Printable 1096 Form

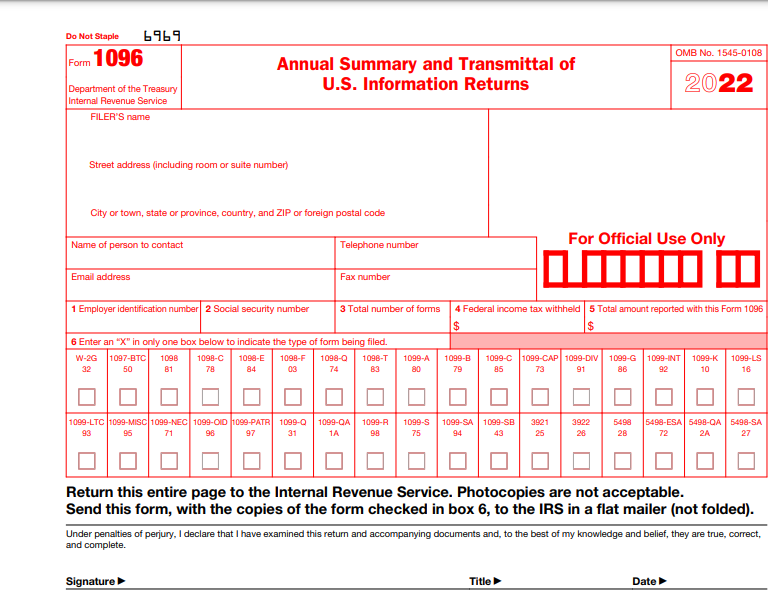

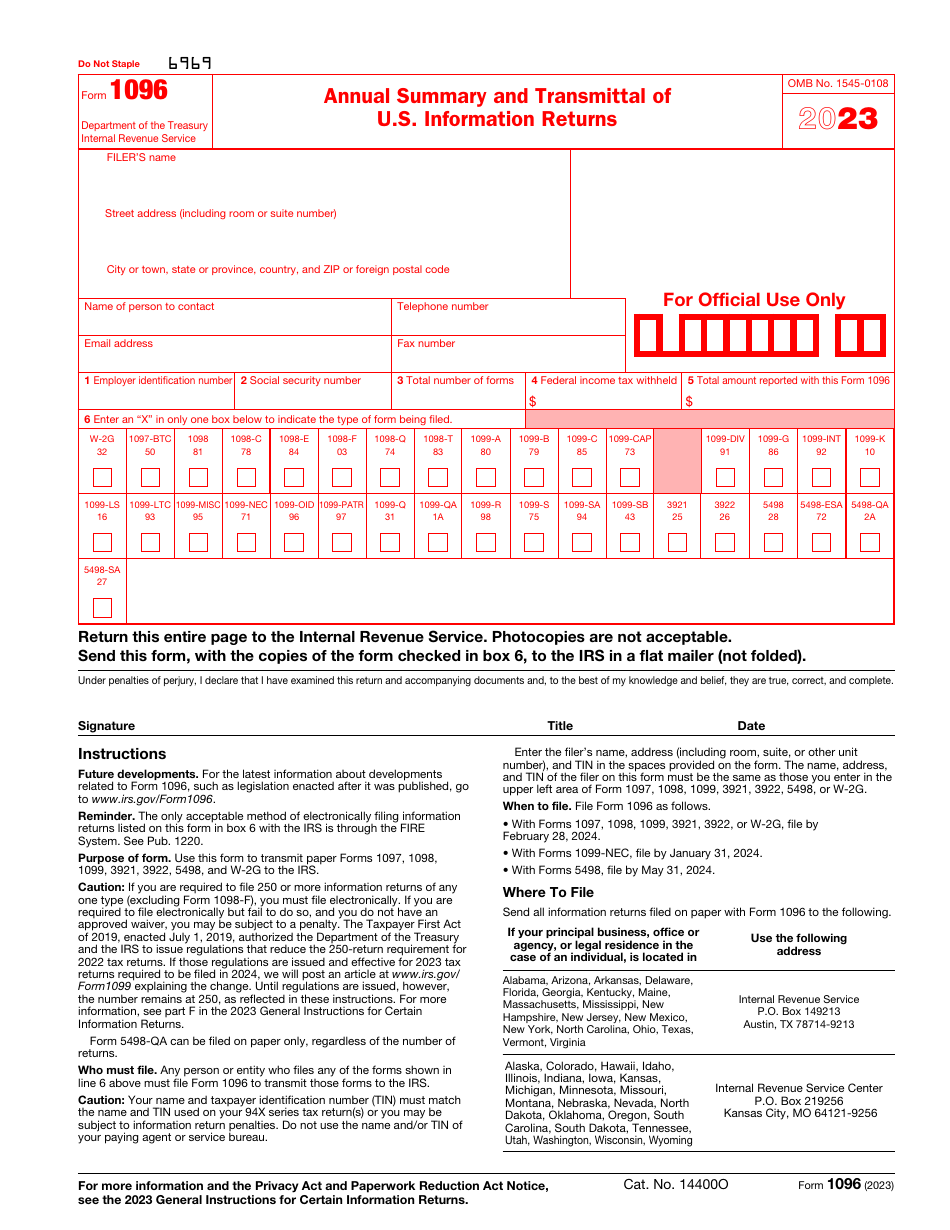

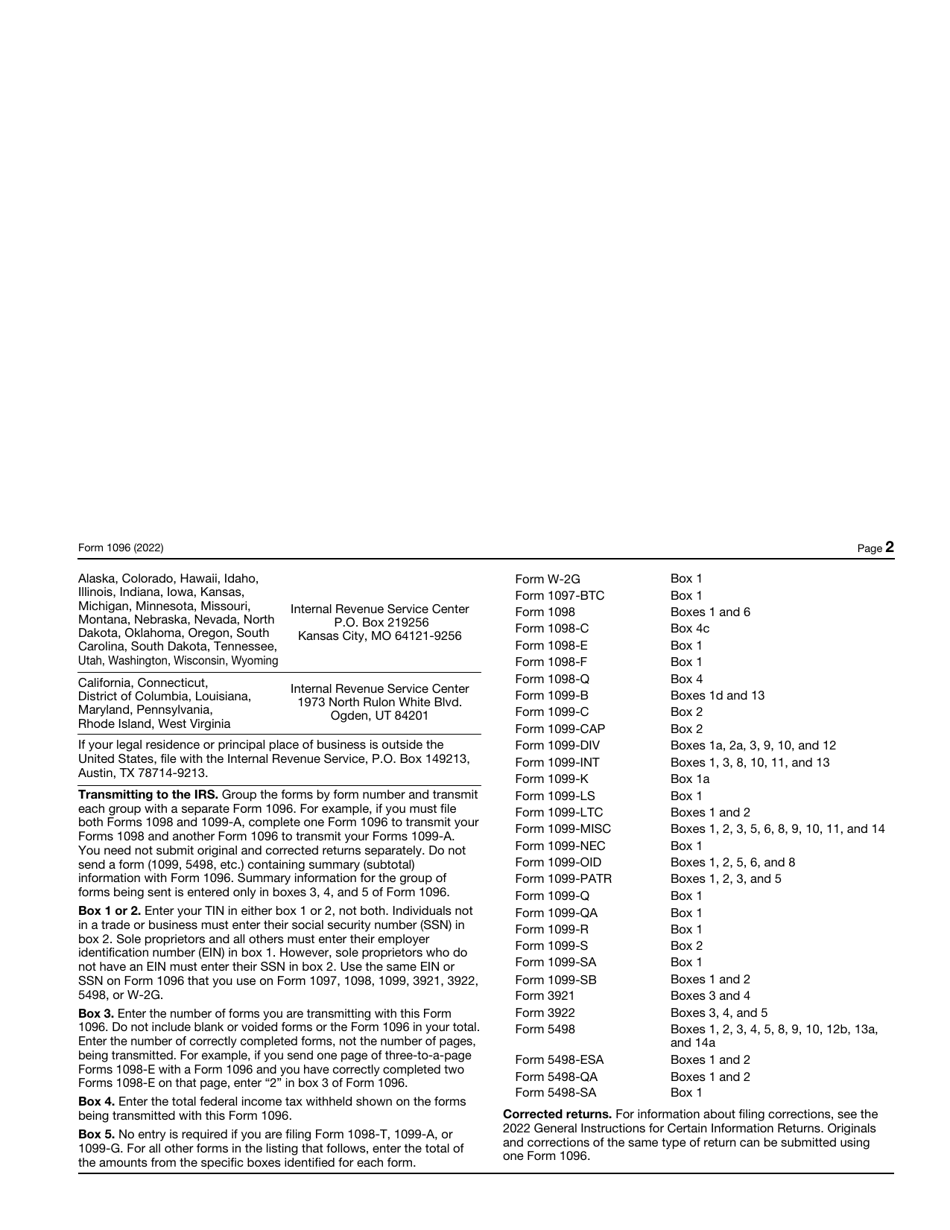

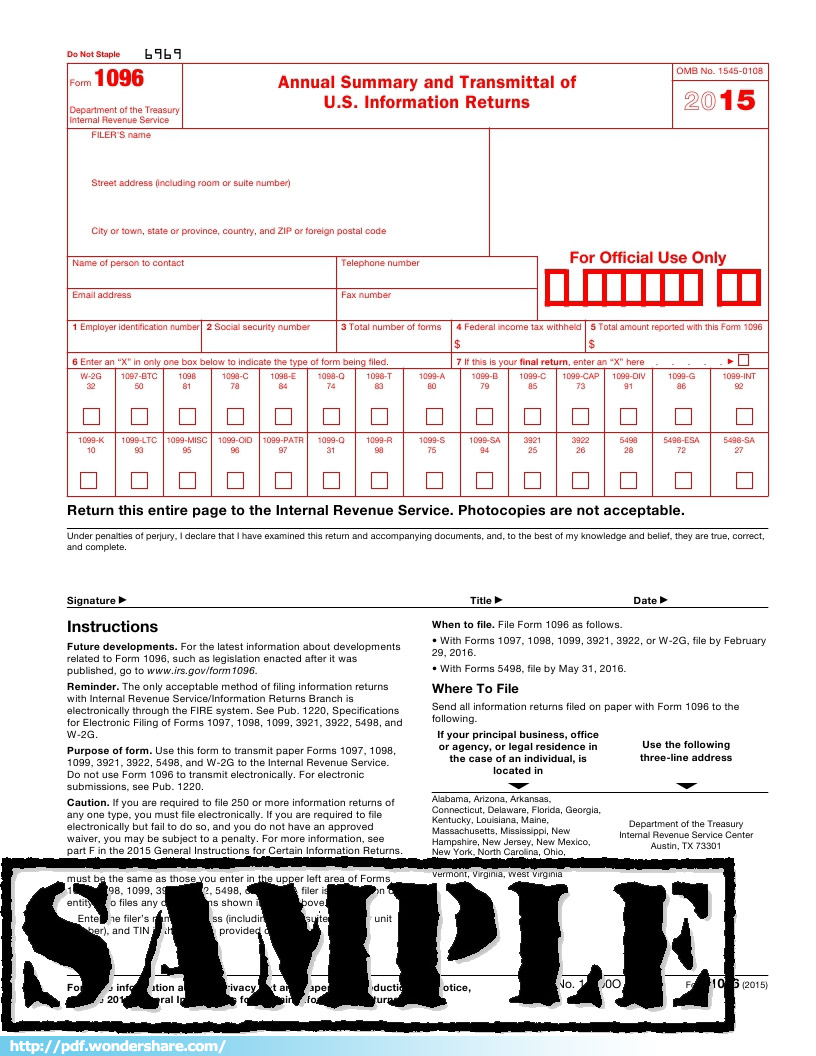

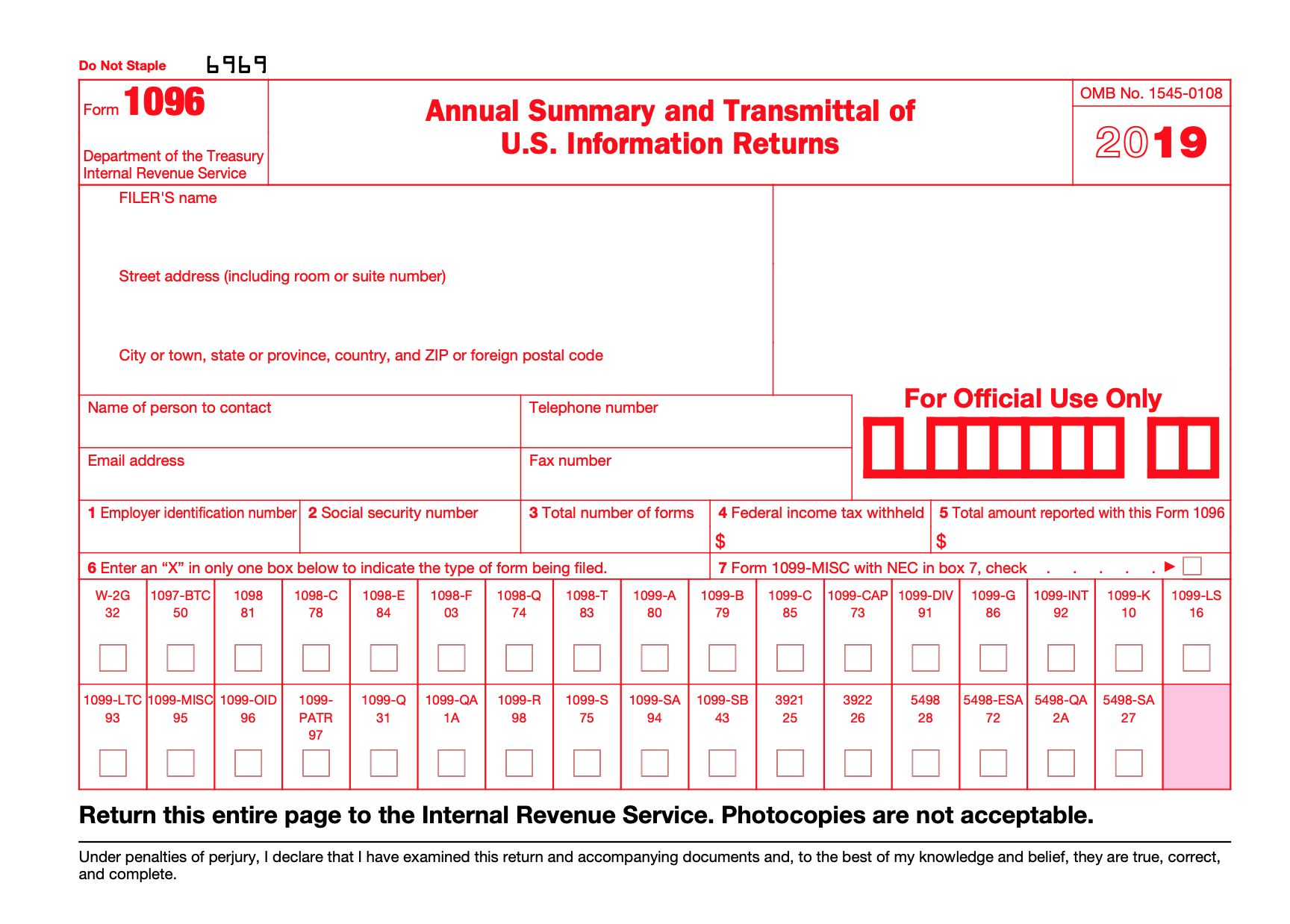

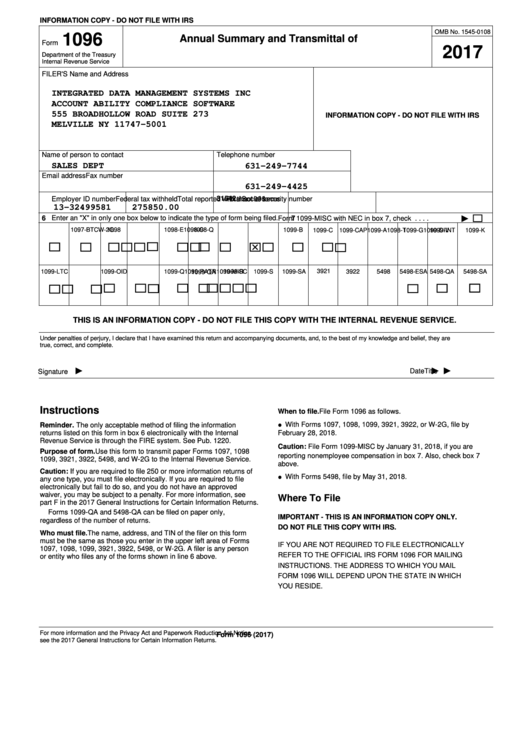

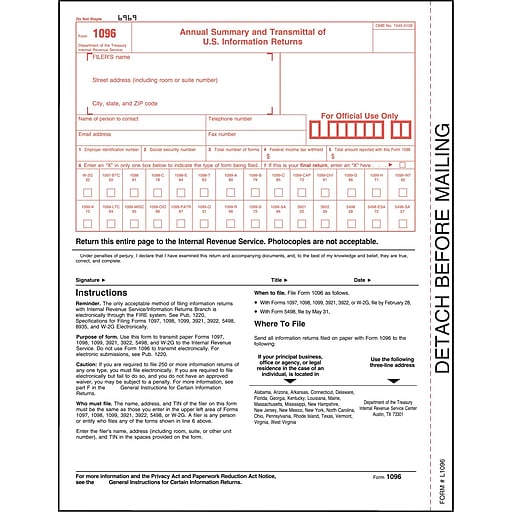

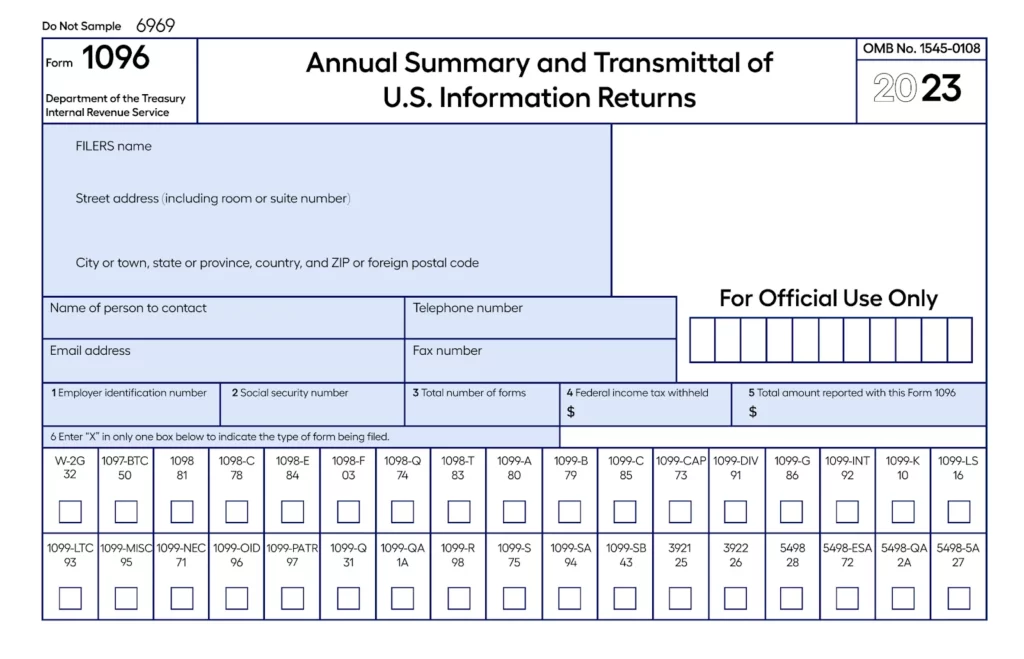

Printable 1096 Form - There is not an online free printable form 1096. Web free printable 1096 form. Form 1096, or the annual summary and transmittal of u.s. Keep in mind that the printed form should be sent through mail and not electronically. Information returns, including recent updates, related forms and instructions on how to file. Web get 1096 forms designed to work with quickbooks or to be filled out by hand and submitted to the irs to summarize your other tax forms. Irs form 1096 is required as a cover sheet to accompany paper copies of. Other items you may find useful. Web what is form 1096? Web the official printed version of this irs form is scannable, but a copy, printed from this website, is not. Web in this guide, we’ll simplify form 1096 for you. Web what is irs form 1096? Information returns, including recent updates, related forms and instructions on how to file. Form 1096, or the annual summary and transmittal of u.s. Form 1096 is also titled annual summary and transmittal of u.s. Other items you may find useful. Learn about the purpose of this irs tax form, how to file, & who needs to file with block advisors. The form is still free, but you’ll need to visit www.irs.gov/orderforms to order the forms. Department of the treasury, u.s. Contractor must file form 1096 in their taxes when filing by mail. This form is provided for informational purposes only. Web yes, you can access and print irs form 1096 online. Fill out the annual summary and transmittal of u.s. Thus, you'll have to print this form outside qbo. Web what is form 1096? Web irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Web form 1096 is required to be filed by businesses and individuals who submit paper copies of certain information returns, such as forms 1099, 1098, and 5498, to the irs. Web instructions for form 1098 (print version pdf) recent developments. Web irs form 1096, officially known as the annual summary and transmittal of u.s. Web in this guide, we’ll simplify form 1096 for you. Contractor must file form 1096 in their taxes when filing by mail. Web irs form 1096, officially known as the annual summary and transmittal of u.s. Web form 1096 is used when you're submitting paper 1099 forms to the irs. Web every company that pays a u.s. Learn everything you need to know about form 1096. Learn everything you need to know about form 1096. Web form 1096 is required to be filed by businesses and individuals who submit paper copies of certain information returns, such as forms 1099, 1098, and 5498, to the irs. Web free printable 1096 form. About general instructions for certain information returns. Learn about the purpose of this irs tax form,. Your business needs to use it only when you submit those forms to the irs in a paper format. Irs form 1096 is often used in u.s. It appears in red, similar to the official irs form. Contractor must file form 1096 in their taxes when filing by mail. Thus, you'll have to print this form outside qbo. Web learn how to print 1099 and, if available, 1096 forms in quickbooks online, quickbooks contractor payments, or quickbooks desktop. Your business needs to use it only when you submit those forms to the irs in a paper format. Form 1096, or the annual summary and transmittal of u.s. Web the official printed version of this irs form is scannable,. Form 1096, annual summary and transmittal of u.s. Web free printable 1096 form. Contractor must file form 1096 in their taxes when filing by mail. The irs requires that form 1096 be scannable for ease of processing, so you must order form 1096 from them ahead of time. Web printing and filling out your form 1096 is unavailable in quickbooks. Web form 1096 is required to be filed by businesses and individuals who submit paper copies of certain information returns, such as forms 1099, 1098, and 5498, to the irs. Information returns, is — as its official name implies — a summary document. Web irs 1099 forms are a series of tax reporting documents used by businesses and individuals to. Irs form 1096 is required as a cover sheet to accompany paper copies of. Web irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. About general instructions for certain information returns. The purpose of form 1096. Thus, you'll have to print this form outside qbo. Learn everything you need to know about form 1096. Contractor must file form 1096 in their taxes when filing by mail. Web irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings,. It is submitted as an accompanying. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. Your business needs to use it only when you submit those forms to. If you are filing electronically, form 1096 isn't required by the irs. The irs requires that form 1096 be scannable for ease of processing, so you must order form 1096 from them ahead of time. Information returns, including recent updates, related forms and instructions on how to file. Do not print and file a form 1096 downloaded from this website;. Web free printable 1096 form. Why do you need it? Form 1096 is also titled annual summary and transmittal of u.s. Web printing and filling out your form 1096 is unavailable in quickbooks online (qbo) and quickbooks contractor payments since qbo doesn't provide form 1096 complying with irs guidelines. Thus, you'll have to print this form outside qbo. The irs requires that form 1096 be scannable for ease of processing, so you must order form 1096 from them ahead of time. Web what is form 1096? Web form 1096 is an information return form that summarizes the information about any payment that you've made to any recipient for tax purposes. It appears in red, similar to the official irs form. Contractor must file form 1096 in their taxes when filing by mail. Attention filers of form 1096: Web get 1096 forms designed to work with quickbooks or to be filled out by hand and submitted to the irs to summarize your other tax forms. Department of the treasury, u.s. Explaining the basics of form 1096. Web irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Form 1096, annual summary and transmittal of u.s.IRS Form 1096. Annual Summary and Transmittal of U.S. Information

IRS Form 1096 Download Fillable PDF or Fill Online Annual Summary and

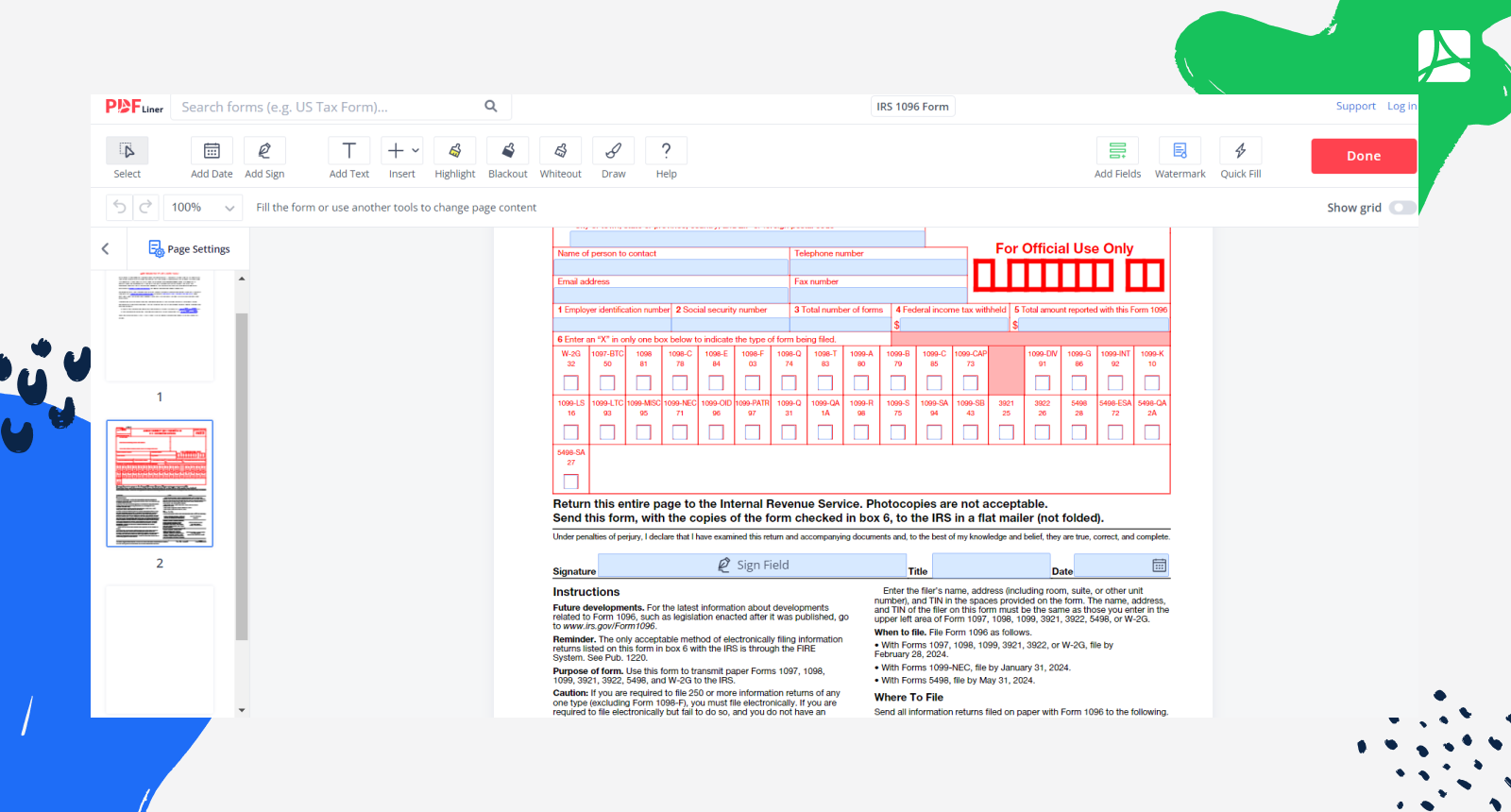

IRS 1096 Form 2024 Printable blank, sign forms online — PDFliner

IRS Form 1096 Download Printable PDF or Fill Online Annual Summary and

IRS 1096 Form Download, Create, Edit, Fill and Print

Printable Irs Form 1096 Printable Forms Free Online

Form 1096 Annual Summary And Transmittal Of U.s. Information Returns

Printable 1096 Form

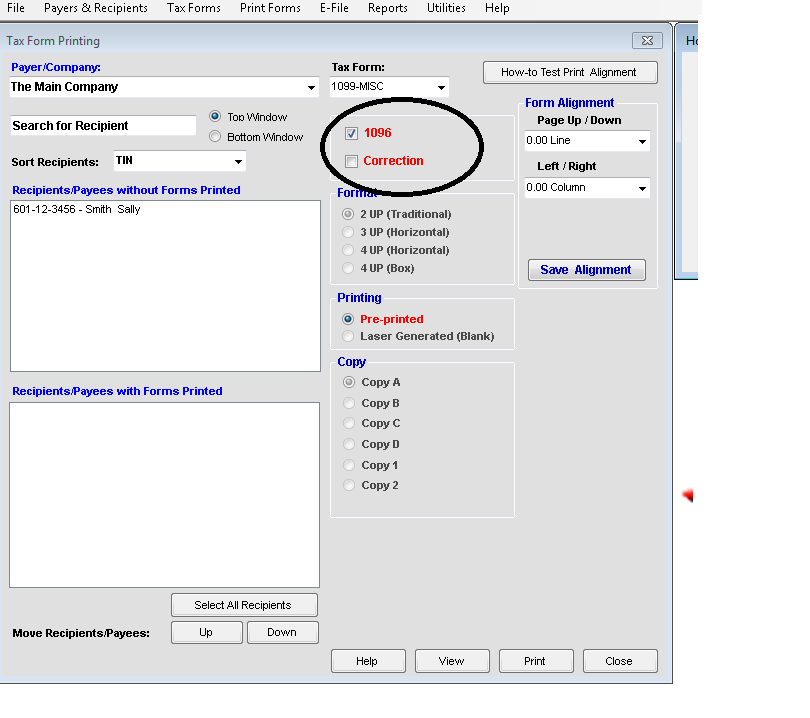

How to Print a 1096 Form Tax Software & Web Support Services

Understanding and Filing Form 1096 Multiplier

Learn Everything You Need To Know About Form 1096.

Web If You Hire Contractors, You May Need To File Form 1096.

Information Returns Online And Print It Out For Free.

The Official Printed Version Of This Irs Form Is Scannable, But A Copy, Printed From This Website, Is Not.

Related Post: