Lbo Model Template

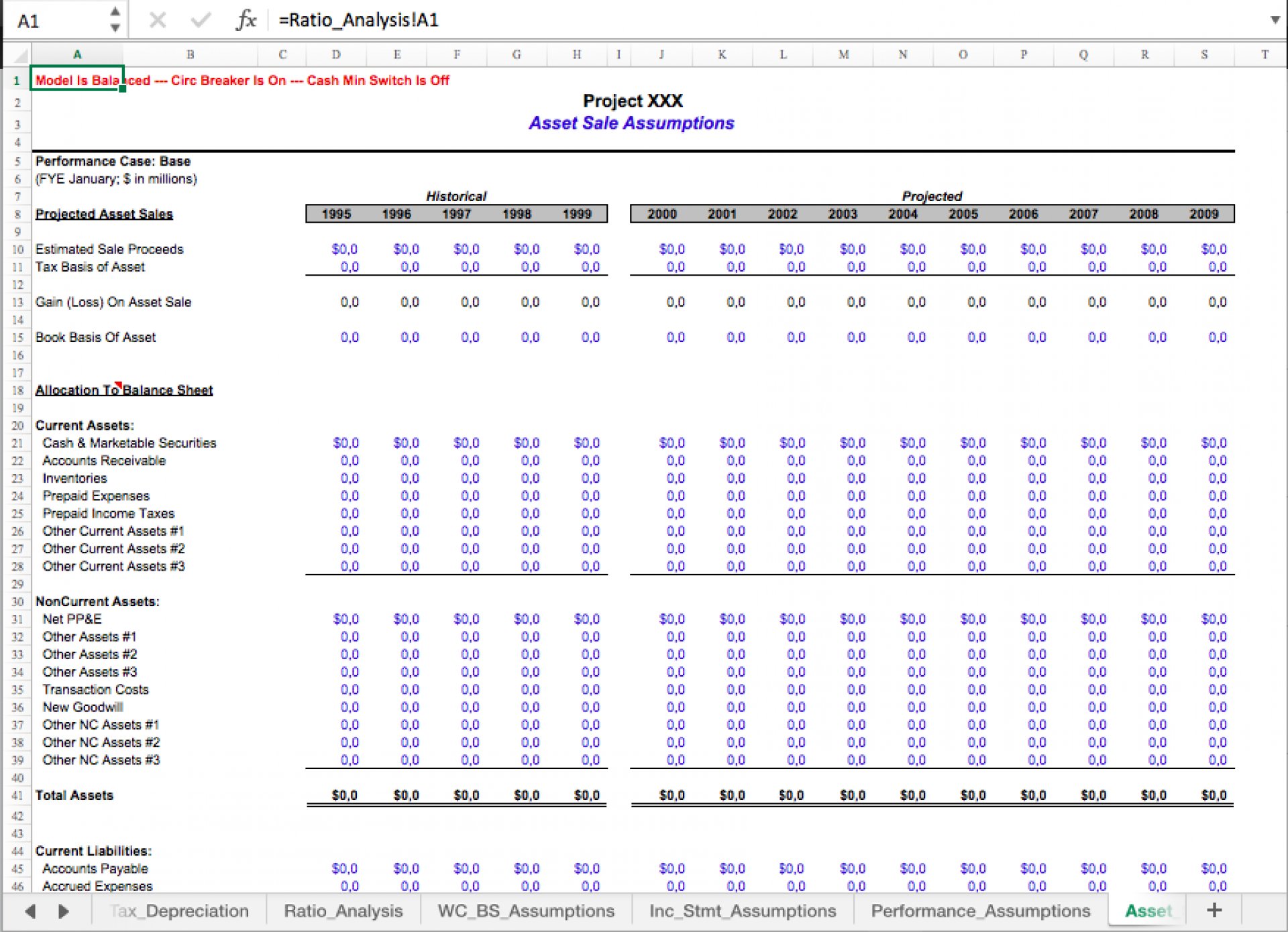

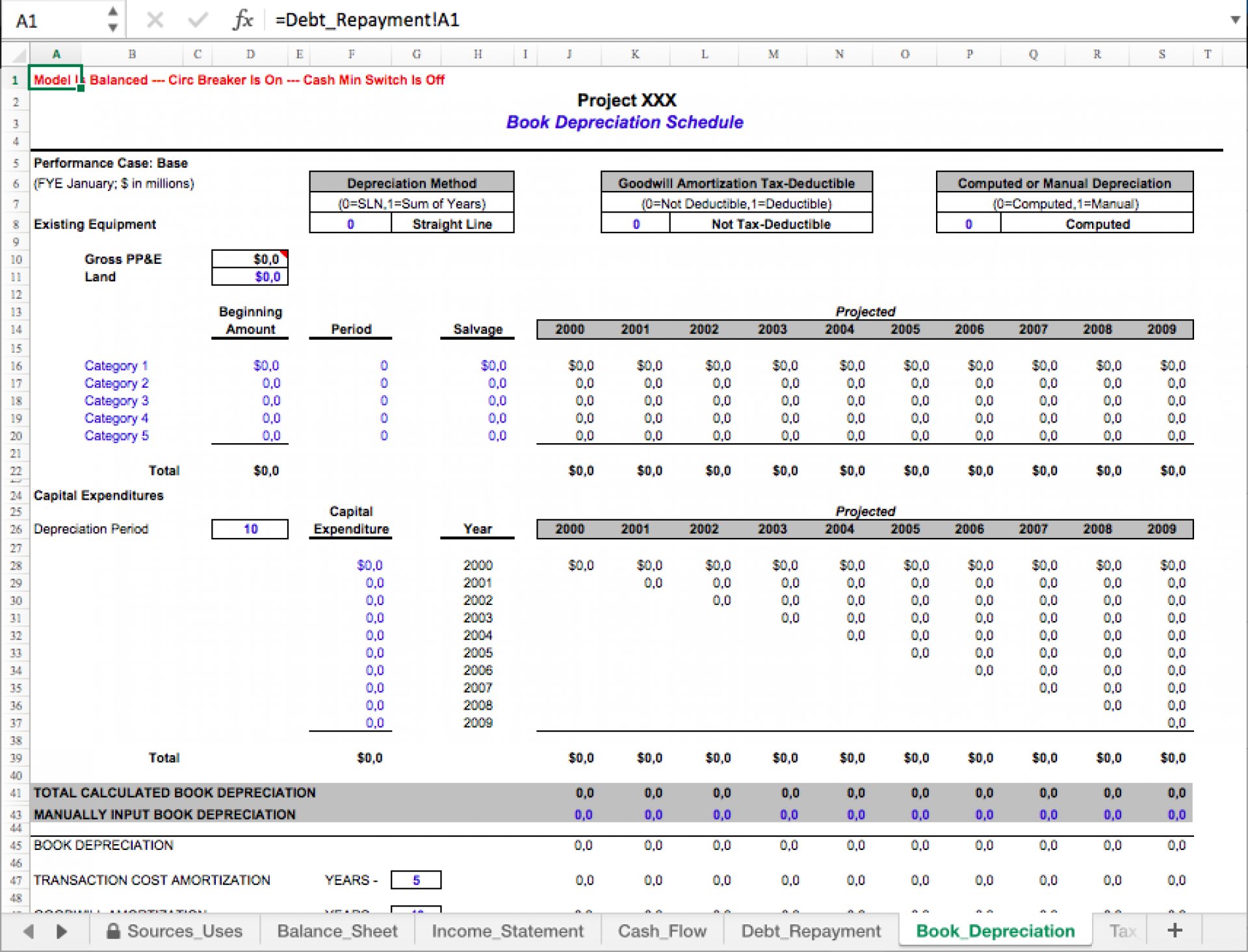

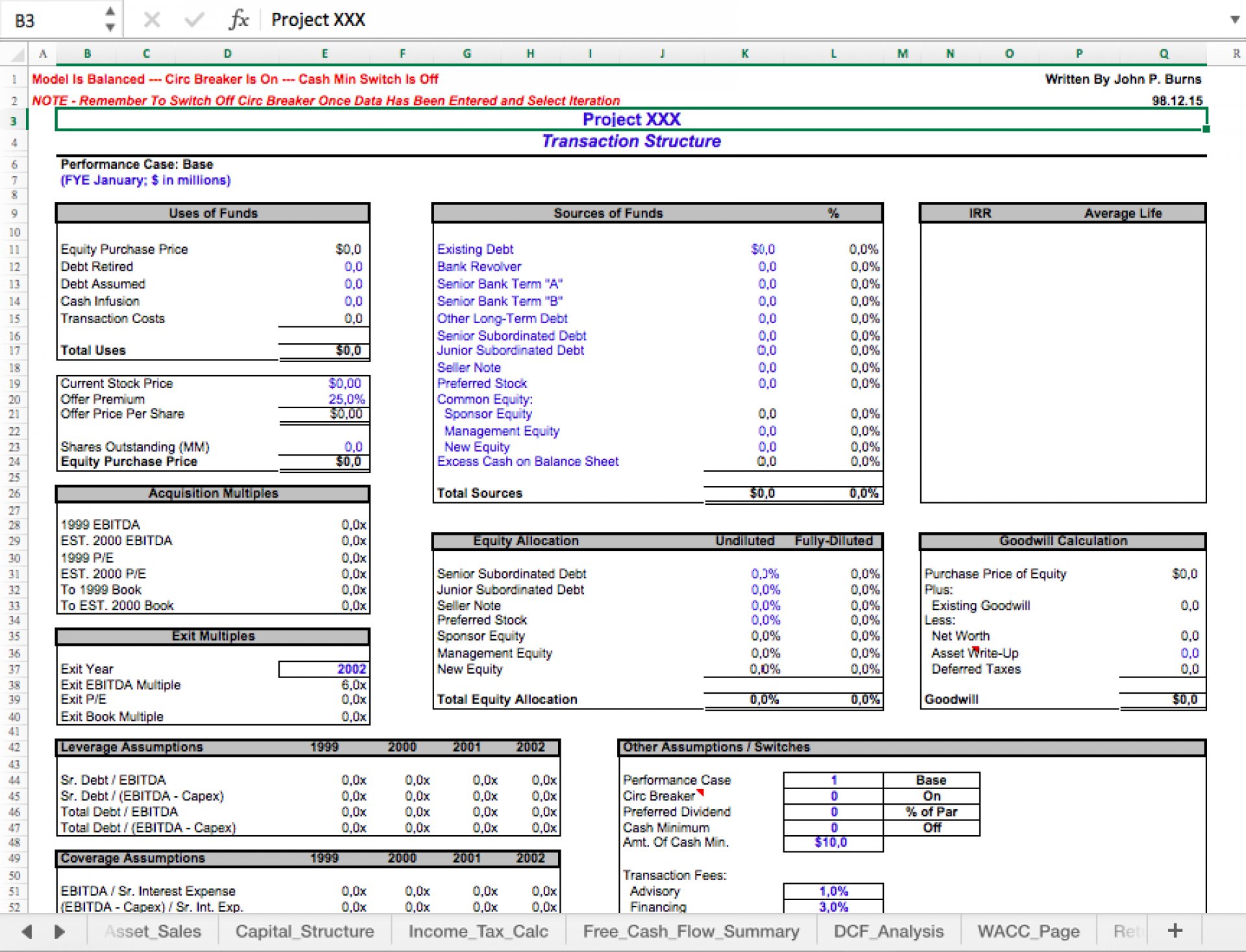

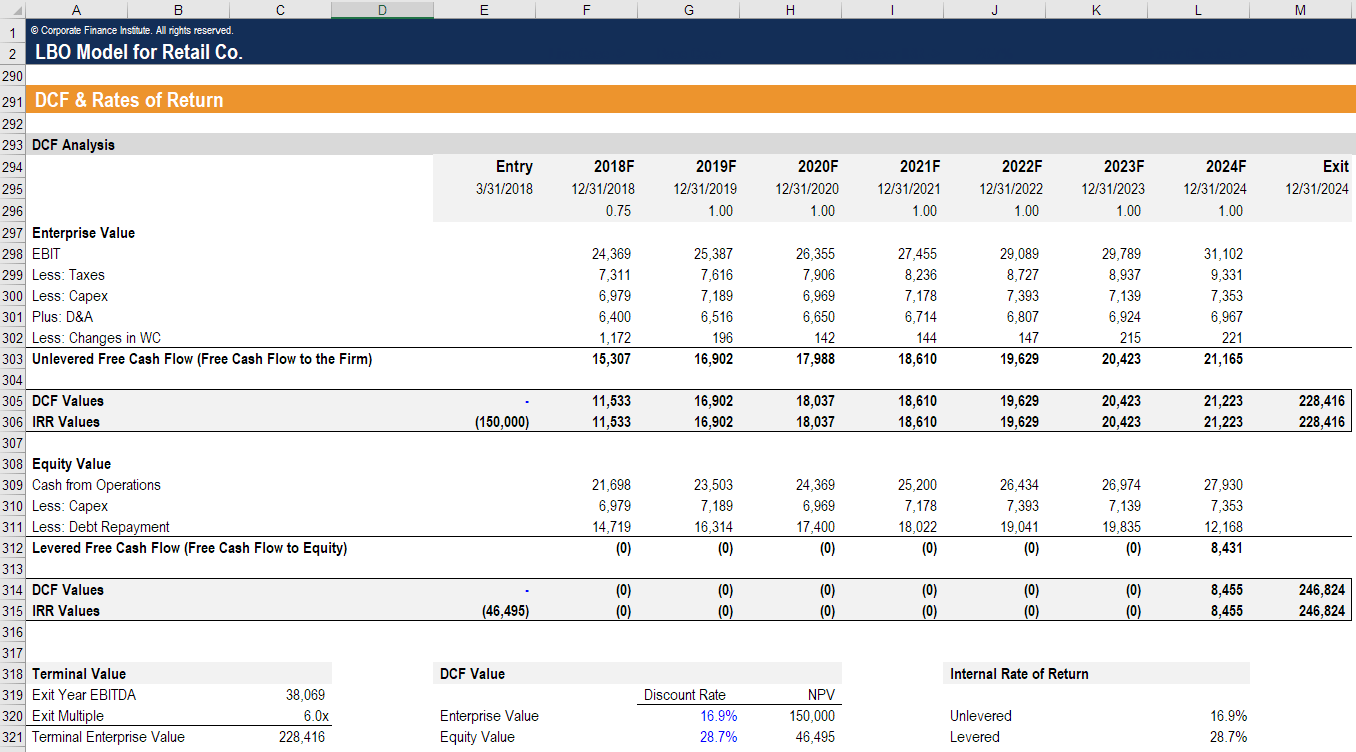

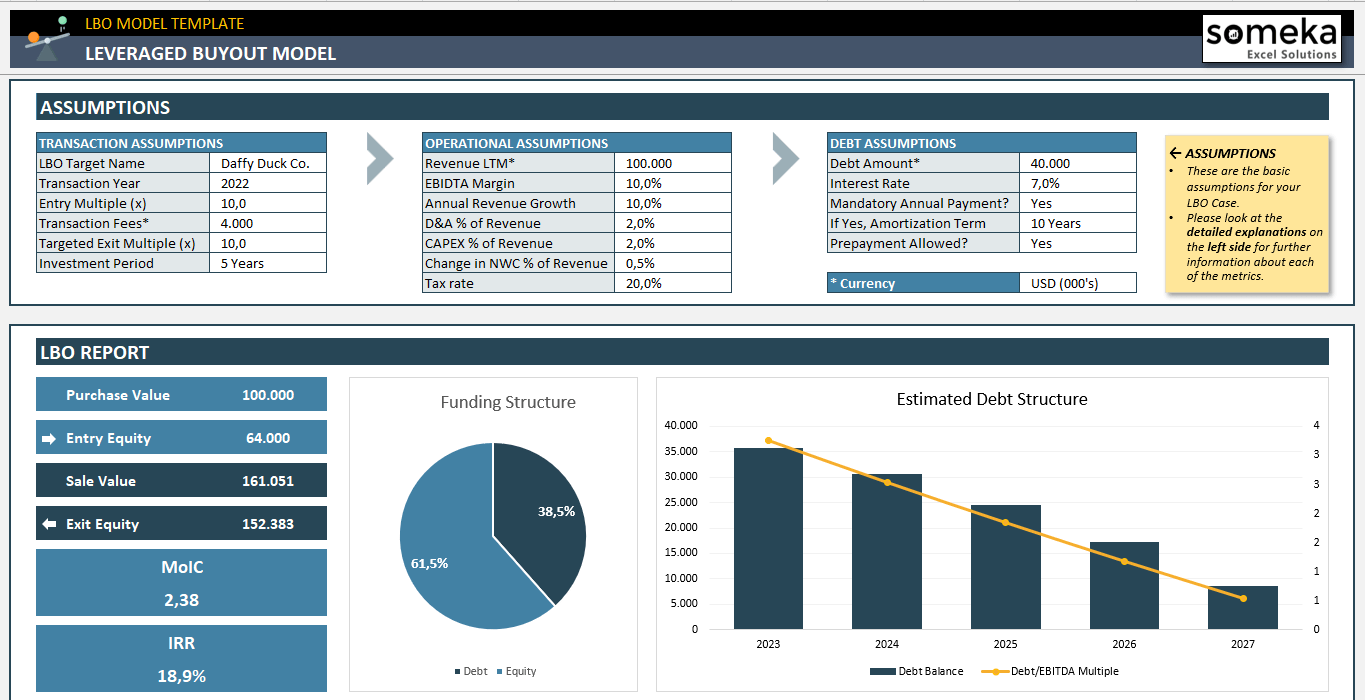

Lbo Model Template - Input all relevant assumptions related to acquisition price, financing mix, and operational performance. Web the use of significant debt to acquire a company over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. The model generates the three financial statements, the exit analysis, a summary, metrics and bank ratios as. The model is clean, simple and easily customizable. With the help of this model, you will be able to analyse: Outline the typical capital structure of an lbo transaction in terms of leverage and types of capital. Web lbo (leveraged buyout) financial model for private companies (clean, simple, functional, and reusable template). The leveraged buyout (lbo) model forecasts future equity value and irr while analyzing a target business for acquisition using an lbo structure. Web steps for using the lbo model template. Identify the characteristics of good candidates for lbo transactions. Web an lbo model is built in excel to evaluate a leveraged buyout (lbo) transaction, the acquisition of a company funded using a significant amount of debt. Examine a number of typical lbo exit strategies used by private equity firms. Web the use of significant debt to acquire a company over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Input all relevant assumptions related to acquisition price, financing mix, and operational performance. Web the leveraged buyout (lbo) model is used to model one of the most complex types of transactions in finance. The model is clean, simple and easily customizable. Web download wso's free leveraged buyout (lbo) model template below! In this article, you will learn about leveraged buyouts, how they are modeled, and the difference between lbo and discounted cash flow (dcf) models. Evaluate potential deals and make informed investment decisions. Web try lbo modeling with our comprehensive excel template. Evaluate potential deals and make informed investment decisions. Web lbo (leveraged buyout) financial model for private companies (clean, simple, functional, and reusable template). Web the leveraged buyout (lbo) model is used to model one of the most complex types of transactions in finance. Web an lbo model is built in excel to evaluate a leveraged buyout (lbo) transaction, the acquisition of a company funded using a significant amount of debt. Start with an integrated financial statement model & add components needed for analysis. Identify the characteristics of good candidates for lbo transactions. Input all relevant assumptions related to acquisition price, financing mix, and operational performance. Web lbo (leveraged buyout) financial model for private companies (clean, simple, functional, and reusable template). Web download wso's free leveraged buyout (lbo) model template below! Web this excel model template and accompanying videos will help you to improve your financial modeling skills and give you the capability to create and build your own lbo analysis models. Web usually, lbo models are created using microsoft excel to estimate the returns for all parties involved in the transactions. Identify the characteristics of good candidates for lbo transactions. Outline the typical capital structure of an lbo transaction in terms of leverage and types of capital. Examine a number of typical lbo exit strategies used by private equity firms. Web. Web usually, lbo models are created using microsoft excel to estimate the returns for all parties involved in the transactions. Throughout the tutorial, a baseline understanding of the theory behind leveraged buyouts (lbos) will be assumed. Evaluate potential deals and make informed investment decisions. In this article, you will learn about leveraged buyouts, how they are modeled, and the difference. It is built not just for the basic valuation of a company but also to account for the debt raised to finance the transaction and forecast how much return the private equity firm can make. The model generates the three financial statements, the exit analysis, a summary, metrics and bank ratios as. Develop pro forma income statement, balance sheet and. Web a full leveraged buyout (lbo) model template in excel for a project to understand its different components (valuation, dcf, wacc etc.) and work with your own. Web how to build an lbo model: With the help of this model, you will be able to analyse: It is built not just for the basic valuation of a company but also. In this article, you will learn about leveraged buyouts, how they are modeled, and the difference between lbo and discounted cash flow (dcf) models. Understand key concepts, calculate returns, and gain actionable insights. Web usually, lbo models are created using microsoft excel to estimate the returns for all parties involved in the transactions. Web define a leveraged buyout (lbo) and. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. Web try lbo modeling with our comprehensive excel template. Web define a leveraged buyout (lbo) and build a simple lbo model. Identify the characteristics of good candidates for lbo transactions. It is built not just for the basic valuation of a company. Web an lbo model is built in excel to evaluate a leveraged buyout (lbo) transaction, the acquisition of a company funded using a significant amount of debt. Web this excel model template and accompanying videos will help you to improve your financial modeling skills and give you the capability to create and build your own lbo analysis models. Outline the. Evaluate potential deals and make informed investment decisions. Input all relevant assumptions related to acquisition price, financing mix, and operational performance. Web gain deeper insights into leveraged buyouts with our comprehensive lbo model template. Web download wso's free leveraged buyout (lbo) model template below! Understand key concepts, calculate returns, and gain actionable insights. Web steps for using the lbo model template. Identify the characteristics of good candidates for lbo transactions. Web this excel model template and accompanying videos will help you to improve your financial modeling skills and give you the capability to create and build your own lbo analysis models. Web in this lbo model tutorial, you’ll learn how to build a. With the help of this model, you will be able to analyse: Web in this lbo model tutorial, you’ll learn how to build a very simple lbo model “on paper” that you can use to answer quick questions in private equity (and other) interviews. Web the leveraged buyout (lbo) model is used to model one of the most complex types. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. Web download wso's free leveraged buyout (lbo) model template below! The leveraged buyout (lbo) model forecasts future equity value and irr while analyzing a target business for acquisition using an lbo structure. Web the leveraged buyout (lbo) model provides a business valuation of a target company for investment. Start with an integrated financial statement model & add components needed for analysis. It is built not just for the basic valuation of a company but also to account for the debt raised to finance the transaction and forecast how much return the private equity firm can make. Develop pro forma income statement, balance sheet and cash flow statement to forecast the company’s performance. Web steps for using the lbo model template. Web leveraged buy out (lbo) model presents the business case of the purchase of a company by using a high level of debt financing. The model generates the three financial statements, the exit analysis, a summary, metrics and bank ratios as. Evaluate potential deals and make informed investment decisions. Identify the characteristics of good candidates for lbo transactions. Understand key concepts, calculate returns, and gain actionable insights. Web usually, lbo models are created using microsoft excel to estimate the returns for all parties involved in the transactions. Web the leveraged buyout (lbo) model is used to model one of the most complex types of transactions in finance. Web try lbo modeling with our comprehensive excel template.Leveraged Buyout (LBO) Model Template Excel Eloquens

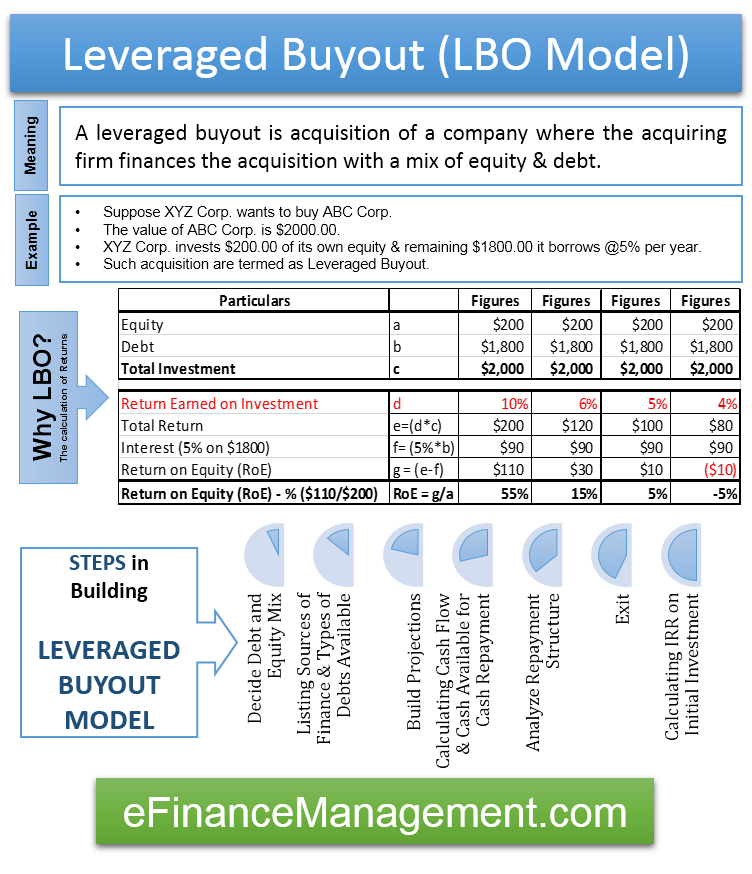

Leveraged Buyout (LBO) Model Define, Example, Why LBO, Steps eFM

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

LBO Model Overview, Example, and Screenshots of an LBO Model

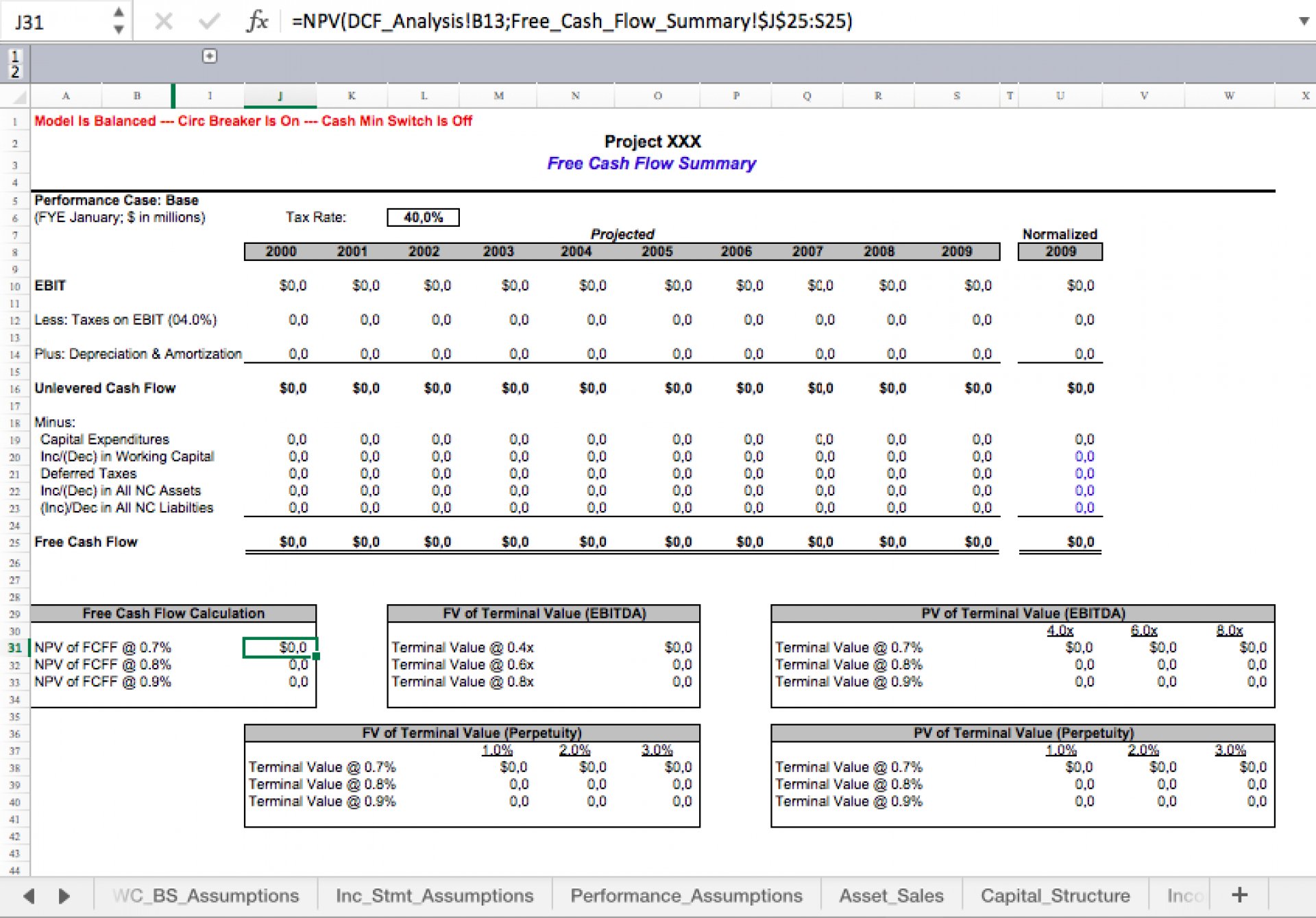

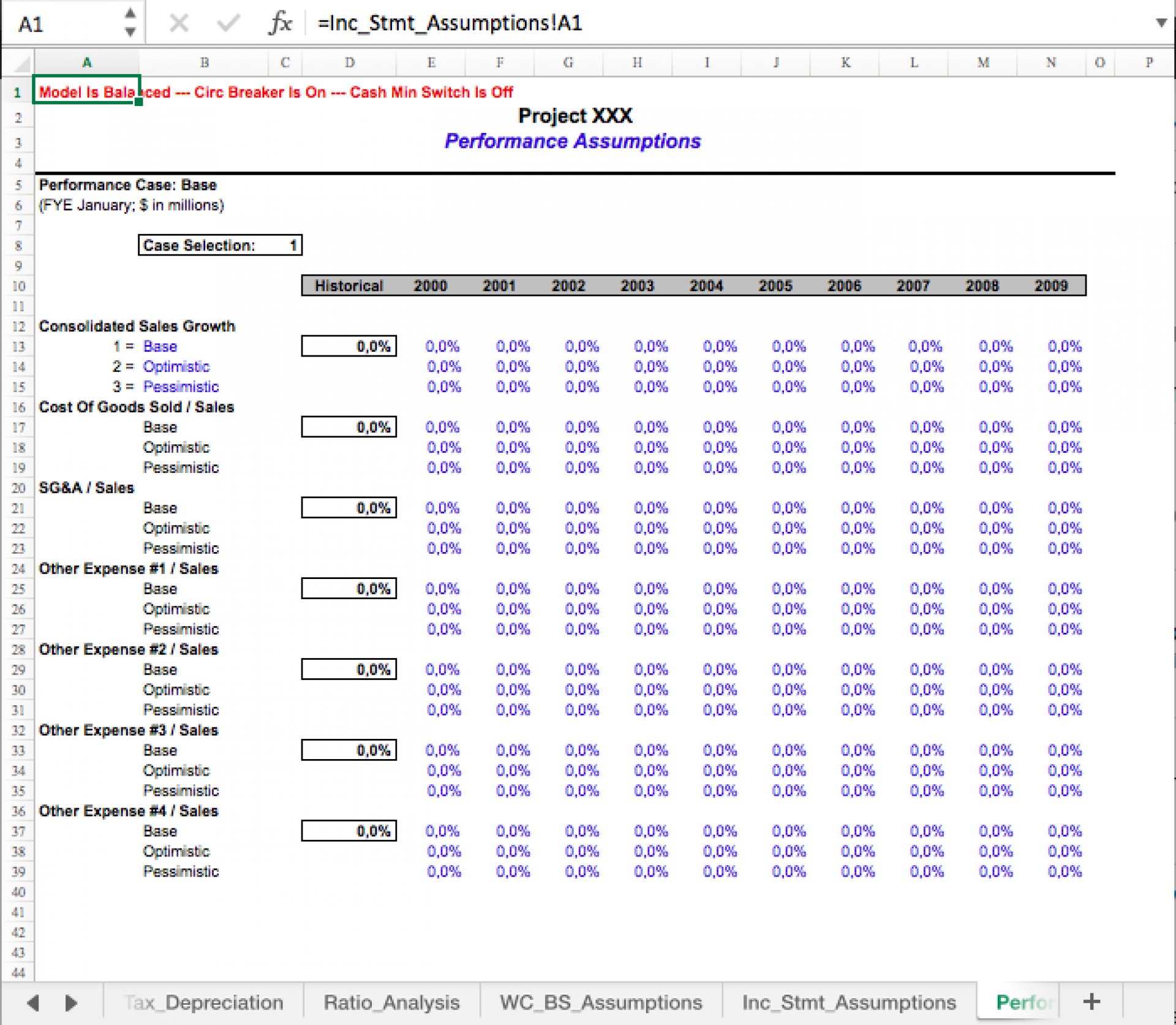

LBO Model Templates Macabacus

Leveraged Buyout (LBO) Model Template Excel Eloquens

LBO Model Guide Definition, Steps, and Excel Worksheet

LBO Model (Long Form) Free Excel Template Macabacus

Written By Tim Vipond An Lbo Model Is A Financial Tool Typically Built In.

Web Lbo (Leveraged Buyout) Financial Model For Private Companies (Clean, Simple, Functional, And Reusable Template).

Web Get An Introduction To A Simple Leveraged Buyout Model.

Web The Use Of Significant Debt To Acquire A Company Over 1.8 Million Professionals Use Cfi To Learn Accounting, Financial Analysis, Modeling And More.

Related Post: