Printable Small Business Tax Deductions Worksheet

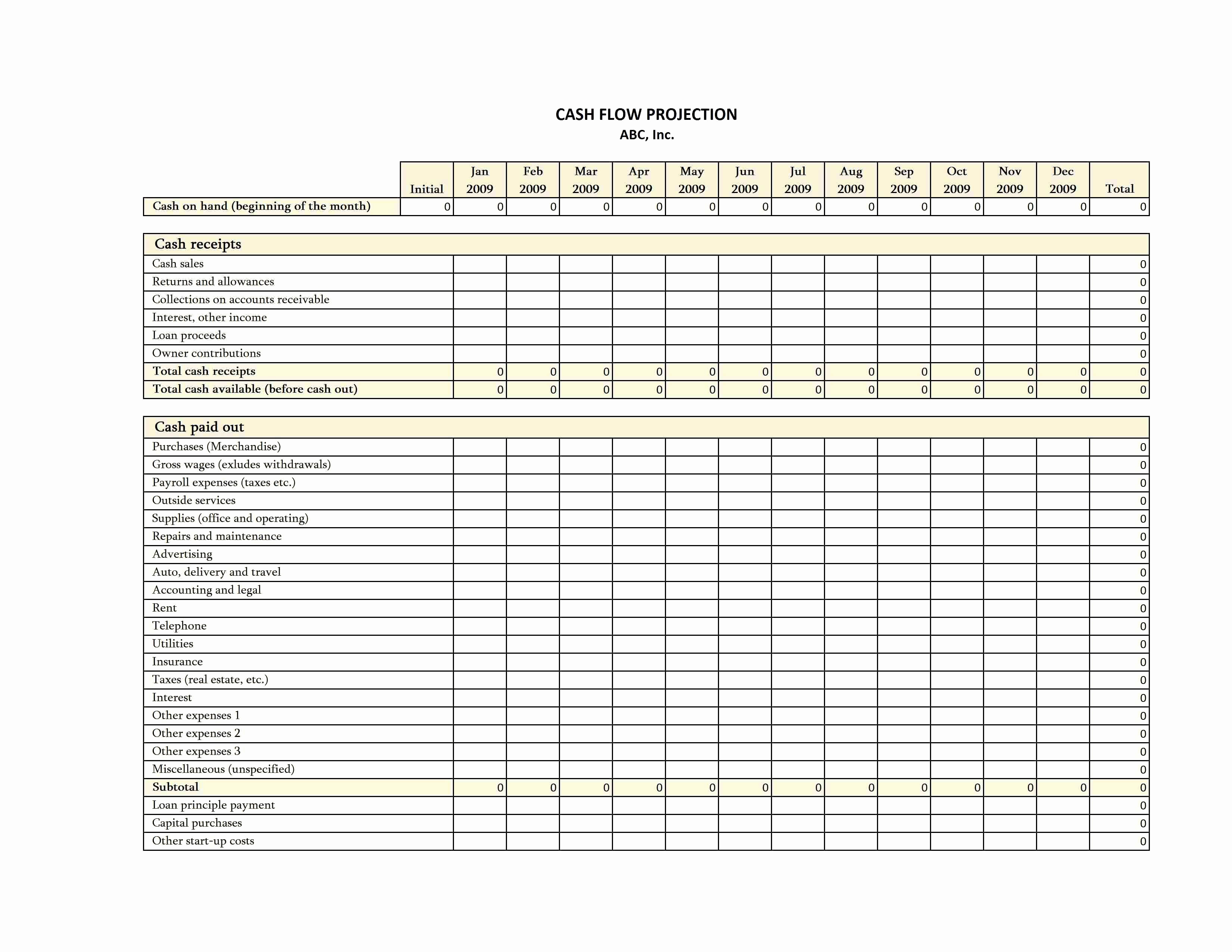

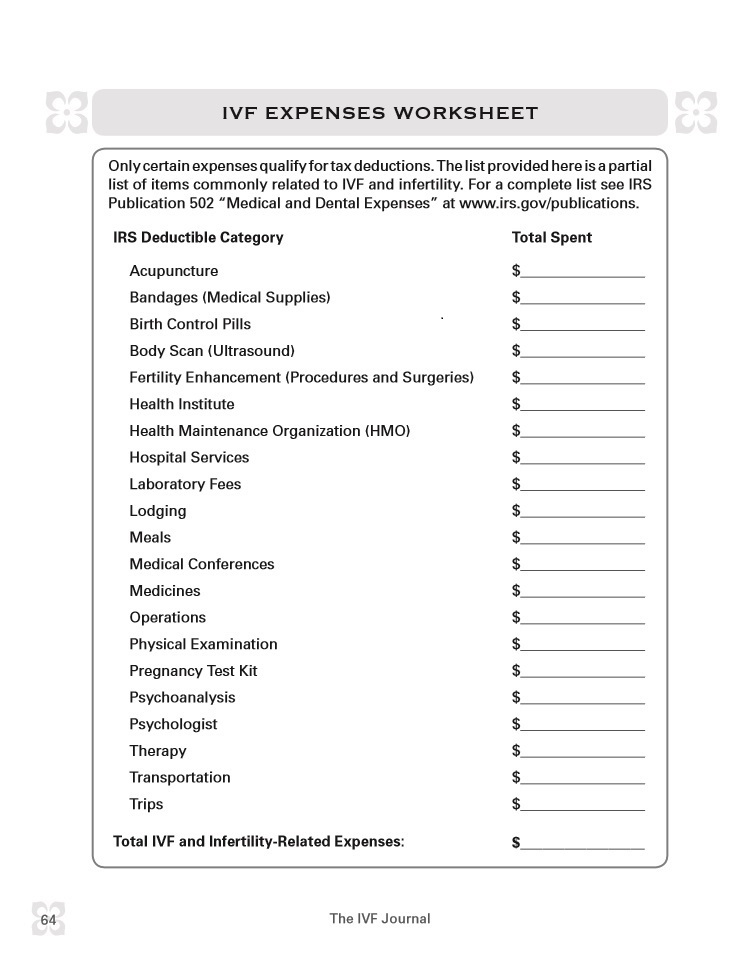

Printable Small Business Tax Deductions Worksheet - Web this small business tax preparation checklist breaks down the six basics of filing small business taxes and includes a downloadable checklist to stay on top of your small business tax prep needs—including what. Use our free printable small business tax deductions worksheet to make sure you haven’t forgotten anything Web what’s on this free small business tax spreadsheet. Web start up expenses are those expenses which would have been deductible if you were actively engaged in a trade or business, but which were incurred before the start of business. Web if you're a freelancer, independent contractor, or small business owner who uses your home for business purposes, the home office tax deduction can be huge. These deductions may lower the amount of income payable to both federal and state taxes. In this day and age, most business bank and credit card accounts provide an excel version of your transactions online and not just the paper or pdf statement. We have selected the most common business expense categories identified by the irs—such as employee wages and benefits, excise taxes, and advertising and marketing costs—since it’s impossible to cover every type of deductible business expense. Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible business expenses. This publication does not cover the topics listed in the following table. We have selected the most common business expense categories identified by the irs—such as employee wages and benefits, excise taxes, and advertising and marketing costs—since it’s impossible to cover every type of deductible business expense. Web if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help and resources that you might need. Use the existing category names or enter your own column headings to best track business expenses. Web tim yoder, ph.d., cpa. The value of a tax deduction depends on the tax bracket you’re in. In order for an books & magazines expense to be deductible, it must be considered an business cards ordinary and necessary expense. Web make your tax preparation a breeze with this free template. Web small business worksheet client: Web top 25 tax deductions for small businesses. Use this spreadsheet to track payments, itemize expenses, and more. What may be considered a business expense? In order for an books & magazines expense to be deductible, it must be considered an business cards ordinary and necessary expense. The value of a tax deduction depends on the tax bracket you’re in. Web what are small business expenses? It lets you write off part of your rent and related expenses, including: When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re claiming all the tax deductions available to your small business. Web if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help and resources that you might need. To speed this process up a bit, you can start by downloading an excel copy of your bank or credit card transactions. All businesses have to file tax returns—but how they actually pay taxes depends on how they’re structured. Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. This publication does not cover the topics listed in the following table. How much is a tax deduction worth? Qualified business income (qbi) business travel expenses. We have selected the most common business expense categories identified by the irs—such as employee wages and benefits, excise taxes, and advertising and marketing costs—since it’s impossible to cover every type of deductible business. Qualified business income (qbi) business travel expenses. To speed this process up a bit, you can start by downloading an excel copy of your bank or credit card transactions. Use the existing category names or enter your own column headings to best track business expenses. We have selected the most common business expense categories identified by the irs—such as employee. In order for an books & magazines expense to be deductible, it must be considered an business cards ordinary and necessary expense. Web tim yoder, ph.d., cpa. Web make your tax preparation a breeze with this free template. All businesses have to file tax returns—but how they actually pay taxes depends on how they’re structured. In this day and age,. Web small business worksheet client: Web what are small business expenses? Use our free printable small business tax deductions worksheet to make sure you haven’t forgotten anything We have selected the most common business expense categories identified by the irs—such as employee wages and benefits, excise taxes, and advertising and marketing costs—since it’s impossible to cover every type of deductible. How much is a tax deduction worth? Web make your tax preparation a breeze with this free template. This publication does not cover the topics listed in the following table. Web if you're a freelancer, independent contractor, or small business owner who uses your home for business purposes, the home office tax deduction can be huge. Web what are small. Web this publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file your income tax return. Web what’s on this free small business tax spreadsheet. What may be considered a business expense? Qualified business income (qbi) business travel expenses. Ordinary advertisement and promotional marketing costs related to your business are. Web if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help and resources that you might need. How much is a tax deduction worth? Web if you're a freelancer, independent contractor, or small business owner who uses your home for business purposes, the home office tax. Web this publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file your income tax return. Web a tax deduction is one that’s specifically listed as such in the internal revenue code or is not specifically listed but meets the conditions of being ordinary and necessary and is not otherwise. Use our free printable small business tax deductions worksheet to make sure you haven’t forgotten anything Web start up expenses are those expenses which would have been deductible if you were actively engaged in a trade or business, but which were incurred before the start of business. Web if you're a freelancer, independent contractor, or small business owner who uses. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. We have selected the most common business expense categories identified by the irs—such as employee wages and benefits, excise taxes, and advertising and marketing costs—since it’s impossible to cover every type of deductible business expense.. Web work with a bookkeeper, accountant, or tax advisor when you’re filing your taxes; To speed this process up a bit, you can start by downloading an excel copy of your bank or credit card transactions. The cost of advertising and promotion is 100% deductible, including things like the cost of printing business cards. Web a tax deduction is one that’s specifically listed as such in the internal revenue code or is not specifically listed but meets the conditions of being ordinary and necessary and is not otherwise barred by tax law. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re claiming all the tax deductions available to your small business. Use the existing category names or enter your own column headings to best track business expenses. Web make your tax preparation a breeze with this free template. We have selected the most common business expense categories identified by the irs—such as employee wages and benefits, excise taxes, and advertising and marketing costs—since it’s impossible to cover every type of deductible business expense. In this day and age, most business bank and credit card accounts provide an excel version of your transactions online and not just the paper or pdf statement. All businesses have to file tax returns—but how they actually pay taxes depends on how they’re structured. Web this small business tax deductions checklist includes over 100 tax deductions. Web if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help and resources that you might need. Use this spreadsheet to track payments, itemize expenses, and more. Web what are small business expenses? Qualified business income (qbi) business travel expenses. This publication does not cover the topics listed in the following table.Printable Small Business Tax Deductions Worksheet

Itemized Deduction Small Business Tax Deductions Worksheet

Printable Itemized Deductions Worksheet

Small Business Tax Deductions Worksheet 2022

Small Business Tax Deduction Worksheets

Printable Itemized Deductions Worksheet

Printable Yearly Itemized Tax Deduction Worksheet Fill and Sign

Small Business Tax Spreadsheet Business worksheet, Business tax

Small Business Tax Deductions Worksheets

Printable Small Business Tax Deductions Worksheet

What May Be Considered A Business Expense?

Simply Follow The Instructions On This Sheet And Start Lowering Your Social Security And Medicare Taxes.

In Order For An Books & Magazines Expense To Be Deductible, It Must Be Considered An Business Cards Ordinary And Necessary Expense.

Click To Print Tax Deduction Checklist For Small Businesses.

Related Post: