Loss Run Report Template

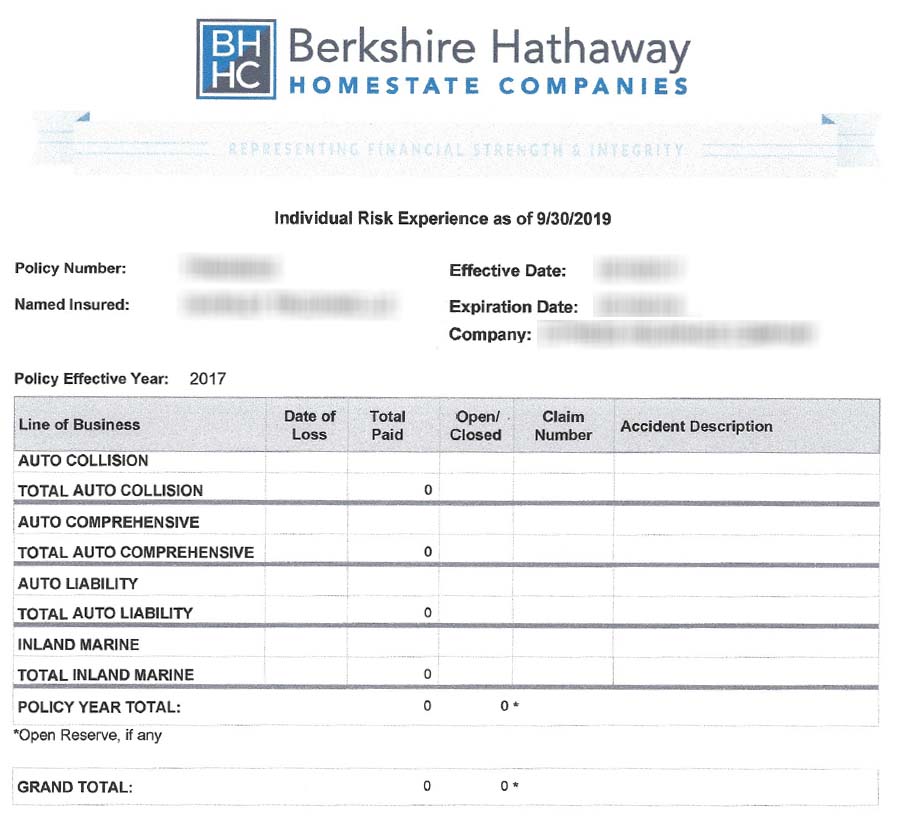

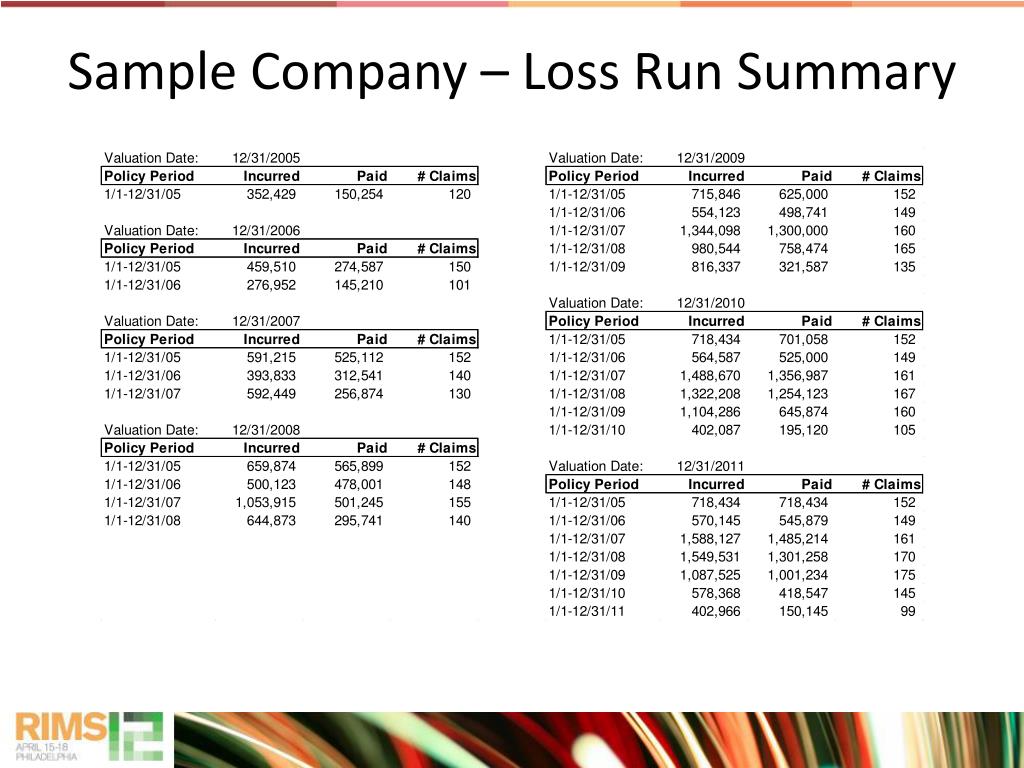

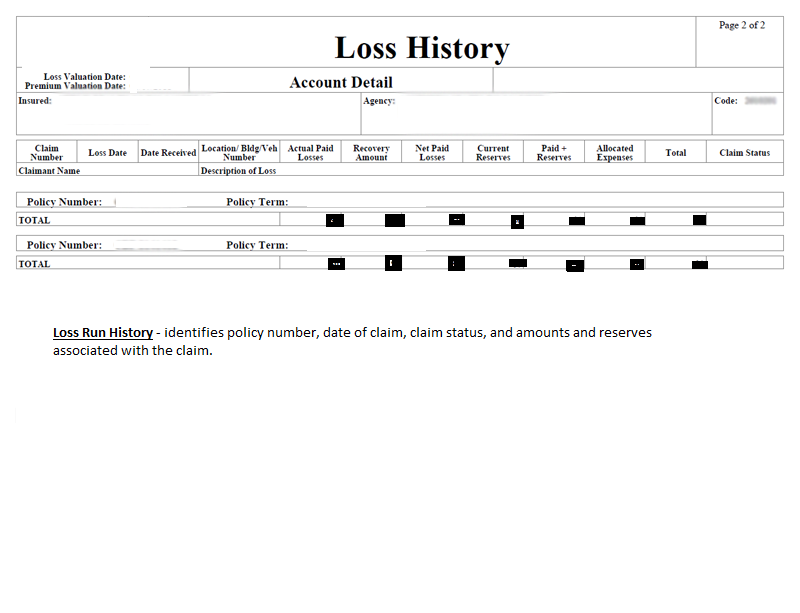

Loss Run Report Template - Name of the agency , attention to : You can also download it, export it or print it out. You can also download it, export it or print it out. Web loss runs are a written report that provides a snapshot of a business’s past insurance claims. Web a loss run report template is used to track the history of an insurance policyholder's claims. Loss run reports come from your insurance company or third party administrator (tpa). Loss run reports are typically completed within 2 business days of submission. Typically, an insurance company will request up to five years of history, or for however long coverage has been provided. By reviewing your loss runs reports, insurance companies will evaluate the severity of the losses as well as the frequency with which they occur. Web zurich riskintelligence allows you to download loss runs, locate adjuster information, view adjuster notes, and more. As a dsp owner, it is important to know all financial exposure for your profit/loss statement. Typically, an insurance company will request up to five years of history, or for however long coverage has been provided. Web loss runs are a written report that provides a snapshot of a business’s past insurance claims. Typically generated by insurance carriers or brokers, they provide a wealth of data which includes: These reports are generated by the insurance carrier and include details such as the type of claim, when it occurred, and. Web analyzing loss run reports is a critical part of the underwriting process. Type text, add images, blackout confidential details, add comments, highlights and more. Web send loss run report example via email, link, or fax. Insurance providers use loss run reports for a variety of purposes, such as assessing your risk level and underwriting or determining your premiums. Web loss run reports provide a summary of a small business’ insurance claims history, including the types of claims filed in the past, the frequency of past claims filed and the related costs. Loss run reports are typically completed within 2 business days of submission. Agent, email address and fax number. My name is samuel schroeder, and i am writing to request a complete loss run report for the policies listed below, held by my company [company’s name]. Web loss run reports provide a summary of a small business’ insurance claims history, including the types of claims filed in the past, the frequency of past claims filed and the related costs. If none have been filed, the report will say, “no losses reported”. Web a loss run report template is used to track the history of an insurance policyholder's claims. Web a loss run report shows the history of claim activity on a commercial insurance policy. Complete this form to request a loss run report. Web your loss run report is a snapshot of claims filed against your dsp business which can affect your bottom line. Web loss runs are reports that provide a history of claims made on a commercial insurance policy. Web send loss run request letter template via email, link, or fax. As a dsp owner, it is important to know all financial exposure for your profit/loss statement. Web a loss run report demonstrates to an insurance company how committed your business is to minimizing risk potential and enables your insurance provider to determine the terms they are willing to. Web zurich riskintelligence allows you to download loss runs, locate adjuster information, view adjuster notes, and more. You can also download it, export it or print it out. Web loss run reports provide a summary of a small business' insurance claims history, including the types of claims filed in the past, the frequency of past claims filed and the related. It provides a comprehensive overview of an individual's claims history, including dates, types of losses, and the amounts paid out. A loss run report is a snapshot of insurance claims previously filed against your insurance policy. These reports are generated by the insurance carrier and include details such as the type of claim, when it occurred, and. Web loss run. Agent, email address and fax number. Web loss run reports provide a summary of a small business' insurance claims history, including the types of claims filed in the past, the frequency of past claims filed and the related costs. Web a loss run is a report that outlines the details of workers compensation claims and the cost paid during a. A loss run can be created to reflect the job related accidents and claims of the most recent month, most recent quarter, most recent year or a combination of years. You can also download it, export it or print it out. Web analyzing loss run reports is a critical part of the underwriting process. Web with regard to the above. Dear [insurance company’s name], i hope this letter finds you well. Web loss run reports provide a summary of a small business’ insurance claims history, including the types of claims filed in the past, the frequency of past claims filed and the related costs. This report can be useful if you’re looking for new small business insurance. As a dsp. Web send loss run report example via email, link, or fax. These reports are generated by the insurance carrier and include details such as the type of claim, when it occurred, and. Web with regard to the above captioned policy, this letter authorizes and requests your company to release the complete detailed loss runs showing all experience ( open and. Insurance providers use loss run reports for a variety of purposes, such as assessing your risk level and underwriting or determining your premiums. Agent, email address and fax number. Web zurich riskintelligence allows you to download loss runs, locate adjuster information, view adjuster notes, and more. Web a loss run report shows the history of claim activity on a commercial. Web a loss run report demonstrates to an insurance company how committed your business is to minimizing risk potential and enables your insurance provider to determine the terms they are willing to offer. This data is used by insurers to help. Loss run reports come from your insurance company or third party administrator (tpa). Type text, add images, blackout confidential. If none have been filed, the report will say, “no losses reported”. Web zurich riskintelligence allows you to download loss runs, locate adjuster information, view adjuster notes, and more. Web the reports give you and potential insurers a clear picture of your experience and the risk associated with insuring your company. Web a loss run report demonstrates to an insurance. You can also download it, export it or print it out. Loss run reports come from your insurance company or third party administrator (tpa). An insurance loss run report from your current insurance carrier provides valuable information for you and your insurer. Web loss run reports. Sign it in a few clicks. Type text, add images, blackout confidential details, add comments, highlights and more. By reviewing your loss runs reports, insurance companies will evaluate the severity of the losses as well as the frequency with which they occur. It provides a comprehensive overview of an individual's claims history, including dates, types of losses, and the amounts paid out. As a dsp owner, it is important to know all financial exposure for your profit/loss statement. Typically, an insurance company will request up to five years of history, or for however long coverage has been provided. Web a loss run report template is used to track the history of an insurance policyholder's claims. Web loss runs are a written report that provides a snapshot of a business’s past insurance claims. Loss runs are comprehensive reports that provide detailed information about historical losses, i.e., claims history, associated with an insured party for a commercial or specialty insurance policy. Typically generated by insurance carriers or brokers, they provide a wealth of data which includes: If none have been filed, the report will say, “no losses reported”. These reports are generated by the insurance carrier and include details such as the type of claim, when it occurred, and.Loss Run Report Template

The Complete Guide To Insurance Loss Runs

Loss Run Report Template

A "LOSS RUNS" IS... Florida Construction Legal Updates

Automating data extraction from loss runs Sensible Blog

Insurance Loss Runs How do I upload my Loss Run Report? / Flatworld

Loss Run Report Template

Loss / Damage Report Format

How To Benefit from LossRun History for Trucking Insurance Rates

Loss Run Report Template

Web Send Loss Run Report Example Via Email, Link, Or Fax.

Web Loss Run Request Letter.

Loss Run Reports Are Typically Completed Within 2 Business Days Of Submission.

This Data Is Used By Insurers To Help.

Related Post:

.png)