Mo 1040 Printable Form

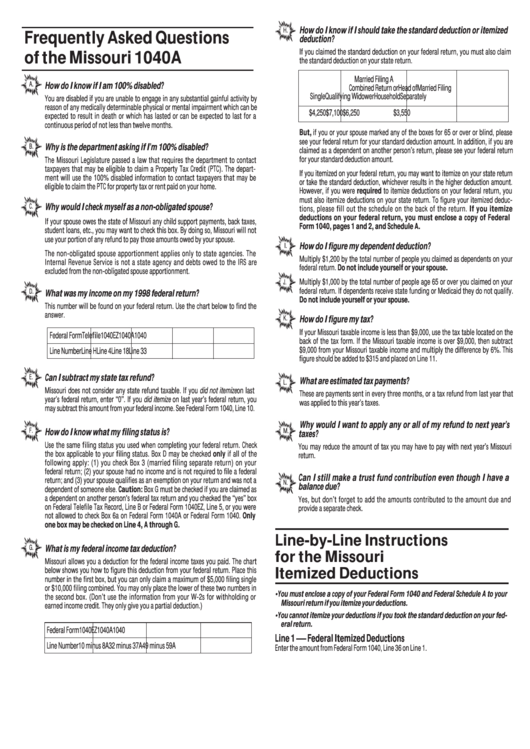

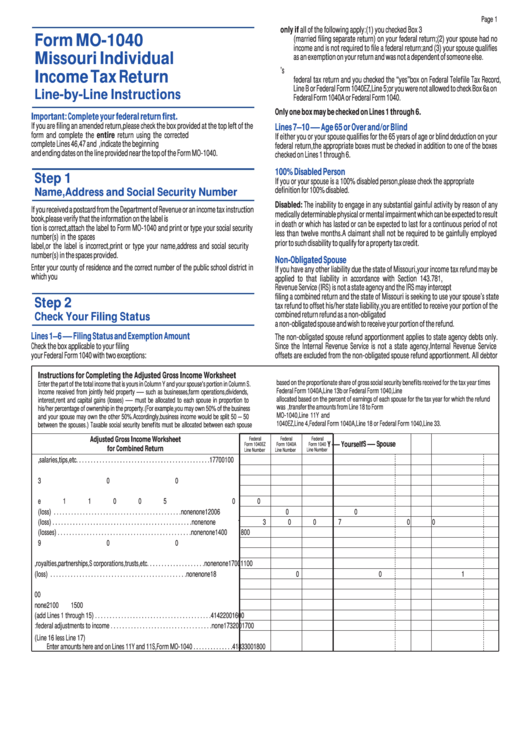

Mo 1040 Printable Form - It is a universal form that can be used by any taxpayer. You must file your taxes yearly by april 15. Web before you get started with your missouri registration. Complete the respective missouri tax form(s) then download, print, sign, and mail them to the missouri department of revenue. Attach a copy federal extension (form 4868). Use fill to complete blank online missouri pdf forms for free. Have previously filed a prior year missouri return (this online method is not allowed for first time missouri filers.) For more information about the missouri income tax, see the missouri income tax page. The short forms are less complicated and provide only the Once completed you can sign your fillable form or send for signing. Select this box if you are a farmer exempt from the underpayment of estimated tax penalty. This online filing method is available for use by taxpayers who: For privacy notice, see instructions. Web the missouri tax forms are listed by tax year below and all mo back taxes for previous years would have to be mailed in. Web download or print the 2023 missouri (individual income tax return) (2023) and other income tax forms from the missouri department of revenue. To utilize the full functionality of a fillable pdf file, you must download the form, and fill in the form fields using your default browser. Web before you get started with your missouri registration. Web amended return composite return. You can use this digital form filler to register for the first time or report a change of name, address, or political party to your state election office. Web print or download 62 missouri income tax forms for free from the missouri department of revenue. Web print or download 62 missouri income tax forms for free from the missouri department of revenue. You must file your taxes yearly by april 15. Attach a copy federal extension (form 4868). Have previously filed a prior year missouri return (this online method is not allowed for first time missouri filers.) You must file your taxes yearly by april 15. How do i select the easiest tax form that satisfies my tax filing needs? Attach a copy federal extension (form 4868). Use fill to complete blank online missouri pdf forms for free. Web download or print the 2023 missouri (individual income tax return) (2023) and other income tax forms from the missouri department of revenue. All forms are printable and downloadable. It's essentially a document you file with the state of missouri to determine how much income tax you owe or if you're eligible for a refund. It is a universal form that can be used by any taxpayer. Have previously filed a prior year missouri return (this online method is not allowed for first time missouri filers.) If you pay. For more information about the missouri income tax, see the missouri income tax page. If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form. Attach a copy federal extension (form 4868). Web file individual income tax return. You must file your taxes yearly. Complete the respective missouri tax form(s) then download, print, sign, and mail them to the missouri department of revenue. It's essentially a document you file with the state of missouri to determine how much income tax you owe or if you'll receive a refund. Web before you get started with your missouri registration. The short forms are less complicated and. Web the missouri tax forms are listed by tax year below and all mo back taxes for previous years would have to be mailed in. Web download or print the 2023 missouri (individual income tax return) (2023) and other income tax forms from the missouri department of revenue. How do i select the easiest tax form that satisfies my tax. Please accept the mytax missouri usage terms to register for a portal account. Have previously filed a prior year missouri return (this online method is not allowed for first time missouri filers.) Select this box if you are a farmer exempt from the underpayment of estimated tax penalty. All forms are printable and downloadable. Web before you get started with. Web print or download 62 missouri income tax forms for free from the missouri department of revenue. If you pay by check, you authorize the department of revenue to process the check. It's essentially a document you file with the state of missouri to determine how much income tax you owe or if you're eligible for a refund. Web amended. Once completed you can sign your fillable form or send for signing. Short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Have previously filed a prior year missouri return (this online method is not allowed for first time missouri filers.) To utilize the full functionality of a fillable pdf file, you. Complete the respective missouri tax form(s) then download, print, sign, and mail them to the missouri department of revenue. Attach a copy federal extension (form 4868). Have previously filed a prior year missouri return (this online method is not allowed for first time missouri filers.) For privacy notice, see instructions. The short forms are less complicated and provide only the You must file your taxes yearly by april 15. This online filing method is available for use by taxpayers who: You can complete the forms with the help of efile.com free tax calculators. Have previously filed a prior year missouri return (this online method is not allowed for first time missouri filers.) It's essentially a document you file with the. For privacy notice, see instructions. To utilize the full functionality of a fillable pdf file, you must download the form, and fill in the form fields using your default browser. Attach a copy federal extension (form 4868). Web print or download 62 missouri income tax forms for free from the missouri department of revenue. You can complete the forms with. Web download or print the 2023 missouri (individual income tax return) (2023) and other income tax forms from the missouri department of revenue. All forms are printable and downloadable. It's essentially a document you file with the state of missouri to determine how much income tax you owe or if you'll receive a refund. For more information about the missouri income tax, see the missouri income tax page. This online filing method is available for use by taxpayers who: It is a universal form that can be used by any taxpayer. Once completed you can sign your fillable form or send for signing. It's essentially a document you file with the state of missouri to determine how much income tax you owe or if you're eligible for a refund. Complete the respective missouri tax form(s) then download, print, sign, and mail them to the missouri department of revenue. Web file individual income tax return. Web personal tax form selector. Short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. To utilize the full functionality of a fillable pdf file, you must download the form, and fill in the form fields using your default browser. You must file your taxes yearly by april 15. Select this box if you are a farmer exempt from the underpayment of estimated tax penalty. Web amended return composite return.Fill Free fillable form mo1040 missouri individual tax return

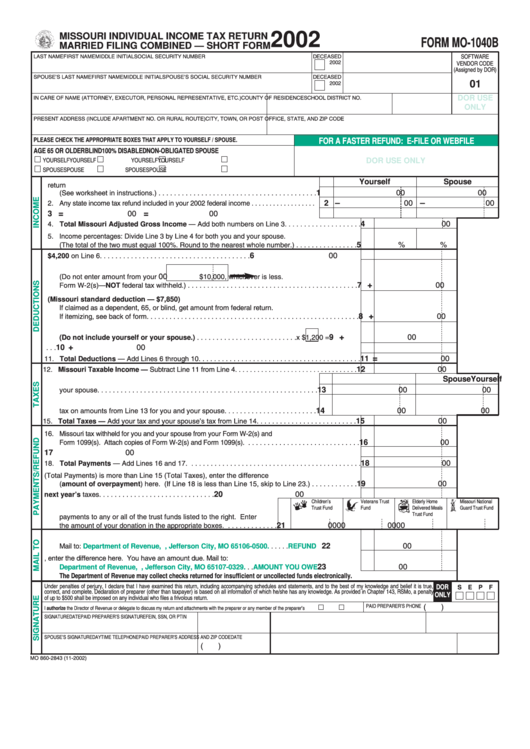

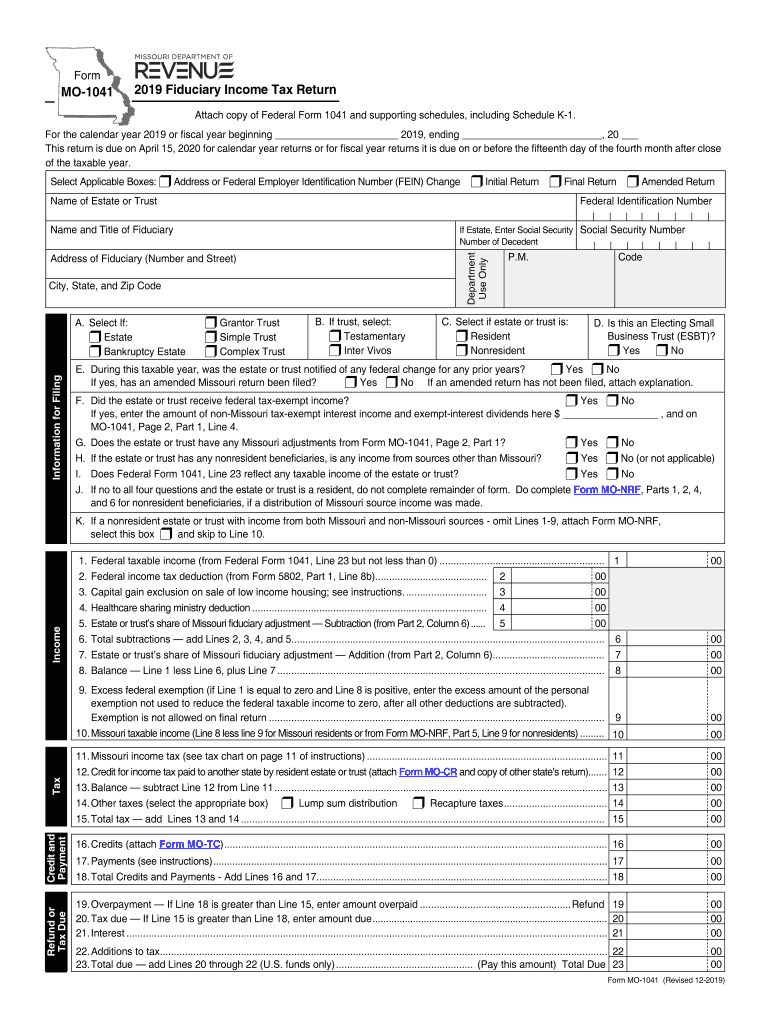

2019 MO Form MO1040A Fill Online, Printable, Fillable, Blank pdfFiller

Mo 1040 Printable Form

Fill Free fillable form mo1040 missouri individual tax return

Mo 1040 Fill out & sign online DocHub

Fillable Online MO1040 2017 individual Tax Long Form Fax Email

Mo 1040A Printable Form

Fill Free fillable form mo1040 missouri individual tax return

Form Mo1040 Missouri Individual Tax Return printable pdf download

Mo 1040 form 2023 Fill out & sign online DocHub

All Missouri Short Forms Allow The Standard Or Itemized Deduction.

Use Fill To Complete Blank Online Missouri Pdf Forms For Free.

You Can Complete The Forms With The Help Of Efile.com Free Tax Calculators.

The Short Forms Are Less Complicated And Provide Only The

Related Post: