Premoney Safe Template

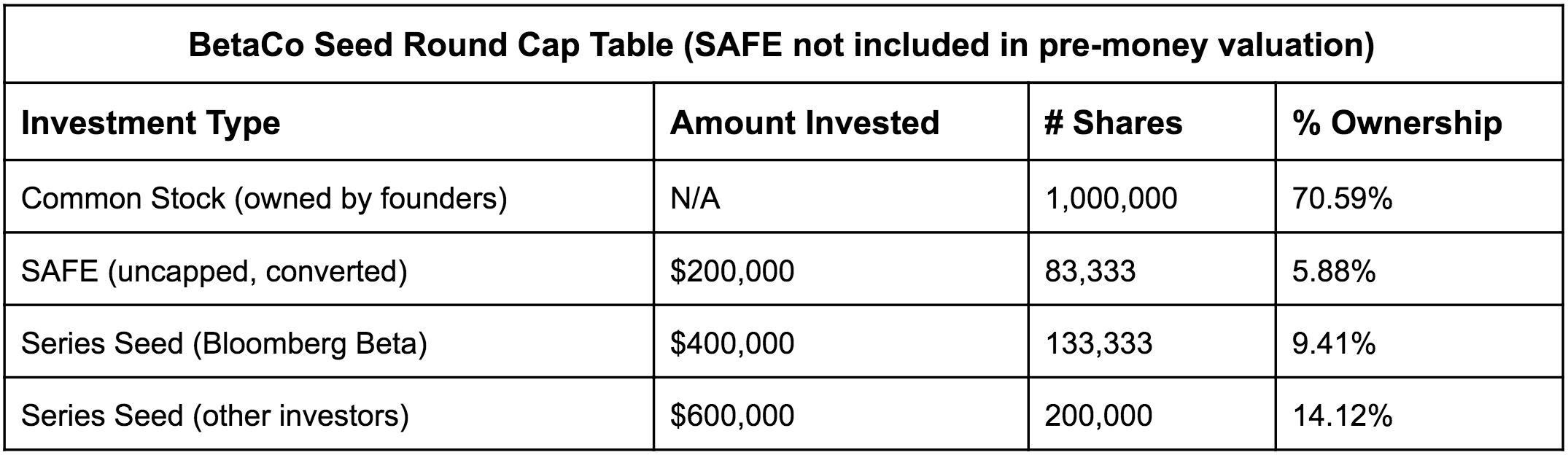

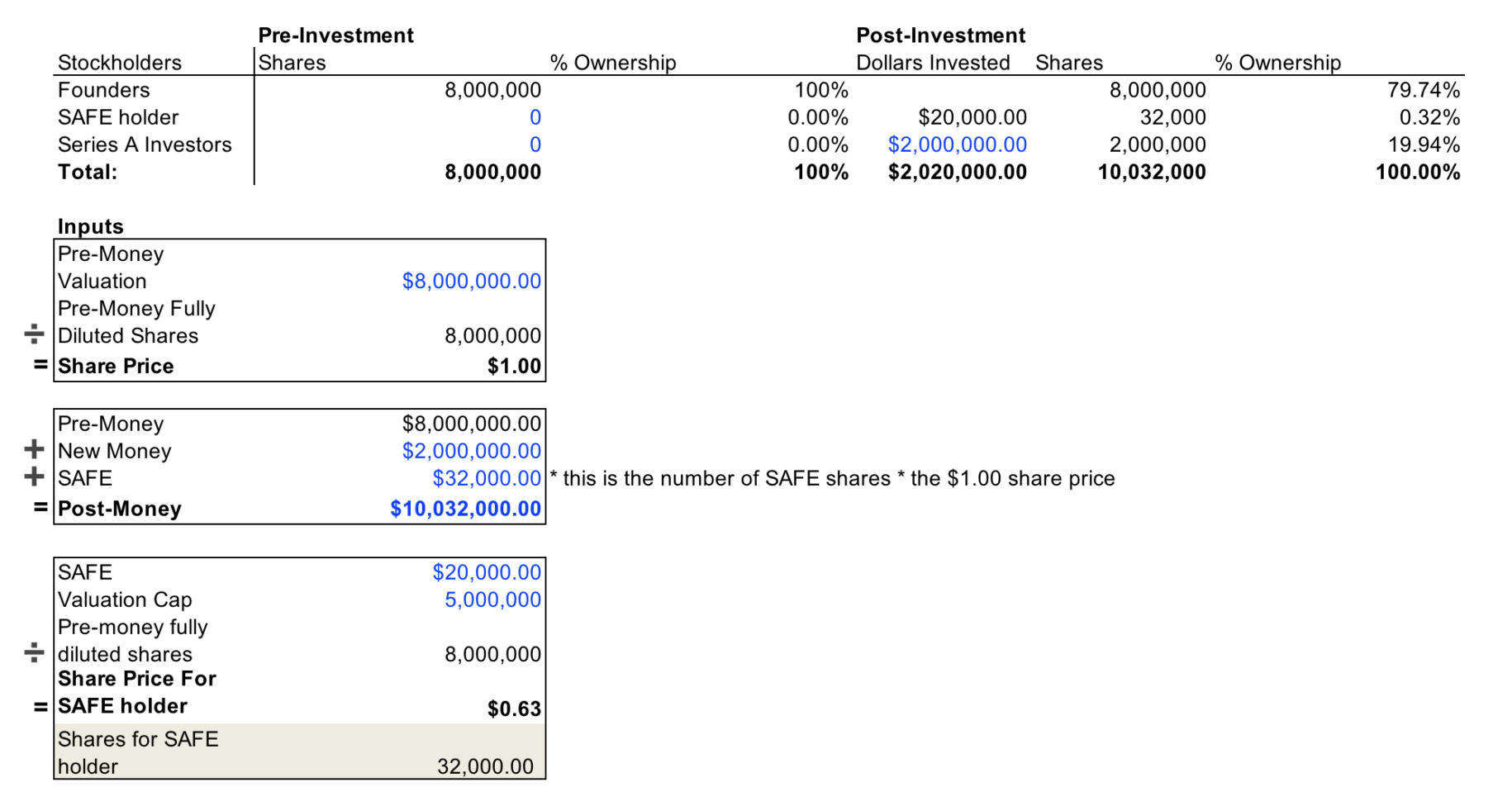

Premoney Safe Template - This type of investment can be helpful because it lets startups get the money they need without needing to figure out the company’s value first. Web with the safe insights tool, use current market data to know what terms to ask for, and understand how it impacts your ownership before you fundraise. Calculate ownership percentages based on the company's value after new investments have been made. It’s the only one on the internet. Knowing which type of safe makes sense for your startup can save you a lot in stress. They come in a few different flavors, all of which we present. And similarly with the 2018 yc safe templates: This quick start guide will show how to take advantage of this new structure for the most common use cases. A safe is an agreement between an investor and a startup company. Safes allow startups to structure their seed investments without interest rates or maturity dates. This type of investment can be helpful because it lets startups get the money they need without needing to figure out the company’s value first. You aren't sure how startup investment. It’s the only one on the internet. Web this article describes the pre money safe document and how you can access it on savvi. You can view their template here. The answer is, it depends, for the following two reasons. The safe was a simple and fast way to get that first money into the company, and the concept was that holders of safes. It’s the only one on the internet. Web startup accelerator y combinator (commonly referred to simply as “yc”) released a set of financing documents (referred to as “safe”, or “simple agreement for future equity”). Calculate ownership percentages based on the company's value before new investments. It’s the only one on the internet. You aren't sure how startup investment. Web in this guide, we’ll walk you through the basics of safes and introduce you to the two key types: Safes allow startups to structure their seed investments without interest rates or maturity dates. The answer is, it depends, for the following two reasons. This type of investment can be helpful because it lets startups get the money they need without needing to figure out the company’s value first. The safe was a simple and fast way to get that first money into the company, and the concept was that holders of safes. Web with the safe insights tool, use current market data to know what terms to ask for, and understand how it impacts your ownership before you fundraise. Knowing which type of safe makes sense for your startup can save you a lot in stress. Web we have created a generator on cooley go for preparing your own customized set for free, plus an additional generator that produce modified forms of safe for use by singapore companies. Calculate ownership percentages based on the company's value before new investments. And similarly with the 2018 yc safe templates: It’s the only one on the internet. They come in a few different flavors, all of which we present. Knowing which type of safe makes sense for your startup can save you a lot in stress. The answer is, it depends, for the following two reasons. Web startup accelerator y combinator (commonly referred to simply as “yc”) released a set of financing documents (referred to as “safe”, or “simple agreement for future equity”). It’s the only one on the internet. Web this article describes the pre money safe document and how you can access it on. This quick start guide will show how to take advantage of this new structure for the most common use cases. Web in this guide, we’ll walk you through the basics of safes and introduce you to the two key types: Web yc partner kirsty nathoo gives the lowdown on several different ways to capitalize your company and how those impact. This type of investment can be helpful because it lets startups get the money they need without needing to figure out the company’s value first. Web startup accelerator y combinator (commonly referred to simply as “yc”) released a set of financing documents (referred to as “safe”, or “simple agreement for future equity”). It’s the only one on the internet. They. You aren't sure how startup investment. It’s the only one on the internet. This type of investment can be helpful because it lets startups get the money they need without needing to figure out the company’s value first. They come in a few different flavors, all of which we present. Web in this guide, we’ll walk you through the basics. Web startup accelerator y combinator (commonly referred to simply as “yc”) released a set of financing documents (referred to as “safe”, or “simple agreement for future equity”). Web in this guide, we’ll walk you through the basics of safes and introduce you to the two key types: Web we have created a generator on cooley go for preparing your own. Safes allow startups to structure their seed investments without interest rates or maturity dates. It’s the only one on the internet. They come in a few different flavors, all of which we present. This quick start guide will show how to take advantage of this new structure for the most common use cases. You can view their template here. This type of investment can be helpful because it lets startups get the money they need without needing to figure out the company’s value first. You can view their template here. Knowing which type of safe makes sense for your startup can save you a lot in stress. A safe is an agreement between an investor and a startup company.. It’s the only one on the internet. A safe is an agreement between an investor and a startup company. This type of investment can be helpful because it lets startups get the money they need without needing to figure out the company’s value first. And similarly with the 2018 yc safe templates: Web yc partner kirsty nathoo gives the lowdown. This quick start guide will show how to take advantage of this new structure for the most common use cases. Calculate ownership percentages based on the company's value after new investments have been made. You can view their template here. It’s the only one on the internet. It’s the only one on the internet. The answer is, it depends, for the following two reasons. The safe was a simple and fast way to get that first money into the company, and the concept was that holders of safes. Web startup accelerator y combinator (commonly referred to simply as “yc”) released a set of financing documents (referred to as “safe”, or “simple agreement for future equity”). Safes allow startups to structure their seed investments without interest rates or maturity dates. A safe is an agreement between an investor and a startup company. This type of investment can be helpful because it lets startups get the money they need without needing to figure out the company’s value first. And similarly with the 2018 yc safe templates: Web with the safe insights tool, use current market data to know what terms to ask for, and understand how it impacts your ownership before you fundraise. They come in a few different flavors, all of which we present. Web we have created a generator on cooley go for preparing your own customized set for free, plus an additional generator that produce modified forms of safe for use by singapore companies. This quick start guide will show how to take advantage of this new structure for the most common use cases. Web this article describes the pre money safe document and how you can access it on savvi. It’s the only one on the internet. Calculate ownership percentages based on the company's value after new investments have been made. Knowing which type of safe makes sense for your startup can save you a lot in stress. It’s the only one on the internet.Pre Money Safe Template Printable Word Searches

Pre Money Safe Template

Pre Money Safe Template

Pre Money Safe Template

Pre Money Safe Template

Pre Money Safe Template

Pre Money Safe Template

Pre Money Safe Template Printable Word Searches

Pre Money Safe Template

Pre Money Safe Template

Web In This Guide, We’ll Walk You Through The Basics Of Safes And Introduce You To The Two Key Types:

You Aren't Sure How Startup Investment.

Calculate Ownership Percentages Based On The Company's Value Before New Investments.

Web Yc Partner Kirsty Nathoo Gives The Lowdown On Several Different Ways To Capitalize Your Company And How Those Impact Founder Equity And Cap Tables Overall.

Related Post: