Superannuation Salary Sacrifice Agreement Template

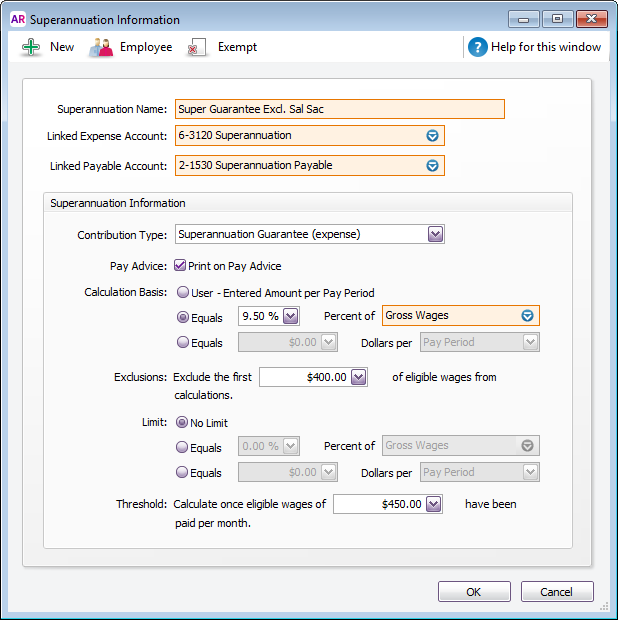

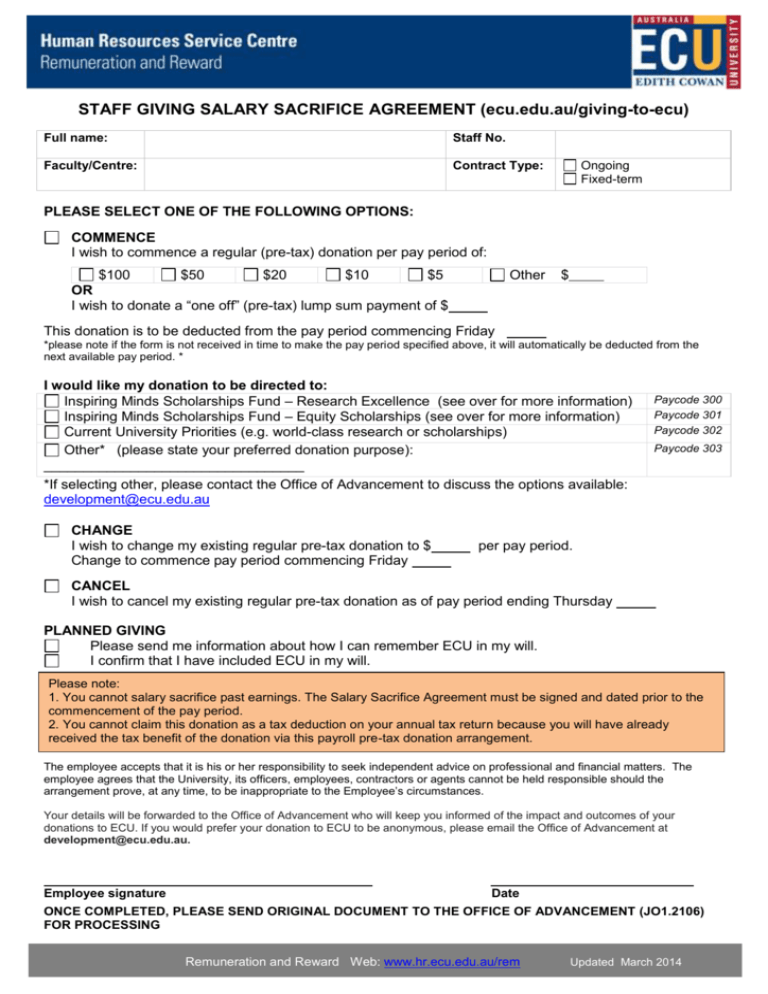

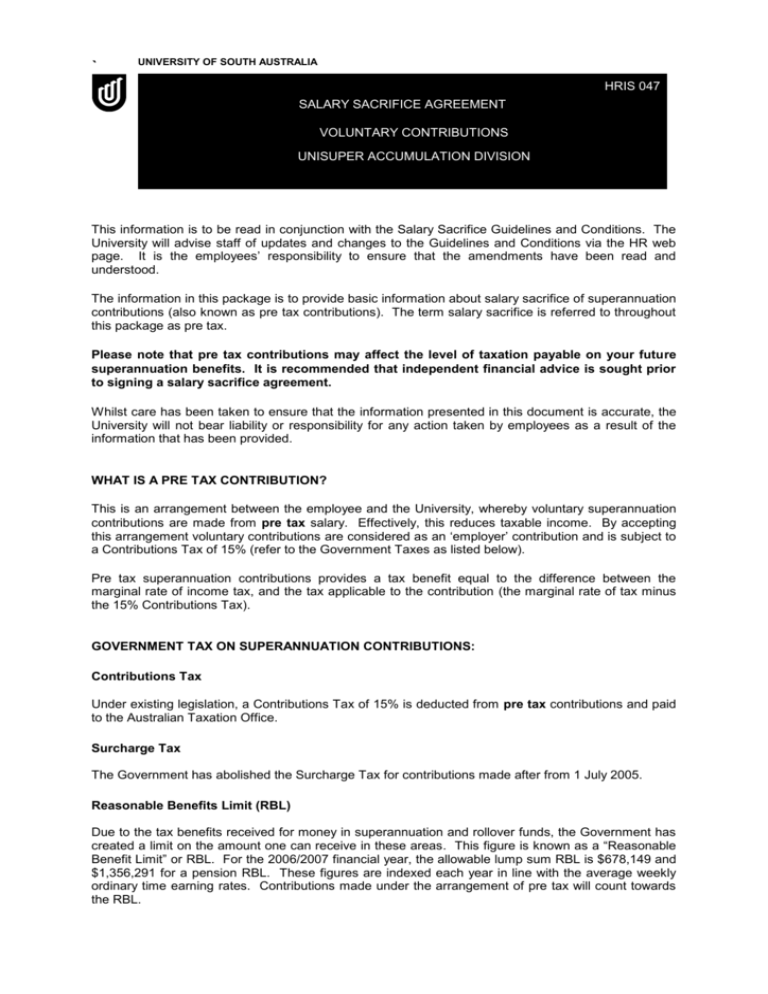

Superannuation Salary Sacrifice Agreement Template - In july 2027, olga applies for an fhss determination. The contributions are made under an effective salary sacrifice arrangement. Ask your employer if they ofer salary sacrifice, what your options are and any impacts it might have on your salary and benefits. Superannuation is one of the most popular benefits in a salary sacrifice agreement. These concessional contributions are taxed in the super fund at a rate of 15%, which is generally less than your marginal. Web you can claim a tax deduction for salary sacrifice contributions for your employees if you meet all 3 conditions: Web you can use a salary sacrifice arrangement to have some of your salary or wages paid into your super fund instead of to you. Most commonly employers offer childcare, healthcare, transport, and increased pension contributions. Web subject to the terms of any contract of employment or industrial agreement, you can renegotiate a salary sacrifice arrangement at any time. Complete and provide the add to your super through your employer form to your employer or. Your contract of employment should detail your remuneration, including any salary sacrifice arrangement. Web you can use a salary sacrifice arrangement to have some of your salary or wages paid into your super fund instead of to you. Ask your employer if they ofer salary sacrifice, what your options are and any impacts it might have on your salary and benefits. Salary sacrificing is sometimes called salary packaging. This top up is in addition to your superannuation guarantee and will count towards your concessional contributions cap. Web your employee agrees to forgo part of their salary or wages in return for benefits of a similar value, such as more super or a car. Superannuation is one of the most popular benefits in a salary sacrifice agreement. The following table outlines what should and shouldn't be included in salary sacrifice super (salary sacrifice type s). Under an effective salary sacrifice arrangement: The contributions are made to a complying super fund. The ato states that employer contributions aren’t fringe benefits as long as they’re made on behalf of the employee and. Complete all parts of this form and provide it to your employer/payroll department. Superannuation is one of the most popular benefits in a salary sacrifice agreement. It's an extra payment on top of the super guarantee contribution your employer has to pay. Complete and provide the add to your super through your employer form to your employer or. Please use the links provided for further information. Ask your employer if they ofer salary sacrifice, what your options are and any impacts it might have on your salary and benefits. When you set up resc, you can choose the amount sacrificed each pay run as a percentage or fixed dollar amount of. Web you can claim a tax deduction for salary sacrifice contributions for your employees if you meet all 3 conditions: This effectively reduces your taxable income, meaning you pay less tax on your income. Ask your employer if they ofer salary sacrifice, what your options are and any impacts it might have on your salary and benefits. You should use this form if you would like to enter into an agreement to deduct part of your salary as a superannuation salary sacrifice on top of the standard 11% superannuation guarantee. Most commonly employers offer. What would you like to do? Web there is no application form for salary sacrificing, however, you can request your employer to write up an agreement on the terms of the salary sacrifice arrangement between you and them. If an employee wants to make additional superannuation payments, set up resc in their pay template. Web you can claim a tax. Web salary sacrificing to super is when you choose to pay part of your salary into your super account before tax. Complete and provide the add to your super through your employer form to your employer or. Complete all parts of this form and provide it to your employer/payroll department. Most commonly employers offer childcare, healthcare, transport, and increased pension. The following table outlines what should and shouldn't be included in salary sacrifice super (salary sacrifice type s). Web employees may request to salary sacrifice a portion of their salary/wage before tax is deducted to their superannuation. Web there is no application form for salary sacrificing, however, you can request your employer to write up an agreement on the terms. Ask your employer if they ofer salary sacrifice, what your options are and any impacts it might have on your salary and benefits. Web there is no application form for salary sacrificing, however, you can request your employer to write up an agreement on the terms of the salary sacrifice arrangement between you and them. When you set up resc,. It's an extra payment on top of the super guarantee contribution your employer has to pay. Web there is no application form for salary sacrificing, however, you can request your employer to write up an agreement on the terms of the salary sacrifice arrangement between you and them. The contributions are made under an effective salary sacrifice arrangement. Please use. You should use this form if you would like to enter into an agreement to deduct part of your salary as a superannuation salary sacrifice on top of the standard 11% superannuation guarantee. Web employees may request to salary sacrifice a portion of their salary/wage before tax is deducted to their superannuation. This form ensures these requirements are met and. Web your employee agrees to forgo part of their salary or wages in return for benefits of a similar value, such as more super or a car. To be able to do this, there are certain record keeping requirements that must be met. Web you can claim a tax deduction for salary sacrifice contributions for your employees if you meet. Your contract of employment should detail your remuneration, including any salary sacrifice arrangement. Web there is no application form for salary sacrificing, however, you can request your employer to write up an agreement on the terms of the salary sacrifice arrangement between you and them. The following table outlines what should and shouldn't be included in salary sacrifice super (salary. You should use this form if you would like to enter into an agreement to deduct part of your salary as a superannuation salary sacrifice on top of the standard 11% superannuation guarantee. Complete all parts of this form and provide it to your employer/payroll department. The following table outlines what should and shouldn't be included in salary sacrifice super. Web your employee agrees to forgo part of their salary or wages in return for benefits of a similar value, such as more super or a car. These concessional contributions are taxed in the super fund at a rate of 15%, which is generally less than your marginal. In july 2027, olga applies for an fhss determination. The contributions are made to a complying super fund. The contributions are made under an effective salary sacrifice arrangement. What would you like to do? This top up is in addition to your superannuation guarantee and will count towards your concessional contributions cap. Web superannuation salary sacrifice deduction agreement. Web salary sacrificing to super is when you choose to pay part of your salary into your super account before tax. Web subject to the terms of any contract of employment or industrial agreement, you can renegotiate a salary sacrifice arrangement at any time. Ask your employer if they ofer salary sacrifice, what your options are and any impacts it might have on your salary and benefits. Web employees may request to salary sacrifice a portion of their salary/wage before tax is deducted to their superannuation. Please use the links provided for further information. Complete and provide the add to your super through your employer form to your employer or. Web there is no application form for salary sacrificing, however, you can request your employer to write up an agreement on the terms of the salary sacrifice arrangement between you and them. Web you can use a salary sacrifice arrangement to have some of your salary or wages paid into your super fund instead of to you.Salary Sacrifice to Superannuation Explained Guided Investor

Fillable Online Request to Salary Sacrifice Superannuation Fax Email

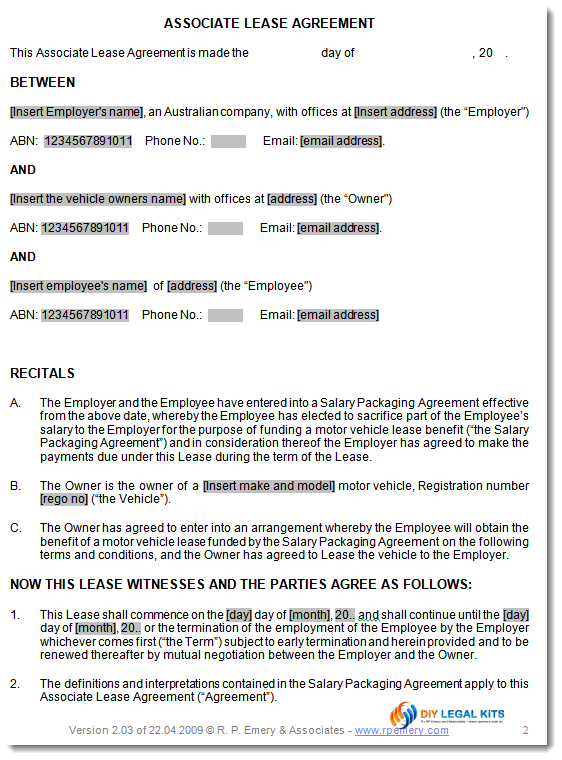

Salary Sacrifice Agreement Template Fill and Sign Printable Template

Superannuation Salary Sacrifice Agreement Template

Superannuation Salary Sacrifice Agreement Template Australia HQ

Salary Sacrifice Agreement Template WONDERFUL TEMPLATES

Super Salary Sacrifice Agreement Template

Hays Salary Sacrifice Fill Online, Printable, Fillable, Blank pdfFiller

salary sacrifice agreement University of South Australia

Effective Salary Sacrifice Agreement Template Master Template

The Following Table Outlines What Should And Shouldn't Be Included In Salary Sacrifice Super (Salary Sacrifice Type S).

This Effectively Reduces Your Taxable Income, Meaning You Pay Less Tax On Your Income.

The Ato States That Employer Contributions Aren’t Fringe Benefits As Long As They’re Made On Behalf Of The Employee And.

Web In Order To Salary Sacrifice The Employee Must Nominate The Service Provider In Order To Administer The Salary Sacrifice Arrangement Except Where Permitted By The Employer In Instances Where The Employee Sacrifices Directly Into South Australian Government Superannuation Schemes;

Related Post: