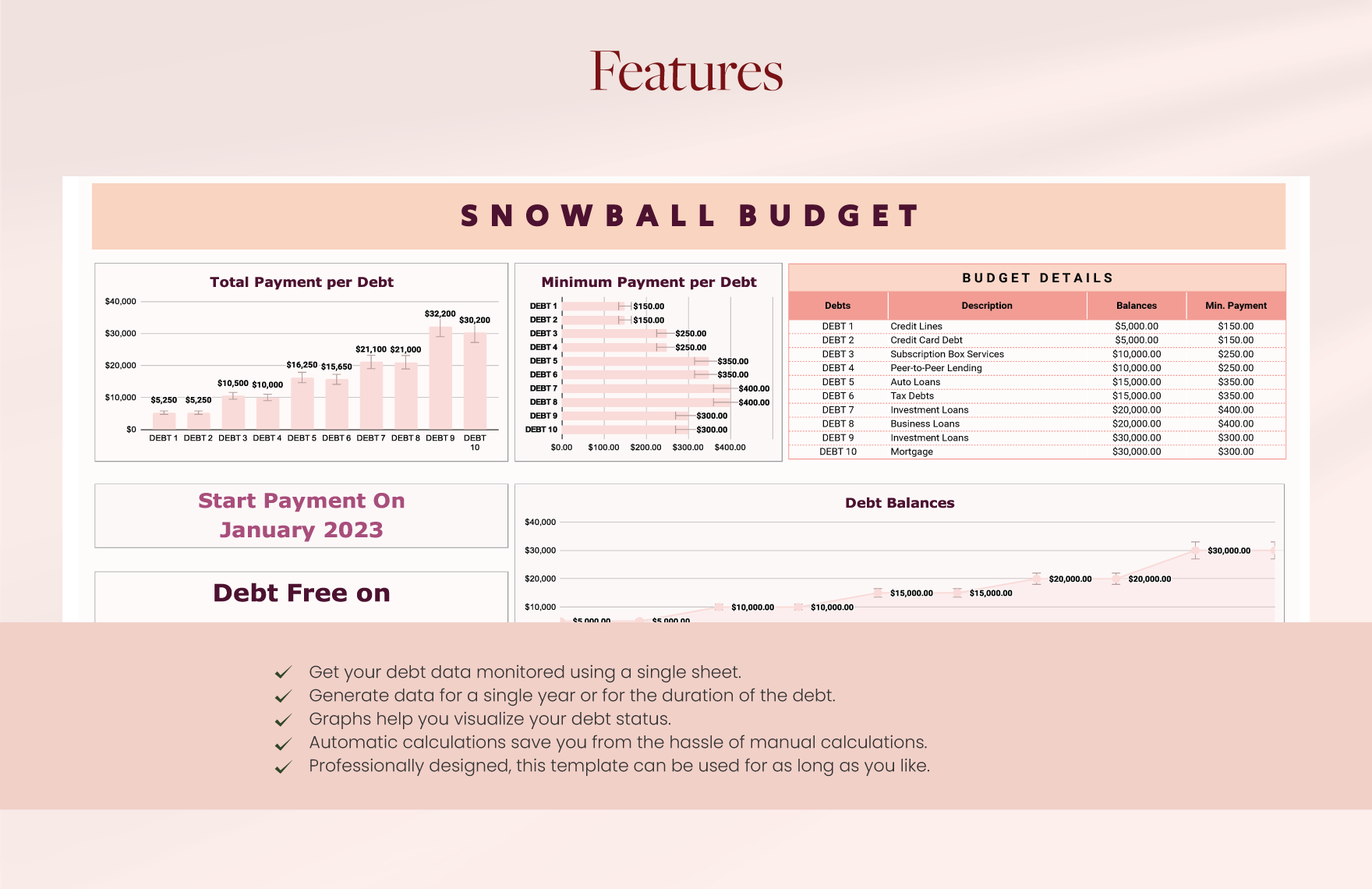

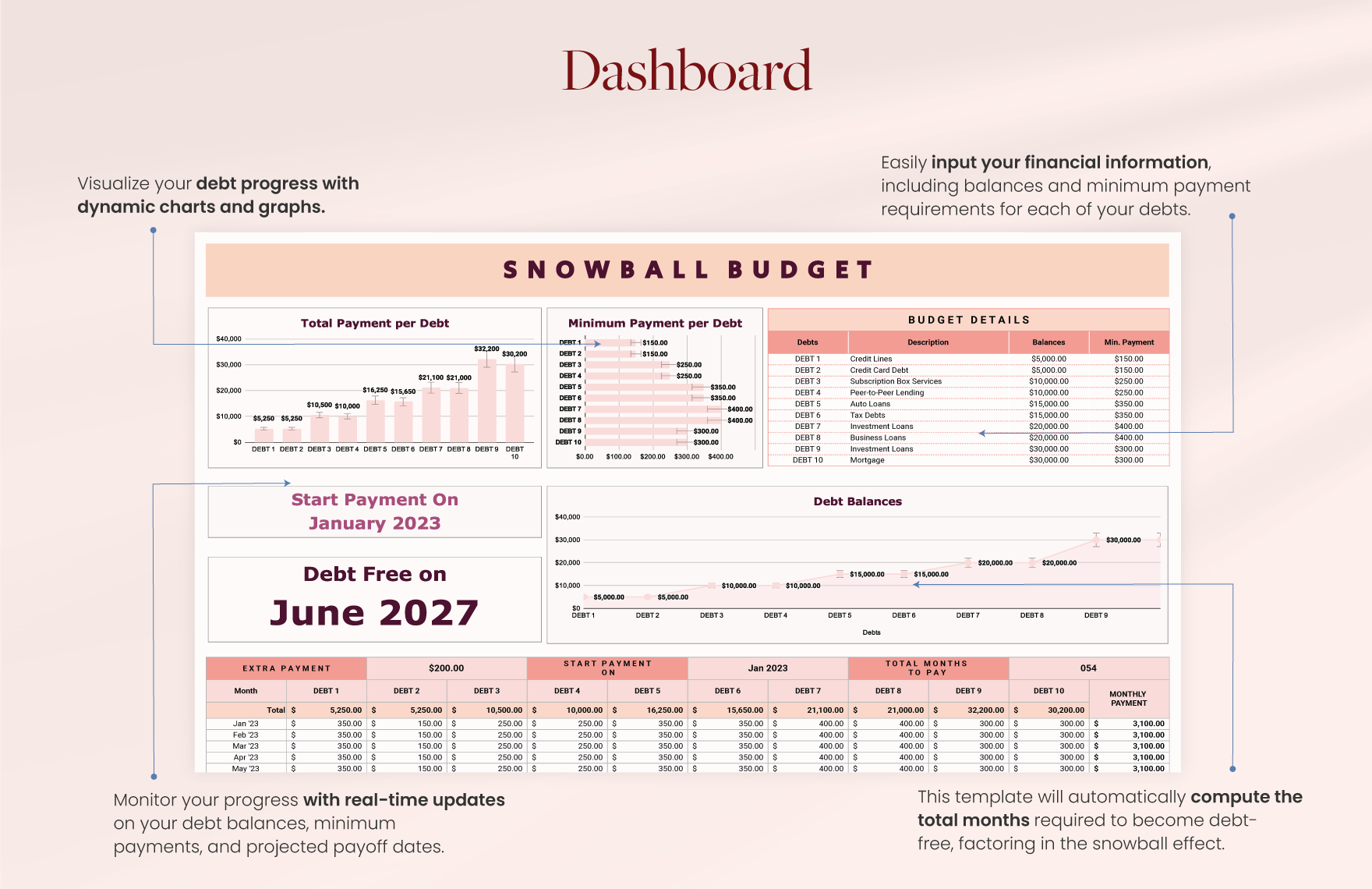

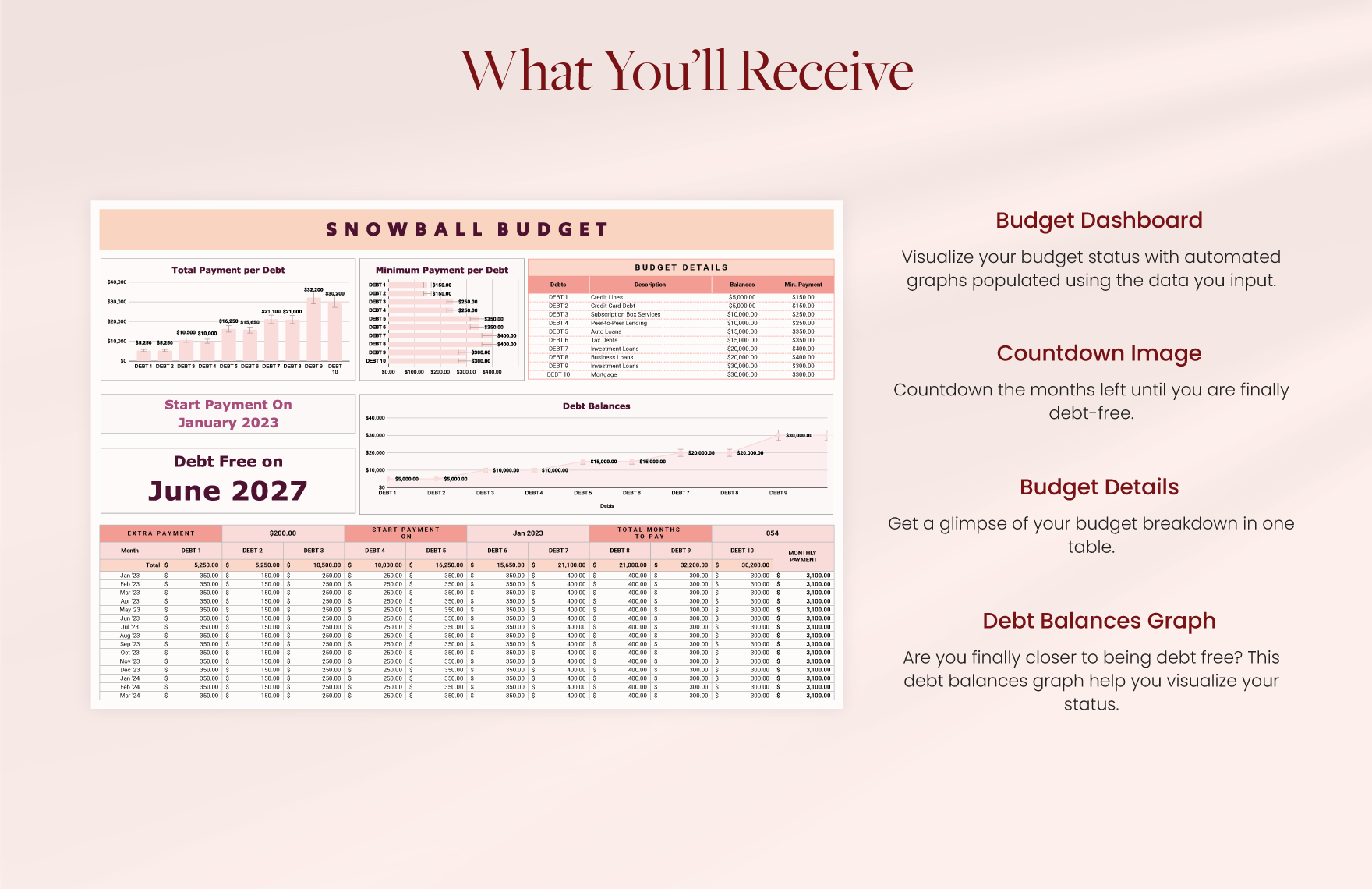

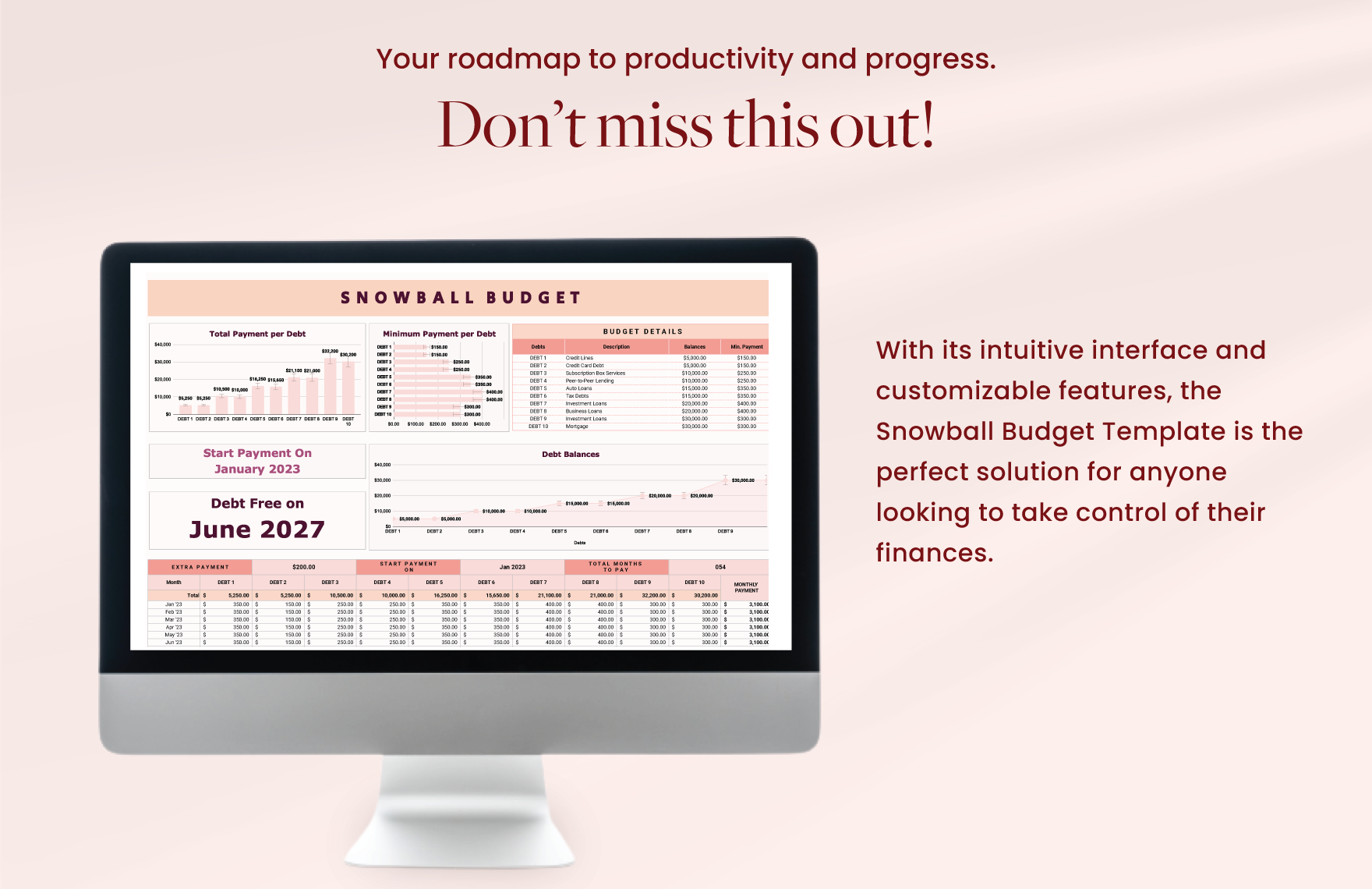

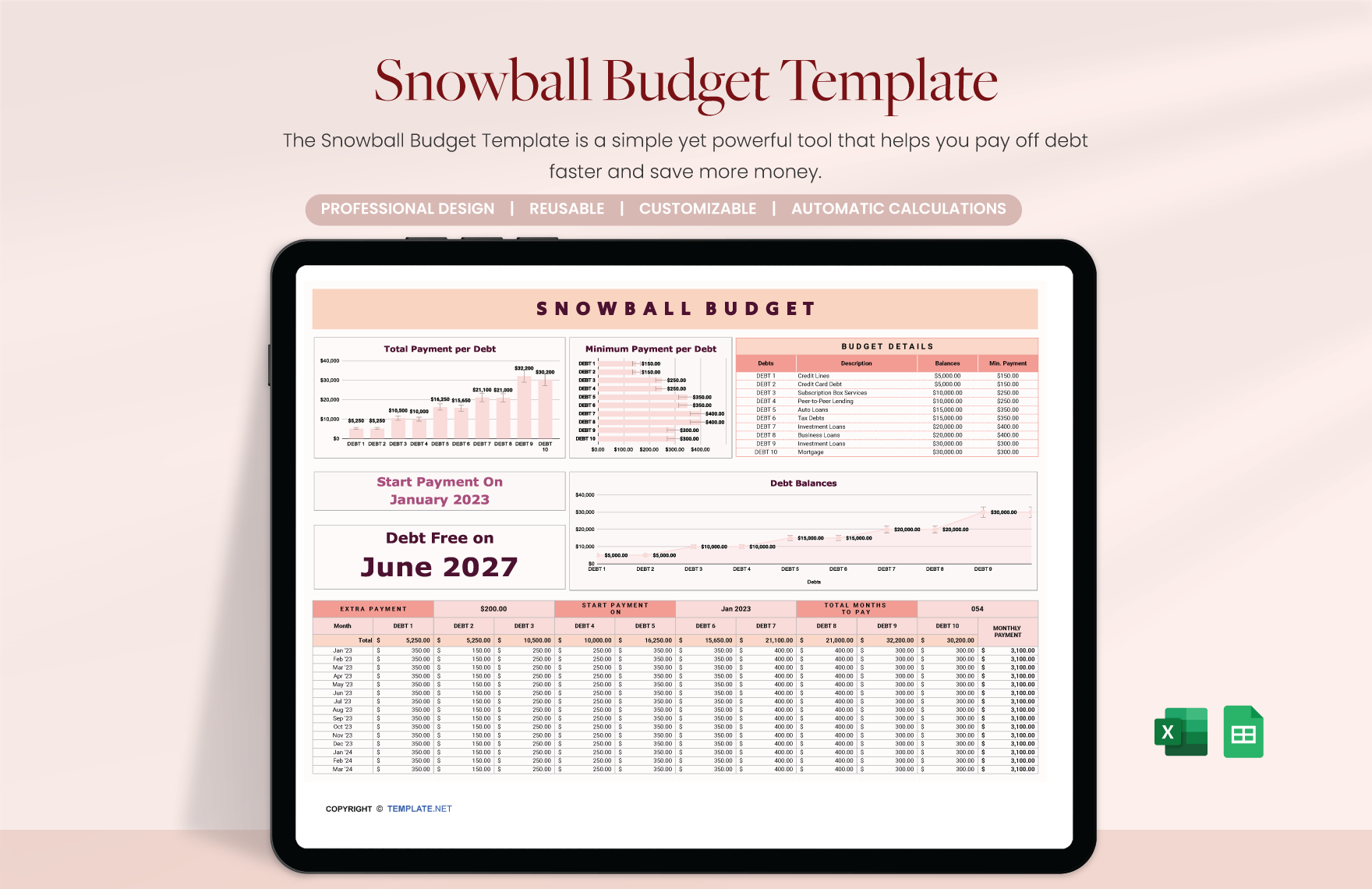

Snowball Budget Template

Snowball Budget Template - If you’ve been looking into how to get out of debt, then you may have heard of the debt snowball method. Web here’s how to use the debt snowball spreadsheet to start paying down your debt today: Web key features of the template: Web use this debt snowball worksheet to stay organized and track the progress of your own debt payment. It contains tables for each date, including the monthly payments, balances, and payment dates. Repeat until each debt is paid in full. Pay as much as possible on your smallest debt. This is the exact amount you have leftover at the end of the month. Just like an actual snowball rolling down a hill, the idea is the amount you pay towards each debt accumulates over time, and your debt is paid off faster. In the first worksheet, you enter your creditor information and your total monthly payment. Like travel or retire early. It boasts plenty of tools to calculate monthly and yearly expenses instantly. I just was making some updates to our budgeting templates page where we have a bunch of free excel and google doc spreadsheets available. Web here’s how to use the debt snowball spreadsheet to start paying down your debt today: Web here’s how the debt snowball works: Web if you have multiple credit card balances, the debt snowball method helps you prioritize paying off your debt by smallest amount. Web a debt snowball worksheet is a fillable form that users can complete to create a snowball plan to repay their debts. List your debts from smallest to largest. Available as printable pdf or google docs sheet. Web to make it easier for you to start your debt snowball, i created a free printable debt snowball worksheet! Web to make it easier for you to start your debt snowball, i created a free printable debt snowball worksheet! Web use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. It contains tables for each date, including the monthly payments, balances, and payment dates. Make minimum payments on all your debts except the smallest. Web a debt snowball worksheet is a fillable form that users can complete to create a snowball plan to repay their debts. As you can see, by paying an extra $500 a month, we’ll be able to snowball them and escape the grips of debt in just 1.6 years ( instead of over four years ). Pay as much as possible on your smallest debt. Visualize the expected date for complete debt freedom based on your chosen repayment strategy. If you haven’t already, download a copy of my budget template, fill out all your budget details, and then see what is left. We have lots of budget printables available in our shop and for free to help you on your debt free journey. Web in this article, we review the best free debt snowball templates for excel & google sheets to help you manage your finances more effectively. Web to make it easier for you to start your debt snowball, i created a free printable debt snowball worksheet! Manage up to 32 debts seamlessly. Web use this debt snowball worksheet to stay organized. The worksheets are designed to simplify the process by guiding users where and what information to input. Manage up to 32 debts seamlessly. Web key features of the template: Repeat until each debt is paid in full. Web use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Web here’s how to use the debt snowball spreadsheet to start paying down your debt today: We have lots of budget printables available in our shop and for free to help you on your debt free journey. Web see the updated debt snowball tracker template below: Easily create a debt reduction schedule based on the popular debt snowball strategy, or. Manage up to 32 debts seamlessly. Just like an actual snowball rolling down a hill, the idea is the amount you pay towards each debt accumulates over time, and your debt is paid off faster. Web here’s how to use the debt snowball spreadsheet to start paying down your debt today: Make minimum payments on all debts except the smallest—throwing. Pay as much as possible on your smallest debt. You can use these forms to list down all your debts and add them to come up with the total. Web to make it easier for you to start your debt snowball, i created a free printable debt snowball worksheet! Then you can plan out how much you’ll set aside per. List your debts from smallest to largest. Like travel or retire early. Pay as much as possible on your smallest debt. Web in order to keep track of the payments you’re making, you can use a debt snowball form or a debt payoff spreadsheet. Then you can plan out how much you’ll set aside per month for your debts. Just like an actual snowball rolling down a hill, the idea is the amount you pay towards each debt accumulates over time, and your debt is paid off faster. Then you can plan out how much you’ll set aside per month for your debts. Make minimum payments on all debts except the smallest—throwing as much money as you can at. It boasts plenty of tools to calculate monthly and yearly expenses instantly. You can use these forms to list down all your debts and add them to come up with the total. Web in order to keep track of the payments you’re making, you can use a debt snowball form or a debt payoff spreadsheet. Web here’s how the debt. Then you can plan out how much you’ll set aside per month for your debts. Web in this article, we review the best free debt snowball templates for excel & google sheets to help you manage your finances more effectively. As you can see, by paying an extra $500 a month, we’ll be able to snowball them and escape the. You can use these forms to list down all your debts and add them to come up with the total. This is the exact amount you have leftover at the end of the month. The worksheets are designed to simplify the process by guiding users where and what information to input. Web if you have multiple credit card balances, the. It contains tables for each date, including the monthly payments, balances, and payment dates. Web key features of the template: Make minimum payments on all debts except the smallest—throwing as much money as you can at that one. Web use this debt snowball worksheet to stay organized and track the progress of your own debt payment. Learn how to create one and download our free template to track your payments and save money. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. These spreadsheets work best with the debt snowball method. Web eliminate debt fast with a debt snowball spreadsheet. If you’ve been looking into how to get out of debt, then you may have heard of the debt snowball method. Web debt snowball spreadsheets are extremely helpful in planning your debt freedom strategy. Like travel or retire early. Web in order to keep track of the payments you’re making, you can use a debt snowball form or a debt payoff spreadsheet. Web to make it easier for you to start your debt snowball, i created a free printable debt snowball worksheet! Once that debt is gone, take its payment and apply it to the next smallest debt (while continuing to make minimum. Web here’s how the debt snowball method works: Web find the best free printable debt snowball worksheet or spreadsheet in google docs for your needs so you can get out of debt fast.Snowball Budget Template in Excel, Google Sheets Download

Snowball Budget Template in Excel, Google Sheets Download

Debt Snowball Tracker and Weekly Budget Planner Spreadsheet, Printable

Snowball Budget Template in Excel, Google Sheets Download

Snowball Debt Plan Worksheet Excel

Snowball Budget Template in Excel, Google Sheets Download

Snowball Budget Template in Excel, Google Sheets Download

Snowball Budget Template in Excel, Google Sheets Download

Debt Snowball Tracker Budget Template Planner Inserts Etsy Canada

Snowball Budget Template in Excel, Google Sheets Download

List Your Debts From Smallest To Largest.

Web In This Article, We Review The Best Free Debt Snowball Templates For Excel & Google Sheets To Help You Manage Your Finances More Effectively.

Make Minimum Payments On All Your Debts Except The Smallest.

List Your Debts From Smallest To Largest Regardless Of Interest Rate.

Related Post: