Schedule C Template

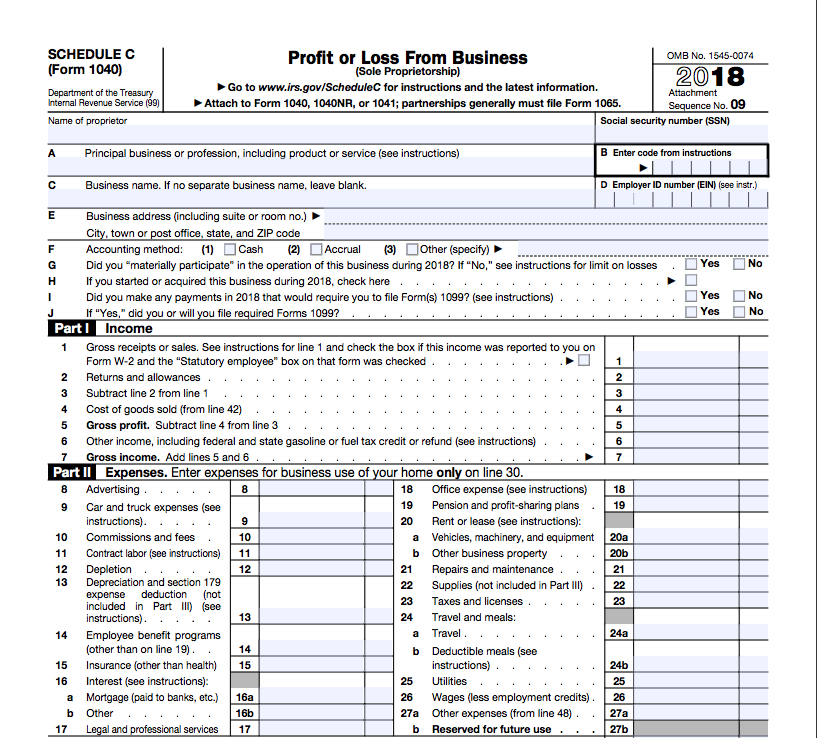

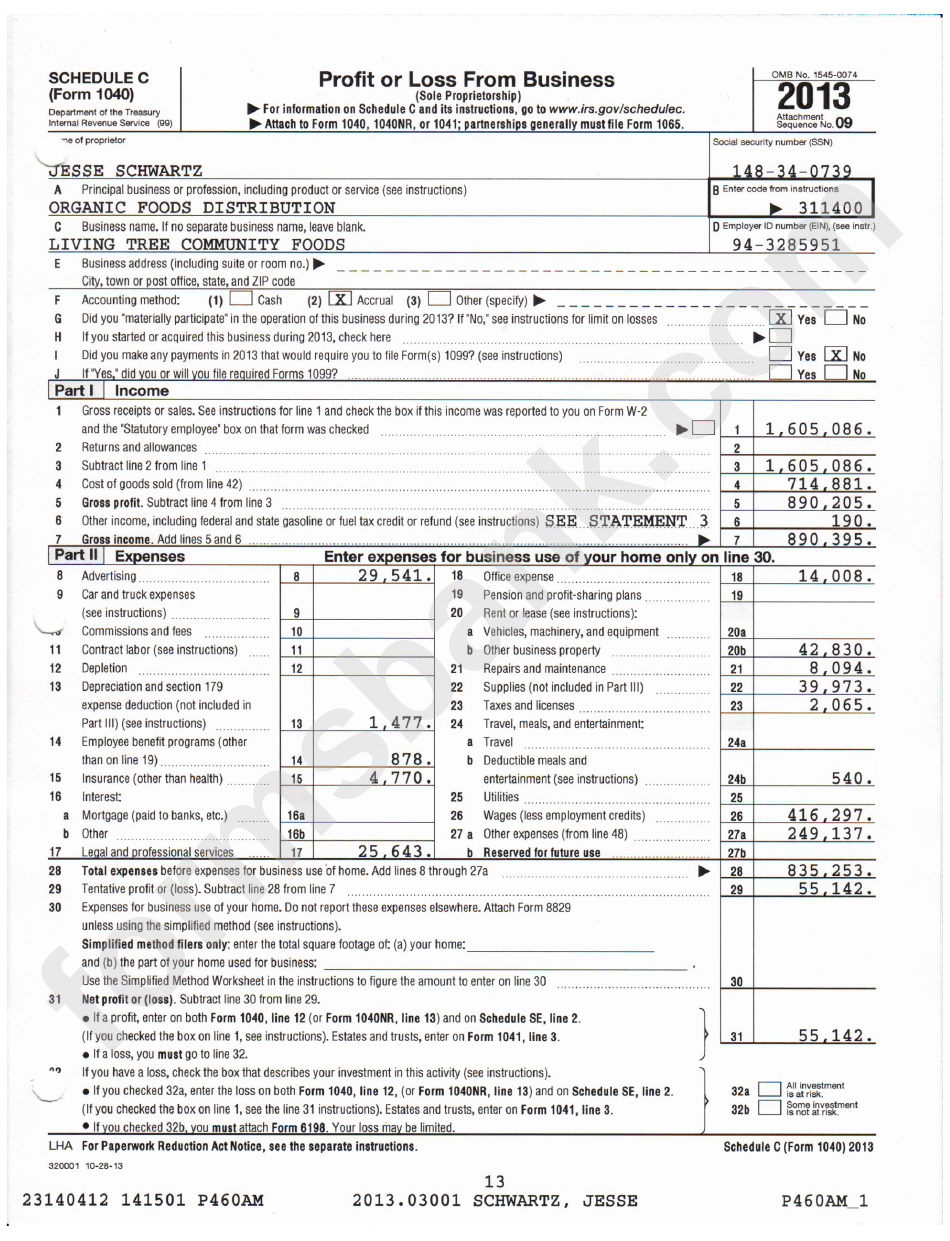

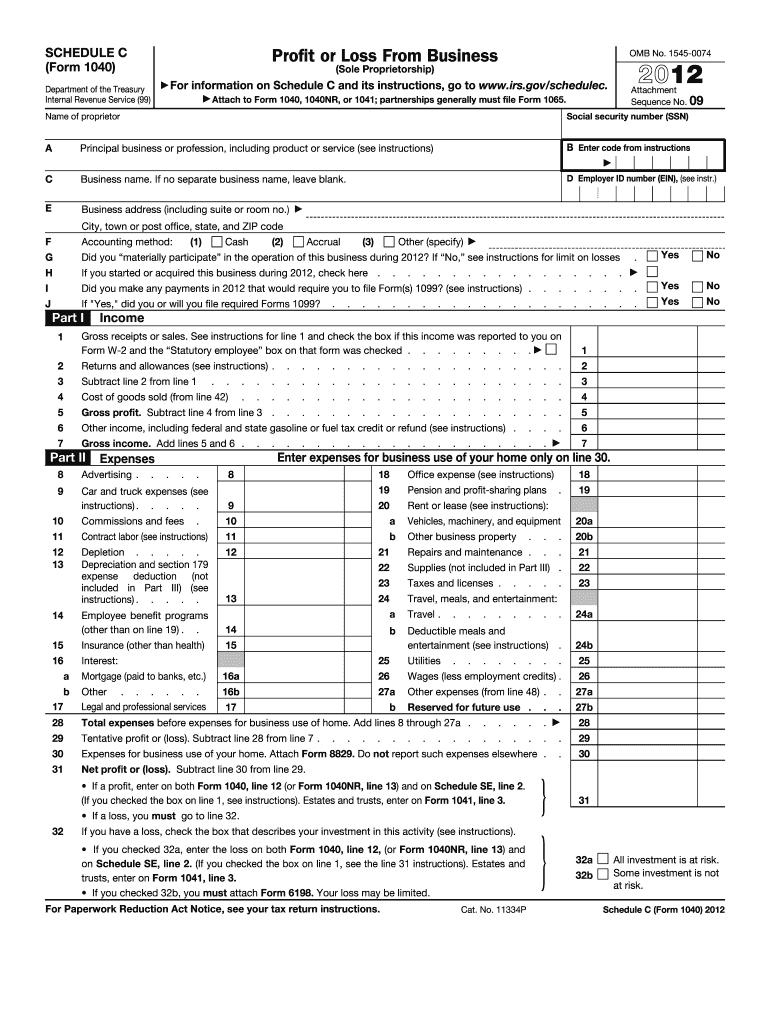

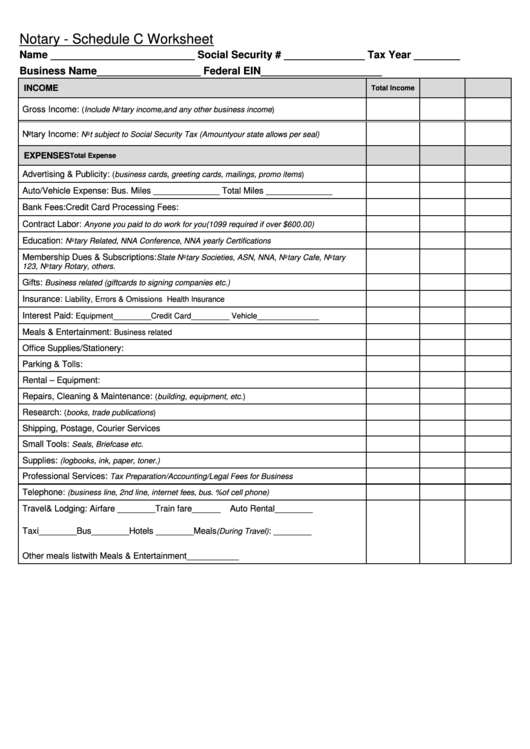

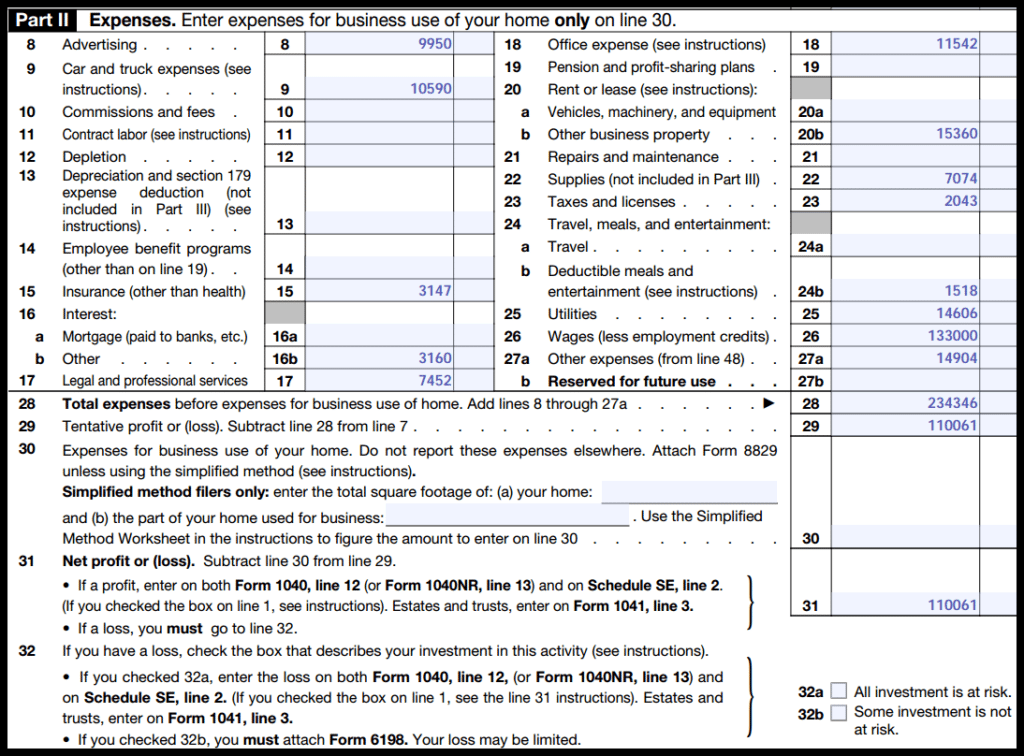

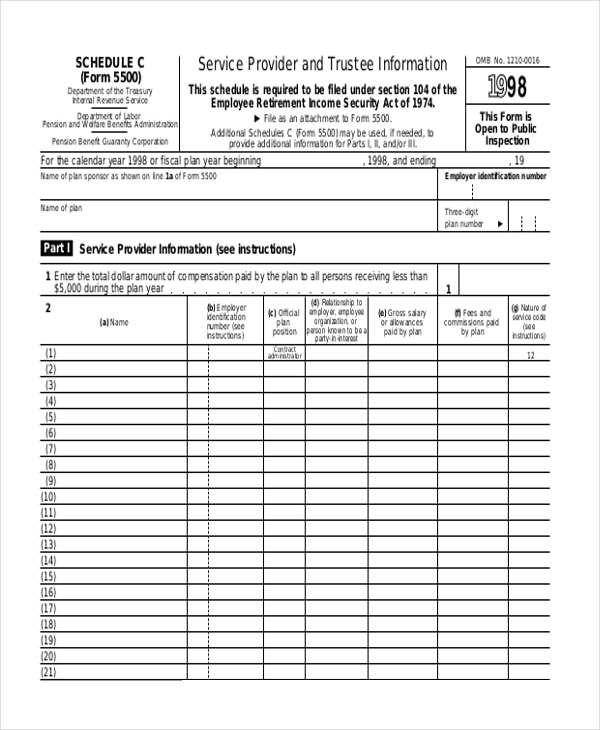

Schedule C Template - Complete the form, adding information and doing the calculations as you go. Known as a profit or loss from business. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. This guide covers who needs to use it, how many forms to. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web what is schedule c? Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. You fill out schedule c at tax time and attach it to or file it. Web our schedule c tax preparation checklist for self employed tax filers will help you determine what paperwork is needed and what you can deduct Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Complete the form, adding information and doing the calculations as you go. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Schedule c is an irs tax form to report the profit and loss from a business operated or profession performed as a sole proprietor. Web what is schedule c? Web schedule c is for business owners to report their income for tax purposes. Web what is schedule c? Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web our schedule c tax preparation checklist for self employed tax filers will help you determine what paperwork is needed and what you can deduct Web what is schedule c: Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Profit or loss from business (form 1040)? Browse 21 form 1040 schedule c templates collected for any of your needs. Web what is schedule c: An activity qualifies as a business if your. Schedule c is an irs tax form to report the profit and loss from a business operated or profession performed as a sole proprietor. Web schedule c is for business owners to report their income for tax purposes. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Complete the form, adding information and doing the calculations as you go. A schedule c form is a supplemental form that is sent with a 1040 when someone is a sole proprietor. Web our schedule c tax preparation checklist for self employed tax filers will help you determine what paperwork is needed and what you can deduct An activity qualifies as a business if your. Schedule c is an irs tax form to report the profit and loss from a business operated or profession performed as a sole proprietor. An activity qualifies. An activity qualifies as a business if Web what is schedule c: Known as a profit or loss from business. Web schedule c details all of the income and expenses incurred by your business, and the resulting profit or loss is included on schedule 1 of form 1040. Browse 21 form 1040 schedule c templates collected for any of your. Profit or loss from business (form 1040)? Web what is schedule c? Web our schedule c tax preparation checklist for self employed tax filers will help you determine what paperwork is needed and what you can deduct Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to. Web what is schedule. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web schedule c details all of the income and expenses incurred by your business, and the resulting profit or loss is included on schedule 1 of form 1040. A schedule c form is a supplemental. Complete the form, adding information and doing the calculations as you go. Web view, download and print fillable schedule c irs 1040 in pdf format online. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. Web use schedule c (form 1040) to report. Web our schedule c tax preparation checklist for self employed tax filers will help you determine what paperwork is needed and what you can deduct Known as a profit or loss from business. This guide covers who needs to use it, how many forms to. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have. Web schedule c form 1040. An activity qualifies as a business if Schedule c is an irs tax form to report the profit and loss from a business operated or profession performed as a sole proprietor. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Browse 21 form 1040 schedule c templates collected for any of your needs. You fill out schedule c at tax time and attach it to or file it. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web what is. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to. Web schedule c details all of the income and expenses incurred by your business, and the resulting profit or loss is included on schedule 1 of form 1040. Known as a profit or loss from business. An activity qualifies as a. Irs schedule c is a tax form for reporting profit or loss from a business. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. Web schedule c form 1040. Web what is schedule c? An activity qualifies as a business if your. Web what is schedule c? Web schedule c details all of the income and expenses incurred by your business, and the resulting profit or loss is included on schedule 1 of form 1040. Browse 21 form 1040 schedule c templates collected for any of your needs. Known as a profit or loss from business. Profit or loss from business (form 1040)? Complete the form, adding information and doing the calculations as you go. A schedule c form is a supplemental form that is sent with a 1040 when someone is a sole proprietor. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. You fill out schedule c at tax time and attach it to or file it. Web what is schedule c: An activity qualifies as a business ifFREE 9+ Sample Schedule C Forms in PDF MS Word

FREE 9+ Sample Schedule C Forms in PDF MS Word

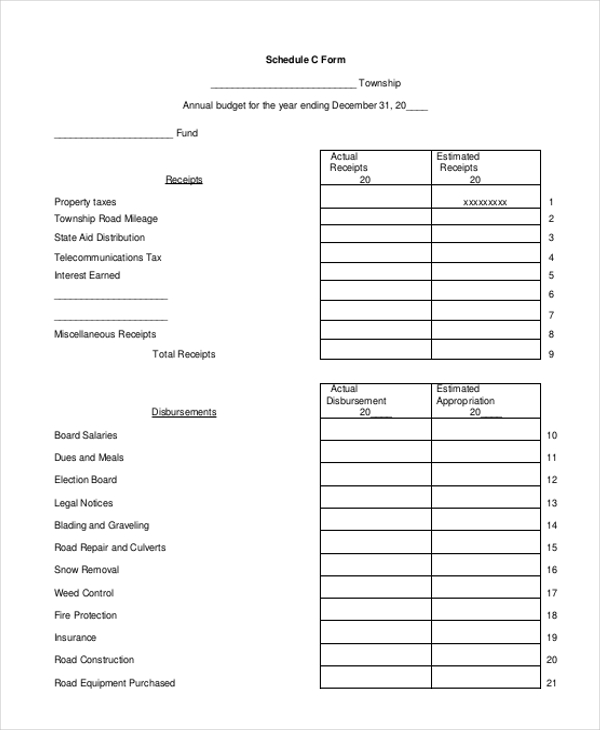

Schedule C Form Fillable Free

Form 1040 Schedule C Sample Profit Or Loss From Business printable

FREE 9+ Sample Schedule C Forms in PDF MS Word

1040 Schedule C 20122024 Form Fill Out and Sign Printable PDF

Schedule C Form Template

How to Complete Schedule C Profit and Loss From a Business

FREE 9+ Sample Schedule C Forms in PDF MS Word

FREE 9+ Sample Schedule C Forms in PDF MS Word

Web If You Are The Sole Owner Of A Business Or Operate As An Independent Contractor, You Will Need To File A Schedule C To Report Income Or Loss From Your Business Activities.

An Activity Qualifies As A Business If

Irs Schedule C Is A Tax Form For Reporting Profit Or Loss From A Business.

Irs Schedule C, Profit Or Loss From Business, Is A Tax Form You File With Your Form 1040 To.

Related Post: