Safe Agreement Template

Safe Agreement Template - Use the clara safe note template to get faster funding for your startup & save time. The example below illustrates how a conversion is calculated on a $50,000 investment with a safe agreement offering a 20% discount rate and a $4m valuation cap. Web can the safe model be used in the netherlands and what adjustments are needed? You can view their template here. Web safe stands for simple agreement for future equity. Web generate a simple agreement for future equity (safe)online in a few simple steps & secure funds faster. The safe allows the company to receive capital while not distributing shares to investors until a future date. •it saves startups the trouble of negotiating and agreeing on the amount of equity financing, which is often quite difficult to agree upon between the investor and the company at an early stage of the business. Web a simple agreement for future equity (safe) is a contractual agreement between a startup company and its investors. They come in a few different flavors, all of which we present. In this article we explain how the safe works and for what purpose is the financing instrument. Use the clara safe note template to get faster funding for your startup & save time. Web generate a simple agreement for future equity (safe)online in a few simple steps & secure funds faster. Web safe agreements, also known as simple agreements for future equity and safe notes, are financial agreements that startups use to raise seed financing capital and similar to a warrant. The safe allows the company to receive capital while not distributing shares to investors until a future date. The example below illustrates how a conversion is calculated on a $50,000 investment with a safe agreement offering a 20% discount rate and a $4m valuation cap. They’re an alternative to convertible notes and kiss notes and were introduced by y combinator in 2013. Web the price of the equity that the safe holders receive on conversion is lower than the price of the securities issued to vc investors in connection with a next equity financing, based on both or either: Web a simple agreement for future equity (safe) is a flexible agreement between an investor and a startup where in exchange for upfront money, the investor gains a contractual right to convert that amount into shares in. It exchanges the investor's investment for the right to preferred shares in. Web a simple agreement for future equity (safe) is a flexible agreement between an investor and a startup where in exchange for upfront money, the investor gains a contractual right to convert that amount into shares in. Web this article describes the pre money safe document and how you can access it on savvi. The safe investor would receive 6,250 shares. Web create a simple agreement for future equity (safe) agreement contract in less than 5 minutes with zegal's document builder. A safe is an agreement between an investor and a startup company. You just need to provide your raise goal, valuation cap, and discount rate, and a standard safe note agreement will be generated for you. Web a safe (simple agreement for future equity) agreement is a convertible security that outlines the terms of an investment, including the valuation cap, discount rate, and most favored nation provisions, which collectively determine. Web download the safe agreement template from y combinator that has been annotated to highlight the key features. Use the clara safe note template to get faster funding for your startup & save time. Web a simple agreement for future equity (safe) is a contractual agreement between a startup company and its investors. Web •a simple agreement for future equity (safe) is designed to be simple and short. A safe is an agreement between an investor and a startup company. You just need to provide your raise goal, valuation cap, and discount rate, and a standard safe note agreement will be generated for you. Web can the safe model be used in the. Web a safe (simple agreement for future equity) agreement is an innovative investment instrument that allows startups to secure funding from investors without immediately issuing equity. The safe allows the company to receive capital while not distributing shares to investors until a future date. Web this article describes the pre money safe document and how you can access it on. Web startup accelerator y combinator (commonly referred to simply as “yc”) released a set of financing documents (referred to as “safe”, or “simple agreement for future equity”). Use the clara safe note template to get faster funding for your startup & save time. You just need to provide your raise goal, valuation cap, and discount rate, and a standard safe. A safe is a convertible instrument, which is a type of investment that converts into equity at a specified time. You just need to provide your raise goal, valuation cap, and discount rate, and a standard safe note agreement will be generated for you. They come in a few different flavors, all of which we present. Web •a simple agreement. Web download the safe agreement template from y combinator that has been annotated to highlight the key features. A safe is a convertible instrument, which is a type of investment that converts into equity at a specified time. Web safe stands for simple agreement for future equity. You can view their template here. You just need to provide your raise. Web startup accelerator y combinator (commonly referred to simply as “yc”) released a set of financing documents (referred to as “safe”, or “simple agreement for future equity”). In this article we explain how the safe works and for what purpose is the financing instrument. Use the clara safe note template to get faster funding for your startup & save time.. A safe is an agreement between an investor and a startup company. Web the price of the equity that the safe holders receive on conversion is lower than the price of the securities issued to vc investors in connection with a next equity financing, based on both or either: Web can the safe model be used in the netherlands and. You can view their template here. Web safe stands for simple agreement for future equity. Web learn all about safe agreements fast and easy with examples. Use the clara safe note template to get faster funding for your startup & save time. Web simple agreement for future equity (safe) is a financing tool for startups, offering a simpler, more flexible. You just need to provide your raise goal, valuation cap, and discount rate, and a standard safe note agreement will be generated for you. Web a safe (simple agreement for future equity) agreement is a convertible security that outlines the terms of an investment, including the valuation cap, discount rate, and most favored nation provisions, which collectively determine. With safes,. Web generate a simple agreement for future equity (safe)online in a few simple steps & secure funds faster. In this article we explain how the safe works and for what purpose is the financing instrument. Web the price of the equity that the safe holders receive on conversion is lower than the price of the securities issued to vc investors. A safe is an agreement between an investor and a startup company. Web a simple agreement for future equity (safe) is a flexible agreement between an investor and a startup where in exchange for upfront money, the investor gains a contractual right to convert that amount into shares in. Web •a simple agreement for future equity (safe) is designed to be simple and short. Web learn all about safe agreements fast and easy with examples. Web the price of the equity that the safe holders receive on conversion is lower than the price of the securities issued to vc investors in connection with a next equity financing, based on both or either: They come in a few different flavors, all of which we present. Web safe (simple agreement for future equity) a safe is an investment agreement between an early stage company and an investor. The safe allows the company to receive capital while not distributing shares to investors until a future date. They’re an alternative to convertible notes and kiss notes and were introduced by y combinator in 2013. •it saves startups the trouble of negotiating and agreeing on the amount of equity financing, which is often quite difficult to agree upon between the investor and the company at an early stage of the business. A safe is a convertible instrument, which is a type of investment that converts into equity at a specified time. Web safe agreements, also known as simple agreements for future equity and safe notes, are financial agreements that startups use to raise seed financing capital and similar to a warrant. Web startup accelerator y combinator (commonly referred to simply as “yc”) released a set of financing documents (referred to as “safe”, or “simple agreement for future equity”). The safe investor would receive 6,250 shares. Find out the benefits and risks in comparison to the other investment methods. Web a safe agreement is an investment contract between a startup and investors that grants the investors rights to future equity in the company, without determining a specific valuation at the time of the investment.SAFE Note or SAFE Agreement Template Customizable Legal Document

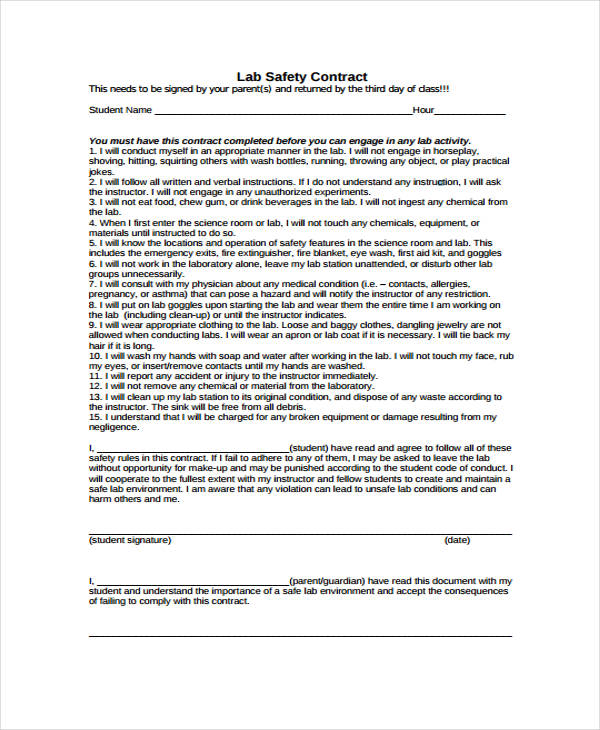

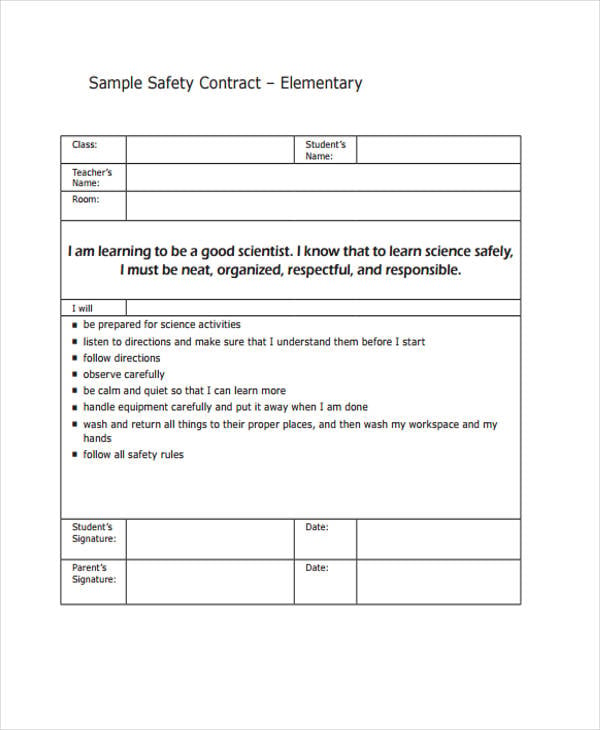

6+ Safety Contract Templates Free Sample, Example Format Download

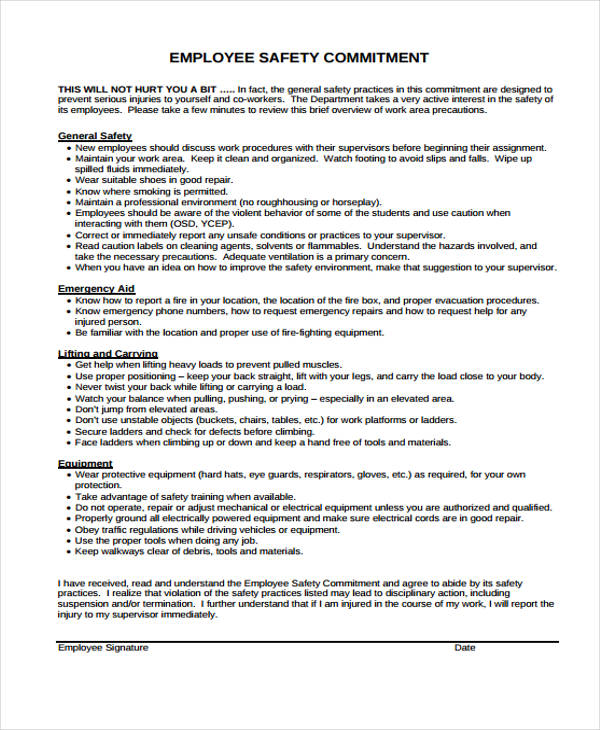

Safety Contract Templates 9+Free Word, PDF Format Download

FREE 5+ Safety Contract Samples & Templates in PDF MS Word

6+ Safety Contract Templates Free Sample, Example Format Download

FREE 15+ Safety Contract Samples & Templates in MS Word PDF

FREE 5+ Safety Contract Samples & Templates in PDF MS Word

Safety Contract Template What You Need To Know Free Sample, Example

FREE 15+ Safety Contract Samples & Templates in MS Word PDF

SAFE (Simple Agreement for Future Equity) Template in Word doc

Web Can The Safe Model Be Used In The Netherlands And What Adjustments Are Needed?

You Just Need To Provide Your Raise Goal, Valuation Cap, And Discount Rate, And A Standard Safe Note Agreement Will Be Generated For You.

Web Create A Simple Agreement For Future Equity (Safe) Agreement Contract In Less Than 5 Minutes With Zegal's Document Builder.

It Exchanges The Investor's Investment For The Right To Preferred Shares In.

Related Post: