Non Profit Organization Donation Receipt Template

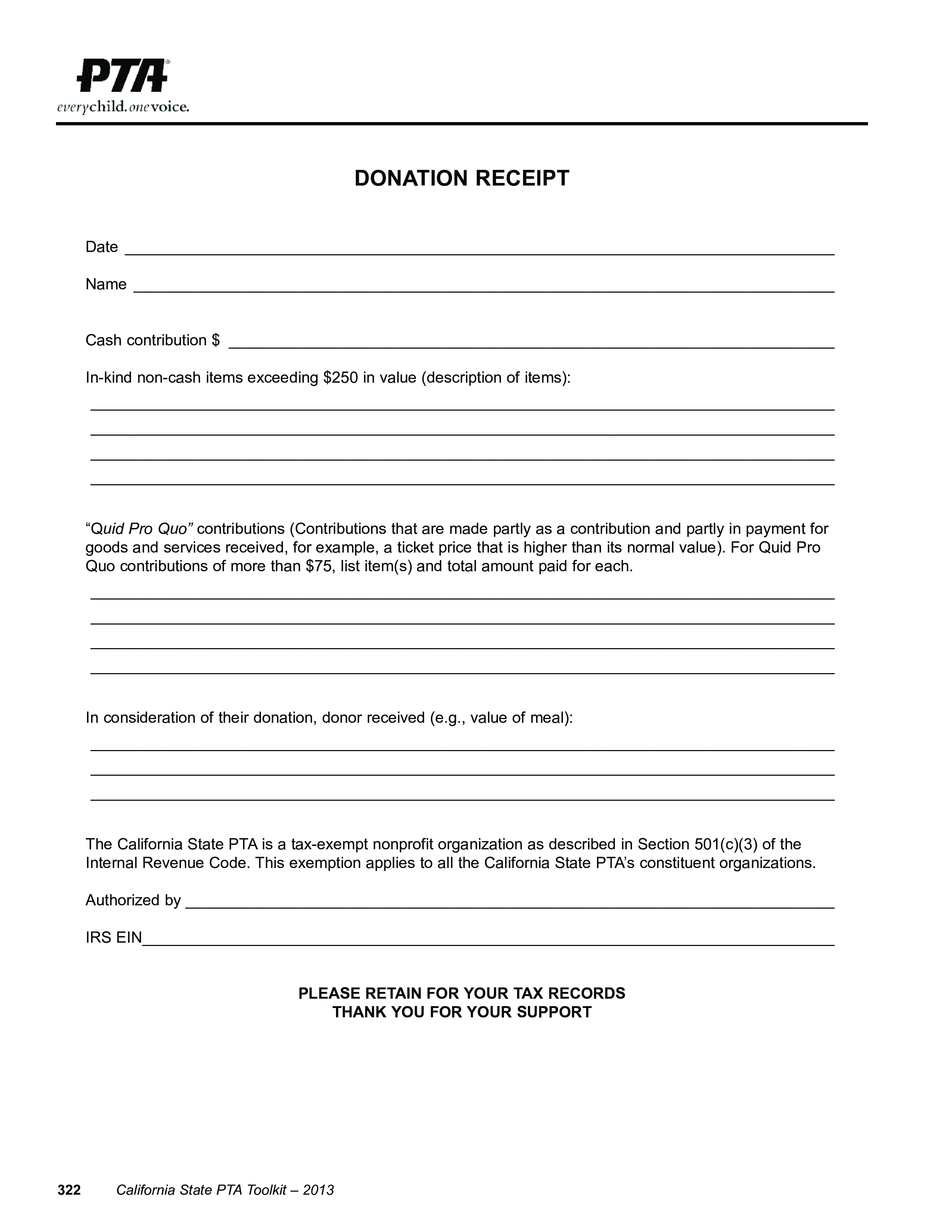

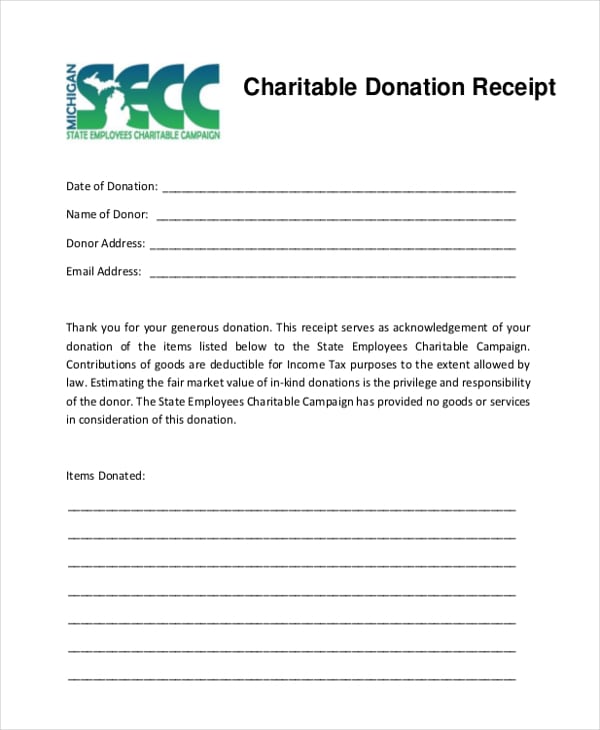

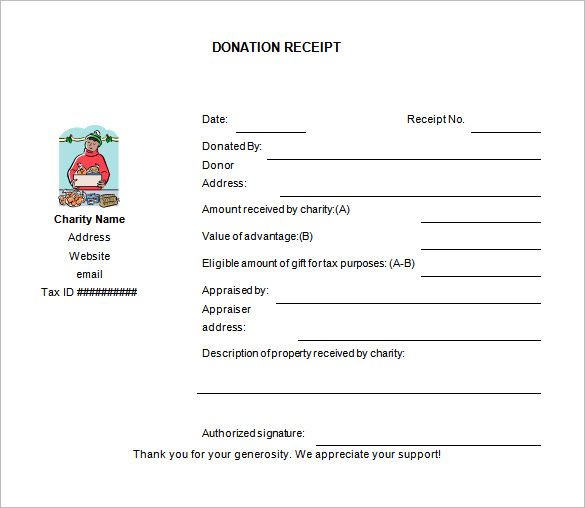

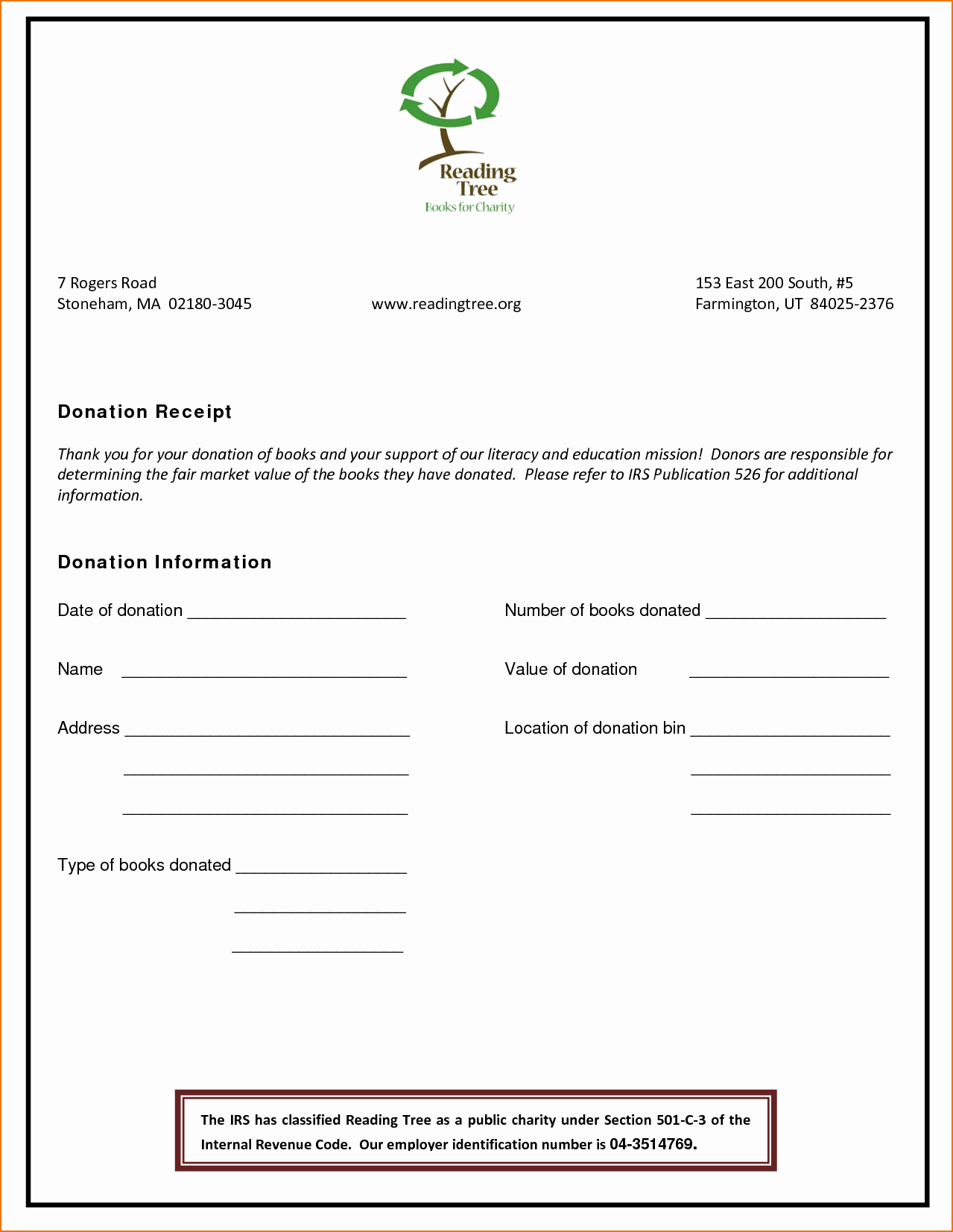

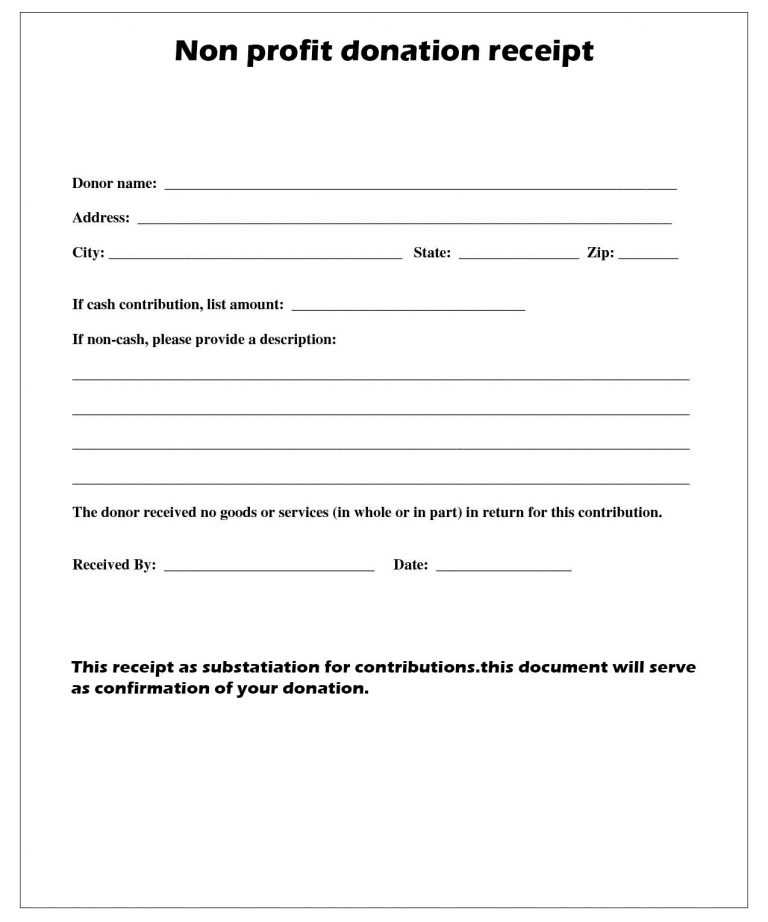

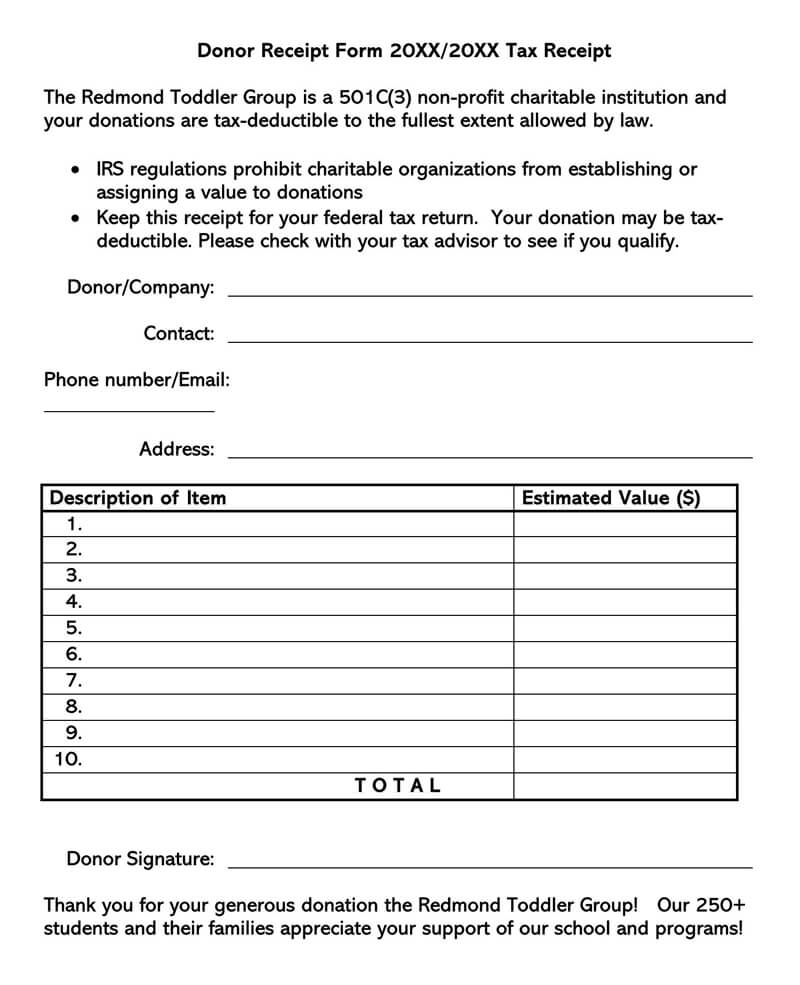

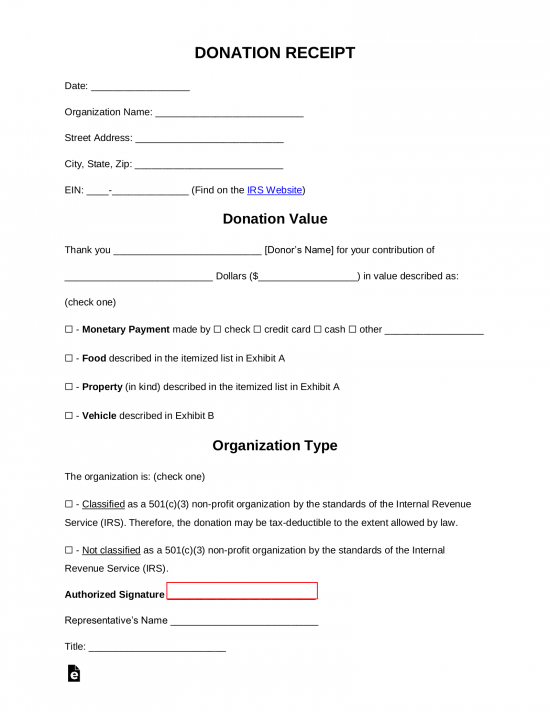

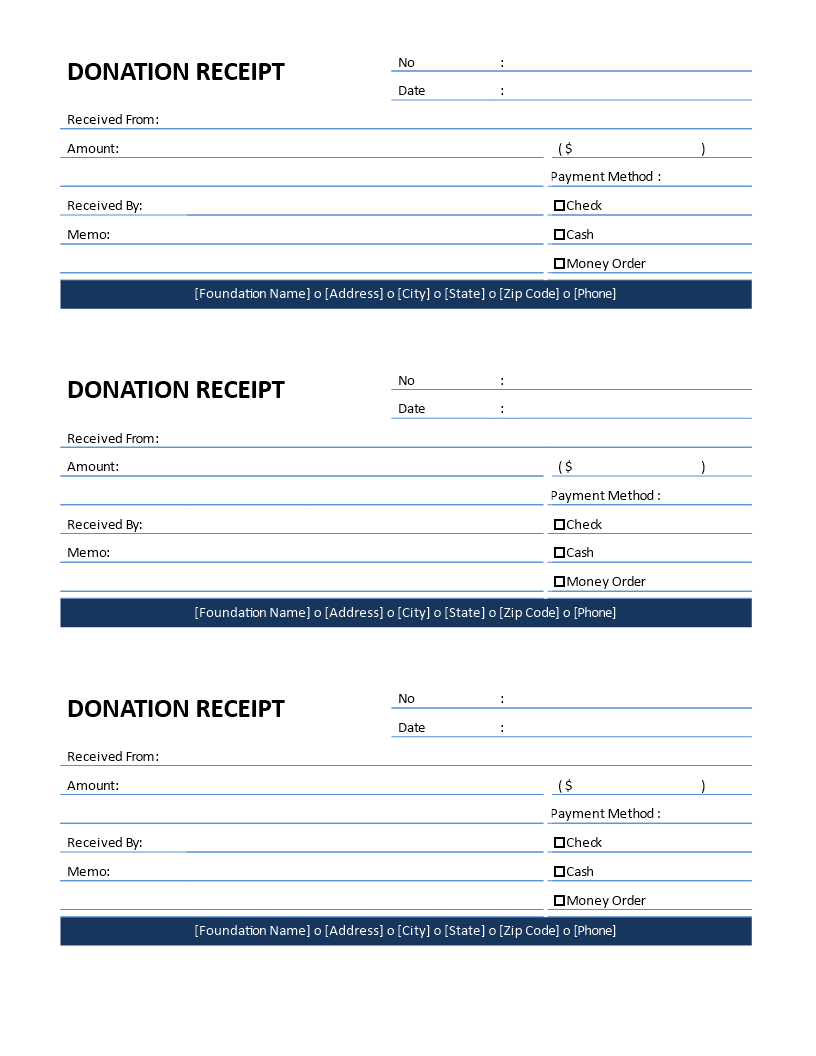

Non Profit Organization Donation Receipt Template - Web our readers can download donation receipt templates from our site at no charge. Each template also includes a fundraising tip that will make your receipts even more effective! Web writing a donation receipt from scratch is a big task, but these templates will get you started. A donation can be in the form of cash or property. Web choosing the right donation receipt template for your nonprofit not only ensures compliance with legal requirements but also helps build lasting relationships with your donors. For a donation receipt to. Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. Explore these options to find the template that best suits your organization’s needs, and keep accurate records for tax purposes. The organization details section includes fields for the organization’s name, contact number, address, charity identification. Our form builder and pdf editor lets you redesign the template and. Web free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. This donation receipt will act as official proof of the contribution, and help donors claim a tax deduction. Web below we have listed some of the best nonprofit donation receipt templates we could find. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. With the template, the user won’t have to worry about forgetting the necessary details to include in the receipt. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. We’ve included templates for standard donation receipts, event registrations, and other common nonprofit transactions. Web writing a donation receipt from scratch is a big task, but these templates will get you started. Nonprofit receipts are given to the donor when he donates to a nonprofit organization. Web a nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. Explore these options to find the template that best suits your organization’s needs, and keep accurate records for tax purposes. Instead of creating from scratch, you can get and use these donation receipt templates for free. Web use these donation receipt email & letter templates to help you stay compliant, save time, and maintain good relationships with your donors. The donation receipt may be issued by your charity, organization, or group to document the receipt of a donation. Web below we have listed some of the best nonprofit donation receipt templates we could find. Web choosing the right donation receipt template for your nonprofit not only ensures compliance with legal requirements but also helps build lasting relationships with your donors. A charitable donation receipt serves as proof of the contribution made by a donor to a nonprofit organization. Web a nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. Using a template, the user has to do is. This donation receipt will act as official proof of the contribution, and help donors claim a tax deduction. For a donation receipt to. Web organizations that accept donations must have receipts. Web for every online donation submission, this free template instantly generates a pdf receipt that can be downloaded, printed for your records, or automatically emailed to donors for their tax returns.thank your donors with a beautifully customized donation receipt. With the template, the user won’t have to. Web below we have listed some of the best nonprofit donation receipt templates we could find. Web organizations that accept donations must have receipts. Web use givebutter’s free donation receipt templates for smooth donor appreciation. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Web our readers can download donation receipt templates. Web our readers can download donation receipt templates from our site at no charge. Web writing a donation receipt from scratch is a big task, but these templates will get you started. Web free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to. We’ve included templates for standard donation receipts, event registrations, and other common nonprofit transactions. This donation receipt will act as official proof of the contribution, and help donors claim a tax deduction. A charitable donation receipt serves as proof of the contribution made by a donor to a nonprofit organization. Web writing a donation receipt from scratch is a big. Use an online donation receipt template for anyone who’s made a donate on your website. The organization details section includes fields for the organization’s name, contact number, address, charity identification. Web choosing the right donation receipt template for your nonprofit not only ensures compliance with legal requirements but also helps build lasting relationships with your donors. Web use these nonprofit. Instead of creating from scratch, you can get and use these donation receipt templates for free. Web organizations that accept donations must have receipts. Our form builder and pdf editor lets you redesign the template and. A donation can be in the form of cash or property. Web use these nonprofit donation receipt letter templates for the different types of. Web organizations that accept donations must have receipts. Web a nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. A charitable donation receipt serves as proof of the contribution made by a donor to a nonprofit organization. Web below we have listed. These donation receipts are written records that acknowledge a gift to an organization with a proper legal status. Web use givebutter’s free donation receipt templates for smooth donor appreciation. A charitable donation receipt serves as proof of the contribution made by a donor to a nonprofit organization. Each template also includes a fundraising tip that will make your receipts even. Web for every online donation submission, this free template instantly generates a pdf receipt that can be downloaded, printed for your records, or automatically emailed to donors for their tax returns.thank your donors with a beautifully customized donation receipt. These are given when a donor donates to a nonprofit organization. A charitable donation receipt serves as proof of the contribution. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. These donation receipts are written records that acknowledge a gift to an organization with a proper legal. Web writing a donation receipt from scratch is a big task, but these templates will get you started. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Explore these options to find the template that best suits your organization’s needs, and keep accurate records for tax purposes. These are given when a donor donates to a nonprofit organization. The donation receipt may be issued by your charity, organization, or group to document the receipt of a donation. A charitable donation receipt serves as proof of the contribution made by a donor to a nonprofit organization. Web below we have listed some of the best nonprofit donation receipt templates we could find. Web for every online donation submission, this free template instantly generates a pdf receipt that can be downloaded, printed for your records, or automatically emailed to donors for their tax returns.thank your donors with a beautifully customized donation receipt. Our form builder and pdf editor lets you redesign the template and. With the template, the user won’t have to worry about forgetting the necessary details to include in the receipt. Each template also includes a fundraising tip that will make your receipts even more effective! For a donation receipt to. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. A donation can be in the form of cash or property.Sample Non Profit Donation Templates at

5 Charitable Donation Receipt Templates Free Sample Templates

Free Donation Receipt Template 501(c)(3) PDF Word eForms

501c3 Donation Receipt ,501c3 Donation Receipt Template , 501c3

10+ Donation Receipt Templates DOC, PDF

50 Non Profit Donation Receipt Form

Non Profit Organization Donation Receipt Template

Free Nonprofit (Donation) Receipt Templates (Forms)

Free Donation Receipt Templates Samples PDF Word eForms

Nonprofit Donation Receipt for Cash Donation Templates at

Web Organizations That Accept Donations Must Have Receipts.

Web Use Givebutter’s Free Donation Receipt Templates For Smooth Donor Appreciation.

Web Our Readers Can Download Donation Receipt Templates From Our Site At No Charge.

Web Choosing The Right Donation Receipt Template For Your Nonprofit Not Only Ensures Compliance With Legal Requirements But Also Helps Build Lasting Relationships With Your Donors.

Related Post: