Template For Letter To Irs

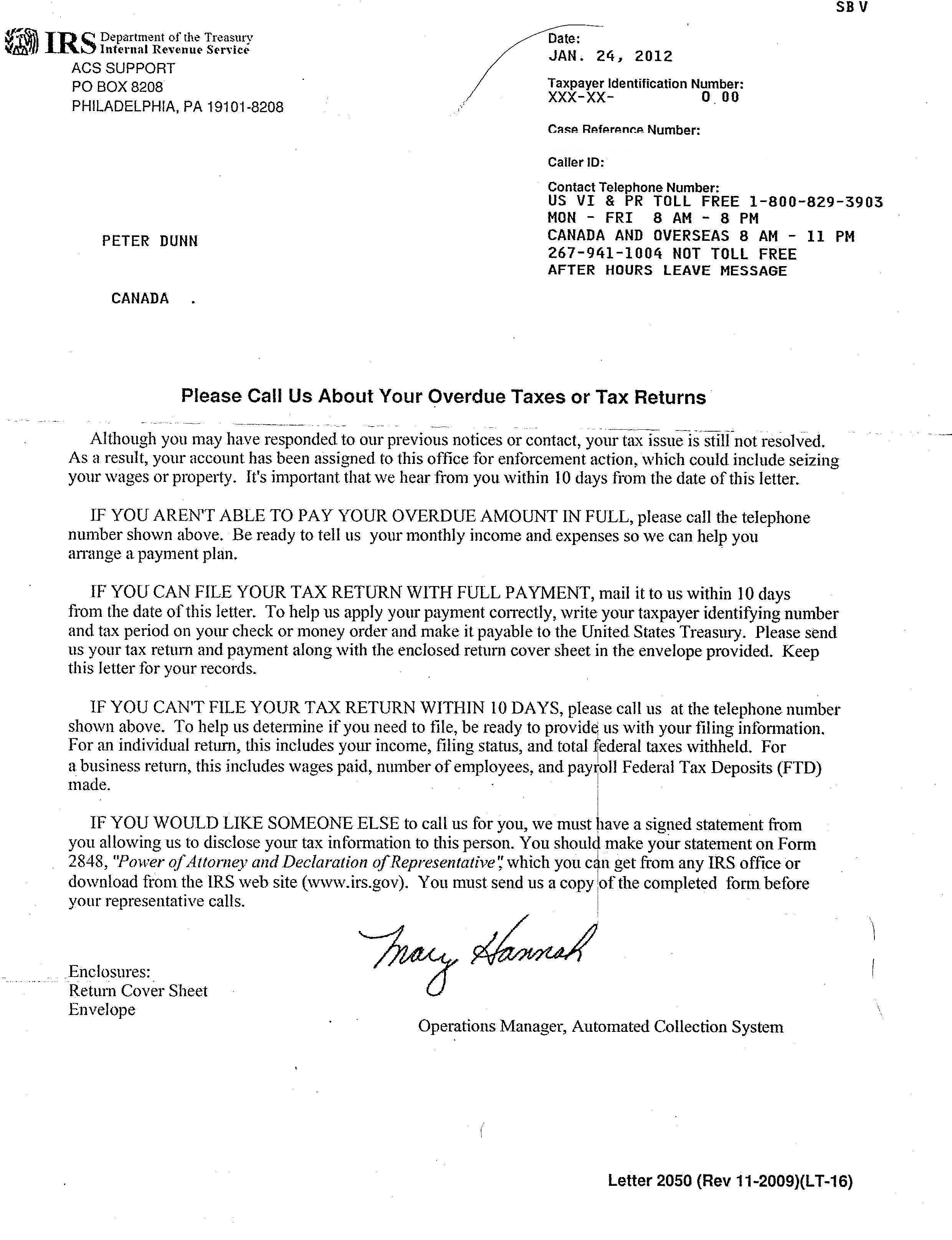

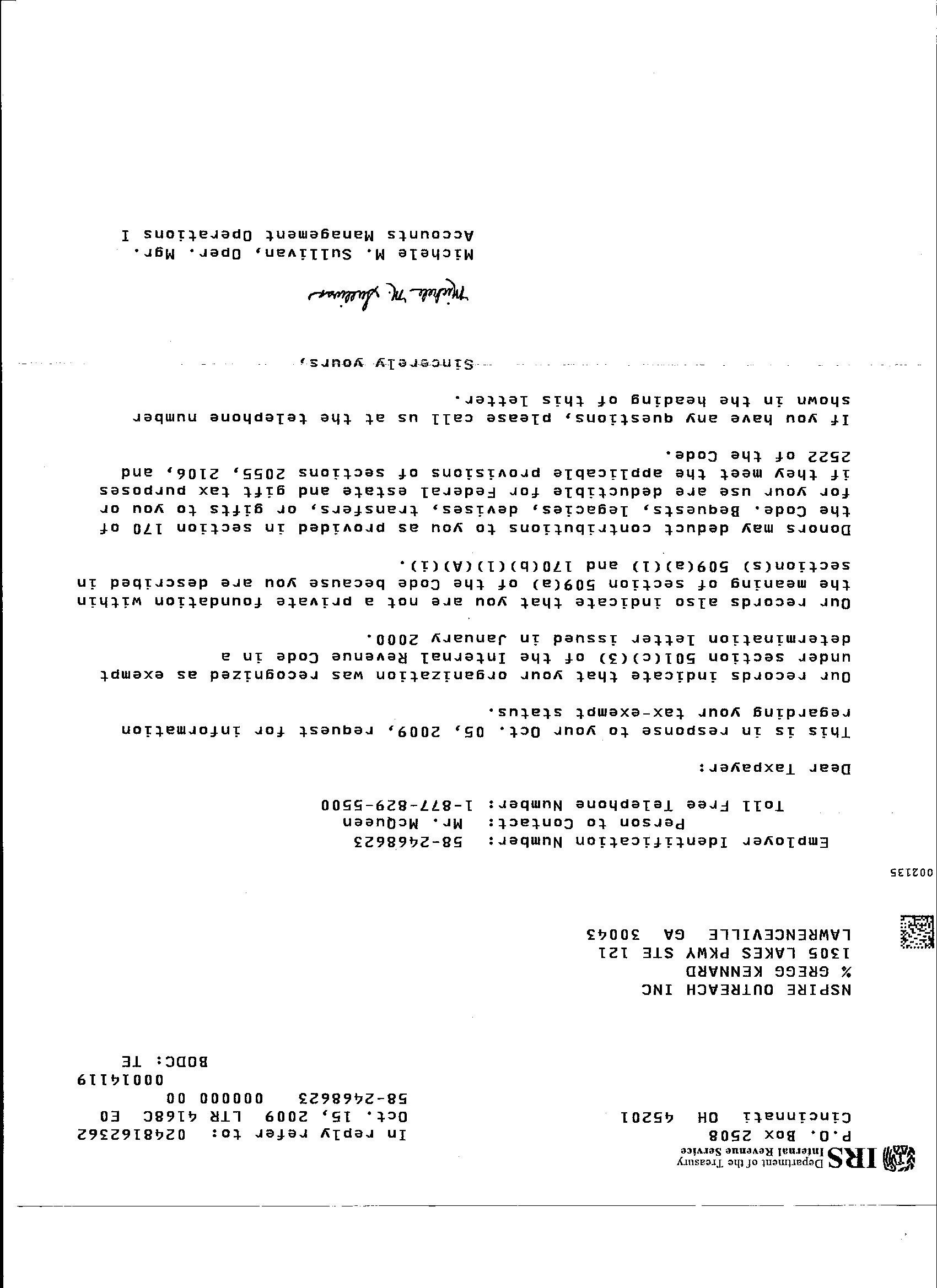

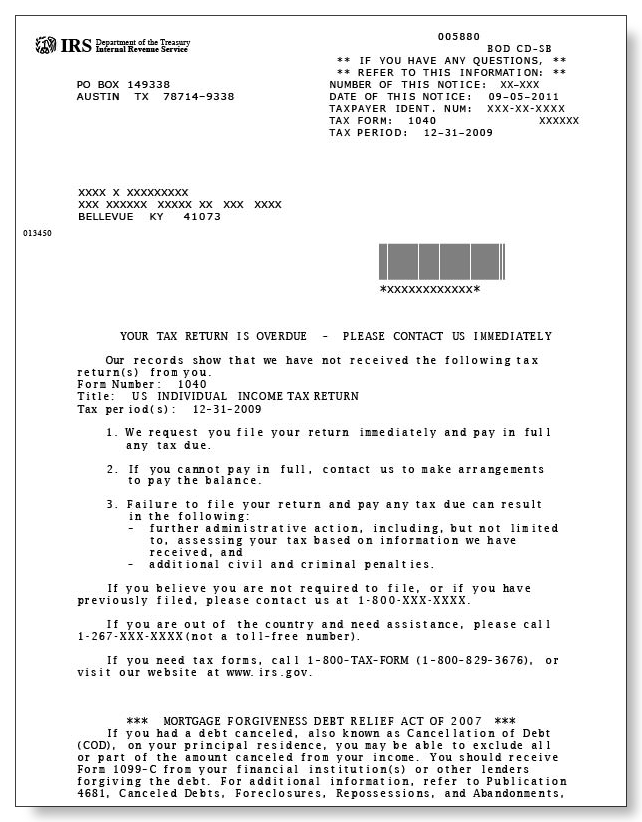

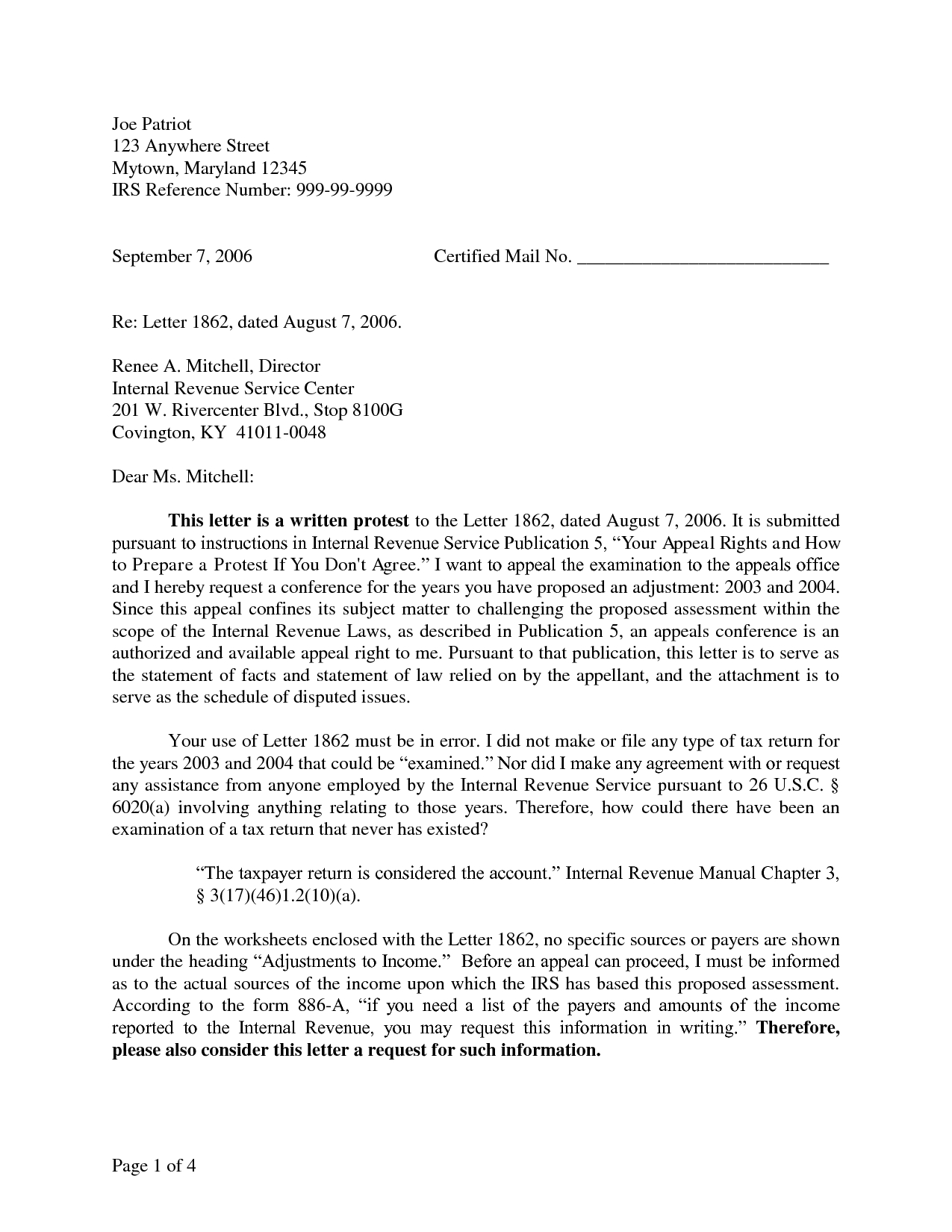

Template For Letter To Irs - If you’ve received mail from the irs, don’t panic. After you’ve laid out your. Web discover how quickly and painlessly you can write those important letters using the collection of templates included in the ultimate irs communicator. Organize your arguments in a logical and readable manner The collection is over 150 articulate letters that make your job so much easier and assure that you appear as the talented professional you are. Requesting an extension for filing taxes. Web the aicpa has created a template for members to use when requesting a penalty abatement from the irs. Once you draft your letter, you can sign, print, and download it for mailing. Web taxpayers can contest many irs tax bills, although there are times when it is wiser not to. Web home > notices > notice / letter template. Once you draft your letter, you can sign, print, and download it for mailing. Web when an irs letter or notice arrives in the mail, here's what taxpayers should do: Dear irs, we write to request an extension of the deadline for filing taxes for our company, [company name]. Typically, there’s no need to worry. Save on finance charges and resolve tax disputes effectively. These samples will help you craft a clear and concise letter that effectively communicates your message to the irs. Web whether you need to request an adjustment, address penalties and interest, or report identity theft or fraud, it is essential to know how to compose an effective letter to the irs. View our interactive tax map to see where you are in the tax process. Under each item, explain the facts accurately, then discuss the law that applies to each fact. In this article, we will provide you with a detailed guide on the steps involved in writing a letter to the irs. Typically, there’s no need to worry. Web a letter of appeal is more effective when it’s written concisely and contains complete information that can help the irs gauge the validity of your protest. If you’ve received mail from the irs, don’t panic. Web discover how quickly and painlessly you can write those important letters using the collection of templates included in the ultimate irs communicator. It is important to approach this letter with a calm and professional tone, avoiding any confrontational language. Under each item, explain the facts accurately, then discuss the law that applies to each fact. Requesting an extension for filing taxes. Web the aicpa has created a template for members to use when requesting a penalty abatement from the irs. November 4, 2020 | last updated: Web did you receive an irs notice or letter? It could help you navigate your way through the irs. Web in this article, we will provide you with templates and examples of cover letters to the irs. Different formats and samples are available based on specific circumstances, and truthfully stating personal reasons is crucial. Web discover how quickly and painlessly you can write those important letters using the collection. Web you can write a letter to the irs to request relief from late filing, late payment, late deposit, and late information return penalties. Web discover how quickly and painlessly you can write those important letters using the collection of templates included in the ultimate irs communicator. It is important to approach this letter with a calm and professional tone,. November 4, 2020 | last updated: Web you can write a letter to the irs to request relief from late filing, late payment, late deposit, and late information return penalties. Pay attention to the order in which notices arrive and the specific ways in which taxpayers can respond. Typically, there’s no need to worry. For the bulk of your letter,. Web 7 sample template letters to irs from business. Pay attention to the order in which notices arrive and the specific ways in which taxpayers can respond. Under each item, explain the facts accurately, then discuss the law that applies to each fact. View our interactive tax map to see where you are in the tax process. It could help. These samples will help you craft a clear and concise letter that effectively communicates your message to the irs. Once tax season has come and gone, the irs starts sending out letters and notices to taxpayers. Web the aicpa has created a template for members to use when requesting a penalty abatement from the irs. Web discover how quickly and. Under each item, explain the facts accurately, then discuss the law that applies to each fact. Save on finance charges and resolve tax disputes effectively. Most irs letters and notices are about federal tax returns or tax accounts. After you’ve laid out your. Web taxpayers can contest many irs tax bills, although there are times when it is wiser not. Different formats and samples are available based on specific circumstances, and truthfully stating personal reasons is crucial. It is important to approach this letter with a calm and professional tone, avoiding any confrontational language. Web in this article, we will provide you with templates and examples of cover letters to the irs. Search for your notice or letter to learn. November 4, 2020 | last updated: The collection is over 150 articulate letters that make your job so much easier and assure that you appear as the talented professional you are. It could help you navigate your way through the irs. Web learn how to write a persuasive letter to the irs to request a waiver of penalties. Requesting an. Search for your notice or letter to learn what it means and what you should do. View our interactive tax map to see where you are in the tax process. Web whether you need to request an adjustment, address penalties and interest, or report identity theft or fraud, it is essential to know how to compose an effective letter to. Under each item, explain the facts accurately, then discuss the law that applies to each fact. Web an irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Requesting an extension for filing taxes. Web in this article,. After you’ve laid out your. Pay attention to the order in which notices arrive and the specific ways in which taxpayers can respond. Web an irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. It is important to approach this letter with a calm and professional tone, avoiding any confrontational language. Web in this article, we will provide you with templates and examples of cover letters to the irs. Web common irs letters and how to respond. Web the aicpa has created a template for members to use when requesting a penalty abatement from the irs. November 4, 2020 | last updated: Once tax season has come and gone, the irs starts sending out letters and notices to taxpayers. Web a letter of appeal is more effective when it’s written concisely and contains complete information that can help the irs gauge the validity of your protest. If you’ve received mail from the irs, don’t panic. Web when an irs letter or notice arrives in the mail, here's what taxpayers should do: Make sure you meet the payment and compliance requirements before sending your letter. Web did you receive an irs notice or letter? When taxpayers disagree with the irs, procedure is important. Web home > notices > notice / letter template.Letter To Irs Free Printable Documents

How to Write a Letter of Explanation to the IRS.pdf Google Drive

Letter To Irs Free Printable Documents

IRS Form W 9 Request Letter

Irs Letterhead Templates Complete with ease airSlate SignNow

Letter To Irs Free Printable Documents

Sample Letter To Irs Free Printable Documents

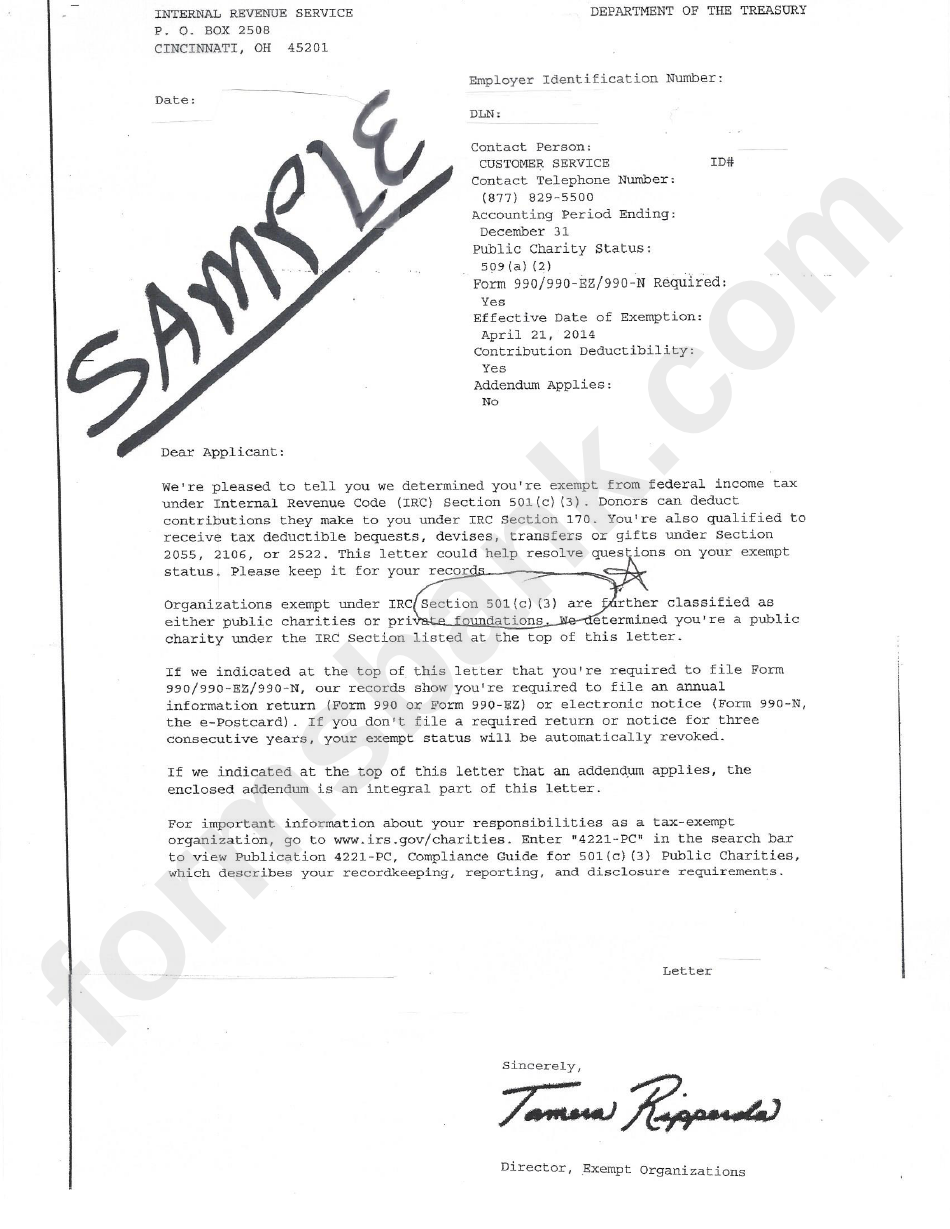

Example Of Irs Letter Template printable pdf download

Letter To The Irs Template

IRS Audit Letter 692 Sample 1

These Samples Will Help You Craft A Clear And Concise Letter That Effectively Communicates Your Message To The Irs.

Different Formats And Samples Are Available Based On Specific Circumstances, And Truthfully Stating Personal Reasons Is Crucial.

Most Irs Letters And Notices Are About Federal Tax Returns Or Tax Accounts.

Dear Irs, We Write To Request An Extension Of The Deadline For Filing Taxes For Our Company, [Company Name].

Related Post: