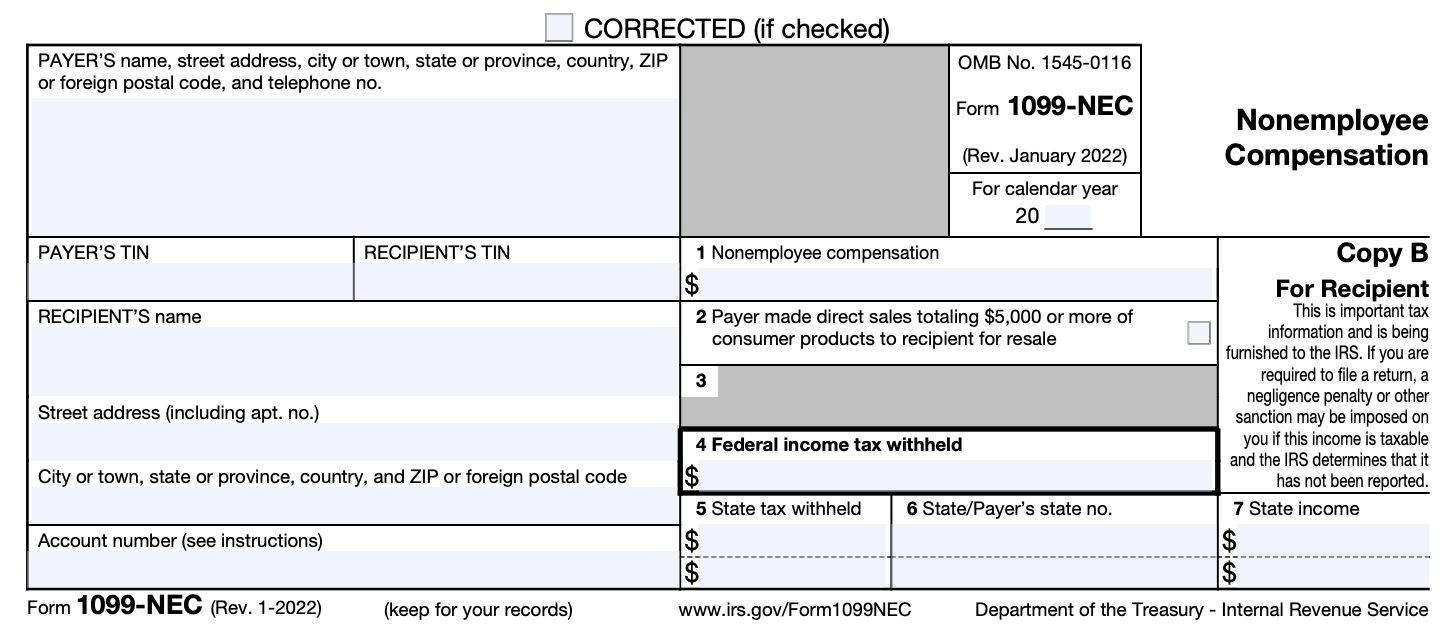

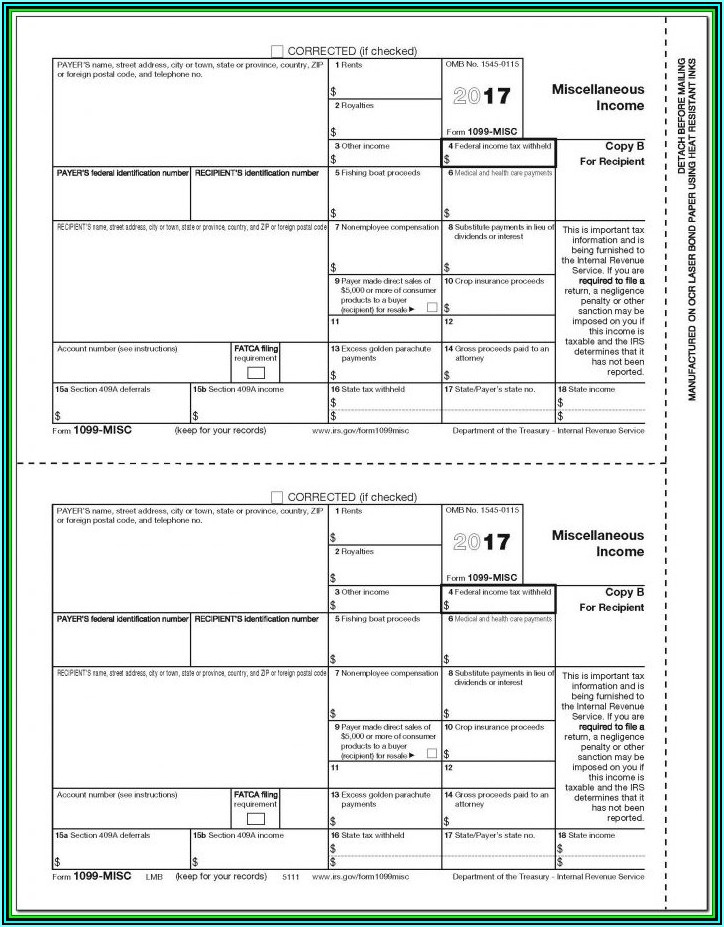

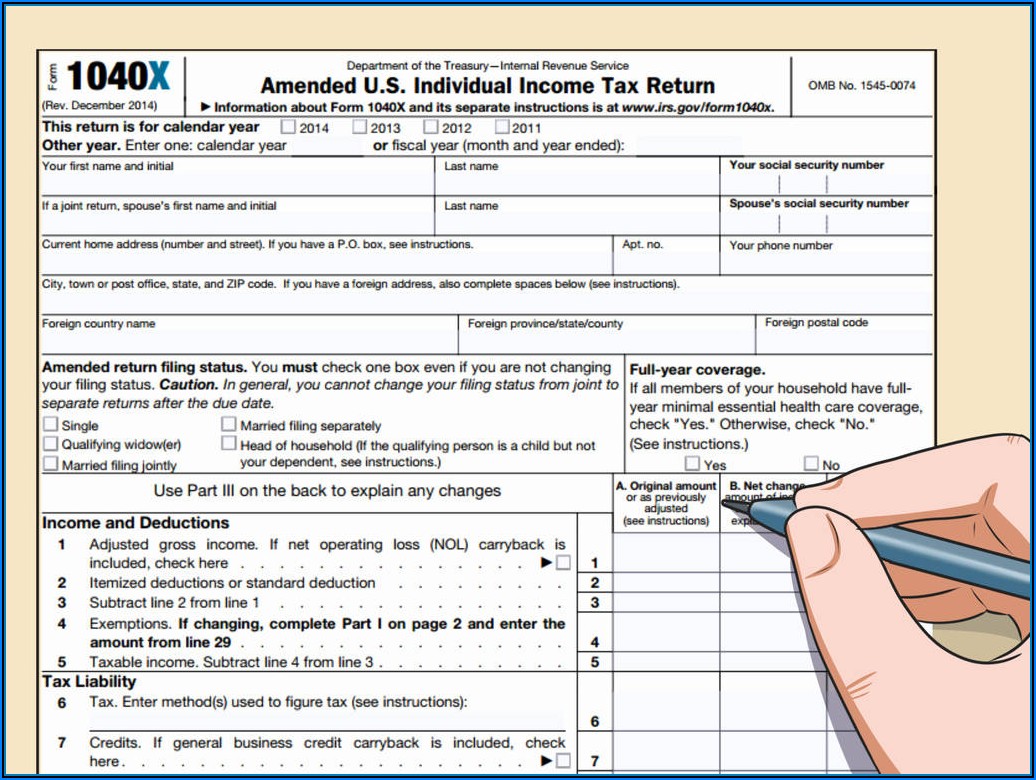

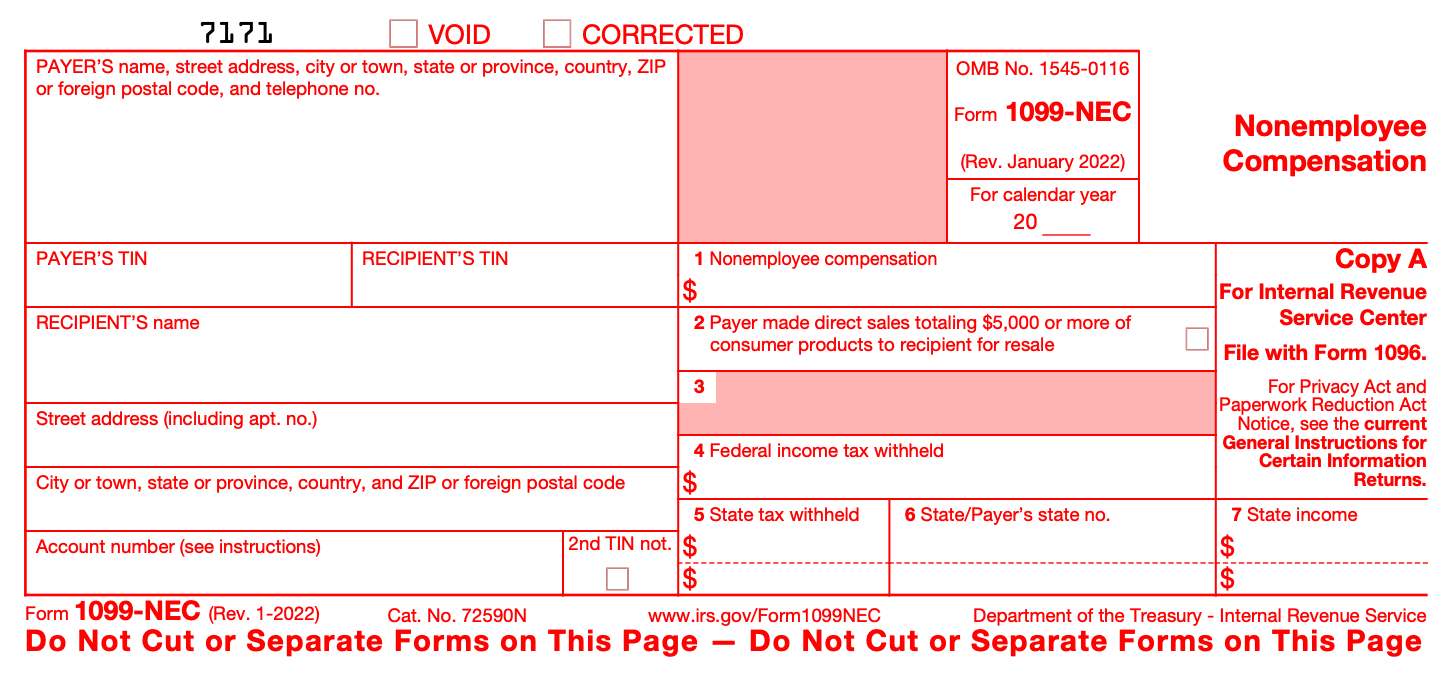

Printable 1099 Form Independent Contractor

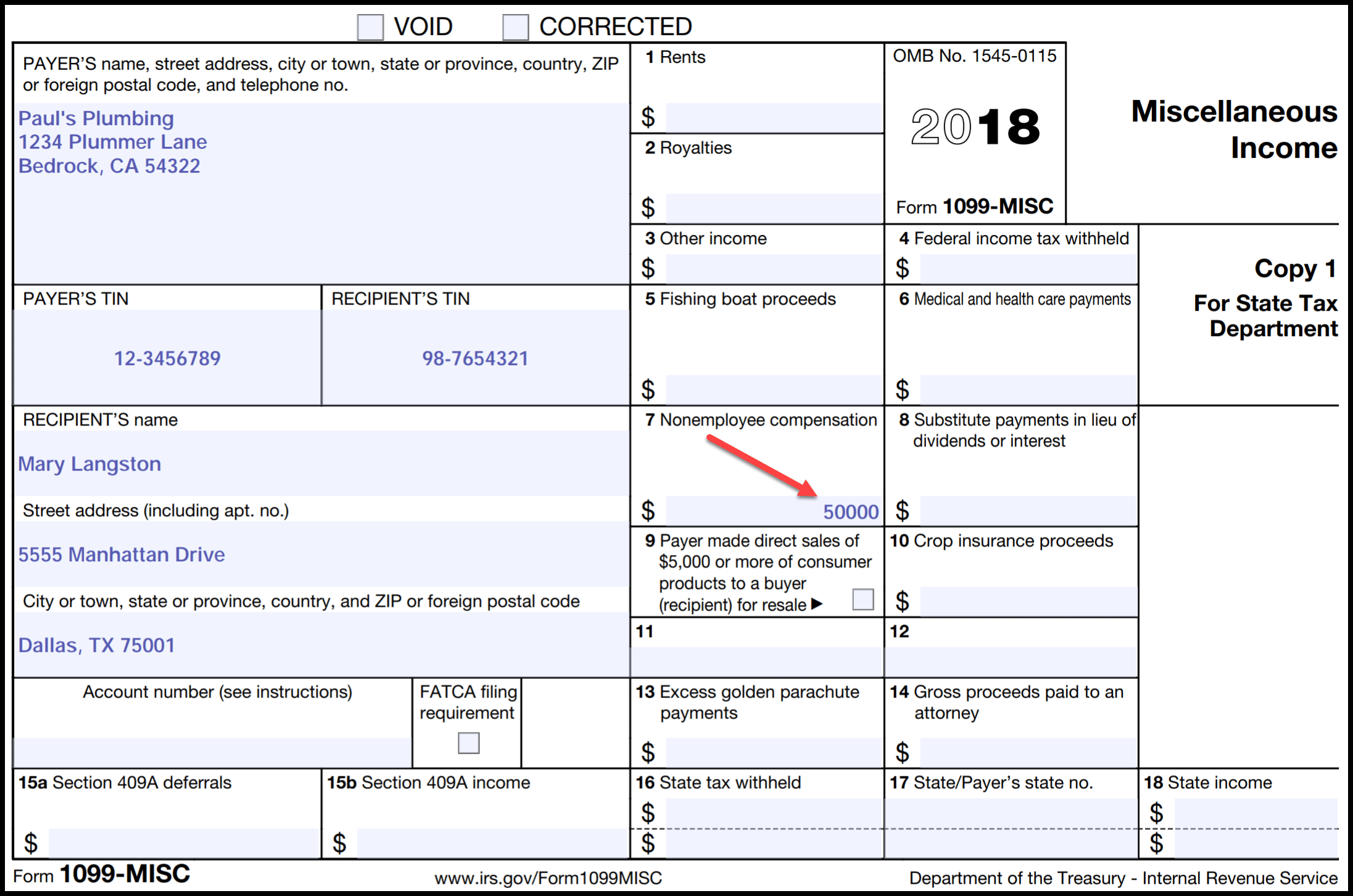

Printable 1099 Form Independent Contractor - Checkout the forms and associated taxes for independent contractors to stay irs compliant. Web simply put, if you’re an independent contractor who has earned $600 or more from a business or individual during the tax year, you’ll likely receive a 1099 form. This form serves as a record of the income you received. This income can come from a variety of sources, such as freelance work, interest payments, or rental income. Web form 1099 nec & independent contractors. Web form 1099 for contractors: Web this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. Web businesses use 1099 forms to report any payments that total more than $600 they’ve made to independent contractors. How to print 1099s from a spreadsheet. Printing 1099s from sage 50. Web there are three basic categories of factors that are relevant to determining a worker's classification: Report wages, tips, or other. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Although these forms are called information returns, they serve different functions. Therefore, payments should be made in full. An independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Web independent contractor (1099) invoice template. Printing 1099s from sage 50. Written by erica gellerman, cpa. When should you print and send your 1099s? What to do before you print your 1099s. Web independent contractor agreement template. Web independent contractor (1099) invoice template. This form serves as a record of the income you received. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. See the instructions for box 1. Clients are not responsible for paying the contractor’s taxes; Web form 1099 for contractors: Web simply put, if you’re an independent contractor who has earned $600 or more from a business or individual during the tax year, you’ll likely receive a 1099 form. This income can come from a variety of sources, such as freelance work, interest payments, or rental income. Clients are not responsible for paying the contractor’s taxes; (53) make a free invoice now. If you’re a business owner, you’ll be responsible for filling these out and mailing them to any contractors you’ve worked with throughout the tax year. Written by erica gellerman, cpa. Updated oct 15, 2020 · 6 min read. Web independent contractor (1099) invoice template. What to do before you print your 1099s. (53) make a free invoice now. See the instructions for box 1. Clients are not responsible for paying the contractor’s taxes; See the instructions for box 1. Updated oct 15, 2020 · 6 min read. Report wages, tips, or other. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. This form serves as a record of the income you received. An independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. How to print 1099s from quickbooks. Clients are not responsible for paying the contractor’s taxes; What to do before you print your 1099s. Web form 1099 nec & independent contractors. Written by sara hostelley | reviewed by brooke davis. This form serves as a record of the income you received. Web businesses use 1099 forms to report any payments that total more than $600 they’ve made to independent contractors. Web form 1099 for contractors: Report wages, tips, or other. Property management services collecting rent on. Although these forms are called information returns, they serve different functions. Web there are three basic categories of factors that are relevant to determining a worker's classification: Printing 1099s from sage 50. Can you print 1099s on plain paper? Web form 1099 nec & independent contractors. What to do before you print your 1099s. (53) make a free invoice now. Report wages, tips, or other. Web independent contractors are among the recipients who should receive a 1099 form. Web independent contractors are among the recipients who should receive a 1099 form. See the instructions for box 1. Printing 1099s from sage 50. Web this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. What to do before you print your 1099s. Web independent contractor agreement template. If you’re a business owner, you’ll be responsible for filling these out and mailing them to any contractors you’ve worked with throughout the tax year. Property management services collecting rent on. This form serves as a record of the income you received. Web this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and. Clients are not responsible for paying the contractor’s taxes; This income can come from a variety of sources, such as freelance work, interest payments, or rental income. Where to order printable 1099 forms. Web simply put, if you’re an independent contractor who has earned $600 or more from a business or individual during the tax year, you’ll likely receive a. Web individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. This income can come from a variety of sources, such as freelance work, interest payments, or rental income. Web this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. Web simply put, if you’re an independent contractor who has earned $600 or more from a business or individual during the tax year, you’ll likely receive a 1099 form. The test consists of the following factors: Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Checkout the forms and associated taxes for independent contractors to stay irs compliant. Web independent contractor (1099) invoice template. Can you print 1099s on plain paper? Web independent contractor agreement template. How to print 1099s from quickbooks. Updated oct 15, 2020 · 6 min read. (53) make a free invoice now. Clients are not responsible for paying the contractor’s taxes; Written by sara hostelley | reviewed by brooke davis. Although these forms are called information returns, they serve different functions.Printable Independent Contractor 1099 Form Printable Forms Free Online

Printable 1099 Forms For Independent Contractors

Irs 1099 Forms For Independent Contractors Form Resume Examples

Printable 1099 Form Independent Contractor

Printable 1099 Form Independent Contractor 2023

6 mustknow basics form 1099MISC for independent contractors Bonsai

Free Independent Contractor Agreement Template 1099 Word PDF eForms

Printable 1099 Form Independent Contractor Printable Form, Templates

IRS Form 1099 Reporting for Small Business Owners

Free Independent Contractor Agreement Template 1099 Word PDF eForms

Web Form 1099 Nec & Independent Contractors.

Web Form 1099 For Contractors:

Property Management Services Collecting Rent On.

Printing 1099S From Sage 50.

Related Post: