Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

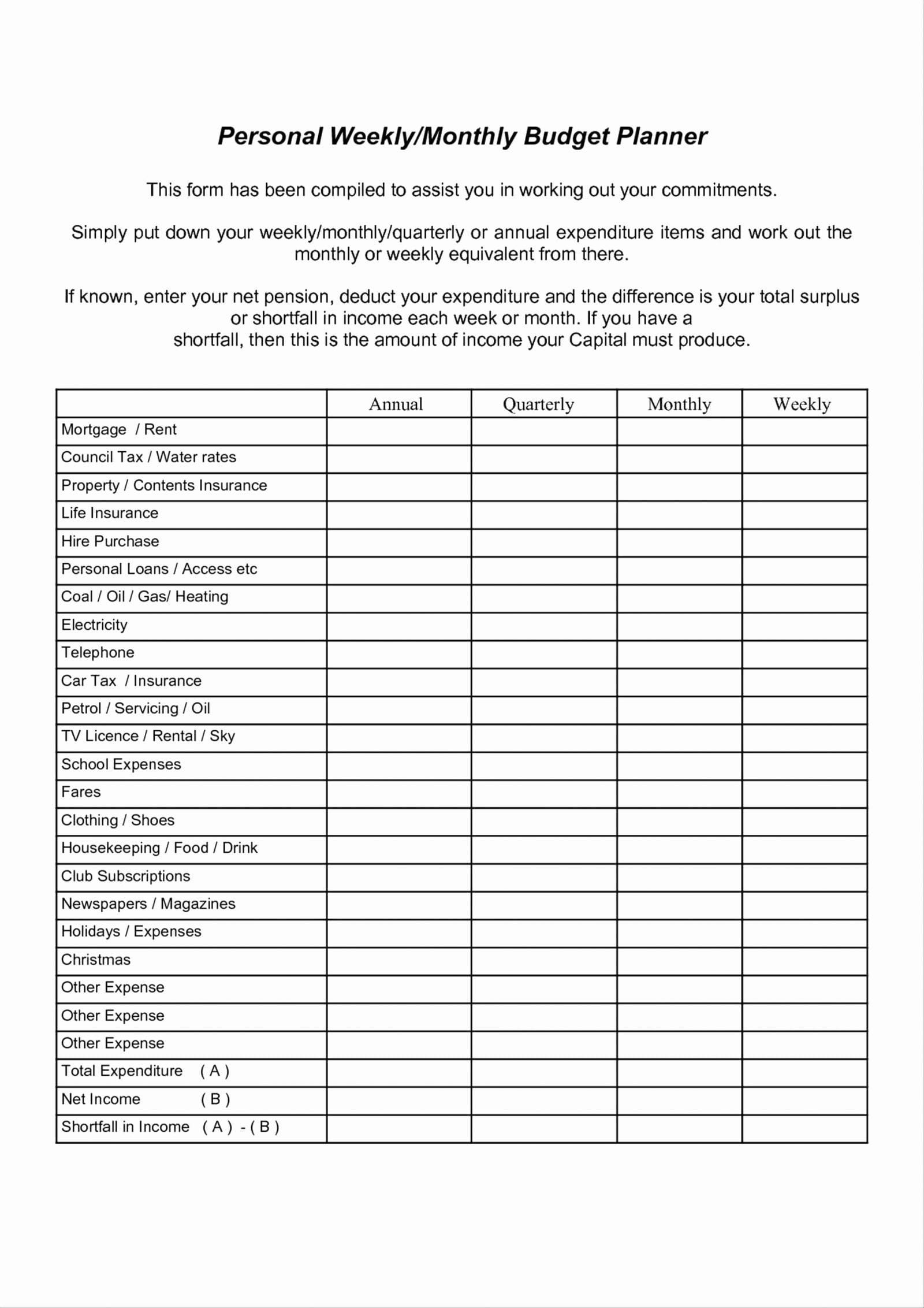

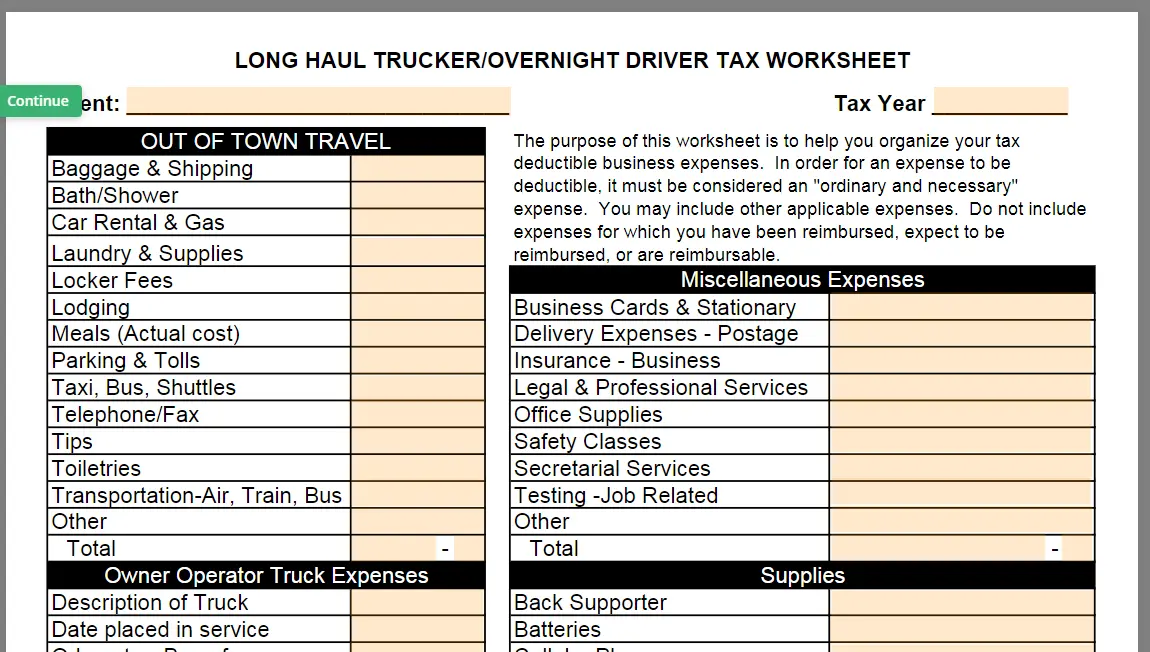

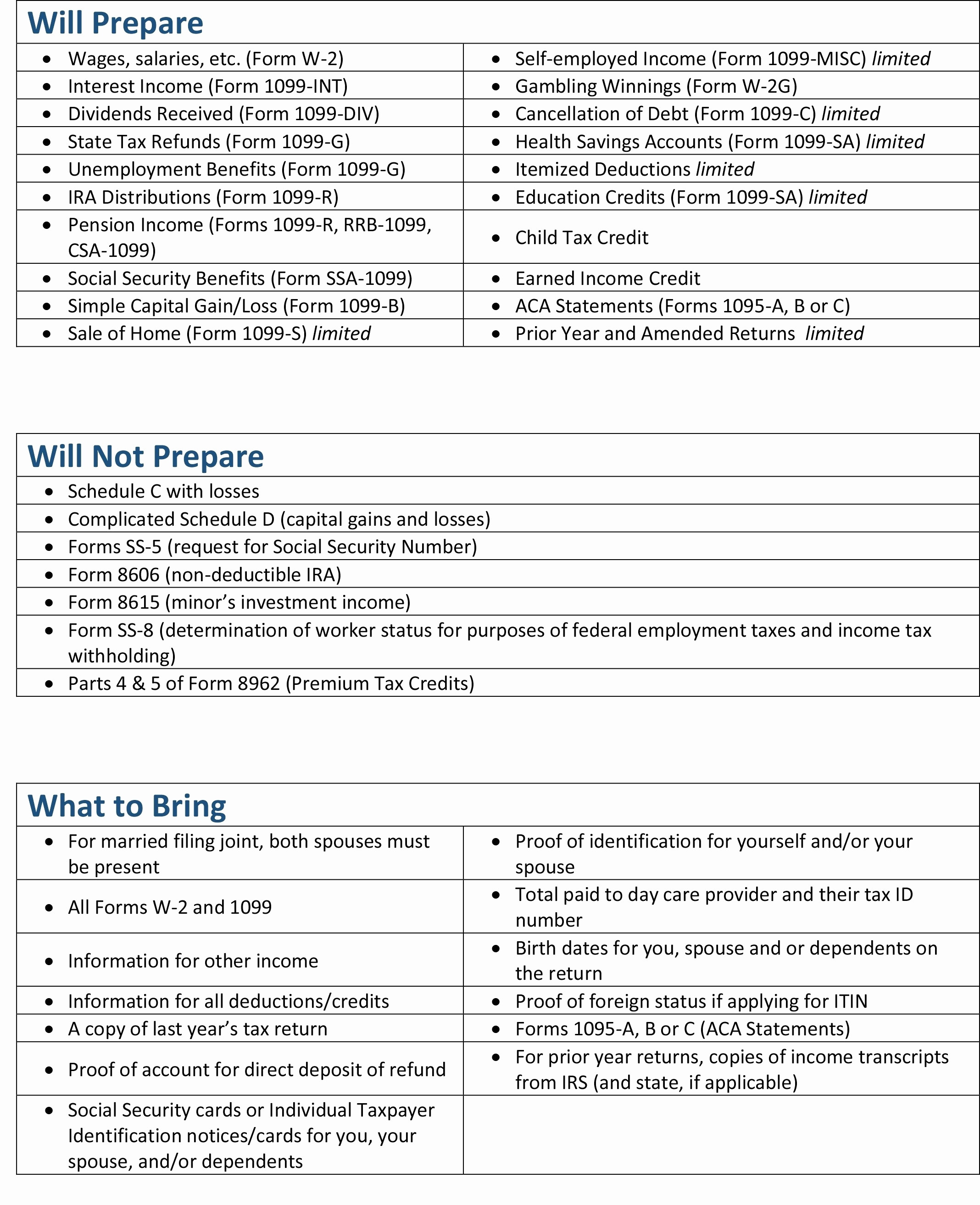

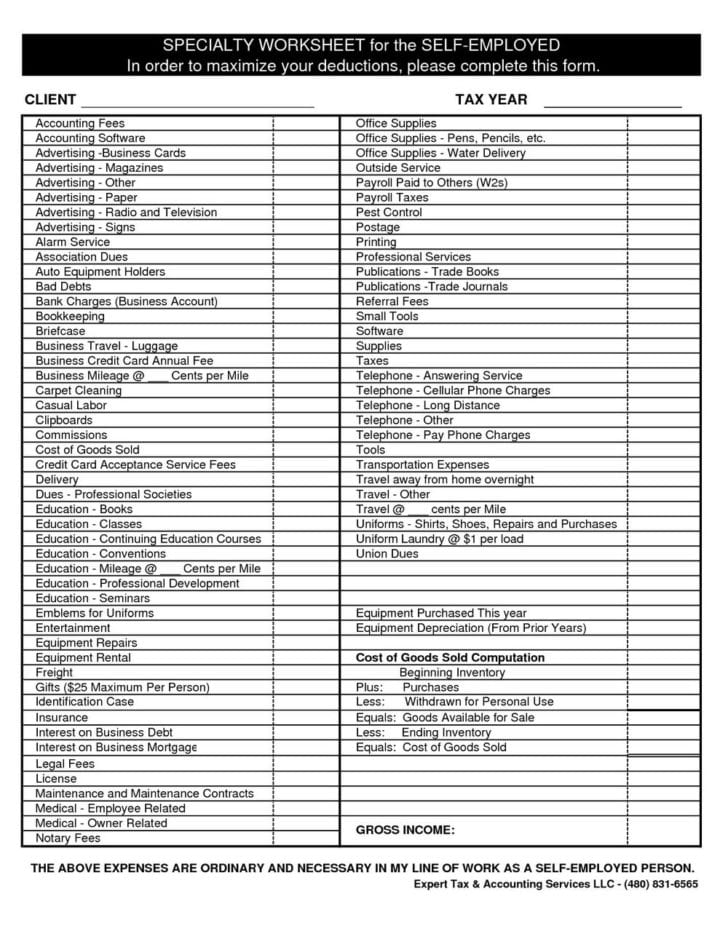

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet - Professional drivers can anticipate paying more to the irs if they were fortunate enough to cash in on rising trucker salaries. It encompasses many expense categories, including truck payments, licenses, permits, insurance premiums, and maintenance costs. Use freshbooks to simplify your tax preparation. Web make use of tax deductions. Common truck driver tax deductions. However, this income is before deduction of operating and business expenses. Tips for efficiently filing taxes and tracking deductions. If you don’t deduct all your expenses, you could end up paying significantly more taxes than you need to. Postage, stationery, office supplies, bank charges, pens, faxes, etc. Web 13 tax deductions for truck drivers. Using spreadsheets has been shown to help businesses save time and money, reduce errors, and better plan for the future. Web long haul/overnight truck driver deductions. It encompasses many expense categories, including truck payments, licenses, permits, insurance premiums, and maintenance costs. Web download our free trucking expenses spreadsheet template to help run your business smoothly. Web 13 tax deductions for truck drivers. However, this income is before deduction of operating and business expenses. Professional drivers can anticipate paying more to the irs if they were fortunate enough to cash in on rising trucker salaries. Tax breaks for truck drivers. Web truck driver tax brackets depend largely on taxable income and filing statuses, including single, married filing jointly or qualifying widow (er), married filing separately, or head of household. Common truck driver tax deductions. Or learn everything you need to make your own from scratch. Using spreadsheets has been shown to help businesses save time and money, reduce errors, and better plan for the future. Get our powerful tms for brokers and carriers alike. It delineates expenses that qualify as ordinary and necessary, thereby assisting in the identification of. Truck lease machinery and equipment # other bus. Maps, safety supplies small tools taxes: Web long haul/overnight truck driver deductions. Property, locker fees repairs & maintenance: Use get form or simply click on the template preview to open it in the editor. Professional drivers can anticipate paying more to the irs if they were fortunate enough to cash in on rising trucker salaries. If you don’t deduct all your expenses, you could end up paying significantly more taxes than you need to. Web most truck driver pay about $550 dollar for heavy highway use tax. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to irs. Using spreadsheets has been shown to help. Web long haul/overnight truck driver deductions. Web 13 tax deductions for truck drivers. It encompasses many expense categories, including truck payments, licenses, permits, insurance premiums, and maintenance costs. Truck lease machinery and equipment # other bus. The purpose of this worksheet is to help you organize your tax deductible business expenses. Web download our free trucking expenses spreadsheet template to help run your business smoothly. Web long haul/overnight truck driver deductions. Web 13 tax deductions for truck drivers. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to irs. Web make use of tax deductions. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to irs. Get our powerful tms for brokers and carriers alike. Web make use of tax deductions. This means you need to keep accurate records of your deductions as well as your earnings. Common truck driver tax deductions. Tax breaks for truck drivers. Using spreadsheets has been shown to help businesses save time and money, reduce errors, and better plan for the future. Property, locker fees repairs & maintenance: Tips for efficiently filing taxes and tracking deductions. Postage, stationery, office supplies, bank charges, pens, faxes, etc. Use get form or simply click on the template preview to open it in the editor. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to irs. Web truck driver tax brackets depend largely on taxable income and filing statuses, including single, married filing jointly or qualifying widow (er), married. Professional drivers can anticipate paying more to the irs if they were fortunate enough to cash in on rising trucker salaries. Who can claim truck driver tax deductions? Truck lease machinery and equipment # other bus. Web make use of tax deductions. Property, locker fees repairs & maintenance: Common truck driver tax deductions. Use get form or simply click on the template preview to open it in the editor. Who can claim truck driver tax deductions? Truck lease machinery and equipment # other bus. What are you waiting for? Use freshbooks to simplify your tax preparation. Web long haul/overnight truck driver deductions. Web quick steps to complete and design truck driver tax deductions worksheet online: Who can claim truck driver tax deductions? Maps, safety supplies small tools taxes: Professional drivers can anticipate paying more to the irs if they were fortunate enough to cash in on rising trucker salaries. Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway use tax. Postage, stationery, office supplies, bank charges, pens, faxes, etc. Maps, safety supplies small tools taxes: What are you waiting for? Web quick steps to complete and design truck driver tax deductions worksheet online: Use get form or simply click on the template preview to open it in the editor. What are you waiting for? In order for an expense to be deductible, it must be considered an “ordinary and necessary” expense for. If you don’t deduct all your expenses, you could end up paying significantly more taxes than you need to. Truck drivers can deduct business expenses that are “regular and necessary” by the irs. Web 13 tax deductions for truck drivers. This means you need to keep accurate records of your deductions as well as your earnings. Common truck driver tax deductions. Web most truck driver pay about $550 dollar for heavy highway use tax. Start completing the fillable fields and carefully type in required information. Tips for efficiently filing taxes and tracking deductions. Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway use tax. Property, locker fees repairs & maintenance: Using spreadsheets has been shown to help businesses save time and money, reduce errors, and better plan for the future. Web make use of tax deductions.Owner Operator Truck Driver Tax Deductions Worksheet

Printable Truck Driver Expense Owner Operator Tax Deductions

4 Printable Truck Driver Expense Owner Operator Tax Deductions

Truck Driver Tax Deductions

Printable Truck Driver Expense Owner Operator Tax Deductions

Truck Driver Tax Deductions Worksheets

2021 Truck Driver Tax Deductions Worksheet

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Printable Truck Driver Expense Owner Operator Tax Deductions

Tax Deductions For Truck Drivers List

Web Truck Driver Tax Brackets Depend Largely On Taxable Income And Filing Statuses, Including Single, Married Filing Jointly Or Qualifying Widow (Er), Married Filing Separately, Or Head Of Household.

Web Download The Truck Driver Tax Deductions Worksheet In Pdf To Help You Save Your Money On Taxes!

Who Can Claim Truck Driver Tax Deductions?

However, This Income Is Before Deduction Of Operating And Business Expenses.

Related Post: