Standby Letter Of Credit Template

Standby Letter Of Credit Template - An overview of the different types of sblc available Web ein standby letter of credit (sblc) ist eine art von garantie, die von einer bank oder einem finanzinstitut im auftrag eines kunden ausgestellt wird. Web commercial lawyers can use this annotated template standby letter of credit to draft when, at a customer's request, a bank must honor drafts or other demands for payment by the beneficiary of the letter of credit. Web standby letter of credit (lc) is a globally accepted financial instrument where an issuing bank takes on its clients’ obligation to: Top tips and best practice for corporates. Web a standby letter of credit (sblc) is a legal instrument issued by a bank. Repay money borrowed by or advanced to or for the account of the account party, make payment on account of any indebtedness undertaken by the account party, or. Web ‘standby letter of credit (sblc) is a type of letter of credit (lc) where the issuing bank commits to pay to the beneficiary if the applicant fails to make the payment. Web standby letters of credit (sblc): Diese garantie stellt sicher, dass ein bestimmter betrag an den begünstigten gezahlt wird, falls der kunde seinen vertraglichen verpflichtungen nicht nachkommt. The sblc describes the conditions that would cause the bank to pay. Risks and considerations to be aware of when using standby letters of credit; Web a standby letter of credit (sblc) refers to a legal instrument issued by a bank on behalf of its client, providing a guarantee of its commitment to pay the seller if its client (the buyer) defaults on the agreement. The standby letter of credit (standby lc) is, like the guarantee, commonly used to cover the risk of a contract party not fulfilling agreed obligations, for instance failure to pay or deliver. It is a payment of last resort from. Web standby letters of credit. It ensures payment and delivery of goods by guaranteeing that the buyer will pay for the goods supplied by the seller within a specified time period. Our free templates and this guide can help you get started. Web in this extremely comprehensive guide to standby letters of credit (sblc), we cover: Web standby letters of credit (sloc) have become an integral part of the modern business world, providing companies with essential financial protection and security. Web letter of credit is a financial instrument that plays an important role in protecting both parties in a trade transaction. Web you can request a standby letter of credit from the bank that examines your creditworthiness and makes a decision within several days or weeks. A printable standby letter of credit template can be downloaded through the link below. Web a standby letter of credit (sloc) provides financial security to a seller by guaranteeing payment or performance if the buyer defaults on a contract. Web ‘standby letter of credit (sblc) is a type of letter of credit (lc) where the issuing bank commits to pay to the beneficiary if the applicant fails to make the payment. Risks and considerations to be aware of when using standby letters of credit; Diese garantie stellt sicher, dass ein bestimmter betrag an den begünstigten gezahlt wird, falls der kunde seinen vertraglichen verpflichtungen nicht nachkommt. Web a standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be made even if their client cannot fulfill the payment. Web standby letter of credit (lc) is a globally accepted financial instrument where an issuing bank takes on its clients’ obligation to: The sblc describes the conditions that would cause the bank to pay. Vivian brings over 15 years of banking experience to her role as product manager at bank of china, london, where she oversees the guarantees/sblc product, including management, marketing, and innovation. Web what is a standby letter of credit (sblc) •in short (and very simply put) ; What a standby letter of credit is; Why sblcs are used more commonly in. The sblc describes the conditions that would cause the bank to pay. Web ‘standby letter of credit (sblc) is a type of letter of credit (lc) where the issuing bank commits to pay to the beneficiary if the applicant fails to make the payment. Diese garantie stellt sicher, dass ein bestimmter betrag an den begünstigten gezahlt wird, falls der kunde. Web the most common types of letters of credit today are commercial letters of credit, standby letters of credit, revocable letters of credit, irrevocable letters of credit,. Web ‘standby letter of credit (sblc) is a type of letter of credit (lc) where the issuing bank commits to pay to the beneficiary if the applicant fails to make the payment. Web. Web a standby letter of credit (sblc) can add a safety net that ensures payment for a completed service or a shipment of physical goods. It represents the bank’s guarantee to make payment to the seller of a certain amount in the event the buyer is unable to make the payment themself as agreed. The standby letter of credit (standby. It represents the bank’s guarantee to make payment to the seller of a certain amount in the event the buyer is unable to make the payment themself as agreed. Slocs are commonly used in international trade and large transactions to reduce risk and ensure trust between unfamiliar parties. Web a standby letter of credit (sblc) is a legal instrument issued. Web what is a standby letter of credit (sblc) •in short (and very simply put) ; A standby letter of credit is a legal template that outlines an agreement between a bank and a customer, where the bank guarantees payment to a third party in the event that the customer fails to fulfill their financial obligations. It represents the bank’s. Web a standby letter of credit (sloc) is a legal document that guarantees a bank's commitment of payment to a seller in the event that the buyer—or the bank's client—defaults on the. Web commercial lawyers can use this annotated template standby letter of credit to draft when, at a customer's request, a bank must honor drafts or other demands for. A standby letter of credit is a legal template that outlines an agreement between a bank and a customer, where the bank guarantees payment to a third party in the event that the customer fails to fulfill their financial obligations. Vivian brings over 15 years of banking experience to her role as product manager at bank of china, london, where. Our free templates and this guide can help you get started. What is sblc used for? It represents the bank’s guarantee to make payment to the seller of a certain amount in the event the buyer is unable to make the payment themself as agreed. Vivian brings over 15 years of banking experience to her role as product manager at. Web we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit shall be duly honoured on due presentation and delivery of documents as specified, if presented to us on or before ____________________ in ____________________. Web standby letter of credit (lc) is a globally accepted financial instrument where an issuing bank takes. It is a payment of last resort from. Why sblcs are used more commonly in the usa; Top tips and best practice for corporates. Web standby letters of credit. Web we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit shall be duly honoured on due presentation and delivery of documents as specified, if presented to us on or before ____________________ in ____________________. Web a standby letter of credit (sblc) refers to a legal instrument issued by a bank on behalf of its client, providing a guarantee of its commitment to pay the seller if its client (the buyer) defaults on the agreement. A printable standby letter of credit template can be downloaded through the link below. Vivian brings over 15 years of banking experience to her role as product manager at bank of china, london, where she oversees the guarantees/sblc product, including management, marketing, and innovation. Web commercial lawyers can use this annotated template standby letter of credit to draft when, at a customer's request, a bank must honor drafts or other demands for payment by the beneficiary of the letter of credit. The standby letter of credit (standby lc) is, like the guarantee, commonly used to cover the risk of a contract party not fulfilling agreed obligations, for instance failure to pay or deliver. Diese garantie stellt sicher, dass ein bestimmter betrag an den begünstigten gezahlt wird, falls der kunde seinen vertraglichen verpflichtungen nicht nachkommt. Slocs are commonly used in international trade and large transactions to reduce risk and ensure trust between unfamiliar parties. Web letter of credit is a financial instrument that plays an important role in protecting both parties in a trade transaction. It ensures payment and delivery of goods by guaranteeing that the buyer will pay for the goods supplied by the seller within a specified time period. The sblc describes the conditions that would cause the bank to pay. It represents the bank’s guarantee to make payment to the seller of a certain amount in the event the buyer is unable to make the payment themself as agreed.10+ Letter of Credit Samples PDF, Word, Pages Sample Templates

FREE 18+ Sample Letter of Credit in PDF Word

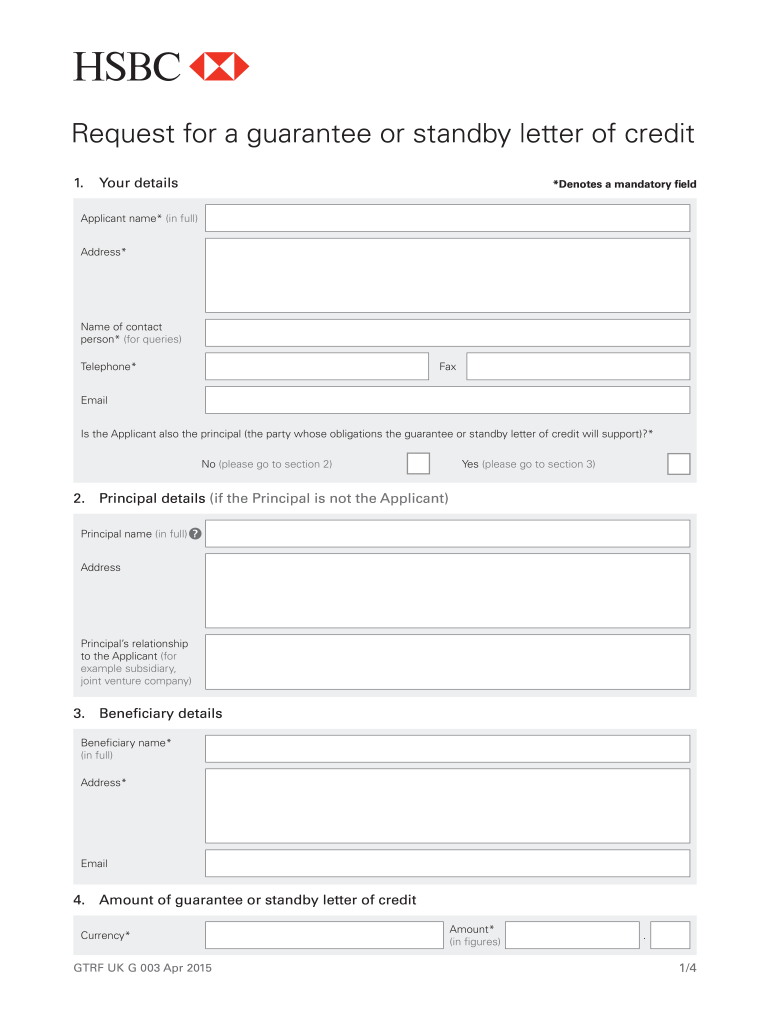

Standby Letter of Credit Sample Hsbc 20152024 Form Fill Out and Sign

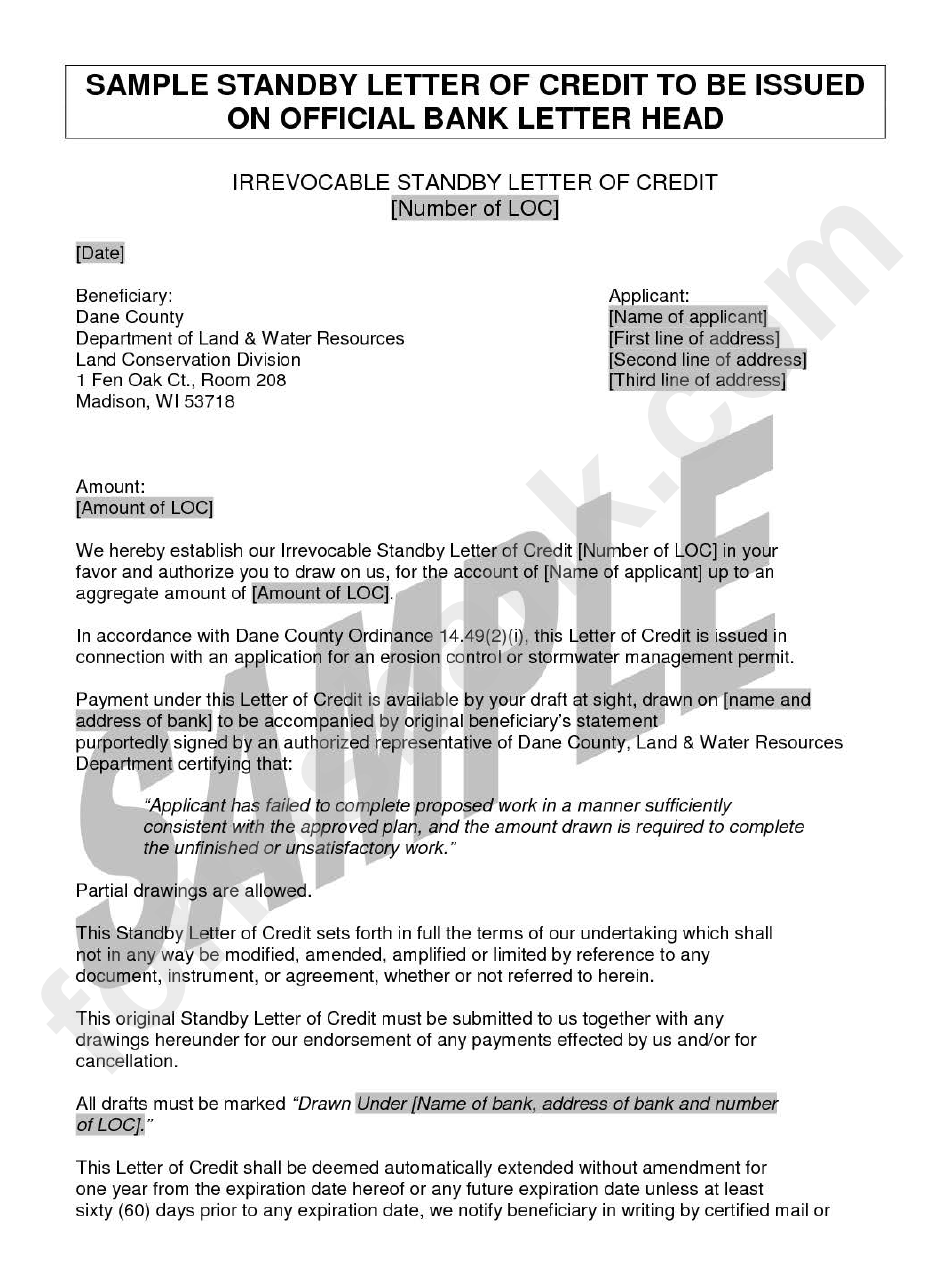

Sample Standby Letter Of Credit Template printable pdf download

Standby Letter of Credit UBS Example PDF Letter Of Credit Service

Standby Letter of Credit Sample Text

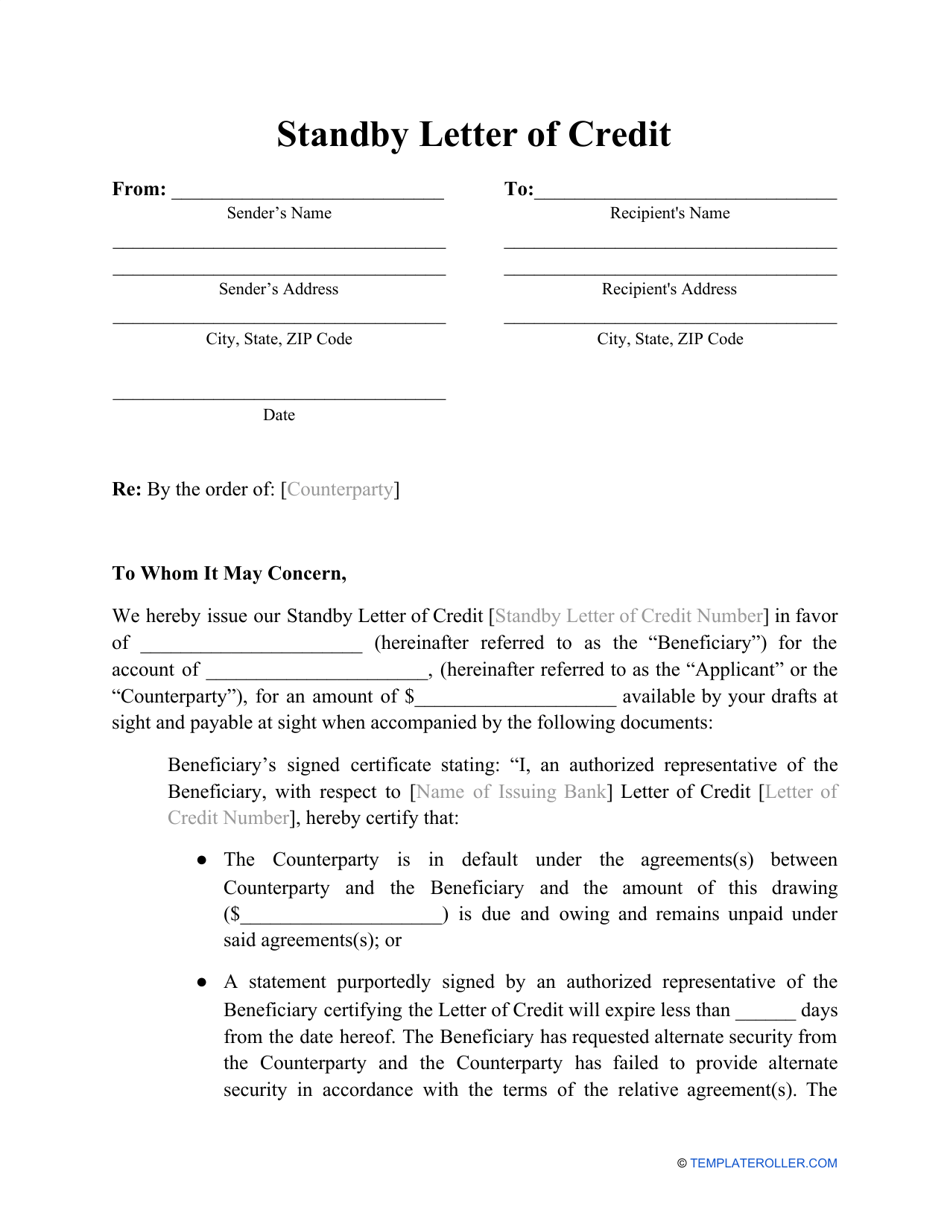

Standby Letter of Credit Template Download Printable PDF Templateroller

10+ Sample Letter of Credit Format, Template and Examples of Letter

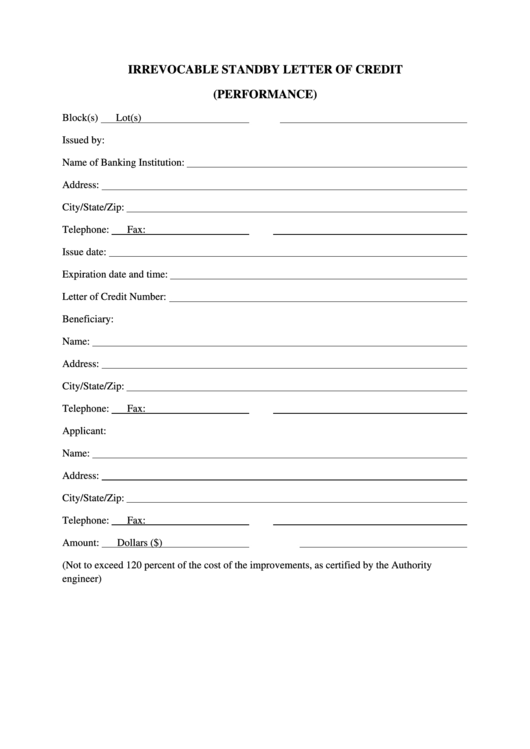

Irrevocable Standby Letter Of Credit (Performance) printable pdf download

10+ Sample Letter of Credit Format, Template and Examples of Letter

Web Standby Letters Of Credit (Sloc) Have Become An Integral Part Of The Modern Business World, Providing Companies With Essential Financial Protection And Security.

What A Standby Letter Of Credit Is;

Web A Standby Letter Of Credit (Sblc) Can Add A Safety Net That Ensures Payment For A Completed Service Or A Shipment Of Physical Goods.

Our Free Templates And This Guide Can Help You Get Started.

Related Post: