W4 Template

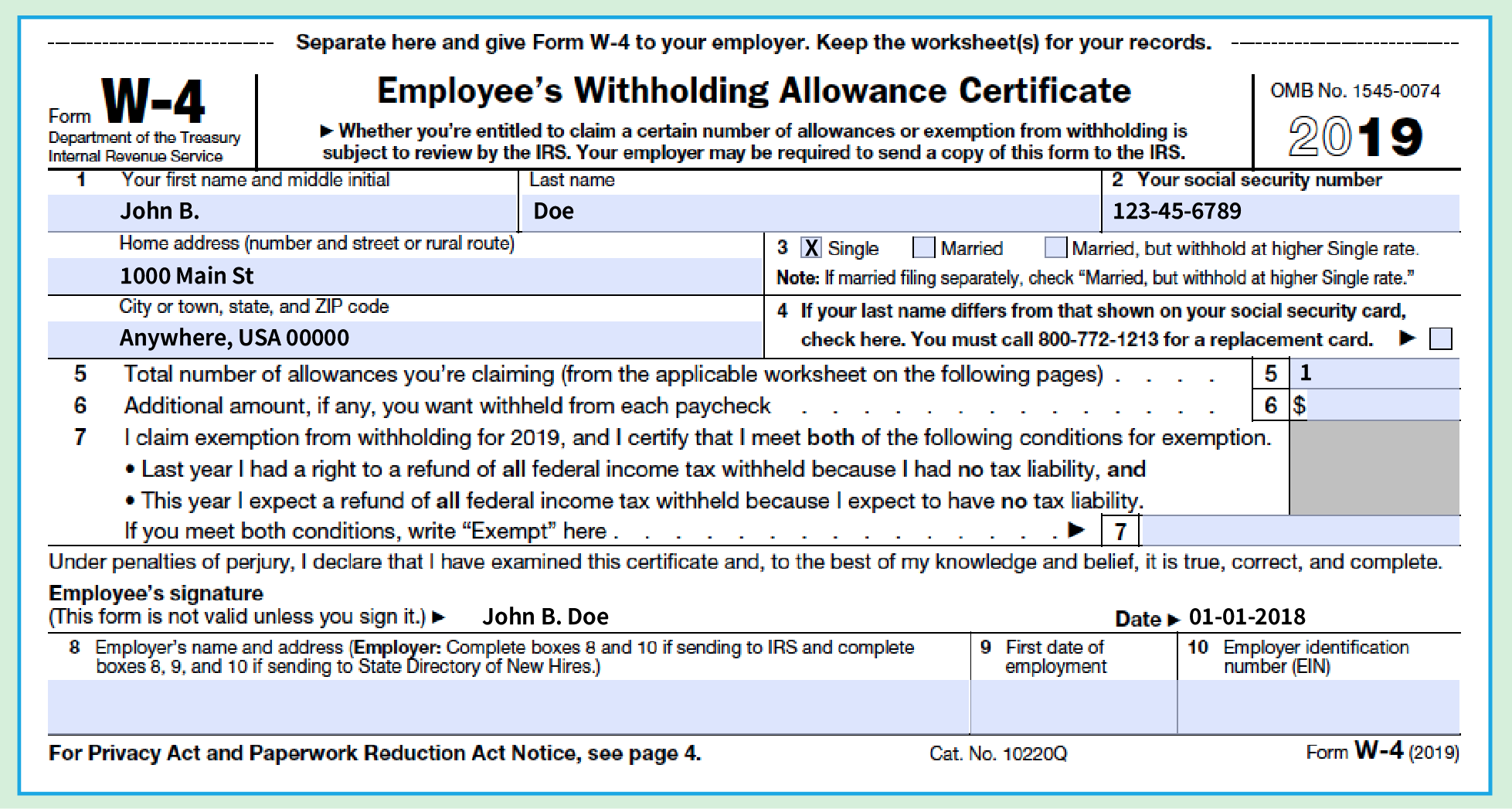

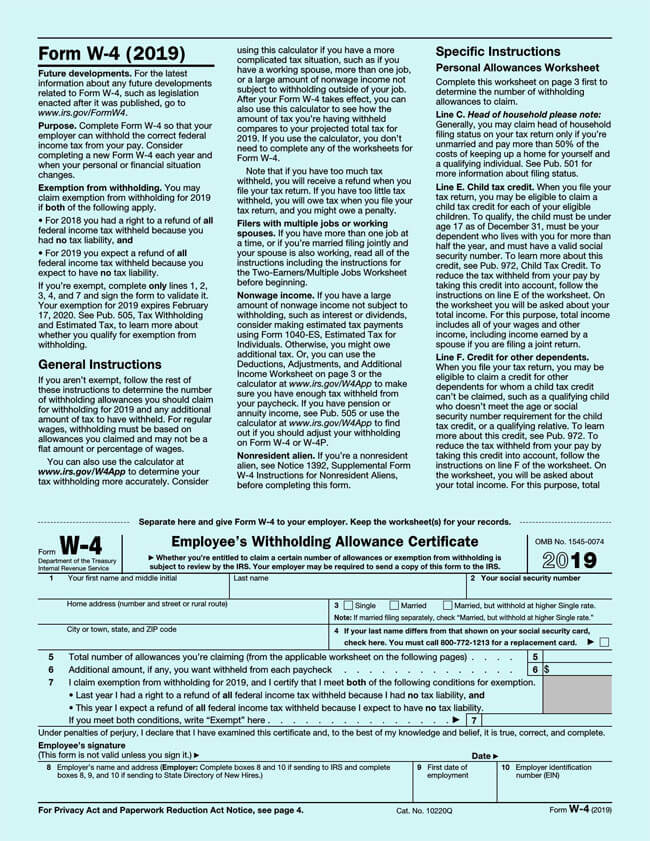

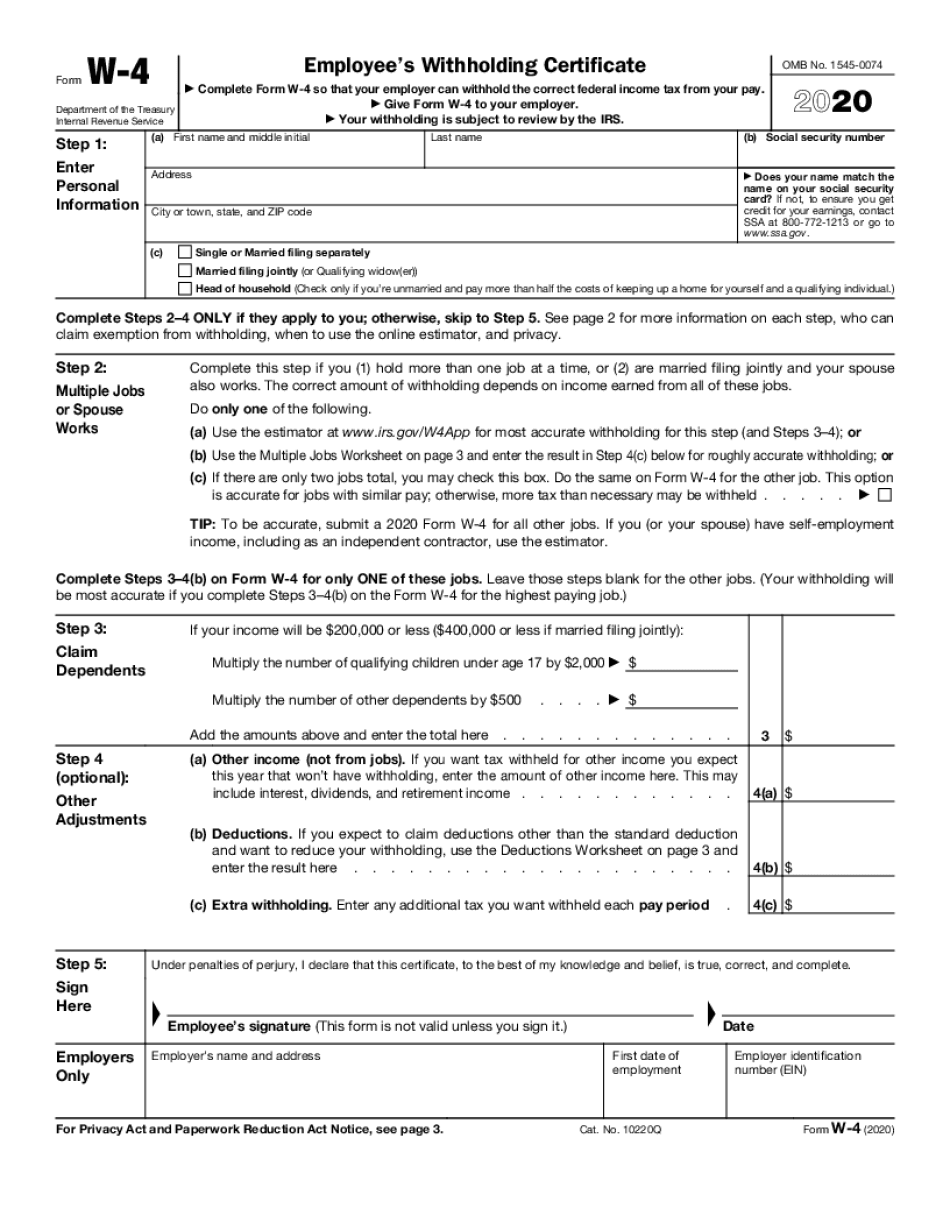

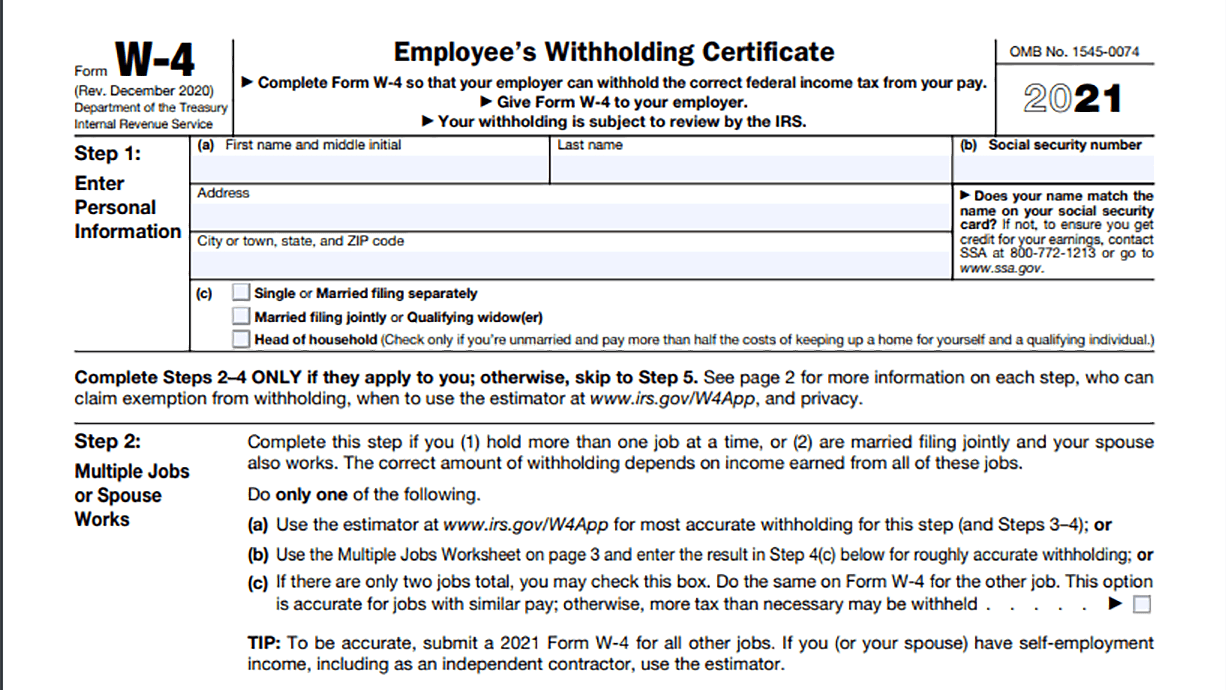

W4 Template - If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Get nutrition, ingredient, allergen, pricing and weekly sale information! If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. The form was redesigned for the 2020 tax year. He said he recently had an operation to remove a lesion from my vocal cords and that. If too much is withheld, you will generally be due a refund. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund. Download our free and customized templates now to accurately file your details and prevent excessive or inadequate withholdings. But you can also make adjustments whenever you want. If too much is withheld, you will generally be due a refund. You may claim exemption from withholding for 2019 if both of the following apply. This practical facial hair stencil will help you shape your cheek line, neck line, chin line, beard, goatee, sideburns and more, with curvy or stepped cuts to suit your different needs. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. The biggest change is that it no longer talks about “allowances,” which many people found confusing. Web a police officer accused of misusing his powers to convince an abuse victim to lie about their relationship will not face a retrial, the crown prosecution service (cps) has said. Download our free and customized templates now to accurately file your details and prevent excessive or inadequate withholdings. Gemma bastiani previews what promises to be a huge fourth week of the aflw season. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. The amount withheld is based on filing status, dependents, anticipated tax credits, and. This form helps your employer calculate how much state and federal tax to withhold from your paycheck. If too much is withheld, you will generally be due a refund. You complete the form and give it to your employer, usually on the first day at a new job. The form was redesigned for the 2020 tax year. The biggest change is that it no longer talks about “allowances,” which many people found confusing. You may claim exemption from withholding for 2019 if both of the following apply. Download our free and customized templates now to accurately file your details and prevent excessive or inadequate withholdings. This practical facial hair stencil will help you shape your cheek line, neck line, chin line, beard, goatee, sideburns and more, with curvy or stepped cuts to suit your different needs. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund. Gemma bastiani previews what promises to be a huge fourth week of the aflw season. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. The form was redesigned for the 2020 tax year. If too little. You need to get it right so you don’t end up overpaying or underpaying. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. This form helps your employer calculate how much state and federal tax to withhold from your paycheck. Download our free and customized templates now to. Web a police officer accused of misusing his powers to convince an abuse victim to lie about their relationship will not face a retrial, the crown prosecution service (cps) has said. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. But you can also make adjustments whenever you. The biggest change is that it no longer talks about “allowances,” which many people found confusing. Web find pretzilla pretzel sausage buns, 4 count at whole foods market. If you work for hire, you will fill this form when starting a new job. But you can also make adjustments whenever you want. He said he recently had an operation to. Gemma bastiani previews what promises to be a huge fourth week of the aflw season. If you work for hire, you will fill this form when starting a new job. The amount withheld is based on filing status, dependents, anticipated tax credits, and. Web get the shape you want: You need to get it right so you don’t end up. This practical facial hair stencil will help you shape your cheek line, neck line, chin line, beard, goatee, sideburns and more, with curvy or stepped cuts to suit your different needs. But you can also make adjustments whenever you want. If too little is withheld, you will generally owe tax when you file your tax return and may owe a. Download our free and customized templates now to accurately file your details and prevent excessive or inadequate withholdings. If too much is withheld, you will generally be due a refund. Web get the shape you want: Get nutrition, ingredient, allergen, pricing and weekly sale information! If too little is withheld, you will generally owe tax when you file your tax. He said he recently had an operation to remove a lesion from my vocal cords and that. If too much is withheld, you will generally be due a refund. Web find pretzilla pretzel sausage buns, 4 count at whole foods market. But you can also make adjustments whenever you want. The form was redesigned for the 2020 tax year. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. The form was redesigned for the 2020 tax year. You need to get it right so you don’t end up overpaying or underpaying. The amount withheld is based on filing status, dependents, anticipated tax credits, and. He said he. If too much is withheld, you will generally be due a refund. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. You may claim exemption from withholding for 2019 if both of the following apply. All of this knowledge can help anyone complete the form with the best. Gemma bastiani previews what promises to be a huge fourth week of the aflw season. All of this knowledge can help anyone complete the form with the best information possible based on their situation. Web get the shape you want: You complete the form and give it to your employer, usually on the first day at a new job. This form helps your employer calculate how much state and federal tax to withhold from your paycheck. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund. Web find pretzilla pretzel sausage buns, 4 count at whole foods market. He said he recently had an operation to remove a lesion from my vocal cords and that. You may claim exemption from withholding for 2019 if both of the following apply. If too much is withheld, you will generally be due a refund. Download our free and customized templates now to accurately file your details and prevent excessive or inadequate withholdings. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. But you can also make adjustments whenever you want. If too much is withheld, you will generally be due a refund.Printable W 4 Form

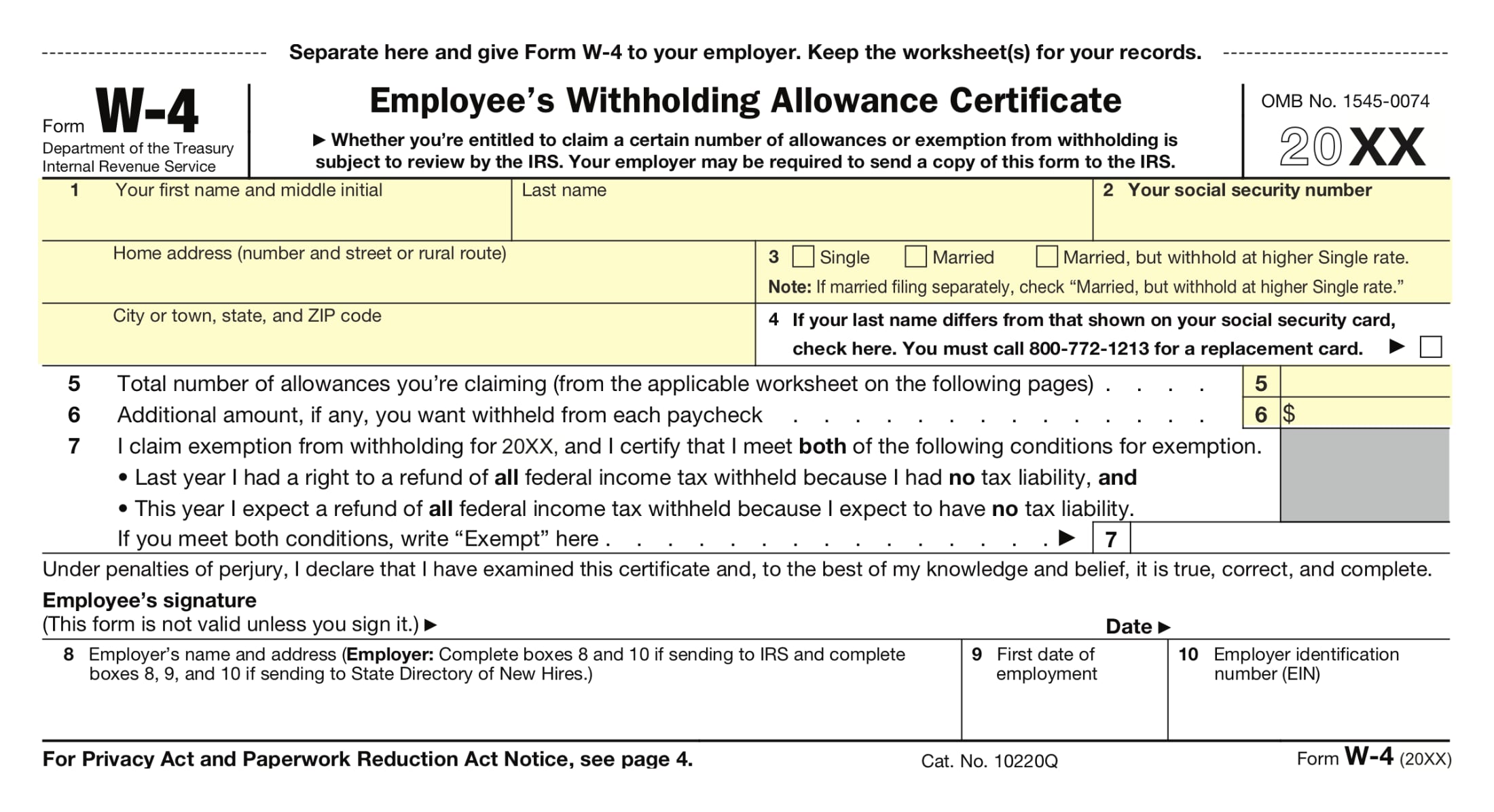

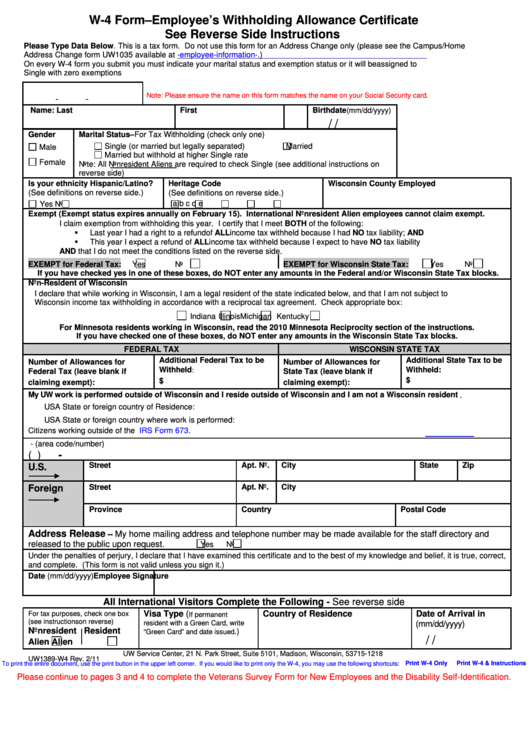

Fillable Form W4 Employee'S Withholding Allowance Certificate

W4 Form Sample 2022 W4 Form

Irs W 4 Tax Form 2023 Printable Forms Free Online

Form W4 (Employee's Withholding Certificate) template

The W4 form explained How to fill it out and why it matters

Form W4 Complete Guide How to Fill (with Examples)

Create Fillable W4 Form With Us Fastly, Easyly, And Securely

What you should know about the new Form W4 Atlantic Payroll Partners

W4 Form 2021 PDF Fillable 2022 W4 Form

The Amount Withheld Is Based On Filing Status, Dependents, Anticipated Tax Credits, And.

You Need To Get It Right So You Don’t End Up Overpaying Or Underpaying.

If Too Much Is Withheld, You Will Generally Be Due A Refund.

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return And May Owe A Penalty.

Related Post: