Letter To Irs Template Word

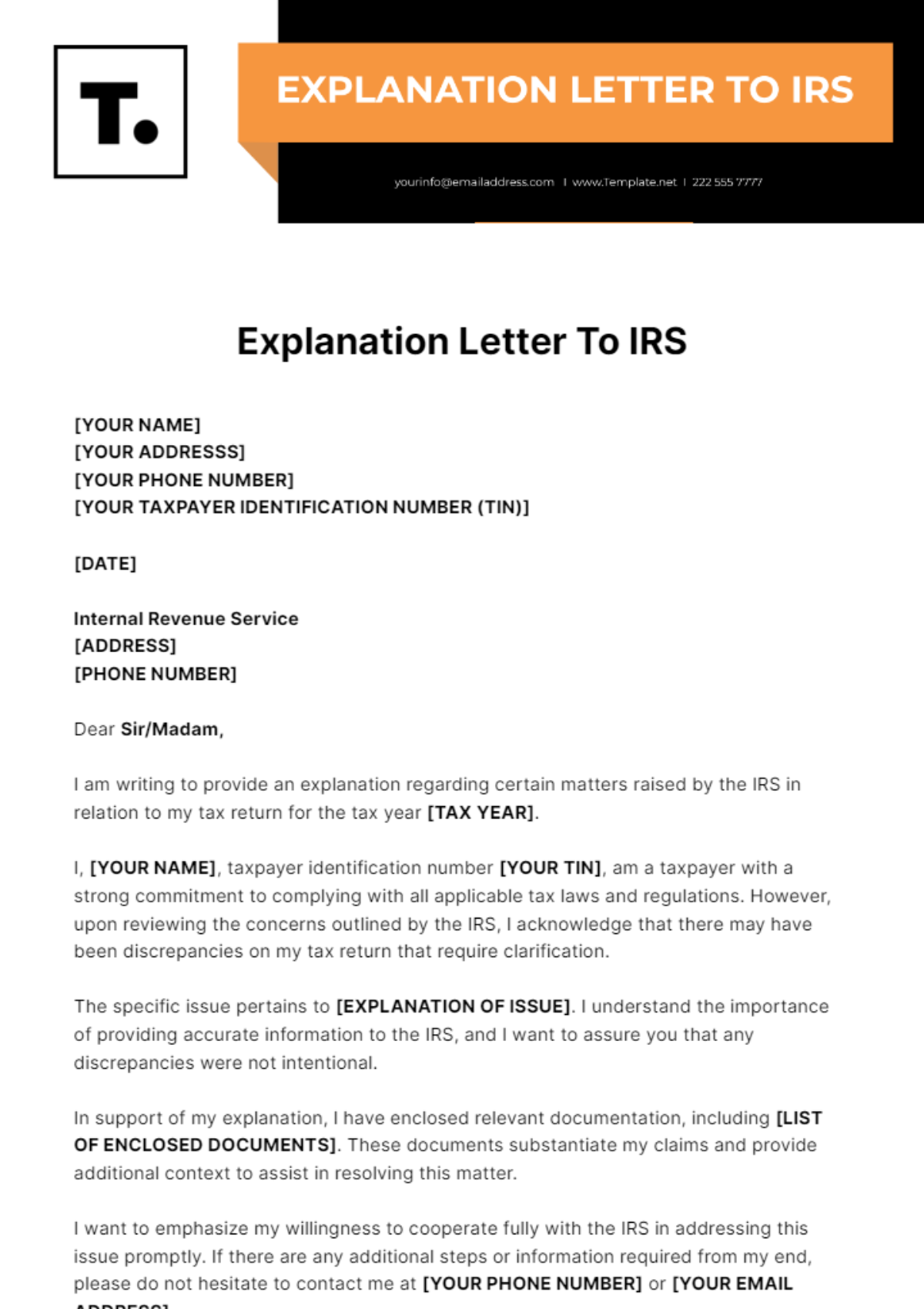

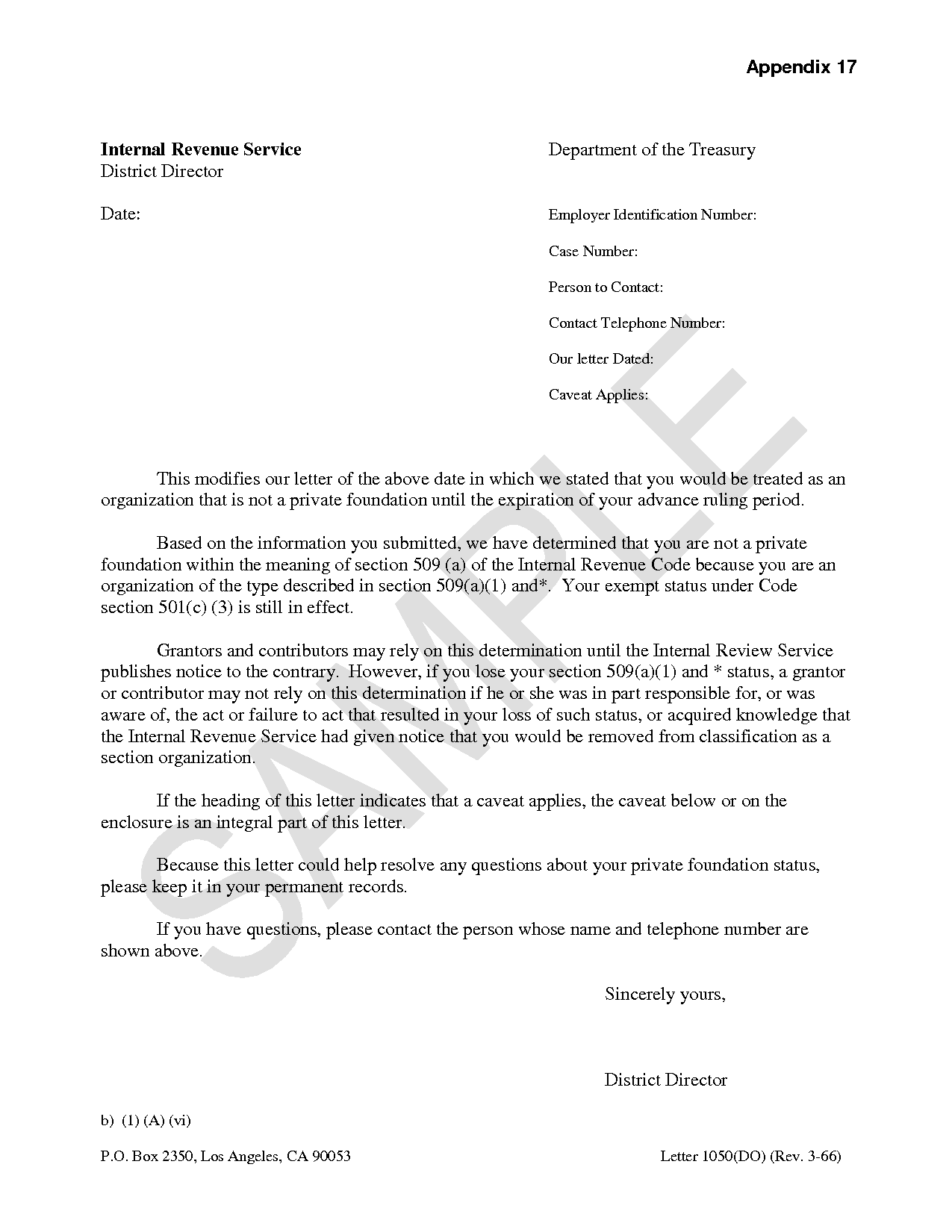

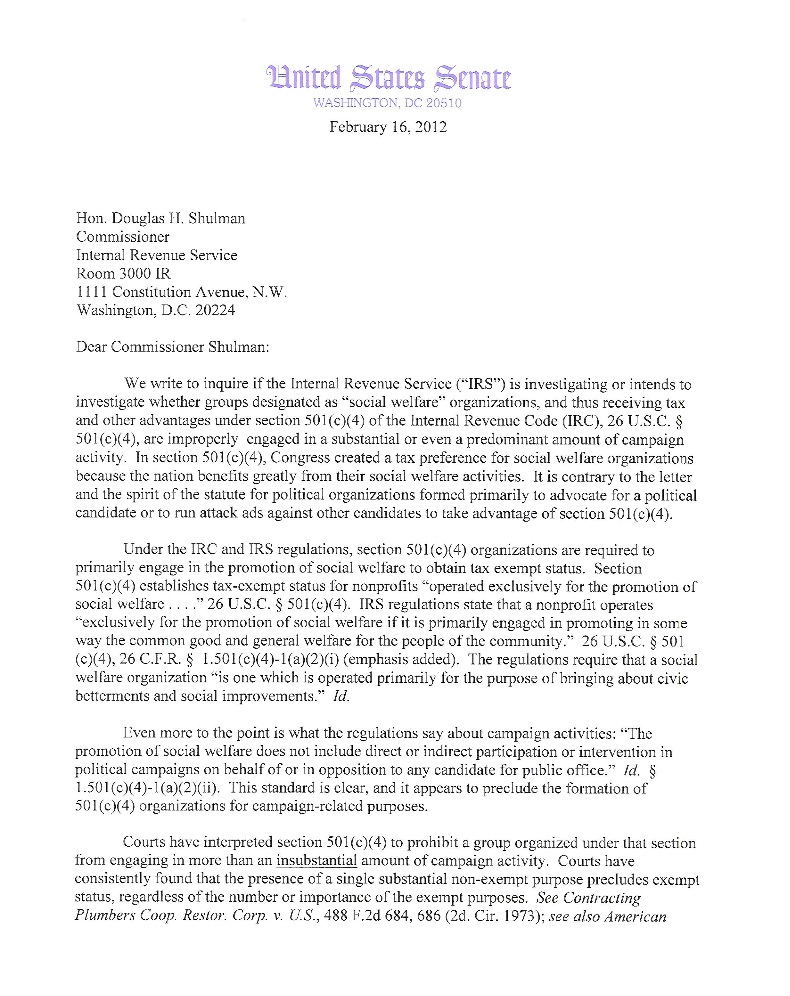

Letter To Irs Template Word - It could help you navigate your way through the irs. The letter is a response to a notice cp2000 claiming tax owed. Web here is how you can draft a hardship letter to the irs: Web a response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a tax return, specifically to add items of unreported or incorrectly reported income. Digits on irs forms crossword clue answer contains 4 letters and has been last seen on september 17 2024 as part of wall street journal crossword. Provide all necessary information and remember to keep a copy of the letter for your records. Web write the full legal name of the person or business who is requesting that the irs review a penalty assessed. In either case, you’ll be given 30 days to respond. Web according to the irs, your letter should include the following: Puts forth as a theory. Web according to the irs, your letter should include the following: Explain the reasons for the hardship in full detail. Digits on irs forms crossword clue answer contains 4 letters and has been last seen on september 17 2024 as part of wall street journal crossword. Web discover how quickly and painlessly you can write important irs letters using the collection of templates included in the ultimate irs communicator. Puts forth as a theory. Web easily request abatement of irs penalties using our free irs penalty abatement request letter template. You can use this irs penalty response letter to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. A statement expressing your desire to appeal irs’s findings to the office of appeals. Letter to the irs template. This entity will be known as the requester going forward. Digits on irs forms crossword clue answer contains 4 letters and has been last seen on september 17 2024 as part of wall street journal crossword. Responding to a request for information. Web in order to file a letter ruling request, you must go to pay.gov to make a payment prior in order to receive a payment receipt that must be submitted with the letter ruling request. Web write the full legal name of the person or business who is requesting that the irs review a penalty assessed. Looking for a free irs letter templates? Web sample letter to irs. A statement expressing your desire to appeal irs’s findings to the office of appeals. This entity will be known as the requester going forward. Letter to the irs template. Fill, save, and download in pdf or word format. Puts forth as a theory. Different formats and samples are available based on specific circumstances, and truthfully stating personal reasons is crucial. Web a response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a tax return, specifically to add items of unreported. An irs letter notifies the taxpayer about issues regarding their latest tax return, approves the retirement plan, or provides information requested by third parties. Sample letter to the irs template. The original, signed ruling request and supporting materials must be submitted together by mail or hand delivery to the irs. In either case, you’ll be given 30 days to respond.. Responding to a request for information. According to the irs, the most common underreporter issues are: Web here is how you can draft a hardship letter to the irs: Browse through thousands of blank customizable samples and forms in pdf format on formsbank. Web discover how quickly and painlessly you can write important irs letters using the collection of templates. Web a penalty abatement letter outlines to the internal revenue service (irs) why you missed the due date for your tax filing or payment and provides you a chance to request penalty relief. Web according to the irs, your letter should include the following: Web protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect. Different formats and samples are available based on specific circumstances, and truthfully stating personal reasons is crucial. The letter is a response to a notice cp2000 claiming tax owed. According to the irs, the most common underreporter issues are: It requests documentation to prove the validity of the claim, including signed certifications and delegations of authority from irs officers. Taxpayer’s. Browse through thousands of blank customizable samples and forms in pdf format on formsbank. Web whether you need to request an adjustment, address penalties and interest, or report identity theft or fraud, it is essential to know how to compose an effective letter to the irs. Different formats and samples are available based on specific circumstances, and truthfully stating personal. This is a 30 day notice, please enter the date of your notice so we can help you determine how much time you have left to pay. Web a response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a tax return, specifically. Explain the reasons for the hardship in full detail. Web formats word and pdf. Once you draft your letter, you can sign, print, and download it for mailing. Browse through thousands of blank customizable samples and forms in pdf format on formsbank. Web an irs penalty response letter is a document used to file a request with the irs that. Web sample letter to irs. Fill, save, and download in pdf or word format. Provide all necessary information and remember to keep a copy of the letter for your records. An irs letter notifies the taxpayer about issues regarding their latest tax return, approves the retirement plan, or provides information requested by third parties. The letter is a response to. Web write the full legal name of the person or business who is requesting that the irs review a penalty assessed. Different formats and samples are available based on specific circumstances, and truthfully stating personal reasons is crucial. Web here is how you can draft a hardship letter to the irs: Web whether you need to request an adjustment, address. Web a response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a tax return, specifically to add items of unreported or incorrectly reported income. Web formats word and pdf. Web write the full legal name of the person or business who is requesting that the irs review a penalty assessed. The letter is a response to a notice cp2000 claiming tax owed. Web whether you need to request an adjustment, address penalties and interest, or report identity theft or fraud, it is essential to know how to compose an effective letter to the irs. Additionally, we will provide a sample letter to serve as a guide. Web here is how you can draft a hardship letter to the irs: Web a penalty abatement letter outlines to the internal revenue service (irs) why you missed the due date for your tax filing or payment and provides you a chance to request penalty relief. An irs letter notifies the taxpayer about issues regarding their latest tax return, approves the retirement plan, or provides information requested by third parties. A statement expressing your desire to appeal irs’s findings to the office of appeals. Web easily request abatement of irs penalties using our free irs penalty abatement request letter template. Browse through thousands of blank customizable samples and forms in pdf format on formsbank. Use these downloadable forms to create a letter for any occasion! Provide all necessary information and remember to keep a copy of the letter for your records. Web sample letter to irs. Letter to the irs template.Explanation Letter To IRS Template Edit Online & Download Example

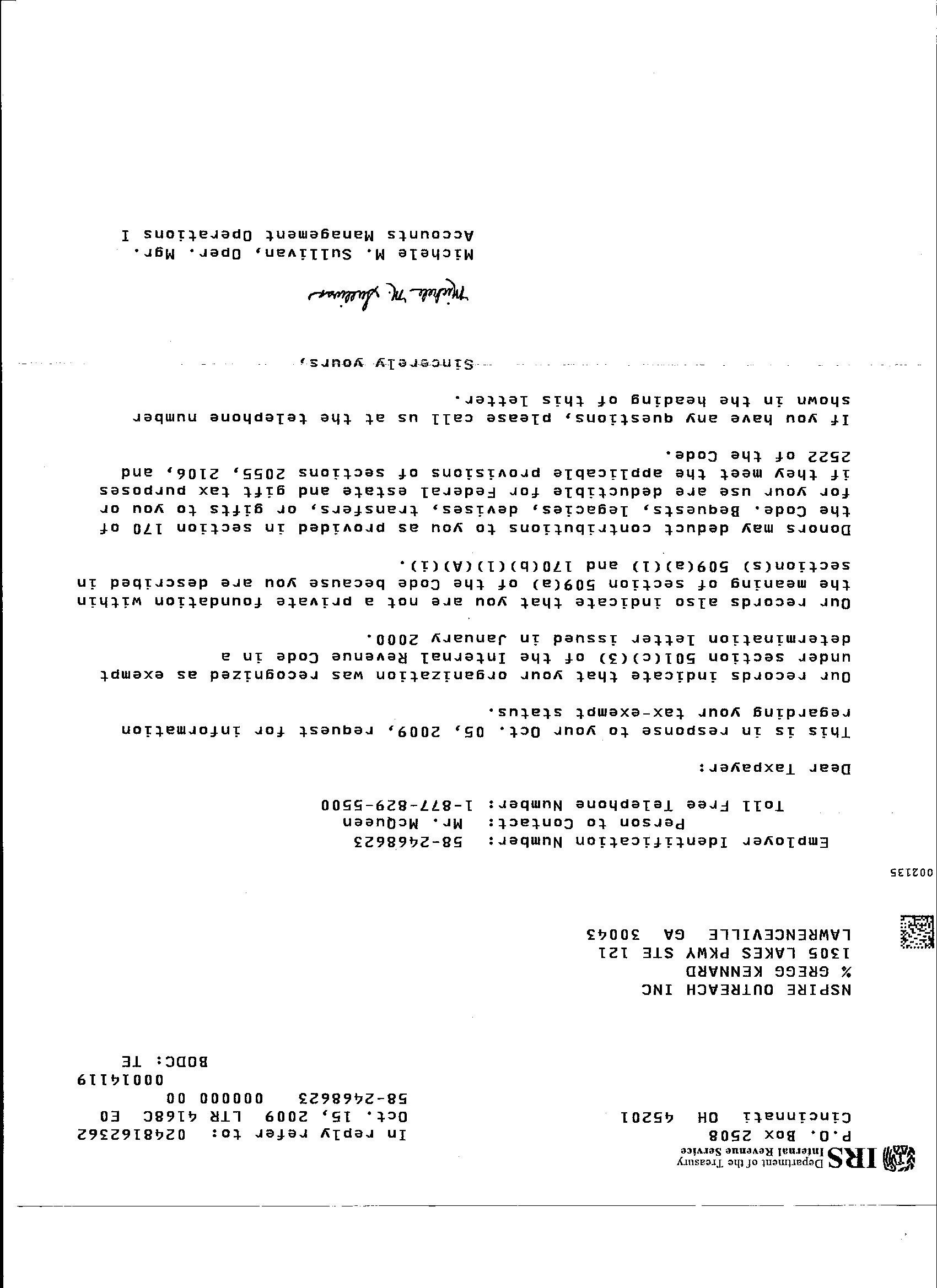

Sample Letter To Irs Free Printable Documents

Letter To Irs Template Word

Letter To Irs Free Printable Documents

How To Write A Cover Letter To The Irs Coverletterpedia

Letter To Irs Free Printable Documents

Template For Letter To Irs

B Notice Irs Fill Online, Printable, Fillable, Blank pdfFiller

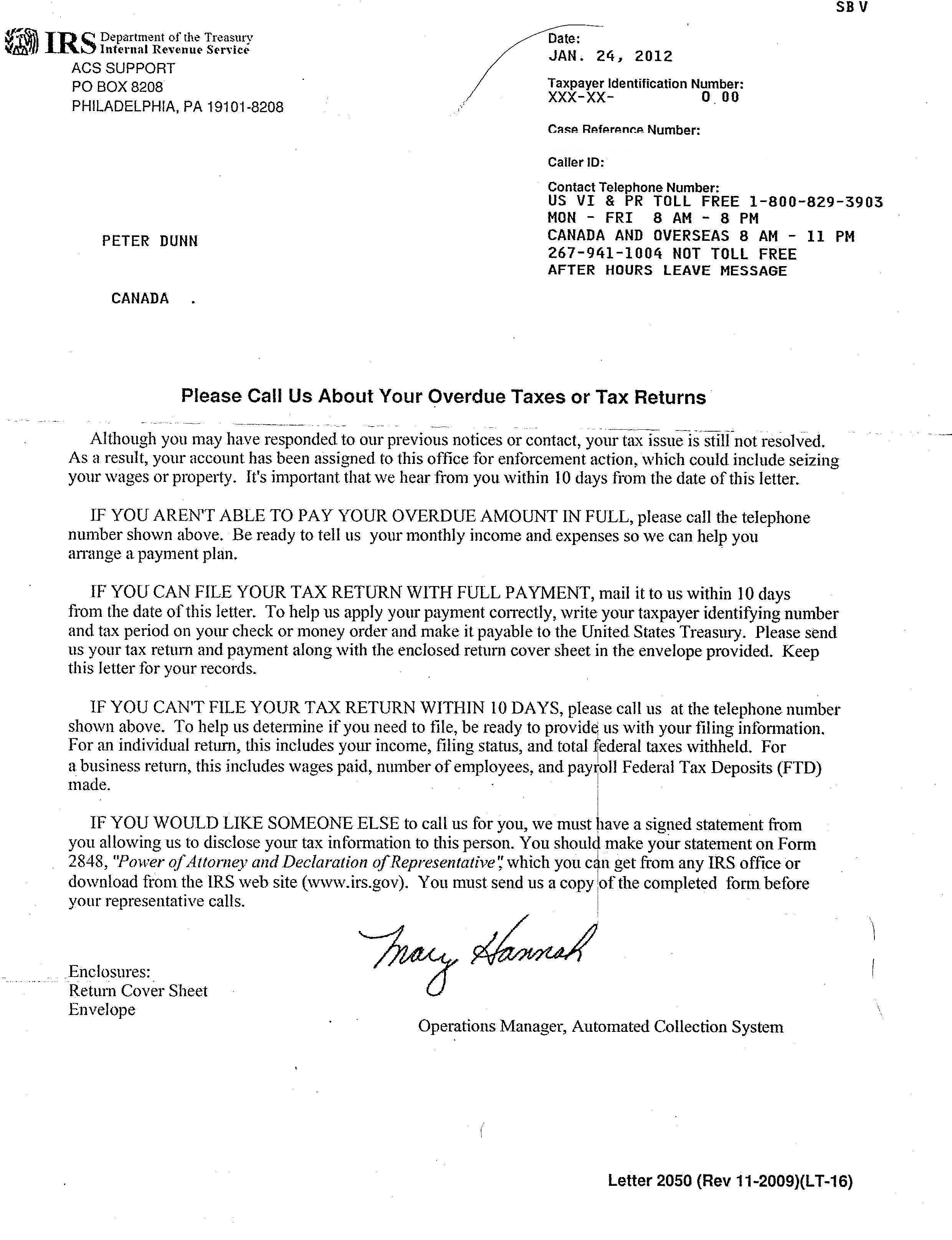

Free Response to IRS Notice Make & Download Rocket Lawyer

IRS Letter 2202 Sample 1

Taxpayer’s Name, Address, And Contact Information.

Web Get Sample Letters To Request Irs Penalty Abatement.

Different Formats And Samples Are Available Based On Specific Circumstances, And Truthfully Stating Personal Reasons Is Crucial.

Once You Draft Your Letter, You Can Sign, Print, And Download It For Mailing.

Related Post: