Irs Mileage Log Template

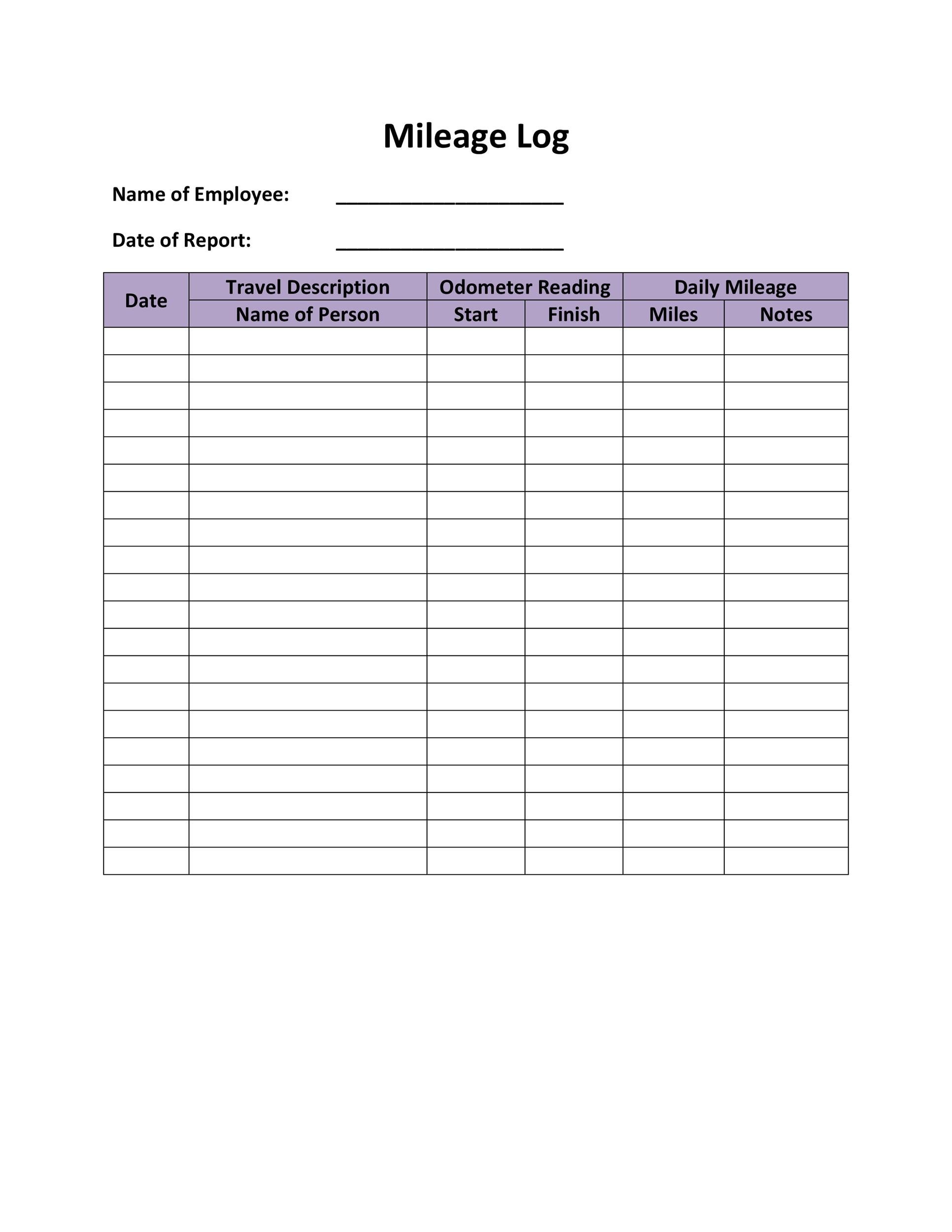

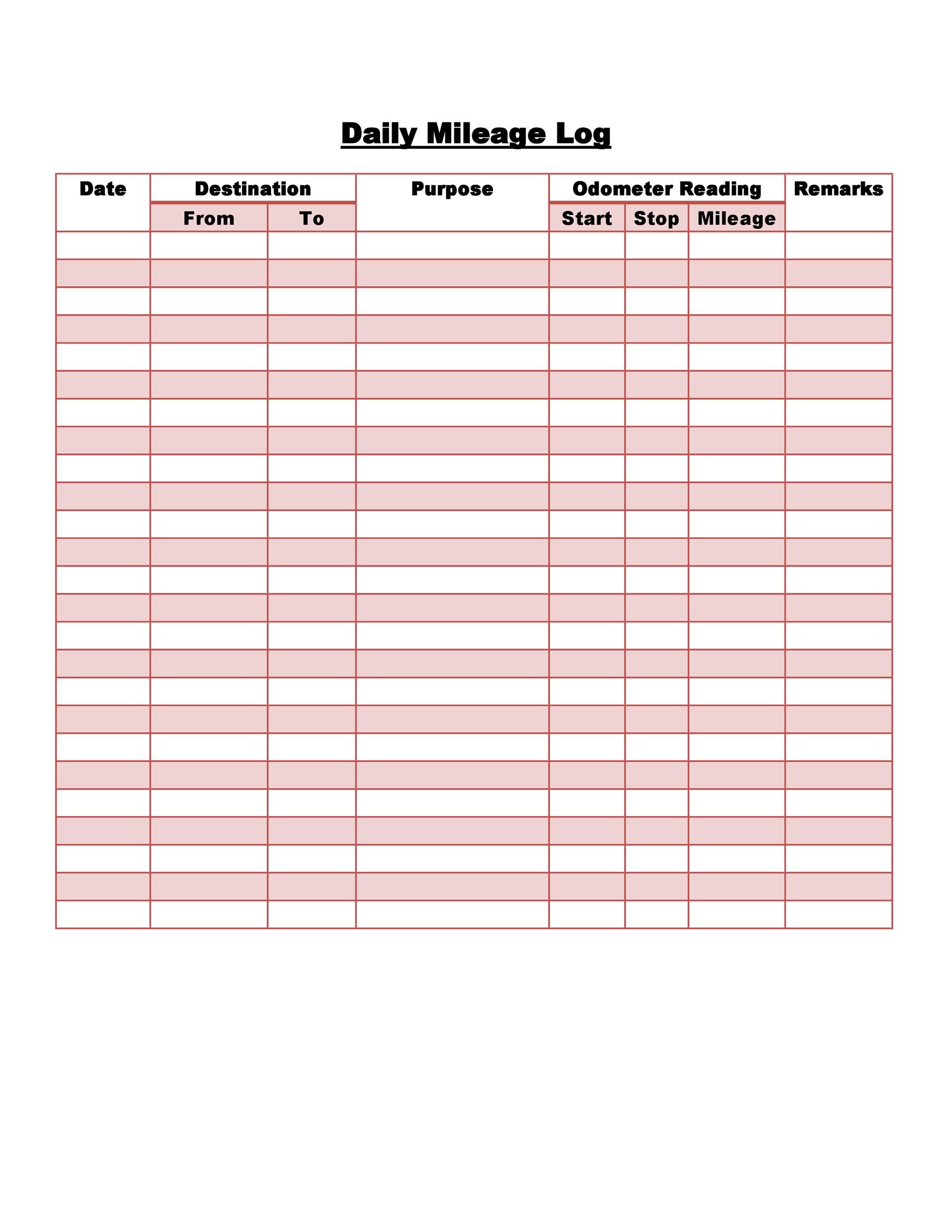

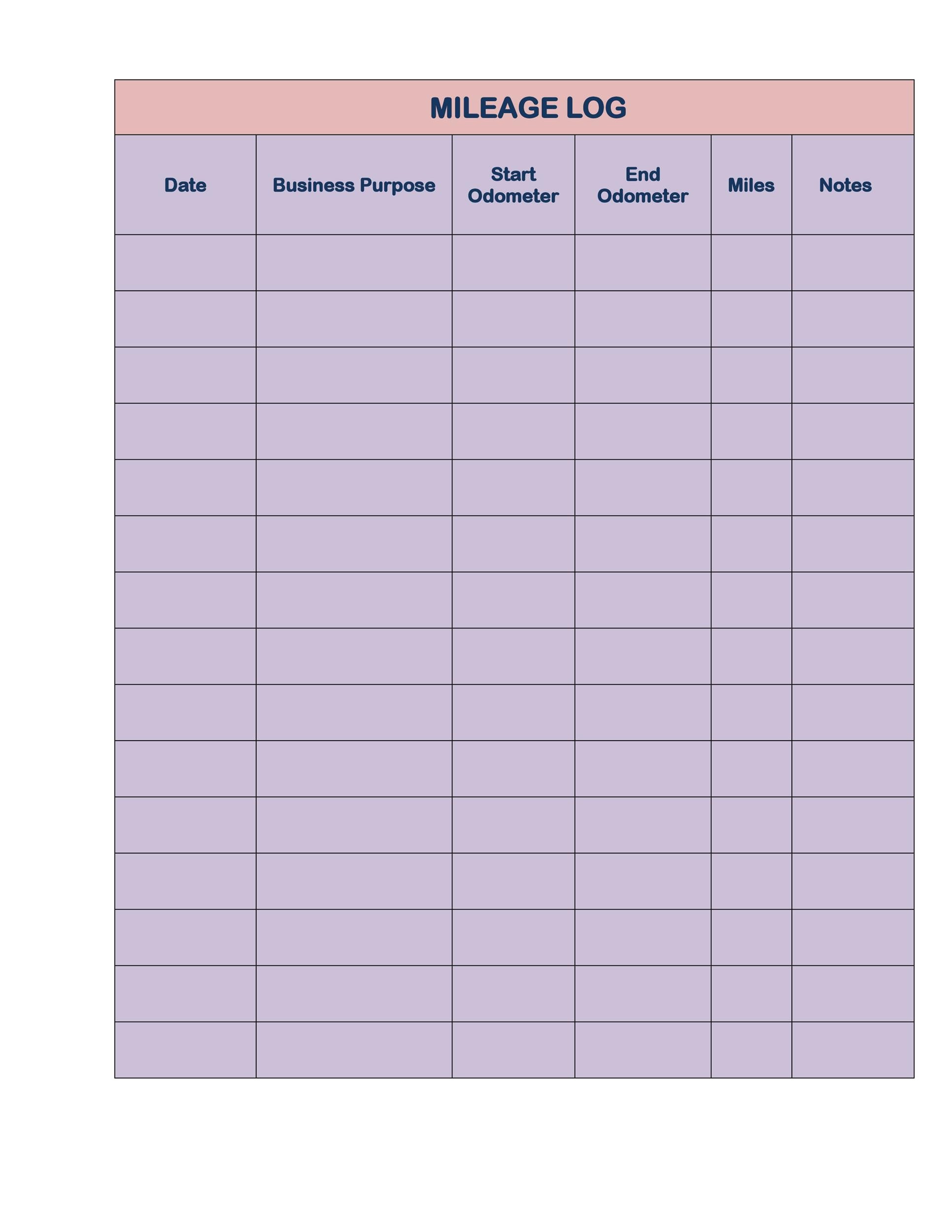

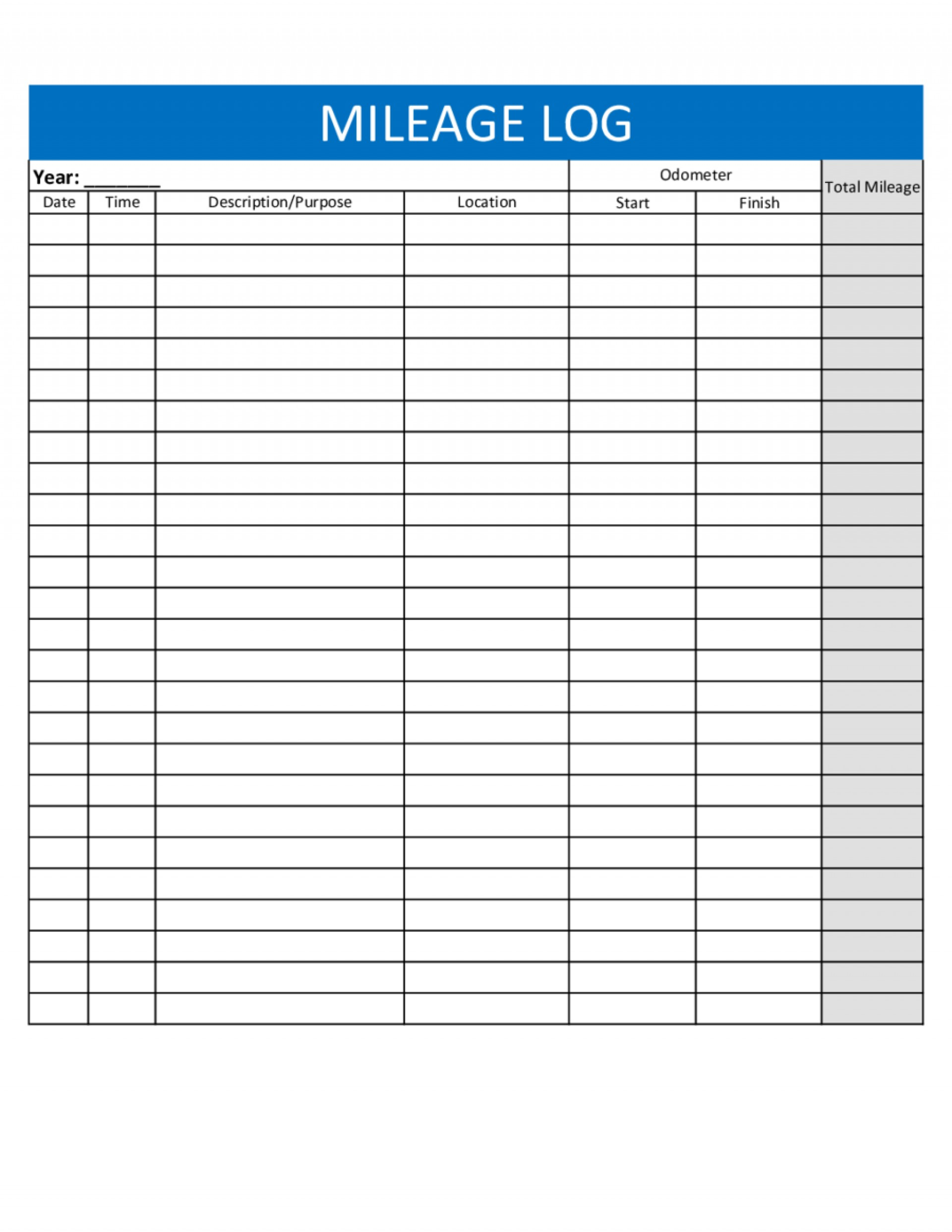

Irs Mileage Log Template - Web download free excel mileage log template. Total miles driven, missing mileage, vehicle status/operator comments, and more. Many business owners underestimate how beneficial it is to track their business mileage. Tips for keeping a mileage log for taxes. Web download the free 2024 mileage log template as a pdf, sheets or excel version and keep track of your trips. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Web irs compliant mileage log template 2022 in excel, openoffice calc & google sheets to record and claim irs tax deductions of mileage expenses. And finally the summary data: 31 high quality mileage log templates in excel, word or pdf. If you drive for work, it’s important to keep track of your mileage for both tax deduction and reimbursement purposes. 31 high quality mileage log templates in excel, word or pdf. What is a mileage log book? Web irs compliant mileage log template 2022 in excel, openoffice calc & google sheets to record and claim irs tax deductions of mileage expenses. Web the purpose of your trip. Car expenses and use of the standard mileage rate are explained in chapter 4. And finally the summary data: Learn how to maintain accurate records, choose the right mileage log template, and navigate the complexities of mileage tracking for tax compliance. How to keep an irs compliant mileage log for taxes. Depreciation limits on cars, trucks, and vans. In this blog post, we’ll provide you with just such a logbook! In this blog post, we’ll provide you with just such a logbook! Date time description purpose from to mileage odometer start odometer finish driver’s name and id: How to keep an irs compliant mileage log for taxes. It is used as a supporting document to claim deductions or reimbursements on your tax returns. Free irs printable mileage log form to download. Like the name implies, this method involves reporting all actual vehicle expenses to the irs. Web as of 2021, the standard mileage rate for vehicles is 56 cents per mile. Web this mileage log spreadsheet was designed to help you quickly review and compare the following individual vehicle metrics: Why are people using expressmileage to create mileage logs? Web irs mileage log form total mileagevehicle recorded: 31 high quality mileage log templates in excel, word or pdf. Many business owners underestimate how beneficial it is to track their business mileage. The snippet below shows all the above mentioned details, except for the odometer and the summary data, which we’ll show on the next images: Date time description purpose from to mileage odometer start odometer finish driver’s. If you drive for work, it’s important to keep track of your mileage for both tax deduction and reimbursement purposes. Our online mileage log generator helps you make mileage logs in a matter of minutes. The snippet below shows all the above mentioned details, except for the odometer and the summary data, which we’ll show on the next images: Web. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Car expenses and use of the standard mileage rate are explained in chapter 4. Web download the free 2024 mileage log template as a pdf, sheets or excel version and keep track of your trips. Our online mileage. If you drive for work, it’s important to keep track of your mileage for both tax deduction and reimbursement purposes. Does the irs require odometer readings? Requirements for the actual expense method. Tips for keeping a mileage log for taxes. Many business owners underestimate how beneficial it is to track their business mileage. How to keep an irs compliant mileage log for taxes. Why are people using expressmileage to create mileage logs? Car expenses and use of the standard mileage rate are explained in chapter 4. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Our online mileage log. Web the irs requires this mileage log template to ensure that individuals and businesses have accurate details of their travel expenses, such as fuel costs, vehicle maintenance, and depreciation. Depreciation limits on cars, trucks, and vans. Web you can use it as a free irs mileage log template. Web 21+ free mileage log templates (for irs mileage tracking) whether you. Web do you need a mileage log for reimbursement or irs tax purposes? Web irs mileage log form total mileagevehicle recorded: Depreciation limits on cars, trucks, and vans. And finally the summary data: Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. In this blog post, we’ll provide you with just such a logbook! Web this mileage log spreadsheet was designed to help you quickly review and compare the following individual vehicle metrics: How to keep an irs compliant mileage log for taxes. 31 high quality mileage log templates in excel, word or pdf. Web do you need a mileage log for. Web the purpose of your trip. In this blog post, we’ll provide you with just such a logbook! Web as of 2021, the standard mileage rate for vehicles is 56 cents per mile. Like the name implies, this method involves reporting all actual vehicle expenses to the irs. 31 high quality mileage log templates in excel, word or pdf. Car expenses and use of the standard mileage rate are explained in chapter 4. Where to buy a mileage log for your taxes. You can keep a mileage log in a notebook and update it by hand, or. Does the irs require odometer readings? If you drive for work, it’s important to keep track of your mileage for both tax. It is used as a supporting document to claim deductions or reimbursements on your tax returns. Web you can use it as a free irs mileage log template. The snippet below shows all the above mentioned details, except for the odometer and the summary data, which we’ll show on the next images: Web irs compliant mileage log template 2022 in excel, openoffice calc & google sheets to record and claim irs tax deductions of mileage expenses. What is a mileage log book? Car expenses and use of the standard mileage rate are explained in chapter 4. Learn how to maintain accurate records, choose the right mileage log template, and navigate the complexities of mileage tracking for tax compliance. Web download our free printable mileage log templates, forms and samples! Date time description purpose from to mileage odometer start odometer finish driver’s name and id: In this blog post, we’ll provide you with just such a logbook! Where to buy a mileage log for your taxes. Depreciation limits on cars, trucks, and vans. And finally the summary data: For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Does the irs require odometer readings? All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer.Irs Mileage Reimbursement 2024 Rate Chart Isabel Mariel

Irs Mileage Log Template Excel For Your Needs

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab Mileage log

25 Printable IRS Mileage Tracking Templates GOFAR

Irs mileage report form samples

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Mileage Report Template

Mileage Log Spreadsheet Google Spreadshee mileage log printable free

Irs Mileage Log Template

Web 21+ Free Mileage Log Templates (For Irs Mileage Tracking) Whether You Choose To Claim Your Business Auto Expenses By Submitting Your Total Gas Receipts Or By Claiming The Irs Standard Mileage Rate, You Will Need To Keep Track Of Your Mileage.

Web Do You Need A Mileage Log For Reimbursement Or Irs Tax Purposes?

Web Irs Mileage Log Form Total Mileagevehicle Recorded:

31 High Quality Mileage Log Templates In Excel, Word Or Pdf.

Related Post: