Template Yc Safe Valuation Cap And Discount

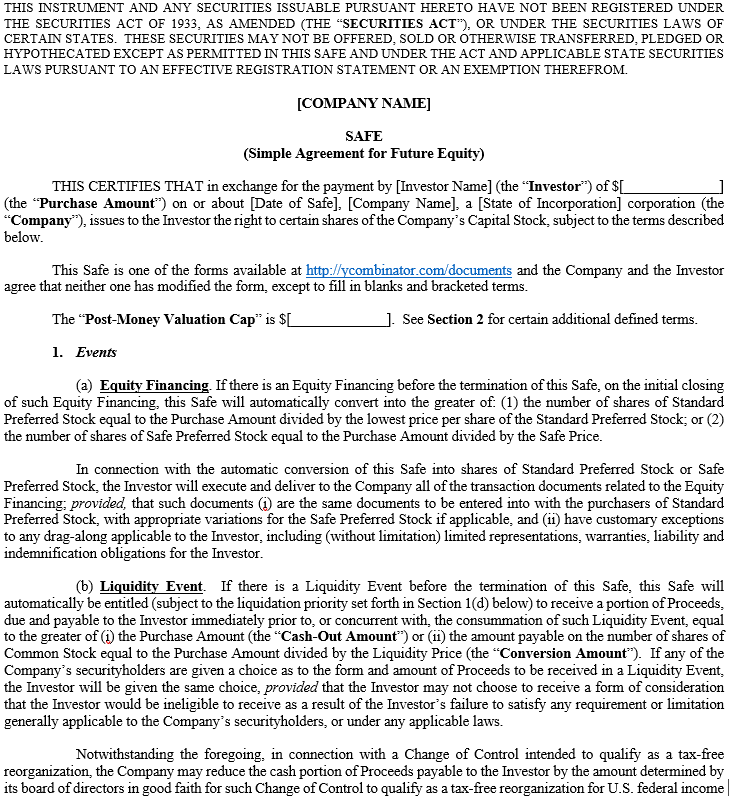

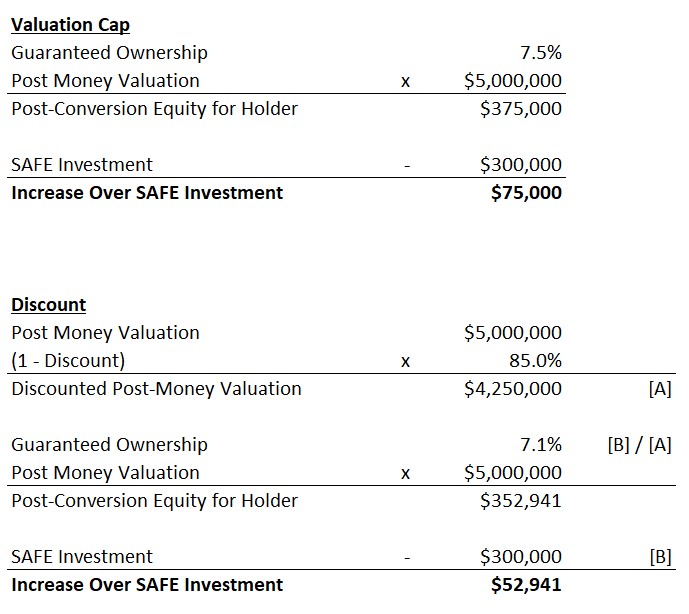

Template Yc Safe Valuation Cap And Discount - The only way you are really going to understand is by digging in and learning. Whichever gives the lower price for investors. Some companies require much less or much more to get going, so think carefully and use your judgment. For whatever reason, removed between aug 13 and aug 26. So, instead of capping the valuation. Web as of the date of this article, there are three different types of safe hosted in the y combinator safe document repository: Web the yc safe is a simple investment document for startups, used in place of convertible notes. Founders and investors can use it to. It is typical to sell around 15% equity in a seed round. It is the maximum valuation that the safe investor will pay, regardless. Web the “valuation cap” is $[___________]. Web a typical safe sets out an investment amount, a valuation cap, and a discount, but does not include a maturity date or interest. Web link to the cap discount: Web the yc safe is a simple investment document for startups, used in place of convertible notes. The only way you are really going to understand is by digging in and learning. Some safes may include a discount rate, giving investors a lower price per share compared to later investors in the priced round. The “discount rate” is [100 minus the discount]%. This means that it is possible that a safe investment may never be repaid if an equity funding round doesn’t happen. Offers investors a discount on the share price during the equity financing round. Whichever gives the lower price for investors. Web the yc safe is a simple investment document for startups, used in place of convertible notes. So, there may be the concept of a discount instead of a cap. Whichever gives the lower price for investors. (1) the discount variation, with no valuation cap, (2) the valuation cap variation, with no discount, and (3) the mfn variation, with no valuation cap and no discount. The only way you are really going to understand is by digging in and learning. Offers investors a discount on the share price during the equity financing round. Web a safe can have a valuation cap, or be uncapped, just like a note. Web the “valuation cap” is $[___________]. Web key components of a safe note. I’m going to walk you through how the post and pre safe work with examples. See section 2 for certain additional defined terms. Web yc’s mfn safe will automatically convert in the priced round on the terms of the lowest cap safe (or other most favorable terms, such as a discount) issued between the specific mfn start date (around the start of the batch) and the priced round. This quick start guide will show how. For whatever reason, removed between aug 13 and aug 26. Web the “valuation cap” is $[___________]. Sets a maximum valuation at which the investment can convert into equity, potentially rewarding early investors if the company’s valuation increases significantly. Web yc’s mfn safe will automatically convert in the priced round on the terms of the lowest cap safe (or other most. This means that it is possible that a safe investment may never be repaid if an equity funding round doesn’t happen. Mfn, no valuation cap, no discount. The legal terms explained line by line. Web yc’s mfn safe will automatically convert in the priced round on the terms of the lowest cap safe (or other most favorable terms, such as. Web investor has purchased a safe for $100,000. Web yc’s mfn safe will automatically convert in the priced round on the terms of the lowest cap safe (or other most favorable terms, such as a discount) issued between the specific mfn start date (around the start of the batch) and the priced round. Web a typical safe sets out an. The legal terms explained line by line. Web so, i'm going to talk only about safes with valuation caps here to keep things simple, but just be aware there are other different flavors of safes that you can use and that you may have already used or that you may find that you'll use in future. Web a typical safe. Some safes may include a discount rate, giving investors a lower price per share compared to later investors in the priced round. This quick start guide will show how to take advantage of this structure for the most common use cases. Web link to the cap discount: So, instead of capping the valuation. The only way you are really going. It is typical to sell around 15% equity in a seed round. Before using any of these international forms, you should consult with a lawyer licensed in the relevant country. Provides investors with a discount to the price per share paid by future investors, as a reward for investing early. Web a valuation cap is the highest valuation at which. Web yc’s mfn safe will automatically convert in the priced round on the terms of the lowest cap safe (or other most favorable terms, such as a discount) issued between the specific mfn start date (around the start of the batch) and the priced round. It defers valuation to a later funding round, converting to equity then, often at a. Web i can't seem to find a template for a safe with a discount and valuation cap, although i feel like it use to be here: This means that it is possible that a safe investment may never be repaid if an equity funding round doesn’t happen. Web so, i'm going to talk only about safes with valuation caps here. Web a valuation cap is a ceiling on the price at which the investment will convert to equity. Web investor has purchased a safe for $100,000. Web a valuation cap is the highest valuation at which the amount invested in the safe would be converted into shares. Web link to the cap discount: Was wondering if anyone has come across. So, there may be the concept of a discount instead of a cap. (1) the discount variation, with no valuation cap, (2) the valuation cap variation, with no discount, and (3) the mfn variation, with no valuation cap and no discount. Offers investors a discount on the share price during the equity financing round. Some safes may include a discount rate, giving investors a lower price per share compared to later investors in the priced round. Mfn, no valuation cap, no discount. Founders and investors can use it to. Web i can't seem to find a template for a safe with a discount and valuation cap, although i feel like it use to be here: Web a valuation cap is the highest valuation at which the amount invested in the safe would be converted into shares. I’m going to walk you through how the post and pre safe work with examples. This means that it is possible that a safe investment may never be repaid if an equity funding round doesn’t happen. Web download the safe calculator and have a play. The legal terms explained line by line. So, instead of capping the valuation. This quick start guide will show how to take advantage of this structure for the most common use cases. Often includes a valuation cap, which sets a maximum company valuation at which the safe will convert into equity, providing potential benefits to early investors. Web a safe can have a valuation cap, or be uncapped, just like a note.Y Combinator Safe Template

SAFE Convertible Note Template Eqvista

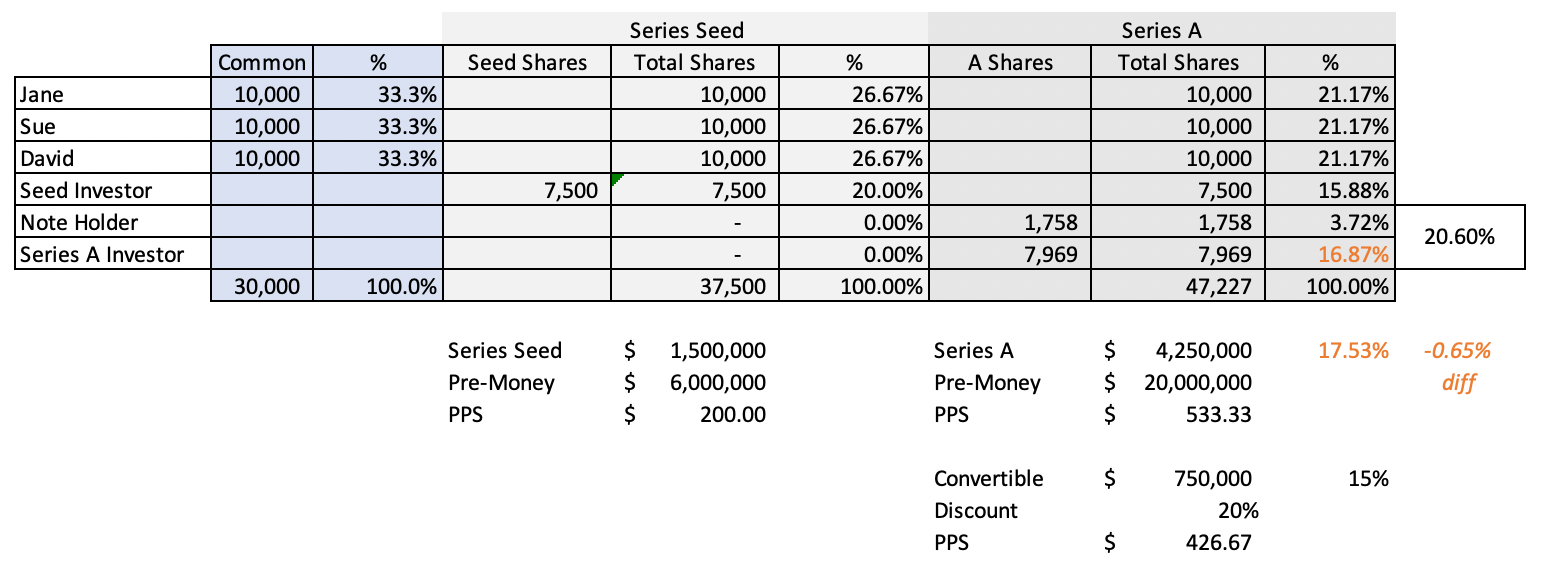

Safe Cap Table Template

SAFE Notes Explained Video, Guide, and Excel File

Pre Money Safe Template

Valuation cap for SAFE Notes Eqvista

Understanding SAFEs and their Impact on 409A Valuation CLA

Yc Safe Template

Post Money Safe Agreement Valuation Cap and Discount Doc Template

Post Money SAFE Cap and Discount Explained Line by Line www

Whichever Gives The Lower Price For Investors.

Web Link To The Cap Discount:

It Is Typical To Sell Around 15% Equity In A Seed Round.

Provides Investors With A Discount To The Price Per Share Paid By Future Investors, As A Reward For Investing Early.

Related Post: