Trust Accounting Template California

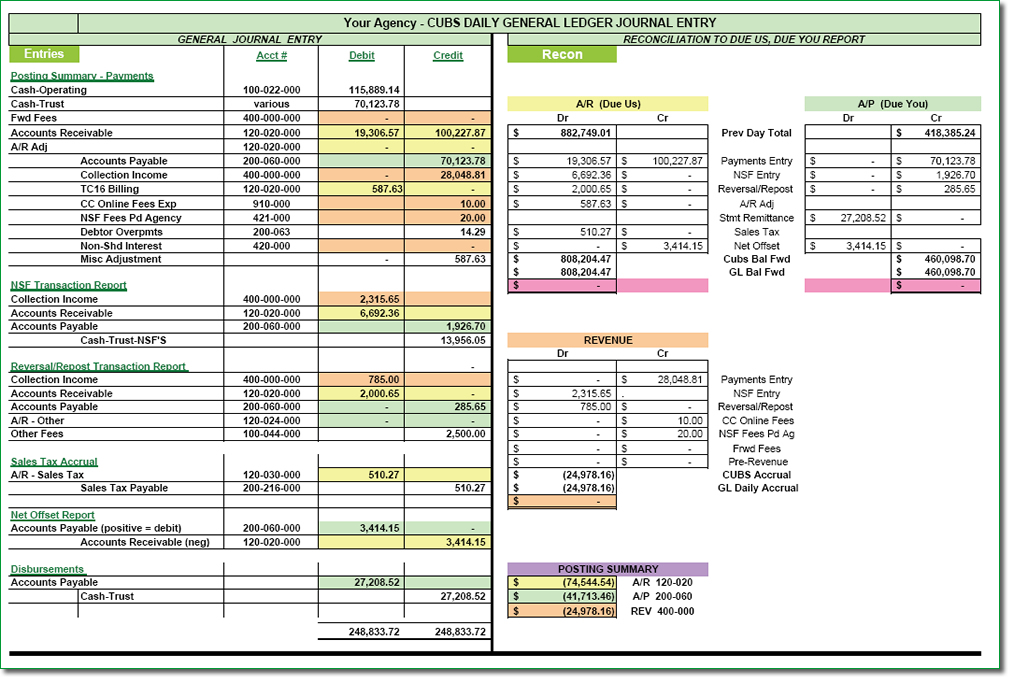

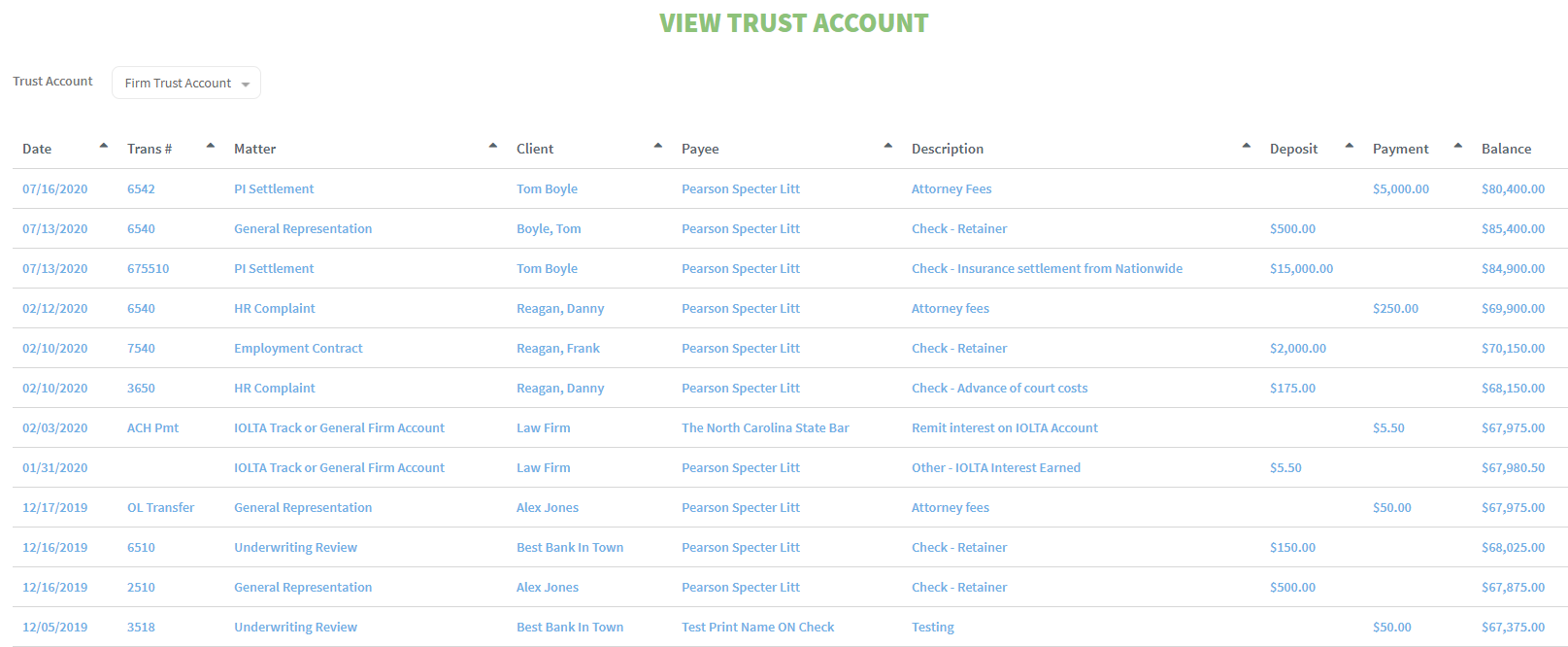

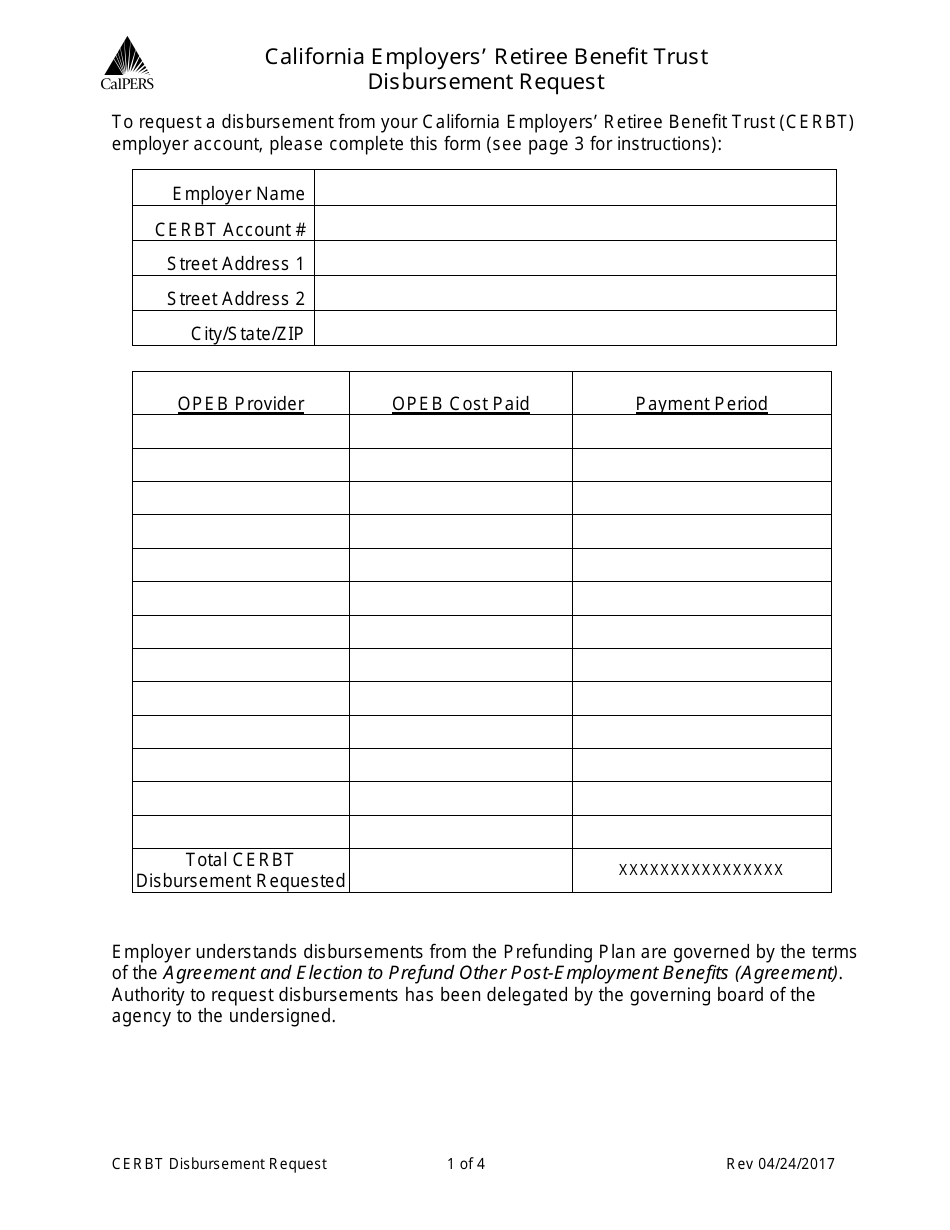

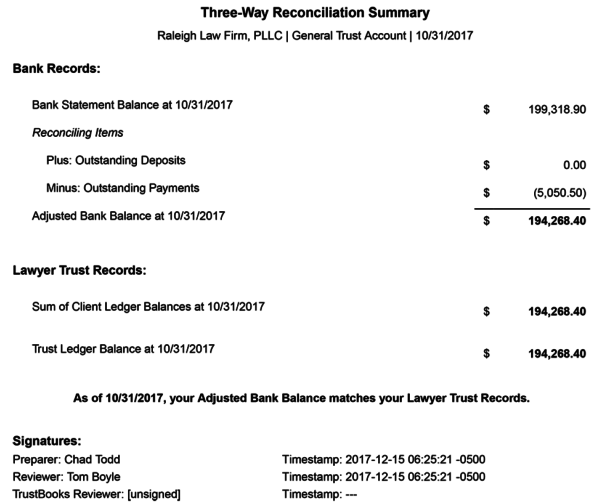

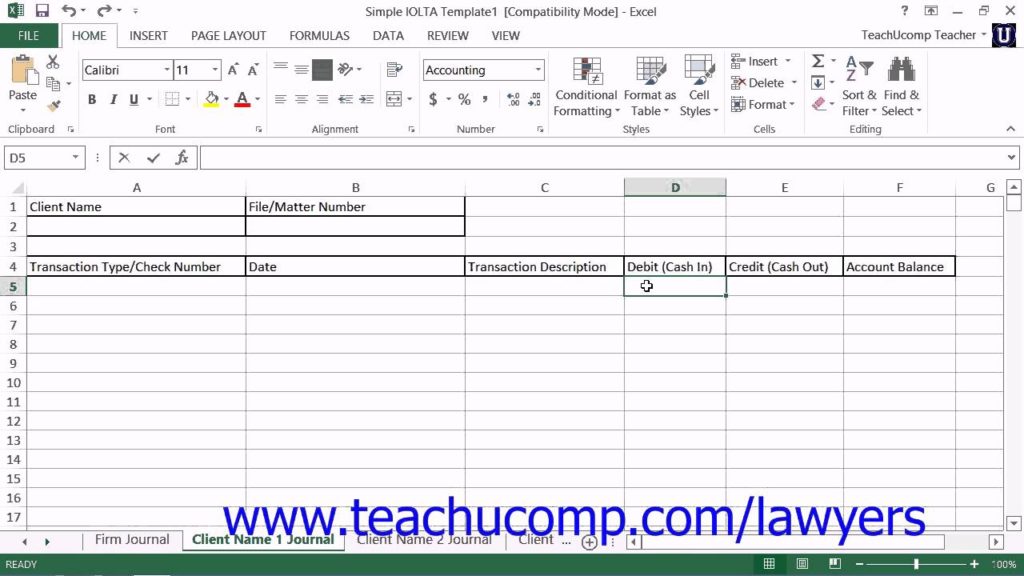

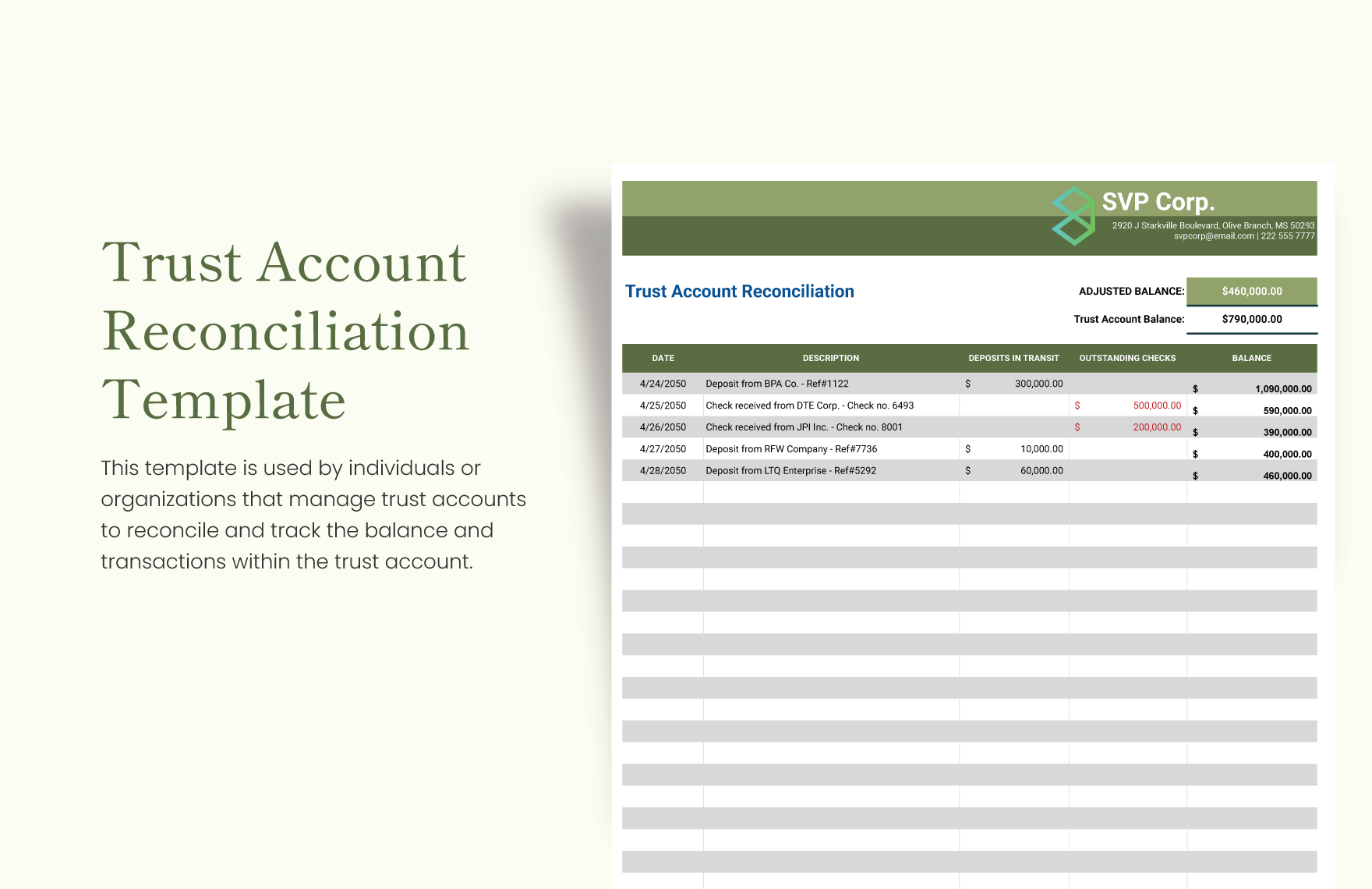

Trust Accounting Template California - These materials are taught in the client trust accounting practical skills course, soon to be available online. To keep from distracting you from basic accounting, the citations have been kept to a minimum. I always say that every accounting balances, it is just a matter of finding the right information. Web get the basics of trust accounting in california, find out what documents you will need, and understand when you will need trust accounting. An accounting should also include trust terms and specifics about how they have administered it. Web client trust accounting resources. As part of this duty, trustees must provide all beneficiaries with an accounting of the trust assets and how they have been used. Web probate accounting, also known as trust accounting, is simply an accounting of the transactions undertaken by an estate during a specific reporting period. Most trusts do not have regular court or state agency supervision. In this blog, we summarize some of the main principles of client trust accounting in the golden. A copy of the standards and statutes relating to an attorney's trust accounting requirements; I always say that every accounting balances, it is just a matter of finding the right information. In this blog, we summarize some of the main principles of client trust accounting in the golden. Organize financial transactions by date. Still, it can be frustrating to put together a year or two (or three or four) of information and not have the accounting balance. A trust is a legal document that designates a trustee to manage assets for a grantor while the grantor is incapacitated or has died. Web in california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply. These materials are taught in the client trust accounting practical skills course, soon to be available online. Web the practice guide for fiduciary (trust) accounting is designed to provide information on subjects covered for “best practice” guidelines, and is not the final authority. Web probate accounting, also known as trust accounting, is simply an accounting of the transactions undertaken by an estate during a specific reporting period. Gain a complete understanding of the state bar of california trust rules. These materials are taught in the client trust accounting practical skills course, soon to be available online. Web how accurate does a trust accounting have to be in order to be approved by the court? Web client trust accounting resources. By law, trustees must provide beneficiaries with reports about the assets, liabilities, receipts, and disbursements, which are all features of trust accounting. Web get the basics of trust accounting in california, find out what documents you will need, and understand when you will need trust accounting. As part of this duty, trustees must provide all beneficiaries with an accounting of the trust assets and how they have been used. Web trust accounting template california. Web in the state of california, trustees have a duty to keep the beneficiaries of the trust reasonably informed about the trust and how it is being administered. Web basic principles are important to understand when determining how to do trust accounting in california. An accounting should also include trust terms and specifics about how they have administered it. Insight into the rules and best practices to keep you compliant. 2023 handbook on client trust accounting for california attorneys (pdf) client trust account school. And a trust or probate accounting is a unique animal—it’s unlike any other type of accounting and not every accountant. Web in the state of california, trustees have a duty to keep the beneficiaries of the trust reasonably informed about the trust and how it is being administered. Most trusts do not have regular court or state agency supervision. Web download a sample fiduciary accounting prepared for a special needs trust. Keep beneficiaries ‘reasonably’ informed about how they manage the. Per california probate code sections 16060 and 16062, trustees must: Web client trust accounting resources. Explore the comprehensive and compliant trust accounting template california for seamless management of trust transactions, audits, and beneficiary updates. Keep beneficiaries ‘reasonably’ informed about how they manage the trust. While keeping good trust accounting records is important for any u.s. Web probate accounting, also known as trust accounting, is simply an accounting of the transactions undertaken by an estate during a specific reporting period. Web section 16063 of the california probate code lists the information needed in a trust’s formal accounting, including all transactions, assets, liabilities, trustee compensation, and hired professionals. I always say that every accounting balances, it is. As part of this duty, trustees must provide all beneficiaries with an accounting of the trust assets and how they have been used. Web every trustee and every executor owe an absolute duty to account. Web how accurate does a trust accounting have to be in order to be approved by the court? Most trusts do not have regular court. An index of selected cases and opinions by topic; Web premier trust accounting in california. Web any california law firm must have solid client trust accounting. Still, it can be frustrating to put together a year or two (or three or four) of information and not have the accounting balance. The formal requirements for a trust accounting can be found. A trust is a legal document that designates a trustee to manage assets for a grantor while the grantor is incapacitated or has died. Trustbooks is proud to be recommended as an affinity partner with calbar connect and california lawyers association. The formal requirements for a trust accounting can be found at probate code sections 16063 and 1061 (all accountings. What that accounting is and when it is required is the subject of this article. A trust is a legal document that designates a trustee to manage assets for a grantor while the grantor is incapacitated or has died. Trustbooks is proud to be recommended as an affinity partner with calbar connect and california lawyers association. Failure to provide accurate. Web trust accounting for a trust is a comprehensive and detailed accounting record of all trust income and expenses. What data is required to be included? Web any california law firm must have solid client trust accounting. Such an accounting is done in the situation where there are no lawsuits or disputed court petitions involving the trust. In this blog,. Insight into the rules and best practices to keep you compliant. We encourage the user to consult the resources provided in the appendix of this guide. Gain a complete understanding of the state bar of california trust rules. Section 16062 of the california probate code requires trustees to provide an accounting at least once a year. Provide an accounting at. I always say that every accounting balances, it is just a matter of finding the right information. Trustbooks is proud to be recommended as an affinity partner with calbar connect and california lawyers association. By law, trustees must provide beneficiaries with reports about the assets, liabilities, receipts, and disbursements, which are all features of trust accounting. Still, it can be frustrating to put together a year or two (or three or four) of information and not have the accounting balance. What that accounting is and when it is required is the subject of this article. What data is required to be included? Organize financial transactions by date. Gain a complete understanding of the state bar of california trust rules. As part of this duty, trustees must provide all beneficiaries with an accounting of the trust assets and how they have been used. In this blog, we summarize some of the main principles of client trust accounting in the golden. Web the practice guide for fiduciary (trust) accounting is designed to provide information on subjects covered for “best practice” guidelines, and is not the final authority. Web every trustee and every executor owe an absolute duty to account. Web a trust accounting should meet the california probate code requirements, but preparing a trust accounting can be tedious and very complicated. Web probate accounting, also known as trust accounting, is simply an accounting of the transactions undertaken by an estate during a specific reporting period. Web trust accounting for a trust is a comprehensive and detailed accounting record of all trust income and expenses. Provide an accounting at least once annually.Trust Accounting Excel Template California

Trust Accounting Template California

Trust Accounting Template California

Trust Accounting Template California

California Trust Accounting Software TrustBooks

Trust Accounting Excel Template California

Trust Accounting Excel Template California

USA California Bank Trust bank statement, Word and PDF template

Trust Accounting Excel Template California

Trust Accounting Excel Template California

Insight Into The Rules And Best Practices To Keep You Compliant.

Explore The Comprehensive And Compliant Trust Accounting Template California For Seamless Management Of Trust Transactions, Audits, And Beneficiary Updates.

Web Any California Law Firm Must Have Solid Client Trust Accounting.

Web Trust Accounting Template California.

Related Post: