W4P Form 2024 Printable

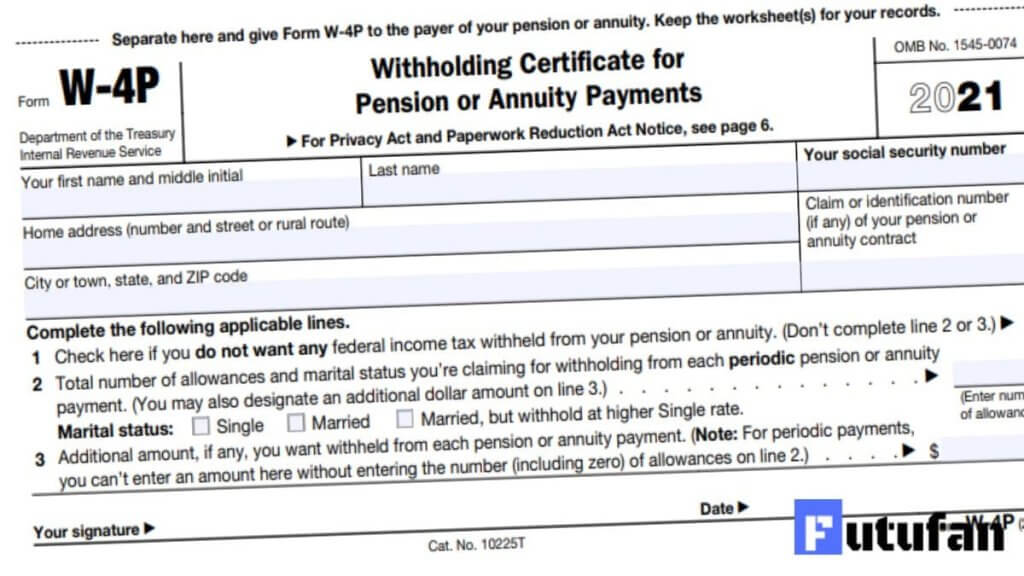

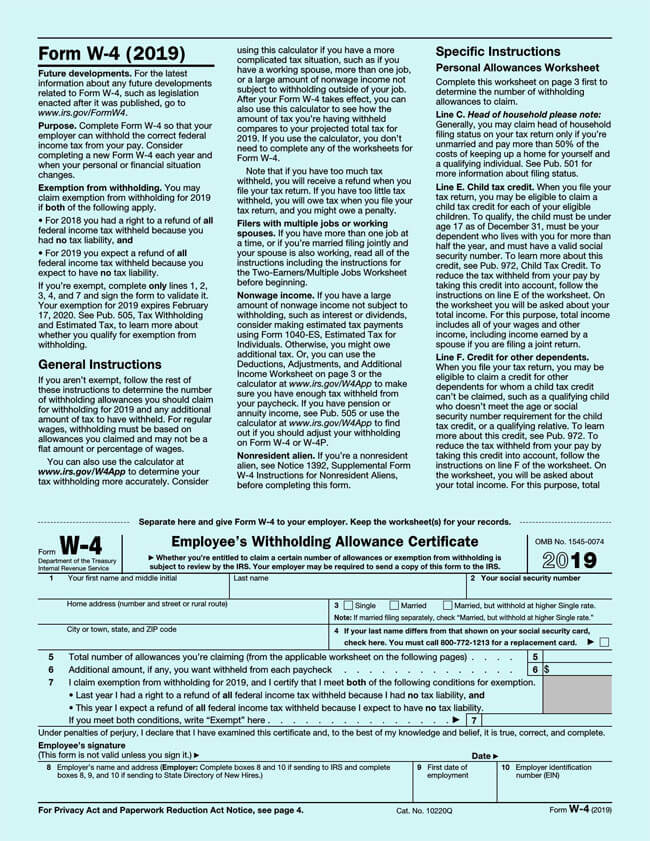

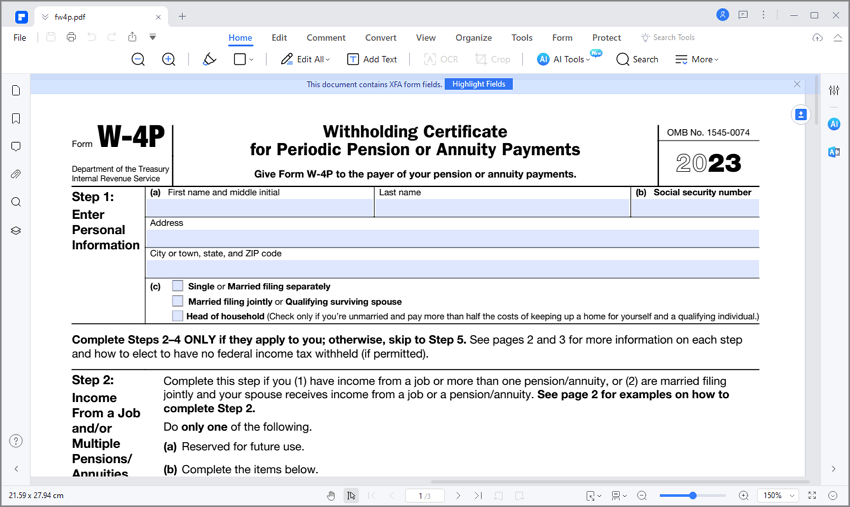

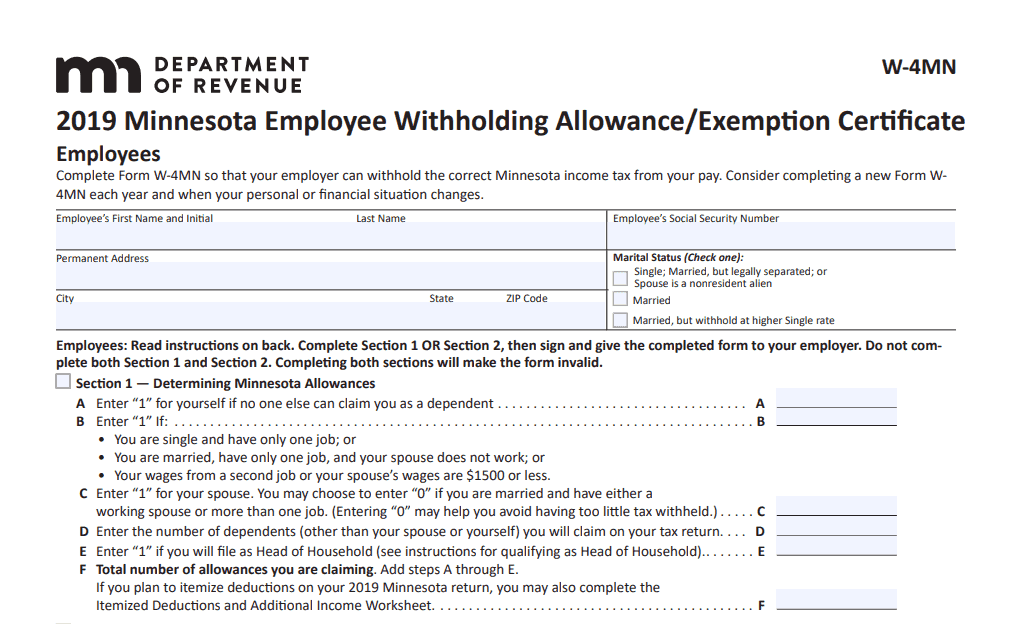

W4P Form 2024 Printable - Ann also has a job that pays $25,000 a year and another pension that pays $20,000 a year. Form ct‐w4p provides your payer with the necessary information to withhold the correct amount of connecticut income tax from your pe This form is for income earned in tax year 2023, with tax returns due in april 2024. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web payee general instructions annuities and certain other deferred compensation subject to connecticut income tax. Taxpayers under 55 are exempt if: Ncdor is a proud 2024 gold recipient of mental health america's bell seal. Save or instantly send your ready documents. Individual income tax refund inquiries: This was what determined how much tax was going to be withheld from your check every pay period. • you are single and your total income is $9,000 or less and you are not claimed as a dependent on another person’s iowa return. Individual income tax refund inquiries: Web payee general instructions annuities and certain other deferred compensation subject to connecticut income tax. Ann will enter $25,000 in step 2(b)(i), $20,000 in step 2(b)(ii), and $45,000 in. If too much is withheld, you will generally be due a refund. Federal income tax withholding applies to the taxable part of these payments. Easily fill out pdf blank, edit, and sign them. Streamlining pension and annuity withholding. Form ct‐w4p provides your payer with the necessary information to withhold the correct amount of connecticut income tax from your pe This form is for income earned in tax year 2023, with tax returns due in april 2024. North carolina department of revenue. Web payee general instructions annuities and certain other deferred compensation subject to connecticut income tax. This form is for income earned in tax year 2023, with tax returns due in april 2024. Ann will enter $25,000 in step 2(b)(i), $20,000 in step 2(b)(ii), and $45,000 in. If too much is withheld, you will generally be due a refund. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Taxpayers under 55 are exempt if: You can print other federal tax forms here. Ncdor is a proud 2024 gold recipient of mental health america's bell seal. Easily fill out pdf blank, edit, and sign them. Streamlining pension and annuity withholding. Easily fill out pdf blank, edit, and sign them. Federal income tax withholding applies to the taxable part of these payments. Ann also has a job that pays $25,000 a year and another pension that pays $20,000 a year. • you are single and your total income is $9,000 or less and you are not. If too much is withheld, you will generally be due a refund. Federal income tax withholding applies to the taxable part of these payments. Ann also has a job that pays $25,000 a year and another pension that pays $20,000 a year. Form ct‐w4p provides your payer with the necessary information to withhold the correct amount of connecticut income tax. If too much is withheld, you will generally be due a refund. North carolina department of revenue. Form ct‐w4p provides your payer with the necessary information to withhold the correct amount of connecticut income tax from your pe Save or instantly send your ready documents. This form is for income earned in tax year 2023, with tax returns due in. Ncdor is a proud 2024 gold recipient of mental health america's bell seal. This was what determined how much tax was going to be withheld from your check every pay period. Ann will enter $25,000 in step 2(b)(i), $20,000 in step 2(b)(ii), and $45,000 in. Fill out the withholding certificate for periodic pension or annuity payments online and print it. Federal income tax withholding applies to the taxable part of these payments. Streamlining pension and annuity withholding. • your total income is less than $5,000 and you are claimed as a dependent on another person’s iowa return. Ann will enter $25,000 in step 2(b)(i), $20,000 in step 2(b)(ii), and $45,000 in. You can print other federal tax forms here. Ann also has a job that pays $25,000 a year and another pension that pays $20,000 a year. Form ct‐w4p provides your payer with the necessary information to withhold the correct amount of connecticut income tax from your pe • you are single and your total income is $9,000 or less and you are not claimed as a dependent on. This form is for income earned in tax year 2023, with tax returns due in april 2024. Streamlining pension and annuity withholding. Web payee general instructions annuities and certain other deferred compensation subject to connecticut income tax. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Ann will enter $25,000 in step 2(b)(i), $20,000 in step 2(b)(ii), and $45,000 in. North carolina department of revenue. You can print other federal tax forms here. Streamlining pension and annuity withholding. Save or instantly send your ready documents. Ann will enter $25,000 in step 2(b)(i), $20,000 in step 2(b)(ii), and $45,000 in. Individual income tax refund inquiries: Save or instantly send your ready documents. Taxpayers under 55 are exempt if: Federal income tax withholding applies to the taxable part of these payments. Taxpayers under 55 are exempt if: If too much is withheld, you will generally be due a refund. Ncdor is a proud 2024 gold recipient of mental health america's bell seal. • your total income is less than $5,000 and you are claimed as a dependent on another person’s iowa return. North carolina department of revenue. Easily fill out pdf blank, edit, and sign them. Taxpayers under 55 are exempt if: Individual income tax refund inquiries: • you are single and your total income is $9,000 or less and you are not claimed as a dependent on another person’s iowa return. Federal income tax withholding applies to the taxable part of these payments. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Form ct‐w4p provides your payer with the necessary information to withhold the correct amount of connecticut income tax from your pe Streamlining pension and annuity withholding. You can print other federal tax forms here. Ncdor is a proud 2024 gold recipient of mental health america's bell seal. Ann also has a job that pays $25,000 a year and another pension that pays $20,000 a year. • your total income is less than $5,000 and you are claimed as a dependent on another person’s iowa return. Ann will enter $25,000 in step 2(b)(i), $20,000 in step 2(b)(ii), and $45,000 in. This was what determined how much tax was going to be withheld from your check every pay period. Web payee general instructions annuities and certain other deferred compensation subject to connecticut income tax. If too much is withheld, you will generally be due a refund.2025 W4 Form Printable Keith Duncan

Form W 4 Employee S Withholding Allowance Certificate vrogue.co

W4 Form 2024 Withholding Adjustment W4 Forms TaxUni

2024 W4p Form Celine Beverlie

2023 W 4p Form Printable Forms Free Online

2024 W 4 Form Printable Spanish Carree Kattie

W4 Form 2024 Printable Free Heddi Rosita

Mn W 4 Form 2024 Printable Shae Delcine

W 4 Form 2024 Printable Free Jobye

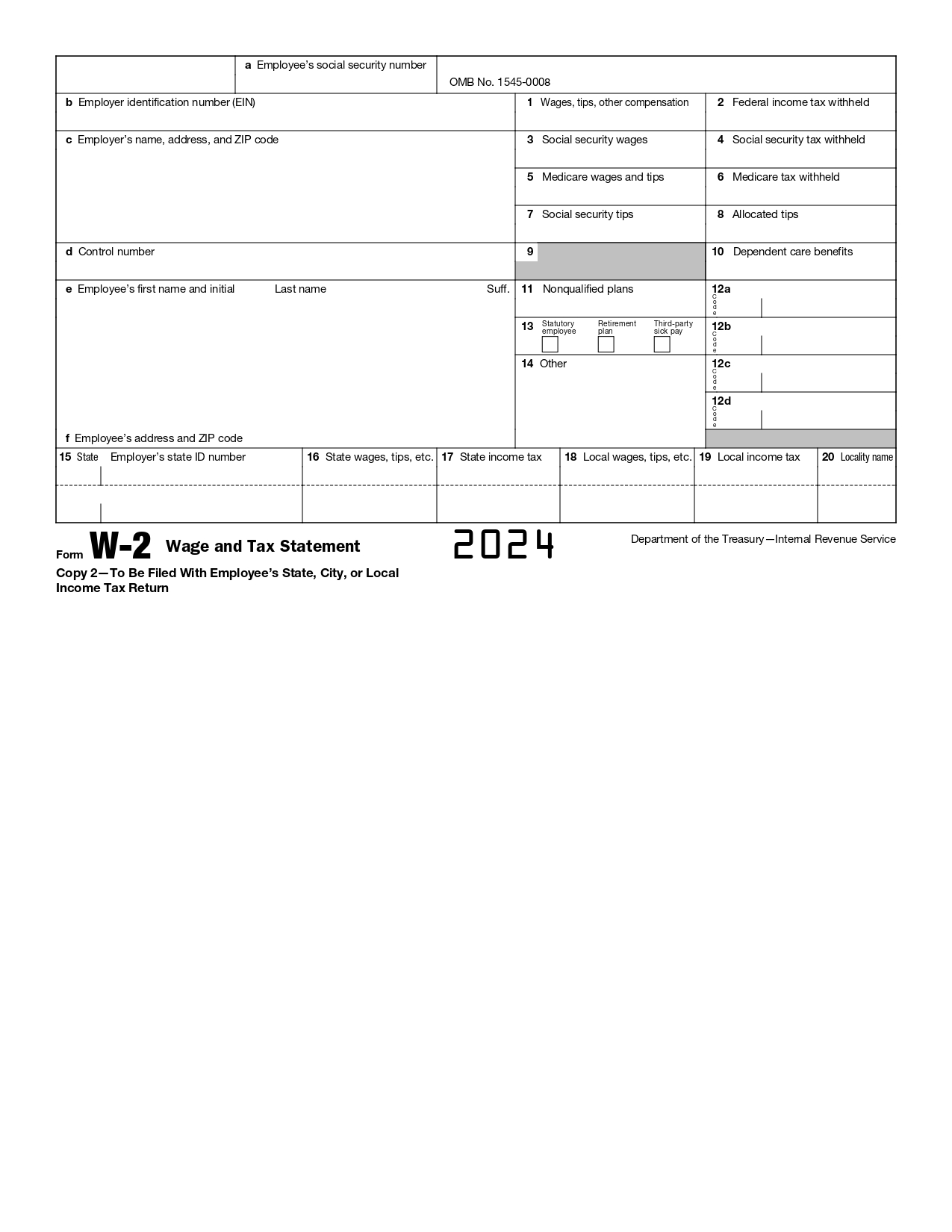

W2 Form 2024 Printable IRS Tax Forms 2024

Save Or Instantly Send Your Ready Documents.

Fill Out The Withholding Certificate For Periodic Pension Or Annuity Payments Online And Print It Out For Free.

This Form Is For Income Earned In Tax Year 2023, With Tax Returns Due In April 2024.

North Carolina Department Of Revenue.

Related Post: