter Template

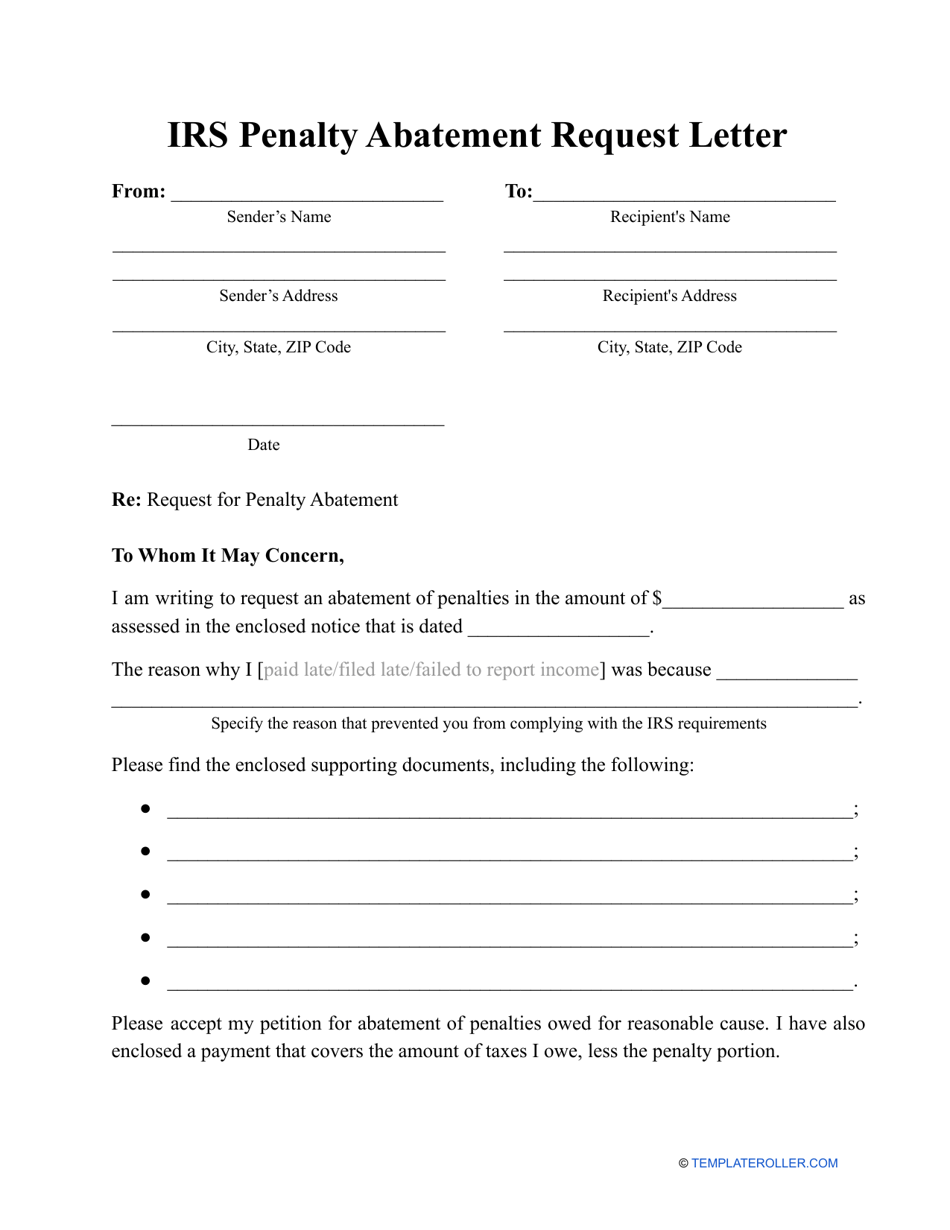

Irs Abatement Letter Template - Request for penalty abatement [taxpayer name(s)] [address] [ssn or tin] [date] to whom it may concern: Web after the irs has assessed a penalty, the taxpayer can request penalty abatement, typically by writing a penalty abatement letter or by calling the irs. Applicable if the tax return isn’t filed by the due date. (use the address provided in your tax bill) re: Web a penalty abatement letter should begin by stating your name, contact information, the irs tax id number, and the tax year. Web if we correctly charged the partnership or s corporation a penalty for filing late, but you believe it had reasonable cause for doing so, you can mail a written. This template reflects our winning formula and best practices, and. Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a penalty. Web this column summarizes common irs penalties that tax practitioners see almost daily, and practical ways to obtain a penalty abatement. Web you can request penalty abatement by writing a letter to the irs. Web after the irs has assessed a penalty, the taxpayer can request penalty abatement, typically by writing a penalty abatement letter or by calling the irs. Web taxpayers can request abatement of return accuracy penalties after they are assessed, but the abatement process may require using special irs procedures or. The penalty to pay is a percentage of the taxes in the late filing. Web in this guide, i’ll share my insights and provide three unique templates to help you write an effective irs penalty abatement request letter. Web you may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. Internal revenue service penalty abatement coordinator [address provided on notice of tax amount due] [indicate what tax form it is pertaining to, e.g. The letter should explain why you deserve abatement. You may qualify for relief from a penalty. Fortunately, we have a sample petition letter so you get a. Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a penalty. This template reflects our winning formula and best practices, and. Web the aicpa has created a template for members to use when requesting a penalty abatement from the irs. Web you may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. The penalty to pay is a percentage of the taxes in the late filing. Web penalty relief is available on late filing and late payment penalties. Web this column summarizes common irs penalties that tax practitioners see almost daily, and practical ways to obtain a penalty abatement. Web taxpayers can request abatement of return accuracy penalties after they are assessed, but the abatement process may require using special irs procedures or. Applicable if the tax return isn’t filed by the due date. Web in this guide, i’ll share my insights and provide three unique templates to help you write an effective irs penalty abatement request letter. Internal revenue service penalty abatement coordinator [address provided on notice of tax amount due] [indicate what tax form it is pertaining to, e.g. It explains that the irs. If you received a notice or. Request for penalty abatement [taxpayer name(s)] [address] [ssn or tin] [date] to whom it may concern: Web a penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an explanation of your circumstances. Web this column summarizes common irs penalties that tax practitioners. Here are three detailed templates. Internal revenue service penalty abatement coordinator [address provided on notice of tax amount due] [indicate what tax form it is pertaining to, e.g. Web this column summarizes common irs penalties that tax practitioners see almost daily, and practical ways to obtain a penalty abatement. Web you may qualify for penalty relief if you tried to. Web this column summarizes common irs penalties that tax practitioners see almost daily, and practical ways to obtain a penalty abatement. Here are three detailed templates. Web if we correctly charged the partnership or s corporation a penalty for filing late, but you believe it had reasonable cause for doing so, you can mail a written. Web you may qualify. You should also explain why you. It explains that the irs. Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a penalty. Web you may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. Fortunately, we have a. Web if we correctly charged the partnership or s corporation a penalty for filing late, but you believe it had reasonable cause for doing so, you can mail a written. Web the aicpa has created a template for members to use when requesting a penalty abatement from the irs. Web a penalty abatement request letter asks the irs to remove. Web this column summarizes common irs penalties that tax practitioners see almost daily, and practical ways to obtain a penalty abatement. This template reflects our winning formula and best practices, and. Web the aicpa has created a template for members to use when requesting a penalty abatement from the irs. Request for penalty abatement [taxpayer name(s)] [address] [ssn or tin]. Web you may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. Web the aicpa has created a template for members to use when requesting a penalty abatement from the irs. Web you can request penalty abatement by writing a letter to the irs. You should also explain. Request for penalty abatement [taxpayer name(s)] [address] [ssn or tin] [date] to whom it may concern: Web after the irs has assessed a penalty, the taxpayer can request penalty abatement, typically by writing a penalty abatement letter or by calling the irs. Here are three detailed templates. Web taxpayers can request abatement of return accuracy penalties after they are assessed,. If you received a notice or. Request for penalty abatement [taxpayer name(s)] [address] [ssn or tin] [date] to whom it may concern: Web penalty relief is available on late filing and late payment penalties. You may qualify for relief from a penalty. (use the address provided in your tax bill) re: Internal revenue service penalty abatement coordinator [address provided on notice of tax amount due] [indicate what tax form it is pertaining to, e.g. Web a penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an explanation of your circumstances. Web you can request penalty abatement by writing a letter to the irs. Web. Web if we correctly charged the partnership or s corporation a penalty for filing late, but you believe it had reasonable cause for doing so, you can mail a written. Web in this guide, i’ll share my insights and provide three unique templates to help you write an effective irs penalty abatement request letter. Applicable if the tax return isn’t filed by the due date. Web here is a simplified irs letter template that you can use when writing to the irs: Web the aicpa has created a template for members to use when requesting a penalty abatement from the irs. The letter should explain why you deserve abatement. Many taxpayers are receiving penalty notices after. Web penalty relief is available on late filing and late payment penalties. Web you may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. 1040, 1065, etc, and the tax period] re: Here are three detailed templates. You should also explain why you. Web a penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an explanation of your circumstances. Internal revenue service penalty abatement coordinator [address provided on notice of tax amount due] [indicate what tax form it is pertaining to, e.g. Fortunately, we have a sample petition letter so you get a. You may qualify for relief from a penalty.50 Irs First Time Penalty Abatement Letter Example Ig2s Letter

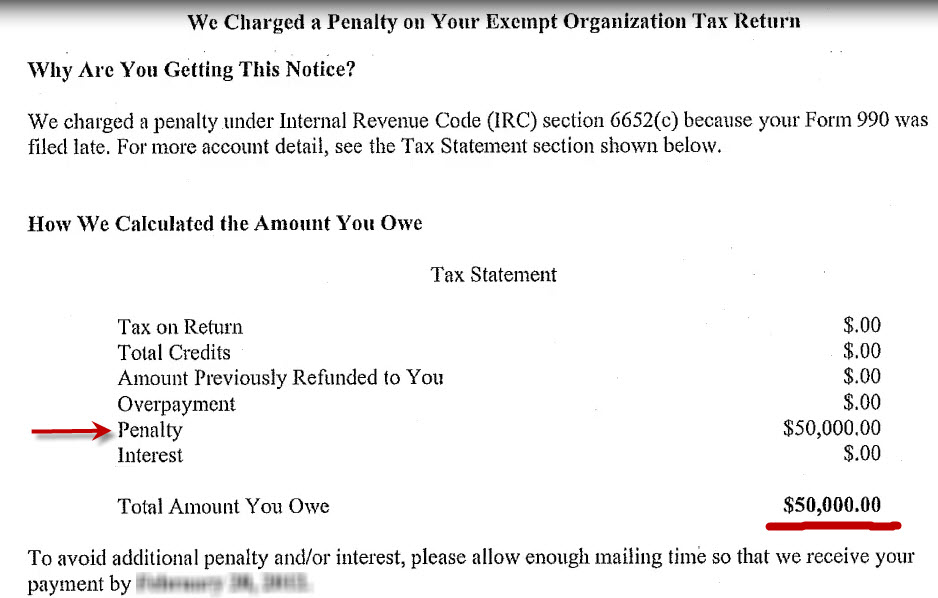

How to remove an IRS form 990 late filing penalty. Write an Effective

letter for abatement of penalty.word.docx

Irs Abatement Letter Template

Sample Letter To Irs Requesting An Abatement

Reasonable Cause Sample Letter To Irs To Waive Penalty

Sample Irs Penalty Abatement Request Letter

IRS Penalty Abatement Request Letter Template Download Printable PDF

How to remove IRS tax penalties in 3 easy steps. The IRS Penalty

Irs Tax Penalty Abatement Sample Letter

Request For Penalty Abatement [Taxpayer Name(S)] [Address] [Ssn Or Tin] [Date] To Whom It May Concern:

Web Find Out About The Irs First Time Penalty Abatement Policy And If You Qualify For Administrative Relief From A Penalty.

Web This Document Provides Sample Letters That Can Be Used To Request An Abatement Of Irs Penalties For Failure To File, Failure To Pay, Or Failure To Deposit.

Web After The Irs Has Assessed A Penalty, The Taxpayer Can Request Penalty Abatement, Typically By Writing A Penalty Abatement Letter Or By Calling The Irs.

Related Post: