Letter To The Irs Template

Letter To The Irs Template - Web i am writing to notify the irs that i have been assigned a social security number. Make sure you meet the payment and compliance. Web if you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to the irs in a clear and concise manner. My complete name is [write your full. These 13 tips can help practitioners and taxpayers respond effectively to notices from the irs. Web you can download a printable irs hardship letter template through the link below. Web whether you need to request an adjustment, address penalties and interest, or report identity theft or fraud, it is essential to know how to compose an effective letter to the. Web the irs sends letters or notices to taxpayers for various reasons, such as changes to their account, taxes owed, or payment requests. Web discover how quickly and painlessly you can write important irs letters using the collection of templates included in the ultimate irs communicator. To ensure acceptance by the internal revenue service, the request for an irs audit reconsideration must be carefully prepared. Web the irs will ask you for a letter and proof of your inability to pay and will continue charging fees and interest during this period. Web you can write a letter to the irs to request relief from late filing, late payment, late deposit, and late information return penalties. Web clients that are unable to pay their tax liabilities have a few options to get back in compliance with the irs before a tax lien is filed or a levy is issued. You have received, or will receive upon closing of the examination, certain examination administrative file records. Irs notice response tips everyone should know. Web this type of request is known as a direct release request. Web this letter ruling request template will be helpful as an outline for anyone writing one. Web discover how quickly and painlessly you can write important irs letters using the collection of templates included in the ultimate irs communicator. The irs independent office of appeals seeks. So what should you include in this hardship letter to. How to write an irs hardship letter to the irs? See different formats and samples based on specific. Make sure you meet the payment and compliance. My complete name is [write your full. Learn how to read, review,. Web whether you need to request an adjustment, address penalties and interest, or report identity theft or fraud, it is essential to know how to compose an effective letter to the. Web complete your protest and mail it to the irs address on the letter that explains your appeal rights. The irs independent office of appeals seeks. The irs audit reconsideration is an. If your request is different from the sample format, a different format will not defer. Web this type of request is known as a direct release request. The irs audit reconsideration is an. Make sure you meet the payment and compliance. The irs independent office of appeals seeks. Web i am writing to notify the irs that i have been assigned a social security number. These 13 tips can help practitioners and taxpayers respond effectively to notices from the irs. Web the irs will ask you for a letter and proof of your inability to pay and will continue charging fees and interest during this period. You have received, or will receive upon closing of the examination, certain examination administrative file records. To ensure acceptance. Once you draft your letter, you. The irs audit reconsideration is an. Web i am writing to notify the irs that i have been assigned a social security number. How to write an irs hardship letter to the irs? If your request is different from the sample format, a different format will not defer. The irs independent office of appeals seeks. Web you can write a letter to the irs to request relief from late filing, late payment, late deposit, and late information return penalties. Web if you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to the irs in a clear and concise manner. Irs notice response tips. So what should you include in this hardship letter to. See different formats and samples based on specific. My complete name is [write your full. Learn how to read, review,. Web if you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to the irs in a clear and concise manner. Irs notice response tips everyone should know. Web this letter ruling request template will be helpful as an outline for anyone writing one. Web whether you need to request an adjustment, address penalties and interest, or report identity theft or fraud, it is essential to know how to compose an effective letter to the. Learn how to read, review,. Web. Learn how to read, review,. Please combine my tax records under this new number. Web i am writing to notify the irs that i have been assigned a social security number. The irs audit reconsideration is an. Web the irs will ask you for a letter and proof of your inability to pay and will continue charging fees and interest. The irs independent office of appeals seeks. My complete name is [write your full. The irs audit reconsideration is an. Make sure you meet the payment and compliance. These 13 tips can help practitioners and taxpayers respond effectively to notices from the irs. Web the irs will ask you for a letter and proof of your inability to pay and will continue charging fees and interest during this period. So what should you include in this hardship letter to. Learn how to read, review,. Web whether you need to request an adjustment, address penalties and interest, or report identity theft or fraud, it. If your request is different from the sample format, a different format will not defer. These 13 tips can help practitioners and taxpayers respond effectively to notices from the irs. Don’t send your protest directly to the irs independent. Learn how to read, review,. The irs audit reconsideration is an. Web you can write a letter to the irs to request relief from late filing, late payment, late deposit, and late information return penalties. You have received, or will receive upon closing of the examination, certain examination administrative file records. Once you draft your letter, you. The irs audit reconsideration is an. Learn how to read, review,. Don’t send your protest directly to the irs independent. Web the irs will ask you for a letter and proof of your inability to pay and will continue charging fees and interest during this period. Web i am writing to notify the irs that i have been assigned a social security number. Make sure you meet the payment and compliance. Web discover how quickly and painlessly you can write important irs letters using the collection of templates included in the ultimate irs communicator. Web whether you need to request an adjustment, address penalties and interest, or report identity theft or fraud, it is essential to know how to compose an effective letter to the. If your request is different from the sample format, a different format will not defer. These 13 tips can help practitioners and taxpayers respond effectively to notices from the irs. Web clients that are unable to pay their tax liabilities have a few options to get back in compliance with the irs before a tax lien is filed or a levy is issued. To ensure acceptance by the internal revenue service, the request for an irs audit reconsideration must be carefully prepared. Web this type of request is known as a direct release request.Free Response to IRS Notice Make & Download Rocket Lawyer

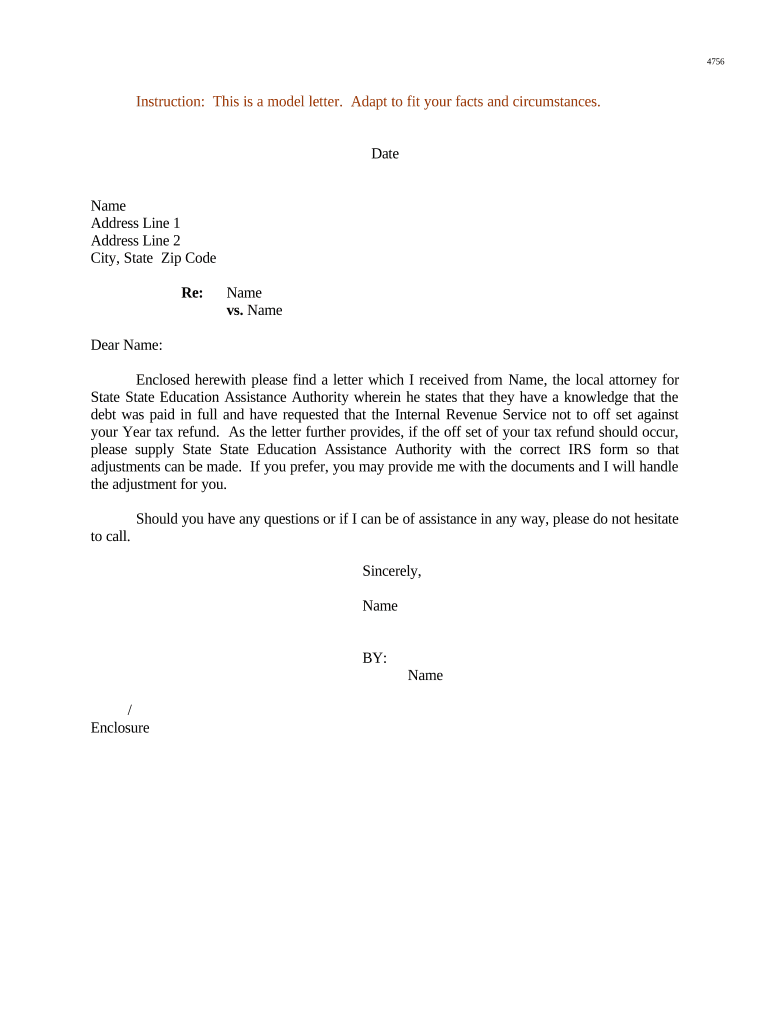

Example Letters to Irs on Cp504 Form Fill Out and Sign Printable PDF

Letter From Irs 2024

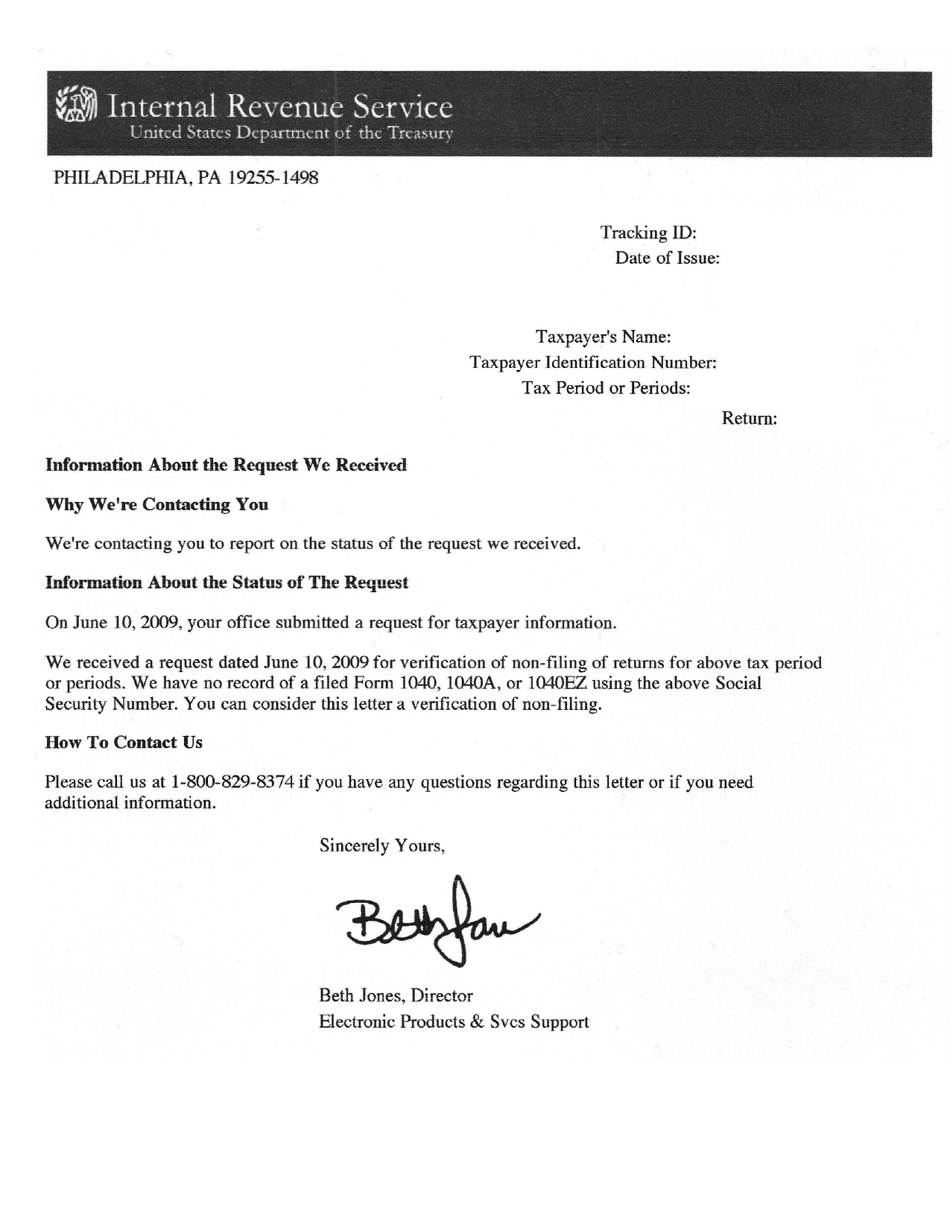

IRS Verification of Nonfiling Letter Fill Out, Sign Online and

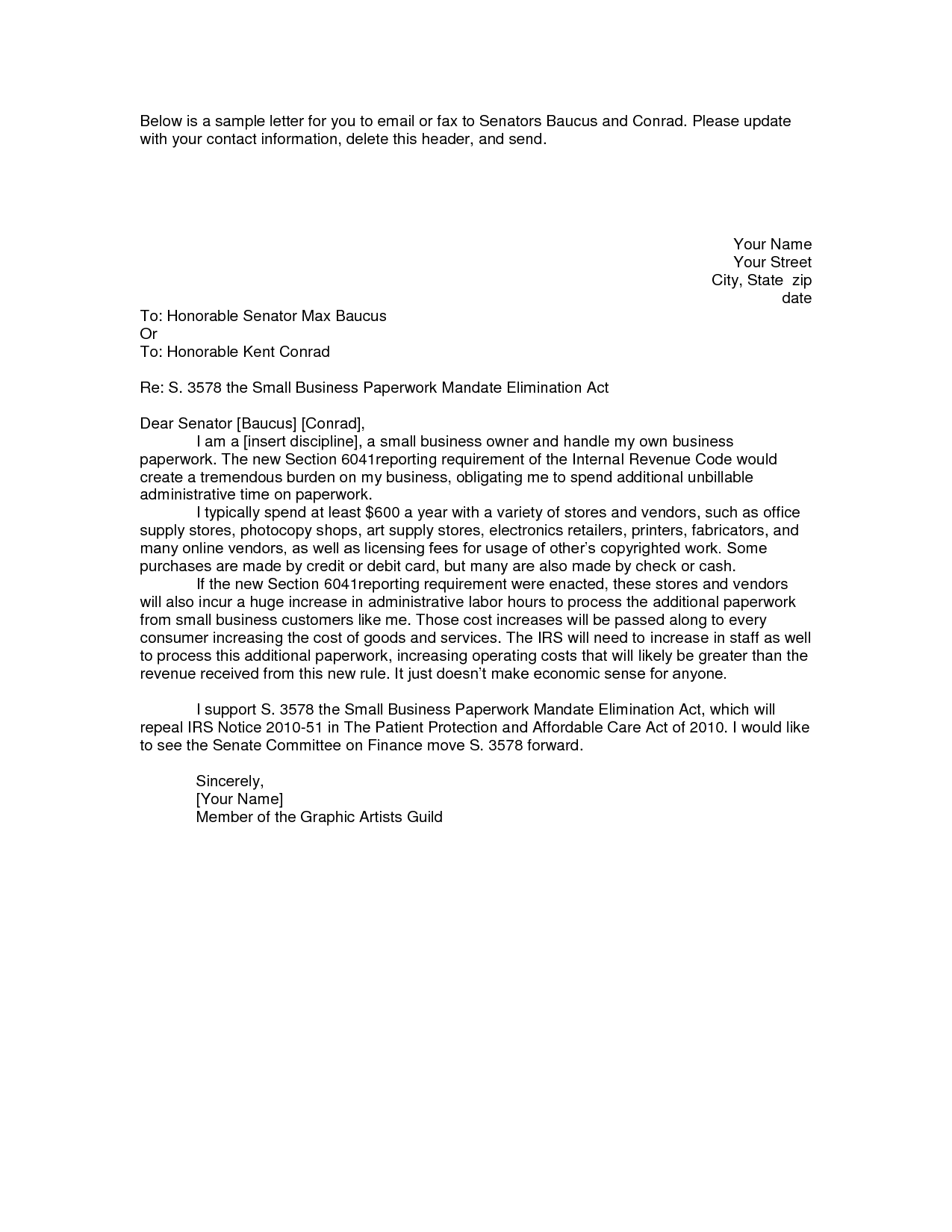

Sample Letter To Irs Free Printable Documents

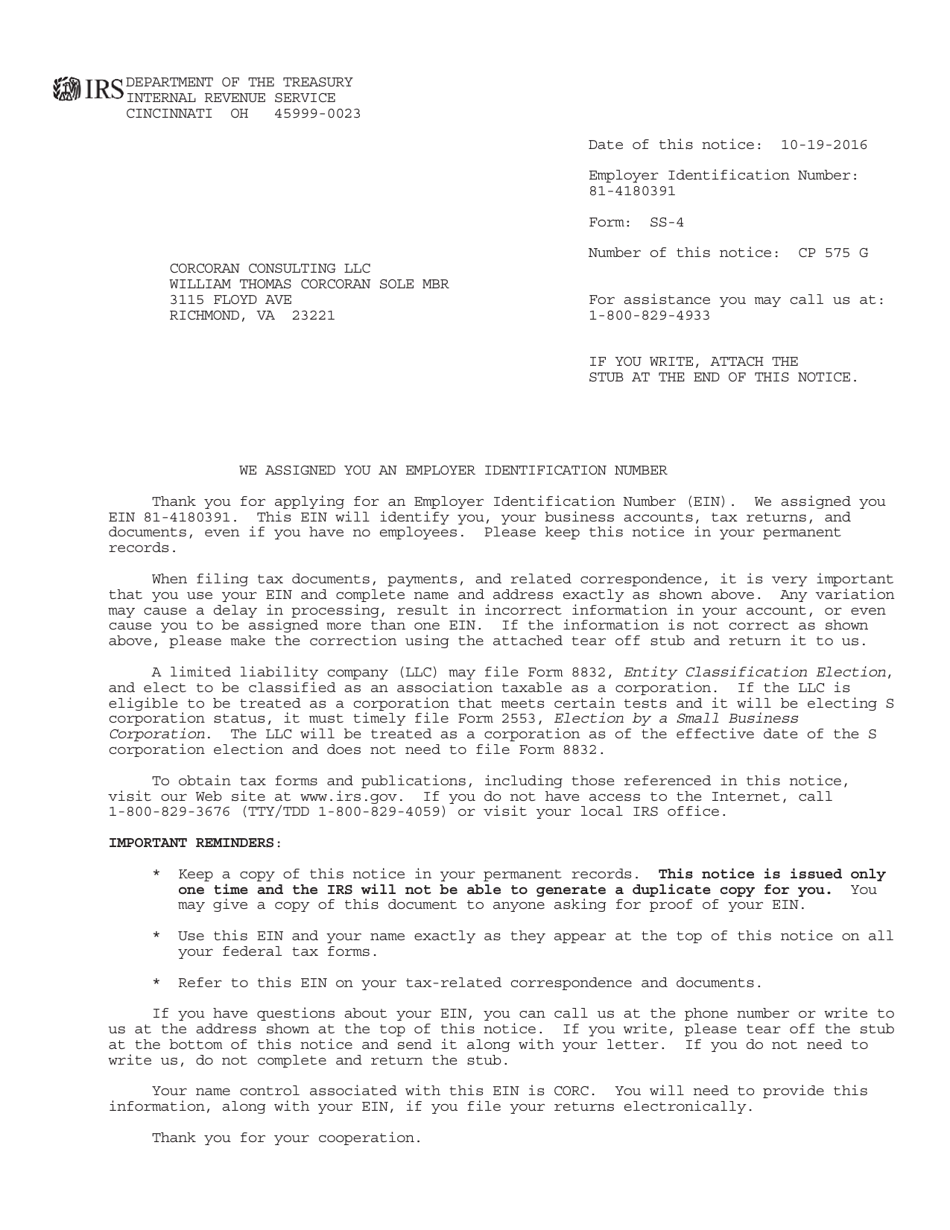

IRS Letter Cp575, Employer Identification Number (Ein) Confirmation

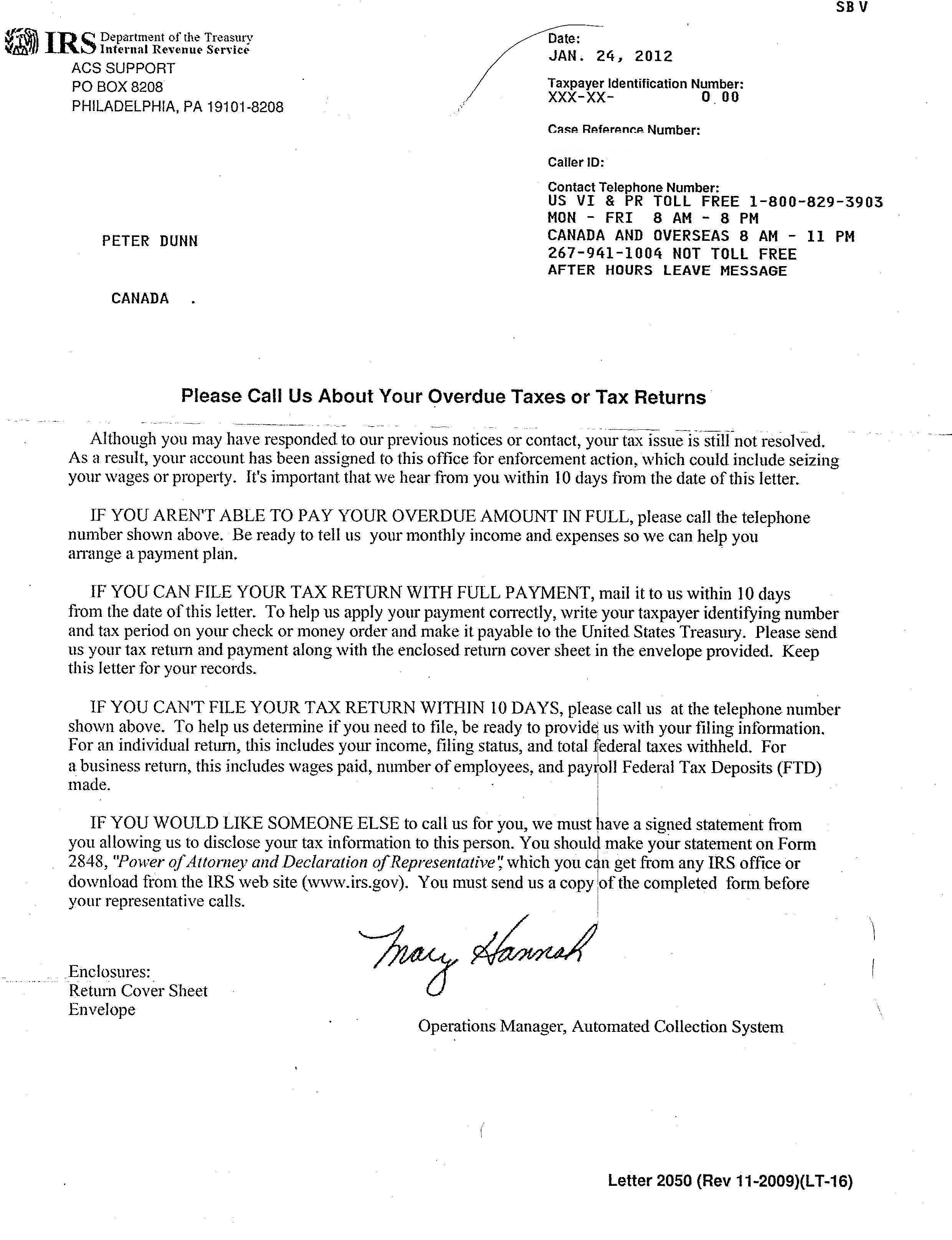

Letter to the IRS IRS Response Letter Form (with Sample)

IRS Audit Letter 4364C Sample 1

Letter To Irs Free Printable Documents

IRS Audit Letter 531T Sample 1

Web This Letter Ruling Request Template Will Be Helpful As An Outline For Anyone Writing One.

The Irs Independent Office Of Appeals Seeks.

How To Write An Irs Hardship Letter To The Irs?

Please Combine My Tax Records Under This New Number.

Related Post: