Private Letter Ruling Template

Private Letter Ruling Template - Web a private letter ruling is a written opinion by the irs on a specific tax issue affecting a taxpayer. Web a private letter ruling, or plr, is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer's specific set of facts. Find out the procedures, user fees, and related content for 2024. Web learn about the different forms of irs guidance, including private letter rulings, that provide taxpayers with official interpretations and directions. It applies the tax law to a particular situation and helps the taxpayer know their rights and responsibilities. Learn when and how to request a plr for tax exempt bonds, and the difference between a plr and a closing agreement. Web a private letter ruling (plr) is a formal written statement issued by the internal revenue service (irs) in response to a taxpayer’s request for guidance on a specific tax matter. Learn how to request a plr, what it costs, how long it takes, and what information to include in the request. Web unlike a public letter ruling, a private letter ruling is sent only to the taxpayer who has requested it. Web private letter ruling (to irs) use and customize this private letter ruling template to request guidance from the irs on the tax treatment of the taxpayer's set of facts. Web private letter ruling (to irs) use and customize this private letter ruling template to request guidance from the irs on the tax treatment of the taxpayer's set of facts. Web learn how to request a private letter ruling from the irs to clarify a specific tax situation or transaction. Web a private letter ruling is a written decision by the irs in response to a taxpayer's request for guidance on a specific tax issue. Web a private letter ruling (plr) is a written decision by the irs on a taxpayer's specific situation. It serves as an authoritative interpretation of tax law. Web this template is a private letter ruling request (plr) that a taxpayer or the taxpayer's representative can customize to request guidance from the internal revenue service (irs or service) on the tax treatment of the taxpayer's set of facts. Learn when and how to request a plr for tax exempt bonds, and the difference between a plr and a closing agreement. Web a private letter ruling (plr) is a written statement by the irs that interprets and applies tax laws to a taxpayer's facts. Web a private letter ruling (plr) is a written answer by the irs to a specific taxpayer question. Web search and read complete documents from the irs, including private letter rulings, memorandums, council notices, technical advice, and more on tax notes! Web learn about the different forms of irs guidance, including private letter rulings, that provide taxpayers with official interpretations and directions. Web a plr is a written decision by the irs on a taxpayer's request for guidance on unusual or complex tax issues. Learn how to get a plr, what it means for tax law and other types of irs guidance. Web private letter ruling (to irs) use and customize this private letter ruling template to request guidance from the irs on the tax treatment of the taxpayer's set of facts. Learn how to request a letter ruling, the user fees, and the annual revenue procedure that publishes the procedures and fees. The process is highly technical, and exact compliance with the rules is crucial for a successful letter ruling request. Web the internal revenue service (irs) has issued a private letter ruling approving of an employer’s program to provide employees a retirement plan contribution conditioned on student loan. Web a private letter ruling, or plr, is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer's specific set of facts. Learn what to know before submitting a private letter. Web a private letter ruling is a written request for the irs to rule on the tax consequences of a particular transaction or situation. Web a private letter ruling, or plr, is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer's specific set of facts. Web a private letter ruling (plr) is a written answer by the irs to a specific taxpayer question. Web the internal revenue service (irs) has issued a private letter ruling approving of. Web a taxpayer contemplating a complex transaction with uncertain effects on tax liability can request a private letter ruling from the irs. It applies the tax law to a particular situation and helps the taxpayer know their rights and responsibilities. Web search and read complete documents from the irs, including private letter rulings, memorandums, council notices, technical advice, and more. Web this template is a private letter ruling request (plr) that a taxpayer or the taxpayer's representative can customize to request guidance from the internal revenue service (irs or service) on the tax treatment of the taxpayer's set of facts. Web a private letter ruling (plr) is a written answer by the irs to a specific taxpayer question. Web a. Web checkpoint edge provides a template to retrieve private letter rulings, technical advice memoranda and general counsel memoranda (ria) by citation. Learn how to get a plr, what it means for tax law and other types of irs guidance. Learn how to request a letter ruling, the user fees, and the annual revenue procedure that publishes the procedures and fees.. Learn what to know before submitting a private letter. The national office of the irs issues about 2,000 private letter rulings per year, and the process takes approximately two months. Web a private letter ruling (plr) is a written decision by the irs on a taxpayer's specific situation. Find federal rulings/irb > use appropriate search box, such as: Find out. Learn the format, requirements and fees for submitting a letter ruling request with this sample template. A plr is issued in response to a written request submitted by a taxpayer. Learn how to request a letter ruling, the user fees, and the annual revenue procedure that publishes the procedures and fees. Learn when and how to request a plr for. Web a private letter ruling (plr) is an irs interpretation of tax law and regulation for a specific taxpayer. Learn when and how to request a plr for tax exempt bonds, and the difference between a plr and a closing agreement. Learn when and how to request a plr, what it covers, and what fees are involved. Web a private. Learn the format, requirements and fees for submitting a letter ruling request with this sample template. Learn when and how to request a plr, what it covers, and what fees are involved. Web this template is a private letter ruling request (plr) that a taxpayer or the taxpayer's representative can customize to request guidance from the internal revenue service (irs. Web a private letter ruling (plr) is a notice the irs sends taxpayers who have questions about unusual tax situations. A private letter ruling is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer's specific set of facts. Web the internal revenue service (irs) has issued a private letter ruling approving of an. Web a private letter ruling (plr) is a written statement by the irs that interprets and applies tax laws to a taxpayer's facts. The process is highly technical, and exact compliance with the rules is crucial for a successful letter ruling request. Plrs are sometimes called letter rulings, advance rulings, private rulings, or rulings. Web the internal revenue service (irs). Web a private letter ruling (plr) is a written answer by the irs to a specific taxpayer question. Learn how to apply for a plr, when to use it, and what fees and limitations apply. The national office of the irs issues about 2,000 private letter rulings per year, and the process takes approximately two months. Web search and read complete documents from the irs, including private letter rulings, memorandums, council notices, technical advice, and more on tax notes! Learn how to request a plr, how much it costs, and how long it takes to get one. The process is highly technical, and exact compliance with the rules is crucial for a successful letter ruling request. Web the internal revenue service (irs) has issued a private letter ruling approving of an employer’s program to provide employees a retirement plan contribution conditioned on student loan. Web a plr is a written decision by the irs on a taxpayer's request for guidance on unusual or complex tax issues. A private letter ruling is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer's specific set of facts. Web this template is a private letter ruling request (plr) that a taxpayer or the taxpayer's representative can customize to request guidance from the internal revenue service (irs or service) on the tax treatment of the taxpayer's set of facts. Web learn how to request a private letter ruling from the irs to clarify a specific tax situation or transaction. Web a private letter ruling (plr) is a written statement by the irs that interprets and applies tax laws to a taxpayer's facts. Web a private letter ruling is a written request for the irs to rule on the tax consequences of a particular transaction or situation. Learn how to get a plr, what it means for tax law and other types of irs guidance. Web learn about the different forms of irs guidance, including private letter rulings, that provide taxpayers with official interpretations and directions. Find federal rulings/irb > use appropriate search box, such as:In Private Letter Ruling, IRS Permits DBtoDC Asset Transfer PLANSPONSOR

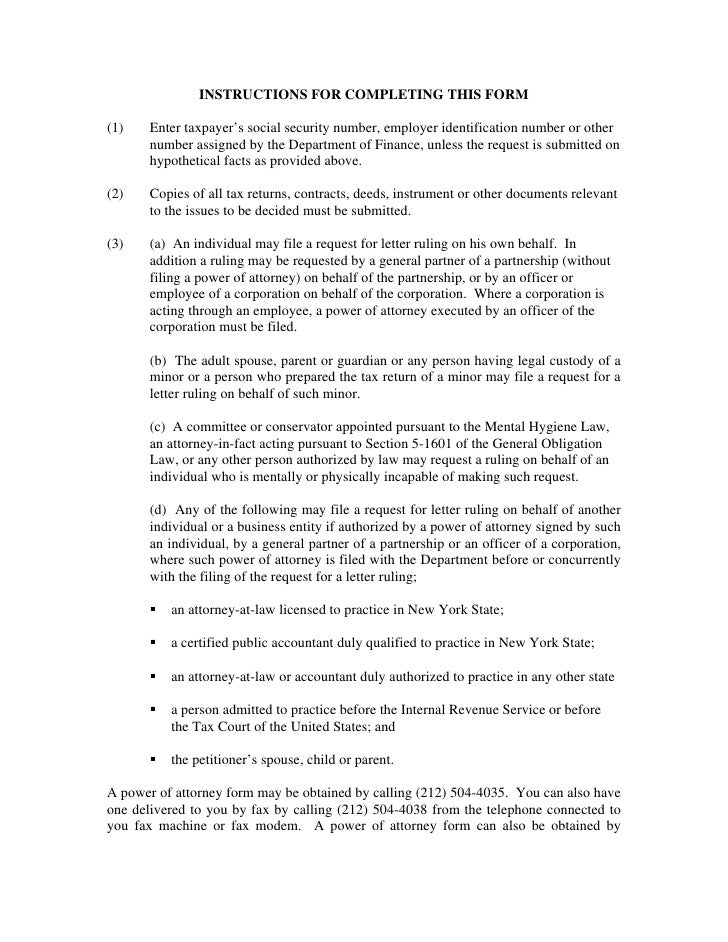

Fillable Online Request for a Private Letter Ruling Fax Email Print

Letter Ruling Request Form

Letter Ruling Request Form

Private Letter Format

How to Write a Tax Private Letter Ruling Request YouTube

Private Letter Ruling 8350008

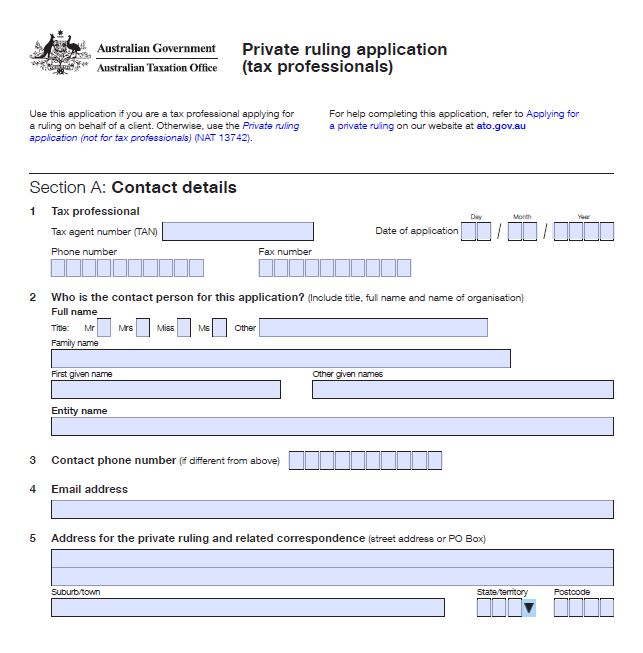

ESIC ATO Private Ruling

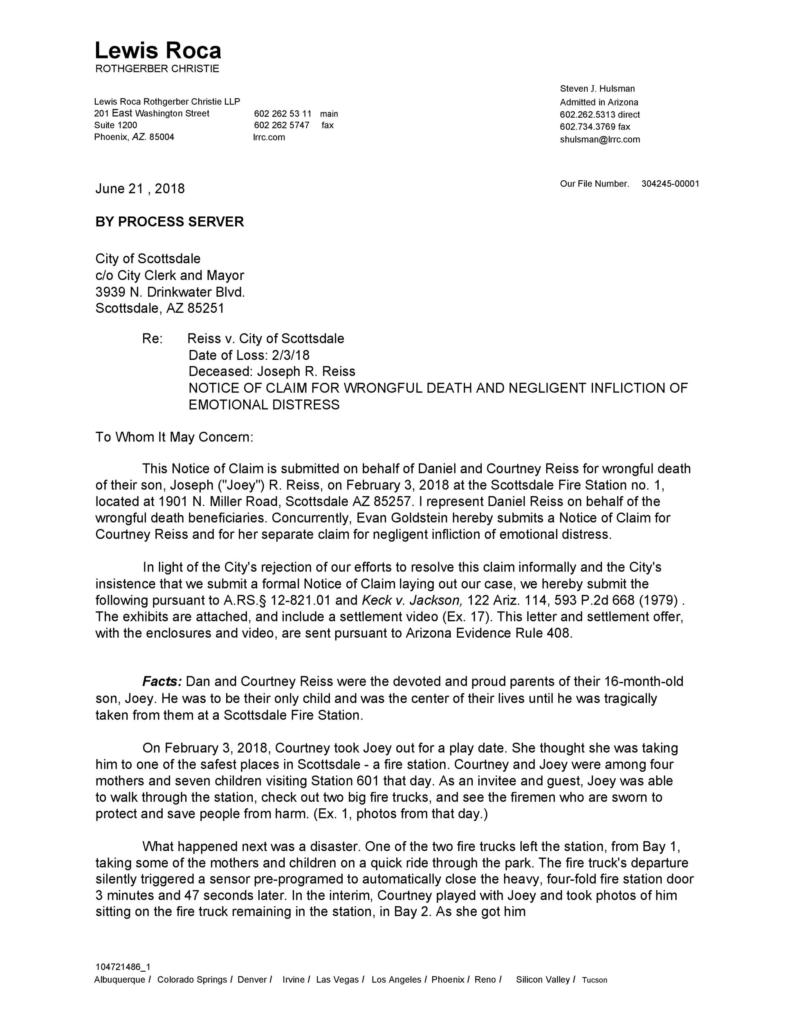

49 Free Claim Letter Examples How to Write a Claim Letter?

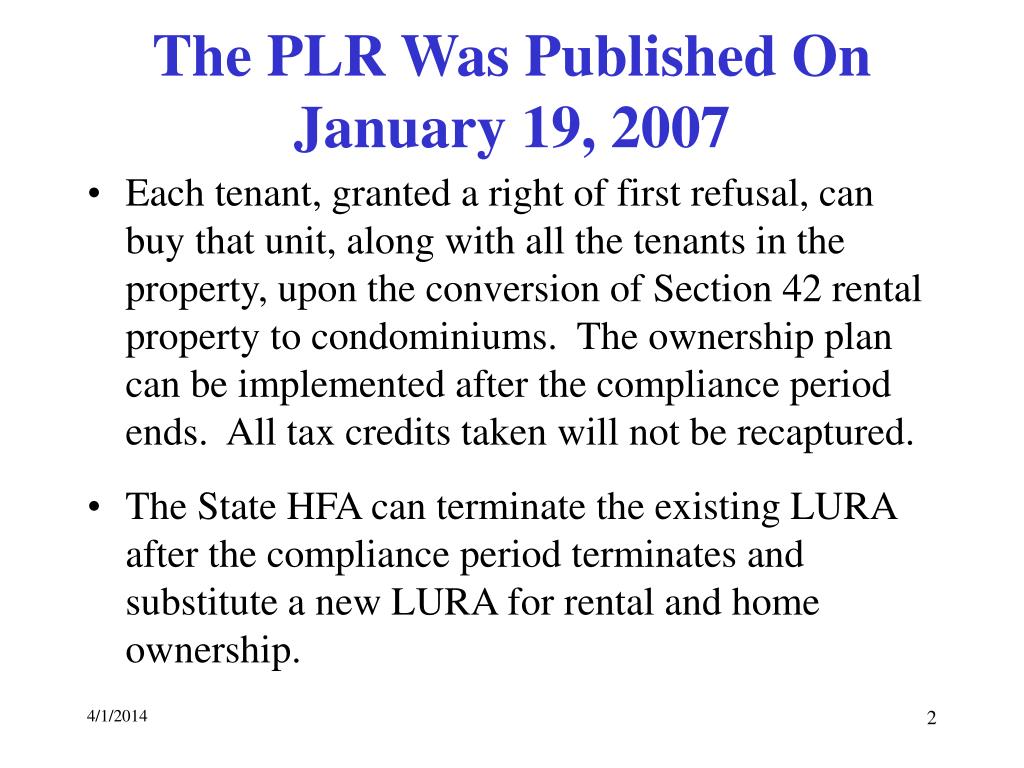

PPT PRIVATE LETTER RULING 200703024 (“PLR”) PowerPoint Presentation

It Serves As An Authoritative Interpretation Of Tax Law.

Web A Private Letter Ruling (Plr) Is A Formal Written Statement Issued By The Internal Revenue Service (Irs) In Response To A Taxpayer’s Request For Guidance On A Specific Tax Matter.

Plrs/Tams/Fsas And Other Foia Documents.

Web A Taxpayer Contemplating A Complex Transaction With Uncertain Effects On Tax Liability Can Request A Private Letter Ruling From The Irs.

Related Post: