Free Printable Tax Deduction Worksheet

Free Printable Tax Deduction Worksheet - Web find out what you need to file your 2023 taxes, including personal information, income, deductions, credits, and taxes paid. Web track and automate your home office tax savings with this free worksheet. The web page also explains the rules. Web download a free pdf worksheet to help you claim 55 tax deductions for your small business in 2022. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your federal and/or state return. Customize the template to suit your home, business, or brand and keep track of your financial details and receipts. Find out how to minimize your tax obligations and comply with filing requirements with casey moss tax. Learn who needs to file a schedule a, what. Learn what a tax deduction is, how it works, and what expenses are deductible. Includes categories such as clothing, household goods, books, and vehicles, with examples and sources. Web download and fill out over 25 worksheets, forms and checklists to prepare for your tax interview. Single $12,950 married $25,900 hoh $19,400 Web learn what expenses are deductible for your small business and get a free printable worksheet to organize them. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Follow the instructions and worksheets to complete the form and claim exemption, credits, deductions, or other adjustments. The web page also explains the rules. Sales of stock, land, etc. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Web learn how to calculate your home office deduction using the simplified or regular method with this free excel worksheet. Web download and fill out this tax organizer to collect and report the information needed for your 2023 income tax return. Learn who needs to file a schedule a, what. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web download a free excel template to calculate your standard or itemized tax deductions for the year. Follow the instructions and worksheets to complete the form and claim exemption, credits, deductions, or other adjustments. Web download a free pdf worksheet to help you claim 55 tax deductions for your small business in 2022. The web page also explains the rules. Web tax worksheets & logs. Web learn how to determine if a taxpayer should itemize deductions and what expenses qualify as itemized deductions. Web download and print pdf worksheets and forms to organize your income tax data by topic, occupation, or year. Save them to your computer for use next year or print them out for easy reference. Sales of stock, land, etc. Find general, specialized, and home improvement worksheets to maximize your deductions and minimize errors. Web download a free pdf worksheet to help you claim 55 tax deductions for your small business in 2022. Web find out what you need to file your 2023 taxes, including personal information, income, deductions, credits, and taxes paid. Find out. Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. Web learn how to deduct your expenses from your income and pay less taxes as a private practice owner. Web tax worksheets & logs. Customize the template to suit your home, business, or brand and keep track of your financial details and receipts. Find. Web tax worksheets & logs. Download and print a pdf checklist to organize your documents and save time. Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. Customize the template to suit your home, business, or brand and keep track of your financial details and receipts. Web download a free excel template to. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your federal and/or state return. Web learn how to deduct your expenses from your income and pay less taxes as a private practice owner. Web find out what you need to file your 2023 taxes,. Single $12,950 married $25,900 hoh $19,400 It covers income, deductions, credits, health insurance, education, direct deposit, foreign income and more. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Follow the instructions and worksheets to complete the form and claim exemption, credits, deductions, or. The web page also explains the rules. Includes categories such as clothing, household goods, books, and vehicles, with examples and sources. Sales of stock, land, etc. Customize the template to suit your home, business, or brand and keep track of your financial details and receipts. Learn who needs to file a schedule a, what. The web page also explains the rules. It covers income, deductions, credits, health insurance, education, direct deposit, foreign income and more. Save them to your computer for use next year or print them out for easy reference. Web find out what you need to file your 2023 taxes, including personal information, income, deductions, credits, and taxes paid. Web download a. Download and print a pdf checklist to organize your documents and save time. Web learn how to calculate your home office deduction using the simplified or regular method with this free excel worksheet. Web download a free excel template to calculate your standard or itemized tax deductions for the year. Learn who needs to file a schedule a, what. Learn. Customize the template to suit your home, business, or brand and keep track of your financial details and receipts. Scores 4.80 with 905 votes. Learn who needs to file a schedule a, what. Web learn how to calculate your home office deduction using the simplified or regular method with this free excel worksheet. Otherwise, reporting total figures on this form. Save them to your computer for use next year or print them out for easy reference. Find out how to report itemized deductions on schedule a and what recordkeeping requirements apply to charitable contributions. Web download a free excel template to calculate your standard or itemized tax deductions for the year. Follow the instructions and worksheets to complete the form. Web download and fill out over 25 worksheets, forms and checklists to prepare for your tax interview. Web download and print pdf worksheets and forms to organize your income tax data by topic, occupation, or year. Web learn how to calculate your home office deduction using the simplified or regular method with this free excel worksheet. Sales of stock, land, etc. Use the following tax deduction checklist when filing your annual return: Learn what a tax deduction is, how it works, and what expenses are deductible. Customize the template to suit your home, business, or brand and keep track of your financial details and receipts. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. Web track and automate your home office tax savings with this free worksheet. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your federal and/or state return. Single $12,950 married $25,900 hoh $19,400 Web download a free pdf worksheet to help you claim 55 tax deductions for your small business in 2022. Web learn what expenses are deductible for your small business and get a free printable worksheet to organize them. Learn who needs to file a schedule a, what. Web tax worksheets & logs.Deductions Worksheet Fill Online, Printable, Fillable, Blank pdfFiller

Printable Self Employed Tax Deductions Worksheet Studying Worksheets

Free Printable Tax Deduction Worksheet Pdf

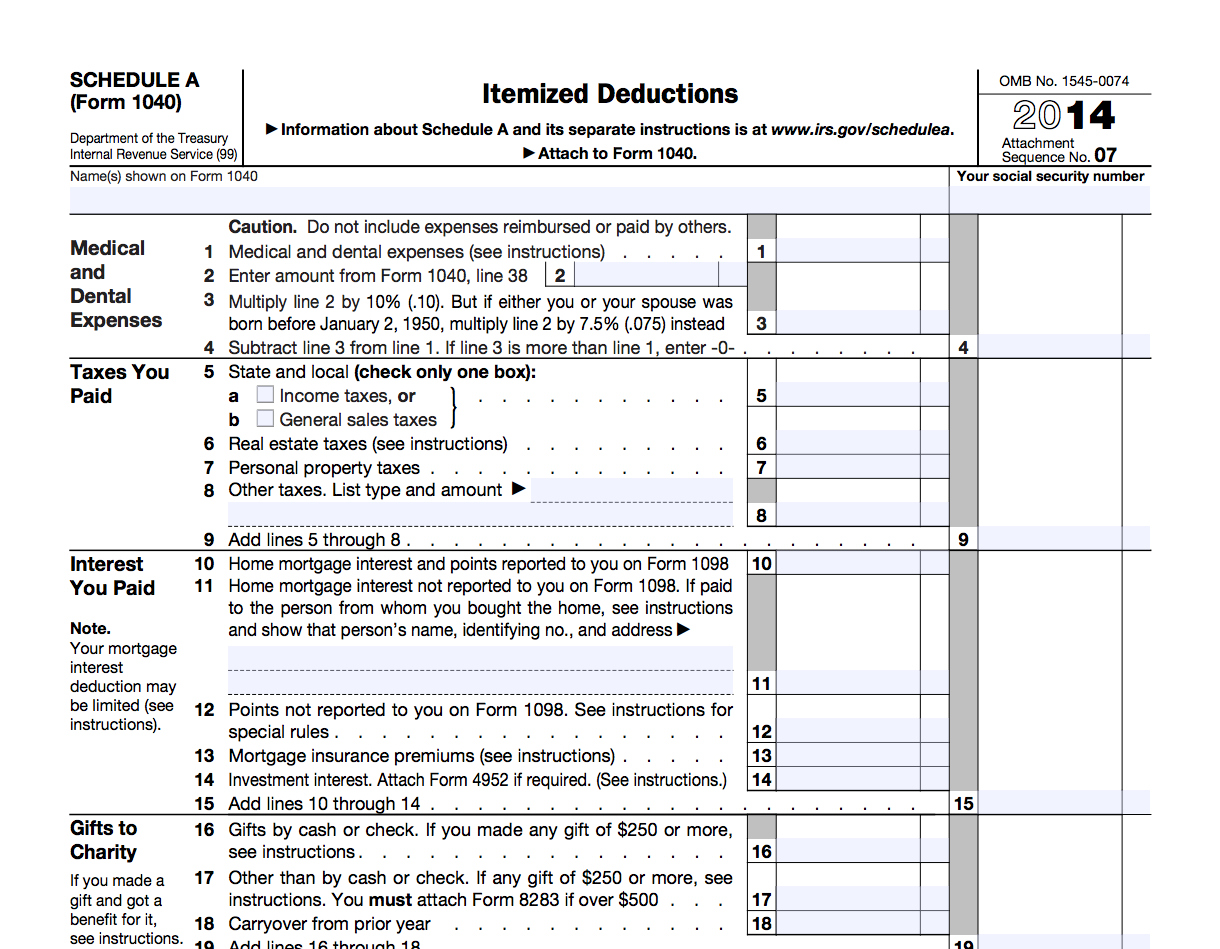

Printable Itemized Deductions Worksheet

Free Printable Tax Deduction Worksheets

Tax Itemized Deductions Worksheet

Printable Self Employed Tax Deductions Worksheet Studying Worksheets

8 Tax Itemized Deduction Worksheet /

Tax Deduction Worksheet 2023

Printable Itemized Deductions Worksheet

Save Them To Your Computer For Use Next Year Or Print Them Out For Easy Reference.

Find Out How To Minimize Your Tax Obligations And Comply With Filing Requirements With Casey Moss Tax.

Find Out How To Report Itemized Deductions On Schedule A And What Recordkeeping Requirements Apply To Charitable Contributions.

Web Download And Fill Out This Tax Organizer To Collect And Report The Information Needed For Your 2023 Income Tax Return.

Related Post: